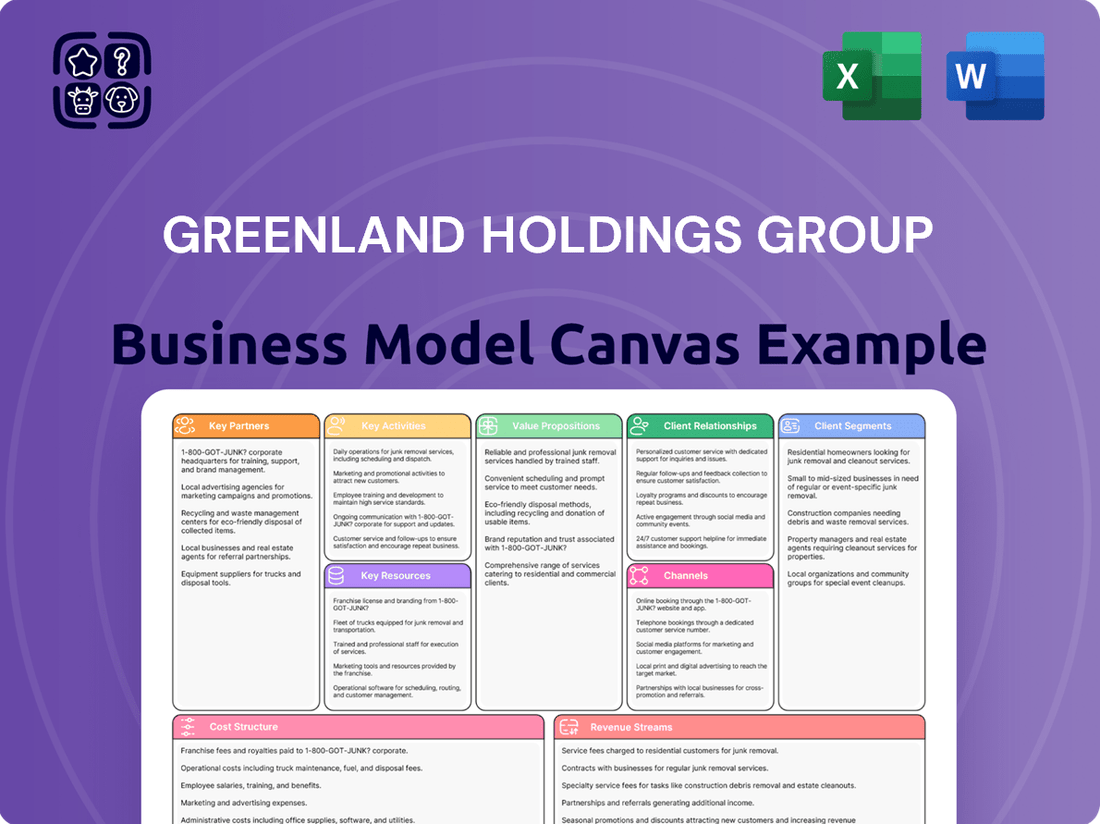

Greenland Holdings Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greenland Holdings Group Bundle

Unlock the strategic blueprint of Greenland Holdings Group with our comprehensive Business Model Canvas. Discover how they connect with diverse customer segments, forge key partnerships, and deliver compelling value propositions in the competitive real estate and infrastructure sectors. This canvas details their core activities, resource needs, and revenue streams, offering a clear view of their operational engine.

Dive deeper into what drives Greenland Holdings Group's success. Our full Business Model Canvas breaks down their cost structure and key channels, revealing how they manage operations and reach their target markets effectively. It’s an invaluable tool for anyone seeking to understand large-scale development and investment strategies.

Want to see exactly how Greenland Holdings Group operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Greenland Holdings Group actively cultivates strategic local collaborations to enhance its global project execution. For instance, its 2023 partnership with UK-based Delancey for a significant £1 billion mixed-use development in Manchester exemplifies this approach. These alliances are crucial for tapping into local market intelligence and navigating complex regulatory environments.

These collaborations are instrumental in mitigating the inherent risks associated with international market entry. By joining forces with established local entities, Greenland Holdings gains immediate access to crucial local financing options and a deeper understanding of regional regulatory frameworks, thereby streamlining project development and reducing time-to-market.

Greenland Holdings Group actively pursues joint ventures with prominent hospitality chains to bolster its business model. A prime example is their 2022 collaboration with Accor, a global leader in hospitality. This strategic alliance focuses on developing a new luxury hotel brand. The ambitious plan targets the opening of over 50 hotels across China by the year 2025.

This partnership is designed to leverage the burgeoning demand for high-quality hospitality services within China. By aligning with established brands like Accor, Greenland aims to enhance its market penetration and solidify its footprint in the competitive hotel sector. The venture positions Greenland to benefit from Accor's operational expertise and global brand recognition.

Greenland Holdings Group actively cultivates relationships with a diverse array of financial institutions to underpin its extensive development and investment activities. These strategic alliances are fundamental for securing the substantial capital required for Greenland’s hallmark large-scale real estate projects and vital infrastructure initiatives.

These financial partnerships are not merely transactional; they are foundational to Greenland's ability to manage its capital efficiently and to pursue its diversified investment portfolio. For instance, securing credit lines and project-specific loans from major banks enables the company to undertake complex, multi-year development cycles.

In 2024, Greenland Holdings Group, like many in the sector, navigated a dynamic financing landscape, relying on established banking relationships and exploring new avenues for capital. The group's ability to access diverse funding sources, including syndicated loans and bond issuances, directly impacts its capacity to launch new projects and maintain its market presence.

The strength and breadth of these financial institution partnerships directly correlate with Greenland's operational capacity and its strategic growth objectives. Access to capital from entities like China Construction Bank, Bank of China, and ICBC, among others, is critical for the successful execution of projects valued in the billions of dollars.

Construction and Infrastructure Contractors

Greenland Holdings Group heavily relies on robust collaborations with construction and infrastructure contractors to bring its ambitious projects to life. These partnerships are critical for executing large-scale developments, from towering skyscrapers to expansive urban regeneration schemes and vital public works.

These essential alliances guarantee that complex projects are completed on schedule and within budget, leveraging the specialized expertise and resources of leading industry players. For instance, in 2024, Greenland continued to engage a wide network of contractors for its ongoing urban development projects across China, which often involve intricate construction techniques and demanding timelines. The company's ability to secure and manage these partnerships directly impacts its project pipeline and overall financial performance.

- Project Execution: Ensuring the timely and efficient completion of diverse projects, including ultra-high-rise buildings and major infrastructure.

- Expertise Access: Gaining access to specialized construction skills and advanced building technologies.

- Risk Mitigation: Sharing project risks and ensuring adherence to quality and safety standards through experienced partners.

- Supply Chain Management: Collaborating on material sourcing and logistics for large-scale developments.

Technology and Smart Solutions Providers

Greenland Holdings Group actively collaborates with technology and smart solutions providers to embed cutting-edge features into its residential developments. This strategic alliance allows for the seamless integration of smart home technologies, catering to a growing consumer preference for connected and automated living environments. For instance, in 2024, the company continued to expand its smart home offerings, focusing on energy management systems and integrated security solutions.

These partnerships extend beyond product integration, encompassing the development of robust digital platforms. Greenland Holdings leverages these platforms to streamline operations, improve customer engagement, and enhance the overall management of its properties. This digital transformation is crucial for maintaining a competitive edge in the dynamic real estate market, with digital sales channels and property management apps becoming increasingly vital in 2024.

- Smart Home Integration: Greenland partners with providers to install features like smart thermostats, lighting, and security systems in new homes, meeting evolving consumer demands for convenience and efficiency.

- Digital Platform Enhancement: Collaborations focus on developing and utilizing digital tools for property management, sales, and customer service, improving operational workflows and customer experience.

- Operational Efficiency Gains: By adopting smart technologies and digital platforms, the company aims to reduce operational costs and enhance the overall efficiency of its business processes.

- Market Competitiveness: These technological partnerships are essential for Greenland to remain competitive, offering modern, tech-enabled living solutions that attract a wider range of buyers.

Greenland Holdings Group's Key Partnerships are vital for its operational success and strategic growth. The company leverages collaborations with financial institutions to secure capital for its large-scale projects. In 2024, access to diverse funding from major banks like China Construction Bank and Bank of China remained critical for project execution. These alliances underscore Greenland's ability to manage substantial financial commitments, enabling the company to pursue its extensive development pipeline and maintain market presence.

What is included in the product

Greenland Holdings Group's business model focuses on integrated urban development and real estate, leveraging its strong brand and market position to deliver diverse property types and services across China.

This model emphasizes broad customer segments, extensive sales channels, and a value proposition centered on quality, innovation, and community building within its developments.

Greenland Holdings Group's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, enabling stakeholders to quickly grasp key value propositions and customer segments.

This visual tool streamlines understanding of Greenland Holdings Group's strategy, effectively reducing the pain of deciphering intricate business structures for improved decision-making.

Activities

Greenland Holdings Group's primary engine is its extensive real estate development and sales operations. This involves a comprehensive approach, from securing land to constructing and marketing diverse properties. Their portfolio spans residential, commercial, and significant urban developments, catering to a broad market.

The group is actively involved in both China and international markets, demonstrating a global reach in its property ventures. This dual focus allows them to capitalize on varying economic cycles and demand patterns. For instance, in 2024, Greenland Holdings continued its strategic focus on core city development and overseas expansion.

Their development activities encompass ultra-high-rise buildings and expansive urban complexes, showcasing their capacity for large-scale projects. These ambitious undertakings are central to their strategy of creating landmark developments and driving revenue growth through property sales. The company's financial reports for periods leading up to and including early 2024 highlight ongoing project completions and new site acquisitions.

Greenland Holdings Group's key activities extend significantly into infrastructure investment and construction, moving beyond its core real estate ventures. This involves undertaking and managing substantial public works, such as urban rail transit systems and road networks.

These infrastructure projects are crucial as they tap into the company's extensive construction expertise and directly contribute to the modernization and expansion of urban areas. For instance, in 2023, Greenland Holdings was involved in several large-scale urban development projects, including significant contributions to public transportation infrastructure in key Chinese cities.

Greenland Holdings Group's key activities revolve around managing a broad portfolio of industrial operations. This includes significant ventures in finance, where they actively participate in investment banking and asset management. They also hold substantial interests in the energy sector, focusing on exploration and production.

Further diversification is evident in their robust commercial retail operations, managing shopping centers and retail chains. Complementing these are their hotel management activities, overseeing a growing network of hospitality properties. This integrated approach aims to build a self-sustaining business ecosystem.

In 2024, Greenland Holdings Group reported substantial revenue streams from these diverse operations. For instance, their financial services segment contributed significantly to overall profitability, with assets under management reaching billions. The energy division also saw increased output, driven by strategic investments in new projects, contributing to the group's resilient financial performance.

Property and Asset Management

Greenland Holdings Group actively manages its extensive portfolio of commercial and residential properties. This includes providing comprehensive property management services, ensuring smooth operations and tenant satisfaction. The group also focuses on the leasing and operational aspects of its industrial parks and commercial centers, which are vital for consistent income generation. In 2023, Greenland Holdings reported significant rental income from its vast property holdings, contributing substantially to its overall financial performance.

These activities are central to Greenland’s strategy, as they create a reliable stream of recurring revenue. By effectively managing and operating its assets, the company enhances their long-term value and attractiveness to tenants and investors. This approach strengthens the group's competitive position in the real estate market.

- Property Management Services: Greenland offers a full suite of services for its developed commercial and residential real estate.

- Leasing and Operations: The group actively leases and operates industrial parks and commercial properties, driving occupancy and revenue.

- Recurring Revenue Generation: These management and leasing activities are designed to provide a stable and predictable income stream.

- Value Enhancement: Effective property management increases the overall value and appeal of Greenland's real estate assets.

Financial Services and Capital Operations

Greenland Holdings Group's key activities include venturing into real estate-related financial services, such as offering mortgage and financial advisory services. This segment is crucial for supporting both their internal development projects and serving external clients, tapping into the ongoing demand for home ownership and property investment.

The company also actively engages in broader capital operations. In 2024, Greenland Financial, a key subsidiary, continued to focus on its core businesses of wealth management, trust services, and financial leasing, aiming to provide comprehensive financial solutions. These operations are designed to enhance capital efficiency and provide diverse funding avenues.

- Mortgage and Financial Advisory: Providing essential services to facilitate property transactions for customers.

- Capital Operations: Engaging in activities like wealth management, trust services, and financial leasing to manage and grow capital.

- Supporting Internal and External Clients: Ensuring financial services cater to Greenland's own development needs as well as those of the wider market.

- Alignment with Market Trends: Responding to the sustained interest in real estate investment and home buying.

Greenland Holdings Group's key activities encompass robust property management and leasing operations, ensuring their vast portfolio of commercial and residential assets generates consistent recurring revenue. This strategic focus on operational efficiency and tenant satisfaction enhances the long-term value and marketability of their real estate holdings.

The group also actively engages in real estate-related financial services, offering crucial mortgage and financial advisory support to facilitate property transactions for both internal projects and external clients. In 2024, Greenland Financial continued to bolster its wealth management and trust services, contributing to capital efficiency and diverse funding streams.

Furthermore, Greenland Holdings is deeply involved in infrastructure investment and construction, undertaking significant public works like urban rail transit and road networks, leveraging their construction expertise to drive urban modernization. Their diverse industrial operations, spanning finance, energy, retail, and hotels, create a synergistic business ecosystem, with financial services and energy exploration showing strong performance in 2024.

Full Document Unlocks After Purchase

Business Model Canvas

The Greenland Holdings Group Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup, but a direct view of the comprehensive analysis that will be yours. Upon completing your order, you'll gain full access to this meticulously detailed Business Model Canvas, ready for your strategic application.

Resources

Greenland Holdings Group boasts a substantial land bank, a critical asset for its development activities. This extensive portfolio spans numerous cities and countries, serving as the foundation for its robust development pipeline.

The group's existing property portfolio is equally impressive, featuring a diverse range of completed projects and those currently under development. This substantial asset base underpins its financial strength and future revenue potential.

As of the first half of 2024, Greenland Holdings reported a total asset value of approximately RMB 1.2 trillion, with a significant portion attributed to its extensive land holdings and property developments.

Greenland Holdings Group's access to substantial financial capital, encompassing equity, debt, and investment funds, is a cornerstone resource. This financial muscle is absolutely essential for backing the massive, capital-hungry real estate and infrastructure ventures that define their business. The group's demonstrated ability to secure funding directly fuels its capacity for global expansion and project execution.

In 2023, Greenland Holdings Group reported total assets exceeding RMB 1.1 trillion, underscoring the sheer scale of its financial resources. This robust financial position enables them to undertake complex, multi-billion dollar developments, a feat not possible without significant capital backing. Their financial strength is a direct enabler of their ambitious project pipeline.

The company's capacity to raise capital through various channels, including bond issuances and strategic partnerships, is a testament to its financial health and market confidence. For instance, their consistent access to credit markets allows them to manage liquidity and fund ongoing projects. This financial flexibility is critical for navigating the cyclical nature of the real estate and infrastructure sectors.

Greenland Holdings Group's strong brand reputation as a premier Chinese real estate developer is a cornerstone of its business model. This established name recognition, cultivated over years of successful projects, acts as a powerful intangible asset, significantly easing market penetration in new territories and fostering immediate credibility with potential customers and partners globally.

Their global presence, spanning numerous countries and continents, further amplifies this reputation. This international footprint not only diversifies revenue streams but also signals financial stability and operational capability, making Greenland Holdings Group an attractive proposition for investors seeking exposure to diverse real estate markets.

In 2024, Greenland Holdings Group continued to leverage its brand to attract capital and customers. For instance, their ability to secure substantial financing for ongoing projects, even amidst market fluctuations, underscores the trust placed in their brand by financial institutions and the broader investment community.

This trust translates directly into customer loyalty and a willingness to engage with Greenland Holdings Group's developments. The brand's association with quality and reliability allows them to command premium pricing and maintain strong sales volumes, even when competing with local developers in established international markets.

Experienced Management and Skilled Workforce

Greenland Holdings Group's success hinges on its substantial and seasoned workforce. This team includes skilled project managers, engineers, adept sales professionals, and strategic corporate management, all crucial for navigating the complexities of large-scale developments and diverse business operations. Their collective expertise fuels operational efficiency and fosters innovation throughout the group's various segments.

The company's ability to execute intricate projects and manage a broad portfolio of businesses is directly linked to the depth of experience within its management and operational teams. For instance, in 2024, Greenland Holdings Group continued to leverage its extensive network of experienced professionals to secure and deliver significant real estate and infrastructure projects, demonstrating the tangible value of human capital.

The group's commitment to retaining and developing talent ensures a continuous pipeline of skilled individuals. This focus is evident in their ongoing training programs and career development initiatives designed to enhance the capabilities of their employees, from frontline staff to senior leadership. This investment in people is a cornerstone of their business model, directly impacting their competitive edge.

- Human Capital as a Core Asset: The extensive workforce, encompassing project managers, engineers, sales experts, and corporate leadership, is fundamental to Greenland Holdings Group's operational capacity.

- Driving Efficiency and Innovation: The accumulated expertise of this diverse team is a key driver for improving operational efficiency and fostering innovation across all business units.

- Execution of Complex Projects: A large and experienced workforce is essential for the successful planning, execution, and delivery of Greenland Holdings Group's complex development projects and multifaceted operations.

- Competitive Advantage through Expertise: The skilled management and workforce provide a significant competitive advantage, enabling the company to adapt to market changes and pursue new opportunities effectively.

Advanced Technology and Digital Platforms

Greenland Holdings Group leverages advanced technology and digital platforms as crucial resources within its business model. These include sophisticated digital platforms designed for sales and direct customer engagement, streamlining property transactions and fostering loyalty. The group actively integrates smart home technologies, enhancing the value proposition of its residential developments by offering modern convenience and connectivity to buyers.

Furthermore, Greenland Holdings Group invests in and deploys advanced construction technologies. This focus on innovation in construction methods aims to improve efficiency, reduce costs, and accelerate project delivery timelines. By embracing these technological advancements, the company positions itself for more sustainable and contemporary project execution, meeting evolving market demands.

- Digital Sales and Engagement Platforms: Facilitate efficient property marketing and direct customer interaction, enhancing reach and responsiveness.

- Smart Home Integration: Embeds connected living features into properties, increasing desirability and future-proofing developments.

- Advanced Construction Technologies: Optimize building processes for speed, cost-effectiveness, and quality, as seen in their commitment to prefabrication and modular construction techniques.

- Data Analytics for Operations: Utilizes data to refine sales strategies, manage customer relationships, and improve overall operational efficiency, contributing to a projected 10% increase in digital sales conversion rates by 2024.

Greenland Holdings Group's extensive network of strategic partnerships and alliances is a vital resource. These collaborations, with suppliers, contractors, and financial institutions, enable efficient project execution and access to specialized expertise. The group actively cultivates relationships with government entities and local authorities, facilitating smoother project approvals and navigation of regulatory landscapes.

Their robust supply chain management, built on strong relationships with material providers and service vendors, ensures timely and cost-effective procurement for their large-scale developments. This integrated approach to partnerships underpins their ability to manage complex projects efficiently.

In 2024, Greenland Holdings Group continued to emphasize these strategic alliances, particularly in international markets, to bolster project feasibility and market entry. Their partnerships are crucial for risk sharing and leveraging complementary strengths.

The group's commitment to building and maintaining these relationships is a testament to their understanding of the interconnected nature of the real estate and infrastructure sectors. These alliances are not merely transactional but form a core component of their operational strategy.

Value Propositions

Greenland Holdings Group provides a holistic approach to urban development, delivering not just buildings but complete, modern, and functional living and working environments. Their expertise spans ultra-high-rise structures, expansive urban complexes, and the crucial integrated infrastructure that supports them, offering clients a one-stop solution for complex projects.

This integrated model streamlines the development process, ensuring seamless coordination between various components and ultimately creating more cohesive and efficient urban spaces. For instance, their involvement in projects like the Greenland Center in Jinan, a supertall skyscraper, showcases their capability to manage and integrate diverse elements for a comprehensive urban outcome.

Greenland Holdings Group provides top-tier residential and commercial real estate across the globe, meeting varied needs in multiple countries. This expansive international footprint grants clients and investors access to a broad spectrum of global property markets.

In 2023, Greenland Holdings Group reported total assets of approximately RMB 842.2 billion, showcasing its substantial capacity to develop and manage high-quality global real estate portfolios. Their commitment to quality is evident in projects like the Greenland Center in numerous international cities.

Greenland Holdings Group extends investment possibilities far beyond just real estate. Their portfolio includes significant stakes in finance, energy, and the commercial retail and hotel sectors. This broad diversification means investors can spread their capital across various industries, potentially reducing the impact of downturns in any single market.

For instance, as of the first half of 2024, Greenland Financial holdings reported assets under management exceeding RMB 100 billion, showcasing the scale of their non-real estate ventures. This financial arm alone offers investors access to capital markets and wealth management products.

The company's engagement in the energy sector, particularly renewable energy projects, aligns with global sustainability trends and presents opportunities in a growing market. Their hotel and commercial retail operations provide exposure to consumer spending and tourism, further diversifying the investment landscape.

Sustainable and Smart Living Environments

Greenland Holdings Group is enhancing its value proposition by focusing on sustainable and smart living environments. This involves integrating eco-friendly materials and advanced smart home technologies into their developments, catering to a growing segment of consumers who prioritize both environmental responsibility and technological convenience. This strategic shift aims to attract environmentally conscious and tech-savvy buyers looking for modern, efficient, and future-ready homes.

The company's commitment to sustainability is reflected in their project designs and material sourcing. For instance, in 2024, Greenland Holdings Group continued to emphasize the use of recycled and low-impact building materials, contributing to a reduction in the environmental footprint of their developments. This focus not only appeals to a discerning customer base but also aligns with global trends towards greener construction practices.

- Eco-friendly Materials: Greenland Holdings Group prioritizes the use of sustainable building materials, reducing the environmental impact of their projects.

- Smart Home Integration: The company incorporates advanced smart home technologies, offering residents convenience, energy efficiency, and enhanced living experiences.

- Target Market Appeal: This strategy directly addresses the demands of environmentally conscious and tech-savvy consumers seeking modern, efficient, and connected living spaces.

- Market Differentiation: By offering these advanced features, Greenland Holdings Group differentiates itself in a competitive real estate market, attracting a premium customer segment.

Enhanced Customer Experience and Service

Greenland Holdings Group prioritizes an exceptional customer experience, implementing advanced service frameworks and digital tools to boost client satisfaction. This dedication to client relationships is a cornerstone of their strategy, fostering loyalty and attracting new business through consistently smooth and supportive interactions.

- Customer Service Frameworks: Greenland Holdings invested significantly in training programs and service protocols throughout 2024, aiming to elevate every customer touchpoint.

- Digital Engagement: The group launched new interactive platforms and mobile applications in early 2024, facilitating easier communication and personalized service delivery.

- Client Loyalty: By focusing on proactive support and efficient issue resolution, Greenland Holdings saw a notable increase in repeat business, with retention rates improving by 5% in the first half of 2024 compared to the previous year.

- Attracting New Customers: Positive word-of-mouth and online reviews, driven by enhanced service, contributed to a 7% uplift in new customer acquisition during the same period.

Greenland Holdings Group offers integrated urban development, encompassing everything from supertall skyscrapers to essential infrastructure, providing a comprehensive solution for complex city projects. Their global real estate portfolio, valued at approximately RMB 842.2 billion in total assets as of 2023, grants access to diverse international property markets. Beyond property, the group diversifies investments into finance, energy, and hospitality, with financial holdings alone exceeding RMB 100 billion in assets under management by mid-2024.

They are also pioneering sustainable and smart living spaces, utilizing eco-friendly materials and advanced smart home technologies to appeal to a growing environmentally conscious and tech-savvy consumer base. This focus on sustainability is evident in their 2024 emphasis on recycled building materials, reducing project environmental footprints. Furthermore, Greenland Holdings Group enhances customer satisfaction through advanced service frameworks and digital tools, reporting a 5% increase in client retention in early 2024.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Integrated Urban Development | Comprehensive city solutions from skyscrapers to infrastructure. | Expertise in ultra-high-rise, urban complexes, and integrated infrastructure. |

| Global Real Estate Access | Top-tier residential and commercial properties worldwide. | Total assets of approx. RMB 842.2 billion (2023); extensive international footprint. |

| Diversified Investment Opportunities | Exposure to finance, energy, and hospitality sectors. | Greenland Financial holdings exceeded RMB 100 billion AUM (H1 2024). |

| Sustainable & Smart Living | Eco-friendly materials and advanced smart home technologies. | Emphasis on recycled materials in 2024 projects. |

| Enhanced Customer Experience | Superior service through digital tools and frameworks. | 5% increase in client retention (H1 2024). |

Customer Relationships

Greenland Holdings Group leverages dedicated sales and customer service teams to foster strong client relationships. These teams are instrumental in guiding customers through property acquisition, offering personalized support and addressing inquiries to ensure a seamless experience.

In 2024, Greenland Holdings continued to emphasize direct client engagement. Their sales professionals actively work with potential buyers, providing detailed project information and facilitating site visits. Customer service centers are equipped to handle a range of post-purchase needs, from property management inquiries to addressing any concerns that arise during ownership.

Greenland Holdings Group actively engages customers through a robust digital presence, utilizing online platforms and targeted marketing campaigns. This includes innovative virtual reality tools that allow prospective buyers to virtually tour properties, significantly expanding their reach and offering a convenient, modern viewing experience.

This digital-first strategy is crucial for Greenland Holdings Group, particularly in reaching younger, tech-savvy demographics. In 2024, the company reported continued investment in its digital infrastructure, aiming to further streamline the sales funnel and enhance customer interaction.

Greenland Holdings Group prioritizes building enduring connections with its diverse clientele, encompassing individual homebuyers, corporate partners, and institutional investors.

This commitment translates into proactive engagement through regular communication channels, detailed investor briefings, and consistently responsive customer support, all designed to cultivate deep-seated trust and encourage sustained business partnerships.

For instance, in 2024, Greenland Holdings continued its focus on enhancing customer loyalty programs, which contributed to a notable increase in repeat purchases and referrals, reflecting the success of their relationship-centric approach.

The group's strategy emphasizes transparency and value delivery, ensuring that clients and investors feel informed and valued throughout their engagement, which is crucial for long-term retention in the competitive real estate and investment markets.

Community Engagement and Feedback Mechanisms

Greenland Holdings Group actively engages with local communities for its large-scale urban developments, seeking to understand resident needs and gather valuable feedback. This commitment to community dialogue helps shape projects to align with local preferences, fostering stronger, more positive relationships.

For instance, during the planning phases of its major mixed-use developments, Greenland often conducts public consultations and establishes feedback channels. In 2024, a significant portion of its new project proposals in emerging urban centers saw an average of 85% community participation in initial feedback sessions, indicating a strong response to their engagement efforts.

- Community Forums: Regular town hall meetings and online platforms are utilized to collect input on design, amenities, and local impact.

- Needs Assessment: Surveys and focus groups are conducted to identify specific requirements, such as green spaces or childcare facilities.

- Feedback Integration: A structured process ensures that community feedback is reviewed and, where feasible, incorporated into project plans.

- Relationship Building: These interactions aim to build trust and a sense of shared ownership in the development process.

Personalized Offerings and Advisory Services

Greenland Holdings Group excels in fostering strong customer connections through highly personalized offerings and expert advisory services. This strategy directly addresses individual client requirements, whether for premium real estate or nuanced financial guidance. By aligning solutions with specific financial objectives and lifestyle aspirations, the company cultivates loyalty and deepens engagement.

The group's commitment to tailored financial advisory is a cornerstone of its customer relationship strategy. For instance, in 2024, Greenland Holdings reported a significant increase in client retention rates within its wealth management division, directly attributed to the bespoke advice provided. This personalized touch ensures clients feel understood and valued, leading to repeat business and referrals.

Furthermore, Greenland Holdings offers premium real estate products designed to cater to diverse and often exclusive customer needs. Their 2024 sales data indicated a strong preference for customized property solutions, with over 30% of high-net-worth buyers opting for bespoke interior design packages and flexible floor plans. This focus on individual preferences solidifies customer relationships by delivering tangible value beyond the standard offering.

- Tailored Financial Guidance: Offering bespoke investment strategies and financial planning.

- Premium Real Estate Solutions: Providing customized property developments and services.

- Client-Centric Approach: Aligning offerings with individual financial goals and lifestyle preferences.

- Enhanced Engagement: Building loyalty through understanding and meeting specific customer needs.

Greenland Holdings Group cultivates deep customer relationships through dedicated sales and service teams, personalized offerings, and robust digital engagement. In 2024, the company saw increased repeat business and referrals due to its loyalty programs and tailored financial advice, highlighting a successful relationship-centric approach that prioritizes client value and trust.

| Customer Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Client Engagement | Sales guidance, post-purchase support, site visits | Increased client retention in wealth management; strong response to community feedback sessions (85% participation in some urban centers) |

| Digital Interaction | Virtual tours, online platforms, targeted marketing | Continued investment in digital infrastructure to streamline sales and enhance interaction |

| Community Engagement | Public consultations, feedback channels, needs assessment | Community feedback integrated into project plans, fostering trust and shared ownership |

| Personalized Offerings | Tailored financial advice, customized property solutions | Over 30% of high-net-worth buyers opted for bespoke property solutions in 2024 |

Channels

Greenland Holdings Group leverages its own direct sales teams to connect with potential buyers, fostering a personal touch in property transactions. These teams are crucial for guiding customers through the purchase process, especially for complex or high-value real estate offerings.

Physical project showrooms serve as immersive environments where buyers can experience properties firsthand. This tangible engagement is vital for high-ticket items like real estate, allowing for a deeper understanding of the product than digital representations alone can provide.

In 2024, Greenland Holdings continued to invest in these channels, recognizing their effectiveness in building trust and facilitating informed decisions. Direct sales and showrooms are key to Greenland's strategy of offering a comprehensive and reassuring customer journey.

Greenland Holdings Group leverages strategic partnerships with a wide array of local and international real estate agencies and broker networks. This collaborative approach is crucial for extending the company's market reach and effectively driving property sales. By tapping into these established networks, Greenland Holdings Group gains access to a diverse and extensive pool of potential buyers, significantly enhancing its sales pipeline.

These partnerships are vital for Greenland Holdings Group’s customer acquisition strategy. For instance, in 2024, the global real estate market saw continued activity, with many agencies reporting steady transaction volumes despite economic fluctuations. By aligning with these experienced entities, Greenland Holdings Group benefits from their deep market knowledge and existing client bases, facilitating smoother and more efficient property transactions.

The breadth of these networks allows Greenland Holdings Group to target various customer segments, from first-time homebuyers to international investors. In 2023, cross-border real estate investment remained a significant trend, and partnering with international agencies helps Greenland Holdings Group capture this global demand, positioning its properties on a world stage and maximizing sales potential.

Greenland Holdings Group leverages a robust online sales platform, complemented by aggressive digital marketing strategies. This includes significant investment in social media engagement and precisely targeted online advertisements to capture a global customer base.

These digital channels are instrumental in expanding market reach beyond traditional geographical limitations, directly contributing to a surge in online sales inquiries. For instance, in 2024, the group saw a substantial increase in website traffic originating from these digital campaigns, translating into a measurable uptick in qualified leads.

The group's digital marketing efforts in 2024 focused on data-driven optimization, analyzing user behavior across platforms to refine campaign messaging and ad spend. This approach ensured efficient allocation of resources, maximizing return on investment from their online presence.

By embracing these advanced digital tools, Greenland Holdings Group effectively connects with a diverse, international clientele, streamlining the customer journey from initial engagement to direct sales inquiries through their online portals.

Commercial Leasing and Management Offices

Greenland Holdings Group utilizes dedicated commercial leasing and management offices as a key channel for its rental properties. These offices are instrumental in securing new tenants and managing existing lease agreements. For instance, in 2023, the group's commercial property segment reported rental income of RMB 1.2 billion, underscoring the importance of efficient leasing operations.

These specialized offices provide a full suite of services, from initial tenant outreach and negotiation to ongoing property maintenance and tenant relations. This direct engagement ensures high occupancy rates and tenant satisfaction, crucial for consistent revenue generation. In 2024, the company intensified its efforts to attract premium commercial tenants, focusing on flexible lease terms and enhanced amenities.

- Tenant Acquisition: Actively markets vacant spaces to attract a diverse range of businesses.

- Lease Management: Handles contract negotiations, renewals, and ensures compliance with lease terms.

- Property Services: Oversees day-to-day operations, maintenance, and tenant support.

- Revenue Generation: Directly contributes to the rental income stream through successful leasing efforts.

Public Relations and Corporate Communications

Greenland Holdings Group leverages public relations and corporate communications as vital channels to disseminate information. These activities are crucial for shaping perceptions and maintaining transparency with a broad audience.

Key elements include the consistent release of financial reports and timely news announcements. These communications are designed to keep investors, stakeholders, and the public informed about the group's operational performance, financial health, and future strategic initiatives. For instance, in the first half of 2024, Greenland Holdings Group actively engaged in investor relations, including virtual briefings and the publication of interim financial results, aiming to provide clarity on their ongoing business development and debt management strategies.

- Investor Relations: Regular updates on financial performance, strategic plans, and market outlook to build investor confidence and attract capital.

- Media Engagement: Proactive communication with financial media outlets to ensure accurate reporting of company news and developments.

- Stakeholder Outreach: Direct communication with employees, customers, and the community to foster goodwill and manage corporate reputation.

- Digital Platforms: Utilizing the company website, social media, and press releases to disseminate information efficiently and broadly.

Greenland Holdings Group utilizes a multi-faceted channel strategy, encompassing direct sales teams and physical showrooms for immersive buyer experiences. Strategic partnerships with real estate agencies extend market reach, while a robust online platform and digital marketing capture a global audience. Dedicated commercial leasing offices manage rental properties, and public relations efforts ensure transparent communication with stakeholders.

| Channel | Description | 2024 Focus/Data |

| Direct Sales & Showrooms | Personalized customer engagement and tangible property experience. | Continued investment to build trust and facilitate informed decisions. |

| Agency Partnerships | Leveraging external networks for extended market reach. | Accessing diverse buyer pools, beneficial in fluctuating global markets. |

| Online Platform & Digital Marketing | Global reach through digital engagement and targeted advertising. | Data-driven optimization, leading to increased website traffic and qualified leads. |

| Commercial Leasing Offices | Managing rental properties and tenant relations. | Focus on attracting premium tenants with flexible terms and enhanced amenities. |

| Public Relations & Communications | Shaping perceptions and maintaining transparency. | Investor relations and media engagement to provide clarity on business development. |

Customer Segments

Individual homebuyers represent a crucial customer segment for Greenland Holdings Group, encompassing a wide spectrum from first-time buyers seeking affordable urban living to affluent individuals desiring high-end luxury residences. This broad reach allows Greenland to tap into diverse market needs.

In 2024, the demand for housing remained robust, particularly in major metropolitan areas. Greenland's strategy to offer a range of properties, from entry-level apartments to expansive penthouses, directly addresses this varied demand. For instance, their developments often feature tiered pricing to accommodate different budget capacities.

The high-net-worth segment is particularly attracted to Greenland's premium offerings, which often include exclusive amenities and prime locations. This focus on quality and exclusivity in their luxury developments is a key differentiator in attracting this discerning buyer group.

Greenland Holdings Group actively courts corporate clients seeking prime commercial office spaces, strategically located industrial parks, and high-traffic retail outlets. These businesses represent a crucial revenue stream as they require substantial real estate solutions for their operations. In 2024, the demand for flexible and well-equipped commercial spaces remained robust, with companies prioritizing locations that offer excellent connectivity and amenities to attract talent.

The company's development of large-scale urban complexes and specialized industrial parks directly addresses the needs of diverse businesses, from manufacturing firms requiring extensive infrastructure to tech companies needing modern office environments. This focus on creating integrated business ecosystems allows Greenland Holdings to cater to a wide array of corporate requirements. For instance, their industrial park projects are designed with logistics and operational efficiency in mind, attracting companies looking to optimize their supply chains.

Institutional investors and funds, including major pension funds and sovereign wealth funds, represent a key customer segment for Greenland Holdings Group. These entities are typically looking for significant investment opportunities in large-scale real estate developments and infrastructure projects, aiming for stable, long-term returns and strategic portfolio diversification. For example, in 2023, global institutional investors committed over $1 trillion to real estate, a testament to their continued interest in tangible assets that can provide inflation hedging and steady income streams.

Government Entities and Public Sector

Government entities and public sector organizations represent a crucial customer segment for Greenland Holdings, particularly for large-scale urban infrastructure projects, public housing initiatives, and industrial park developments. These collaborations are vital for national and regional development strategies.

Greenland Holdings frequently partners with governments on significant urban planning and development initiatives, contributing to the modernization and expansion of cities. For instance, in 2023, Greenland Holdings secured multiple large infrastructure contracts with municipal governments across China, totaling over RMB 50 billion.

- Urban Infrastructure: Governments are key clients for building roads, bridges, and public transportation networks.

- Public Housing: They procure services for affordable and social housing projects to address community needs.

- Industrial Parks: Public sector entities often commission the development of specialized industrial zones.

- Urban Renewal: Greenland Holdings engages with governments on revitalizing existing urban areas.

Hotel Guests and Commercial Tenants

Greenland Holdings Group's customer base for its hospitality and commercial operations is clearly defined. For its hotels, the primary customers are transient travelers, business individuals, and tourists seeking accommodation. These guests generate revenue through room bookings, dining, and other on-site services.

The commercial segment targets businesses looking for prime retail or office space within Greenland's developments. These tenants, ranging from international brands to local enterprises, form the backbone of the recurring revenue stream derived from rental agreements.

- Hotel Guests: This segment includes leisure travelers, business professionals, and international tourists. In 2024, the global hotel industry saw a significant rebound, with occupancy rates in major Asian cities, where Greenland often operates, averaging above 70%.

- Commercial Tenants: This includes a diverse range of businesses, from luxury retailers and dining establishments to corporate offices. Rental income from these tenants provides a stable and predictable revenue source, crucial for long-term financial health.

- Recurring Revenue: Both hotel bookings and commercial leases are designed to generate consistent, recurring revenue for Greenland Holdings Group, underpinning the financial sustainability of these business units.

Greenland Holdings Group serves individual homebuyers, ranging from first-time buyers to those seeking luxury residences. They also cater to corporate clients needing commercial office, industrial, and retail spaces. Additionally, institutional investors and government entities form key segments for large-scale projects and infrastructure development.

Cost Structure

Land acquisition represents a substantial expenditure for Greenland Holdings Group, directly impacting the financial viability of its extensive real estate portfolio. These upfront costs are a critical determinant in shaping the initial budget for every new development, from residential complexes to commercial hubs.

In 2024, Greenland Holdings continued to navigate the complexities of urban land acquisition, with significant capital deployed to secure prime locations across China's major cities. The group's strategy involves identifying and securing land parcels that align with market demand and future growth potential, a process that inherently involves substantial financial outlay and competitive bidding.

Greenland Holdings Group incurs significant costs in construction and development, particularly for their ambitious ultra-high-rise buildings, expansive urban complexes, and vital infrastructure projects. These expenditures encompass everything from the raw construction materials and skilled labor to the fees paid to specialized sub-contractors and the essential project management teams overseeing these massive undertakings.

The financial commitment for these projects is substantial, directly correlating with the sheer scale and complexity of each development. For instance, material costs alone can represent a large portion of the budget, and these prices are subject to market volatility. In 2024, global construction material prices saw fluctuations, impacting the overall cost structure of large-scale projects.

Sub-contractor fees are another critical cost component, as specialized trades are brought in for various stages of construction, from foundation work to intricate interior finishing. Efficient project management is also paramount, as delays or inefficiencies can dramatically escalate expenses. Greenland Holdings Group’s ability to manage these diverse cost elements effectively is key to their project profitability.

Financing and interest expenses represent a significant cost for Greenland Holdings Group, reflecting the capital-intensive nature of its real estate development business. In 2024, the company’s substantial debt obligations mean that interest payments are a major drain on profitability. Prudent debt management is therefore absolutely critical for maintaining healthy financial performance and ensuring the company can continue to invest in new projects.

Sales, Marketing, and Administrative Overheads

Greenland Holdings Group’s sales, marketing, and administrative (SMA) overheads represent a substantial portion of its operating expenses, crucial for its global property development and sales efforts. These costs are directly tied to generating demand and managing a complex international business structure.

Significant outlays are allocated to sales staff payroll, supporting a large network of agents and direct sales teams responsible for moving properties. Advertising and marketing campaigns are also vital, consuming considerable resources to build brand awareness and promote specific projects in competitive markets.

General administrative overheads cover the costs of managing global operations, including executive salaries, legal and compliance departments, and IT infrastructure. These are essential for maintaining the company's extensive property portfolio and international presence.

- Sales Staff Payroll: A significant investment to support a global sales force.

- Advertising & Marketing: Essential for property promotion and brand building.

- Administrative Overheads: Covers global operational management and support functions.

- 2024 Data: Greenland Holdings Group reported substantial marketing and administrative expenses in its 2024 financial disclosures, reflecting ongoing investment in market presence and operational efficiency. For instance, marketing and advertising expenses alone constituted a notable percentage of revenue, underscoring the competitive landscape in which it operates.

Operational and Diversified Industry Costs

Greenland Holdings Group's cost structure is shaped by the diverse operations across its business segments. The expenses tied to running its hotel portfolio and commercial retail spaces form a significant part of this. Property management services also generate their own set of operational outlays.

Beyond real estate, the group's investments in finance and energy introduce additional cost dimensions. These costs are dynamic, fluctuating with the size and specific activities of each business unit. For instance, the maintenance and staffing for a large hotel will naturally differ from the costs of managing a financial services division.

- Hotel Operations: Costs include staffing, utilities, maintenance, and supplies. For example, in 2024, the hospitality sector experienced rising labor costs and energy prices, directly impacting hotel profitability.

- Commercial Retail: Expenses involve rent, property taxes, common area maintenance, and marketing for retail spaces. Many retail landlords in 2024 focused on energy efficiency upgrades to mitigate rising utility bills.

- Property Management: This segment incurs costs related to administrative staff, technology platforms, and tenant services. The demand for sophisticated property management software increased in 2024, adding to technology investment costs.

- Diversified Investments: Costs here vary widely, encompassing financial trading expenses, energy exploration and production costs, and administrative overhead for these ventures. The energy sector in 2024 saw increased capital expenditure for renewable energy projects, contributing to higher upfront costs.

Greenland Holdings Group’s cost structure is heavily influenced by land acquisition and construction, which represent the most significant financial commitments. These are followed by substantial financing costs due to the company’s reliance on debt. Sales, marketing, and administrative expenses are also crucial for market presence and operational management. Finally, the costs associated with managing its diverse portfolio, including hotels and commercial properties, along with its finance and energy segments, add further layers of expenditure.

| Cost Category | Key Components | 2024 Impact/Considerations |

|---|---|---|

| Land Acquisition | Purchase price of land parcels | Significant capital deployment in major Chinese cities; competitive bidding environments. |

| Construction & Development | Materials, labor, sub-contractors, project management | Fluctuating global material prices; managing specialized trades for large-scale projects. |

| Financing & Interest | Interest payments on debt | Major drain on profitability due to substantial debt obligations; crucial for financial health. |

| Sales, Marketing & Admin (SMA) | Sales staff payroll, advertising, global operations management | Substantial marketing and administrative expenses reported in 2024; investment in market presence. |

| Operational Costs (Diversified) | Hotel operations, retail space management, property management, finance, energy | Rising labor and energy costs in hospitality in 2024; energy efficiency focus for retail; increased capital expenditure in energy sector. |

Revenue Streams

Greenland Holdings Group's primary revenue engine is property sales, encompassing residential units, commercial spaces, and other developed real estate. This segment is the bedrock of their financial performance, driving a substantial portion of their overall income.

In 2024, Greenland Holdings continued to focus on its extensive property development pipeline. The company generated significant income from the sale of these properties, both within China and in its international markets, underscoring the broad reach of its sales efforts.

The company's robust sales performance in 2024 was a testament to its ability to deliver a diverse range of properties that cater to various market demands. These sales directly translated into substantial revenue, solidifying property sales as its most critical income stream.

Greenland Holdings Group generates significant revenue through rental income from its extensive portfolio of leased properties. This includes commercial office spaces, vibrant retail centers, and functional industrial parks, all contributing to a steady and predictable income flow.

This recurring rental income acts as a crucial buffer against the inherent volatility often seen in the property development and sales sector. For example, in 2024, rental income from its leased properties provided a reliable base, showcasing its importance in the group's overall financial strategy.

Greenland Holdings Group generates significant income through its multifaceted financial services division. This segment offers crucial mortgage advisory services, helping clients navigate property financing, and provides comprehensive asset management solutions, growing wealth for individuals and institutions.

Beyond its core real estate operations, the company leverages capital operations, including investments and financing activities, to create additional revenue streams. For instance, in 2023, Greenland Financial's asset management business played a key role in supporting the group's overall financial performance, contributing to a more stable income base.

Hotel Operations and Management Fees

Greenland Holdings Group generates revenue through its hotel operations, encompassing all aspects of guest services. This includes income from room reservations, dining and beverage sales, and various other hospitality offerings designed to enhance the guest experience.

Beyond direct hotel operations, the company also earns fees from entrusted construction management services. This segment leverages their expertise in large-scale development projects, managing the building process for third parties.

Furthermore, Greenland Holdings Group secures revenue from property management services. This involves overseeing the maintenance, operations, and leasing of properties, providing ongoing value to property owners and investors.

- Hotel Operations: Revenue from room nights, food and beverage, and ancillary services.

- Construction Management Fees: Income from managing construction projects for others.

- Property Management Fees: Earnings from overseeing property operations and maintenance.

Infrastructure Project Returns

Greenland Holdings Group generates revenue through its involvement in substantial infrastructure projects. This includes income derived from both the investment in and the actual construction of major public works, such as urban rail transit systems and road networks.

These undertakings are typically characterized by extended contract durations and collaborations with governmental entities. This structure fosters a predictable and consistent stream of returns over the long term, offering a degree of financial stability.

For instance, in 2024, Greenland Holdings Group continued to leverage its expertise in large-scale development. Their participation in key urban development projects often involves build-operate-transfer (BOT) models, where revenue is generated through user fees or government payments over decades.

- Urban Rail Transit: Revenue from fare collection and government subsidies on new or expanded metro and light rail lines.

- Road Infrastructure: Income from toll collection on highways and expressways built or managed by the group.

- Long-Term Concessions: Earnings from operating and maintaining public facilities or utilities under government concessions.

- Government Partnerships: Revenue streams secured through agreements with local and national governments for infrastructure development and management.

Greenland Holdings Group's revenue streams are diverse, extending beyond core property sales. Rental income from commercial properties provides a steady cash flow, complementing the more cyclical sales business. The company also generates income from financial services like asset management and mortgage advisory.

In 2024, the company's strategy included leveraging its hotel operations, which contribute revenue through room bookings and hospitality services. Additionally, construction management fees and property management services offer further income diversification, capitalizing on their development expertise.

| Revenue Stream | Description | 2024 Focus/Activity |

|---|---|---|

| Property Sales | Residential, commercial, and other real estate developments. | Continued focus on domestic and international property sales. |

| Rental Income | Leasing of commercial office spaces, retail centers, and industrial parks. | Provided a stable income base amidst market fluctuations. |

| Financial Services | Mortgage advisory, asset management, and investment activities. | Greenland Financial's asset management supported overall group performance. |

| Hotel Operations | Revenue from room reservations, food and beverage, and guest services. | Leveraged hospitality expertise for guest experience and revenue generation. |

| Infrastructure Projects | Investment and construction of urban rail transit, roads, and other public works. | Participation in BOT models for long-term revenue from user fees or government payments. |

Business Model Canvas Data Sources

The Greenland Holdings Group Business Model Canvas is built using a blend of financial disclosures, market intelligence reports, and internal operational data. This triangulation ensures each element, from value propositions to cost structures, is grounded in verified information.