Greif Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

Unlock the core of Greif's operational success with a comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for their market dominance. Ideal for anyone seeking to understand or replicate strategic business frameworks.

Partnerships

Greif's key partnerships with raw material suppliers are foundational to its operations. They depend on a worldwide network for crucial inputs such as steel, plastic resins, fiber, and recycled materials. These relationships are vital for maintaining a steady, high-quality, and cost-efficient supply chain, which directly impacts their broad range of products.

Greif actively cultivates technology and innovation partnerships to drive advancements in packaging. Collaborations with research institutions and tech firms are crucial for developing novel packaging designs and more efficient manufacturing processes. These alliances are key to Greif's strategy for enhancing sustainability in its product lines.

These partnerships enable Greif to explore cutting-edge material science and implement automation technologies. For instance, advancements in digital platforms like Greif+ are a direct result of such collaborations, aimed at improving customer experience and operational streamlining. The company's commitment to innovation is reflected in its ongoing investments in R&D, which are often amplified through these strategic alliances.

Greif relies on a robust network of logistics and distribution partners to manage its global operations, ensuring products reach customers efficiently. These collaborations are critical for navigating the complexities of international shipping, warehousing, and last-mile delivery across Greif's presence in over 35 countries.

In 2024, Greif continued to leverage these partnerships to optimize its supply chain, a significant undertaking given the vast quantities of industrial packaging materials it produces. Effective logistics management is crucial for maintaining competitive pricing and customer satisfaction in the diverse markets Greif serves.

Reconditioning and Recycling Network Partners

Greif actively cultivates a robust reconditioning and recycling network, a cornerstone of its commitment to a circular economy. This network is vital for extending the life of industrial containers and significantly reducing waste. In 2024, Greif continued to integrate acquired reconditioning capabilities and forge new collaborations, enhancing its capacity to manage the full lifecycle of its products.

These strategic partnerships are crucial for Greif's sustainability goals, enabling the efficient reuse of containers and diverting substantial volumes of material from landfills. By investing in and expanding this network, Greif not only reinforces its environmental stewardship but also creates economic value through the circularity of its offerings.

- Expanded Reconditioning Capacity: Greif's strategic acquisitions in 2024 broadened its reconditioning footprint, increasing the number of facilities capable of processing used industrial containers.

- Circular Economy Focus: Partnerships are integral to Greif's strategy of promoting container reuse, thereby minimizing environmental impact and resource consumption.

- Waste Diversion: The reconditioning network plays a key role in diverting significant tonnage of materials from landfills, contributing to Greif's ambitious sustainability targets.

Strategic Acquisition Targets

Greif actively seeks strategic acquisitions to bolster its product offerings, broaden its market presence, and enhance its technological expertise. This inorganic growth strategy is fundamental to its long-term vision.

A prime example is the acquisition of Ipackchem, a move that underscores Greif's commitment to expanding into higher-growth, higher-margin solutions. This acquisition specifically targeted strengthening their position within specialized packaging segments, demonstrating a clear strategic intent.

- Strategic Focus: Greif prioritizes acquisitions that align with its strategy of moving towards more specialized and value-added packaging solutions.

- Growth Driver: Acquisitions are a key engine for Greif's revenue growth and market share expansion, particularly in niche areas.

- Ipackchem Example: The 2023 acquisition of Ipackchem for approximately $414 million highlights Greif's pursuit of companies with strong positions in attractive end markets like agrochemicals and pharmaceuticals.

- Synergies: Greif aims to realize significant synergies through these acquisitions, leveraging its scale and operational expertise to improve profitability.

Greif's key partnerships extend to financial institutions and investors, crucial for funding its extensive operations and strategic growth initiatives. These relationships provide access to capital necessary for acquisitions, capital expenditures, and ongoing research and development efforts.

In 2024, Greif continued to focus on strengthening its balance sheet and managing its debt effectively, supported by these financial partnerships. The company's ability to secure favorable financing terms directly impacts its investment capacity and overall financial health.

Greif also engages with industry associations and regulatory bodies, fostering collaboration and staying abreast of evolving market trends and compliance requirements. These engagements are vital for maintaining its license to operate and for shaping industry standards.

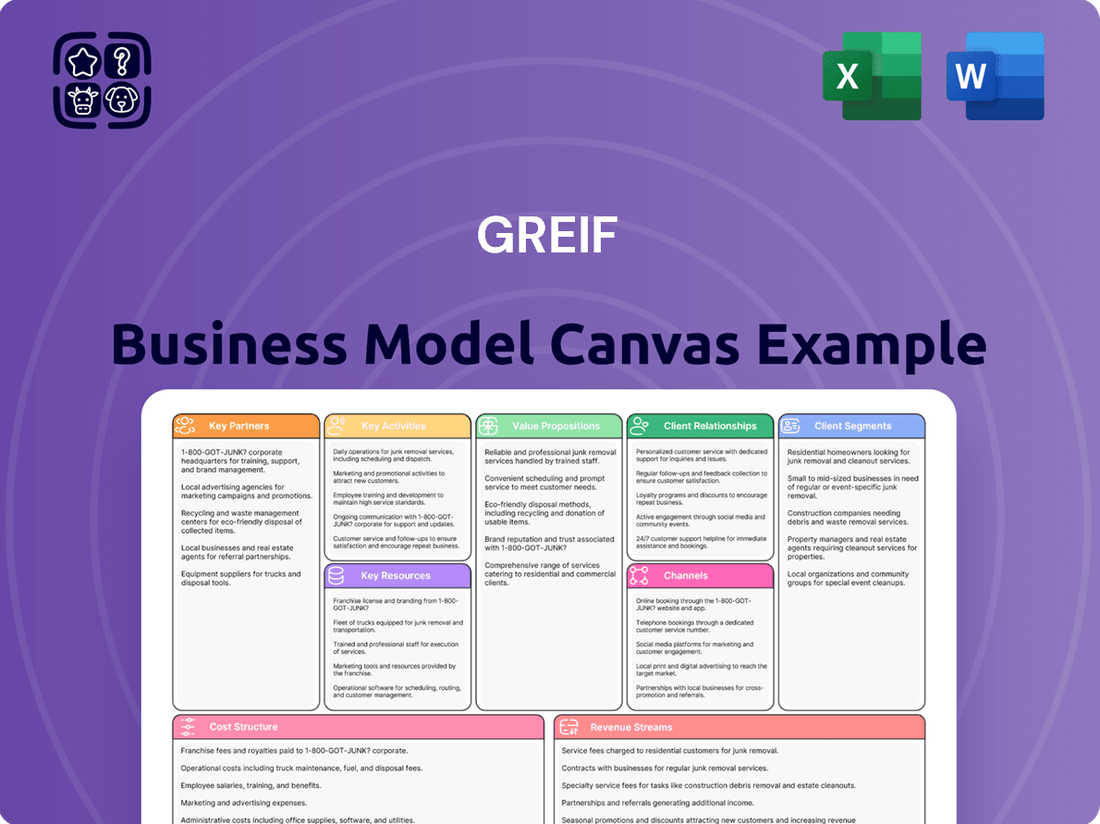

What is included in the product

A detailed breakdown of Greif's operations, outlining key partnerships, activities, and resources to deliver its packaging solutions.

Illustrates Greif's customer relationships, revenue streams, and cost structure, providing a clear view of its market approach.

The Greif Business Model Canvas offers a structured approach to pinpoint and address strategic weaknesses, acting as a powerful pain point reliever by visualizing and clarifying potential business model inefficiencies.

Activities

Greif's core activities revolve around the large-scale, efficient manufacturing of industrial packaging. This includes producing a wide range of products like steel drums, plastic drums, fiber drums, intermediate bulk containers (IBCs), and corrugated containers. They operate a significant global network of production facilities to meet diverse customer needs.

A key focus is on continuous investment in advanced manufacturing technologies. This commitment aims to enhance production efficiency, product quality, and sustainability across their operations. For instance, in fiscal year 2023, Greif invested $251.7 million in capital expenditures, a significant portion of which supports manufacturing upgrades and expansions.

Greif actively pursues product design and innovation, focusing on creating new packaging solutions that address changing customer demands and environmental targets. This drive for novelty ensures their offerings remain competitive and relevant in a dynamic market.

The company's innovation efforts are geared towards enhancing the performance of existing packaging designs, making them more durable and efficient. For instance, in 2024, Greif continued to invest in research and development to optimize the structural integrity of their steel and plastic drums, leading to a reported 5% improvement in crush resistance for certain product lines.

A significant aspect of Greif's product development strategy involves increasing the integration of recycled and recyclable materials. By 2024, they achieved a milestone of sourcing over 70% of their steel for rigid containers from recycled content, a testament to their commitment to circular economy principles and reducing their environmental footprint.

Grief's sales and marketing efforts are central to its business, focusing on actively promoting a broad portfolio of packaging solutions and services across numerous industries. This global commercial team works diligently to connect with customers through diverse channels, ensuring a deep understanding of each sector's unique needs.

In 2024, Grief continued to leverage its extensive sales network. For instance, the company reported strong performance in its Industrial Packaging segment, driven by robust demand from key markets like chemicals and petroleum, which represent a significant portion of their customer base.

Supply Chain Management

Greif's key activities heavily revolve around managing a complex global supply chain. This involves everything from securing raw materials, like steel and paperboard, to ensuring finished goods, such as industrial packaging, reach customers efficiently. In 2024, the company continued to focus on optimizing its procurement strategies and inventory levels across its numerous manufacturing sites worldwide.

The company's supply chain operations are multifaceted, encompassing procurement, warehousing, transportation, and the efficient movement of goods. Greif's commitment to supply chain excellence is underscored by its efforts to enhance logistics and streamline material flow. For instance, in the fiscal year ending September 2024, Greif reported significant investments in its global manufacturing footprint, aiming to improve operational efficiency and responsiveness to market demands.

- Procurement: Securing essential raw materials like steel coils and paperboard at competitive prices.

- Inventory Management: Maintaining optimal stock levels of raw materials and finished goods to meet customer demand while minimizing holding costs.

- Logistics and Transportation: Managing the complex movement of materials and products across Greif's global network of facilities and to customer locations.

- Network Optimization: Continuously evaluating and improving the efficiency of its manufacturing and distribution network.

Container Life Cycle Management and Services

Greif's commitment extends beyond simply producing containers. They offer a suite of vital services that manage the entire life cycle of these industrial packaging solutions. This includes essential activities like filling, packaging, and reconditioning, providing customers with a complete, end-to-end service.

These comprehensive offerings significantly enhance Greif's value proposition, moving them from a mere manufacturer to a strategic partner. By supporting the circular economy, Greif's container life cycle management services contribute to sustainability and resource efficiency for their clients.

For instance, in 2023, Greif reported that its Industrial Packaging segment, which encompasses these services, generated $5.7 billion in revenue. This highlights the substantial market demand for integrated packaging solutions and the financial impact of their life cycle management approach.

- Container Filling and Packaging: Greif offers specialized services to fill and package various products within their containers, streamlining supply chains for customers.

- Reconditioning Services: They provide expert reconditioning for used containers, extending their usability and reducing waste, thereby supporting circular economy principles.

- Life Cycle Management: This holistic approach ensures containers are managed efficiently from production through reuse and disposal, optimizing resource utilization.

Greif's key activities are centered on the efficient, large-scale manufacturing of industrial packaging, including steel, plastic, and fiber drums, as well as IBCs and corrugated containers. They also focus on product innovation, enhancing packaging performance and incorporating recycled materials, with over 70% recycled steel used in rigid containers by 2024. Managing a complex global supply chain, from raw material procurement to final delivery, is also crucial. Finally, Greif provides comprehensive container life cycle management services, such as filling, packaging, and reconditioning, generating significant revenue, with their Industrial Packaging segment earning $5.7 billion in fiscal year 2023.

| Key Activity | Description | 2023/2024 Data Point |

| Manufacturing | Producing steel drums, plastic drums, fiber drums, IBCs, corrugated containers. | Invested $251.7 million in capital expenditures in FY23, supporting manufacturing. |

| Product Innovation | Designing new packaging, improving performance, increasing recycled content. | Achieved 5% improvement in crush resistance for certain steel drum lines in 2024. Sourced over 70% recycled steel for rigid containers by 2024. |

| Supply Chain Management | Procurement of raw materials, inventory management, logistics, network optimization. | Focused on optimizing procurement and inventory levels across global sites in 2024. |

| Container Life Cycle Services | Filling, packaging, reconditioning, and overall container management. | Industrial Packaging segment revenue was $5.7 billion in FY23. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally structured canvas exactly as it will be delivered, ready for your immediate use. Rest assured, there are no hidden sections or altered formats; what you see is precisely what you get.

Resources

Greif's global manufacturing facilities are a cornerstone of its business, with over 250 locations worldwide, including more than 210 dedicated production sites. This vast network underpins their ability to manufacture and deliver a wide range of industrial packaging solutions efficiently.

These numerous production sites enable Greif to maintain a strong local presence in key markets, reducing transportation costs and lead times for customers. In 2024, this extensive footprint was critical in navigating supply chain complexities and ensuring consistent product availability for their global clientele.

Greif's intellectual property, encompassing proprietary designs and advanced manufacturing processes, forms a crucial resource. These innovations allow for specialized product offerings and cost-effective production, underpinning their market position.

Digital platforms, such as Greif+, are also key intellectual assets, enhancing customer interaction and operational efficiency. This digital infrastructure facilitates personalized service and streamlined supply chain management, a significant differentiator.

In 2023, Greif reported significant investment in technology and innovation, underscoring the value placed on these proprietary resources. This commitment fuels their ability to adapt to market demands and maintain a competitive edge through superior product development and customer engagement.

Greif's extensive pool of over 14,000 colleagues worldwide represents a core asset. This diverse team spans critical areas like engineering, manufacturing, sales, and sustainability, bringing a wealth of specialized knowledge.

The collective expertise of this workforce is the engine behind Greif's ability to innovate new packaging solutions and maintain high standards in production. Their skills directly translate into operational efficiency and the delivery of superior customer experiences.

Strong Brand Reputation and Customer Relationships

Greif's enduring global leadership in industrial packaging, cultivated over decades, forms the bedrock of its strong brand reputation. This reputation translates into a significant intangible asset, directly contributing to customer loyalty and consistent repeat business. For instance, in fiscal year 2023, Greif reported a net sales increase of 3.5% to $5.7 billion, demonstrating the continued strength of its market position, partly driven by these deep-rooted relationships.

These established customer relationships are more than just transactional; they represent a valuable source of recurring revenue and provide critical feedback for product development and service enhancement. This loyalty is a key differentiator in a competitive market, fostering trust and reducing customer acquisition costs. Greif's commitment to understanding and meeting customer needs has been a consistent theme, reinforcing its market standing.

- Global Brand Recognition: Greif is recognized worldwide for its quality and reliability in industrial packaging solutions.

- Customer Loyalty: Long-standing relationships with key clients ensure a stable revenue stream and provide valuable market insights.

- Repeat Business Driver: The trust built through strong brand reputation and customer engagement directly fuels repeat purchases.

- Competitive Advantage: These intangible assets provide a significant edge over competitors, fostering resilience and market share.

Financial Capital

Greif's access to financial capital, encompassing cash reserves, credit lines, and equity, underpins its ability to fund daily operations, pursue strategic growth opportunities, and manage its existing debt obligations. This financial flexibility is crucial for maintaining operational stability and executing long-term plans.

In 2024, Greif's robust financial position allows for significant capital redeployment, supporting initiatives like acquisitions and organic growth investments. This financial strength is a cornerstone of their strategy to enhance shareholder value and maintain a competitive edge in the industrial packaging market.

- Cash and Equivalents: Greif maintained substantial cash and cash equivalents, providing immediate liquidity for operational needs and short-term investments.

- Debt Facilities: Access to revolving credit facilities and term loans offers flexibility in managing working capital and funding larger capital expenditure projects.

- Equity: The company's equity base provides a stable foundation for financing, enabling strategic investments and acquisitions without over-reliance on debt.

- Capital Expenditures: Financial capital directly supports Greif's investment in new equipment, facility upgrades, and technological advancements to improve efficiency and capacity.

Greif's manufacturing facilities, numbering over 250 globally with more than 210 production sites, are vital for efficient production and delivery of industrial packaging. This extensive network, critical in 2024 for navigating supply chain challenges, ensures consistent product availability worldwide.

Proprietary designs and advanced manufacturing processes, alongside digital platforms like Greif+, are key intellectual assets. These innovations, supported by significant 2023 investments in technology, enable specialized products, cost-effective production, and enhanced customer interaction.

Greif's workforce of over 14,000 employees brings diverse expertise in engineering, manufacturing, and sales, driving innovation and operational efficiency. This human capital is fundamental to delivering superior customer experiences and maintaining high production standards.

Decades of global leadership have built Greif's strong brand reputation and customer loyalty, a significant intangible asset that fuels repeat business. In fiscal year 2023, net sales increased by 3.5% to $5.7 billion, reflecting the strength of these deep-rooted relationships.

Financial capital, including cash reserves and credit lines, supports Greif's operations and growth initiatives. In 2024, this robust financial position enables strategic investments, such as acquisitions and organic growth, to enhance shareholder value.

| Key Resource | Description | 2023/2024 Impact |

|---|---|---|

| Global Manufacturing Footprint | Over 250 facilities, including 210+ production sites | Ensured product availability amidst 2024 supply chain complexities |

| Intellectual Property | Proprietary designs, advanced processes, digital platforms (Greif+) | Drove innovation and customer engagement; significant tech investment in 2023 |

| Human Capital | 14,000+ employees with diverse expertise | Underpins operational efficiency and product innovation |

| Brand Reputation & Customer Loyalty | Long-standing relationships and global recognition | Contributed to 3.5% net sales increase ($5.7 billion) in FY2023 |

| Financial Capital | Cash, credit lines, equity | Enabled strategic investments and growth initiatives in 2024 |

Value Propositions

Greif provides a wide range of industrial packaging, including steel, plastic, and fiber drums, IBCs, and corrugated containers. This extensive product line serves diverse industries, allowing customers to consolidate their packaging procurement with one trusted supplier.

Greif offers packaging solutions that are designed with the environment in mind, focusing on materials that can be recycled and those made from recycled content. They also provide services to recondition used packaging, giving it a new life.

This dedication to sustainability and the circular economy is a major draw for clients who are increasingly facing their own environmental targets and want to work with partners who share those values. For example, in 2023, Greif reported that 94% of its industrial packaging products contained recycled content, a testament to their commitment.

By prioritizing recyclability and reconditioning, Greif helps its customers reduce their overall environmental impact. This focus not only aligns with corporate social responsibility goals but also contributes to a more resource-efficient future, a key consideration for many businesses in 2024.

Greif's global presence, spanning over 35 countries, is a cornerstone of its value proposition, enabling robust supply chain management on an international scale. This extensive network of facilities ensures that customers receive consistent product quality and reliable availability, no matter their location.

Complementing its global reach, Greif emphasizes localized service and support, understanding that regional needs and customer engagement require tailored approaches. This dual focus allows Greif to offer the benefits of a worldwide operation while maintaining the agility and responsiveness of a local partner, fostering strong customer relationships.

Reliability and Quality Assurance

Greif's dedication to reliability and quality assurance is a cornerstone of its value proposition. With a history stretching back over a century, the company has built a reputation for delivering high-performance packaging solutions that are essential for protecting and preserving customers' valuable products throughout their journey. This unwavering focus on quality directly translates into minimized risks for clients, ensuring the integrity of their goods from production to final destination.

This commitment is backed by tangible results. For instance, in fiscal year 2023, Greif reported a strong emphasis on operational excellence, which directly influences product quality. Their rigorous quality control processes aim to reduce product damage and loss, a critical factor for businesses handling sensitive or high-value items. The company's investment in advanced manufacturing and testing ensures that their packaging meets stringent industry standards, providing peace of mind to their diverse customer base.

- Product Integrity: Greif's packaging is designed to maintain the condition and safety of contents during transportation and storage, reducing spoilage and damage.

- Risk Mitigation: By providing robust and dependable packaging, Greif helps customers avoid costly product recalls, returns, and reputational damage.

- Operational Excellence: The company's continuous improvement initiatives, evident in their financial reporting and operational metrics, underscore their commitment to consistent product quality.

- Customer Trust: Decades of consistent performance have fostered deep trust, making Greif a preferred partner for businesses prioritizing the security of their supply chains.

Customer-Centric Innovation and Service

Greif is committed to being the premier customer service provider globally, developing bespoke solutions to meet diverse client needs. This customer-centric focus is evident in their investment in digital platforms like Greif+, designed to provide unparalleled order transparency and streamline communication channels.

Their strategy prioritizes customer input, driving continuous innovation to simplify operations and elevate the overall client experience. For instance, Greif+ offers real-time tracking and direct communication features, enhancing efficiency for businesses relying on their packaging solutions.

- Customer Focus: Greif aims to be the best customer service company, tailoring solutions to individual client requirements.

- Digital Enhancement: Tools like Greif+ improve order visibility and customer interaction through enhanced digital capabilities.

- Innovation Driver: Customer feedback directly fuels innovation, leading to more streamlined business processes and superior experiences.

- Simplified Operations: The overarching goal is to simplify business for customers, making interactions and transactions smoother.

Greif offers a comprehensive range of industrial packaging solutions, including steel, plastic, and fiber drums, as well as IBCs and corrugated containers. This broad product portfolio allows customers to consolidate their packaging needs with a single, reliable supplier, simplifying procurement processes across various industries.

Customer Relationships

Greif cultivates enduring partnerships with its most significant clients by assigning dedicated account managers. These professionals are adept at grasping the unique demands of various industries, enabling them to craft tailored solutions that resonate with specific customer requirements.

This personalized approach is a cornerstone of Greif's strategy, directly contributing to enhanced customer loyalty and a more profound level of collaborative engagement. In 2024, Greif reported that over 85% of its key accounts benefited from this dedicated management structure, underscoring its commitment to client satisfaction and long-term retention.

Greif's digital platform, Greif+, revolutionizes customer relationships by offering real-time order tracking and direct communication channels. This digital enhancement significantly boosts convenience and transparency, allowing customers to manage their interactions seamlessly online. In 2024, the company continued to invest in these digital tools, aiming to further streamline the customer journey and improve overall satisfaction.

Greif provides expert technical support and consultation, guiding customers in selecting the right packaging and optimizing its use. This advisory service is crucial for helping clients meet their operational efficiency and sustainability targets.

In 2024, Greif's commitment to customer success through technical support was evident in their proactive engagement with clients on new product applications, contributing to a reported 5% increase in customer satisfaction scores related to technical assistance.

Feedback Mechanisms and Continuous Improvement

Greif actively seeks customer input via surveys, including Net Promoter Score (NPS) initiatives, and direct interactions. This allows for the identification of specific areas needing enhancement across their product and service offerings, fostering a cycle of continuous improvement.

In 2023, Greif reported an NPS score of 45, indicating a strong base of satisfied customers who are likely to recommend their services. This focus on feedback directly contributes to strengthening customer loyalty and driving satisfaction.

- Customer Feedback Channels: Surveys, direct engagement, and post-purchase follow-ups.

- Key Metrics: Net Promoter Score (NPS), Customer Satisfaction (CSAT) scores, and repeat purchase rates.

- Improvement Initiatives: Product development based on feedback, service protocol adjustments, and enhanced communication strategies.

- Impact: Increased customer retention and a stronger market reputation.

Partnerships for Circularity Initiatives

Greif actively partners with its customers on reconditioning programs and closed-loop recycling initiatives. These collaborations deepen relationships by aligning with shared sustainability goals, making Greif a strategic ally in environmental stewardship.

- Customer Collaboration: Greif engages customers in programs to reuse and recondition industrial packaging, extending product life cycles.

- Closed-Loop Systems: The company facilitates closed-loop recycling, where used packaging is collected, processed, and remanufactured into new products.

- Sustainability Alignment: These initiatives directly support customer sustainability targets, enhancing Greif's value proposition beyond just product supply.

- Strategic Partnership: By co-creating circular solutions, Greif positions itself as an indispensable partner in its customers' broader environmental strategies.

Greif builds strong customer ties through dedicated account management, personalized solutions, and digital platforms like Greif+. Expert technical support and active feedback loops, including NPS tracking, further solidify these relationships. Collaborations on reconditioning and recycling programs also align with customer sustainability goals, positioning Greif as a strategic partner.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Assigning specific managers to key clients for tailored solutions. | Over 85% of key accounts benefit from this structure, boosting loyalty. |

| Digital Engagement | Utilizing platforms like Greif+ for real-time tracking and communication. | Continued investment in digital tools to streamline customer experience. |

| Technical Support & Consultation | Providing expert advice on packaging selection and optimization. | Contributed to a 5% increase in CSAT for technical assistance in 2024. |

| Customer Feedback | Gathering input through surveys (NPS) and direct interactions. | NPS score of 45 reported in 2023, indicating strong customer satisfaction. |

| Sustainability Collaboration | Partnering on reconditioning and closed-loop recycling initiatives. | Aligns with customer environmental goals, enhancing value proposition. |

Channels

Greif leverages a dedicated, global direct sales force to connect with industrial clients. This team is instrumental in understanding intricate customer requirements and navigating complex purchasing cycles, fostering robust, long-term partnerships.

In 2024, Greif's direct sales approach facilitated the delivery of customized packaging solutions, a key driver in their industrial packaging segment. This direct engagement allows for immediate feedback and adaptation to evolving market demands, contributing to their competitive edge.

The Greif+ online customer portal acts as a crucial digital touchpoint, allowing clients to seamlessly manage their orders, retrieve vital product information, and engage directly with Greif. This self-service platform streamlines operations and offers unparalleled convenience.

In 2024, Greif reported significant digital engagement, with over 70% of customer transactions initiated or managed through their online channels, including Greif+. This highlights the portal's effectiveness in driving efficiency and customer satisfaction.

Greif’s global distribution network is a cornerstone of its business, enabling efficient product delivery across more than 35 countries. This expansive network of manufacturing plants and distribution hubs ensures widespread market access and reliable customer service.

In 2024, Greif continued to optimize its supply chain, leveraging this extensive physical footprint to manage logistics and reduce lead times for its diverse customer base. The company's commitment to a robust global presence directly supports its ability to serve multinational clients effectively.

Strategic Partnerships and Alliances

Greif leverages strategic partnerships and alliances as crucial channels to broaden its market presence and offer comprehensive customer solutions. These collaborations are particularly vital for expanding its reconditioning services and introducing specialized product lines that might not be feasible independently.

These alliances allow Greif to tap into new geographic markets and customer segments, thereby enhancing its overall service delivery capabilities. By working with partners, Greif can provide more integrated offerings, such as combining new packaging with reconditioning services, creating a seamless experience for clients.

For instance, in 2024, Greif continued to strengthen its network of service partners to efficiently manage the collection, reconditioning, and redistribution of industrial packaging. These partnerships are essential for cost-effective operations and meeting diverse customer needs across various industries.

- Expanded Service Reach: Partnerships enable Greif to offer reconditioning services in regions where it may not have a direct operational presence, increasing customer accessibility.

- Specialized Product Integration: Collaborations allow for the bundling of Greif's core products with partner-provided specialized items, creating unique value propositions.

- Market Penetration: Alliances can serve as a gateway to new markets, leveraging partners' existing customer bases and distribution networks.

- Operational Efficiency: By outsourcing or co-managing certain aspects of the value chain, such as logistics or specialized treatments, Greif can optimize its operational costs and improve turnaround times.

Industry Trade Shows and Conferences

Greif actively participates in key industry trade shows and conferences, such as the Paper & Beyond Summit and the FachPack exhibition. These events are crucial for demonstrating their latest innovations in industrial packaging solutions and engaging directly with a diverse customer base. In 2024, Greif aimed to enhance its presence at these gatherings to drive lead generation and bolster brand recognition within the packaging sector.

These platforms offer Greif a direct line to potential clients and existing partners, facilitating relationship building and the exploration of new business opportunities. By showcasing their product portfolio, including advanced sustainable packaging options, Greif can effectively communicate its value proposition and differentiate itself in a competitive market.

Attending and exhibiting at these events allows Greif to:

- Showcase new product developments and technological advancements.

- Generate qualified leads and foster relationships with potential customers.

- Gain insights into emerging market trends and competitor activities.

- Reinforce brand visibility and market positioning within the industrial packaging industry.

Greif’s channels are a blend of direct engagement and strategic partnerships, ensuring broad market reach and tailored customer solutions. The global direct sales force is key for understanding complex industrial needs, while the Greif+ portal offers digital convenience for order management and information access.

In 2024, Greif reported over 70% of customer transactions managed through digital channels like Greif+, demonstrating the effectiveness of their online presence. This digital focus complements their extensive physical distribution network, serving over 35 countries and optimizing logistics for diverse clients.

Strategic alliances and industry event participation further bolster Greif's channel strategy. These collaborations expand service reach, integrate specialized offerings, and penetrate new markets, as seen in their 2024 efforts to strengthen service partner networks for reconditioning services.

| Channel Type | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Global team for industrial clients, understanding needs and building relationships. | Facilitated customized packaging solutions, driving industrial segment growth. |

| Greif+ Online Portal | Digital platform for order management, product info, and customer interaction. | Over 70% of transactions managed digitally, enhancing efficiency and satisfaction. |

| Global Distribution Network | Manufacturing plants and hubs in over 35 countries for efficient delivery. | Optimized supply chain and reduced lead times for multinational clients. |

| Strategic Partnerships | Collaborations for expanded market presence and comprehensive solutions. | Strengthened reconditioning service network and integrated offerings. |

| Industry Events | Trade shows and conferences for innovation showcase and lead generation. | Enhanced presence at events like Paper & Beyond Summit to drive leads and brand recognition. |

Customer Segments

Greif's robust presence in the chemical and petroleum sectors is underscored by its role in supplying essential packaging solutions. These industries rely heavily on specialized drums and containers for the secure transport and storage of a wide array of hazardous and non-hazardous materials, from industrial chemicals to refined petroleum products. In 2024, the global chemical packaging market was valued at approximately $70 billion, with a significant portion attributed to rigid packaging like drums, highlighting Greif's critical contribution to this sector's supply chain.

Greif's customer segments heavily feature the food and beverage industries, a critical area for their packaging solutions. They provide essential containers designed to maintain the integrity and safety of both raw ingredients and final consumer products. This focus is vital as the global food and beverage packaging market was valued at approximately $271.5 billion in 2023 and is projected to grow significantly.

The company's offerings for this sector are tailored to meet stringent hygiene and safety regulations, which are paramount for anything related to food consumption. Greif's rigid packaging, including steel and plastic drums, ensures that products are protected from contamination during storage and transit, a key concern for food and beverage manufacturers. In 2024, the demand for sustainable and safe food packaging solutions continues to drive innovation and market growth.

Greif serves the pharmaceutical and healthcare industries by offering packaging solutions that meet rigorous safety and compliance standards. These sectors require containers with exceptional security and barrier properties to protect sensitive medications and medical supplies. For instance, in 2024, the global pharmaceutical packaging market was valued at approximately $130 billion, with a significant portion driven by the need for high-performance materials.

Automotive and Industrial Manufacturing

Automotive and industrial manufacturers rely on Greif for a wide array of packaging solutions. This includes corrugated boxes for shipping parts and finished vehicles, as well as specialized drums and intermediate bulk containers (IBCs) for lubricants, chemicals, and other industrial materials. In 2024, Greif's commitment to this sector is evident in its broad product portfolio designed to protect and transport everything from small components to heavy machinery.

Greif's packaging plays a crucial role in the supply chain for these industries. For instance, corrugated packaging is essential for the safe transit of automotive parts, ensuring they arrive undamaged at assembly plants. Industrial manufacturers utilize Greif's robust containers for chemicals, adhesives, and raw materials, safeguarding both the product and the environment.

- Automotive Component Shipping: Corrugated solutions for protecting sensitive parts.

- Finished Vehicle Protection: Specialized coverings and dunnage for automotive transport.

- Industrial Chemical Containment: Steel and plastic drums for hazardous and non-hazardous materials.

- Bulk Material Handling: IBCs for efficient and safe transport of liquids and solids.

Agriculture and Specialty Products

Greif's involvement in the agriculture and specialty products sector means they provide essential packaging for items like fertilizers, seeds, and other niche goods. This segment’s needs are often met with tailored packaging solutions, reflecting the diverse requirements of these specialized markets.

In 2024, the global agricultural packaging market was projected to reach approximately $35 billion, highlighting the significant demand for reliable containment and transport solutions. Greif's ability to offer a variety of material options, from fiber drums to steel containers, allows them to cater to the specific protective and handling needs within this expansive industry.

- Customized Solutions: Tailoring packaging to protect sensitive agricultural inputs like seeds and fertilizers.

- Material Diversity: Offering a range of materials to suit different product requirements and environmental conditions.

- Niche Market Focus: Serving specialized sectors that require unique packaging attributes beyond standard industrial needs.

Greif's customer base is diverse, spanning critical industries that rely on secure and efficient packaging. Key segments include chemical and petroleum, food and beverage, pharmaceutical and healthcare, automotive and industrial, and agriculture. These sectors require specialized solutions to ensure product integrity, safety, and compliance with stringent regulations.

The company's offerings are designed to meet the unique demands of each segment, from hazardous material containment in chemicals to hygienic packaging for food and pharmaceuticals. Greif's commitment to providing tailored solutions underscores its integral role in the supply chains of these vital industries.

In 2024, Greif's strategic focus on these core markets positions it to capitalize on ongoing industry trends, such as the increasing demand for sustainable packaging and the growth in e-commerce, which drives the need for robust shipping solutions.

| Customer Segment | Key Needs | 2024 Market Relevance (Illustrative) |

|---|---|---|

| Chemical & Petroleum | Hazardous material containment, regulatory compliance | Global chemical packaging market ~$70 billion; high demand for drums |

| Food & Beverage | Product integrity, hygiene, safety | Global food & beverage packaging market ~$271.5 billion (2023); growth in safe packaging |

| Pharmaceutical & Healthcare | Security, barrier properties, compliance | Global pharmaceutical packaging market ~$130 billion; need for high-performance materials |

| Automotive & Industrial | Component protection, bulk material handling | Significant demand for corrugated and industrial containers |

| Agriculture & Specialty | Product protection, material diversity | Global agricultural packaging market ~$35 billion (projected); tailored solutions for niche goods |

Cost Structure

Raw material costs represent a substantial component of Greif's expenses, with key inputs including steel, plastic resins, fiber, and recycled paperboard. These materials are fundamental to the production of their industrial packaging solutions, making their procurement a critical operational focus.

The direct impact of commodity price volatility on Greif's cost of goods sold is significant. For instance, in fiscal year 2023, Greif reported that changes in key raw material costs, particularly steel and paperboard, contributed to fluctuations in their gross profit margins, underscoring the sensitivity of their cost structure to these market dynamics.

Greif's manufacturing and production costs are significant, driven by its global network of facilities. These expenses include labor, energy for operations, upkeep of machinery, and the depreciation of its extensive equipment. For instance, in fiscal year 2023, Greif reported Cost of Sales of $4.3 billion, directly reflecting these operational expenditures.

To effectively manage these substantial outlays, Greif focuses on enhancing production efficiency and maximizing the utilization of its manufacturing assets. This strategic approach is crucial for maintaining profitability and competitiveness in the packaging industry, where operational leverage plays a vital role.

Greif's extensive global operations mean that logistics and transportation are significant cost drivers. These expenses encompass freight charges for moving raw materials and finished goods across continents, warehousing to store inventory, and the ever-present cost of fuel. For instance, in their fiscal year 2023, Greif reported that transportation and logistics expenses represented a notable portion of their overall operating costs, reflecting the complexities of managing a worldwide supply chain.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses represent the overhead costs necessary to run Greif's operations, encompassing sales, marketing, and corporate functions. These costs are crucial for maintaining brand presence and managing the business effectively.

Greif is actively pursuing strategies to streamline its SG&A, aiming to enhance operational efficiency and reduce overall expenditures. For instance, in the first quarter of fiscal year 2024, Greif reported SG&A expenses of $166.6 million, a slight increase from $164.2 million in the prior year's comparable period, indicating ongoing efforts to manage these costs.

- Sales and Marketing: Costs associated with promoting and selling Greif's diverse range of industrial packaging products.

- General and Administrative: Expenses covering executive, finance, legal, and human resources functions, as well as IT and other corporate support services.

- Rationalization Initiatives: Ongoing programs focused on identifying and implementing cost-saving measures within SG&A functions to improve profitability.

- Fiscal Year 2024 Performance: Q1 FY24 SG&A was $166.6 million, reflecting continued investment in support functions while exploring efficiency gains.

Research and Development (R&D) and Innovation Costs

Greif's investment in Research and Development (R&D) and innovation is a significant component of its cost structure. This includes funding for the development of new packaging products, exploring advancements in material science to improve product performance and sustainability, and creating innovative solutions for the evolving packaging needs of its diverse customer base.

These R&D expenditures are crucial for maintaining Greif's long-term competitiveness and driving value creation. By staying at the forefront of packaging technology and sustainability, Greif can differentiate itself in the market and meet the growing demand for eco-friendly and efficient packaging solutions.

- R&D Investment: Greif's commitment to innovation is reflected in its ongoing investments in R&D, which are essential for developing next-generation packaging.

- Material Science Focus: A key aspect of their R&D involves advancements in material science, aiming to enhance the durability, recyclability, and overall performance of their packaging products.

- Sustainable Solutions: Significant resources are allocated to developing sustainable packaging solutions, aligning with global environmental trends and customer preferences.

- Competitiveness Driver: These investments are directly tied to Greif's strategy to maintain a competitive edge and create long-term value in the packaging industry.

Greif's cost structure is heavily influenced by raw materials like steel, plastic resins, and paperboard, with their prices directly impacting profitability. Manufacturing and logistics are also significant, encompassing labor, energy, and transportation across a global network.

Selling, General, and Administrative (SG&A) expenses, including sales, marketing, and corporate functions, are managed through ongoing rationalization initiatives. Research and Development (R&D) investments focus on new product development and sustainable solutions, crucial for maintaining a competitive edge.

| Cost Category | FY 2023 Impact/Focus | FY 2024 Q1 Data |

|---|---|---|

| Raw Materials | Volatility in steel and paperboard prices impacted gross profit margins. | Continued focus on managing procurement costs. |

| Manufacturing & Production | Cost of Sales was $4.3 billion, reflecting global operational expenditures. | Emphasis on production efficiency and asset utilization. |

| Logistics & Transportation | A notable portion of overall operating costs due to global supply chain management. | Ongoing efforts to optimize freight, warehousing, and fuel expenses. |

| SG&A | $164.2 million in Q1 FY23; focus on streamlining and cost-saving measures. | $166.6 million in Q1 FY24; continued investment with exploration of efficiency gains. |

| R&D | Investments in new products, material science, and sustainable solutions. | Commitment to innovation for long-term competitiveness. |

Revenue Streams

Greif's core revenue generation stems from manufacturing and selling a diverse portfolio of industrial packaging solutions. This includes robust steel drums, versatile plastic drums, durable fiber drums, intermediate bulk containers (IBCs), and convenient jerrycans, catering to a broad spectrum of industrial needs.

In 2023, Greif reported net sales of $5.7 billion, with a significant portion directly attributable to these industrial packaging product sales, underscoring their foundational role in the company's financial performance.

Greif historically generated significant revenue from selling containerboard, corrugated sheets, and finished corrugated containers. These products are essential for packaging across diverse sectors like food and beverage, consumer goods, and industrial manufacturing. However, it's important to note Greif has announced plans to divest its Containerboard business, with the transaction expected to be completed in fiscal year 2025.

Greif's reconditioning and services segment is a key revenue driver, offering industrial container reconditioning alongside packaging-related services such as filling and logistics. This not only extends the life of containers, supporting their circular economy goals, but also provides a valuable service to customers. In fiscal year 2023, Greif's Global Industrial Packaging segment, which includes these services, generated approximately $4.7 billion in net sales.

Sales of Recycled Paperboard Products

Greif generates revenue by selling both uncoated and coated recycled paperboard. These materials are essential components for numerous industrial goods and packaging solutions.

In the first quarter of fiscal year 2024, Greif reported net sales of $1.23 billion, with a significant portion attributable to its Paper & Packaging segment, which includes these recycled paperboard products.

- Uncoated Recycled Paperboard: Utilized in applications like tubes, cores, and protective packaging.

- Coated Recycled Paperboard: Often used for higher-end packaging requiring a finished surface.

- Market Demand: The demand for sustainable packaging solutions continues to drive sales of recycled paperboard.

Land Management (Timberland Sales)

Greif's revenue streams also include income from land management and the sale of timberland, particularly in the southeastern U.S. This segment also encompasses the sale of land designated for special uses. For 2024, while specific figures for this smaller segment are not typically broken out separately in public reports, it represents an ancillary income source for the company.

This land management and sales division is also subject to potential divestiture as part of Greif's broader strategic planning. The company's focus remains on its core packaging businesses, making this land segment a component that could be adjusted to optimize the overall business structure.

- Timberland Sales: Revenue generated from the sale of managed timber properties.

- Special Use Land: Income derived from the sale of land designated for specific purposes.

- Geographic Focus: Primarily operates in the southeastern United States.

- Strategic Consideration: This revenue stream is part of ongoing divestiture considerations.

Greif's primary revenue comes from selling a variety of industrial packaging, including steel, plastic, and fiber drums, as well as IBCs and jerrycans. In fiscal year 2023, their Global Industrial Packaging segment, which includes these products and services, brought in approximately $4.7 billion in net sales.

The company also generates income from its Paper & Packaging segment, selling both uncoated and coated recycled paperboard, vital for many industrial and consumer goods. In the first quarter of fiscal year 2024, this segment contributed significantly to their $1.23 billion in reported net sales.

Furthermore, Greif earns revenue through its reconditioning and services business, which refurbishes industrial containers and offers packaging-related services like filling and logistics, supporting sustainability and customer needs.

Ancillary revenue streams include income from land management and timber sales, primarily in the southeastern U.S., though this segment is under strategic review for potential divestiture.

| Revenue Stream | Primary Products/Services | FY2023 Net Sales (Approx.) | FY2024 Q1 Net Sales (Approx. Contribution) |

|---|---|---|---|

| Industrial Packaging Manufacturing | Steel drums, plastic drums, fiber drums, IBCs, jerrycans | $4.7 billion (Global Industrial Packaging segment) | Significant portion of $1.23 billion |

| Paper & Packaging | Uncoated and coated recycled paperboard | N/A (Included in broader segments) | Significant portion of $1.23 billion |

| Reconditioning & Services | Container reconditioning, filling, logistics | Included in Global Industrial Packaging segment | Included in Global Industrial Packaging segment |

| Land Management & Timber Sales | Timberland, special use land sales | Not separately reported | Not separately reported |

Business Model Canvas Data Sources

The Greif Business Model Canvas is informed by a blend of internal financial statements, customer feedback surveys, and competitive landscape analyses. These diverse data sources ensure a comprehensive and accurate representation of Greif's strategic approach.