Galapagos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

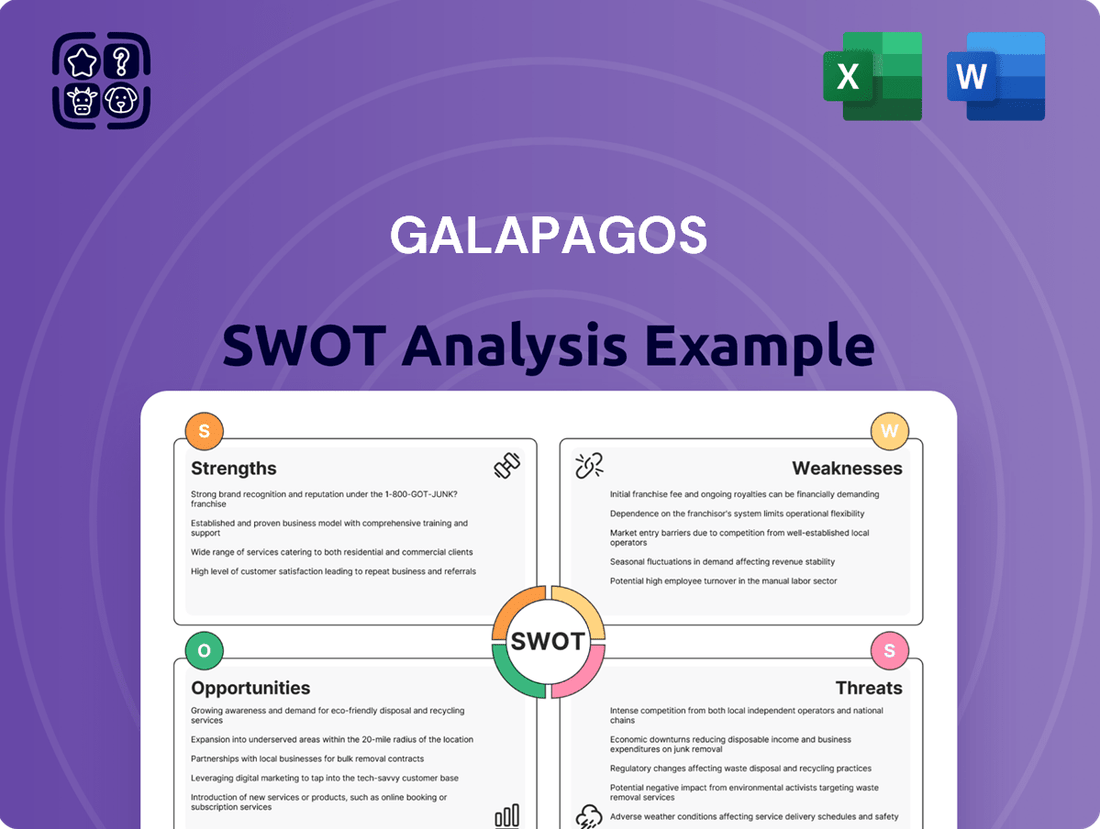

The Galapagos SWOT analysis reveals a unique ecosystem facing both remarkable strengths and significant threats. While its unparalleled biodiversity and scientific appeal are clear advantages, the delicate balance of its environment and reliance on tourism present considerable vulnerabilities.

Want the full story behind the Galapagos's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Galapagos' proprietary target discovery platform is a significant strength, allowing them to pinpoint novel drug candidates. This advanced system focuses on specific pathways implicated in chronic diseases, increasing the probability of positive clinical outcomes. This innovative approach firmly establishes Galapagos as a leader in the biopharmaceutical sector.

Galapagos boasts a robust clinical pipeline, with numerous compounds progressing through various stages of development, particularly in oncology and immunology. This strong pipeline is a significant asset, offering potential for future revenue streams and market expansion.

The company's strategic focus on addressing high unmet medical needs, especially in inflammatory and fibrotic diseases, positions it favorably in key therapeutic areas. This targeted approach can lead to greater clinical success and market penetration.

Expanding its pipeline to include next-generation cell therapies for hematologic malignancies further diversifies Galapagos' offerings and taps into a growing and critical area of medical innovation. This strategic move enhances its competitive edge.

Galapagos boasts a robust financial standing, underscored by its substantial cash reserves. As of June 30, 2025, the company reported a healthy €3.1 billion in cash and financial investments. This significant liquidity acts as a powerful enabler, allowing Galapagos to confidently advance its drug development pipeline and sustain its operational activities.

This strong financial foundation is crucial for Galapagos' strategic ambitions. It provides the necessary capital to fuel research and development, ensuring the acceleration of promising candidates through clinical trials. Furthermore, this financial strength positions Galapagos advantageously to explore and secure strategic business development opportunities, potentially through partnerships or acquisitions, thereby enhancing its long-term growth prospects.

Innovative Decentralized Cell Therapy Manufacturing

Galapagos's innovative decentralized manufacturing platform for CAR T-cell therapies is a significant strength. This system is engineered to produce fresh, stem-like, early memory cells, achieving a remarkable vein-to-vein turnaround time of just seven days. This rapid production cycle is crucial for patients with aggressive conditions who need swift access to potentially life-saving treatments.

This decentralized approach directly addresses a major bottleneck in cell therapy: manufacturing capacity and speed. By enabling faster and more widespread patient access, Galapagos positions itself as a leader in making these advanced therapies more readily available. The company's 2024 strategic focus includes scaling this platform, aiming to significantly increase the number of patients who can benefit from their CAR T-cell treatments.

- Rapid Vein-to-Vein Time: Achieves a seven-day turnaround for CAR T-cell production, crucial for rapidly progressive diseases.

- Decentralized Manufacturing: A unique platform designed to overcome traditional manufacturing limitations and expand patient access.

- Early Memory Cells: Focuses on producing potent, stem-like early memory cells for potentially enhanced therapeutic efficacy.

- Strategic Scaling: Plans to significantly increase manufacturing capacity in 2024 to meet growing demand and broaden treatment reach.

Strategic Collaborations and Partnerships

Galapagos actively cultivates strategic alliances, notably with Gilead Sciences, which has been instrumental in advancing its pipeline, particularly in areas like inflammation. These collaborations are crucial for sharing R&D costs and accessing specialized expertise, thereby de-risking the drug development process.

Further strengthening its capabilities, Galapagos has partnered with companies like Adaptimmune for cell therapies and Lonza and Catalent for manufacturing. These alliances not only broaden its therapeutic reach but also secure vital manufacturing capacity, essential for bringing new treatments to market efficiently. For instance, the collaboration with Lonza in 2020 aimed to bolster its cell therapy manufacturing capabilities.

- Gilead Sciences Partnership: A cornerstone collaboration providing significant R&D support and market access for Galapagos's innovative therapies.

- Cell Therapy Expansion: Alliances with Adaptimmune, Lonza, and Catalent are key to building robust manufacturing infrastructure for next-generation cell therapies.

- Risk Mitigation: Strategic partnerships help distribute the substantial financial burden and scientific challenges inherent in drug discovery and development.

- Therapeutic Diversification: Collaborations enable Galapagos to explore and develop treatments across a wider range of disease areas and modalities.

Galapagos possesses a strong financial position, evidenced by its substantial cash reserves. As of June 30, 2025, the company held €3.1 billion in cash and financial investments, providing significant flexibility for R&D and strategic initiatives.

The company's proprietary target discovery platform is a key strength, enabling the identification of novel drug candidates for chronic diseases. This advanced technology enhances the likelihood of successful clinical outcomes, positioning Galapagos as an innovator in the biopharmaceutical space.

Galapagos maintains a robust clinical pipeline with multiple compounds advancing in oncology and immunology, offering substantial future revenue potential. Their strategic focus on high unmet medical needs, particularly in inflammatory and fibrotic diseases, further strengthens their market position.

The expansion into next-generation cell therapies for hematologic malignancies diversifies their portfolio and taps into a rapidly growing area of medical innovation, enhancing their competitive edge.

What is included in the product

Delivers a strategic overview of Galapagos’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical threats and weaknesses, thereby alleviating strategic uncertainty.

Weaknesses

Galapagos has faced a significant hurdle with rising operating expenses. This surge is primarily due to the ambitious expansion of their oncology CAR T clinical programs and the development of a decentralized manufacturing network.

These investments, coupled with substantial restructuring and separation costs, have unfortunately impacted the company's bottom line. For the first half of 2025, Galapagos reported a net loss, underscoring the financial strain of these strategic initiatives.

Galapagos's strategic re-evaluation, particularly the May 2025 decision to reconsider its planned separation into two entities, introduces significant uncertainty. This pivot, prompted by evolving regulatory landscapes and market dynamics, casts a shadow over the future organizational structure and strategic direction, impacting key business segments like cell therapy.

Galapagos is navigating a crucial leadership transition, marked by the retirement of its long-serving CEO and the recent appointments of a new CEO and CFO. This shift, intended to invigorate strategic direction, could lead to temporary operational hiccups as the new team settles in and begins to execute its agenda.

The effectiveness of this leadership overhaul remains to be seen, with investors closely watching how the new management team integrates and drives forward the company's pipeline and strategic objectives. The successful implementation of their vision is key to overcoming potential short-term disruptions and capitalizing on future growth opportunities.

Dependence on Pipeline Success

As a biotechnology firm, Galapagos' fortunes are intrinsically tied to its research and development pipeline. Success in bringing new therapies through clinical trials, gaining regulatory approval, and ultimately launching them commercially is paramount. Any stumbles in these critical stages, such as trial failures or regulatory hurdles, could severely affect the company's financial health and standing in the market.

For instance, the company's reliance on its CAR-T platform for oncology, with candidates like GLPG345, highlights this vulnerability. While promising, the path to market for such advanced therapies is fraught with challenges, and delays or setbacks in the development of GLPG345 or other key pipeline assets could have a substantial negative impact.

- Pipeline Dependency: Galapagos' core business model hinges on the successful progression of its drug candidates.

- Clinical Trial Risks: Setbacks in clinical trials for key assets like GLPG345 could jeopardize future revenue streams.

- Regulatory Hurdles: Delays or rejections from regulatory bodies like the FDA or EMA can significantly impact commercialization timelines and financial projections.

Profitability and Cash Flow Challenges

Galapagos has encountered persistent profitability and cash flow hurdles. Despite maintaining a robust cash reserve, the company has reported a net loss, signaling ongoing cash burn. Management has acknowledged this, reaffirming cash burn guidance following a recent separation, highlighting the critical need for effective financial management to support future expansion.

Key financial indicators underscore these challenges:

- Net Loss: The company's financial statements continue to reflect a net loss, indicating that operating expenses currently exceed revenues.

- Cash Burn Rate: While specific figures for the latest reporting period are crucial for precise analysis, the ongoing cash burn necessitates careful financial planning and resource allocation.

- Guidance Reaffirmation: The reaffirmation of cash burn guidance post-separation suggests that while the situation is understood, the path to profitability remains a significant focus.

Galapagos's financial performance is hampered by persistent net losses and a notable cash burn rate, despite efforts to manage expenses. The company's strategic initiatives, including the expansion of its CAR T programs and the development of a decentralized manufacturing network, have contributed to increased operating costs. For the first half of 2025, Galapagos reported a net loss, underscoring the financial strain of these investments and restructuring efforts.

Full Version Awaits

Galapagos SWOT Analysis

This is the same Galapagos SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real Galapagos SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Galapagos has a compelling opportunity to establish itself as a frontrunner in the burgeoning field of cell therapy, with a particular focus on tackling significant unmet needs within hematologic malignancies. This strategic focus positions them to capture a substantial share of a market projected to reach over $30 billion by 2030.

Their lead candidate, GLPG5101, a CD19 CAR T therapy, is making substantial progress, moving into pivotal development stages. Recent clinical data has been highly encouraging, suggesting a strong potential for regulatory approval, with a target submission anticipated around 2028.

Galapagos is strategically broadening its research and development efforts to encompass novel CAR T candidates and advanced next-generation programs. This includes a focused push into therapeutic areas beyond its established strengths, such as targeting solid tumors and exploring new autoimmune indications.

This diversification is a key opportunity for Galapagos to access untapped markets and establish new revenue streams. By expanding its pipeline into areas like solid tumors, the company can leverage its scientific expertise to address significant unmet medical needs.

For instance, the company's commitment to innovation in oncology, particularly in CAR T therapies for difficult-to-treat cancers, positions it to capture a growing segment of the cancer treatment market. The global CAR T therapy market was valued at approximately $6.3 billion in 2023 and is projected to reach over $20 billion by 2030, showcasing the immense potential for companies with strong development pipelines.

Galapagos's considerable cash reserves, bolstered by recent financing activities, position them strongly for strategic acquisitions. As of their latest reports, they maintain a robust financial footing, enabling them to explore and execute transformative business development deals. This financial capacity is key to pursuing innovative medicines that have already shown promising results, thereby accelerating pipeline expansion and diversification.

The company's stated strategic pivot towards acquiring assets with demonstrated proof-of-concept is a significant opportunity. This approach mitigates some of the inherent risks in early-stage drug development. By focusing on de-risked assets, Galapagos can potentially achieve faster pipeline build-out and market entry, leveraging their financial strength to secure valuable intellectual property and therapeutic candidates.

Leveraging Decentralized Manufacturing Platform

Galapagos's unique decentralized manufacturing platform for cell therapies presents a significant opportunity. This innovative approach allows for faster and broader patient access to potentially life-changing treatments, a key differentiator in the competitive biotech landscape.

Scaling up this capacity and further optimizing its efficiency offers a chance to fundamentally change how cell therapies are delivered. By streamlining production and distribution, Galapagos can solidify its position as a leader in this rapidly evolving field.

- Enhanced Patient Access: Decentralized manufacturing can reduce lead times for cell therapy production, potentially shortening the time from diagnosis to treatment for patients.

- Cost Efficiency Gains: Optimizing the decentralized model could lead to reduced logistical costs and improved resource utilization, making treatments more accessible.

- Market Expansion: A more efficient and scalable manufacturing process allows for broader geographical reach and the ability to serve a larger patient population.

- Competitive Advantage: Galapagos's early investment in and refinement of this platform provides a distinct advantage over competitors who may rely on more traditional, centralized manufacturing models.

Partnerships for Small Molecule Assets

Galapagos is actively pursuing partnerships to divest certain small molecule assets, a strategic move aimed at optimizing its portfolio. A key example is GLPG3667, a TYK2 inhibitor currently in Phase 3-enabling studies, which represents a significant opportunity for a collaborating entity.

Securing these partnerships offers a dual benefit: it injects crucial funding into Galapagos and enables the company to reallocate its valuable resources towards its burgeoning cell therapy division. This focus is critical as the biopharmaceutical landscape increasingly favors specialized therapeutic areas.

- GLPG3667: TYK2 inhibitor in late-stage development, targeting autoimmune diseases.

- Funding Infusion: Partnerships can provide non-dilutive capital, strengthening Galapagos' financial position.

- Resource Reallocation: Allows greater investment in high-potential cell therapy programs.

- Portfolio Optimization: Streamlines operations by focusing on core competencies.

Galapagos is well-positioned to capitalize on the growing cell therapy market, with a lead candidate, GLPG5101, progressing into pivotal stages. The company's strategy to expand its pipeline into new indications like solid tumors and autoimmune diseases offers significant market expansion potential, tapping into a global CAR T therapy market projected to exceed $20 billion by 2030.

The company's robust cash reserves, strengthened by recent financing, provide a solid foundation for strategic acquisitions of de-risked, proof-of-concept assets. This financial flexibility allows Galapagos to accelerate pipeline growth and diversification, focusing on innovative medicines with demonstrated early success.

Galapagos's unique decentralized manufacturing platform for cell therapies offers a competitive advantage by enabling faster and broader patient access. Optimizing this platform can lead to cost efficiencies and market expansion, solidifying its leadership in this evolving field.

Strategic partnerships for divesting certain small molecule assets, such as the TYK2 inhibitor GLPG3667, are crucial for portfolio optimization and funding its cell therapy focus. These collaborations can provide non-dilutive capital, allowing Galapagos to reallocate resources to its high-potential cell therapy programs.

Threats

Galapagos operates in a fiercely competitive biotechnology landscape, particularly within its focus areas of inflammatory, fibrotic, and oncology diseases. The market is crowded with both large, established pharmaceutical giants and nimble emerging biotechs, all aggressively pursuing innovation and market share. This intense rivalry means Galapagos must constantly differentiate its offerings and demonstrate clear clinical and commercial advantages to succeed.

Galapagos faces significant regulatory hurdles, as the path to bringing new medicines to market is a complex and lengthy process. Delays in securing approvals from bodies like the FDA or EMA for their promising pipeline candidates, such as those in inflammatory diseases or fibrosis, could severely impact their financial projections and strategic timelines. For instance, a setback in the approval process for a key drug could mean millions in lost revenue and extended development costs, potentially affecting investor confidence.

Clinical trial failures represent a significant threat to Galapagos. The inherent unpredictability of drug development means that even highly anticipated candidates can falter in later-stage trials due to insufficient efficacy or safety concerns. For instance, in 2023, several biopharmaceutical companies experienced high-profile trial setbacks, impacting stock valuations and R&D pipelines.

These failures can result in substantial financial write-offs, as significant investment is poured into each stage of clinical development. Beyond the direct monetary loss, a failed trial can also erode investor confidence and damage Galapagos' reputation within the scientific and investment communities, potentially hindering future funding and partnerships.

Intellectual Property Challenges

Protecting intellectual property is paramount in the competitive biotechnology landscape, and Galapagos is no exception. The company continually navigates the threat of patent challenges, which can arise from competitors seeking to invalidate existing patents or design around them. Such challenges can significantly impact the exclusivity and market potential of Galapagos' innovative drug candidates and proprietary technologies.

Furthermore, the risk of patent infringement remains a constant concern. If other entities are found to be using Galapagos' patented inventions without authorization, it can lead to costly legal battles and potential loss of revenue. For instance, as of early 2024, the biopharmaceutical sector is seeing increased litigation over gene-editing technologies and novel drug delivery systems, areas where Galapagos is actively engaged.

The rapid pace of technological advancement in biotech also presents a threat. The emergence of new, more efficient, or cost-effective technologies could potentially diminish the competitive advantage of Galapagos' existing platforms or drug candidates. This necessitates continuous investment in research and development to stay ahead of the curve and adapt to evolving scientific landscapes.

- Patent Challenges: Competitors may contest the validity or scope of Galapagos' patents, potentially reducing market exclusivity for its products.

- Infringement Risks: Unauthorized use of Galapagos' patented technologies or drug candidates by third parties can lead to legal disputes and financial losses.

- Technological Obsolescence: Rapid advancements in biotechnology could render Galapagos' proprietary platforms or drug candidates less competitive if not continuously innovated upon.

Financial Market Volatility and Investor Sentiment

Galapagos, as a publicly traded entity, faces the inherent risk of financial market volatility. Fluctuations in broader economic conditions and investor sentiment, particularly within the biotechnology sector, can directly impact its stock price and its capacity to secure necessary funding. For instance, a downturn in global markets or a shift in investor appetite for riskier assets like biotech stocks could negatively affect Galapagos' valuation. This volatility can constrain its strategic options, including potential acquisitions or research and development investments.

Investor sentiment towards the biotech industry, often driven by factors like drug trial success rates and regulatory approvals, plays a crucial role. A general cooling of investor enthusiasm for biotech, perhaps due to a series of high-profile trial failures across the sector, could disproportionately impact Galapagos. This sentiment directly influences its ability to raise capital through equity offerings or debt financing, potentially delaying or hindering its growth plans. For example, if the biotech sector experiences a significant correction, Galapagos might find it more challenging and expensive to secure capital compared to periods of strong market confidence.

- Market Volatility Impact: Broader economic downturns can depress Galapagos' stock price, potentially hindering its ability to raise capital through equity offerings.

- Sector-Specific Sentiment: Negative investor sentiment toward the biotechnology sector, driven by trial failures or regulatory hurdles elsewhere, can unfairly impact Galapagos' valuation.

- Capital Raising Challenges: Increased market volatility and negative sentiment can lead to higher borrowing costs and reduced investor demand for Galapagos' securities.

- Strategic Flexibility: Financial market instability can limit Galapagos' flexibility in pursuing strategic partnerships, acquisitions, or significant R&D expansions.

Galapagos must contend with intense competition from established pharmaceutical firms and emerging biotechs, requiring constant innovation and differentiation to secure market share. The company also faces significant regulatory hurdles, where delays in approvals for pipeline candidates like those in inflammatory diseases could impact financial projections and investor confidence. Clinical trial failures are a major threat, potentially leading to substantial financial write-offs and damage to reputation, as seen with sector-wide setbacks in 2023 that affected valuations.

SWOT Analysis Data Sources

The data sources for this Galapagos SWOT analysis include comprehensive financial reports, detailed market research, and expert opinions from industry professionals to ensure a robust and insightful evaluation.