Greenland Holdings Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greenland Holdings Group Bundle

Political stability, economic growth, and evolving social attitudes are crucial external factors shaping Greenland Holdings Group's trajectory. Understand how these forces, alongside technological advancements, environmental regulations, and legal frameworks, create both opportunities and challenges for the company. Gain a competitive edge by leveraging these insights.

Don't get caught off guard by the shifting global landscape affecting Greenland Holdings Group. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, environmental, and legal factors impacting their operations. Unlock actionable intelligence to inform your strategic decisions and secure your own market advantage.

Ready to make informed decisions about Greenland Holdings Group? Our expert-crafted PESTLE analysis provides a clear roadmap of the external forces at play. From government policies to consumer trends and environmental concerns, this report offers the critical intelligence you need to navigate the complexities of their market. Download the full version now for immediate insights.

Political factors

The Chinese government's active role in shaping the real estate market significantly influences Greenland Holdings Group. Policies enacted in 2024-2025 prioritize stabilizing the market and curbing speculation, directly affecting the company's operational landscape.

A key focus for the government in 2024-2025 is a 'people-centered urbanization' strategy. This involves boosting housing affordability, driving urban renewal projects, and mitigating market fluctuations, all of which present both opportunities and challenges for Greenland Holdings.

To manage developer debt and ensure project completion, the government is implementing financing coordination mechanisms. This initiative aims to provide stability and support for companies like Greenland Holdings, particularly in navigating the current economic climate.

China's commitment to a 'people-centered new urbanization' strategy significantly shapes Greenland Holdings Group's development landscape. This approach prioritizes sustainable urban growth, aiming to integrate rural populations into urban centers while fostering balanced regional development. Such policies can unlock substantial opportunities for large-scale urban complexes and vital infrastructure projects in targeted regions.

The nation's urbanization rate is projected to hit 70% within the next five years, signaling sustained demand for housing and urban infrastructure. This ongoing demographic shift presents Greenland Holdings with a continuous pipeline of potential projects, particularly in emerging urban hubs and revitalized rural areas.

Greenland Holdings Group's expansive global footprint makes it highly sensitive to shifts in geopolitical landscapes and international trade dynamics, especially concerning China's relationships with other economic powers. Fluctuations in global investment policies, the imposition of trade tariffs, or altered diplomatic ties can directly affect the viability and profitability of its diverse overseas ventures and ongoing projects. For example, escalating trade disputes could directly impact the cost-effectiveness and market access for its new energy vehicle (NEV) export initiatives, potentially affecting sales volumes and margins.

Regulatory Environment for Diversified Investments

Greenland Holdings Group's expansion into finance, energy, and retail means navigating a complex web of political and regulatory landscapes. For instance, China's financial sector has seen ongoing regulatory adjustments, including stricter capital requirements for financial institutions, which could impact Greenland's financial services arm. In the energy sector, government policies supporting renewable energy development, such as subsidies or carbon pricing mechanisms, will shape investment decisions and profitability for Greenland's energy ventures.

The retail and hotel industries are also subject to evolving regulations concerning consumer protection, labor laws, and environmental standards. For example, changes in tourism policies or regulations on e-commerce platforms can directly influence Greenland's commercial retail and hospitality operations.

- Financial Sector Oversight: China's financial regulatory bodies, like the PBOC and CBIRC, continue to refine rules impacting lending, investment, and risk management, affecting Greenland's financial services segment.

- Energy Transition Policies: Government initiatives promoting clean energy and phasing out fossil fuels, evident in China's 14th Five-Year Plan (2021-2025), will guide Greenland's energy investments.

- Retail and Consumer Protection: Evolving regulations on online sales, data privacy, and product safety can impact Greenland's retail operations and customer trust.

- International Regulatory Alignment: For international operations, Greenland must comply with diverse regulatory frameworks, such as those governing foreign investment and financial services in markets like the UK or Australia.

Government Support and State-Owned Enterprise (SOE) Influence

Greenland Holdings Group, as a major Chinese real estate developer, operates within a political landscape that can significantly shape its trajectory. Government policies, particularly those favoring state-owned enterprises (SOEs) or strategic sectors, often provide a crucial edge. For instance, initiatives like the 'Project Whitelist,' implemented to stabilize the property market, directly impact developers by facilitating access to much-needed financing. This support mechanism is vital for large-scale projects and overall market stability, demonstrating the government's active role in guiding the sector's development.

The influence of state ownership extends beyond direct financial support. Government directives can steer investment priorities towards national development goals, potentially aligning Greenland's expansion with broader economic strategies. This can manifest in preferential treatment for land acquisition, access to capital markets, or even specific project approvals. For example, in 2023, the Chinese government continued to emphasize the importance of housing stability and affordability, which could translate into policy support for developers undertaking projects aligned with these objectives.

- Government Support Mechanisms: Initiatives such as the 'Project Whitelist' aim to unblock developer financing, a critical factor for Greenland Holdings Group's ongoing projects.

- SOE Advantages: As a prominent developer, Greenland may benefit from policies designed to bolster state-backed or strategically important enterprises.

- Policy Alignment: Investment decisions are often influenced by government priorities, such as ensuring housing affordability and stability, which were key themes in 2023 policy discussions.

- Market Influence: The government's role in land allocation and regulatory oversight directly impacts the operational environment for real estate developers like Greenland.

Government policies in China, especially those related to urbanization and real estate, directly shape Greenland Holdings Group's operational landscape. The 'people-centered new urbanization' strategy, emphasizing sustainable growth and urban integration, presents significant opportunities for large-scale developments. China's urbanization rate is expected to reach 70% in the next five years, indicating sustained demand for housing and infrastructure.

The Chinese government's financial sector oversight, including stricter capital requirements, impacts Greenland's financial services arm. Energy policies promoting renewables, as outlined in the 14th Five-Year Plan (2021-2025), will guide investment in Greenland's energy ventures. Retail regulations concerning consumer protection and e-commerce also influence Greenland's commercial operations.

Government support mechanisms like the 'Project Whitelist' are crucial for unblocking developer financing. As a major developer, Greenland may benefit from policies favoring state-backed enterprises, aligning its investments with national goals like housing affordability.

Greenland Holdings is sensitive to geopolitical shifts and international trade dynamics. For example, escalating trade disputes could impact the cost-effectiveness and market access for its new energy vehicle (NEV) export initiatives.

What is included in the product

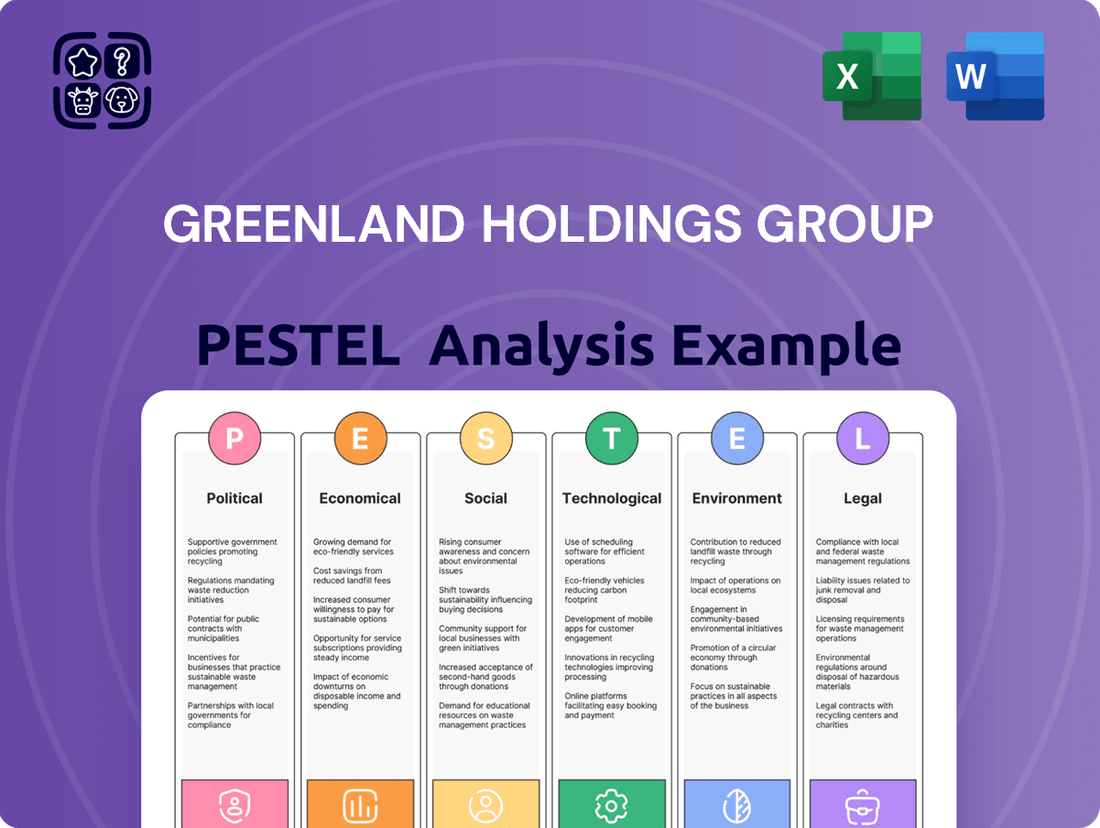

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Greenland Holdings Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support scenario planning and proactive strategy design for Greenland Holdings Group.

A clear, concise summary of the Greenland Holdings Group PESTLE analysis, presented in easily digestible bullet points, serves as a pain point reliever by streamlining complex external factors into actionable insights for strategic decision-making.

Economic factors

The Chinese real estate sector experienced considerable strain through 2024, with housing prices and sales volumes continuing to decline. While government stimulus, including interest rate cuts and eased purchase restrictions, has shown some stabilizing effects in major cities like Beijing and Shanghai, a comprehensive market rebound is not anticipated for 2025.

This persistent downturn directly affects Greenland Holdings Group, as real estate development and sales represent its core business. Declining property values in 2024 could negatively impact the company's balance sheet and its ability to generate revenue from ongoing projects.

Monetary policy plays a crucial role in Greenland Holdings Group's operational landscape. In 2024, China's continued interest rate cuts, coupled with a low inflation rate, were intended to boost economic activity. This environment theoretically lowers borrowing costs for developers like Greenland and prospective homebuyers.

However, the broader trend indicates a shift away from the rapid credit expansion previously fueled by the real estate sector. This evolving credit environment presents a significant challenge, potentially tightening access to capital for companies heavily reliant on debt financing, including Greenland Holdings Group.

Specifically, the People's Bank of China maintained its benchmark lending rates, such as the Loan Prime Rate (LPR), at stable levels throughout much of 2024, reflecting a cautious approach to monetary easing. While designed to support growth, this policy shift signals a recalibration of the financial ecosystem, impacting how developers secure necessary funding for projects.

Consumer confidence in China has been notably weak, directly impacting Greenland Holdings Group's sales. This is compounded by a significant rise in household debt, which has surpassed 60% of GDP, more than doubling since 2010. This economic environment makes consumers more hesitant to commit to large purchases like real estate.

The sensitivity of Greenland Holdings Group's sales and future project demand to consumer willingness to buy property is a critical factor. Economic uncertainty and concerns about personal financial stability, driven by high debt levels, directly dampen this willingness. For instance, data from early 2024 indicated a slowdown in new home sales across major Chinese cities.

Diversification Impact and Sector Performance

Greenland Holdings Group's diversified portfolio, spanning finance, energy, commercial retail, and hotels, offers resilience through multiple income sources. However, each sector's performance is intrinsically linked to its specific economic drivers and outlook. For instance, the energy sector's profitability will be heavily influenced by global commodity prices and demand trends anticipated through 2025.

The commercial real estate segment, a key area for Greenland, faces headwinds. In Greater China, a significant surge in office supply is projected for 2025, potentially leading to increased vacancy rates and downward pressure on rental income. This situation could directly impact Greenland's revenue from its commercial property holdings.

Key sector performance considerations for Greenland Holdings Group include:

- Finance: Performance is tied to interest rate environments and credit market stability, which are expected to remain dynamic in 2025.

- Energy: Exposure to fluctuations in oil and gas prices, with forecasts suggesting continued volatility.

- Commercial Retail: Sensitivity to consumer spending patterns and e-commerce competition, which are projected to intensify.

- Hotel Operations: Reliance on domestic and international travel trends, with a gradual recovery anticipated but subject to evolving travel advisories and economic confidence.

The interplay of these sector-specific economic factors will ultimately shape Greenland Holdings Group's overall financial performance and the effectiveness of its diversification strategy as we move through 2025.

Local Government Fiscal Health and Land Sales

Local governments across China are facing significant fiscal pressures, primarily due to a sharp decline in land sale revenues. This critical income stream, which often funds local public services and infrastructure, has been hit hard. For instance, in the first half of 2024, China's land revenue from state-owned land use rights sales dropped by 21.3% year-on-year, reaching approximately 1.49 trillion yuan. This fiscal strain directly impacts the land market, potentially leading to reduced land availability, altered pricing strategies, and slower approval processes for new development projects, which are crucial for Greenland Holdings Group's expansion plans.

The reduced fiscal capacity of local governments can manifest in several ways that affect Greenland Holdings Group. They might become more selective in land auctions, potentially pushing up prices for desirable plots as governments seek to maximize revenue from fewer transactions. Conversely, some might offer incentives or more flexible terms to attract developers. The overall pace of new land supply could also slow down as local authorities prioritize projects that offer immediate fiscal benefits or address urgent public needs. This environment necessitates careful strategic planning for Greenland Holdings Group to secure necessary land resources for its ongoing and future projects.

- Declining Land Sale Revenues: China's land revenue from state-owned land use rights sales saw a 21.3% decrease in H1 2024.

- Fiscal Pressure on Local Governments: Reduced land sale income impacts local government budgets for public services and infrastructure.

- Impact on Land Market: Fiscal challenges can lead to changes in land availability, pricing, and the speed of project approvals.

- Strategic Implications for Developers: Greenland Holdings Group must adapt to a potentially tighter or more competitive land acquisition landscape.

The Chinese real estate downturn continued through 2024, with stimulus measures only partially stabilizing major markets and a full rebound unlikely in 2025, directly impacting Greenland's core business and potentially its balance sheet. This economic climate, marked by cautious monetary policy and persistent low inflation, theoretically lowers borrowing costs but signals a broader recalibration away from credit expansion, potentially tightening capital access for developers like Greenland. Weak consumer confidence, exacerbated by household debt exceeding 60% of GDP, further dampens demand for real estate. Local governments are facing significant fiscal strain due to a 21.3% year-on-year drop in land sale revenues in the first half of 2024, which could alter land market dynamics, affecting Greenland's expansion strategies.

| Economic Factor | 2024 Data/Trend | Outlook for 2025 | Impact on Greenland Holdings |

|---|---|---|---|

| Real Estate Market | Continued price/volume declines; partial stabilization in major cities. | No comprehensive rebound anticipated. | Core business revenue and asset valuation negatively affected. |

| Monetary Policy | Interest rate cuts; low inflation; cautious easing. | Stable benchmark rates (e.g., LPR); recalibration of credit environment. | Lower borrowing costs theoretically, but potential tightening of capital access. |

| Consumer Confidence | Notably weak; household debt >60% of GDP. | Continued hesitancy for large purchases like real estate. | Directly impacts sales volumes and future project demand. |

| Local Government Fiscal Health | 21.3% drop in land sale revenue (H1 2024). | Continued fiscal pressure; potential changes in land market dynamics. | May affect land availability, pricing, and project approval speeds. |

Same Document Delivered

Greenland Holdings Group PESTLE Analysis

The preview you see here is the exact Greenland Holdings Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Greenland Holdings Group. Understand the critical external forces shaping its operations and strategic decisions. This is the real product; after purchase, you’ll instantly receive this exact, detailed PESTLE analysis.

Sociological factors

China's urbanization is evolving. Instead of just building more, the focus is shifting to making cities better places to live for people. This "people-centered" approach means Greenland Holdings Group must adjust its plans. They need to think more about updating existing urban areas, providing better public services, and helping people moving from rural areas settle in, rather than just building massive new projects.

This change is significant. By the end of 2023, China's urbanization rate reached 66.16%, a slight increase from the previous year but indicating a slowing pace of raw expansion. The government's emphasis on quality development suggests a greater demand for integrated urban renewal projects and enhanced public amenities. For Greenland Holdings, this translates to opportunities in retrofitting older districts and developing mixed-use spaces that prioritize community well-being and sustainable living.

Chinese housing policy is evolving, moving beyond simply ensuring people have a roof over their heads to emphasizing the quality of that dwelling. This shift means consumers are increasingly looking for homes that are not only affordable but also well-designed and built with sustainability in mind. This focus on 'having a better home' directly influences what Greenland Holdings Group needs to offer, pushing for improvements in their product development to meet these rising expectations.

The demand for affordability remains crucial, particularly for the growing urban populations and migrant workers who are essential to China's economic engine. For example, in 2024, the urbanization rate in China surpassed 65%, indicating a continuous influx of people into cities. Greenland Holdings Group must cater to this significant segment by providing accessible housing solutions, balancing quality with price sensitivity to capture market share.

Demographic shifts are a key consideration for Greenland Holdings Group. For instance, in many developed markets, populations are aging; by 2025, it's projected that over 20% of the population in the EU and Japan will be 65 or older. This trend suggests a growing demand for senior living facilities and accessible housing. Concurrently, shrinking family sizes and increased urbanization are reshaping housing preferences, potentially boosting demand for smaller, more efficient urban apartments and co-living spaces.

Lifestyle changes, driven by evolving work patterns and consumer expectations, also impact property development. The rise of remote work, for example, may decrease the need for traditional large office spaces while increasing demand for flexible, mixed-use developments that combine residential, commercial, and recreational amenities. Greenland Holdings Group must adapt its project portfolios to align with these evolving needs, such as developing properties with integrated smart home technology or community-focused shared spaces to attract a more mobile and digitally connected demographic.

Social Responsibility and Community Impact

Societal expectations for large real estate developers like Greenland Holdings Group are intensifying regarding their social responsibility. There's a growing demand for these companies to actively benefit local communities, not just economically but also through social programs and infrastructure development. Greenland Holdings Group, in particular, faces scrutiny over its urban renewal projects, with a need to address potential displacement and ensure fair treatment of affected residents and workers. For instance, in 2023, reports highlighted community engagement efforts in several of their overseas projects, aiming to integrate local needs into development plans.

Meeting these expectations is crucial for maintaining a positive brand image and social license to operate. This includes:

- Fair Labor Practices: Adherence to ethical employment standards and fair wages across all construction and operational phases.

- Community Investment: Direct contributions to local social infrastructure, education, and environmental initiatives.

- Mitigating Social Disruption: Proactive strategies to manage the impact of large-scale projects on existing communities, including transparent communication and relocation assistance where necessary.

- Environmental Stewardship: Implementing sustainable building practices and minimizing the ecological footprint of developments.

Public Perception and Brand Reputation

Public perception of Chinese real estate developers has been a significant concern, particularly following market turbulence and developer debt issues. Greenland Holdings Group, like its peers, faces scrutiny regarding its financial stability and ability to deliver on projects. A strong brand reputation is vital for Greenland to secure both buyer confidence and investor capital.

Managing public perception requires Greenland to proactively showcase its commitment to project completion, quality standards, and financial transparency. For instance, in early 2024, a key focus for developers has been demonstrating robust cash flow and progress on stalled projects to rebuild trust. Greenland's efforts in this area directly impact its market standing and future growth potential.

- Brand Reputation: Crucial for attracting homebuyers and investors in a challenging market.

- Market Instability: Public perception has been negatively impacted by recent sector-wide debt concerns.

- Proactive Management: Greenland must actively demonstrate financial stability and project delivery.

- Commitment to Quality: Highlighting successful project completion is key to rebuilding trust.

Societal expectations for developers like Greenland Holdings Group are rising, with an increased demand for positive community impact beyond just economic contributions. The company must actively engage in social programs and infrastructure development, particularly in urban renewal projects where managing displacement and ensuring fair treatment of residents is paramount. Demonstrating commitment to fair labor practices and community investment is crucial for maintaining a strong social license to operate.

Technological factors

China's commitment to smart city development is a significant technological driver, with substantial government investment pouring into integrating AI, IoT, and big data into urban infrastructure. This push creates opportunities for Greenland Holdings Group to embed cutting-edge smart building systems and digital management platforms within its projects, enhancing operational efficiency and resident experience. For instance, by 2025, smart city investments in China are projected to reach hundreds of billions of dollars, offering a robust market for integrated technological solutions.

Greenland Holdings Group can leverage innovations like prefabrication and modular construction to boost project efficiency and cut expenses. These methods, along with Building Information Modeling (BIM), are transforming the construction industry by improving quality and sustainability. By integrating these advanced technologies, Greenland can optimize its development workflows and solidify its market position.

PropTech innovations present significant opportunities for Greenland Holdings Group to enhance operational efficiency and customer engagement. For instance, the adoption of virtual reality (VR) for property tours can broaden market reach, allowing potential buyers to experience properties remotely. Data analytics can provide deeper market insights, informing development strategies and investment decisions. In 2024, the global PropTech market was valued at approximately $26.7 billion, with projections showing substantial growth, indicating a strong trend towards digital integration in real estate.

Energy Management and Green Building Technologies

Technological advancements are reshaping the real estate sector, particularly in energy management and green building. Greenland Holdings Group can leverage these innovations to enhance sustainability and market appeal. For instance, integrating solar photovoltaic (PV) systems can reduce operational energy costs. In 2023, the global solar PV market reached over 1,100 GW of installed capacity, with continued strong growth projected through 2025, driven by declining costs and supportive government policies.

Smart building technologies, such as intelligent HVAC systems and automated lighting controls, offer significant energy savings. These systems optimize energy consumption based on occupancy and environmental conditions, leading to lower utility bills for residents and businesses. The global smart buildings market is expected to grow substantially, with projections indicating a compound annual growth rate (CAGR) of around 10-15% leading up to 2025.

The adoption of low-carbon building materials, like mass timber and recycled aggregates, is also becoming increasingly important. These materials reduce the embodied carbon footprint of construction projects. Greenland Holdings Group can benefit from this trend by incorporating such materials, aligning with stricter environmental regulations and consumer preferences for eco-friendly living and working spaces. The market for sustainable building materials is expanding rapidly, fueled by a global push for net-zero construction goals.

Key technological considerations for Greenland Holdings Group include:

- Solar Integration: Implementing rooftop solar PV systems to generate on-site renewable energy.

- Smart HVAC: Utilizing intelligent heating, ventilation, and air conditioning systems for optimized energy efficiency.

- Low-Carbon Materials: Sourcing and using sustainable materials like recycled steel, bamboo, and sustainably harvested timber.

- Energy Monitoring: Deploying smart meters and building management systems to track and analyze energy consumption patterns.

Diversification into New Technology Sectors

Greenland Holdings Group's strategic diversification into new technology sectors, notably new energy vehicle (NEV) exports, signifies a significant technological pivot. This expansion necessitates building robust capabilities in advanced manufacturing processes, sophisticated supply chain logistics for battery components and electronics, and navigating complex international trade regulations for high-tech goods. The group is actively developing expertise in areas like electric powertrain technology and charging infrastructure integration, moving beyond its established real estate foundation.

This technological diversification is reflected in market trends. For instance, the global NEV market saw substantial growth, with China's NEV exports reaching approximately 1.77 million units in 2023, a nearly 65% increase from the previous year. Greenland's entry into this dynamic sector aims to capitalize on this momentum, requiring them to adapt and innovate in their technological approach.

- Manufacturing Expertise: Acquiring and developing skills in advanced automotive manufacturing, including battery production and intelligent assembly lines.

- Supply Chain Sophistication: Establishing resilient and technologically advanced supply chains for critical NEV components like lithium-ion batteries and semiconductors.

- International Trade Acumen: Gaining proficiency in global trade practices specific to electric vehicles, including homologation and compliance with diverse market standards.

- Research and Development: Investing in R&D for next-generation battery technology, autonomous driving systems, and vehicle software.

Technological advancements are revolutionizing construction, with Greenland Holdings Group adopting prefabrication and Building Information Modeling (BIM) to enhance efficiency and sustainability. The integration of smart building technologies, such as intelligent HVAC and automated lighting, is projected to significantly reduce energy consumption, with the smart buildings market experiencing a CAGR of 10-15% leading up to 2025. Furthermore, the company's strategic pivot into new energy vehicle (NEV) exports taps into a rapidly growing market, with China's NEV exports surging by nearly 65% in 2023 to approximately 1.77 million units.

| Technology Area | Impact on Greenland Holdings | Relevant 2024/2025 Data/Projections |

| Smart City Infrastructure | Opportunities for integrated smart building systems and digital management platforms. | China's smart city investments projected to reach hundreds of billions of dollars by 2025. |

| Prefabrication & BIM | Boost project efficiency, cut expenses, improve quality and sustainability. | Transforming construction industry workflows. |

| PropTech | Enhance operational efficiency and customer engagement (e.g., VR tours, data analytics). | Global PropTech market valued at ~$26.7 billion in 2024, with substantial growth expected. |

| Green Building Tech | Integrate solar PV and low-carbon materials for cost savings and market appeal. | Global solar PV installed capacity exceeding 1,100 GW in 2023; market expansion driven by net-zero goals. |

| New Energy Vehicles (NEVs) | Developing expertise in advanced manufacturing, supply chain logistics, and R&D for NEV exports. | China's NEV exports grew ~65% in 2023, reaching 1.77 million units. |

Legal factors

Greenland Holdings Group navigates a stringent legal landscape in China, governed by foundational laws like the Civil Code and specific urban real estate administration regulations. These legal structures dictate everything from property rights to development approvals, significantly shaping the company's operational scope and project feasibility.

Policy shifts announced for 2024-2025 concerning urban renewal projects and village redevelopment are particularly influential. For instance, new guidelines may streamline approval processes for certain redevelopment zones, potentially accelerating Greenland’s project timelines. Conversely, changes in land supply mechanisms, such as adjustments to auction reserves or land use rights transfer policies, could impact acquisition costs and the availability of prime development sites, influencing Greenland's strategic land banking.

China's property tax system, still in its pilot phase in cities like Shanghai and Chongqing, presents an evolving landscape that could influence property valuations and how investors approach the market. For Greenland Holdings Group, understanding these potential shifts is key to anticipating market reactions.

Financial regulations are equally vital, particularly those concerning real estate financing and the loan prime rate. Greenland Holdings Group's financial health is directly tied to these frameworks, including how developer debt restructuring is managed, impacting its ability to secure funding and manage its existing obligations.

Greenland Holdings Group, as a publicly traded entity, operates under strict corporate governance mandates, including the Company Law, with its latest amendment taking effect in July 2024. This framework dictates crucial aspects like shareholder rights, board composition, and the transparency of financial disclosures. Adherence to these regulations is paramount for fostering and retaining investor trust, a cornerstone for sustained market performance.

Environmental Regulations and Green Building Standards

Environmental regulations are tightening globally, impacting the real estate sector significantly. Greenland Holdings Group, like its peers, faces increasing pressure to comply with stricter emission standards and waste management protocols. For instance, China, a key market for Greenland, has been progressively enhancing its environmental protection laws, with a notable focus on reducing pollution from construction and operational phases of buildings.

These evolving standards directly influence property development, requiring adherence to green building certifications and sustainable material sourcing. While these mandates can increase upfront construction costs, they also present opportunities. Companies that proactively integrate sustainable practices can gain a competitive edge, attract environmentally conscious tenants and investors, and potentially benefit from government incentives. The global push towards net-zero emissions by 2050, with many countries setting interim targets, means that compliance is not just a legal necessity but a strategic imperative for long-term viability in the real estate market.

- Mandatory Compliance: Greenland Holdings Group must align its projects with national and international environmental protection laws, such as those governing air and water quality, and carbon emissions.

- Green Building Standards: Adherence to standards like LEED (Leadership in Energy and Environmental Design) or similar regional certifications is becoming increasingly expected, influencing design, material selection, and energy efficiency.

- Increased Costs vs. Long-Term Benefits: While initial investments in sustainable construction can be higher, they can lead to reduced operational costs, enhanced property value, and improved brand reputation.

- Market Opportunities: Proactive adoption of green practices can differentiate Greenland Holdings Group in a market where sustainability is a growing factor in investment and consumer decisions.

International Investment and Trade Laws

Greenland Holdings Group, with its extensive global operations and varied investment portfolio, faces the complex task of complying with a multitude of international investment and trade laws. This necessitates a deep understanding of regulations governing foreign direct investment (FDI), adherence to international trade agreements, and specific sector-based rules in areas like finance, energy, and retail across its various overseas markets.

The legal landscape is constantly evolving, impacting Greenland's ability to conduct business and invest internationally. For instance, as of early 2024, many countries are reviewing or updating their FDI screening mechanisms, potentially affecting the approval process for Greenland's acquisitions and joint ventures. Changes in trade policies, such as tariffs or non-tariff barriers, directly influence the cost and feasibility of its international trade activities, particularly in its commercial retail segments.

- Navigating diverse FDI regulations: Greenland must adhere to country-specific rules on foreign ownership limits, national security reviews, and repatriation of profits.

- Compliance with international trade pacts: Adherence to agreements like those under the World Trade Organization (WTO) or regional trade blocs is crucial for its import/export operations.

- Industry-specific legal frameworks: Operating in finance and energy requires strict compliance with capital adequacy rules, environmental regulations, and energy market liberalization laws in each jurisdiction.

- Impact of evolving trade policies: For example, shifts in trade relations between major economies in 2024 could create new compliance challenges or opportunities for Greenland's global supply chains.

Greenland Holdings Group is subject to China's evolving legal framework for real estate, including urban renewal policies and land use regulations, which significantly shape its development strategies and operational costs.

The company must also navigate corporate governance mandates, with the Company Law's latest amendment effective July 2024, impacting shareholder rights and financial disclosure transparency. Furthermore, evolving property tax pilots in key cities could influence market valuations and investment approaches.

Financial regulations, particularly those pertaining to real estate financing and developer debt management, directly impact Greenland's access to capital and its overall financial stability.

Environmental factors

China's ambitious 'dual carbon' targets, aiming for peak emissions by 2030 and carbon neutrality by 2060, are creating a substantial shift in environmental regulations impacting Greenland Holdings Group. These national goals, coupled with increasing global awareness of climate change, translate into stricter mandates for the construction and real estate industries.

Greenland Holdings Group is compelled to embed sustainable practices across its operations, from material sourcing to project lifecycle management. This includes adopting low-carbon technologies, such as green building materials and renewable energy integration, and prioritizing energy-efficient designs in all new developments to meet these evolving environmental standards.

The company's ability to adapt and innovate in response to these mandates will be crucial for its long-term viability and market positioning. Failure to adequately address sustainability concerns could lead to regulatory penalties, reputational damage, and missed opportunities in a market increasingly valuing eco-friendly construction.

China's commitment to sustainability is accelerating the green building movement, with initiatives like the 2024 Green Industry Catalogue driving demand for eco-friendly construction. This policy landscape mandates the use of sustainable materials and construction methods. Greenland Holdings Group must adapt its projects to comply with these evolving environmental standards, impacting material sourcing and operational efficiency.

Meeting stringent national and international green building certifications, such as LEED or China's Three Star System, is becoming a critical benchmark for developers like Greenland Holdings. For instance, in 2023, the market for green building materials in China was valued at approximately $250 billion USD, indicating significant investment and growth in this sector. Successfully achieving these certifications enhances a project's marketability and investor appeal.

Urban development, a core focus for Greenland Holdings Group, inherently drives significant resource consumption and waste generation. The company’s commitment to sustainability necessitates a strong emphasis on resource efficiency. This includes proactive measures in water conservation, a critical factor given increasing global water stress, and the responsible sourcing of building materials to minimize ecological footprints.

Effective waste management strategies are paramount throughout Greenland Holdings Group's project lifecycle. From construction to demolition, minimizing landfill waste and maximizing recycling and reuse are key operational considerations. For instance, by 2024, the construction industry globally generated approximately 1.5 billion tonnes of waste, highlighting the scale of the challenge and the opportunity for companies like Greenland to implement circular economy principles.

Pollution Control and Environmental Impact Assessments

Stricter regulations on air and water pollution, alongside mandatory environmental impact assessments for major undertakings, directly influence Greenland Holdings Group's construction methodologies and where it chooses to build. These requirements mean the company must actively invest in pollution mitigation technologies and conduct thorough ecological studies before breaking ground.

For instance, China's Ministry of Ecology and Environment has been progressively tightening emission standards. By the end of 2024, specific industrial sectors are expected to see a further 10-15% reduction in particulate matter and sulfur dioxide emissions compared to 2020 levels, a trend that impacts construction material sourcing and on-site operations.

Greenland Holdings Group's commitment to sustainability is increasingly tied to its ability to manage and minimize its environmental footprint. This includes adopting greener building materials and advanced waste management systems on its project sites. The company reported in its 2023 sustainability report that it had reduced construction waste by 8% year-on-year through improved recycling initiatives.

- Stricter Environmental Regulations: Expect continued tightening of air and water pollution controls, impacting construction materials and processes.

- Environmental Impact Assessments (EIAs): Comprehensive EIAs are crucial for project approval, influencing site selection and development plans.

- Pollution Control Measures: Greenland Holdings Group must implement and invest in technologies to manage emissions and wastewater from construction activities.

- Ecosystem Protection: Ensuring developments do not harm local flora and fauna is a growing requirement, necessitating careful planning and monitoring.

Biodiversity Protection and Green Spaces

There's a noticeable shift towards prioritizing biodiversity and green spaces in urban development projects. This trend is driven by increasing public awareness and governmental mandates aimed at creating more sustainable and livable cities. Greenland Holdings Group's approach to urban planning and design needs to actively integrate these elements, fostering richer ecosystems within their developments and enhancing overall environmental resilience.

Consideration for biodiversity protection and the creation of accessible green spaces is becoming a key differentiator in real estate. For instance, in 2024, several major cities globally, including Singapore and Copenhagen, announced ambitious targets to increase urban green cover by specific percentages by 2030, often linked to new development approvals. This suggests a growing regulatory and market expectation for developers like Greenland Holdings Group to contribute positively to urban ecological health.

- Increased Demand for Biophilic Design: Consumers and businesses are increasingly seeking developments that incorporate natural elements, improving well-being and property values.

- Regulatory Incentives: Governments are offering tax breaks or expedited approvals for projects demonstrating strong biodiversity conservation and green space provision.

- Corporate Social Responsibility (CSR) Alignment: Integrating biodiversity protection aligns with global CSR goals, enhancing corporate reputation and attracting ESG-focused investors.

- Resilience Against Climate Change: Green spaces and biodiverse areas help mitigate urban heat island effects and improve stormwater management, crucial for climate adaptation.

Greenland Holdings Group faces increasing pressure from China's ambitious 'dual carbon' targets, pushing for stricter environmental regulations in construction. This necessitates integrating sustainable practices, such as low-carbon materials and energy efficiency, into all projects to meet evolving standards and avoid penalties. The company's success hinges on its ability to innovate and adapt to this greener landscape, as indicated by the 2024 Green Industry Catalogue, which drives demand for eco-friendly building.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Greenland Holdings Group is built on a comprehensive review of official government publications from China and other relevant jurisdictions, alongside reports from international financial institutions and reputable industry analysis firms. This ensures that our insights into political stability, economic trends, and regulatory changes are grounded in authoritative data.