Greenland Holdings Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greenland Holdings Group Bundle

Greenland Holdings Group navigates a complex landscape shaped by intense competition and significant buyer power within the real estate sector.

The threat of new entrants is moderate, as high capital requirements and established brand loyalty present barriers, yet innovative business models can emerge.

Supplier power, particularly from construction material providers and land developers, can exert considerable influence on project costs and timelines.

The availability of substitute products, such as alternative investment opportunities or rental markets, also impacts Greenland's market position.

Understanding these forces is crucial for strategic planning and investor confidence.

The complete report reveals the real forces shaping Greenland Holdings Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Greenland Holdings Group faces supplier power influenced by the concentration of providers for essential materials like steel and cement. If a limited number of large suppliers control these markets, they can command higher prices, directly impacting Greenland's costs.

The need for specialized components in complex projects, such as those for ultra-high-rise structures, can further amplify supplier leverage. This reliance on niche providers means Greenland has fewer alternatives if these specialized suppliers decide to increase their rates or limit supply.

In 2024, global steel prices, a key input for Greenland, saw volatility, with benchmarks like the TSI China Imported 62% Fe Iron Ore CFR Tianjin index fluctuating significantly throughout the year. This market dynamism underscores the potential for suppliers to wield considerable influence.

The availability of substitute materials or services significantly influences a supplier's bargaining power. For Greenland Holdings Group, common construction inputs like concrete or steel may have numerous suppliers, diluting individual supplier leverage. However, when specialized financial services or proprietary smart building technology are required, the limited availability of alternatives grants those suppliers considerably more power.

Greenland Holdings faces significant switching costs when dealing with its core suppliers, a factor that bolsters supplier bargaining power. Consider the extensive lead times and specialized nature of materials required for their massive infrastructure and real estate projects. For example, a shift in concrete suppliers for a multi-billion dollar development could necessitate costly re-engineering and extensive testing, potentially delaying project timelines by months.

The complexity of Greenland's projects means that retraining skilled labor to work with new equipment or materials from alternative suppliers is another substantial hurdle. This investment in training adds to the overall expense and operational disruption. In 2024, the global construction industry continued to grapple with supply chain volatility, making the reliability of established suppliers even more critical for large developers like Greenland.

Furthermore, the long-standing relationships Greenland has cultivated with certain key partners often involve bespoke product specifications and integrated supply chain processes. Disrupting these established ties for cost savings with a new supplier would require a thorough re-evaluation and re-negotiation of contracts, often involving significant upfront investment and a period of reduced efficiency.

Importance of Greenland Holdings to Suppliers

The bargaining power of suppliers to Greenland Holdings is influenced by Greenland's significance as a customer. If Greenland represents a substantial portion of a supplier's revenue, that supplier is likely to be more accommodating regarding pricing and payment terms to secure continued business. For instance, if a key material supplier's revenue is heavily reliant on Greenland's projects, they have a stronger incentive to maintain a favorable relationship.

Conversely, if Greenland's purchases constitute a minor share of a supplier's overall sales, the supplier has less motivation to offer concessions. This dynamic can shift depending on the specific industry and the availability of alternative buyers for the supplier's products or services. For example, in 2024, the construction sector in many regions saw increased demand, potentially strengthening supplier positions where their capacity was strained.

- High Dependence: Suppliers whose sales are predominantly to Greenland Holdings may offer better terms to retain this significant client.

- Low Dependence: Suppliers with a diversified customer base may exert more leverage due to Greenland Holdings being a smaller part of their business.

- Market Conditions: General market demand for raw materials and services in 2024 could impact a supplier's willingness to negotiate, especially if demand outstripped supply.

- Availability of Alternatives: The presence of other large buyers for a supplier's goods or services can reduce Greenland's ability to negotiate favorable terms.

Threat of Forward Integration by Suppliers

Suppliers could potentially move into Greenland Holdings Group's core business of real estate development or related services, creating direct competition. This forward integration would allow suppliers to capture more of the value chain, potentially squeezing Greenland's margins.

While less probable for basic material suppliers, specialized service providers such as engineering or architectural firms might expand their offerings to include project management and even development. For instance, a large-scale construction contractor could decide to develop its own projects, leveraging its existing expertise and relationships.

This threat is amplified if suppliers possess unique capabilities or control critical proprietary technologies. For 2024, the construction industry has seen a rise in integrated service providers, particularly in areas like sustainable building solutions, which could be a precursor to broader forward integration.

- Increased Competition: Suppliers entering development directly challenges Greenland's market position.

- Margin Pressure: Forward integration by suppliers can reduce Greenland's profitability.

- Service Provider Expansion: Specialized firms may offer end-to-end solutions, increasing their leverage.

- Industry Trends: The push for integrated sustainable building services in 2024 highlights this potential shift.

Greenland Holdings Group's suppliers hold considerable power, particularly those providing specialized components or raw materials with limited alternatives. The significant switching costs associated with changing core suppliers, due to project complexity and retraining needs, further solidify this leverage. In 2024, global supply chain volatility and increased demand in the construction sector generally strengthened supplier positions.

| Factor | Impact on Greenland Holdings | 2024 Context |

|---|---|---|

| Supplier Concentration | Limited suppliers can dictate higher prices. | Key inputs like steel experienced price fluctuations. |

| Switching Costs | High costs for changing suppliers due to project specifics. | Supply chain disruptions made reliability paramount. |

| Dependence of Supplier on Greenland | Low dependence grants suppliers more power. | Increased construction demand in 2024 potentially reduced supplier dependence on any single buyer. |

| Threat of Forward Integration | Suppliers entering development could increase competition. | Trend towards integrated service providers in sustainable building noted. |

What is included in the product

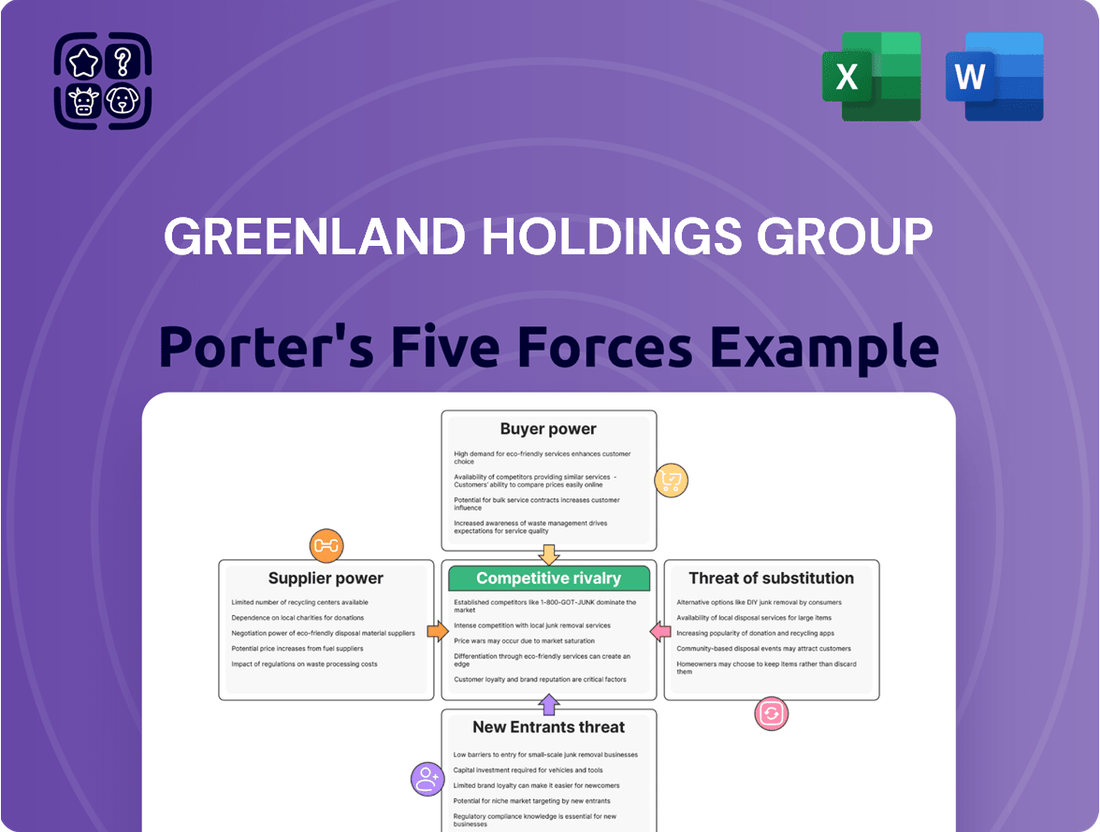

This Porter's Five Forces analysis for Greenland Holdings Group identifies the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the availability of substitutes impacting its real estate and infrastructure operations.

Greenland Holdings Group's Porter's Five Forces analysis is a pain point reliever by providing a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

In 2024, the Chinese real estate market is experiencing elevated customer price sensitivity. This is largely driven by substantial unsold inventory and a general dip in consumer confidence, creating a buyer's market where negotiation power is significantly tilted towards purchasers.

For Greenland Holdings Group, this translates to considerable pressure on pricing. With many regions seeing declining property values, both individual homebuyers and commercial renters are in a strong position to demand concessions, impacting Greenland's revenue and profit margins.

The bargaining power of customers for Greenland Holdings Group is significantly influenced by the sheer availability of alternative properties across China. In many real estate markets, an oversupply situation means potential buyers and tenants have a wide selection to choose from, diminishing their reliance on any single developer.

This abundance of choice, particularly evident in lower-tier cities, empowers customers. They can readily find comparable residential, commercial, or industrial spaces, effectively reducing their bargaining leverage against Greenland Holdings.

For instance, by mid-2024, China's property market continued to grapple with unsold inventory. Reports indicated that in numerous provincial capitals, the months of inventory exceeded the typical six-to-nine-month benchmark, directly translating to more options for buyers.

Buyer information and market transparency significantly bolster the bargaining power of customers in the real estate sector. With readily accessible data on property prices, developer track records, and prevailing market trends, potential buyers are far more equipped to negotiate effectively. For instance, in 2024, online property portals and real estate analytics firms provided unprecedented detail, allowing buyers to compare offerings across multiple developers and locations with ease.

This increased transparency directly challenges a developer's ability to set premium prices without justification. Armed with comparative market analysis, buyers can confidently demand better terms, potentially leading to price reductions or added amenities. Greenland Holdings Group, like other developers, faces this reality where informed consumers can readily identify value propositions and exert pressure for more favorable deals, thus diminishing the developer's pricing power.

Low Switching Costs for Buyers

For potential buyers or tenants looking at properties, switching from one to another is generally quite straightforward. The main hurdles are typically just the transaction fees involved and the time spent searching for a new place. This low barrier to switching significantly strengthens the bargaining power of customers.

Because it's easy to move to a competitor's offering, customers can readily choose another property if Greenland Holdings Group's terms aren't to their liking. This situation puts pressure on Greenland to offer competitive pricing and favorable lease agreements to retain its clientele.

- Low Switching Costs: Transaction fees and search time are the primary costs for buyers/tenants, making it easy to change providers.

- Enhanced Bargaining Power: Customers can readily switch to competitors if Greenland's terms are unfavorable, increasing their leverage.

- Competitive Pressure: This ease of switching forces Greenland to maintain competitive pricing and attractive property offerings.

Diversified Customer Segments

Greenland Holdings Group caters to a broad spectrum of clients, encompassing individual residential buyers, various commercial entities, and significant institutional investors. This diversification means the bargaining power of customers isn't uniform across the board.

While individual homebuyers, particularly in saturated markets, can exert considerable pressure on pricing due to numerous alternatives, larger players often operate under different dynamics. For instance, institutional investors or government bodies engaging Greenland for large-scale infrastructure developments might prioritize project execution, timeline adherence, and long-term partnerships over minute price concessions. This can temper the overall bargaining power within these specific segments.

For example, in the 2024 property market, while developers faced pressure from individual buyers seeking affordability, major urban regeneration projects often involved government entities or large funds that negotiated terms based on strategic value and certainty of delivery rather than solely on price per square meter.

- Diverse Customer Base: Greenland serves individual homebuyers, commercial tenants, and institutional investors.

- Varying Bargaining Power: Individual buyers may have high power due to market alternatives.

- Institutional Influence: Large investors and government entities involved in infrastructure may have less price sensitivity.

- Strategic Motivations: These larger clients often focus on project completion and strategic alignment, influencing negotiation leverage.

In 2024, the Chinese real estate market's oversupply, particularly in lower-tier cities, has significantly amplified customer bargaining power. This abundance of choice means buyers and tenants can easily find comparable properties, diminishing their reliance on any single developer like Greenland Holdings Group and enabling them to negotiate more favorable terms.

The ease with which customers can switch between developers, incurring only minor transaction fees and search time, further strengthens their leverage. This low switching cost compels Greenland to offer competitive pricing and attractive property features to retain its customer base.

While individual buyers face high price sensitivity due to market alternatives, institutional investors and government bodies involved in large projects often prioritize project execution and timely delivery over minor price concessions, demonstrating a more nuanced bargaining dynamic.

| Factor | Impact on Greenland Holdings | 2024 Data/Observation |

|---|---|---|

| Oversupply of Properties | Increases customer choice, heightens price sensitivity. | Months of inventory in many Chinese provincial capitals exceeded the typical 6-9 month benchmark by mid-2024. |

| Low Switching Costs | Empowers customers to easily move to competitors. | Primary costs are transaction fees and search time, minimal compared to property value. |

| Information Transparency | Enables informed negotiation by buyers. | Online portals in 2024 provided extensive data on pricing and developer track records. |

| Customer Segmentation | Varying bargaining power across different client types. | Individual buyers have high leverage; institutional clients may focus on strategic value and delivery. |

Same Document Delivered

Greenland Holdings Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Greenland Holdings Group, detailing the competitive landscape impacting the company's profitability. You'll receive this exact, professionally written document immediately after purchase, providing actionable insights into the industry's dynamics. The analysis thoroughly examines the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors, all within the context of Greenland Holdings Group's operations. No surprises, no placeholders—just the complete, ready-to-use analysis you see here.

Rivalry Among Competitors

The Chinese real estate sector is intensely competitive, featuring a broad range of domestic and international developers actively pursuing market share. Greenland Holdings Group contends with established state-backed enterprises, agile private developers, and specialized regional players, each employing distinct business strategies and targeting specific market niches.

In 2024, the sheer volume of participants intensifies this rivalry. For instance, while specific market share figures fluctuate, the top 100 Chinese developers by sales volume consistently represent a significant portion of the market, indicating a crowded landscape where differentiation is key.

This diversity means Greenland must constantly adapt to competitors who may have lower overhead, greater flexibility in project execution, or stronger relationships within specific local markets, all of which pressure pricing and profit margins.

The Chinese real estate market, a key sector for Greenland Holdings Group, is facing a noticeable slowdown in its growth trajectory. This sluggishness, coupled with a substantial oversupply, especially in residential and commercial properties, is directly fueling more intense competition among developers.

Developers are now compelled to aggressively vie for market share, often resorting to significant price reductions and attractive incentives to draw in potential buyers and tenants. This competitive pressure is a direct consequence of a market where demand is not keeping pace with the sheer volume of available properties.

For instance, in 2023, China's property sales volume saw a contraction, contributing to the oversupply challenges. This environment forces companies like Greenland Holdings to constantly innovate and differentiate their offerings, as simply having inventory is no longer enough to guarantee sales.

The intensified competition means thinner profit margins and a greater need for efficient operations and strategic marketing. Companies must be adept at managing inventory and understanding evolving consumer preferences to navigate this challenging landscape.

While Greenland Holdings Group explores unique ventures like ultra-high-rise structures and mixed-use developments, the broader real estate sector, particularly in established markets, struggles with substantial product differentiation. Competition frequently hinges on factors like price, prime locations, and the range of amenities offered.

This intense rivalry compels developers, including Greenland, to focus on innovation in architectural design, the integration of smart building technologies, and the adoption of sustainable construction practices. For instance, in 2024, the global green building market was projected to reach significant growth, indicating a strong consumer demand for eco-friendly developments.

High Exit Barriers

The real estate sector, including companies like Greenland Holdings Group, is characterized by substantial exit barriers. This is primarily due to the immense capital tied up in land acquisition, ongoing construction projects, and the inherently long development timelines. These factors make it exceptionally challenging for companies facing difficulties to divest their assets or simply leave the market.

This immobility among struggling developers often results in prolonged price wars as they attempt to offload inventory. It also contributes to persistent oversupply in certain markets, further intensifying the competitive rivalry among all players. For instance, in 2024, the Chinese real estate market continued to grapple with these issues, with developers like Greenland Holdings Group facing pressure to manage their debt and project pipelines, contributing to a highly competitive environment.

- Significant Capital Investment: Real estate development requires vast sums for land purchase and construction, creating a high cost of exit.

- Long Development Cycles: Projects can take years to complete, locking in capital and making quick divestment difficult.

- Market Stalemate: High exit barriers force underperforming companies to remain active, often leading to price competition and market saturation.

- Impact on Rivalry: This dynamic directly fuels intense rivalry as companies fight for market share and survival, even when profitability is low.

Diversified Business Segments

Greenland Holdings Group's extensive diversification into finance, energy, commercial retail, and hospitality means it contends with intense competitive rivalry across numerous distinct industries. This broad operational footprint necessitates competing not just with traditional real estate developers but also with highly specialized companies in each of its non-property sectors.

This multi-industry competition means Greenland must constantly adapt its strategies to the unique competitive dynamics of finance, energy markets, and consumer-facing retail and hotel businesses. For instance, in 2024, the global hotel industry saw occupancy rates rebound, but also faced increased competition from alternative accommodation providers, requiring Greenland's hotel segment to innovate its service offerings.

- Diversified Competition: Greenland Holdings faces rivals in real estate, finance, energy, retail, and hospitality sectors.

- Specialized Rivalry: Competes with niche players in each diversified segment, not just other developers.

- Industry-Specific Challenges: Each segment presents unique competitive pressures and market dynamics.

- 2024 Market Realities: For example, the hotel segment in 2024 contended with recovering but highly competitive markets, demanding differentiation.

The Chinese real estate market, a key sector for Greenland Holdings Group, is characterized by intense competition due to oversupply and a slowdown in growth, forcing developers to engage in price wars and aggressive marketing to capture market share.

This fierce rivalry is amplified by the sheer number of participants, including state-backed firms, agile private developers, and regional specialists, each vying for dominance. For instance, in 2023, China's property sales volume contracted, exacerbating the oversupply and intensifying competition.

Greenland must differentiate itself through innovation in design, technology, and sustainability, as evidenced by the projected growth in the global green building market in 2024.

The high capital investment and long development cycles in real estate create significant exit barriers, trapping underperforming companies and prolonging price competition, a situation Greenland actively navigates in 2024.

| Competitive Factor | Description | Impact on Greenland Holdings | 2024 Context |

|---|---|---|---|

| Market Saturation | High number of developers and existing inventory | Pressure on pricing and profit margins | Continued oversupply in key segments |

| Price Sensitivity | Buyers prioritize cost due to economic slowdown | Need for aggressive pricing strategies | Developers offering significant discounts |

| Product Differentiation | Limited unique offerings in established markets | Emphasis on innovation in design and amenities | Growing demand for green and smart buildings |

| Exit Barriers | High capital tied up in projects | Companies remain in market, intensifying rivalry | Struggling developers contribute to price wars |

SSubstitutes Threaten

For residential customers, the threat of substitutes is significant, with renting and purchasing existing second-hand properties posing direct alternatives to new developments. In 2024, declining rental prices in certain Chinese cities, coupled with a substantial inventory of pre-owned homes, made these options increasingly appealing. This can directly dampen demand for Greenland Holdings Group's new construction projects.

The growing prevalence of remote work and e-commerce presents a significant threat of substitutes for Greenland Holdings Group's traditional commercial property developments. As more companies adopt flexible work arrangements, the demand for large physical office spaces diminishes, with many businesses opting for smaller footprints or fully remote models.

This shift directly impacts the need for new office buildings, as companies re-evaluate their real estate requirements. For instance, a significant portion of the global workforce continues to work remotely, with estimates suggesting that by 2024, roughly 30% of all workers will be remote. This trend reduces the necessity for extensive corporate office spaces, a core offering for developers like Greenland.

Similarly, the rapid expansion of e-commerce provides an alternative to brick-and-mortar retail. Consumers increasingly prefer online shopping, leading to reduced foot traffic and sales in physical stores. This can depress demand for retail properties, a sector that often complements office developments in mixed-use projects.

Greenland's reliance on commercial and retail leasing revenue is therefore susceptible to these evolving consumer and business behaviors. The cost savings and convenience offered by remote work and online retail make them attractive substitutes, putting pressure on the value and occupancy rates of traditional commercial real estate assets.

Alternative investment vehicles present a significant threat to real estate, particularly for Greenland Holdings Group. For instance, in the first half of 2024, global equity markets saw robust performance, with major indices like the S&P 500 delivering substantial returns, potentially drawing capital away from less liquid real estate assets.

When real estate markets face volatility or offer diminishing yields, investors often pivot to more liquid and potentially higher-returning alternatives. For example, in 2023, bond yields rose significantly, making fixed-income investments more attractive compared to a static or declining property market, thus posing a direct substitute for real estate capital allocation.

The availability of diverse asset classes like cryptocurrencies or private equity funds also provides avenues for capital that might otherwise be directed towards traditional real estate. These alternatives can offer different risk-return profiles, further fragmenting the investment landscape and challenging real estate's appeal.

Modular and Prefabricated Construction

The rise of modular and prefabricated construction offers a significant threat of substitutes for Greenland Holdings Group. These methods, emphasizing speed and cost-efficiency, challenge traditional on-site building. For instance, companies like Katerra (though facing its own challenges) demonstrated the potential for off-site manufacturing to streamline projects, potentially reducing overall development timelines and costs compared to conventional approaches.

While these alternatives don't replace the need for land or prime locations, they can reshape the demand for traditional construction services and materials. The global modular construction market was valued at approximately USD 130.6 billion in 2023 and is projected to grow significantly, indicating a clear shift in how buildings are conceived and executed.

- Faster Project Completion: Prefabricated components can be manufactured simultaneously with site preparation, leading to quicker overall project timelines.

- Potential Cost Savings: Factory-controlled environments can reduce waste and labor inefficiencies, potentially lowering construction costs.

- Sustainability Focus: Many modular builders emphasize sustainable practices, using recycled materials and minimizing on-site disruption, which appeals to environmentally conscious developers and buyers.

- Market Adoption: Increased investment and technological advancements are making modular construction more viable and attractive across various sectors, from residential to commercial developments.

Government-Subsidized Housing

The burgeoning supply of government-subsidized housing in China presents a significant threat of substitutes for Greenland Holdings Group's residential developments. This initiative directly targets the lower and middle-income segments, offering more affordable alternatives that can siphon demand away from Greenland's market-rate projects. For instance, in 2023, China's housing ministry continued to emphasize the development of affordable rental housing, with plans to increase supply in major cities, directly impacting private developers' market share.

Government intervention, driven by objectives of social equity and housing affordability, can significantly alter market dynamics. By providing subsidized options, the government effectively lowers the price ceiling for housing, making it harder for private developers like Greenland to compete on price alone, particularly for entry-level buyers. This policy shift aims to stabilize the housing market and ensure basic housing needs are met, potentially limiting growth opportunities for companies heavily reliant on traditional market-rate sales.

- Increased affordability: Government subsidies directly reduce the cost of housing for eligible buyers.

- Demand diversion: Subsidized units attract buyers who might otherwise purchase from private developers.

- Policy impact: Government housing policies are actively shaping the competitive landscape for developers.

- Market segment focus: The threat is most pronounced in the affordable housing segments of the market.

Alternative investment vehicles, particularly equities and bonds, pose a significant threat to Greenland Holdings Group's real estate ventures. In the first half of 2024, the S&P 500 delivered strong returns, attracting capital that might otherwise flow into property. Similarly, rising bond yields in 2023 made fixed-income investments more appealing than stagnant real estate.

The rise of modular and prefabricated construction methods presents a viable substitute for traditional building. The global modular construction market, valued at approximately USD 130.6 billion in 2023, is growing rapidly, offering faster project completion and potential cost savings that challenge conventional development.

Government-subsidized housing initiatives in China directly compete with Greenland's residential projects. By offering more affordable options, these programs can divert demand, especially from lower and middle-income buyers, as evidenced by continued government emphasis on affordable rental housing development in major cities throughout 2023.

| Threat of Substitutes | Description | Impact on Greenland Holdings Group | 2023/2024 Data Point | Example |

|---|---|---|---|---|

| Alternative Investments | Other asset classes like stocks and bonds offering different risk/return profiles. | Capital diversion from real estate, potentially reducing demand and investment. | S&P 500 strong performance H1 2024; rising bond yields in 2023. | Investors choosing equities over property due to higher liquidity and returns. |

| Modular/Prefab Construction | Off-site construction methods promising speed and cost efficiency. | Challenges traditional construction timelines and costs, potentially impacting market share. | Global modular construction market valued at ~$130.6 billion in 2023. | Faster project delivery reducing the need for traditional, slower building methods. |

| Government-Subsidized Housing | Affordable housing options provided by the state. | Siphons demand from private market-rate projects, particularly in entry-level segments. | Continued Chinese government emphasis on affordable rental housing in 2023. | Buyers opting for subsidized units instead of Greenland's new developments. |

Entrants Threaten

The threat of new entrants in Greenland Holdings Group's real estate development sector is significantly dampened by high capital requirements. Developing large-scale projects, such as the ultra-high-rise buildings and expansive urban complexes characteristic of the industry, demands substantial financial outlay for land acquisition, construction materials, labor, and ongoing financing. For instance, major urban development projects often run into billions of dollars, making it exceedingly difficult for smaller or less capitalized firms to compete effectively.

Navigating China's complex regulatory landscape and securing necessary permits presents a significant hurdle for new entrants in the real estate sector. Greenland Holdings, with its long-standing presence, possesses established relationships and a deep understanding of these requirements, which newer companies struggle to replicate. For instance, the stringent approval processes for large-scale developments, coupled with evolving zoning laws, can delay projects for years, increasing costs and uncertainty for challengers. This regulatory maze, including environmental impact assessments and land use permits, acts as a powerful deterrent.

The threat of new entrants regarding land acquisition for Greenland Holdings Group is significantly mitigated by the inherent difficulties in securing prime real estate. Obtaining desirable urban land parcels is a formidable task, characterized by extreme scarcity, escalating costs, and intense competition from established and emerging developers. For instance, in 2024, major metropolitan land auctions often saw bid premiums exceeding initial valuations by substantial margins, reflecting the high demand and limited supply.

Greenland Holdings, benefiting from its extensive operational history and robust financial standing, possesses a distinct advantage in navigating these land acquisition challenges. Its considerable capital resources and established relationships allow it to compete effectively and secure strategic land assets essential for its broad portfolio of residential, commercial, and infrastructure developments. This financial muscle is a critical barrier for potential new entrants who may lack the liquidity to engage in such high-stakes land procurements.

Brand Reputation and Trust

In the real estate sector, particularly for high-value transactions, brand reputation and customer trust are paramount. Greenland Holdings Group, with its extensive global footprint as a prominent developer, enjoys significant established brand recognition. New market entrants would face a substantial hurdle in replicating this level of trust and recognition quickly, making direct competition challenging.

Building a strong brand reputation in real estate often involves a track record of successful projects, consistent quality, and transparent dealings. Greenland Holdings has cultivated this over years of operation, a significant barrier for newcomers. For instance, by 2023, Greenland Holdings had completed over 500 projects globally, a testament to its established presence and customer trust.

- Established Brand Recognition: Greenland Holdings benefits from a well-known global brand, making it easier to attract customers and partners compared to new, unproven entities.

- Customer Trust: Years of successful development and delivery foster customer loyalty and confidence, a difficult asset for new entrants to acquire.

- Barriers to Entry: The time and resources required to build a comparable brand reputation represent a significant deterrent for potential new competitors.

- Market Share Protection: A strong brand acts as a defensive moat, protecting Greenland Holdings' market share from new entrants attempting to gain traction.

Access to Financing and Distribution Channels

New entrants often struggle to gain access to the capital needed for major real estate development and to build robust distribution networks. For Greenland Holdings Group, this translates into a significant barrier, as their established financial arms and extensive sales channels provide a distinct advantage. In 2024, the global real estate sector continued to see tightened lending conditions for developers without proven track records, making it harder for newcomers to secure the necessary funding for large-scale projects.

Greenland Holdings Group's diversified investment portfolio, which includes financial services, allows them to self-finance or secure more favorable terms for their own projects. This financial flexibility is a key differentiator. Furthermore, their established sales and marketing infrastructure, developed over years of operation, provides them with a direct and efficient route to market, something emerging competitors would find costly and time-consuming to replicate.

- Financing Barriers: Difficulty for new entrants to secure competitive loan terms for substantial development projects.

- Distribution Challenges: New companies face hurdles in establishing effective sales and marketing networks comparable to Greenland's.

- Greenland's Advantage: Diversified financial investments and existing sales channels give Greenland a competitive edge.

- 2024 Market Context: Tightened global lending conditions in real estate further exacerbate financing difficulties for new developers.

The threat of new entrants for Greenland Holdings Group is considerably low due to the substantial capital requirements for large-scale real estate development. Newcomers face immense financial hurdles in acquiring land and covering construction costs, often in the billions of dollars for major urban projects. This high barrier effectively limits the pool of potential competitors who can enter the market and challenge established players like Greenland.

Furthermore, navigating China's intricate regulatory environment and securing necessary permits presents a significant challenge for new entrants. Greenland Holdings' established relationships and deep understanding of these processes offer a distinct advantage. For instance, the complex approval timelines, including environmental assessments, can significantly increase costs and uncertainty for challengers, acting as a powerful deterrent.

Securing prime real estate is another major obstacle, with escalating costs and intense competition making it difficult for new developers. In 2024, land auctions in major cities saw bid premiums rise substantially, reflecting limited supply and high demand. Greenland's financial strength and established relationships allow it to compete effectively for these crucial land assets, further marginalizing new entrants lacking similar resources.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Greenland Holdings Group is built upon a foundation of publicly available financial reports, including annual and interim statements, alongside industry-specific market research and governmental economic data.

We supplement this with insights from reputable financial news outlets, analyst reports, and competitor disclosures to provide a comprehensive understanding of the competitive landscape.