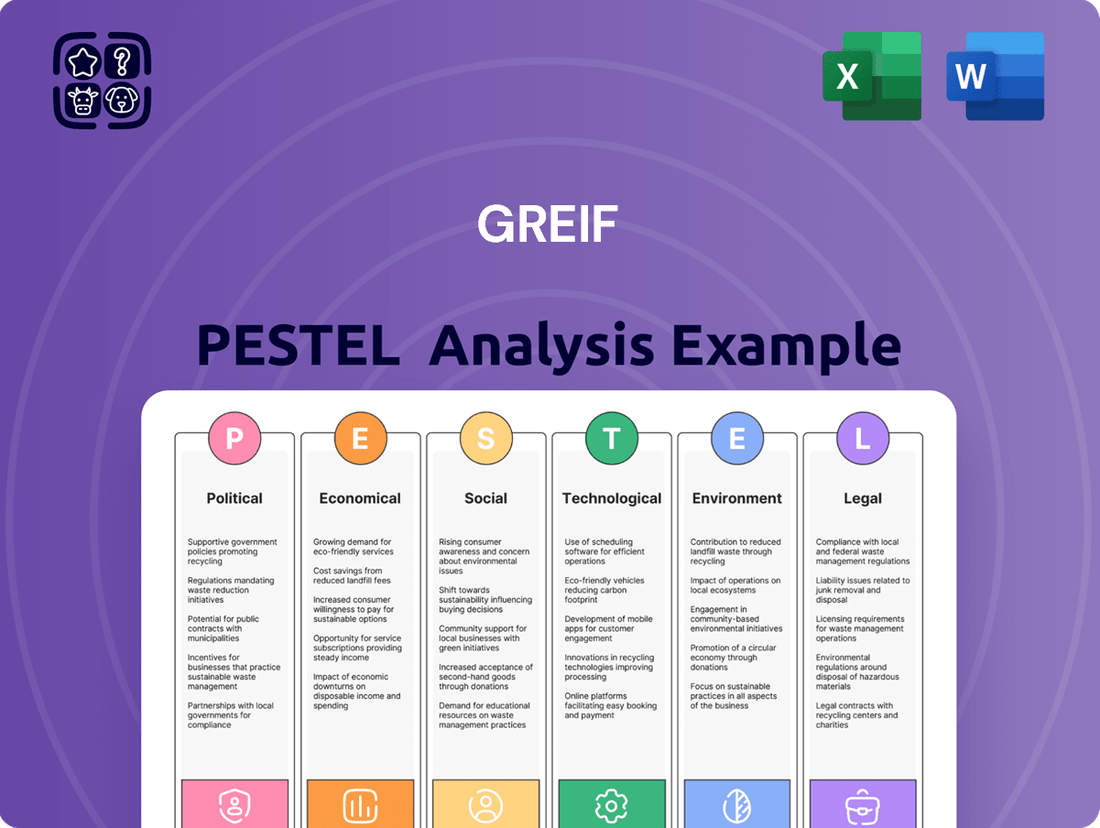

Greif PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

Uncover the intricate web of external forces shaping Greif's destiny with our meticulously crafted PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the critical factors driving the company's performance and future trajectory. Equip yourself with actionable intelligence to navigate market complexities and secure a competitive advantage. Download the full analysis now and gain the strategic clarity you need to thrive.

Political factors

Greif's global presence means it's highly sensitive to evolving trade policies and tariffs. While Greif often localizes sourcing and production, changes in international trade agreements or new tariffs could increase raw material costs or hinder efficient service to international clients. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which, while not directly on packaging, impacted the cost of steel used in some industrial packaging components, a factor that remains relevant in ongoing trade discussions.

Governments globally enforce strict manufacturing and safety regulations, particularly for industrial packaging that may transport hazardous materials. Greif must comply with standards like UN/DOT regulations, ensuring their products meet demanding performance and safety benchmarks.

Adherence to these rules involves continuous testing and meticulous documentation to maintain certifications and prevent operational interruptions. For instance, in 2024, the European Union continued to update its REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, impacting the materials used in packaging and requiring extensive data submission from manufacturers like Greif to ensure product safety and environmental compliance.

Greif's extensive operations across more than 35 countries mean that political stability in these diverse regions is a critical consideration. Geopolitical tensions, instances of political unrest, or sudden shifts in governmental policies can significantly disrupt established supply chains, alter market demand dynamics, and introduce substantial operational hurdles for the company.

The company's broad global presence demands constant vigilance and thorough monitoring of evolving political landscapes to effectively identify and mitigate potential risks. For instance, in 2024, ongoing geopolitical conflicts in Eastern Europe continue to pose challenges to international trade and manufacturing, impacting raw material availability and logistics for companies with a global footprint like Greif.

Government Support for Sustainable Practices

Governments worldwide are increasingly incentivizing sustainable manufacturing and circular economy practices. Greif’s focus on increasing recycled content in its packaging, aiming for 50% recycled content across its global portfolio by 2030, directly aligns with these policy directions. This alignment could lead to favorable regulations and potential financial benefits from government support programs.

These supportive policies can manifest in various forms, such as tax credits for green investments, grants for waste reduction technologies, and preferential treatment for companies demonstrating strong environmental, social, and governance (ESG) performance. Greif’s engagement in initiatives like virtual power purchase agreements (VPPAs) to secure renewable energy further positions it to capitalize on governmental pushes for decarbonization, with renewable energy accounting for approximately 30% of Greif's electricity consumption in fiscal year 2023.

- Government Incentives: Policies like the Inflation Reduction Act in the US offer tax credits for renewable energy and sustainable manufacturing, directly benefiting companies like Greif investing in these areas.

- Circular Economy Focus: Many nations are enacting legislation promoting recycled content and waste reduction, creating a favorable market for Greif's sustainable packaging solutions.

- Renewable Energy Adoption: Government support for renewable energy procurement, such as through VPPAs, helps companies like Greif reduce their carbon footprint and operational costs.

- ESG Reporting Standards: Increasing governmental emphasis on ESG reporting encourages transparency and can lead to better access to capital for companies with strong sustainability credentials.

Industry-Specific Regulations and Standards

The industrial packaging sector, including companies like Greif, operates under a stringent framework of industry-specific regulations. These rules dictate acceptable materials, product performance standards, and crucial waste management practices. For instance, regulations around recycled content and packaging sustainability are constantly evolving, impacting manufacturing processes and material sourcing.

Greif's Global Regulatory Steering Committee plays a vital role in anticipating and adapting to these changes. This committee actively monitors emerging regulations across its global operations, developing strategic responses to ensure ongoing compliance. By staying ahead of regulatory shifts, Greif aims to minimize operational disruptions and maintain its competitive edge in the market.

- Material Compliance: Adherence to regulations on virgin vs. recycled content, chemical restrictions (e.g., REACH in Europe), and food-grade certifications.

- Product Safety Standards: Meeting specifications for strength, durability, and containment, particularly for hazardous materials transport, often guided by UN recommendations.

- Environmental Regulations: Compliance with waste reduction targets, recycling mandates, and emissions standards related to manufacturing processes.

- Global Harmonization Efforts: Monitoring and adapting to efforts to align packaging regulations across different economic blocs to simplify international trade.

Political stability across Greif's operational regions is paramount, as geopolitical tensions and policy shifts can disrupt supply chains and market demand. For example, ongoing global conflicts in 2024 continue to present logistical challenges and impact raw material availability for multinational corporations. Governments worldwide are also increasingly promoting sustainable practices, with many nations enacting legislation to boost recycled content and reduce waste, creating a favorable market for Greif's eco-friendly packaging solutions.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Greif across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A clear, actionable breakdown of external factors impacting Greif, enabling proactive strategy development and mitigating potential disruptions.

Economic factors

Greif's performance is closely linked to the health of global industrial production. When factories are churning out more goods, the demand for packaging like steel drums, plastic drums, and fiber drums naturally increases. This is a fundamental driver for their business.

Looking ahead, Greif anticipates a challenging environment. They project continued industrial contraction through fiscal year 2025, meaning they aren't seeing signs of a significant pickup in demand for their products. This forecast suggests that volumes across their entire product portfolio, from steel and plastic drums to containerboard, could face pressure.

Greif's profitability is significantly tied to the cost of essential inputs like steel, plastic resins, and fiber. While some forecasts suggest price stability, the company has indeed navigated periods of elevated raw material expenses, which have put pressure on its gross profit margins.

For instance, in fiscal year 2023, Greif reported that higher input costs, particularly for corrugated medium and recycled fiber, contributed to a decline in its Paper Packaging & Services segment's gross profit margin, even as sales volume increased.

Effectively managing these fluctuating costs through strategic sourcing and the capacity to adjust selling prices to customers is a critical factor for maintaining and enhancing Greif's financial performance.

Greif's global footprint, spanning over 35 countries, means currency exchange rate fluctuations are a significant economic factor. For instance, if the US dollar strengthens against the Euro, Greif's Euro-denominated sales will translate into fewer dollars, potentially impacting reported revenues.

These shifts can directly affect the company's reported profits when converting foreign currency earnings back to its reporting currency, the US dollar. This volatility requires proactive management.

To counter this, Greif likely employs currency hedging strategies, such as forward contracts, to lock in exchange rates for future transactions. Diversifying revenue streams across various currency zones also helps to naturally mitigate some of this risk.

Economic Growth and GDP Trends

The overall health of the global economy and its GDP growth rates are critical indicators for the industrial packaging sector. As industrial activities pick up pace worldwide, the demand for industrial packaging solutions naturally increases. This trend is expected to continue, with projections pointing towards global economic expansion in both 2024 and 2025, which directly benefits companies like Greif.

The industrial packaging market is poised for growth, fueled by a global uptick in manufacturing and trade. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a steady pace that supports increased industrial output and, consequently, packaging demand.

- Global economic expansion is a key driver for Greif's performance.

- The industrial packaging market size is expected to grow significantly due to rising industrial activities.

- IMF forecasts global GDP growth of 3.2% for 2024, indicating a favorable economic climate.

Acquisitions and Divestitures Impact

Greif's strategic acquisitions and divestitures are reshaping its financial landscape. The acquisition of Ipackchem, completed in early 2024, is expected to significantly boost Greif's global reach and product offerings in the rigid packaging sector. This move, alongside the divestiture of its containerboard business to Packaging Corporation of America for $723 million in late 2023, and the sale of its timberland assets, demonstrates a clear strategy to streamline operations and focus on core, higher-margin businesses.

These portfolio adjustments directly influence Greif's financial performance. The Ipackchem acquisition, valued at approximately €1.1 billion, will undoubtedly impact debt levels and capital structure, while the divestitures aim to improve profitability and reduce financial leverage. For instance, the containerboard divestiture allowed Greif to reduce its net debt and strengthen its balance sheet, freeing up capital for strategic investments in growth areas.

- Acquisition Impact: The Ipackchem acquisition is projected to add approximately $1.5 billion in annual revenue and contribute to earnings per share growth in the first full year.

- Divestiture Proceeds: The sale of the containerboard business generated substantial cash, enabling debt reduction and enhancing financial flexibility.

- Portfolio Optimization: These moves signal a strategic shift towards specialized packaging solutions, potentially leading to improved margins and a more focused business model.

- Debt Management: Greif's commitment to deleveraging is evident through these transactions, aiming to achieve a more robust financial position by mid-2025.

Greif's performance is intrinsically tied to global industrial production and GDP growth. Projections for 2024 and 2025 suggest a favorable economic climate, with the IMF forecasting 3.2% global GDP growth for 2024. This expansion directly fuels demand for Greif's industrial packaging solutions.

However, Greif anticipates continued industrial contraction through fiscal year 2025, indicating potential headwinds for volume growth across its product lines. Fluctuations in raw material costs, such as steel and plastic resins, remain a key economic factor impacting profitability, as seen with increased input expenses affecting margins in fiscal year 2023.

Currency exchange rate volatility is another significant economic consideration given Greif's extensive global operations. Strategic acquisitions, like Ipackchem in early 2024, and divestitures, such as the containerboard business sale in late 2023, are actively reshaping its financial structure and strategic focus.

| Economic Factor | Impact on Greif | 2024/2025 Data/Outlook |

|---|---|---|

| Global GDP Growth | Drives demand for industrial packaging | IMF projects 3.2% global growth in 2024 |

| Industrial Production | Directly correlates with packaging volumes | Anticipated continued industrial contraction through FY2025 |

| Raw Material Costs | Affects gross profit margins | Elevated input costs noted in FY2023; price stability sought |

| Currency Exchange Rates | Impacts reported revenues and profits | Volatility necessitates proactive management and hedging |

| Mergers & Acquisitions | Reshapes financial landscape and strategic focus | Ipackchem acquisition (early 2024) expected to boost revenue; containerboard divestiture (late 2023) reduced debt |

Full Version Awaits

Greif PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Greif PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable insights for strategic planning.

Sociological factors

Greif actively champions diversity, equity, and inclusion (DEI), with a specific goal of achieving global gender pay parity. This commitment isn't just about social responsibility; it's a strategic imperative. For instance, in 2023, Greif reported that women held 33.3% of management positions globally, a figure they are working to increase.

A workforce that truly reflects a variety of backgrounds and perspectives is a powerful engine for innovation. Companies with diverse teams are often better equipped to understand a wider range of customer needs and to develop creative solutions. This focus on inclusion also plays a crucial role in attracting and retaining top talent, as employees increasingly seek out organizations that value their unique contributions, leading to higher engagement and overall job satisfaction.

Consumers and businesses alike are increasingly prioritizing packaging that is both sustainable and environmentally responsible. This shift is driven by a growing awareness of environmental issues and a desire to reduce ecological impact.

Greif is actively responding to this trend by emphasizing products made with recyclable materials and recycled content, implementing circular manufacturing processes, and working to divert waste from landfills. For example, Greif's commitment to sustainability includes increasing the use of post-consumer recycled (PCR) content in its products, with some of its steel drums containing up to 30% PCR steel.

Meeting these evolving customer preferences is not just about environmental responsibility; it's a key factor in ensuring customer satisfaction and maintaining a competitive edge in the market. Companies that fail to adapt to these demands risk losing market share to more eco-conscious competitors.

Greif's commitment to its over 14,000 employees across more than 250 global facilities highlights employee health and safety as a crucial sociological factor. Initiatives like the 'Zero Harm' program are designed to foster a secure workplace, directly impacting employee morale and operational stability.

By investing in comprehensive ethics and compliance training, Greif aims to cultivate a culture of responsibility and well-being. This focus on employee welfare is not just about risk mitigation; it's a strategic element that can boost productivity and reduce costly incidents, contributing to overall business resilience.

Community Engagement and Social Responsibility

Greif demonstrates a strong commitment to community engagement and social responsibility, actively participating in philanthropic efforts and upholding human rights initiatives, as detailed in its recent sustainability reports. This dedication to societal well-being extends beyond its core business, aiming to create a positive impact in the areas where it operates. For instance, in 2023, Greif reported contributing over $1.5 million to various community causes and employee-led volunteer programs, underscoring its investment in local development and social welfare.

Building and maintaining positive community relations is paramount for Greif, as it directly influences brand reputation and fosters stakeholder trust. A strong social license to operate, cultivated through responsible corporate citizenship, can mitigate risks and enhance long-term business sustainability. This approach is increasingly vital in the 2024-2025 period, with heightened public scrutiny on corporate ethical practices and environmental stewardship.

- Community Investment: Greif's 2023 sustainability report noted a total of $1.5 million invested in community programs and philanthropic activities.

- Human Rights Focus: The company has implemented enhanced due diligence processes for human rights across its supply chain, aiming for zero tolerance of forced labor.

- Employee Volunteerism: Greif encourages employee participation in local community initiatives, with over 5,000 volunteer hours logged in 2023.

- Reputation Enhancement: Positive social impact initiatives are directly linked to improved brand perception and stronger relationships with customers and investors.

Labor Relations and Workforce Availability

Greif's global manufacturing presence means its production capacity and cost structure are significantly influenced by labor relations and workforce availability. Potential labor shortages or strong union activity in key operational regions can disrupt supply chains and increase operating expenses. For instance, in 2024, many manufacturing sectors experienced ongoing challenges with skilled labor recruitment, impacting output.

The company's strategic emphasis on colleague engagement and robust talent development programs is designed to mitigate these risks. By fostering a positive work environment and investing in employee training, Greif aims to ensure a stable, skilled workforce capable of meeting production demands. This proactive approach is crucial for maintaining operational efficiency and competitive pricing in the global market.

- Skilled Labor Shortages: Reports from late 2024 indicated persistent shortages in skilled manufacturing roles across North America and Europe, potentially affecting Greif's production capacity.

- Unionization Trends: While specific unionization rates for Greif are proprietary, broader trends in the industrial sector show varying levels of union influence, impacting wage negotiations and work rules.

- Talent Development Investment: Greif's commitment to training and development aims to build a resilient workforce, addressing potential skill gaps and enhancing employee retention to counter labor market volatility.

Greif's dedication to Diversity, Equity, and Inclusion (DEI) is a key sociological driver, with a 2023 report showing 33.3% of global management positions held by women, a metric they are actively working to increase to foster innovation and talent retention.

The company's commitment to employee well-being is evident through its 'Zero Harm' safety program and comprehensive ethics training, aiming to cultivate a secure and productive workplace, which is crucial for operational stability and employee morale.

Greif's significant community investment, totaling over $1.5 million in 2023 for philanthropic efforts and volunteer programs, strengthens its social license to operate and enhances brand reputation in an era of heightened scrutiny on corporate citizenship.

Labor availability and relations are critical, with 2024 data indicating persistent skilled labor shortages in manufacturing sectors, influencing Greif's strategy to invest in talent development and employee engagement to ensure workforce stability.

| Sociological Factor | Greif's Action/Data (2023-2024) | Impact/Strategic Implication |

|---|---|---|

| Diversity & Inclusion | 33.3% of global management positions held by women (2023) | Drives innovation, broadens market understanding, enhances talent attraction. |

| Employee Well-being & Safety | 'Zero Harm' program, ethics training | Improves morale, reduces incidents, enhances productivity and business resilience. |

| Community Engagement | >$1.5 million invested in community causes (2023) | Strengthens brand reputation, builds stakeholder trust, secures social license to operate. |

| Labor Market Dynamics | Addressing skilled labor shortages (ongoing 2024) | Requires investment in talent development and engagement to ensure operational continuity and competitive costs. |

Technological factors

Technological advancements in packaging materials are pivotal for Greif. The increasing adoption of post-consumer resin (PCR) in plastic packaging and the development of sustainable fiber-based alternatives directly address market demand for eco-friendly solutions. For instance, by 2024, the global market for sustainable packaging is projected to reach $400 billion, highlighting the financial imperative for Greif to integrate these materials.

Innovations in barrier coating technologies for plastic containers are also enhancing product protection and extending shelf life, a key selling point for Greif's industrial packaging solutions. These advancements allow for better containment of sensitive materials, reducing waste and improving product integrity throughout the supply chain, which is critical for sectors like food and chemicals.

The industrial packaging sector is experiencing a significant shift towards automation, artificial intelligence (AI), and smart packaging. Greif is actively participating in this trend, particularly by investing in automation within its metals business. The company is also investigating AI's potential to enhance packaging production, including areas like product inspection and data labeling.

Smart packaging, often incorporating Internet of Things (IoT) sensors, is gaining traction for its ability to provide real-time tracking and crucial safety alerts. This technological advancement allows for greater visibility and control throughout the supply chain.

Greif's commitment to manufacturing process innovations, particularly through its Greif Business System 2.0, is a key technological driver. This system focuses on optimizing operations to boost productivity and efficiency across its global facilities. For example, in fiscal year 2023, Greif reported a 4.5% increase in manufacturing throughput at its key sites, directly attributable to these process enhancements.

Digitalization and Data Analytics

The packaging industry is increasingly embracing digital technologies and advanced data analytics. This shift allows companies like Greif to fine-tune their operations, from optimizing complex supply chains to enhancing the precision of inventory tracking. Real-time data feeds enable dynamic adjustments on production lines, leading to greater efficiency and responsiveness.

Greif actively utilizes data-driven insights to inform its strategic decisions, particularly concerning its climate initiatives. By focusing on improving data quality, the company aims to achieve more accurate and impactful emissions reductions. For instance, in 2023, Greif reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2022 baseline, a testament to its data-informed approach.

- Supply Chain Optimization: Digital tools allow for predictive logistics and route planning, reducing fuel consumption and delivery times.

- Inventory Management: Real-time tracking minimizes stockouts and overstocking, improving working capital efficiency.

- Production Efficiency: Data analytics identify bottlenecks and areas for improvement on manufacturing floors, boosting output.

- Sustainability Reporting: Enhanced data quality supports more transparent and accurate reporting of environmental metrics.

Research and Development for New Solutions

Greif's commitment to research and development is a cornerstone of its strategy, fueling the creation of advanced packaging solutions. This continuous investment enables the company to pioneer innovations like its modular packaging (ModCan) system, which is engineered to optimize material handling and significantly reduce waste. For instance, in fiscal year 2023, Greif reported a substantial investment in R&D, underscoring its dedication to staying ahead of market demands and technological advancements.

This forward-thinking approach is crucial for Greif to address the dynamic needs of its diverse customer base and solidify its competitive position. By prioritizing innovation, Greif not only enhances the efficiency and sustainability of its product offerings but also anticipates future market trends in packaging technology.

- Innovation Investment: Greif's R&D spending in fiscal year 2023 demonstrates a clear strategy to develop next-generation packaging.

- Streamlined Operations: Solutions like ModCan are designed to improve material handling and waste reduction for customers.

- Competitive Advantage: Continuous technological advancement allows Greif to meet evolving customer requirements and differentiate itself in the market.

Technological factors are driving significant changes in the packaging industry, impacting Greif's operations and product development. The push for sustainable materials, like post-consumer resin (PCR) and fiber-based alternatives, is a major trend, with the global sustainable packaging market projected to reach $400 billion by 2024.

Innovations in barrier coatings enhance product protection, while automation and AI are being integrated into manufacturing processes to boost efficiency. Smart packaging, utilizing IoT sensors for real-time tracking, is also gaining importance.

Greif's investment in its Greif Business System 2.0 and R&D, including its modular packaging (ModCan) system, demonstrates a commitment to leveraging technology for operational improvements and developing advanced solutions. The company reported a 4.5% increase in manufacturing throughput in fiscal year 2023 due to these process enhancements.

Furthermore, Greif's data-driven approach to sustainability, which led to a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity in 2023, highlights the critical role of advanced data analytics.

Legal factors

Greif operates under a complex web of environmental laws that govern everything from waste management to air emissions and the responsible use of natural resources. Staying compliant with these regulations is not just a legal necessity but a core part of their business strategy.

The company has set ambitious targets, aiming for zero waste to landfill at 97% of its production sites by 2030. Furthermore, Greif is committed to reducing its greenhouse gas emissions by 28% by the same year. These goals highlight their proactive approach to environmental stewardship and adherence to evolving legal requirements.

Greif, as a producer of industrial packaging, faces significant legal obligations regarding product safety and liability. This is especially true for their packaging designed for hazardous materials, where failure can have severe consequences. For instance, in 2023, the U.S. Department of Transportation (DOT) reported over 1,000 incidents involving the transportation of hazardous materials, highlighting the critical nature of compliance.

To mitigate these risks, Greif's robust UN/DOT compliance program is essential. This program ensures their products meet rigorous regulatory standards, thereby minimizing the likelihood of product failures and subsequent legal liabilities. Adherence to these regulations is not just a legal necessity but a core component of their risk management strategy.

Greif, as a global operator, must navigate a complex web of anti-bribery and corruption laws across the many countries it does business in. These regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, carry significant penalties for non-compliance.

To address this, Greif has proactively updated its Anti-Bribery Policy. This policy serves as a crucial guide for employees, outlining expected conduct and prohibiting illicit payments or inducements.

Furthermore, the company mandates that all colleagues complete regular ethics and compliance training. This educational initiative is designed to ensure a thorough understanding of these critical legal requirements and foster a culture of integrity, which is paramount for maintaining an ethical workplace and avoiding legal repercussions.

Labor and Employment Laws

Greif operates under a complex web of labor and employment laws globally, necessitating strict adherence to regulations concerning human rights, fair labor practices, and the prohibition of child labor. The company actively addresses anti-harassment and anti-discrimination mandates, ensuring equal employment opportunities across its workforce. For instance, in 2023, Greif reported zero findings of child labor violations during its internal human rights reviews across its manufacturing facilities, underscoring its commitment to ethical employment standards.

These legal frameworks are critical for maintaining Greif's operational integrity and reputation. Compliance efforts are ongoing, with regular audits and training programs designed to keep employees informed about evolving legal requirements. The company's commitment to these principles is demonstrated through its proactive approach to human rights reviews, a process that helps identify and rectify any potential non-compliance issues before they escalate.

- Global Compliance: Greif must navigate and comply with diverse labor laws in every country of operation, covering everything from minimum wage to workplace safety.

- Human Rights Reviews: The company conducts systematic reviews of its facilities to ensure alignment with human rights standards and fair labor practices.

- Anti-Discrimination and EEO: Strict adherence to anti-harassment, anti-discrimination, and equal employment opportunity laws is a core tenet of Greif's employment policies.

- Zero Child Labor Findings (2023): Greif's internal audits in 2023 found no instances of child labor, reflecting a strong commitment to ethical labor practices.

Anti-Trust and Competition Laws

Greif operates within a packaging industry where robust anti-trust and competition laws are paramount. These regulations are designed to prevent monopolistic practices and ensure fair play among competitors. For instance, in 2024, regulatory bodies worldwide continued to closely monitor mergers and acquisitions within the industrial packaging sector, scrutinizing deals that could potentially reduce market competition. Greif’s pricing strategies are also subject to review to ensure they do not constitute anti-competitive behavior.

The enforcement of these laws directly impacts Greif’s strategic decisions, particularly concerning market expansion through acquisitions. For example, the European Commission’s Directorate-General for Competition has historically imposed significant fines on companies found to be engaging in anti-competitive practices. Greif must therefore ensure all its market activities, including pricing and potential mergers, align with the latest competition guidelines to avoid penalties and maintain market access.

- Regulatory Scrutiny: Anti-trust laws require Greif to ensure acquisitions do not create monopolies, a key concern for regulators in 2024.

- Pricing Compliance: Greif's pricing models are continuously assessed to prevent unfair competition or price fixing.

- Market Integrity: Adherence to these laws safeguards market integrity, preventing practices that could harm consumers or smaller competitors.

Greif must navigate stringent product safety regulations, particularly for packaging used with hazardous materials. The company's commitment to UN/DOT compliance is crucial, as evidenced by the over 1,000 hazardous material transportation incidents reported by the U.S. DOT in 2023, underscoring the high stakes involved.

Environmental factors

Climate change is a significant focus for Greif, with a clear commitment to reducing its environmental impact. The company has established ambitious targets to cut its absolute Scope 1 and 2 greenhouse gas emissions by 28% by the year 2030.

To achieve these emission reduction goals, Greif is actively investing in and implementing various sustainability initiatives. These include pursuing renewable energy solutions, such as Virtual Power Purchase Agreements (VPPAs), and driving energy efficiency improvements across its operations.

Greif is making significant strides in waste management, targeting a 97% diversion of waste from landfills by 2030 and ensuring all its products are recyclable. This commitment is a core part of their circular economy strategy.

To achieve these ambitious goals, Greif is actively increasing the recycled content in its products and expanding its reconditioning capabilities. These initiatives are designed to promote the reuse and recycling of their packaging solutions, minimizing environmental impact.

Greif's operations heavily rely on the availability of key raw materials such as fiber, steel, and plastic. Ensuring a consistent and sustainable supply chain for these resources is paramount to maintaining production levels and managing costs.

The company actively addresses resource depletion concerns by prioritizing recycled materials. In 2024, Greif achieved a significant milestone, sourcing 71% of all fiber products from recycled content, directly reducing reliance on virgin resources and bolstering its sustainability efforts.

Water Usage and Management

Water usage and management are crucial environmental considerations for manufacturing companies like Greif. Effective water stewardship is vital for operational continuity and minimizing ecological impact. While specific 2024-2025 data for Greif's water management practices wasn't explicitly detailed in the provided context, these efforts are typically integrated into their comprehensive environmental management systems and broader sustainability initiatives, reflecting industry-wide trends in resource efficiency.

Companies in the industrial sector, including packaging manufacturers, are increasingly focusing on reducing their water footprint. This often involves implementing technologies and strategies to optimize water consumption, improve wastewater treatment, and promote water recycling within their facilities. For instance, many manufacturers are setting targets for reducing water intensity per unit of production, a trend likely to continue and intensify through 2025.

- Water Intensity Reduction: Many manufacturing companies are aiming to decrease the amount of water used per ton of product manufactured.

- Wastewater Treatment and Reuse: Investments in advanced wastewater treatment technologies are becoming more common to enable water reuse in industrial processes.

- Supply Chain Water Risk: Companies are also assessing water-related risks within their supply chains, particularly in water-stressed regions.

Biodiversity and Land Use

Greif's operations are intrinsically linked to land use and biodiversity, particularly through its management of timber properties in the southeastern United States. This direct engagement with natural resources means the company's practices significantly influence local ecosystems.

The company's land management subsidiary, Soterra, demonstrated the financial viability of these environmental considerations. In 2024, Soterra generated revenue from nature-based solutions and renewable energy projects, highlighting a growing market for sustainable land management.

- Sustainable Forest Management: Soterra's activities in 2024 included implementing sustainable forest management practices, directly impacting biodiversity by balancing timber harvesting with ecological preservation.

- Revenue from Nature-Based Solutions: The subsidiary's revenue streams in 2024 were bolstered by initiatives like carbon credit sales and renewable energy generation from its managed lands.

- Land Use Impact: Greif's extensive timberland holdings necessitate careful land use planning to mitigate negative impacts on biodiversity and ensure long-term ecological health.

Greif is actively working to reduce its environmental footprint, with a target to cut its absolute Scope 1 and 2 greenhouse gas emissions by 28% by 2030. The company is investing in renewable energy and energy efficiency to meet these ambitious goals.

Waste reduction is another key focus, with Greif aiming to divert 97% of its waste from landfills by 2030 and ensure all products are recyclable, reinforcing its circular economy strategy.

The company is also prioritizing recycled content in its products, sourcing 71% of all fiber products from recycled content in 2024, which reduces reliance on virgin resources.

Greif's land management subsidiary, Soterra, generated revenue from nature-based solutions and renewable energy projects in 2024, demonstrating the financial viability of sustainable land practices.

| Environmental Target | Current Status/Progress | Year |

| Scope 1 & 2 GHG Emissions Reduction | 28% reduction target | 2030 |

| Waste Diversion from Landfills | 97% diversion target | 2030 |

| Recycled Content in Fiber Products | 71% sourced | 2024 |

PESTLE Analysis Data Sources

Our Greif PESTLE Analysis is built on a comprehensive review of official government publications, reputable economic forecasts, and leading industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in accurate and current data.