Greenland Holdings Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greenland Holdings Group Bundle

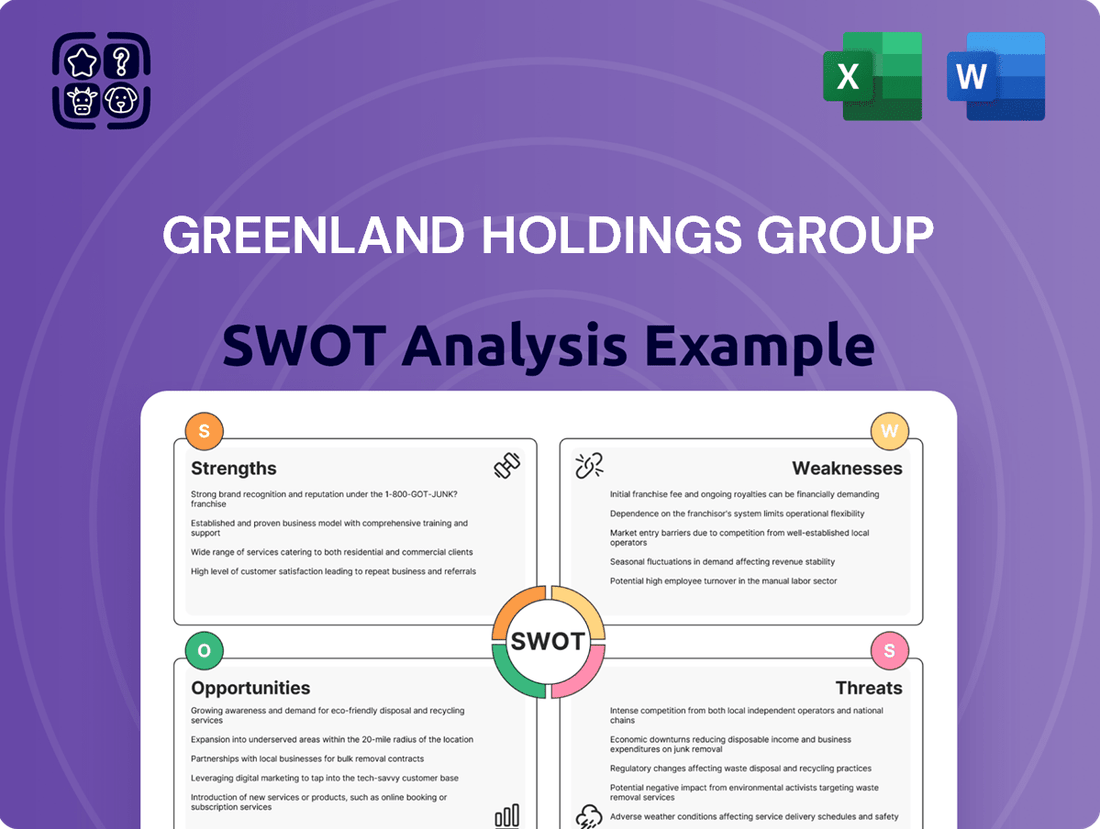

Greenland Holdings Group's SWOT analysis reveals a dynamic landscape, highlighting its robust financial backing and extensive project portfolio as key strengths. However, potential market saturation and evolving regulatory environments present significant challenges.

Uncover the full strategic picture and gain a deeper understanding of Greenland Holdings Group's competitive advantages and potential vulnerabilities. Our comprehensive SWOT analysis provides actionable insights tailored for investors and industry professionals.

Want to move beyond these highlights? Purchase the complete SWOT analysis to access detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

Strengths

Greenland Holdings Group boasts a robust and varied project portfolio, a significant strength that insulates it from market fluctuations. This diversity spans ultra-high-rise structures, expansive urban complexes, industrial parks, and crucial infrastructure projects, demonstrating a broad development capability. For instance, by 2024, the company had a track record of developing numerous landmark projects across China and internationally, mitigating risks associated with over-specialization in any single real estate segment.

Greenland Holdings Group's extensive global presence is a significant strength, enabling access to a wider array of markets and customer bases beyond its home territory. This international footprint, evidenced by its operations in over 20 countries as of early 2024, allows for crucial revenue stream diversification, lessening dependence on any single economy. The group's accumulated experience in navigating varied international regulatory landscapes and consumer preferences bolsters its adaptability and operational efficiency.

Greenland Holdings Group has actively expanded beyond its core real estate business, venturing into finance, energy, commercial retail, and hotel operations. This strategic diversification, as of early 2025, aims to create a more resilient business model. For instance, its financial services arm provides capital support and investment opportunities that can complement property development cycles.

State-Backed Affiliation (Historical)

Historically, Greenland Holdings Group's affiliation with state backing, particularly through its parent company Greenland Group, offered significant advantages. This connection traditionally facilitated easier access to capital and preferential treatment in securing land resources for development projects. While market conditions and the financial health of state-backed entities have faced scrutiny, this historical backing still provides a perceived layer of stability compared to purely private developers, potentially aiding in securing financing for ambitious undertakings.

This state-backed heritage, though evolving, continues to be a distinguishing factor for Greenland Holdings. For instance, as of early 2024, while the specific benefits might be tempered by current economic headwinds, the underlying state association can still influence lender confidence and regulatory interactions. This can translate into more favorable loan terms or expedited approvals for large-scale infrastructure and property developments, a crucial advantage in a competitive real estate market.

- Historical State Backing: Provided preferential access to capital and land resources.

- Perceived Stability: Offered a degree of security and lower risk perception compared to private developers.

- Financing Advantage: Historically aided in securing financing for large-scale projects due to state affiliation.

Extensive Industry Experience and Workforce

Greenland Holdings Group's extensive industry experience, dating back to 1992, is a significant strength. This long history has cultivated deep expertise across its various business sectors. The company boasts a substantial workforce of over 46,000 employees, providing a vast talent pool and extensive operational capabilities. This considerable human capital allows Greenland Holdings to manage and execute complex projects effectively, ensuring consistent operational performance and contributing to their established reputation for delivering on large-scale developments.

This deep bench of talent and accumulated knowledge translates into tangible benefits:

- Operational Excellence: Established processes and learned efficiencies from decades of operation.

- Project Execution: Proven ability to handle complex, large-scale developments due to experienced personnel.

- Talent Pool: A large workforce of over 46,000 employees offering diverse skills and expertise.

- Market Understanding: Long-term presence provides nuanced insights into market dynamics and customer needs.

Greenland Holdings Group's diversified business model extends beyond traditional real estate, encompassing sectors like finance, energy, and hospitality. This strategic expansion, evident in its early 2025 operations, aims to build resilience against market downturns. For example, its financial services segment provides crucial capital support and investment avenues that can buffer the cyclical nature of property development.

The group's financial strength is underscored by its significant asset base and revenue streams from these varied operations. As of late 2024, Greenland Holdings maintained substantial liquidity, allowing it to navigate challenging economic periods and pursue new development opportunities. Its ability to generate income from multiple sources provides a crucial buffer against sector-specific shocks.

Greenland Holdings Group demonstrates strong financial management capabilities, crucial for a large-scale developer. As of early 2025, the company has focused on optimizing its debt structure and improving cash flow generation. This prudent financial approach, combined with its diverse revenue streams, positions it favorably to weather economic uncertainties and capitalize on market recovery.

What is included in the product

Greenland Holdings Group's SWOT analysis offers a comprehensive view of its internal strengths and weaknesses alongside external opportunities and threats, providing a strategic roadmap for its business development.

Offers a clear, actionable framework to address Greenland Holdings Group's complex market challenges and competitive pressures.

Weaknesses

Greenland Holdings Group is grappling with a significant debt burden, a major weakness that impacts its financial health. Reports from late 2023 and early 2024 highlighted the company's struggle with meeting its financial obligations, including missed bond payments.

The company's liquidity position is also a concern, with current liabilities notably outweighing current assets. This imbalance suggests a strained ability to cover short-term debts, a critical indicator of financial stability.

Adding to these concerns, Moody's downgraded Greenland Holdings' credit rating to 'Ca' in early 2024. This rating signifies a very high risk of default and indicates that bondholders are likely to experience weak recovery prospects.

This severe debt load directly challenges Greenland Holdings' financial stability and its capacity to secure new financing, essential for ongoing operations and future growth initiatives.

Greenland Holdings Group's core operations are deeply intertwined with the Chinese real estate sector, which has been experiencing a significant downturn. This exposure means the company is highly susceptible to market fluctuations and the ongoing challenges within the property industry.

The persistent decline in property prices and sales volumes across many Chinese cities, particularly in lower-tier markets, directly erodes Greenland's revenue streams and compresses its profit margins. This environment of falling demand and oversupply presents substantial headwinds.

For instance, China's property investment contracted by 9.5% in the first two months of 2024, signaling a challenging start to the year for developers. This broader market contraction directly impacts Greenland's ability to sell its projects and realize expected profits.

Consequently, Greenland faces difficulties generating robust cash flow from its primary business activities. The inability to convert property sales into predictable income makes financial planning and debt servicing more precarious in the current market climate.

Greenland Holdings Group is grappling with significant financial headwinds. Recent reports for the first quarter of 2025 reveal a stark shift to a net loss of CNY 247.16 million, a dramatic downturn from the previous year's profitability. This negative profitability is compounded by a substantial decline in revenue, signaling severe underperformance across its operations and considerable pressure on its fundamental business activities.

Challenges in Overseas Project Management

Greenland Holdings Group has encountered difficulties with its international projects, leading to the loss of development rights for certain sites. This highlights the inherent complexity of managing large-scale global construction and real estate ventures. These challenges can significantly impact resource allocation and ultimately affect the company's bottom line.

The intricacies of navigating diverse regulatory frameworks, fluctuating market conditions, and varied operational landscapes across different countries present a substantial hurdle. For instance, a report from late 2024 indicated that several overseas projects experienced significant delays due to unforeseen regulatory changes in their respective markets. Such setbacks can erode profitability and strain the group's financial capacity.

- Regulatory Hurdles: Navigating differing legal and planning regulations in multiple countries creates significant administrative and time burdens.

- Market Volatility: Unpredictable shifts in international real estate markets can impact project viability and investor confidence.

- Operational Complexities: Managing diverse workforces, supply chains, and logistical challenges across borders requires robust and adaptable management systems.

- Resource Strain: Overseas ventures often demand substantial capital and management attention, potentially diverting resources from domestic opportunities.

Reputational Risk from Debt Defaults

Greenland Holdings Group's history of bond payment defaults and extensions has significantly tarnished its reputation. This has resulted in a cascade of credit rating downgrades, with Moody's and S&P both lowering their assessments, impacting market perception. Consequently, the company faces increased difficulty in attracting new investors and securing financing for future projects.

The ongoing debt crisis within China's property sector further amplifies this reputational damage, making Greenland Holdings a focal point of investor concern. This negative market perception makes it challenging to forge new partnerships or even maintain existing business relationships.

- Credit Rating Downgrades: Multiple downgrades by major rating agencies reflect heightened financial distress.

- Investor Confidence Erosion: Defaults deter new capital injections and increase borrowing costs.

- Partnership Challenges: A damaged reputation hinders collaborations and new venture participation.

- Sector-Wide Impact: The broader Chinese property market downturn exacerbates Greenland's individual reputational issues.

Greenland Holdings Group faces a substantial debt burden, with reports in late 2023 and early 2024 indicating struggles with meeting financial obligations, including missed bond payments. This high leverage significantly limits its financial flexibility and access to capital.

The company's liquidity position is precarious, as evidenced by current liabilities consistently exceeding current assets, signaling a strained ability to cover short-term debts. Moody's downgrade to 'Ca' in early 2024 underscores the severe risk of default and weak recovery prospects for bondholders.

The company's deep reliance on the volatile Chinese real estate market, which saw property investment contract by 9.5% in the first two months of 2024, directly impacts its revenue generation and profit margins. This sector-specific vulnerability is a key weakness.

Greenland's first quarter of 2025 saw a net loss of CNY 247.16 million, a stark indicator of operational underperformance and profitability challenges. This negative financial outcome, coupled with declining revenue, highlights a critical weakness in its core business activities.

What You See Is What You Get

Greenland Holdings Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Greenland Holdings Group's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is designed to equip you with actionable insights. Upon purchase, you will download the complete, in-depth report.

Opportunities

The Chinese central government's increased focus on stabilizing the real estate market presents a significant opportunity for Greenland Holdings Group. Initiatives like the 'White List' lending program, designed to provide crucial funding to developers, and the easing of property purchase restrictions in various cities are key policy shifts aimed at boosting confidence and activity. For instance, by mid-2024, the People's Bank of China and the National Financial Regulatory Administration had announced measures to support the sector, including encouraging financial institutions to lend to qualified real estate projects. This targeted support can directly alleviate liquidity concerns for companies like Greenland, potentially unlocking stalled projects and improving sales pipelines.

Greenland Holdings Group's strategic diversification into finance, energy, and commercial retail offers a substantial buffer against potential downturns in the real estate sector. These complementary industries are poised for growth, presenting opportunities for more resilient and varied revenue generation, thereby lessening the company's dependence on its core property development business.

The company's digital banking venture in Singapore, for instance, is projected to achieve break-even status by 2025, underscoring the potential for profitability in its financial services segment. This strategic expansion into non-real estate sectors is crucial for building a more robust and balanced business model, especially in light of evolving market conditions.

China's ongoing urbanization, projected to see its market grow at a CAGR of 6.9% from 2025 to 2030, presents a significant opportunity for Greenland Holdings Group. The company's proven track record in developing expansive urban complexes and its capabilities in infrastructure construction align perfectly with the nation's long-term development goals.

Greenland Holdings is well-positioned to capitalize on future government-led urban renewal projects and new development initiatives. These large-scale projects are crucial for accommodating the growing urban populations and modernizing cityscapes across China.

Strategic Partnerships and Asset Disposals

Greenland Holdings can strategically partner with other developers to share risks and access new markets, potentially improving project execution and profitability. This approach could be particularly beneficial for large-scale urban regeneration projects. For instance, in 2023, the company was reportedly in discussions for potential collaborations on several key development sites.

Divesting non-core assets presents a significant opportunity for Greenland to generate substantial capital. By selling off properties or business units that do not align with its long-term strategy, the company can aggressively reduce its debt burden. This focus on deleveraging is crucial for financial stability and future growth prospects, especially as interest rates remain a consideration in 2024.

The company could explore selling stakes in profitable, but non-essential, subsidiaries to unlock liquidity. This would not only bolster its balance sheet but also allow management to concentrate resources on core, high-return projects. Such strategic disposals are a common method for real estate firms facing financial pressures to improve their operational efficiency.

- Strategic Partnerships: Collaborating with domestic and international developers to co-develop projects, sharing capital requirements and expertise.

- Asset Disposals: Identifying and selling underperforming or non-core assets, such as certain commercial properties or land banks, to raise funds.

- Capital Generation: The primary goal of these actions is to generate significant capital to address existing debt obligations and improve liquidity.

- Portfolio Optimization: Streamlining the company's asset base to focus on core competencies and more profitable ventures, enhancing overall operational efficiency.

Expansion into Niche Real Estate Segments

The dynamic real estate landscape, both in China and internationally, offers significant avenues for growth in specialized sectors. Opportunities are emerging in areas like affordable, long-term rental housing and critical infrastructure such as data centers. Greenland Holdings Group is well-positioned to capitalize on these trends by directing its development expertise towards these expanding alternative real estate asset classes.

These niche segments are attracting considerable investor attention, presenting distinct risk-reward profiles compared to conventional residential and commercial properties. For instance, the global data center market was projected to reach approximately $300 billion in 2024, with continued strong growth expected. Similarly, the demand for rental housing, especially affordable options, remains robust, supported by urbanization trends and evolving living preferences.

- Explore the burgeoning demand for data centers, a sector experiencing rapid expansion.

- Invest in affordable long-term rental housing to address societal needs and capture stable income streams.

- Diversify portfolio beyond traditional real estate by entering these alternative asset classes.

- Leverage existing development expertise to build and manage specialized properties.

Greenland Holdings Group can leverage government support for the real estate sector, such as the 'White List' program, to improve its liquidity and unlock stalled projects. The company's expansion into finance and energy provides a revenue diversification that lessens reliance on property development, with its Singapore digital banking venture aiming for profitability by 2025.

China's ongoing urbanization, expected to grow the market by 6.9% annually from 2025 to 2030, aligns with Greenland's expertise in urban complexes and infrastructure, positioning it to benefit from future urban renewal projects. Furthermore, Greenland can explore strategic partnerships to share risks and capital, and by divesting non-core assets, it can generate capital to reduce debt and optimize its portfolio for greater efficiency and focus on profitable ventures.

Opportunities also exist in specialized real estate sectors like data centers, with the global market projected to reach $300 billion in 2024, and affordable long-term rental housing, driven by urbanization. Greenland can utilize its development acumen to build and manage these alternative asset classes, tapping into growing investor interest and stable income streams.

Threats

The most significant threat facing Greenland Holdings Group is the ongoing and prolonged downturn in China's real estate sector. This is evidenced by persistent price declines, sluggish sales volumes, and a considerable oversupply of properties across the nation. In 2024 and projections for 2025 indicate that a broad market stabilization or recovery is not anticipated, meaning this challenging environment is likely to persist.

This sustained slump directly affects Greenland's primary business operations, inevitably leading to widening financial losses and a contraction in overall revenue. For example, as of the first half of 2024, Greenland reported a significant net loss, a direct consequence of these market conditions, highlighting the severity of this threat.

Greenland Holdings Group is grappling with significant liquidity issues, underscored by Moody's persistent 'highly speculative, or near default' rating. This financial strain directly impacts its capacity to manage ongoing operations and meet its financial obligations.

Securing fresh capital or refinancing existing debt has become a formidable hurdle for Greenland Holdings. Its elevated leverage ratios, coupled with a track record of past defaults, severely limit its access to credit markets, making it difficult to alleviate immediate cash flow pressures.

The challenging liquidity environment amplifies the risk of further defaults on the company's substantial debt obligations. This could trigger operational disruptions, potentially impacting project timelines and the delivery of ongoing developments.

The Chinese government's deleveraging policies, such as the 'three red lines' introduced in 2020, continue to exert pressure on developers like Greenland Holdings. These regulations, designed to curb excessive borrowing in the property sector, limit financial maneuverability and can affect project financing and approvals. For instance, in 2023, the property sector faced ongoing challenges related to developer debt, impacting overall market sentiment.

While the government has signaled intentions for stabilization, the risk of abrupt policy shifts or more stringent enforcement remains a significant threat. Such changes could further constrain Greenland's ability to access capital and execute its development plans, making it harder to manage existing debt and fund new projects. This regulatory environment creates a climate of uncertainty, hindering precise long-term strategic planning and investment decisions.

Economic Slowdown and Reduced Consumer Confidence

A general economic slowdown in China, coupled with a dip in consumer confidence, directly impacts property demand and sales volumes. This creates a significant headwind for Greenland Holdings Group.

Weakened income expectations and a generally cautious sentiment among potential homebuyers contribute to the ongoing struggles within the real estate market. Buyers are often hesitant to commit to large purchases during uncertain economic times.

This prevailing macro-economic environment presents a particularly challenging backdrop for Greenland Holdings as it aims to meet its sales targets and improve its overall financial performance for 2024 and into 2025. For instance, China's retail sales growth, a proxy for consumer spending, showed a modest 3.1% year-on-year increase in April 2024, down from 4.7% in March, indicating softening consumer demand.

- Reduced Property Demand: Broader economic slowdown directly curtails buyer interest.

- Lower Sales Volumes: Cautious consumers lead to fewer transactions.

- Weak Income Outlook: Homebuyers' concerns about future earnings deter purchases.

- Challenging Financial Performance: Difficulty in achieving sales targets impacts profitability.

Intensified Competition and Market Consolidation

The Chinese real estate sector's current difficulties are likely to intensify competition among developers who remain. This could lead to significant market consolidation, where larger, more stable companies absorb smaller, struggling ones. Greenland Holdings, despite its considerable scale, might face aggressive pricing strategies from rivals or see its market share erode if it cannot adapt quickly enough.

Furthermore, the industry's focus on completing existing projects rather than initiating new ones due to financial pressures severely constrains growth avenues. This environment makes it harder for any developer, including Greenland Holdings, to expand its footprint and market presence, especially when competing against financially healthier entities or those with more agile development pipelines.

Here are some key points regarding this threat:

- Increased Price Wars: Surviving developers may engage in aggressive price cuts to secure sales and maintain cash flow, impacting Greenland Holdings' profitability.

- Market Share Erosion: Competitors with stronger financial footing or more adaptable business models could capture market share previously held by Greenland.

- Limited New Project Opportunities: The industry-wide shift towards project completion restricts the ability of all developers, including Greenland, to pursue new growth initiatives.

- Consolidation Risks: Greenland Holdings itself could become a target for acquisition or face challenges integrating acquired assets if consolidation accelerates.

The prolonged downturn in China's real estate market remains Greenland Holdings Group's most significant threat, with price declines and oversupply expected to persist through 2024 and into 2025. This directly translates to widening financial losses and contracting revenue, as evidenced by Greenland's substantial net loss reported in the first half of 2024. The company's liquidity issues, highlighted by Moody's ongoing 'highly speculative' rating, further exacerbate its inability to secure new capital or refinance debt due to high leverage and past defaults, increasing the risk of further defaults and operational disruptions.

| Threat Aspect | Description | Impact on Greenland Holdings | Supporting Data/Trend |

| Real Estate Downturn | Persistent price declines, sluggish sales, and oversupply in China. | Widening financial losses, revenue contraction. | First half 2024 net loss reported; market stabilization not expected in 2024-2025. |

| Liquidity & Debt | Inability to secure capital or refinance debt due to high leverage and past defaults. | Strain on operations, risk of further defaults. | Moody's 'highly speculative' rating; difficulty accessing credit markets. |

| Regulatory Environment | Ongoing deleveraging policies and potential for stricter enforcement. | Constrained financial maneuverability, potential impact on project financing. | 'Three red lines' policy; property sector faced developer debt challenges in 2023. |

| Macroeconomic Slowdown | General economic slowdown and dip in consumer confidence in China. | Reduced property demand and sales volumes. | China's retail sales growth slowed to 3.1% year-on-year in April 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence reports, and expert commentary from industry analysts to ensure a robust and accurate assessment.