Galapagos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

Discover the core engine of Galapagos's innovation with a detailed look at their Business Model Canvas. This comprehensive breakdown reveals their unique approach to value creation, customer relationships, and revenue streams. Equip yourself with this strategic blueprint to fuel your own business growth and competitive edge.

Partnerships

Galapagos actively pursues strategic alliances with other pharmaceutical and biotechnology firms. These partnerships are crucial for bolstering research capabilities, speeding up the drug development pipeline, and broadening its therapeutic portfolio. For instance, Galapagos has a significant collaboration with BridGene Biosciences aimed at advancing small molecule drug discovery within the oncology sector.

These collaborations frequently take the form of co-development agreements, licensing deals, and joint ventures. Such structures enable the sharing of vital resources, specialized knowledge, and financial risks, which is essential for successfully bringing novel medicines to the market.

Galapagos actively partners with academic and research institutions to tap into pioneering scientific advancements, essential for developing innovative drug candidates. These collaborations grant access to specialized knowledge, cutting-edge technologies, and a deeper grasp of disease pathways, thereby fueling innovation and speeding up the discovery of new therapeutic targets.

A prime example of this strategy is Galapagos' collaboration with Moffitt Cancer Center. This partnership specifically aims to build robust manufacturing capabilities for CAR-T therapies, demonstrating a commitment to translating research breakthroughs into tangible treatment solutions.

Galapagos relies on Contract Development and Manufacturing Organizations (CDMOs) to produce its advanced cell therapy candidates, crucial for their decentralized manufacturing strategy. These collaborations are vital for ensuring the high-quality and efficient production of intricate biological treatments, ultimately speeding up patient access.

Key CDMO partners for Galapagos' decentralized CAR-T manufacturing include industry leaders like Thermo Fisher Scientific, Landmark Bio, Excellos, Catalent, and CELLforCURE by Seqens. This network of specialized partners underscores Galapagos' commitment to robust and scalable production capabilities, essential for bringing innovative therapies to market.

Strategic Investors and Equity Partners

Galapagos has secured significant backing from strategic investors and equity partners, crucial for fueling its ambitious research and development pipeline. These collaborations not only inject vital capital but also offer invaluable market insights and access, accelerating the journey from discovery to commercialization of novel therapies.

A prime example of such a partnership is with Gilead Sciences, Inc. Gilead's equity investment and their comprehensive Option, License and Collaboration Agreement underscore the strategic importance of these relationships. This collaboration, active in recent years, has been instrumental in advancing Galapagos' drug candidates through clinical trials and towards market approval.

- Gilead Sciences Investment: Gilead Sciences made a substantial equity investment in Galapagos, demonstrating strong confidence in its scientific platform.

- Collaboration Agreement: The Option, License and Collaboration Agreement with Gilead provides Galapagos with significant funding and strategic support for its R&D programs.

- Funding R&D: These partnerships are essential for covering the high costs associated with developing new medicines, from early-stage research to late-stage clinical trials.

- Market Access: Strategic partners can also provide crucial pathways to global markets, enhancing the commercial reach of Galapagos' innovative treatments.

Technology and Platform Providers

Galapagos actively partners with technology and platform providers to bolster its innovative drug discovery and development pipeline. These collaborations grant access to cutting-edge tools and specialized methodologies, crucial for the company's forward-thinking strategy.

For instance, Galapagos has collaborated with Lonza, leveraging their Cocoon® platform for cell therapy manufacturing. This type of partnership is vital for accessing advanced capabilities that might not be feasible to develop in-house, thereby accelerating the path from research to patient.

- Access to Advanced Tools: Partnerships provide specialized technology platforms, enhancing drug discovery and development.

- Proprietary Technologies: Collaborations can offer access to unique target discovery or manufacturing technologies.

- Lonza Collaboration: The partnership with Lonza for the Cocoon® platform exemplifies this strategic approach.

- Accelerated Innovation: Leveraging external expertise speeds up the development of novel therapies.

Galapagos' key partnerships are foundational to its business model, enabling access to crucial research, development, and manufacturing capabilities. These alliances, including collaborations with BridGene Biosciences for oncology drug discovery and Moffitt Cancer Center for CAR-T therapy manufacturing, are vital for expanding its therapeutic offerings and accelerating innovation.

The company leverages collaborations with academic institutions to tap into cutting-edge scientific advancements, ensuring a robust pipeline of innovative drug candidates. Furthermore, partnerships with CDMOs like Thermo Fisher Scientific and Catalent are essential for the high-quality, decentralized production of complex cell therapies, facilitating patient access.

Strategic financial backing, notably from Gilead Sciences through equity investments and a comprehensive collaboration agreement, provides critical funding and market insights. These relationships are instrumental in advancing Galapagos' drug candidates through clinical trials and towards commercialization, underscoring the symbiotic nature of its partnerships.

Galapagos also partners with technology providers like Lonza, utilizing their Cocoon® platform for advanced cell therapy manufacturing. This strategic engagement with external expertise and advanced tools is key to accelerating the development of novel therapies and maintaining a competitive edge in the biopharmaceutical landscape.

| Partner Type | Key Partners | Purpose | Example Collaboration |

|---|---|---|---|

| Biotech/Pharma | BridGene Biosciences | Drug Discovery & Development | Oncology small molecule discovery |

| Academic/Research | Moffitt Cancer Center | Manufacturing Capabilities | CAR-T therapy manufacturing |

| CDMOs | Thermo Fisher Scientific, Catalent, Lonza | Manufacturing & Technology | Decentralized cell therapy production, Cocoon® platform |

| Strategic Investors | Gilead Sciences | Funding & Strategic Support | Option, License and Collaboration Agreement |

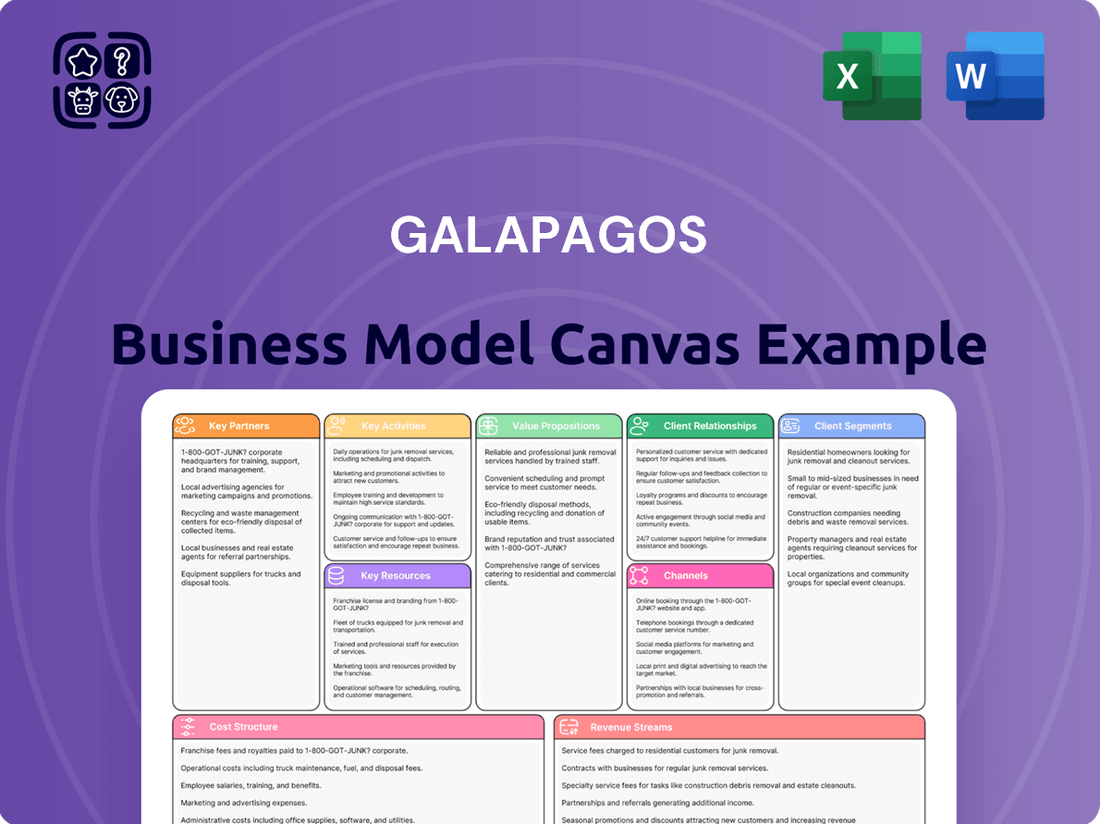

What is included in the product

A structured framework that visually maps out the key components of a business, including customer segments, value propositions, channels, and revenue streams.

It provides a holistic view of how a business creates, delivers, and captures value, facilitating strategic planning and innovation.

The Galapagos Business Model Canvas offers a structured approach to identify and address critical business challenges by visually mapping out key elements, thereby alleviating the pain of disjointed strategies.

It simplifies complex business thinking, providing a clear, actionable framework that relieves the pain of overwhelming strategic planning and execution.

Activities

Galapagos’s central activity revolves around its advanced target discovery platform, a cornerstone for identifying new drug candidates. This involves deep dives into research and preclinical work to unravel disease pathways and pinpoint key molecular targets for treatment, especially for conditions like inflammation and fibrosis.

In 2024, Galapagos continued to invest heavily in R&D, with a significant portion allocated to its discovery engine. The company’s pipeline, built on this platform, includes several promising candidates in early-stage development, underscoring the platform's ongoing success in generating novel therapeutic opportunities.

Galapagos dedicates substantial resources to advancing its drug candidates through preclinical testing and comprehensive clinical trials, including Phase 1, 2, and 3. This critical stage involves meticulous study design and execution to evaluate the safety, efficacy, and appropriate dosing of investigational medicines, particularly those targeting conditions with high unmet medical needs.

In 2024, Galapagos continued to advance its pipeline, with a focus on the strategic initiation of clinical development for new CAR-T candidates. The company's commitment to expanding its portfolio is evident in its plans to further progress these programs and other pipeline assets throughout 2025 and 2026.

Galapagos' key activities in manufacturing and supply chain management are centered on its innovative decentralized approach for cell therapies. This involves building and overseeing a network of manufacturing partners, often Contract Development and Manufacturing Organizations (CDMOs), to produce fresh, stem-like early memory CAR-T cells.

The primary goal is to achieve a rapid vein-to-vein time, which is critical for the efficacy of these complex biological treatments. This necessitates meticulous management of collaborations and a highly efficient, robust supply chain to ensure timely delivery of personalized therapies to patients.

For instance, in 2024, the company continued to expand its CDMO network, aiming to support the growing demand for its CAR-T therapies across multiple geographies. This expansion is crucial for scaling production while maintaining the stringent quality and speed required for patient treatment.

Regulatory Affairs and Market Access

Galapagos' key activities include meticulously navigating the intricate regulatory pathways to secure necessary approvals from health authorities. This is crucial for bringing innovative treatments to patients. For instance, securing approval from the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) involves extensive data submission and rigorous review processes.

Beyond initial approval, ensuring market access for these approved therapies is paramount. This involves proactive engagement with healthcare systems and payers. The goal is to facilitate patient access to Galapagos' transformative treatments, making sure they can reach those who need them.

- Regulatory Navigation: Successfully obtaining marketing authorizations from agencies like the FDA and EMA for new drug applications.

- Market Access Strategies: Developing and implementing plans to ensure reimbursement and patient access within national healthcare systems and private insurance markets.

- Health Technology Assessment (HTA): Engaging with HTA bodies to demonstrate the value and cost-effectiveness of Galapagos' medicines, a critical step for market entry in many European countries.

Intellectual Property Management and Portfolio Building

Galapagos actively safeguards its groundbreaking research through a comprehensive intellectual property strategy, primarily utilizing patents to protect its innovative discoveries. This ensures a competitive edge and secures the value of its scientific advancements.

A core activity involves the strategic development of a strong pipeline of novel medicines. This is achieved through a dual approach: nurturing internal research and development efforts while simultaneously pursuing external growth via strategic acquisitions and licensing agreements.

For instance, in 2023, Galapagos reported significant R&D expenditure, underscoring its commitment to pipeline expansion. The company also highlighted several key licensing deals and collaborations aimed at broadening its therapeutic reach and strengthening its intellectual property portfolio.

- Patent Protection: Securing patents for novel drug candidates and platform technologies.

- Pipeline Development: Investing in internal R&D to advance new medicines through clinical trials.

- Strategic Partnerships: Engaging in licensing and acquisition activities to enhance the pipeline and intellectual property assets.

Galapagos' key activities are centered on its advanced target discovery platform, which fuels its research and preclinical efforts to identify novel drug candidates. The company also focuses on advancing these candidates through rigorous clinical trials, including the strategic initiation of CAR-T programs in 2024.

Manufacturing and supply chain management are critical, particularly for its decentralized cell therapy approach, which relies on a network of CDMOs to ensure rapid vein-to-vein times. Furthermore, Galapagos actively navigates complex regulatory pathways for approvals and develops market access strategies to ensure patient access to its therapies.

Intellectual property protection through patents is a core activity, alongside strategic pipeline development via internal R&D and external collaborations, licensing, and acquisitions. The company's commitment to R&D was evident in its significant expenditures in 2023, supporting pipeline expansion and strengthening its IP portfolio.

| Key Activity | Description | 2024 Focus/Data |

| Target Discovery & R&D | Identifying novel drug candidates and unraveling disease pathways. | Continued investment in discovery engine; pipeline advancement. |

| Clinical Development | Advancing drug candidates through preclinical and clinical trials. | Initiation of new CAR-T candidates; progression of other pipeline assets. |

| Manufacturing & Supply Chain | Decentralized production of cell therapies via CDMOs. | Expansion of CDMO network to meet growing demand. |

| Regulatory & Market Access | Securing approvals and ensuring patient access to therapies. | Navigating regulatory pathways; engaging with healthcare systems. |

| Intellectual Property & Pipeline Growth | Protecting discoveries and expanding therapeutic reach. | Patent protection; licensing and acquisition activities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Galapagos Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, ready-to-use file, ensuring no surprises and full transparency. Once your order is processed, you'll have instant access to this exact same professional and comprehensive Business Model Canvas.

Resources

Galapagos's proprietary target discovery platform is its central intellectual property, crucial for identifying new biological targets for drug development. This platform is a key differentiator, enabling the creation of groundbreaking or superior medicines.

This advanced system allows Galapagos to pinpoint novel therapeutic targets, giving them a significant edge in the competitive biopharmaceutical landscape. Their ability to discover and validate these targets is fundamental to their strategy of developing innovative treatments.

Galapagos relies heavily on its highly specialized scientists, researchers, and clinical development experts. These individuals are the engine of innovation, possessing deep knowledge in drug discovery, preclinical and clinical development, and navigating complex regulatory landscapes. Their collective expertise is crucial for advancing Galapagos' pipeline of novel therapies.

In 2024, Galapagos continued to invest in its human capital, recognizing that scientific talent is a primary driver of its business model. The company's success in bringing new treatments through rigorous development phases, including clinical trials, is directly attributable to the skill and dedication of its R&D personnel. This specialized workforce is a core competitive advantage.

Galapagos's clinical pipeline, a cornerstone of its business model, features a diverse array of drug candidates. These assets are primarily concentrated in areas with significant unmet medical needs, including inflammatory diseases, fibrotic conditions, and oncology. This robust portfolio is the engine for future revenue generation and the company's capacity to innovate.

Key resources within this pipeline include promising compounds like GLPG5101, a CAR-T therapy, and GLPG3667, a TYK2 inhibitor. These candidates are progressing through various stages of preclinical and clinical development, underscoring Galapagos's commitment to advancing novel treatments. The successful progression of these drug candidates is critical for the company's long-term growth and market positioning.

Decentralized Cell Therapy Manufacturing Network

Galapagos' decentralized cell therapy manufacturing network, including collaborations with Contract Development and Manufacturing Organizations (CDMOs), is a cornerstone of its operational strategy. This network is designed for the agile and effective production of patient-specific cell therapies, a vital component for success in the competitive CAR-T market.

This robust network allows for scalability and flexibility, crucial for meeting the growing demand for advanced cell therapies. By leveraging a distributed manufacturing model, Galapagos can optimize production timelines and potentially reduce costs associated with centralized facilities.

- Established Network: A growing number of integrated manufacturing sites and strategic partnerships with specialized CDMOs.

- CAR-T Competitiveness: Enables rapid, efficient, and personalized production, a key differentiator in the CAR-T therapy landscape.

- Operational Efficiency: Supports faster patient treatment initiation and greater manufacturing capacity.

Financial Capital and Funding

Galapagos requires substantial financial capital to fuel its core operations, particularly its extensive research and development pipeline and rigorous clinical trials. This includes securing funds for early-stage discovery, late-stage development, and the potential for strategic acquisitions to bolster its portfolio.

As of June 30, 2025, Galapagos maintained a strong financial position, reporting approximately €3.1 billion in cash and financial investments. This robust liquidity is critical for covering operational expenses, advancing drug candidates through regulatory pathways, and seizing market opportunities.

- Cash Reserves: Significant cash and cash equivalents provide the operational runway needed for ongoing R&D and clinical trial expenditures.

- Investment Capital: Access to investment capital is vital for funding the high costs associated with pharmaceutical development and potential strategic partnerships or acquisitions.

- Funding R&D: Substantial financial resources are allocated to discovery, preclinical studies, and multiple phases of clinical testing for novel therapeutics.

- Financial Stability: Maintaining ample financial resources ensures the company's ability to navigate the long and often unpredictable timelines inherent in drug development.

Galapagos's key resources are its people, its intellectual property, its clinical pipeline, and its manufacturing capabilities. The company's scientific talent is paramount, driving innovation in drug discovery and development.

The proprietary target discovery platform is a significant asset, enabling the identification of novel therapeutic targets. This, combined with a robust pipeline featuring promising candidates like GLPG5101 and GLPG3667, forms the core of Galapagos's value proposition.

Furthermore, Galapagos's decentralized cell therapy manufacturing network, including CDMO partnerships, ensures agile production of CAR-T therapies. Ample financial resources, with approximately €3.1 billion in cash and financial investments as of June 30, 2025, underpin these operations and future growth.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Human Capital | Specialized scientists, researchers, clinical development experts | Drives innovation, drug discovery, and regulatory navigation. |

| Intellectual Property | Proprietary target discovery platform | Enables identification of novel therapeutic targets, a key differentiator. |

| Clinical Pipeline | Drug candidates (e.g., GLPG5101, GLPG3667) in various development stages | Foundation for future revenue generation and innovation in unmet medical needs. |

| Manufacturing | Decentralized cell therapy manufacturing network, CDMO collaborations | Facilitates agile and scalable production of patient-specific cell therapies. |

| Financial Capital | €3.1 billion in cash and financial investments (as of June 30, 2025) | Funds R&D, clinical trials, operations, and strategic opportunities. |

Value Propositions

Galapagos develops groundbreaking treatments for serious inflammatory and fibrotic diseases, alongside blood cancers, targeting areas with significant unmet medical needs. These therapies aim to offer substantial improvements in patient well-being and survival where existing treatments fall short.

For instance, in 2024, Galapagos continued to advance its pipeline, with a particular focus on diseases like idiopathic pulmonary fibrosis (IPF) and rheumatoid arthritis, where patient responses to current therapies can be variable. The company's commitment is to deliver novel solutions that can truly change the trajectory of these challenging conditions.

Galapagos' core value proposition centers on its proprietary science and innovative drug discovery engine. This unique approach leverages a proprietary target discovery platform, enabling the identification of novel drug candidates with distinct mechanisms of action.

This commitment to pioneering science is designed to produce best-in-class therapies. For instance, as of early 2024, Galapagos reported a robust pipeline with multiple candidates in various stages of clinical development, reflecting their ongoing investment in R&D.

Galapagos's decentralized manufacturing platform for CAR-T therapies is a game-changer, slashing vein-to-vein times. This means patients, especially those battling aggressive cancers, get their life-saving treatments much faster.

In 2024, the average vein-to-vein time for CAR-T therapies globally remained a significant hurdle, often stretching to several weeks. Galapagos's approach directly addresses this by optimizing logistics and production closer to the patient.

This speed is critical; the potency of CAR-T cells can degrade over time, making rapid delivery essential for maximum therapeutic effect. Galapagos's model ensures that patients receive the freshest, most potent cells available.

Commitment to Patient-Centric Solutions

Galapagos is deeply committed to prioritizing patients, actively seeking to understand their unique needs and incorporating their valuable feedback throughout the entire drug development lifecycle. This patient-first philosophy is central to their mission of creating treatments that genuinely improve quality of life.

Their dedication to patient-centric solutions is reflected in initiatives like their ongoing clinical trials, where patient reported outcomes are a key metric. For instance, in their Phase 3 studies for filgotinib in rheumatoid arthritis, patient feedback on pain management and daily functioning was meticulously collected and analyzed, demonstrating a tangible commitment to understanding the real-world impact of their therapies.

- Patient Input Integration: Galapagos actively involves patient advocacy groups in advisory boards to shape research priorities and trial designs.

- Focus on Quality of Life: Beyond efficacy, Galapagos measures treatment success by improvements in patient-reported outcomes, such as mobility and daily activity levels.

- Personalized Treatment Approaches: The company explores strategies to tailor therapies based on individual patient characteristics and preferences.

- Transparency in Communication: Galapagos aims to provide clear and accessible information to patients about their conditions and treatment options.

Strategic Partnerships for Accelerated Development

Galapagos leverages strategic partnerships with major pharmaceutical players, academic centers of excellence, and Contract Development and Manufacturing Organizations (CDMOs) to significantly speed up the journey of its innovative medicines from discovery to market. This collaborative approach is crucial for navigating the complex and costly process of drug development and commercialization.

These alliances are designed to bolster Galapagos' capabilities, providing access to extensive clinical trial networks, regulatory expertise, and global manufacturing and distribution channels. For instance, in 2024, Galapagos continued to build on its existing collaborations, such as its long-standing alliance with Gilead Sciences, which has been instrumental in advancing several key pipeline assets.

- Accelerated Timelines: Partnerships provide access to shared resources and expertise, shortening development cycles.

- Enhanced Commercialization: Collaborations with established pharmaceutical companies offer immediate market access and sales infrastructure.

- Risk Mitigation: Sharing development costs and risks with partners makes ambitious R&D programs more feasible.

- Broader Reach: Access to partner networks expands the potential patient population and geographical market for new therapies.

Galapagos' value proposition is built on delivering truly innovative treatments for challenging inflammatory, fibrotic, and blood cancer diseases, aiming for significant patient benefit where current options are insufficient. Their proprietary science engine is key, enabling the discovery of novel drug candidates with unique mechanisms, as seen in their robust pipeline advancement through 2024.

A major differentiator is their decentralized CAR-T manufacturing, drastically cutting vein-to-vein times for cancer patients, a critical factor given cell potency degradation. This speed is vital, as global CAR-T vein-to-vein times in 2024 often exceeded several weeks, a bottleneck Galapagos directly addresses.

Patient-centricity is paramount, with feedback integrated into development, exemplified by patient-reported outcomes in 2024 Phase 3 trials for rheumatoid arthritis, focusing on real-world quality of life improvements.

Strategic partnerships with major pharmaceutical firms, academic institutions, and CDMOs accelerate drug development and market access. These collaborations, like the ongoing one with Gilead in 2024, are vital for navigating complex R&D and commercialization pathways.

| Value Proposition Component | Description | Key Benefit | 2024 Relevance/Example |

|---|---|---|---|

| Innovative Therapies | Developing novel treatments for unmet medical needs in inflammatory, fibrotic diseases, and blood cancers. | Substantial improvement in patient well-being and survival. | Focus on IPF and rheumatoid arthritis pipeline advancement, addressing variable patient responses to existing treatments. |

| Proprietary Science Engine | Leveraging a unique discovery platform to identify novel drug candidates with distinct mechanisms of action. | Creation of best-in-class therapies. | Reported robust pipeline with multiple candidates in clinical development, signifying ongoing R&D investment. |

| Decentralized CAR-T Manufacturing | Optimized logistics and localized production for CAR-T therapies. | Significantly reduced vein-to-vein times for faster patient treatment. | Addresses global CAR-T vein-to-vein times often exceeding several weeks, ensuring cell potency. |

| Patient-Centric Approach | Integrating patient feedback and focusing on quality of life improvements throughout development. | Creation of treatments that genuinely improve patient quality of life. | Inclusion of patient-reported outcomes in 2024 Phase 3 trials, measuring impact on daily functioning. |

| Strategic Partnerships | Collaborations with pharmaceutical companies, academic centers, and CDMOs. | Accelerated development, enhanced commercialization, risk mitigation, and broader market reach. | Continued building on alliances like the one with Gilead Sciences for pipeline asset advancement. |

Customer Relationships

Galapagos cultivates robust connections with physicians and specialists, focusing on those treating inflammatory, fibrotic, and oncological conditions. This direct interaction ensures they receive crucial clinical data and educational materials to support optimal patient care and treatment strategies.

Galapagos actively cultivates relationships with patient advocacy groups and disease-specific foundations. These partnerships are vital for gaining deep insights into unmet medical needs and patient priorities, directly informing their drug development pipeline. For instance, by engaging with groups focused on rare genetic disorders, Galapagos can better tailor its research efforts to address the most pressing challenges faced by these patient communities.

Galapagos actively cultivates strong ties with pharmaceutical giants like Gilead Sciences, a collaboration that has yielded significant advancements and co-development opportunities. These alliances are foundational to their strategy, ensuring access to cutting-edge research and shared development costs.

The company also fosters crucial relationships with numerous biotech firms and leading academic centers globally. These partnerships are vital for sourcing innovative early-stage research and tapping into specialized scientific knowledge, directly fueling the expansion of their drug pipeline.

In 2024, Galapagos continued to emphasize these collaborative efforts, recognizing their indispensable role in driving scientific discovery and bringing novel therapies to market. Such partnerships are not just beneficial; they are critical for sustained innovation and competitive positioning in the biopharmaceutical landscape.

Investor Relations and Shareholder Engagement

Galapagos maintains robust investor relations by fostering open communication with individual and institutional investors, financial analysts, and key stakeholders. This commitment is demonstrated through transparent financial reporting, regular investor calls, and proactive corporate communications.

- Transparent Reporting: Galapagos ensures investors are kept informed about the company's advancements, strategic direction, and financial health through detailed and timely disclosures.

- Engagement Channels: The company utilizes investor calls, webcasts, and dedicated investor relations sections on its website to facilitate dialogue and provide access to crucial information.

- Analyst Coverage: Galapagos actively engages with financial analysts to ensure accurate understanding and dissemination of its performance and future prospects within the market.

Clinical Trial Participants and Caregivers

Galapagos prioritizes a strong, ethical connection with clinical trial participants and their caregivers. This means ensuring everyone involved fully understands the trial's processes, potential upsides, and any risks. Patient safety and overall well-being are central to every interaction.

Maintaining trust is key. Clear, consistent communication helps build this, especially when navigating the complexities of a clinical study. Caregivers often play a vital role, and supporting them directly contributes to a positive participant experience.

- Open Communication: Providing transparent information about trial progress and any changes.

- Support Systems: Offering resources and points of contact for participants and their families.

- Ethical Standards: Upholding the highest ethical principles in all interactions, ensuring respect and dignity.

Galapagos' customer relationships are multifaceted, extending from healthcare professionals and patient groups to investors and collaborators. The company emphasizes direct engagement with physicians to share clinical data, fostering informed treatment decisions.

Building trust with patient advocacy groups and foundations is crucial for understanding unmet needs, directly influencing Galapagos' drug development. In 2024, these partnerships remained a cornerstone for identifying and prioritizing research areas.

Strategic alliances with pharmaceutical giants like Gilead Sciences are vital for co-development and shared research costs. Furthermore, collaborations with biotech firms and academic institutions are key to sourcing early-stage innovation and scientific expertise.

| Relationship Type | Key Engagement | 2024 Focus |

|---|---|---|

| Physicians & Specialists | Clinical data sharing, education | Optimizing patient care |

| Patient Advocacy Groups | Unmet needs identification | Informing drug pipeline |

| Pharmaceutical Partners (e.g., Gilead) | Co-development, research sharing | Advancing novel therapies |

| Biotech & Academic Centers | Early-stage research sourcing | Fueling pipeline expansion |

| Investors | Transparent reporting, communication | Maintaining stakeholder confidence |

Channels

Following regulatory approval, Galapagos would deploy a dedicated direct sales force. This team is essential for building relationships with physicians and healthcare institutions, directly promoting and distributing its approved therapies. For instance, in 2024, many biopharmaceutical companies invest heavily in their sales forces, with average pharmaceutical sales representative salaries ranging from $80,000 to $120,000 annually, plus commission, reflecting the channel's importance.

Galapagos strategically partners with major pharmaceutical companies possessing extensive commercialization capabilities and global networks. This allows for enhanced market access and distribution of its therapeutic innovations, especially in territories where Galapagos lacks its own infrastructure. For instance, the Jyseleca® business was successfully transitioned to Alfasigma, demonstrating a clear model for leveraging partner strengths.

Clinical trial sites, encompassing hospitals, universities, and dedicated research centers, are fundamental channels for Galapagos to develop and test its innovative drug candidates. These facilities are crucial for accessing patient populations and ensuring the rigorous data collection needed to move through clinical phases.

Galapagos leverages extensive research networks to facilitate patient recruitment and gather vital data, a process critical for advancing its pipeline. In 2024, the biopharmaceutical industry continued to see significant investment in clinical trial infrastructure, with global spending on clinical research services estimated to be in the tens of billions of dollars, highlighting the importance of these channels.

Medical Conferences and Scientific Publications

Galapagos leverages medical conferences and scientific publications as crucial channels to share its research. These platforms are essential for disseminating vital clinical trial data and innovative findings to the global medical and scientific community.

Presenting at key industry events and publishing in respected journals builds significant credibility for Galapagos's scientific advancements. This also serves to educate healthcare professionals about the company's novel therapeutic approaches.

- Dissemination of Research: Galapagos actively shares its latest findings at major medical conferences, such as the European Society of Cardiology (ESC) Congress or the American Association for Cancer Research (AACR) Annual Meeting, providing real-time updates on their pipeline progress.

- Building Credibility: Publication in high-impact, peer-reviewed journals like Nature Medicine or The Lancet Oncology validates the scientific rigor and potential of Galapagos's drug candidates, enhancing trust among clinicians and researchers.

- Education and Awareness: These channels are vital for informing the medical community about the mechanisms of action and patient benefits of Galapagos's innovative therapies, fostering potential adoption and collaboration.

Digital Platforms and Corporate Website

Galapagos leverages its corporate website and a suite of digital platforms to connect with a diverse audience. These include investors seeking financial performance data, healthcare professionals interested in pipeline advancements, potential collaborators, and the general public interested in the company's mission.

These digital channels are crucial for disseminating key information such as detailed financial reports, updates on the drug development pipeline, and insights into Galapagos' core values and strategic direction. For instance, in early 2024, Galapagos reported a net loss of €151 million for the full year 2023, a figure detailed on their investor relations portal.

- Website as Information Hub: Galapagos' corporate website serves as the primary repository for official company news, financial filings, and scientific publications, ensuring transparency and accessibility for all stakeholders.

- Digital Engagement: Beyond the website, Galapagos utilizes platforms like LinkedIn and X (formerly Twitter) to share timely updates, engage in industry conversations, and highlight corporate milestones.

- Investor Relations Focus: Specific sections of their digital presence are dedicated to investor relations, offering quarterly earnings calls, presentations, and an overview of the company's financial health and strategic outlook.

Galapagos utilizes a multi-faceted channel strategy, combining direct engagement with strategic partnerships to maximize market reach for its innovative therapies. This approach ensures broad access for patients while leveraging established commercial infrastructures.

The company's direct sales force is critical for building physician relationships and promoting therapies post-approval, a significant investment for biopharma in 2024, with sales rep salaries often exceeding $100,000 annually plus commission. Partnerships with major pharmaceutical firms are also key, enabling distribution in territories where Galapagos lacks its own presence, as seen with the Jyseleca® transition to Alfasigma.

Clinical trial sites and research networks serve as vital channels for drug development and patient recruitment, with global spending on clinical research services in the tens of billions in 2024. Furthermore, medical conferences and scientific publications are essential for disseminating research findings and building credibility within the scientific community.

Digital platforms, including the corporate website and social media, are crucial for investor relations and broader stakeholder communication, providing access to financial reports and pipeline updates. In early 2024, Galapagos reported its 2023 financial results, detailing its net loss of €151 million.

| Channel | Description | Key Activities | Example Data/Impact |

|---|---|---|---|

| Direct Sales Force | Building relationships with physicians and healthcare institutions. | Promoting and distributing approved therapies. | 2024: Avg. pharma sales rep salary $80k-$120k + commission. |

| Strategic Partnerships | Leveraging established commercialization capabilities and global networks. | Market access and distribution of therapies. | Jyseleca® transition to Alfasigma. |

| Clinical Trial Sites & Research Networks | Facilitating drug development, testing, and patient recruitment. | Gathering rigorous data for clinical phases. | 2024: Global clinical research services spending in tens of billions. |

| Medical Conferences & Publications | Disseminating research findings and building scientific credibility. | Educating healthcare professionals on novel therapies. | Presentations at ESC, AACR; publications in Nature Medicine, Lancet Oncology. |

| Digital Platforms (Website, Social Media) | Connecting with investors, healthcare professionals, and the public. | Sharing financial reports, pipeline updates, corporate news. | 2024: Galapagos reported €151M net loss for 2023 on investor portal. |

Customer Segments

This core customer segment comprises patients grappling with severe inflammatory and fibrotic conditions, alongside specific blood cancers like Mantle Cell Lymphoma (MCL) and other non-Hodgkin lymphomas. For these individuals, existing treatments often fall short, leaving significant unmet medical needs.

Galapagos' strategic focus is on creating groundbreaking treatments for these challenging diseases. For instance, in 2024, the company continued its development efforts in areas like idiopathic pulmonary fibrosis (IPF), a condition with limited therapeutic options and a significant unmet need.

Specialist healthcare providers, including oncologists, hematologists, rheumatologists, and gastroenterologists, represent a critical customer segment for Galapagos. These physicians are the primary prescribers and administrators of innovative treatments for diseases targeted by Galapagos's pipeline.

In 2024, the focus on specialized patient populations continues to grow, with an increasing demand for targeted therapies in areas like inflammatory diseases and oncology. The success of Galapagos's medicines hinges on the adoption and trust of these highly specialized medical professionals.

Hospitals and specialized treatment centers are vital for the successful administration of cell therapies, requiring robust infrastructure for patient management and treatment delivery. These institutions act as the primary point of care, ensuring patients receive these complex treatments safely and effectively.

The global cell therapy market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, with many of these treatments administered within hospital settings. This growth underscores the importance of hospitals as key partners in accessing and delivering these innovative therapies.

Global Pharmaceutical Companies for Partnerships

Global pharmaceutical giants are key partners, actively scouting for novel therapies and technologies to bolster their drug portfolios. These companies often engage in strategic alliances, licensing deals, and even outright acquisitions to gain access to promising R&D pipelines like those developed by Galapagos.

In 2024, the pharmaceutical M&A landscape remained robust, with significant deals focused on acquiring innovative assets. For instance, major players continued to invest heavily in biotechnology and specialized therapeutic areas, demonstrating a clear demand for external innovation. Galapagos’s focus on novel targets and disease areas positions it as an attractive collaborator for these large enterprises.

- Pipeline Expansion: Large pharma companies aim to fill gaps in their therapeutic areas and accelerate the development of new drugs.

- Technology Access: They seek access to cutting-edge research platforms and innovative scientific approaches.

- Risk Sharing: Partnerships allow for the sharing of R&D costs and risks associated with drug development.

- Market Reach: Collaborations can leverage the extensive commercial and distribution networks of established pharmaceutical companies.

Investors and Financial Community

This segment encompasses a broad range of stakeholders, from individual retail investors seeking growth opportunities in biotech to large institutional funds like BlackRock and Vanguard, which often hold significant stakes in publicly traded pharmaceutical companies. Financial analysts, such as those at Morgan Stanley and JP Morgan, closely monitor Galapagos's clinical trial progress and pipeline advancements to provide valuation insights and investment recommendations. For instance, in 2024, Galapagos reported revenues of €505 million, highlighting its market presence and the financial community's interest in its performance.

Galapagos's commitment to transparent communication is crucial for this group. Regular financial reports, investor presentations, and scientific updates detailing clinical trial data are key to building trust and demonstrating the company's value proposition. The company's strategic partnerships, such as its collaboration with Gilead Sciences, are also closely scrutinized by investors and analysts as indicators of future revenue streams and R&D success.

- Individual Investors: Seeking exposure to the innovative biotechnology sector.

- Institutional Investors: Including pension funds, mutual funds, and hedge funds looking for long-term growth and diversification.

- Financial Analysts: Providing research coverage and investment ratings for Galapagos and its peers.

- Venture Capitalists and Private Equity: Evaluating potential investment or acquisition opportunities within the biotech landscape.

Galapagos' primary customer segment consists of patients suffering from severe inflammatory and fibrotic conditions, as well as specific blood cancers like Mantle Cell Lymphoma. These individuals often face significant unmet medical needs due to the limitations of current treatments.

Specialist healthcare providers, including oncologists, hematologists, rheumatologists, and gastroenterologists, are crucial as they are the primary prescribers of Galapagos' innovative therapies. In 2024, the demand for targeted treatments in these specialized areas continued to rise.

Hospitals and specialized treatment centers are essential for administering complex treatments, particularly cell therapies, requiring robust infrastructure for patient care. The global cell therapy market, valued at approximately $10.5 billion in 2023, highlights the importance of these institutions.

Global pharmaceutical giants are key partners, seeking novel therapies and technologies to enhance their portfolios through alliances and acquisitions. In 2024, the M&A market showed continued investment in biotechnology, making Galapagos an attractive collaborator.

The financial community, including individual and institutional investors, closely monitors Galapagos' progress. In 2024, Galapagos reported revenues of €505 million, reflecting its market position and the financial sector's keen interest.

Cost Structure

Galapagos invests heavily in Research and Development, a significant cost driver for the company. These expenses cover the entire spectrum of drug development, from identifying potential therapeutic targets and conducting early-stage preclinical research to managing complex and lengthy clinical trials.

This substantial R&D allocation includes costs for highly skilled scientific personnel, essential laboratory consumables and equipment, fees for contract research organizations (CROs) performing specialized studies, and expenses related to managing clinical trial sites globally.

For the first half of 2025, Galapagos reported R&D expenses totaling €278.0 million, underscoring the significant financial commitment required to advance its pipeline of innovative medicines.

Galapagos' manufacturing and supply chain costs are significant, driven by the intricate production of their drug candidates, especially the complex, decentralized manufacturing required for cell therapies. These expenses encompass raw materials, the overheads of specialized facilities, rigorous quality control measures, and the logistics involved in getting products to clinical trial sites or into commercial markets.

For instance, the cost of sales associated with supplying Jyseleca® to Alfasigma reached €18.4 million during the first six months of 2025, illustrating the substantial financial commitment in bringing their therapies to market.

Clinical trials represent a substantial portion of Galapagos' cost structure. These expenses encompass everything from finding and enrolling patients to meticulously monitoring their progress, analyzing the collected data, and preparing the necessary documentation for regulatory bodies. For instance, in 2023, the cost of Phase 3 trials alone can easily run into hundreds of millions of dollars, with some estimates placing the average cost per patient in late-stage trials around $40,000 to $50,000.

The financial outlay for clinical trials is not static; it fluctuates considerably depending on the trial's phase and its inherent complexity. Early-stage trials (Phase 1) are generally less expensive than later-stage trials (Phase 3), which involve a larger patient population and more extensive data collection. Galapagos' investment in trials for its key pipeline assets, such as those targeting inflammatory diseases, directly reflects this dynamic cost model.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are the backbone of Galapagos' corporate functions, covering essential operational costs. These include executive leadership, support staff, legal counsel, accounting services, and the critical IT infrastructure that keeps everything running smoothly. These costs are fundamental to the company's overall management and strategic direction.

For the first half of 2025, Galapagos reported G&A expenses totaling €74.5 million. This figure highlights the significant investment required to maintain the corporate framework necessary for a company of Galapagos' scale and scope.

- Executive Salaries: Compensation for top leadership driving the company's vision.

- Administrative Staff: Support personnel crucial for day-to-day operations.

- Legal and Accounting Fees: Costs associated with compliance and financial oversight.

- IT Infrastructure: Investment in technology systems supporting all business functions.

Sales and Marketing (S&M) Expenses

As Galapagos's products move closer to being available to patients, the company anticipates a significant rise in Sales and Marketing (S&M) expenses. These costs are essential for building market presence and driving adoption.

Activities funded by S&M will include in-depth market research to understand patient and physician needs, meticulous planning for product launches, and the establishment of robust sales teams. Promotional efforts will also ramp up to ensure healthcare providers are well-informed about the benefits and usage of new therapies.

For instance, in 2024, pharmaceutical companies often allocate a substantial portion of their revenue to S&M, sometimes ranging from 15% to 30% or even higher for new product launches, depending on the therapeutic area and competitive landscape.

- Market Research: Gathering insights into market dynamics and customer preferences.

- Product Launch Preparations: Developing marketing materials and launch strategies.

- Sales Force Development: Recruiting, training, and compensating sales representatives.

- Promotional Activities: Engaging healthcare providers through various channels to build awareness.

Galapagos' cost structure is heavily weighted towards Research and Development, reflecting its core mission of discovering and developing innovative medicines. Manufacturing and supply chain costs are also significant, particularly for complex therapies. Clinical trials represent a substantial financial commitment, with later-stage trials incurring higher expenses.

General and Administrative costs support the company's operations, while Sales and Marketing expenses are projected to increase as products approach commercialization. These elements collectively define the significant investment required to bring novel treatments from the lab to patients.

| Cost Category | H1 2025 (€ million) | Notes |

|---|---|---|

| Research & Development | 278.0 | Covers preclinical to clinical trial expenses. |

| Cost of Sales (Jyseleca) | 18.4 | Manufacturing and supply chain for marketed product. |

| General & Administrative | 74.5 | Includes executive, legal, IT, and support functions. |

| Clinical Trials (General Estimate) | N/A | Phase 3 trials can cost hundreds of millions; per-patient costs $40k-$50k. |

| Sales & Marketing (Projected) | N/A | Expected to rise significantly for product launches; 15-30% of revenue is common. |

Revenue Streams

Galapagos generates substantial revenue through collaborations and licensing deals with major pharmaceutical companies. These agreements often include upfront payments, payments tied to achieving specific development milestones, and royalties on future sales of licensed products.

A prime example of this revenue stream is the exclusive access rights granted to Gilead for Galapagos's drug discovery platform. For the first six months of 2025, this arrangement alone brought in €115.1 million, highlighting the financial significance of these strategic partnerships.

Upon securing regulatory approval for its pipeline candidates, Galapagos will generate revenue through direct sales of these innovative medicines to healthcare systems and pharmacies, or via established distribution partners. This represents a fundamental shift from its previous model where Jyseleca® sales were transferred to Alfasigma.

The company's future success hinges on successfully commercializing its next generation of therapies. For instance, its partnered programs in areas like cystic fibrosis and IPF, if they reach market, will contribute significantly to this revenue stream.

Galapagos secures significant funding as its drug candidates advance through crucial development phases. These milestone payments, triggered by achieving specific clinical trial or regulatory targets, are a vital component of their revenue model, directly linking progress to financial inflow.

In 2023, Galapagos reported substantial revenue from these development milestones, demonstrating the success of their partnered programs. For instance, payments related to the progression of their inflammatory disease pipeline were a key contributor to their financial performance, underscoring the value of their research and development efforts.

Royalty Income

Galapagos generates royalty income from the net sales of products that are developed through its various collaboration agreements. This income stream continues even when a partner takes the lead on commercializing the product. For instance, Galapagos has a history of recognizing royalty income, such as from Gilead for the drug Jyseleca®.

This royalty model is a crucial part of Galapagos' revenue strategy, providing a consistent income stream tied to the success of its partnered products. It allows Galapagos to benefit from its research and development efforts without directly managing the complexities of global commercialization.

- Royalty Revenue Source: Net sales of partnered products developed by Galapagos.

- Example Product: Jyseleca®, generating royalty income from Gilead.

- Financial Impact: Contributes to Galapagos' overall revenue and financial stability.

Strategic Asset Divestitures or Spin-offs

Galapagos can unlock substantial capital through strategic asset divestitures or by spinning off new entities, like the planned separation of SpinCo. This financial maneuver provides significant funding for ongoing research and development, directly fueling pipeline advancement.

For instance, in 2023, Galapagos announced its intention to separate its R&D activities into a new, independent company. While the exact capital generated from this specific spin-off is still unfolding, such transactions are typically designed to inject considerable resources into the parent company's core operations. This strategy allows for focused investment in promising therapeutic areas.

- Capital Infusion: Divestitures and spin-offs can generate substantial one-time capital injections.

- R&D Funding: Proceeds are strategically allocated to bolster research and development initiatives.

- Pipeline Acceleration: Enhanced funding directly supports the advancement of drug candidates through clinical trials.

Galapagos' revenue streams are diverse, encompassing upfront payments, milestone achievements, and royalties from collaborations with major pharmaceutical players. Direct sales of its own approved medicines will also become a significant contributor, especially following the transfer of Jyseleca® commercialization rights.

The company's financial performance is heavily influenced by the successful progression of its drug pipeline through clinical trials, with milestone payments directly linking development progress to revenue generation. Royalty income from partnered products, such as Gilead's Jyseleca®, provides a steady income stream, underscoring the value of its research.

Strategic financial maneuvers, like asset divestitures and planned spin-offs, are designed to inject substantial capital, further fueling research and development efforts and accelerating pipeline advancement.

| Revenue Stream | Description | Example/Data Point |

|---|---|---|

| Collaborations & Licensing | Upfront payments, milestone payments, and royalties from partnerships. | €115.1 million from Gilead for exclusive access rights in the first six months of 2025. |

| Direct Product Sales | Revenue from selling its own approved medicines. | Future sales of pipeline candidates in cystic fibrosis and IPF. |

| Milestone Payments | Payments triggered by achieving specific development or regulatory targets. | Substantial revenue reported in 2023 from inflammatory disease pipeline progression. |

| Royalty Income | Income from net sales of partnered products. | Royalties from Gilead for Jyseleca®. |

| Asset Divestitures/Spin-offs | Capital generated from selling assets or creating new entities. | Planned separation of R&D activities into a new company (SpinCo). |

Business Model Canvas Data Sources

The Galapagos Business Model Canvas is built upon a foundation of extensive market research, competitive analysis, and internal operational data. These sources ensure each block is informed by current industry trends and the unique realities of the Galapagos ecosystem.