Galapagos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

Galapagos's industry is shaped by intense rivalry among existing players and the significant bargaining power of buyers, impacting profit margins. Understanding these dynamics is crucial for navigating the competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Galapagos’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Galapagos, a prominent player in the biotechnology sector, depends on highly specialized raw materials, reagents, and biological components for its critical research, development, and manufacturing operations. The intricate nature of these inputs, often proprietary and requiring specific expertise, can significantly bolster the bargaining power of their suppliers.

This leverage is amplified when alternative sources are scarce or when the costs associated with switching suppliers are prohibitively high. For instance, a critical reagent used in Galapagos' gene therapy development might be produced by only a handful of specialized companies globally, granting them considerable pricing influence.

Galapagos' reliance on Contract Research Organizations (CROs) for its complex and expensive clinical trials significantly increases the bargaining power of these CROs. CROs offer specialized knowledge and facilities essential for drug development, making them critical partners.

In 2023, the global CRO market was valued at approximately $55 billion, demonstrating the substantial investment in these services. This large market size indicates a competitive landscape among CROs, but also highlights their indispensable role, allowing well-established CROs with proven track records to command higher prices and favorable terms from companies like Galapagos.

Suppliers who offer proprietary technologies, such as advanced laboratory equipment or unique drug discovery platforms, can exert significant bargaining power. Galapagos' dependence on these specialized tools for its target discovery platform highlights the influence these niche providers hold, potentially allowing them to charge premium prices for their essential innovations.

Highly Skilled Scientific Talent

The biotechnology sector thrives on specialized knowledge, making highly skilled scientific talent a critical resource. This demand for experts in areas like genomics, molecular biology, and clinical trials creates a significant bargaining power for these individuals and the institutions that train them.

The scarcity of this specialized workforce directly translates into leverage for suppliers of this talent, influencing compensation and employment terms. For instance, in 2024, the average salary for a senior research scientist in biotech in the US was reported to be around $130,000, with top-tier talent commanding even higher figures and often negotiating for better benefits and research autonomy.

- High Demand: The need for specialized scientific skills in areas like gene editing and AI-driven drug discovery is consistently high.

- Limited Supply: The number of individuals possessing these niche qualifications remains relatively low globally.

- Negotiating Power: Skilled scientists can negotiate for higher salaries, better research funding, and more flexible working conditions.

- Talent Acquisition Costs: Companies often face increased recruitment costs and longer hiring timelines due to this competitive talent market.

Logistics and Supply Chain Vulnerabilities

The global biopharma supply chain continues to experience significant turbulence. In 2024, factors like elevated transportation expenses and limitations in handling temperature-sensitive materials for drug transport put considerable pressure on companies like Galapagos. These ongoing challenges translate directly into increased bargaining power for specialized logistics providers, particularly those offering robust cold chain management solutions. Their ability to ensure the reliable and secure delivery of vital biological materials and finished products is paramount to Galapagos' operational continuity and success in bringing therapies to market.

The heightened reliance on these specialized logistics services means that providers of cold chain and high-security transportation hold considerable sway. For instance, the International Air Transport Association (IATA) reported in early 2024 that air cargo rates, while moderating from pandemic peaks, remained above pre-pandemic levels, especially for specialized shipments. This cost dynamic, coupled with the critical need for unbroken cold chains to maintain product integrity, empowers logistics partners to command premium pricing and favorable terms. Galapagos, like many in the sector, must navigate these realities, recognizing that the bargaining power of these essential service providers is a significant factor in their overall cost structure and operational resilience.

- High Transportation Costs: In 2024, air cargo rates for specialized biopharmaceutical shipments remained elevated, impacting operational budgets.

- Capacity Constraints: Limited availability of specialized cold chain infrastructure and qualified personnel created bottlenecks.

- Criticality of Reliable Delivery: The need for uninterrupted cold chains for temperature-sensitive biologics amplified the importance of dependable logistics partners.

- Increased Provider Leverage: Consequently, logistics companies offering specialized services gained greater bargaining power due to their essential role.

Suppliers of specialized biological materials and reagents often possess significant bargaining power due to the unique nature and limited availability of their products. Galapagos' reliance on these niche inputs means suppliers can dictate terms. The scarcity of certain advanced research equipment also grants considerable leverage to their providers, impacting Galapagos' ability to access cutting-edge technology.

The bargaining power of suppliers is further amplified by the high costs associated with switching to alternative sources, especially for critical components in drug development. This is particularly true for suppliers offering proprietary technologies or unique manufacturing processes essential for Galapagos' research pipeline.

In 2024, the global market for specialized biopharmaceutical ingredients and services saw continued demand, with some niche suppliers experiencing order backlogs. This tight supply situation, coupled with the critical need for these materials, allowed these suppliers to maintain strong pricing power.

| Supplier Type | Key Factor for Bargaining Power | Impact on Galapagos | 2024 Market Trend |

|---|---|---|---|

| Specialized Reagents | Unique composition, limited producers | Higher input costs, potential supply delays | Steady demand, price stability |

| Proprietary Equipment | Exclusive technology, high R&D investment | Significant capital expenditure, dependence on vendor support | Increased adoption of AI-driven research tools |

| Contract Research Organizations (CROs) | Specialized expertise, regulatory knowledge | High service fees, long-term contract negotiations | Market growth exceeding 10% annually |

What is included in the product

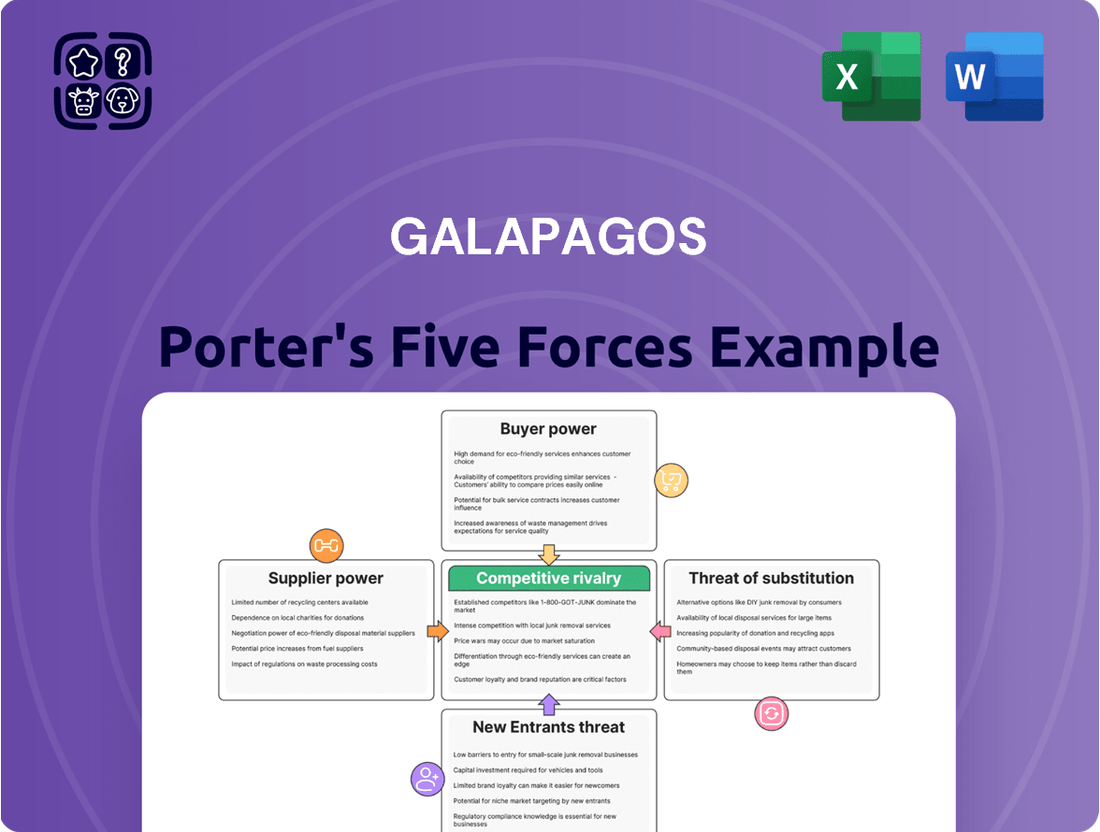

Analyzes the competitive intensity within the Galapagos market by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing firms.

Pinpoint competitive threats and opportunities with a visual representation of each force, making strategic planning more intuitive.

Quickly assess the impact of supplier power and buyer bargaining on your profitability, enabling proactive negotiation strategies.

Customers Bargaining Power

Large healthcare systems, government programs like Medicare and Medicaid, and private insurers represent major customer blocs for pharmaceutical companies, including Galapagos. In 2024, these payers wield considerable influence by dictating which drugs are covered on formularies, negotiating significant price concessions, and acting as gatekeepers for market access. Their collective purchasing power allows them to demand favorable terms, directly impacting Galapagos' revenue streams and the commercial viability of its therapies.

Galapagos' commitment to developing groundbreaking therapies, especially in cutting-edge fields like cell therapy, often results in substantial treatment expenses. For instance, the development of novel biologics can cost billions of dollars. This high price tag naturally gives significant leverage to those who pay for these treatments, like insurance companies and hospitals.

These payers can then push for considerable price reductions, rebates, or require robust proof that Galapagos' innovative treatments offer demonstrably better clinical outcomes and economic benefits compared to existing options. This bargaining power is amplified when alternative treatments are readily available or when the perceived value of the innovation is not clearly established.

The availability of existing therapies directly influences the bargaining power of customers, including patients and healthcare providers. Even if Galapagos aims to address unmet needs, the presence of established treatments, even if suboptimal, offers alternatives. This can reduce the immediate pressure to adopt new Galapagos therapies and heighten price sensitivity among buyers.

Regulatory and Reimbursement Landscape

Government and regulatory bodies significantly shape the bargaining power of customers by dictating reimbursement policies and approving drug indications. These decisions directly influence the perceived value and affordability of Galapagos' offerings, impacting customer adoption rates. For instance, in 2024, the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) continue to be critical gatekeepers for market access, with their approval processes directly affecting how widely Galapagos' therapies can be utilized and reimbursed.

The reimbursement landscape, heavily influenced by governmental bodies, directly impacts customer power by determining the out-of-pocket costs for patients and healthcare systems. Favorable reimbursement policies can increase demand, while restrictive ones can limit market penetration. In 2024, ongoing discussions around drug pricing and value-based healthcare in major markets like the United States and Germany are key factors influencing these dynamics.

- Governmental influence on pricing: Regulatory bodies set reimbursement rates, directly affecting customer willingness to pay for Galapagos' products.

- Market access pathways: Approval processes by agencies like the EMA and FDA determine which patient populations can access therapies, influencing overall demand.

- Affordability impact: Reimbursement policies in 2024 are crucial in determining the affordability of innovative treatments, thereby shaping customer purchasing decisions.

- Value-based healthcare trends: The increasing focus on demonstrating therapeutic value to payers in 2024 can shift bargaining power towards customers who demand proven outcomes.

Strategic Collaborations with Large Pharma

When Galapagos enters strategic collaborations with major pharmaceutical firms, the larger partner typically wields significant bargaining power. This imbalance is frequently observed in licensing and partnership agreements where the dominant entity sets the terms for crucial aspects like development pathways, market access strategies, and profit distribution. For instance, in past deals, the terms often favored the larger pharma company, reflecting their established market presence and extensive resources.

The bargaining power of customers, particularly large pharmaceutical companies acting as partners or licensees, can significantly impact Galapagos's revenue streams and strategic flexibility. These powerful entities can negotiate favorable terms, potentially reducing Galapagos's share of future profits or dictating the pace and direction of product development. This dynamic is a key consideration in assessing the competitive landscape.

- Leverage of Large Pharma: Major pharmaceutical companies often possess greater negotiating leverage due to their established market share, extensive distribution networks, and significant financial resources.

- Deal Structure Influence: This leverage allows them to influence the terms of licensing agreements, including upfront payments, milestone payments, and royalty rates, often to their advantage.

- Development Control: In many collaborations, the larger partner dictates the development and commercialization strategy, impacting Galapagos's control over its own innovations.

- Revenue Share Negotiation: The revenue-sharing models are frequently negotiated in favor of the larger entity, directly affecting Galapagos's potential profitability from successful products.

The bargaining power of customers is a significant force for Galapagos, particularly from large payers like government programs and private insurers. In 2024, these entities wield substantial influence by controlling formulary access and negotiating prices, directly impacting Galapagos' revenue. Their ability to demand favorable terms, coupled with the high cost of developing innovative therapies, amplifies their leverage.

The presence of alternative treatments, even if less effective, provides customers with options, thereby increasing price sensitivity. Furthermore, government and regulatory bodies like the EMA and FDA act as critical gatekeepers, with their reimbursement policies and approval processes directly shaping market access and customer adoption rates for Galapagos' products in 2024.

Strategic collaborations with larger pharmaceutical firms also present a dynamic where the dominant partner often dictates terms, influencing development pathways and profit distribution. This leverage can reduce Galapagos' share of future profits and limit its strategic flexibility, as seen in many past licensing agreements.

| Customer Type | Influence Mechanism | Impact on Galapagos (2024) | Example |

|---|---|---|---|

| Major Payers (Insurers, Government) | Formulary control, Price negotiation, Reimbursement policies | Reduced revenue potential, Market access barriers | Negotiating significant rebates on new therapies |

| Healthcare Providers/Hospitals | Adoption rates, Treatment protocols | Influences demand and market penetration | Prioritizing cost-effective alternatives |

| Large Pharmaceutical Partners | Licensing terms, Development control, Profit sharing | Reduced profit share, Limited strategic autonomy | Dictating commercialization strategy for a co-developed drug |

What You See Is What You Get

Galapagos Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of the Galapagos Islands tourism industry provides an in-depth examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products or services, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

Galapagos operates in therapeutic areas like inflammatory diseases, fibrotic diseases, and oncology, which are intensely competitive. These markets are largely controlled by established pharmaceutical giants possessing substantial financial resources, robust research and development pipelines, and significant market penetration. For instance, in 2024, the global pharmaceutical market size was estimated to be over $1.6 trillion, with a significant portion dominated by a few large players who can leverage their scale for pricing power and market access.

The biotechnology sector is characterized by an incredibly fierce competition to innovate. Companies are locked in a perpetual race to discover and bring to market groundbreaking new treatments. This drive for novelty means substantial investments in research and development, making the race to be the first with a successful therapy a defining feature of the industry.

The biotech sector is experiencing intense competition not just from established pharmaceutical giants but also from a burgeoning number of agile, emerging companies. These smaller innovators are particularly active in high-growth areas like oncology and rare diseases, actively pushing the boundaries of drug discovery and development.

This influx of specialized players significantly escalates the competitive rivalry. For instance, in 2024, the number of new biotech IPOs and venture capital funding rounds for early-stage companies remained robust, indicating a vibrant ecosystem of startups eager to challenge existing market dynamics and introduce novel therapeutic approaches.

Pipeline Overlap and Therapeutic Focus

Galapagos faces intense competition as numerous pharmaceutical and biotechnology firms are targeting areas with high unmet medical needs. This shared focus naturally leads to significant overlap in therapeutic targets and the drug candidates being developed.

Galapagos' strategic pivot and ongoing pipeline expansion, particularly in oncology and immunology, places it in direct competition with a multitude of established players and emerging biotechs. For instance, in the oncology space, companies like Pfizer, Merck, and Bristol Myers Squibb are major competitors, each with extensive portfolios and significant R&D investments. Similarly, in immunology, AbbVie, Johnson & Johnson, and Eli Lilly are key rivals with well-established blockbuster drugs.

- Oncology Competition: Galapagos' oncology pipeline directly contends with the vast pipelines of major pharmaceutical companies, many of whom have decades of experience and substantial market share in cancer treatment.

- Immunology Rivalry: The immunology sector is equally crowded, with Galapagos competing against companies that have already secured significant market penetration with treatments for autoimmune diseases and inflammatory conditions.

- R&D Investment Disparity: While Galapagos invests heavily in R&D, the sheer scale of investment by larger competitors, often in the tens of billions of dollars annually, presents a formidable challenge in terms of speed to market and breadth of research.

Strategic Alliances and M&A Activity

The biopharmaceutical industry thrives on strategic alliances and mergers and acquisitions (M&A), as companies constantly look to bolster their drug pipelines and secure a competitive edge. This dynamic environment sees frequent collaborations and consolidations, which in turn fuels intense rivalry by forging larger, more integrated competitors.

For instance, in 2024, the biopharma M&A landscape remained active, with significant deals aimed at acquiring innovative technologies and expanding therapeutic areas. Companies are strategically partnering to share R&D costs and access new markets, effectively raising the bar for smaller players and intensifying competition among established entities.

- Increased Consolidation: M&A activity leads to fewer, but larger, more powerful competitors.

- Pipeline Expansion: Companies acquire or partner to gain access to promising new drugs and technologies.

- Synergies and Efficiency: Mergers can create cost savings and operational efficiencies, enhancing competitive strength.

- Talent and IP Acquisition: Deals often focus on acquiring skilled personnel and valuable intellectual property.

Galapagos faces intense competitive rivalry across its key therapeutic areas, including inflammatory diseases, fibrotic diseases, and oncology. The global pharmaceutical market, valued at over $1.6 trillion in 2024, is dominated by large players with substantial R&D budgets and established market access, creating a high barrier to entry.

The biotech sector's rapid innovation cycle means companies are constantly racing to develop novel treatments, with significant R&D investments fueling this competition. This dynamic is further amplified by a growing number of agile startups actively pursuing high-growth areas like oncology and rare diseases, as evidenced by robust venture capital funding and IPO activity in 2024.

| Competitor Type | Key Areas of Competition | Example Competitors (2024) |

| Large Pharmaceutical Companies | Oncology, Immunology, Broad Therapeutic Areas | Pfizer, Merck, Bristol Myers Squibb, AbbVie, Johnson & Johnson, Eli Lilly |

| Emerging Biotechnology Companies | Oncology, Rare Diseases, Novel Therapies | Numerous agile startups with focused pipelines |

SSubstitutes Threaten

For inflammatory and fibrotic diseases, patients and healthcare providers often have access to a range of conventional treatments. These include established small molecule drugs and biologics that have been available for years, offering a baseline of care.

These older therapies, even if they are less targeted or have more side effects, represent readily available substitutes for newer, potentially more innovative treatments. For instance, in the treatment of rheumatoid arthritis, conventional DMARDs like methotrexate remain a widely used and cost-effective option, limiting the pricing power of newer biologic agents.

The rise of biosimilars and generics poses a significant threat to Galapagos. While Galapagos develops novel therapies, the market availability of lower-cost biosimilar and generic versions of existing biologics and small molecules can lead to considerable pricing pressure. For instance, in 2023, the global biosimilars market was valued at approximately $20 billion, with projections indicating substantial growth, demonstrating a clear trend towards cost-effective alternatives.

These cheaper alternatives can indirectly substitute for Galapagos' more expensive, innovative treatments, especially as patents expire. This dynamic forces companies like Galapagos to continually innovate and demonstrate the added value of their novel drugs to justify premium pricing, as the competitive landscape intensifies with the entry of these substitutes.

Non-pharmacological interventions represent a significant threat of substitutes for Galapagos' pharmaceutical products. For instance, in treating conditions like osteoarthritis, physical therapy and weight management can reduce the need for pain medication. In 2024, the global physical therapy market was valued at an estimated $70 billion, indicating a substantial alternative for pain management.

Similarly, for cardiovascular diseases, lifestyle changes such as improved diet and regular exercise can be as effective as certain medications, directly impacting demand for related drugs. The World Health Organization's 2024 reports highlight that non-communicable diseases, often managed through lifestyle, account for a significant portion of global mortality, underscoring the broad applicability of these substitutes.

Advancements in Other Therapeutic Modalities

The threat of substitutes for Galapagos' traditional drug-based treatments is intensifying due to rapid advancements in medical science. Gene therapies and cell therapies developed by competitors, for instance, are emerging as powerful alternatives. These innovative approaches can offer entirely new ways to address diseases, potentially bypassing the need for small molecule or antibody-based drugs that Galapagos currently focuses on.

These alternative therapeutic modalities can directly substitute existing treatments by offering potentially more targeted or curative solutions. For example, in 2024, the global gene therapy market was valued at approximately $13.5 billion and is projected to grow significantly, indicating a strong market acceptance and development pipeline for these substitute technologies. This growth underscores the increasing viability and adoption of non-traditional therapeutic approaches.

- Emerging Gene Therapies: Companies are making strides in developing gene therapies for a range of conditions, offering a potential cure rather than management of symptoms.

- Advancements in Cell Therapies: CAR T-cell therapies and other engineered cell treatments are showing promise, providing novel mechanisms of action that could replace conventional pharmaceuticals.

- Sophisticated Medical Devices: Innovations in medical devices, such as implantable drug delivery systems or advanced diagnostic tools that enable highly personalized treatment plans, also present a form of substitution.

- Competition from Biologics: While Galapagos develops biologics, other companies' novel biologic approaches, particularly those with different mechanisms of action or superior efficacy profiles, can also act as substitutes.

Off-label Use of Existing Drugs

Physicians sometimes prescribe existing medications for uses not officially approved by regulatory bodies, a practice known as off-label prescribing. This can happen when doctors perceive a therapeutic advantage for a patient or when newer, more targeted treatments are unavailable or too costly. For instance, in 2024, a significant percentage of prescriptions written in the US were for off-label uses, particularly in areas like oncology and neurology, demonstrating the prevalence of this practice.

This off-label utilization can directly substitute for a new drug designed to address a specific, unmet medical need. If an older, cheaper drug proves effective for a condition it wasn't originally intended for, it reduces the immediate market demand for a novel, potentially more expensive, alternative. This dynamic can impact the revenue potential and market penetration of new pharmaceutical innovations.

- Prevalence: Off-label prescriptions account for a substantial portion of drug utilization, with estimates suggesting it can range from 10% to 25% of all prescriptions in certain therapeutic areas.

- Cost Factor: The lower cost of established drugs compared to newly developed ones is a primary driver for off-label use, making them a more accessible substitute for patients and healthcare systems.

- Therapeutic Benefit: When off-label use demonstrates clear clinical efficacy, it creates a strong substitute, challenging the market entry of drugs with similar intended indications.

The threat of substitutes for Galapagos' innovative treatments is multifaceted, encompassing established pharmaceuticals, biosimilars, generics, and non-pharmacological approaches. Conventional treatments, even if less targeted, offer a baseline of care, while the growing biosimilar market, valued at around $20 billion in 2023, exerts significant pricing pressure. Furthermore, lifestyle changes and physical therapies, with the physical therapy market reaching an estimated $70 billion in 2024, present substantial alternatives for managing chronic conditions.

Entrants Threaten

Prohibitive research and development costs present a substantial hurdle for new entrants in the pharmaceutical industry, including Galapagos. Bringing a new drug to market is an incredibly capital-intensive process, often exceeding billions of dollars. For instance, industry estimates suggest the average cost to develop a new drug can range from $1 billion to over $2.6 billion, encompassing discovery, preclinical testing, and multiple phases of rigorous clinical trials. These immense upfront investments create a significant barrier, deterring many potential competitors from entering the market.

Stringent regulatory approval processes represent a significant threat of new entrants in the biotechnology sector. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose lengthy, complex, and exceptionally costly requirements for drug and therapy approval. For instance, the average cost to develop a new drug can exceed $2.6 billion, with clinical trials alone consuming a substantial portion of this, making it a massive hurdle for newcomers.

These rigorous scientific and safety evaluations, often spanning years, demand substantial investment in research, development, and extensive clinical testing. Successfully navigating these hurdles requires deep scientific expertise, considerable financial resources, and established relationships with regulatory bodies, all of which are difficult for new entities to quickly acquire, thereby limiting the threat of new competition.

Galapagos' robust portfolio of patents on novel compounds, particularly for inflammatory, fibrotic, and oncology diseases, creates a significant barrier to entry. This proprietary technology and intellectual property make it exceedingly difficult for new companies to replicate their specific mechanisms of action and challenge their market position. For instance, Galapagos' commitment to R&D is reflected in its significant investment, with €570 million allocated to R&D in 2023, underscoring the depth of its innovation pipeline.

Need for Specialized Expertise and Infrastructure

The development and manufacturing of complex biological drugs, like cell therapies, require highly specialized scientific talent, advanced manufacturing facilities, and intricate supply chains. For instance, the global biopharmaceutical market, valued at approximately $400 billion in 2023, is characterized by high barriers to entry due to these capital-intensive requirements.

Establishing these sophisticated capabilities represents a massive undertaking for any new entrant. The sheer cost and complexity involved in setting up GMP-compliant manufacturing facilities alone can run into hundreds of millions of dollars, deterring many potential competitors.

- High Capital Investment: Building specialized manufacturing facilities for biologics can cost upwards of $200 million, as seen in recent expansions by established players.

- Talent Acquisition: Recruiting and retaining highly skilled scientists and engineers in fields like gene editing and bioprocessing is a significant challenge, with demand often outstripping supply.

- Regulatory Hurdles: Navigating the stringent regulatory pathways for novel biological products requires extensive expertise and resources, adding another layer of difficulty for newcomers.

Established Market Relationships and Distribution Channels

Established pharmaceutical and biotechnology firms in Galapagos's market boast deeply entrenched relationships with healthcare providers, crucial distributors, and influential payers. These existing networks are vital for market access and commercial success.

New entrants grapple with the formidable task of replicating these mature commercialization and distribution channels, a process that demands substantial time and investment. Building comparable market access and earning the trust of stakeholders is a significant barrier.

- Established Relationships: Existing players have long-standing ties with doctors, hospitals, and pharmacies, facilitating product adoption.

- Distribution Networks: Mature companies leverage extensive logistics and supply chain infrastructure, ensuring efficient product delivery.

- Payer Access: Decades of negotiation and data submission have secured favorable formulary placement with insurance providers and government health programs. For instance, in 2024, the average time for a new drug to gain preferred status on a major US health plan formulary could extend beyond 12-18 months, highlighting the hurdle for newcomers.

- Trust and Credibility: A proven track record and consistent product quality build trust, which new entrants must painstakingly earn.

The threat of new entrants for Galapagos is significantly mitigated by the immense capital required for drug development and regulatory approval, often exceeding billions of dollars. For example, industry estimates place the average cost to bring a new drug to market at over $2.6 billion. Furthermore, Galapagos' strong patent portfolio and proprietary technology create substantial barriers, as replicating their novel compounds and mechanisms of action is exceedingly difficult for potential competitors.

The complexity of biopharmaceutical manufacturing, particularly for advanced therapies, demands specialized talent and advanced facilities, representing another major hurdle. Establishing GMP-compliant manufacturing can cost hundreds of millions of dollars. Coupled with this, established players benefit from deeply entrenched relationships with healthcare providers and distributors, which new entrants struggle to replicate, facing an average of 12-18 months to gain preferred formulary status with major health plans in 2024.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Investment | High costs for R&D and manufacturing | Average drug development cost: >$2.6 billion |

| Regulatory Hurdles | Stringent and lengthy approval processes | FDA/EMA approval timelines and costs |

| Intellectual Property | Patents on novel compounds | Galapagos' patent portfolio |

| Manufacturing Complexity | Specialized facilities and talent for biologics | Biologics manufacturing facility costs: ~$200 million+ |

| Market Access & Relationships | Established distribution and payer networks | 12-18 months for preferred formulary status (2024) |

Porter's Five Forces Analysis Data Sources

Our Galapagos Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports from Galapagos and its competitors, industry-specific market research from firms like GlobalData and EvaluatePharma, and regulatory filings from bodies such as the EMA and FDA.