Greenland Holdings Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greenland Holdings Group Bundle

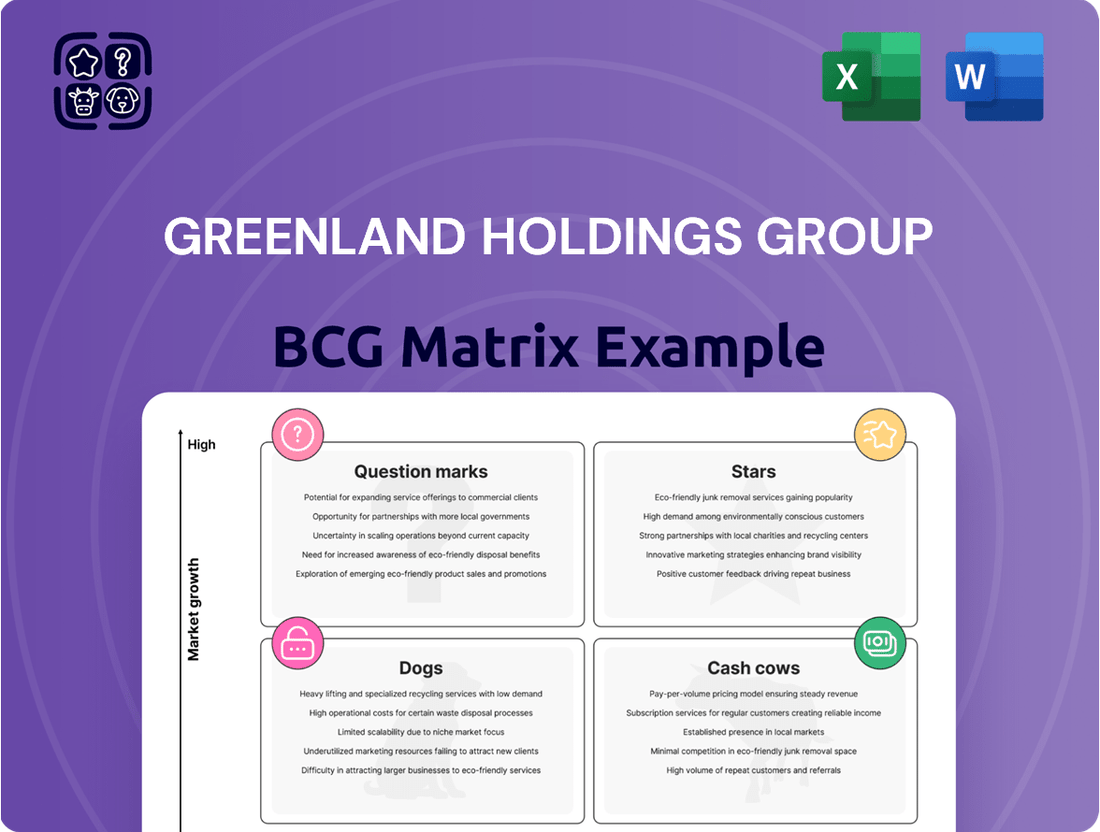

Greenland Holdings Group's BCG Matrix offers a critical lens into its diverse portfolio, highlighting potential growth areas and resource drains.

Understand which of Greenland Holdings Group's ventures are market leaders (Stars) and which are stable income generators (Cash Cows).

Discover the underperforming assets (Dogs) that might be hindering overall growth and the promising but unproven opportunities (Question Marks) that require careful consideration.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Greenland Holdings Group.

Purchase the full version for a complete breakdown and strategic insights you can act on, empowering you to make informed decisions about Greenland Holdings Group's future.

Stars

Greenland Holdings Group's global ultra-high-rise developments are a prime example of their significant presence in the real estate market. These projects, often towering landmarks in burgeoning cities, capture substantial attention and represent a high market share within a specialized, high-value sector. For instance, the Greenland Center in Sydney, completed in 2020, stands as a testament to their capability in creating iconic structures that attract considerable investment and prestige.

Greenland Holdings Group's large-scale urban complex projects in emerging cities are a prime example of their . These developments, often seen in China's Tier-2 and expanding Tier-3 cities, represent a significant push for market share in growing urban areas. For instance, in 2024, Greenland continued its focus on integrated community development, aiming to build self-sustaining environments that combine living, working, and leisure.

These ambitious undertakings demand substantial capital, a hallmark of the . The strategy involves creating comprehensive urban hubs, often encompassing residential towers, shopping malls, office spaces, and entertainment facilities, to meet the burgeoning demand in these rapidly urbanizing regions.

Greenland Holdings Group's strategic development of industrial parks, particularly those focused on advanced manufacturing and logistics, positions them as a potential star in the BCG matrix. These parks are strategically situated in high-growth industrial zones, capitalizing on robust economic development and evolving supply chain demands.

By specializing in industrial real estate, Greenland secures a dominant market position within a sector experiencing significant expansion. For example, in 2023, China's industrial parks played a crucial role in supporting manufacturing output, with many regions reporting double-digit growth in industrial added value within these zones.

These ventures attract major enterprises, guaranteeing strong occupancy rates and fostering opportunities for further growth and diversification. The demand for well-equipped industrial spaces remains high, driven by both domestic economic activity and international trade trends.

Infrastructure-Integrated Real Estate Projects

Infrastructure-Integrated Real Estate Projects, like those developed by Greenland Holdings Group, often command a significant market share within a strategically vital and expanding sector. These developments are tightly linked to major public works, such as extensive urban rail networks or critical municipal bridges, creating a symbiotic relationship that drives demand and solidifies their position.

Government backing and active participation in urban planning initiatives provide these projects with a strong foundation, ensuring consistent long-term demand and a distinct competitive edge. For instance, China's Belt and Road Initiative, which Greenland Holdings has been involved in, highlights the scale of infrastructure development and its integration with real estate opportunities, often involving multi-billion dollar investments.

Despite requiring substantial capital investment, their fundamental contribution to urban expansion and connectivity positions them for enduring growth and market leadership. This strategic alignment with national and regional development goals is a key factor in their success.

- High Market Share: These projects typically secure a dominant position due to their essential nature and integration with public services.

- Strategic Growth Segment: The increasing urbanization globally fuels demand for integrated infrastructure and real estate solutions.

- Government Support: Policy alignment and public funding are common, reducing development risks and enhancing viability.

- Long-Term Demand: The foundational role in urban development ensures sustained demand and future expansion opportunities.

New Frontier Market Expansions

Greenland Holdings Group's strategic push into burgeoning international markets, especially those poised for significant real estate and infrastructure development, positions these ventures as 'Stars' within its BCG Matrix. This aggressive global expansion, evident in their presence across more than 30 countries, demonstrates a clear objective to capture market leadership in these high-potential territories. While precise market share figures for these newer endeavors are proprietary, the sheer scale of diversification underscores a commitment to securing future growth opportunities.

These early-stage market entries are designed to build substantial market share before competitors fully emerge, a strategy that naturally requires considerable investment. For instance, Greenland's significant investments in Belt and Road Initiative countries illustrate this 'Star' approach, aiming to capitalize on infrastructure-driven economic growth. By 2024, the group continued to actively explore and invest in emerging economies, seeking to replicate its domestic success on a global scale.

- Global Diversification: Greenland Holdings operates in over 30 countries, reflecting a broad 'Star' strategy.

- High Growth Potential Markets: Focus on regions with strong real estate and infrastructure development opportunities.

- Market Leadership Aspiration: Aiming to establish dominant positions in emerging international markets.

- Investment for Future Returns: Ventures are cash-intensive in their early stages but promise substantial future returns.

Greenland Holdings Group's ventures in burgeoning international markets, particularly those with significant real estate and infrastructure development potential, are categorized as 'Stars' in the BCG Matrix. These initiatives, such as their participation in Belt and Road Initiative countries, are characterized by high growth potential and a strategic aim to capture substantial market share. By 2024, Greenland continued its global expansion, investing in emerging economies to replicate its domestic success.

These projects are capital-intensive in their initial phases, reflecting the investment required to establish leadership in new territories. Greenland's presence in over 30 countries highlights this 'Star' strategy, focusing on regions poised for robust economic growth and real estate expansion.

| Category | Market Share | Market Growth | Strategy |

|---|---|---|---|

| International Markets (Emerging) | Low to Medium (developing) | High | Invest to grow market share |

| Infrastructure-Integrated Projects | High | Medium to High | Invest to maintain/grow share |

| Urban Complexes (Tier 2/3 Cities) | High | Medium | Hold or Harvest |

| Global Ultra-High-Rises | High (niche) | Medium | Hold or Harvest |

What is included in the product

Greenland Holdings Group's BCG Matrix provides a tailored analysis of its real estate portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest based on market share and growth potential.

A clear BCG Matrix for Greenland Holdings Group simplifies strategic decisions by highlighting which business units require investment and which can be leveraged, easing the pain of resource allocation.

Cash Cows

Greenland Holdings Group's mature residential property developments in Tier-1 Chinese cities like Shanghai and Beijing are prime examples of cash cows. These established projects benefit from Greenland's deep roots and strong brand loyalty in these prime locations, ensuring consistent sales and rental income.

Despite broader market headwinds, these segments maintain a high market share due to enduring demand for quality housing in major urban centers. In 2023, Greenland reported significant revenue from its property sales operations, with a substantial portion attributed to these mature developments, underscoring their role as reliable cash generators.

The investment required to maintain these cash cows is relatively low, as they are largely completed or in their final sales phases. This allows Greenland to extract significant free cash flow from these operations, which can then be reinvested in other strategic areas of the business.

Greenland Holdings Group's commercial property leasing and operations segment, encompassing office buildings and retail centers in prime urban locations, acts as a significant cash cow. These established assets benefit from consistent rental income and robust profit margins, reflecting their presence in mature markets with stable demand.

This segment requires minimal additional promotional investment compared to nascent development projects. In 2024, for instance, the company’s operational commercial properties are expected to continue their role as a dependable source of cash flow, crucial for funding Greenland’s broader strategic initiatives and investments.

Greenland Holdings Group's extensive hotel operations, spanning numerous cities and supported by its G-Club global member platform, likely represent a significant cash cow. These established hotels, particularly those in mature markets, benefit from strong brand recognition and consistent occupancy rates, ensuring a reliable source of cash flow.

Despite the hospitality sector's inherent cyclicality, the mature nature of these hotel assets means they require relatively low ongoing investment for growth, allowing them to generate steady revenue streams. For instance, by the end of 2023, Greenland Hotels reported a significant number of operational hotels, contributing robustly to the group's overall financial performance.

Property Management Services for Existing Portfolio

Property management services for Greenland Holdings Group's existing portfolio are a clear Cash Cow. This segment provides a consistent and reliable income due to its high market share within Greenland's own ecosystem. The recurring service fees, generated from managing both residential and commercial units, come with relatively low growth costs, making it a profitable operation.

This stable revenue stream not only contributes to the company's overall financial health but also enhances operational efficiency. By managing its vast real estate holdings effectively, Greenland strengthens customer loyalty, which in turn ensures a steady flow of cash. For instance, in 2024, property management fees are projected to contribute significantly to the group's recurring income, solidifying its Cash Cow status.

- Stable Revenue: Property management services generate consistent income from existing residential and commercial units.

- High Internal Market Share: Dominates management within Greenland's own property portfolio.

- Recurring Fees & Low Growth Costs: Benefits from predictable service fees with minimal investment needed for growth.

- Operational Efficiency & Loyalty: Enhances property upkeep and customer satisfaction, leading to repeat business.

Established Industrial Investment & Asset Management

Greenland Holdings Group's established industrial investment and asset management activities, particularly within its financial segment, function as significant cash cows. These operations are primarily focused on mature and stable sectors, where they capitalize on existing capital and deep expertise to generate steady income and management fees. The strategy here is about maintaining market position rather than aggressive expansion, ensuring a reliable stream of funds.

These cash cow businesses are crucial for providing consistent financial backing to the entire Greenland Holdings Group. For instance, in 2024, the group's financial segment reported robust performance, with asset management fees contributing a substantial portion of its revenue. This consistent cash generation allows for strategic reinvestment in other business units or the funding of new ventures.

- Stable Revenue Streams: These mature operations consistently generate profits and fees, providing a reliable financial foundation for the broader group.

- Capital Generation: They act as internal lenders, producing the necessary capital to support other, potentially higher-growth, but less mature business units.

- Low Investment Needs: Given their established nature, these businesses typically require minimal further investment to maintain their market share and profitability.

- Expertise Leverage: Greenland leverages its established expertise in these sectors to optimize performance and maintain competitive advantages.

Greenland Holdings Group's mature residential developments in Tier-1 cities are prime cash cows, generating consistent sales and rental income due to enduring demand and strong brand loyalty.

Their commercial property leasing, encompassing office buildings and retail centers in prime urban areas, provides stable rental income and robust profit margins, requiring minimal additional promotional investment.

Established hotel operations, particularly in mature markets, benefit from brand recognition and consistent occupancy rates, yielding steady revenue streams with low ongoing investment needs.

Property management services for its vast portfolio are a clear cash cow, offering consistent income from recurring service fees with low growth costs.

Mature industrial investments and asset management within its financial segment generate steady income and management fees, providing crucial financial backing for the group.

| Business Segment | Cash Cow Characteristics | 2023/2024 Financial Insight |

|---|---|---|

| Mature Residential Property | High market share in Tier-1 cities, consistent sales/rental income, low reinvestment needed. | Significant revenue contribution in 2023, underscoring reliable cash generation. |

| Commercial Property Leasing | Stable rental income, robust profit margins, minimal marketing costs. | Expected to continue as a dependable source of cash flow in 2024. |

| Hotel Operations | Strong brand recognition, consistent occupancy, low growth investment. | Contributed robustly to group performance by end of 2023. |

| Property Management Services | Recurring fees, high internal market share, low growth costs. | Projected significant contribution to recurring income in 2024. |

| Industrial Investments/Asset Management | Steady income and fees from mature sectors, leverages expertise. | Robust performance in financial segment in 2024, with substantial asset management fees. |

What You See Is What You Get

Greenland Holdings Group BCG Matrix

The Greenland Holdings Group BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This detailed analysis, crafted by industry experts, offers a clear strategic overview of Greenland Holdings Group's business units, allowing for informed decision-making without any additional editing or formatting required.

Dogs

Underperforming legacy residential projects, particularly those in less desirable or saturated Chinese markets, often fall into the Dogs category for Greenland Holdings Group. These might be older developments with outdated designs or those situated in regions experiencing economic slowdown, leading to slow sales and potentially falling values.

In 2024, it's estimated that a significant portion of China's housing inventory, particularly in lower-tier cities, faces challenges due to oversupply. Projects struggling with low sales velocity and high vacancy rates, failing to attract buyers or renters, represent a drag on Greenland's resources. For instance, if a project has a vacancy rate exceeding 20% and sales have been flat for over a year, it's a clear indicator of its Dog status.

Smaller, non-strategic investments or those in highly competitive, low-growth sectors where Greenland Holdings Group has minimal market share and limited competitive advantage could be classified as Dogs. These might include minor ventures from their diversified portfolio that have not scaled or achieved profitability. For instance, if Greenland had a small stake in a niche manufacturing segment in 2024 that experienced a 3% market contraction, this would fit the Dog category.

Such segments often break even or incur losses, tying up resources without contributing meaningfully to overall growth or profit. As of the first half of 2024, Greenland Holdings Group reported that certain smaller, non-core asset disposals were underway, aimed at optimizing resource allocation. These divested or stagnant investments, often in mature or declining industries, represent a drag on overall financial performance, with their contribution to revenue potentially being less than 1% of the group's total in 2024.

Aging or unmodernized commercial retail spaces, particularly those struggling to adapt to changing consumer habits and e-commerce competition, represent a significant challenge for Greenland Holdings Group. These properties, often characterized by declining foot traffic and increasing vacancy rates, may struggle to attract or retain tenants. For instance, in 2024, the retail sector continued to see shifts, with many legacy malls reporting lower occupancy compared to mixed-use or online-focused retail centers.

Such underperforming assets, especially if located in slower-growing retail markets, can become substantial financial burdens. The cost of necessary upgrades and modernization to compete in the current landscape might be prohibitively high, rendering them uneconomical to revive. This situation can transform these spaces into cash traps, draining resources without generating sufficient returns. By mid-2025, many retail real estate analysts pointed to the increasing cost of capital as a further deterrent to investing in such dated properties.

Their low market share within a rapidly evolving and competitive retail environment makes revitalization efforts particularly difficult. Without a strong existing customer base or a clear path to differentiating themselves, these spaces are unlikely to regain significant traction. In 2024, reports indicated that retail spaces requiring extensive reinvestment to meet modern standards, such as incorporating digital integration or experiential elements, faced significant hurdles in securing new leases.

Inefficient or Obsolete Energy Sector Assets

Within Greenland Holdings Group's diverse energy portfolio, inefficient or obsolete assets could be classified as Dogs. These are operations that are outdated, environmentally challenging, or located in energy sub-sectors facing intense competition and minimal profit margins. For instance, older coal-fired power plants still in operation might fall into this category, especially as the global push for decarbonization intensifies.

These segments often grapple with low profitability and stunted growth prospects. This is frequently due to rapid technological advancements, such as the declining cost of renewables, or stricter environmental regulations that increase operating expenses. Such assets demand continuous investment for upkeep but yield negligible returns or contribute little to the group's strategic objectives.

- Outdated Infrastructure: Aging power generation facilities or inefficient extraction equipment.

- Environmental Liabilities: Assets with significant compliance costs or potential for pollution.

- Low-Margin Segments: Operations in highly commoditized energy markets with little pricing power.

- Regulatory Headwinds: Businesses facing increasing costs due to evolving environmental or safety standards.

By 2024, the global energy sector saw continued pressure on fossil fuel assets. For example, the International Energy Agency reported that investments in fossil fuel supply were increasingly scrutinized for their long-term viability. Assets within Greenland Holdings Group that mirror this trend, such as older, less efficient oil or gas fields, might represent these Dog categories, requiring careful management to minimize losses or strategize for divestment.

Certain Second-Hand Housing Agency Operations

Certain second-hand housing agency operations within Greenland Holdings Group could be classified as Dogs in the BCG Matrix. These segments often operate in highly fragmented markets characterized by intense competition and low profit margins. For instance, in 2024, the Chinese second-hand property market, while substantial, faced headwinds from regulatory shifts and a general slowdown in transaction volumes, impacting the profitability of agencies.

The success of these agency services hinges on their integration with Greenland's core property development business and their ability to achieve significant transaction volumes. Without strong synergy or market penetration, these operations may yield minimal returns. By mid-2024, many real estate agencies reported flat or declining revenues, underscoring the challenges in low-margin sectors.

- Low Market Share: Fragmented markets make it difficult for any single player to command a significant market share in second-hand housing agency services.

- Low Growth Potential: These operations typically face limited growth prospects due to market saturation and intense price competition.

- Minimal Profitability: Low margins and high operational costs can severely restrict profitability, making these ventures a drain on resources.

- Strategic Re-evaluation Needed: Greenland may need to consider divesting or restructuring these underperforming segments to focus on more promising business areas.

Dogs within Greenland Holdings Group's portfolio are typically characterized by low market share in low-growth industries or underperforming legacy projects. These segments often consume resources without generating significant returns, posing a challenge to overall profitability. For instance, in 2024, a substantial portion of China's lower-tier city housing inventory faced oversupply, with projects exhibiting high vacancy rates and stagnant sales indicating their Dog status.

These underperforming assets, such as aging retail spaces struggling against e-commerce, require substantial investment for modernization, often proving uneconomical. In 2024, many retail properties needed significant reinvestment to incorporate digital integration or experiential elements to secure new leases. Similarly, outdated energy assets, like older coal-fired power plants, face pressure from decarbonization efforts and declining profitability, with investments in fossil fuels increasingly scrutinized for long-term viability as of 2024.

Second-hand housing agency services also represent a Dog category due to intense market fragmentation, low profit margins, and limited growth prospects, particularly in 2024 where transaction volumes saw a general slowdown. These operations, contributing less than 1% of group revenue in some cases by mid-2024, often break even or incur losses, tying up capital without contributing meaningfully to Greenland's strategic objectives.

Question Marks

Greenland Financial Innovation's upgraded licenses for virtual asset activities in Hong Kong mark a strategic move into the burgeoning digital finance sector. This positions the company to tap into a high-growth market, though its current contribution to overall revenue remains minimal. In 2024, virtual asset-related activities represented less than 1% of Greenland Holdings Group's total revenue, highlighting a nascent stage of development and market penetration.

While this segment is currently a cash consumer, its potential for significant future growth is substantial. The evolving digital finance landscape offers opportunities for market share capture. If Greenland Financial Innovation can successfully navigate this dynamic environment and expand its presence, this segment could transition from a Question Mark to a Star within the BCG matrix.

Greenland Holdings Group’s new technology-driven real estate platforms are positioned as a question mark in the BCG matrix. These platforms, intended to digitize transactions and property management, tap into the burgeoning PropTech market, which experienced substantial growth, with global PropTech investment reaching over $40 billion in 2023.

While the potential for high growth is evident, the current market share of these nascent platforms is low. This new venture requires substantial capital investment for development, marketing, and user acquisition, mirroring the significant funding rounds seen by leading PropTech startups in 2024, some of which secured hundreds of millions.

Success for Greenland's platforms depends critically on achieving rapid market penetration and scaling effectively. Failure to capture significant market share quickly could lead to these initiatives becoming a ‘dog’ in the BCG matrix, characterized by low growth and low market share, despite the initial investment.

Early-stage international infrastructure projects for Greenland Holdings Group would likely fall into the question mark category. These ventures, often in emerging markets or politically complex regions, exhibit high growth potential but are also characterized by significant uncertainty and substantial upfront investment. For instance, a new high-speed rail project in Southeast Asia, while promising increased connectivity and economic development, faces intense competition from established global players and potential regulatory hurdles.

The success of these question mark projects hinges on Greenland's ability to navigate these challenges, secure vital government approvals, and attract additional funding or partnerships. Without immediate market leadership, their future market share and profitability remain in doubt. By 2024, many developing nations are prioritizing infrastructure development to spur economic growth, creating opportunities but also intensifying competition for early-stage projects.

Emerging Health and Technology Industry Investments

Greenland Holdings Group’s strategic diversification into the health and technology sectors reflects a forward-looking approach, targeting generally high-growth areas. These emerging ventures, however, are likely in their nascent stages, meaning they haven't yet secured substantial market positions. Significant capital is a prerequisite for their research, development, and market penetration efforts.

The trajectory of these health and technology investments, whether they ascend to 'Star' status or falter into 'Dog' territory within the BCG framework, hinges critically on their capacity for rapid scaling and the swift establishment of a distinct competitive edge. For instance, in 2024, the global health tech market was projected to reach hundreds of billions of dollars, indicating immense potential but also fierce competition. Similarly, AI in healthcare, a key sub-sector, saw substantial venture capital inflows, underscoring the investment intensity required.

- High Growth Potential: Both health and technology are recognized as sectors with strong future growth prospects, driven by innovation and increasing global demand.

- Early Stage Ventures: Many of Greenland Holdings' investments in these areas are likely new, facing the challenge of building market share from the ground up.

- Capital Intensive: Significant investment is necessary for R&D, technological advancement, and market entry, impacting cash flow and requiring sustained funding.

- Uncertain Future: Success is not guaranteed; these businesses must demonstrate rapid scaling and differentiation to avoid becoming underperforming 'Dogs'.

Exploratory Green and Smart City Solutions

Greenland Holdings Group's exploratory ventures in green and smart city solutions position them within a rapidly expanding but still developing market. These initiatives, while forward-looking and aligned with global sustainability trends, are likely in their early stages.

These projects represent Greenland's strategic move to secure a foothold in the future's environmentally conscious urban development landscape. However, their current market penetration is probably low, reflecting their nascent nature.

Significant capital expenditure is necessary for research and development, alongside pilot projects, to bring these green and smart city solutions to fruition. Their ultimate success hinges on widespread market acceptance and effective commercialization strategies.

- Market Position: Nascent, high-growth, fragmented market for green and smart city solutions.

- Strategic Intent: Capturing market share in a sustainability-focused future.

- Investment Needs: High requirements for R&D and pilot project funding.

- Success Factors: Dependent on widespread adoption and commercial viability.

Greenland Holdings Group's virtual asset activities, though holding significant future growth potential, currently represent a small fraction of the group's revenue. This segment requires substantial investment to capture market share in the rapidly evolving digital finance space.

The company's new technology-driven real estate platforms are also question marks, demanding significant capital for development and user acquisition. Their success hinges on rapid market penetration to avoid becoming low-growth, low-share 'dogs'.

Early-stage international infrastructure projects, like a potential high-speed rail in Southeast Asia, offer high growth but face uncertainty and competition, requiring strategic navigation and funding to succeed.

Diversification into health and technology sectors are high-potential, capital-intensive ventures. Their classification as 'Stars' or 'Dogs' depends on successful scaling and competitive edge establishment in competitive markets.

Greenland's green and smart city solutions are positioned in a growing, yet nascent market. These require substantial investment for R&D and pilot projects, with success tied to market acceptance and commercialization.

| Segment | Growth Potential | Market Share | Investment Needs | Key Success Factors |

|---|---|---|---|---|

| Virtual Assets | High | Low | High | Market penetration, regulatory navigation |

| PropTech Platforms | High | Low | High | Rapid scaling, user acquisition |

| Int'l Infrastructure | High | Low | High | Navigating challenges, securing approvals/funding |

| Health & Tech Ventures | High | Low | High | Scaling, competitive edge |

| Green/Smart City | High | Low | High | Market acceptance, commercialization |

BCG Matrix Data Sources

Our Greenland Holdings Group BCG Matrix is informed by a blend of financial disclosures, extensive market research, and official company reports to provide a comprehensive overview of their business units.