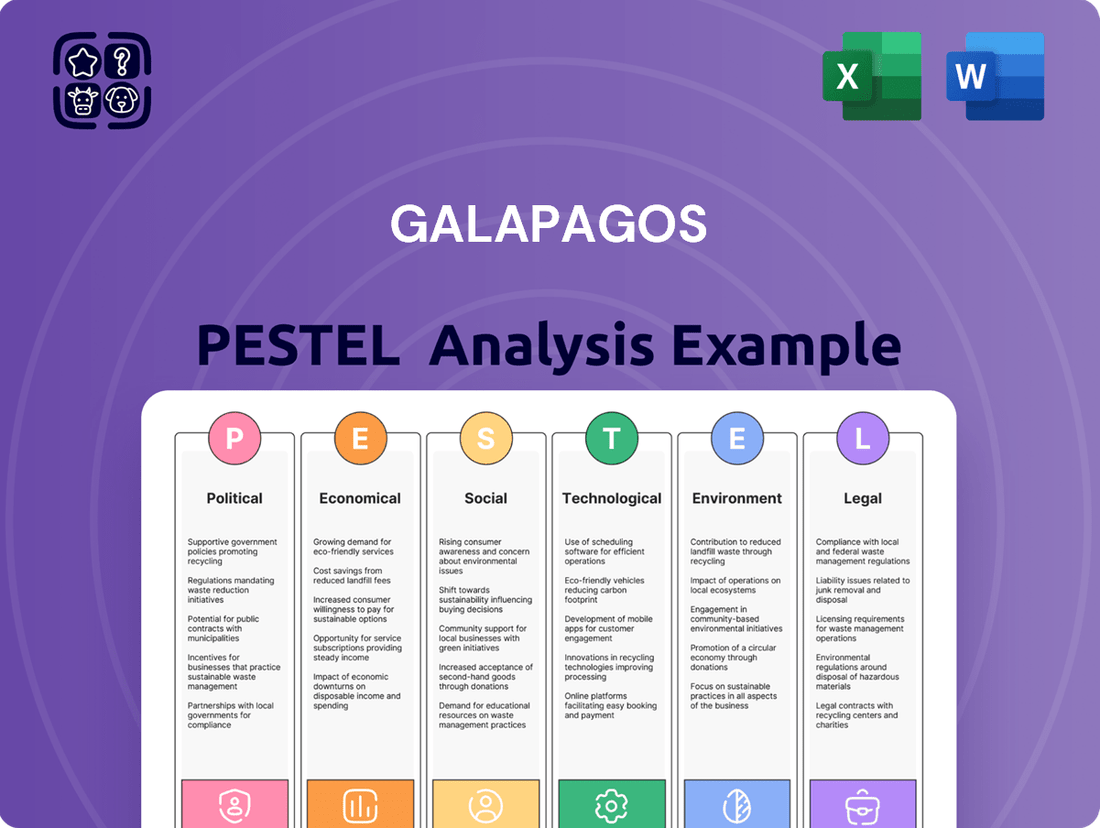

Galapagos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

Unlock the strategic forces shaping Galapagos's trajectory. Our PESTLE analysis dives deep into political stability, economic fluctuations, and societal shifts impacting their operations. Gain a competitive edge by understanding these critical external factors. Download the full PESTLE analysis now for actionable insights to inform your strategy.

Political factors

Government healthcare policies, such as drug pricing regulations and reimbursement models, directly shape the market for pharmaceutical products like those developed by Galapagos. These policies can significantly impact the affordability and demand for innovative medicines.

In 2023, European nations continued to prioritize healthcare spending, with Germany, Austria, and France leading the way. This sustained government investment in healthcare infrastructure and services creates a more favorable environment for pharmaceutical companies seeking to introduce new treatments, though pricing pressures remain a key consideration.

The regulatory environment, governed by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), is paramount for Galapagos' drug development and market access. Changes in leadership or policy within these bodies, such as the FDA's evolving approach to novel therapies observed in 2024-2025, can introduce uncertainty and alter the expected timelines for drug approvals.

Global trade policies and geopolitical stability significantly influence the biotechnology sector. Changes in tariffs and trade agreements can impact the cost of raw materials and finished products, as well as access to international markets for Galapagos. For instance, a more protectionist trade environment could raise import duties on essential components, increasing manufacturing expenses.

Shifting international dynamics are evident in merger and acquisition (M&A) trends. While M&A activity in the biopharma sector saw a slowdown in the US and Europe during 2024, transactions involving Chinese companies demonstrated robust growth. This suggests a recalibration of global investment flows and strategic partnerships within the industry, potentially creating new opportunities or challenges for companies like Galapagos.

Intellectual Property Protection

Galapagos, like many biotech firms, relies heavily on robust intellectual property (IP) protection to secure its significant investments in research and development. This includes patents for novel compounds and data exclusivity periods that prevent competitors from leveraging proprietary clinical trial data. For instance, in 2023, the global biotechnology market, valued at approximately $1.7 trillion, saw continued emphasis on IP as a key driver of value and competitive differentiation.

Navigating the evolving landscape of IP law and regulatory interpretations presents a persistent challenge. Changes in patentability criteria or the duration of data exclusivity by governmental bodies can directly impact a company's ability to recoup R&D costs and maintain market exclusivity for its innovative therapies. The European Union, for example, continues to refine its Unified Patent Court system, aiming to streamline IP litigation across member states, a process that began full operation in June 2023.

- Patent Strength: The strength and breadth of Galapagos' patent portfolio are critical for protecting its pipeline drugs, such as filgotinib (Jyseleca).

- Data Exclusivity: Securing adequate data exclusivity periods post-market approval is vital to prevent generic or biosimilar competition.

- Regulatory Scrutiny: Increased scrutiny of patent validity by regulatory agencies or competitor challenges can impact market exclusivity.

- Global IP Treaties: Adherence to and leveraging of international IP treaties are essential for a global biotech player.

Political Stability and Investment Climate

Galapagos's operating regions, particularly in Europe, generally exhibit strong political stability, which is crucial for attracting the substantial, long-term capital required in biotechnology. This stability directly impacts investor confidence, making countries with predictable policy environments more appealing for research, development, and market entry.

The World Bank's Ease of Doing Business report for 2020, for instance, ranked many of Galapagos's key European markets highly, indicating a favorable regulatory and political landscape. This positive environment supports the capital-intensive nature of biotech innovation, fostering investment in areas like drug discovery and clinical trials.

- Political Stability: High in key European markets, fostering investor confidence.

- Regulatory Environment: Generally favorable, as indicated by high rankings in ease of doing business reports.

- Investment Climate: Encourages long-term capital commitment essential for biotech R&D.

Government healthcare policies, including drug pricing regulations and reimbursement models, significantly influence the market for pharmaceutical products like those developed by Galapagos. These policies impact affordability and demand for new medicines.

In 2023, European nations continued to prioritize healthcare spending, with Germany, Austria, and France leading the way, creating a more favorable environment for pharmaceutical companies, though pricing pressures remain a key consideration.

The regulatory environment, governed by agencies like the FDA and EMA, is paramount for Galapagos' drug development and market access. Evolving approaches to novel therapies observed in 2024-2025 can introduce uncertainty and alter expected drug approval timelines.

Galapagos' operating regions, particularly in Europe, generally exhibit strong political stability, which is crucial for attracting the substantial, long-term capital required in biotechnology, directly impacting investor confidence.

| Factor | Impact on Galapagos | 2023-2025 Trend/Data |

| Healthcare Policy | Shapes drug pricing and reimbursement, affecting market access. | Continued focus on healthcare spending in Europe; ongoing pricing pressures. |

| Regulatory Landscape | Governs drug approval timelines and market access strategies. | Evolving FDA/EMA approaches to novel therapies creating potential timeline shifts. |

| Political Stability | Influences investor confidence and long-term capital commitment. | High stability in key European markets supports biotech investment. |

What is included in the product

This Galapagos PESTLE analysis examines the interplay of Political, Economic, Social, Technological, Environmental, and Legal factors, providing a comprehensive view of the external macro-environment impacting the archipelago.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on the Galapagos ecosystem's external forces.

Easily shareable summary format ideal for quick alignment across teams or departments, mitigating confusion and ensuring everyone understands the key external factors impacting Galapagos.

Economic factors

Galapagos NV's revenue potential is directly tied to healthcare spending. In 2024, European nations like Germany, Austria, and France demonstrated significant investment in healthcare, with spending as a notable percentage of their GDP. This robust expenditure signals strong market opportunities for innovative pharmaceutical solutions.

The availability of funding for research and development is a critical driver for biotechnology firms like Galapagos NV. Venture capital and public grants provide the essential fuel for ongoing drug discovery and clinical trials.

Despite a generally subdued IPO market, the biotechnology sector saw robust venture capital fundraising in 2024, exceeding pre-pandemic figures. This indicates continued investor confidence in the innovation pipeline within the industry.

Healthcare systems and insurers are increasingly focused on managing drug expenditures, leading to significant pricing pressures on pharmaceutical companies like Galapagos. This trend is expected to continue, impacting the profitability of innovative therapies. For instance, in 2024, many European countries are implementing stricter price negotiation frameworks for new drugs, aiming to curb rising healthcare costs.

Reimbursement policies are critical determinants of a company's revenue. Favorable reimbursement decisions can unlock market access and ensure a steady income stream, while restrictive policies can severely limit sales. In 2024, the European Medicines Agency's (EMA) recommendations on pricing and reimbursement continue to influence national-level decisions, with a growing emphasis on demonstrating clear value-for-money for new treatments.

Global Economic Growth and Inflation

Global economic growth and inflation significantly shape the operating environment for companies like those in Galapagos. Broader economic conditions, including projected GDP growth and inflation rates, directly impact consumer purchasing power and healthcare budgets, which are crucial for pharmaceutical and biotech sectors. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, while inflation is expected to continue its descent, albeit with variations across regions.

Inflation presents a direct challenge by increasing operational costs. This includes the price of raw materials essential for drug development and manufacturing, labor costs for skilled researchers and staff, and the expenses associated with conducting clinical trials. Higher inflation can erode profit margins unless companies can effectively pass these increased costs onto consumers or find efficiencies. The persistent inflation seen in many economies throughout 2023 and into 2024 necessitates careful cost management and strategic pricing.

- Global GDP Growth: Projected at 3.2% for 2024 (IMF).

- Inflationary Pressures: While moderating, inflation remains a concern, impacting input costs for R&D and manufacturing.

- Healthcare Spending: Economic slowdowns and inflation can strain government and private healthcare budgets, affecting drug adoption.

- Operational Costs: Rising costs for raw materials, energy, and labor directly impact profitability for companies like Galapagos.

Currency Exchange Rate Fluctuations

Galapagos NV, being a global biopharmaceutical company, is significantly exposed to currency exchange rate fluctuations. Changes in the value of currencies like the US Dollar (USD) and Euro (EUR) directly influence the reported financial performance when revenues and expenses generated in one currency are translated into Galapagos' reporting currency, likely EUR.

For instance, a stronger USD against the EUR could make Galapagos' US-based earnings appear larger in EUR terms, while a weaker USD would have the opposite effect. This volatility can create uncertainty for investors regarding the company's true underlying growth and profitability, impacting share price and valuation.

Considering recent trends, the EUR experienced a notable depreciation against the USD through much of 2023 and early 2024, before showing some recovery. For example, the EUR/USD exchange rate moved from around 1.05 in late 2023 to approximately 1.08 by mid-2024, representing a roughly 2.8% appreciation of the dollar. This shift would have a direct impact on Galapagos' reported financials.

- Impact on Revenue: Revenues generated in USD, a key market for Galapagos, are translated into EUR. A stronger USD boosts reported EUR revenue, while a weaker USD reduces it.

- Impact on Expenses: Similarly, expenses incurred in USD, such as R&D costs or operational expenditures, become cheaper in EUR terms when the USD weakens.

- Investor Perception: Volatile exchange rates can obscure the company's operational performance, leading to increased investor caution and potentially affecting stock valuation.

- Hedging Strategies: Galapagos may employ financial instruments to hedge against adverse currency movements, aiming to stabilize reported earnings and reduce financial risk.

Galapagos NV's financial health is intrinsically linked to global economic performance and prevailing inflation rates. The International Monetary Fund (IMF) projected global GDP growth at 3.2% for 2024, indicating a continued, albeit slightly slower, expansion. However, persistent inflation, though moderating, continues to be a significant factor, directly increasing operational costs for research, development, and manufacturing. These economic headwinds can strain healthcare budgets, potentially impacting the adoption and reimbursement of innovative therapies, which are crucial for Galapagos' revenue streams.

| Economic Factor | 2024 Projection/Trend | Impact on Galapagos NV |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF) | Supports overall market demand for healthcare solutions. |

| Inflation | Moderating but persistent | Increases operational costs (R&D, manufacturing, labor). |

| Healthcare Spending | Influenced by economic conditions | Potential strain on budgets could affect drug adoption and pricing. |

| Currency Exchange Rates (EUR/USD) | EUR approximately 1.08 vs USD mid-2024 | Affects reported revenue and expenses, impacting financial statements. |

What You See Is What You Get

Galapagos PESTLE Analysis

The preview you see here is the exact Galapagos PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Galapagos, providing valuable insights for strategic planning.

You'll gain a detailed understanding of the unique challenges and opportunities facing this biodiverse archipelago.

Sociological factors

The world's population is getting older. By 2050, it's estimated that one in six people globally will be 65 or older, a significant jump from one in 11 in 2015. This demographic shift directly impacts healthcare needs, as older individuals are more susceptible to chronic and age-related diseases.

Galapagos NV, a biopharmaceutical company, is strategically positioned to address this trend. Their research focuses on areas like inflammatory and fibrotic conditions, which are prevalent in aging populations. For instance, the global prevalence of osteoarthritis, a common age-related condition, is projected to affect over 700 million people by 2050.

This growing demand for effective treatments for these conditions presents a substantial market opportunity for Galapagos. As more people age, the need for innovative therapies to manage and treat diseases like rheumatoid arthritis and idiopathic pulmonary fibrosis, both key areas for Galapagos, will only increase. In 2024, the global market for autoimmune disease treatments, a related field, was valued at over $100 billion and is expected to grow.

The rise of patient advocacy groups, like the Cystic Fibrosis Foundation, has demonstrably accelerated drug development. For instance, their early investment and strategic guidance in the 2010s were crucial to the development of breakthrough treatments like Orkambi and Trikafta by Vertex Pharmaceuticals, which saw significant revenue growth, with Vertex reporting $9.8 billion in net profit in 2023. This trend highlights how organized patient voices can directly influence research priorities and market access for innovative therapies, creating a more favorable landscape for companies like Galapagos focusing on unmet medical needs.

Galapagos NV must consider how evolving lifestyle patterns, such as increased sedentary behavior and dietary shifts, are influencing disease prevalence. For instance, the global rise in obesity, projected to affect over 1 billion people by 2030 according to WHO estimates, directly correlates with increased incidence of metabolic and cardiovascular diseases, creating potential markets for innovative therapies.

Environmental factors, including air pollution and climate change, also play a significant role in public health. The World Health Organization reported in 2024 that air pollution causes an estimated 7 million premature deaths annually, highlighting the growing burden of respiratory and related conditions that Galapagos could address.

These interconnected lifestyle and environmental changes are critical for Galapagos to monitor, as they shape the landscape of unmet medical needs. By identifying emerging disease patterns early, the company can strategically align its research and development efforts to target areas with the greatest potential for therapeutic impact and commercial success.

Access to Healthcare and Health Equity

Societal expectations for fair access to healthcare and cutting-edge treatments significantly shape public policy and market entry plans for pharmaceutical firms. In 2024, the European Federation of Pharmaceutical Industries and Associations (EFPIA) highlighted that equitable access remains a key concern across member states, influencing pricing and reimbursement negotiations.

Initiatives aimed at boosting health equity can unlock new market potential, particularly within previously underserved communities. For instance, the World Health Organization's 2025 targets emphasize reaching populations with limited access to essential medicines, potentially opening avenues for companies focusing on affordable and accessible solutions.

- Equitable Access Demands: Public pressure for fair healthcare access influences Galapagos' market access strategies and pricing discussions in key European markets.

- Health Equity Opportunities: Programs designed to address health disparities can create new patient populations and demand for Galapagos' therapies in underserved regions.

- Policy Influence: Evolving health equity policies, driven by societal expectations, can impact regulatory approval pathways and reimbursement rates for new treatments.

Public Perception and Trust in Biotechnology

Public perception of biotechnology significantly influences patient participation in clinical trials and the adoption of new therapies. For instance, a 2024 survey indicated that while 65% of respondents expressed optimism about the potential of biotech to solve health challenges, only 40% fully trusted pharmaceutical companies to prioritize patient well-being over profits.

Galapagos, like other biotech firms, must navigate this landscape by fostering transparency in its research and development processes. Building trust is paramount, especially as the company advances its pipeline, which includes novel treatments for inflammatory diseases. In 2023, Galapagos reported a 15% increase in patient inquiries for its ongoing trials, a positive sign attributed partly to clearer communication about trial objectives and data.

Key factors influencing public trust include:

- Ethical Conduct: Adherence to strict ethical guidelines in research and data handling is foundational.

- Transparency: Open communication about drug development, potential risks, and benefits is vital.

- Patient Advocacy Engagement: Collaborating with patient groups helps address concerns and build confidence.

- Regulatory Oversight: Public faith in regulatory bodies like the EMA and FDA indirectly bolsters trust in approved biotech products.

Societal expectations for equitable healthcare access are increasingly shaping pharmaceutical market strategies. In 2024, discussions around drug pricing and reimbursement in Europe, influenced by public demand for fairness, remained a key focus for industry bodies like EFPIA. Galapagos must align its market access plans with these evolving societal demands to ensure successful product launches and sustained commercial viability.

Opportunities exist to address health disparities by targeting underserved populations, a growing societal priority. The World Health Organization's 2025 goals highlight the importance of reaching communities with limited access to essential medicines, presenting potential new patient bases for companies like Galapagos if they can offer accessible solutions.

Public trust in biotechnology is crucial for patient recruitment in clinical trials and the acceptance of new therapies. A 2024 survey revealed that while a majority expressed optimism about biotech, a significant portion still harbored concerns about pharmaceutical companies prioritizing profit over patient well-being, underscoring the need for transparency from companies like Galapagos.

| Societal Factor | Impact on Galapagos | Supporting Data (2023-2025) |

| Equitable Access Demands | Influences pricing and market access strategies in Europe. | EFPIA highlighted equitable access as a key concern in European markets in 2024. |

| Health Equity Focus | Opens potential markets in underserved regions. | WHO 2025 targets emphasize reaching populations with limited access to medicines. |

| Public Trust in Biotech | Affects patient trial participation and therapy adoption. | A 2024 survey showed 40% of respondents did not fully trust pharma companies to prioritize patient well-being. Galapagos reported a 15% increase in patient trial inquiries in 2023 due to clearer communication. |

Technological factors

Galapagos NV's proprietary target discovery platforms are significantly enhanced by ongoing technological leaps. The integration of artificial intelligence (AI) and machine learning is revolutionizing the speed and precision of identifying potential drug candidates. This technological evolution is crucial for maintaining a competitive edge in the pharmaceutical sector.

The medical landscape is being reshaped by the swift progress and market introduction of cell and gene therapies. This technological evolution offers novel treatment avenues for previously intractable diseases.

Galapagos NV is strategically positioned to benefit from this trend through its development of a decentralized manufacturing model for cell therapies. This approach aims to streamline production and improve accessibility.

By 2024, the global cell and gene therapy market was projected to reach over $15 billion, with significant growth anticipated in the coming years. Galapagos' investment in this area aligns with a major industry expansion.

Technological leaps in identifying biomarkers are revolutionizing drug development. This means treatments can be tailored to individual patients, boosting effectiveness and improving health results. Galapagos NV’s focus on innovative science directly benefits from these advancements, as seen in their ongoing research into inflammatory diseases where personalized approaches are key.

Data Analytics and Digital Health

The pharmaceutical industry, including companies like Galapagos, is increasingly leveraging big data analytics and digital health tools to streamline operations. This technological shift is enhancing clinical trial design, patient monitoring, and post-market surveillance, leading to more efficient and data-informed drug development processes.

The integration of real-world evidence (RWE) is particularly impactful. For instance, by mid-2024, the global RWE market was projected to reach over $100 billion, demonstrating its growing importance in validating drug efficacy and safety outside traditional clinical settings.

- Optimized Clinical Trials: Data analytics allows for better patient stratification and trial site selection, potentially reducing trial duration and costs.

- Enhanced Patient Monitoring: Digital health wearables and platforms enable continuous, real-time patient data collection, improving safety and adherence.

- Informed Post-Market Surveillance: Analyzing large datasets helps identify rare side effects or new therapeutic uses more rapidly.

- Data-Driven Decision-Making: Advanced analytics provide deeper insights into drug performance and patient outcomes, supporting strategic R&D choices.

Manufacturing and Delivery Technologies

Innovations in manufacturing, like decentralized cell therapy production, are reshaping how treatments reach patients. This shift can enhance accessibility and stability for new medicines, directly influencing Galapagos NV's ability to scale its therapies. For instance, advancements in lyophilization (freeze-drying) technology are improving the shelf-life and transportability of complex biologics, a key area for companies like Galapagos.

Drug delivery systems are also seeing significant technological leaps. Novel methods, such as targeted nanoparticle delivery or advanced transdermal patches, can boost drug effectiveness and reduce side effects. These innovations are crucial for Galapagos as they aim to optimize the patient experience and therapeutic outcomes for their pipeline drugs, potentially increasing market penetration.

The impact on Galapagos NV's scalability and market reach is substantial. Improved manufacturing efficiency and advanced delivery mechanisms can lower production costs and broaden the geographical availability of their treatments. By 2024, the global biopharmaceutical contract manufacturing market was valued at over $150 billion, highlighting the significant investment and innovation in this sector that Galapagos can leverage.

- Decentralized Manufacturing: Allows for localized production closer to patient populations, reducing logistical complexities and lead times for therapies like cell and gene therapies.

- Advanced Drug Delivery: Technologies such as liposomal encapsulation or antibody-drug conjugates (ADCs) improve drug targeting and efficacy, potentially increasing the value proposition of Galapagos' pipeline.

- Supply Chain Resilience: Innovations in manufacturing and logistics are creating more robust supply chains, crucial for ensuring consistent availability of specialized treatments.

- Cost Efficiency: Streamlined manufacturing processes and improved delivery technologies can lead to reduced production costs, making treatments more affordable and accessible.

Galapagos NV's R&D is significantly boosted by AI and machine learning, speeding up drug discovery. The company is also capitalizing on the rapid growth of cell and gene therapies, with the global market projected to exceed $15 billion by 2024, by developing decentralized manufacturing models.

Technological advancements in biomarker identification enable personalized medicine, directly benefiting Galapagos' focus on inflammatory diseases. Furthermore, the increasing use of big data analytics and real-world evidence (RWE) in the biopharmaceutical sector, with the RWE market surpassing $100 billion by mid-2024, is enhancing clinical trial efficiency and post-market surveillance.

Innovations in manufacturing, such as decentralized production for cell therapies, alongside advancements in drug delivery systems like targeted nanoparticles, are crucial for Galapagos to improve treatment accessibility and patient outcomes. The biopharmaceutical contract manufacturing market, valued at over $150 billion in 2024, reflects the significant technological investment in this area.

| Technological Factor | Impact on Galapagos NV | Supporting Data (2024/2025 Projections) |

| AI & Machine Learning in Drug Discovery | Accelerated target identification and candidate selection. | Global AI in drug discovery market projected to grow significantly. |

| Cell & Gene Therapy Advancements | Enables development of novel treatments and decentralized manufacturing. | Cell & Gene Therapy market projected over $15 billion (2024). |

| Biomarker Identification & Personalized Medicine | Tailored treatments for improved efficacy and patient outcomes. | Focus on inflammatory diseases where personalization is key. |

| Big Data Analytics & RWE | Streamlined clinical trials, enhanced patient monitoring, and informed decision-making. | RWE market projected over $100 billion (mid-2024). |

| Manufacturing & Drug Delivery Innovations | Improved scalability, accessibility, and therapeutic effectiveness. | Biopharmaceutical Contract Manufacturing market valued over $150 billion (2024). |

Legal factors

Galapagos NV navigates a complex web of pharmaceutical regulations, encompassing rigorous drug approval pathways, stringent Good Manufacturing Practices (GMP), and ongoing post-market surveillance. Failure to adhere to these mandates, such as those set by the FDA in the US or the EMA in Europe, can lead to significant delays or outright rejection of new therapies, impacting market access and revenue potential.

Intellectual property laws, particularly patent protections, are foundational for Galapagos. In 2024, the company continued to leverage its robust patent portfolio to safeguard its novel drug candidates and platform technologies. A key aspect is preventing competitors from replicating their innovations, which directly impacts market exclusivity and revenue streams.

Legal challenges to these patents can pose significant risks. For instance, a successful challenge in a major market could erode Galapagos's projected earnings from a key therapeutic area, potentially impacting its stock valuation and strategic partnerships. The company actively monitors the global IP landscape to defend its innovations.

Galapagos, like all biopharmaceutical companies, operates under stringent data privacy and security regulations. Laws such as the General Data Protection Regulation (GDPR) in Europe and similar frameworks globally dictate how patient data collected during clinical trials and commercial operations must be handled. Failure to comply can result in significant fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Maintaining robust data security is paramount for Galapagos to protect sensitive patient information and uphold trust. In 2023, the healthcare sector continued to see a rise in cyberattacks, emphasizing the critical need for advanced security measures. For Galapagos, ensuring compliance not only avoids legal repercussions but also safeguards its reputation and the integrity of its research and development processes.

Anti-Trust and Competition Laws

Anti-trust and competition laws significantly shape the biotech landscape, directly impacting Galapagos NV's ability to pursue strategic partnerships and market consolidation. Increased scrutiny from regulatory bodies can lead to challenges or outright blocking of mergers and acquisitions, influencing the company's growth trajectory.

The heightened enforcement of these regulations in 2024, for instance, contributed to a noticeable slowdown in merger and acquisition (M&A) activity across various sectors, including pharmaceuticals and biotechnology. This trend suggests that Galapagos must navigate a more rigorous regulatory environment when considering collaborations or potential takeovers.

- Increased Anti-trust Enforcement: Regulatory bodies worldwide are intensifying their review of M&A deals to prevent market monopolization.

- Impact on Biotech M&A: The biotech sector saw a decline in M&A volume in 2024, partly attributed to this stricter anti-trust oversight.

- Galapagos' Strategic Considerations: Galapagos NV must factor in these anti-trust considerations when planning its future partnerships and potential market consolidation strategies.

Corporate Governance and Reporting Requirements

Galapagos NV, as a publicly traded entity, is bound by stringent corporate governance and financial reporting mandates. These include compliance with regulations from exchanges like Euronext Brussels and NASDAQ, where its shares are listed. This necessitates the regular dissemination of financial information and adherence to best practices in board oversight and shareholder engagement.

Key reporting obligations for Galapagos NV include the timely publication of audited annual reports, detailing financial performance and strategic developments. The company must also convene annual general meetings to facilitate shareholder participation in key corporate decisions. For instance, in its 2023 annual report, Galapagos highlighted its commitment to transparency and stakeholder communication, a crucial aspect of its governance framework.

- Euronext Brussels & NASDAQ Listing: Adherence to dual exchange listing requirements for corporate actions and disclosures.

- Annual Report Publication: Mandatory release of comprehensive financial statements and operational reviews.

- Shareholder Meetings: Regular convening of AGMs for voting on resolutions and board elections.

- Compliance with IFRS: Ensuring financial reporting aligns with International Financial Reporting Standards for global comparability.

Galapagos NV's operations are heavily influenced by evolving healthcare legislation and regulatory approvals, with bodies like the EMA and FDA setting strict standards for drug development and market access. Compliance with these evolving regulations, including post-market surveillance, is crucial for maintaining product viability and market presence.

Intellectual property law is paramount, with Galapagos actively defending its patent portfolio to secure market exclusivity for its innovative therapies. The company's ability to protect its intellectual assets directly impacts its revenue potential and competitive advantage in the pharmaceutical market.

Data privacy laws, such as GDPR, impose significant obligations on Galapagos regarding the handling of sensitive patient data from clinical trials. Adherence to these stringent regulations is vital to avoid substantial fines and maintain stakeholder trust, especially in light of increasing cyber threats in the healthcare sector.

Anti-trust regulations are increasingly impacting strategic collaborations and mergers within the biotech sector. Galapagos must navigate this heightened scrutiny, which can affect its growth strategies and potential market consolidation opportunities, as seen in the broader M&A slowdown in 2024.

Environmental factors

Galapagos, like many in the biotechnology sector, faces growing pressure regarding its environmental impact, particularly concerning energy, waste, and water in its manufacturing. This scrutiny is a significant environmental factor. For instance, the EU's Green Deal aims to make the bloc climate-neutral by 2050, influencing manufacturing standards across industries, including biotech.

Embracing sustainable manufacturing isn't just about compliance; it offers tangible benefits. Companies adopting greener processes can see reduced operational costs through efficient resource utilization. Furthermore, a strong commitment to sustainability can significantly boost a company's public image and appeal to environmentally conscious investors and consumers.

Galapagos, like all biotech firms, faces stringent environmental regulations concerning the disposal of biological waste and hazardous materials generated throughout its research, development, and manufacturing processes. Proper management is not just a compliance issue but a significant operational cost and a key environmental responsibility. Failure to adhere to these protocols can result in substantial fines and reputational damage.

In 2024, the global biopharmaceutical waste management market was valued at approximately $18.5 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, indicating the increasing importance and cost associated with these services. Galapagos' commitment to sustainable practices in handling these materials is crucial for maintaining its operational license and environmental stewardship.

Galapagos, like many pharmaceutical firms, faces potential disruptions from climate change. The long-term effects, including more frequent extreme weather events, could impact their supply chains and manufacturing. Resource scarcity, particularly for water and specific raw materials essential for drug production, presents another significant challenge.

Environmental Regulations and Compliance

Galapagos, like all biotechnology firms, must navigate a complex web of environmental regulations. Compliance with rules governing emissions, pollution, and chemical handling is not just a legal necessity but a core operational requirement.

Failure to meet these standards can result in substantial financial penalties and legal entanglements. For instance, in 2023, the European Union continued to strengthen its environmental directives, impacting chemical usage and waste management in pharmaceutical research and development. Non-compliance can also severely damage a company's reputation, affecting investor confidence and public trust.

- Strict adherence to emission standards: Galapagos must ensure its manufacturing processes and research facilities meet stringent air and water quality regulations, which are continually being updated across its operating regions.

- Chemical handling and disposal protocols: Proper management of hazardous materials used in drug discovery and production is paramount, with evolving guidelines for safe storage, use, and disposal to prevent environmental contamination.

- Waste management efficiency: Implementing robust waste reduction and recycling programs is crucial, especially as the biotech sector generates specialized waste streams that require careful treatment and disposal.

Biodiversity and Ecosystem Protection

Galapagos, a company with a name evoking natural wonders, has a distinct opportunity to bolster its corporate social responsibility by championing biodiversity and ecosystem protection. This commitment can be demonstrated through various initiatives, even if its primary operations are not directly on the Galapagos Islands.

For instance, Galapagos could invest in or partner with organizations focused on conservation efforts, mirroring the critical work being done to preserve the unique biodiversity of the Galapagos Archipelago. Such actions resonate strongly with stakeholders increasingly prioritizing environmental stewardship.

- Galapagos Conservation Trust reported that in 2023, over 60% of its funding was allocated to direct conservation projects.

- A 2024 survey indicated that 78% of consumers consider a company's environmental impact when making purchasing decisions.

- Galapagos could support educational programs highlighting the importance of fragile ecosystems, similar to those run by the Charles Darwin Foundation in the Galapagos, which reached over 15,000 students in 2023.

Galapagos must navigate evolving environmental regulations, particularly concerning emissions and waste management, as seen with the EU's Green Deal targeting climate neutrality by 2050. The global biopharmaceutical waste management market, valued at approximately $18.5 billion in 2024, highlights the significant costs and operational importance of proper disposal. Climate change also poses risks, potentially impacting supply chains and resource availability, like water, crucial for drug production.

| Environmental Factor | Impact on Galapagos | Relevant Data/Initiatives |

|---|---|---|

| Regulatory Compliance | Adherence to emission, pollution, and chemical handling standards is critical. Non-compliance can lead to fines and reputational damage. | EU environmental directives strengthened in 2023; strict adherence to emission standards is paramount. |

| Waste Management | Efficient and compliant disposal of biological and hazardous waste is a significant operational cost and responsibility. | Biopharmaceutical waste management market valued at $18.5 billion in 2024, with a CAGR over 6% through 2030. |

| Climate Change & Resource Scarcity | Potential disruption to supply chains and manufacturing due to extreme weather events; scarcity of resources like water. | Long-term effects of climate change can impact operations. |

| Biodiversity & Conservation | Opportunity to enhance corporate social responsibility through conservation support, aligning with growing stakeholder focus on environmental stewardship. | Galapagos Conservation Trust allocated over 60% of its 2023 funding to direct conservation projects; 78% of consumers consider environmental impact in purchasing decisions (2024 survey). |

PESTLE Analysis Data Sources

Our Galapagos PESTLE analysis is meticulously constructed using data from the Galapagos National Park Directorate, international conservation organizations, and scientific research institutions. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the archipelago.