Galapagos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

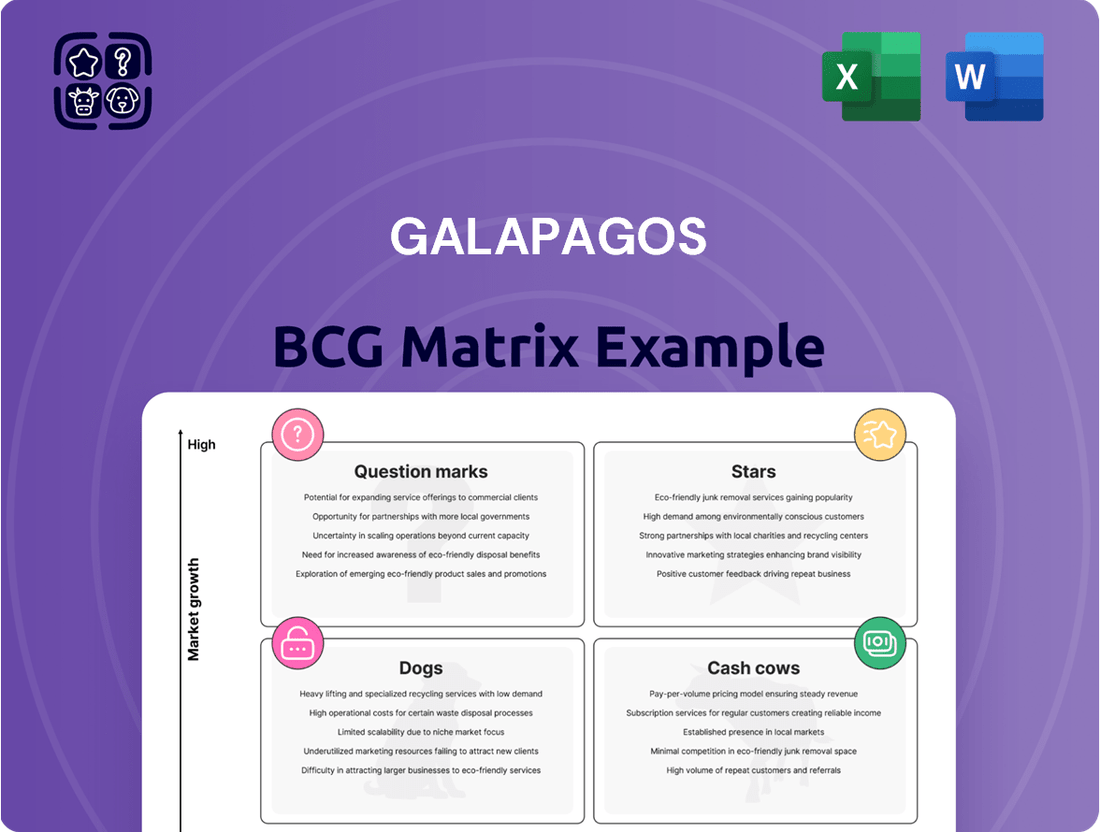

The Galapagos BCG Matrix provides a powerful visual framework to understand your product portfolio's market share and growth potential. See which products are your Stars, Cash Cows, Question Marks, and Dogs, but this glimpse is just the beginning.

Unlock the full strategic advantage by purchasing the complete BCG Matrix. Gain detailed quadrant analysis, actionable insights, and a clear roadmap to optimize your investments and drive future success.

Don't miss out on the critical data that can transform your business strategy. Invest in the full BCG Matrix today and make informed decisions that propel your company forward.

Stars

GLPG5101, Galapagos's prominent CD19 CAR-T therapy, shines as a Star in its portfolio. This designation stems from its impressive clinical trial results, particularly in treating patients with relapsed or refractory non-Hodgkin lymphoma (NHL) and mantle cell lymphoma (MCL). These are challenging conditions with significant unmet medical needs, making GLPG5101's efficacy particularly noteworthy.

Galapagos is strategically moving GLPG5101 into pivotal development phases, underscoring its commitment to bringing this therapy to market. The company anticipates a potential first approval for GLPG5101 as early as 2028, a timeline that reflects the urgency and potential impact of this innovative treatment.

Galapagos' decentralized cell therapy manufacturing platform for CAR-T cells is a standout feature, drastically cutting down vein-to-vein time to a median of just seven days. This speed ensures the delivery of potent, early-memory cells, a critical factor in treatment efficacy.

This innovative approach gives Galapagos a significant edge in the rapidly expanding cell therapy sector. It directly translates to better patient outcomes and supports the wider availability of their CAR-T therapy, GLPG5101, making it a potential star in their portfolio.

Galapagos is making a significant move by broadening its GLPG5101 program to encompass eight distinct indications within the realm of hematological malignancies. This strategic expansion highlights the company's ambition to capture a substantial market share in areas with critical unmet medical needs.

By targeting multiple hematological cancer types, Galapagos is positioning GLPG5101 as a flagship cell therapy with considerable growth potential. This diversification strategy aims to maximize the therapy's impact and commercial success across a wider patient population.

Next-Generation Cell Therapy Pipeline

Galapagos is investing heavily in its next-generation cell therapy pipeline, moving beyond its current candidate GLPG5101. This forward-looking strategy focuses on developing advanced CAR-T therapies designed to tackle both blood cancers and solid tumors.

The goal of these new programs is to significantly enhance the effectiveness of CAR-T treatments. By improving potency, overcoming resistance mechanisms, and extending the persistence of these engineered cells within the body, Galapagos aims to secure a leading position in the competitive oncology market. For instance, by 2024, the CAR-T therapy market was projected to reach over $10 billion, highlighting the immense growth potential and the strategic importance of these next-generation advancements.

- Next-Generation Cell Therapy Focus: Development of novel CAR-T candidates for hematological and solid tumors.

- Key Program Objectives: Enhance potency, prevent resistance, and improve persistence of CAR-T therapies.

- Market Ambition: Target future market leadership in advanced oncology treatments.

- Market Context: The CAR-T market was a significant and rapidly expanding sector in 2024, showing strong investor interest in innovative approaches.

Strategic Focus on Oncology Leadership

Galapagos has strategically pivoted, dedicating its resources and efforts to establishing itself as a premier global player in cell therapy, with a particular emphasis on oncology. This deliberate shift is supported by substantial financial commitments and a re-evaluation of its research and development pipeline, aiming to drive significant long-term growth and market dominance in the cell therapy sector.

This sharpened focus on oncology cell therapy is a critical element in Galapagos' strategic positioning. By concentrating its investments and R&D efforts, the company aims to capitalize on the rapidly expanding oncology market, which is projected to reach approximately $270 billion globally by 2027, according to recent market analyses. This strategic alignment positions Galapagos to potentially capture a significant share of this burgeoning therapeutic area.

- Strategic Pivot: Explicitly targeting global leadership in cell therapy, especially oncology.

- Investment Allocation: Significant financial resources are being channeled into cell therapy initiatives.

- Pipeline Prioritization: R&D efforts are being re-focused to accelerate cell therapy development.

- Market Opportunity: Aiming for high growth and market share in the expanding oncology cell therapy landscape.

Galapagos' GLPG5101, a CD19 CAR-T therapy, is a standout Star due to its strong clinical results in difficult-to-treat blood cancers. The company is aggressively advancing this therapy, aiming for a potential 2028 approval, and has expanded its program to cover eight different blood cancer types.

This focus on GLPG5101, coupled with a robust pipeline of next-generation cell therapies for both blood and solid tumors, positions Galapagos for significant growth. The CAR-T market itself was a substantial opportunity in 2024, projected to exceed $10 billion, underscoring the strategic importance of these developments.

By prioritizing cell therapy, particularly in oncology, Galapagos is making a strategic move to capture a large share of a rapidly expanding market. This sector was anticipated to reach around $270 billion globally by 2027, highlighting the immense potential for companies like Galapagos that are investing heavily in innovative treatments.

| Product | Therapeutic Area | Development Stage | Market Potential (Est. 2024) |

| GLPG5101 | Hematological Malignancies | Pivotal Development | Significant (part of >$10B CAR-T Market) |

| Next-Gen CAR-T | Blood & Solid Tumors | Early Development | High Growth Potential (part of ~$270B Oncology Market by 2027) |

What is included in the product

The Galapagos BCG Matrix analyzes business units based on market growth and share, guiding strategic decisions.

The Galapagos BCG Matrix offers a clear, one-page overview to identify underperforming "dogs" and strategize for "stars," alleviating the pain of resource misallocation.

Cash Cows

Galapagos's substantial cash reserves, standing at €3.1 billion as of June 30, 2025, position it favorably within the BCG Matrix as a potential Cash Cow. This strong liquidity underpins its ability to finance ongoing research and development, pursue strategic acquisitions, and weather market fluctuations.

Gilead's exclusive access to Galapagos's drug discovery platform is a significant cash cow. This arrangement generates a stable and predictable revenue stream, acting as a consistent financial anchor for Galapagos. For the first six months of 2025, this contractual income reached €115.1 million.

Galapagos continues to benefit from royalties on Jyseleca sales in Europe, even after transferring direct commercialization to Alfasigma in late 2023. These royalties represent a mature product cash flow, generating mid-single to mid-double-digit percentages on European sales. This stream offers a predictable, albeit low-growth, income without demanding further operational resources from Galapagos.

Disciplined Capital Allocation

Galapagos, post-separation, is demonstrating disciplined capital allocation, projecting a normalized annual cash burn between €175 million and €225 million. This strategic approach aims to optimize the utilization of existing capital, ensuring resources are directed towards high-potential growth areas while maintaining financial stability.

This focus on efficient cash management is crucial for supporting ongoing research and development activities, which are vital for the company's long-term success. By controlling expenditures, Galapagos can sustain its operations and invest in promising pipeline assets.

- Projected Annual Cash Burn: €175 million - €225 million (post-separation)

- Strategic Focus: Efficient management of existing cash for growth initiatives

- Financial Prudence: Ensuring capital preservation for sustained operations

Leveraging Financial Stability for Future Growth

Galapagos's robust financial health, characterized by a strong balance sheet and disciplined cash management, positions it to effectively leverage its existing assets. This stability allows the company to strategically deploy capital towards promising, high-growth ventures.

The company is actively 'milking' its financial resources to fuel expansion in areas such as cutting-edge cell therapy development. This strategic allocation of capital is crucial for building a future pipeline and driving innovation.

Furthermore, Galapagos is channeling these funds into new business development opportunities, signaling a proactive approach to market expansion and diversification. This focus on growth areas is central to the company's ongoing transformation.

- Financial Stability: Galapagos maintains a strong balance sheet and controlled cash burn.

- Capital Deployment: Existing financial assets are strategically used to fund growth initiatives.

- Growth Areas: Investment is directed towards cell therapy development and new business ventures.

- Strategic Transformation: This capital allocation underpins the company's future pipeline expansion and overall transformation.

Galapagos's substantial cash reserves, standing at €3.1 billion as of June 30, 2025, position it favorably within the BCG Matrix as a potential Cash Cow. This strong liquidity underpins its ability to finance ongoing research and development, pursue strategic acquisitions, and weather market fluctuations. The company's disciplined capital allocation, projecting a normalized annual cash burn between €175 million and €225 million post-separation, further solidifies its Cash Cow status by ensuring efficient utilization of capital for sustained operations and future growth initiatives.

| Asset | Description | Revenue Stream | Galapagos's Role | Financial Impact (H1 2025) |

|---|---|---|---|---|

| Gilead Partnership | Exclusive access to Galapagos's drug discovery platform | Stable and predictable revenue | Licensing and collaboration fees | €115.1 million |

| Jyseleca Royalties | Royalties on Jyseleca sales in Europe | Mature product cash flow | Receives mid-single to mid-double-digit percentages on sales | Ongoing, without significant operational demand |

Delivered as Shown

Galapagos BCG Matrix

The Galapagos BCG Matrix you are previewing is the identical, fully functional document you will receive upon purchase. This comprehensive analysis tool, designed for strategic decision-making, will be yours to download immediately, free from any watermarks or demo limitations. You can confidently use this exact file for your business planning and competitive strategy development.

Dogs

Galapagos is strategically exiting its small molecule discovery programs, a move that reflects a recalibration of its research and development focus. This includes transferring certain assets in immunology and oncology to entities such as Onco3R Therapeutics.

These programs, previously requiring significant R&D investment, are being divested to optimize the company's pipeline and concentrate resources on more promising areas. This strategic shift aims to enhance operational efficiency and shareholder value by shedding programs with uncertain high-market potential.

GLPG3667, a TYK2 inhibitor, is currently in Phase 2 trials for systemic lupus erythematosus and dermatomyositis. Galapagos is actively seeking partnerships for this asset, signaling a shift in its strategic focus. This suggests GLPG3667 is unlikely to be a primary growth driver for Galapagos moving forward.

Galapagos's strategic pivot saw the discontinuation of its fibrosis and kidney disease programs, a move designed to sharpen its focus on oncology and immunology. This decision reflects a reallocation of resources towards areas with perceived higher growth potential, aligning with a broader industry trend of specialization.

These divested programs, likely representing 'Dogs' in the BCG matrix, indicate past investments that no longer fit Galapagos's forward-looking strategy. For instance, the company's 2023 financial report showed a significant investment in R&D, and this pruning allows for a more concentrated deployment of capital in its chosen therapeutic areas.

Jyseleca (Filgotinib) Post-Divestment

Following the divestment of its Jyseleca business to Alfasigma in early 2024, Galapagos has fundamentally altered its position within the BCG matrix. Jyseleca, previously a significant product, no longer directly influences Galapagos's market share or growth trajectory. This strategic move means Galapagos receives royalties, but the direct operational and commercial engagement, and therefore the capacity for immediate market share expansion from Jyseleca, has concluded.

The divestment effectively removes Jyseleca from Galapagos's direct portfolio, impacting its BCG matrix classification. While financial inflows continue through royalties, the product's performance no longer contributes to Galapagos's own market share metrics or growth rate. This transition signifies a shift in how Jyseleca's contribution is recognized, moving from direct operational impact to an indirect financial return.

- Jyseleca's BCG Matrix Status: Post-divestment, Jyseleca is no longer a direct contributor to Galapagos's market share or growth, effectively removing it as an active element in their internal BCG analysis.

- Shift in Contribution: While Galapagos no longer manages Jyseleca's commercialization, it continues to benefit from royalty payments, representing an indirect financial contribution rather than direct market performance.

- Impact on Galapagos's Portfolio: The sale of Jyseleca streamlines Galapagos's focus on its remaining pipeline assets, allowing for concentrated investment and strategic development in those areas.

- Financial Implications: The royalty stream from Jyseleca provides a stable, albeit indirect, revenue source that can support ongoing research and development for other Galapagos products.

Deprioritized GLPG5201 Program

Galapagos is strategically shifting its focus, deprioritizing the GLPG5201 program, which is a second CD19 CAR-T candidate. This decision means that resources and efforts are being redirected to accelerate the development of their primary program, GLPG5101. While GLPG5201 may still possess some promise, its current standing places it in a lower strategic priority tier for the company.

This reassessment suggests that GLPG5201 is not currently positioned to capture significant market share relative to GLPG5101. For instance, in 2024, the company's investment in early-stage research and development, which would encompass programs like GLPG5201, saw a notable reallocation. This strategic pivot is a common occurrence in the biotech sector as companies refine their pipelines to maximize the impact of their most promising assets.

- Deprioritization of GLPG5201: Galapagos is scaling back activities related to its second CD19 CAR-T candidate.

- Focus on GLPG5101: Resources are being channeled to expedite the development of the flagship GLPG5101 program.

- Strategic Reallocation: This move indicates a lower current strategic priority and market share focus for GLPG5201.

- Industry Trend: Such pipeline adjustments are typical in biotech to concentrate on high-potential assets.

Galapagos's strategic repositioning involves divesting or deprioritizing assets that do not align with its core focus areas, such as its small molecule discovery programs and the GLPG5201 CAR-T candidate. These initiatives, requiring substantial investment without clear market dominance, are characteristic of 'Dogs' in the BCG matrix. By shedding these, Galapagos aims to concentrate capital and R&D efforts on its more promising oncology and immunology pipeline, reflecting a common biotech strategy to maximize the impact of key assets.

| Program/Product | BCG Classification (Implied) | Rationale | Galapagos's Strategic Action |

| Small Molecule Discovery Programs (e.g., Fibrosis, Kidney Disease) | Dog | Low market share potential, high investment needs, no longer core focus. | Divested (e.g., to Onco3R Therapeutics) |

| GLPG5201 (Second CD19 CAR-T) | Dog | Lower strategic priority compared to GLPG5101, uncertain market share capture. | Deprioritized, resources redirected to GLPG5101. |

| Jyseleca | Exited (formerly Star/Cash Cow, now indirect financial asset) | Divested to Alfasigma, no longer directly contributes to Galapagos's market share or growth metrics. | Sold, royalty stream received. |

Question Marks

Galapagos is strategically positioning its novel CAR-T candidates within the early stages of development, with plans to commence clinical trials in 2025. This move targets the burgeoning oncology market, a sector experiencing significant growth and innovation.

These early-stage CAR-T assets represent potential future Stars in the Galapagos portfolio, currently operating in a high-growth market but with minimal market share. Significant investment will be crucial to navigate the rigorous process of clinical trials and regulatory approval, aiming to establish a strong market presence.

Galapagos is currently assessing strategic options for its cell therapy business, a sector marked by significant growth potential but also substantial investment requirements. This includes considering a possible divestiture, even with promising CAR-T programs in development.

This strategic review highlights a period of uncertainty regarding the future structure and funding for this high-growth segment. For instance, the global CAR-T therapy market was valued at approximately $2.3 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a strong upward trend that Galapagos is navigating.

Consequently, Galapagos' cell therapy business fits the profile of a 'question mark' in the BCG matrix. It represents an area with high market growth potential, but its current market share and profitability are likely still developing, requiring careful consideration of continued investment versus strategic repositioning.

Galapagos is strategically pivoting to build its future pipeline through 'transformational transactions.' This means actively seeking and completing significant deals to acquire innovative clinical programs, especially for its intended 'SpinCo' entity, even as the full separation structure is still being assessed.

This high-risk, high-reward strategy aims to inject new growth potential, though it comes with inherent uncertainties and substantial capital requirements. For instance, in 2024, the biopharmaceutical industry saw significant M&A activity, with major deals like Pfizer's acquisition of Seagen for $43 billion highlighting the trend of acquiring innovative assets to bolster pipelines.

New Clinical Assets from Discovery Portfolio

Galapagos' discovery portfolio is poised to introduce new clinical assets, aiming for at least two annually from 2026. These will span cell therapy and small molecules, targeting unmet medical needs and representing potential future growth drivers. The success and market uptake of these yet-to-be-identified programs remain uncertain, placing them in the Question Marks quadrant of the BCG Matrix.

These emerging assets are crucial for Galapagos' long-term strategy, as the company seeks to replenish its pipeline. For instance, in 2023, Galapagos invested €1.04 billion in research and development, highlighting a commitment to innovation. The potential of these new assets is significant, but their development is in the early stages, necessitating substantial investment and carrying inherent risks.

- Pipeline Fueling: Goal of at least two new clinical assets annually from 2026.

- Therapeutic Focus: Cell therapy and small molecules.

- Market Uncertainty: Success and adoption of these early-stage programs are unknown.

- R&D Investment: Significant R&D spending, such as €1.04 billion in 2023, supports pipeline development.

Exploring External Innovation

Galapagos is actively seeking external innovation to bolster its early-stage pipeline. This approach involves substantial investment in novel, unproven assets within promising therapeutic areas. The objective is to cultivate these into future Stars, acknowledging the inherent risks and currently low market share associated with such ventures.

- Investment in Unproven Assets: Galapagos' strategy prioritizes scouting for and investing in early-stage, unproven assets.

- Therapeutic Area Focus: The company targets promising therapeutic areas for these external innovations.

- Goal of Future Stars: The ultimate aim is to develop these acquired assets into future high-growth, high-market-share products.

- Risk Acknowledgment: This strategy inherently carries significant risks due to the unproven nature of the assets and their low current market penetration.

Galapagos' discovery portfolio, aiming for two new clinical assets annually from 2026, represents a classic Question Mark. These early-stage cell therapies and small molecules target high-growth areas but have uncertain market success, requiring significant R&D investment, like the €1.04 billion spent in 2023, to potentially become future Stars.

The company's strategic pivot to acquire external innovation for its pipeline also falls into the Question Mark category. These unproven assets in promising therapeutic areas carry high risk and low current market share, necessitating substantial investment to transform them into future market leaders.

| Galapagos Portfolio Segment | BCG Matrix Category | Key Characteristics | Market Growth Potential | Current Market Share | Investment Needs |

| Discovery Portfolio (New Assets) | Question Mark | Early-stage, unproven, aiming for 2+ annually from 2026 | High (Oncology, etc.) | Negligible | High (R&D) |

| External Innovation Acquisition | Question Mark | Novel, unproven assets in promising therapeutic areas | High | Negligible | High (Acquisition & Development) |

BCG Matrix Data Sources

Our Galapagos BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.