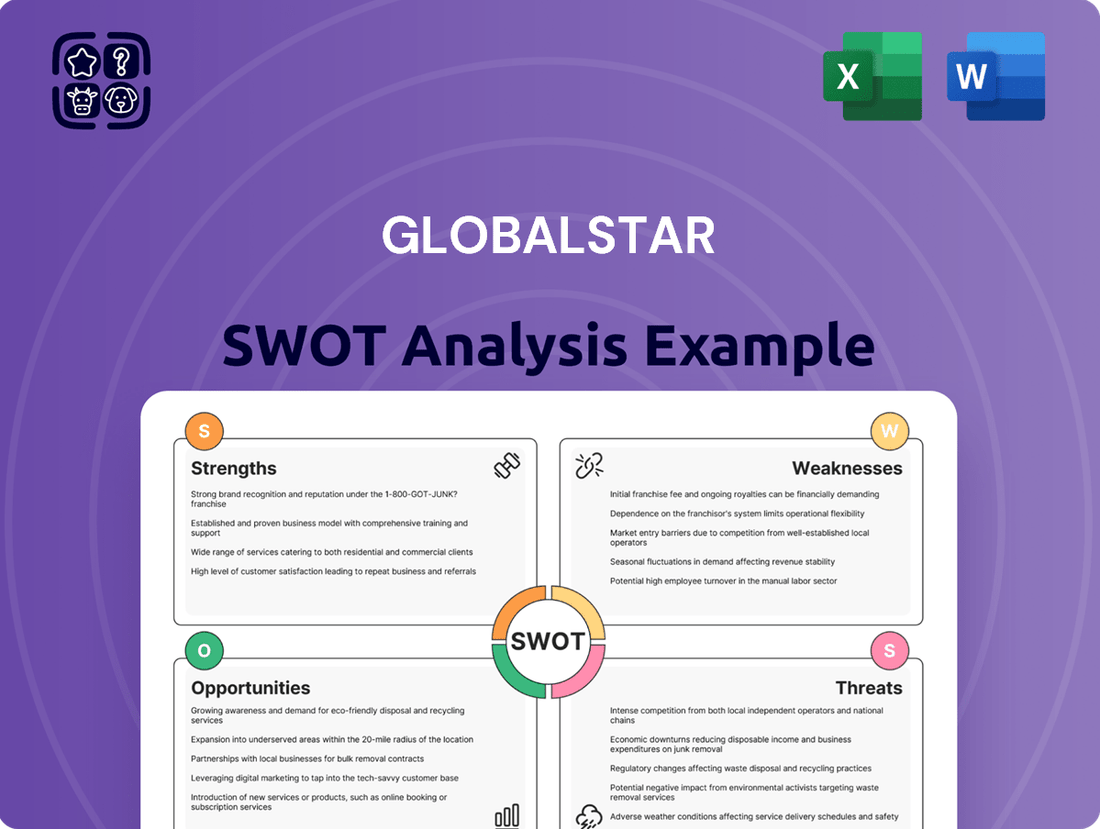

Globalstar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globalstar Bundle

Globalstar's SWOT analysis reveals a unique position in the satellite communications market, leveraging its established network for specific niches. However, understanding the full scope of its competitive advantages and potential challenges is crucial for any strategic decision.

Want to truly grasp Globalstar's market standing and future trajectory? Purchase the complete SWOT analysis to unlock a professionally crafted report packed with actionable insights, financial context, and strategic takeaways—essential for investors, analysts, and entrepreneurs alike.

Strengths

Globalstar's established satellite infrastructure, comprising a constellation of Low Earth Orbit (LEO) satellites, provides a significant strength by ensuring extensive global coverage for voice and data. This is particularly crucial in remote regions lacking terrestrial cellular networks, offering reliable connectivity where it's otherwise unavailable.

The company's global ground station network further solidifies this strength, with ongoing expansions to support its next-generation satellite constellation. This robust network underpins Globalstar's position as a key provider in the mobile satellite services (MSS) market, capable of delivering essential communication services worldwide.

Globalstar's strategic partnerships are a cornerstone of its strength, most notably its significant wholesale capacity agreement with a major tech company, widely understood to be Apple. This deal is projected to generate substantial revenue, helping to cover a considerable portion of the capital needed for new satellite deployments throughout 2024 and into 2025.

Beyond its flagship partnership, Globalstar has cultivated relationships in critical sectors like public safety and defense, alongside collaborations within the automotive industry for telematics solutions. These diverse agreements not only broaden its market reach but also solidify its position as a versatile satellite communications provider.

Globalstar's strength lies in its diverse product range, encompassing satellite phones, modems for M2M and IoT, and consumer gadgets like SPOT trackers. This breadth allows them to serve various market segments effectively.

The company achieved record annual service revenue in its Commercial IoT segment during 2023, a testament to its growing presence and customer adoption in the connected device space. This growth is fueled by both expanding business with existing clients and securing new partnerships, underscoring the demand for their IoT solutions.

Terrestrial Spectrum Holdings (Band 53/n53)

Globalstar's terrestrial spectrum holdings, specifically Band 53 and its 5G counterpart n53, represent a significant strength. This fully licensed spectrum is a key asset for building private networks, offering dedicated channels for enhanced wireless connectivity.

The versatility of Band 53/n53 allows carriers, cable companies, and system integrators to deploy robust wireless solutions. Globalstar is actively investing in this terrestrial network, recognizing its potential for long-term growth and its role in enabling advanced communication services.

- Licensed Spectrum: Band 53/n53 provides a fully licensed channel, ensuring reliable and exclusive use for private network deployments.

- Versatile Application: The spectrum is adaptable for various use cases, supporting improvements in wireless connectivity for diverse industries.

- Strategic Investment: Globalstar's commitment to developing its terrestrial network signals a focus on future revenue streams and market expansion.

Strong Financial Performance and Outlook

Globalstar demonstrated robust financial health in 2024, achieving a record total revenue of $250.3 million, surpassing its own projections. This strong performance is expected to continue, with 2025 revenue anticipated to range between $260 million and $285 million.

The company also reported a record Adjusted EBITDA of $135.3 million for 2024, underscoring significant operational efficiency and cost management. This profitability, coupled with a substantial cash reserve, positions Globalstar favorably for future strategic investments and growth initiatives.

- Record 2024 Revenue: $250.3 million, exceeding guidance.

- Projected 2025 Revenue: $260 million to $285 million.

- Record 2024 Adjusted EBITDA: $135.3 million, indicating strong operational efficiency.

- Financial Flexibility: Substantial cash position supports strategic investments.

Globalstar's extensive satellite network and ground stations offer unparalleled global coverage, crucial for areas lacking terrestrial infrastructure. This robust infrastructure is further bolstered by strategic partnerships, most notably a substantial capacity agreement with a major tech company projected to significantly fund new satellite deployments through 2024 and 2025.

The company's diverse product portfolio, including satellite phones and IoT modems, alongside record Commercial IoT service revenue in 2023, highlights strong market demand and expansion. Furthermore, Globalstar's ownership of licensed terrestrial spectrum (Band 53/n53) provides a unique advantage for private network development and advanced wireless solutions.

Financially, Globalstar demonstrated impressive performance in 2024, achieving record total revenue of $250.3 million and a record Adjusted EBITDA of $135.3 million. Projections for 2025 anticipate revenue between $260 million and $285 million, supported by a healthy cash reserve for strategic growth initiatives.

| Metric | 2023 | 2024 (Actual) | 2025 (Projected) |

|---|---|---|---|

| Total Revenue | $190.4 million | $250.3 million | $260 - $285 million |

| Adjusted EBITDA | $109.7 million | $135.3 million | N/A |

What is included in the product

Analyzes Globalstar’s competitive position through key internal and external factors, detailing its strengths in satellite technology and market niche, weaknesses in subscriber growth, opportunities in IoT and emerging markets, and threats from competitors and regulatory changes.

Offers a clear understanding of Globalstar's market position, helping to identify and address weaknesses before they become critical issues.

Weaknesses

Globalstar's significant reliance on a single major wholesale customer, widely understood to be Apple, presents a considerable weakness. This customer accounts for an overwhelming 85% of Globalstar's network capacity. While this arrangement has been a key driver for revenue and has facilitated crucial investments in new satellite infrastructure, it exposes Globalstar to substantial concentration risk.

The company's financial health and operational capacity are therefore heavily tied to the continued demand and strategic direction of this one dominant partner. Any shift in Apple's needs or its decision to diversify its satellite service providers could have a profound negative impact on Globalstar's business model and future growth prospects.

Globalstar has grappled with net losses despite its revenue growth. For the first quarter of 2025, the company reported a net loss of $17.3 million. This follows a more substantial net loss of $63.2 million for the entirety of 2024.

These reported losses are significantly influenced by non-cash items. Key contributors include losses from the extinguishment of debt and fluctuations in foreign currency exchange rates. While operational performance, as reflected in Adjusted EBITDA, remains robust, these accounting adjustments present a hurdle to overall net profitability.

Globalstar's commitment to expanding its terrestrial network, especially for its XCOM RAN solution, has driven up operating expenses. These strategic investments, while vital for long-term expansion, have put pressure on short-term profitability, impacting Adjusted EBITDA margins.

Subscriber Churn in Certain Service Segments

Globalstar has faced challenges with subscriber churn, particularly impacting its Duplex and SPOT service segments. This churn has led to a noticeable decrease in revenue from these offerings, even as growth in Commercial IoT services continues. For instance, in the first quarter of 2024, while IoT revenue saw an increase, the legacy Duplex and SPOT businesses experienced declines due to subscriber attrition.

The company's ability to retain and expand its subscriber base across all service lines is critical for ensuring stable and predictable revenue streams. Without a strong subscriber base, the growth in newer segments like Commercial IoT may not fully compensate for losses in established areas.

- Subscriber churn negatively impacts Duplex and SPOT service revenue.

- This churn partially offsets growth in Commercial IoT services.

- Maintaining a robust subscriber base is key for consistent revenue.

- Q1 2024 results highlighted this trend with declines in legacy services.

Competition in the Satellite Communications Market

The satellite communications market is intensely competitive. Globalstar faces significant rivalry from established giants such as Iridium Communications and Inmarsat, alongside disruptive new entrants like SpaceX's Starlink and Amazon Kuiper. This crowded field necessitates constant innovation and strategic adaptation to preserve market share and competitive advantage.

Technological advancements are rapidly reshaping the industry, driving down costs and significantly boosting bandwidth capabilities. Companies that fail to keep pace with these developments risk falling behind.

- Market Saturation: The increasing number of satellite constellations, including those from Starlink and Kuiper, intensifies competition for spectrum and customer acquisition.

- Pricing Pressures: New, lower-cost satellite internet services are putting downward pressure on pricing across the industry, impacting revenue streams for all players.

- Technological Obsolescence: Rapid advancements in satellite technology mean that current offerings can quickly become outdated, requiring substantial ongoing investment in R&D and new infrastructure.

Globalstar's heavy dependence on a single major customer, widely believed to be Apple, represents a significant vulnerability. This customer accounts for approximately 85% of Globalstar's network capacity, creating substantial concentration risk. Any change in this partner's strategy or a decision to diversify its satellite providers could severely impact Globalstar's revenue and growth trajectory.

The company has struggled with profitability, reporting net losses even with revenue increases. For the first quarter of 2025, Globalstar posted a net loss of $17.3 million, following a $63.2 million loss for the full year 2024. These losses are exacerbated by non-cash items like debt extinguishment and foreign currency fluctuations, despite positive Adjusted EBITDA.

Subscriber churn, particularly in its Duplex and SPOT services, continues to be a challenge. While Commercial IoT services show growth, subscriber attrition in legacy segments negatively affects overall revenue stability. This trend was evident in Q1 2024, where declines in older services partially offset gains in IoT.

The satellite communications market is highly competitive, with Globalstar facing pressure from established players like Iridium and Inmarsat, as well as emerging giants such as SpaceX's Starlink and Amazon Kuiper. Rapid technological advancements and market saturation from new constellations intensify competition, leading to pricing pressures and the risk of technological obsolescence.

| Weakness | Description | Impact |

| Customer Concentration | Reliance on a single major customer (e.g., Apple) for ~85% of network capacity. | High exposure to changes in customer demand or strategy; significant revenue risk. |

| Net Losses | Consistent reporting of net losses despite revenue growth (Q1 2025: -$17.3M, FY 2024: -$63.2M). | Hinders overall financial health and reinvestment capacity, despite positive Adjusted EBITDA. |

| Subscriber Churn | Attrition in Duplex and SPOT services impacts revenue streams. | Partially offsets growth in newer segments like Commercial IoT, affecting revenue predictability. |

| Intense Competition | Rivalry from established and new satellite providers (Iridium, Starlink, Kuiper). | Requires continuous innovation and strategic adaptation to maintain market share and pricing power. |

Preview Before You Purchase

Globalstar SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a clear understanding of Globalstar's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed report is unlocked after purchase.

Opportunities

Globalstar is actively upgrading its satellite network by introducing next-generation LEO satellites, such as the C-3 System. This initiative incorporates advanced technology and broader ground infrastructure to boost performance.

This strategic expansion, with significant backing from a key wholesale client, is designed to enhance current service offerings and enable innovative two-way satellite IoT solutions.

The investment is also focused on increasing Globalstar's global mobile satellite coverage and overall capacity, positioning the company for future growth in the evolving satellite communications market.

The global IoT services market is projected to reach $342.10 billion in 2024, with continued strong growth expected. Globalstar's specialized satellite IoT and M2M solutions are perfectly aligned with this expansion, offering a unique value proposition for industries requiring reliable connectivity in remote or underserved areas.

Globalstar's focus on low-power, cost-effective satellite data solutions for asset tracking and remote monitoring is a key opportunity. This segment of the IoT market is rapidly expanding, with an estimated 20.4 billion connected IoT devices expected by 2025. The company's ability to provide these essential services at a competitive price point positions it for significant subscriber and revenue growth.

Globalstar's wholly-owned Band 53 and n53 spectrum is a significant asset, providing a fully licensed channel ideal for private 4G/LTE and 5G networks. This dedicated spectrum allows for robust and reliable wireless connectivity, a critical requirement for many industrial applications.

This opens up substantial opportunities for Globalstar to collaborate with major players in the telecommunications industry. By partnering with carriers, cable companies, and system integrators, Globalstar can offer tailored private network solutions, enhancing wireless capabilities in demanding environments.

High-value market segments such as industrial automation, manufacturing plants, busy ports, and complex logistics facilities stand to benefit immensely. These sectors require highly dependable and secure wireless communication, which Globalstar's spectrum can effectively deliver, potentially driving new revenue streams and market penetration.

Increasing Demand for Direct-to-Cellular Services

The burgeoning direct-to-cellular satellite communication market, while still in its early stages, is projected to become a substantial revenue generator. Globalstar's established LEO constellation and its continuous satellite deployments place it in a strong position to offer satellite-powered messaging and emergency services directly to everyday devices like smartphones.

This presents a significant opportunity for Globalstar to capitalize on a rapidly evolving sector. By leveraging its existing infrastructure, the company is poised to integrate seamlessly with the growing demand for ubiquitous connectivity.

- Market Growth Projection: Analysts anticipate the direct-to-device satellite market to reach billions in revenue by the end of the decade, with many expecting substantial growth in 2024 and 2025 as partnerships solidify and services launch.

- Globalstar's Advantage: Globalstar's existing LEO constellation, which has been operational for years, provides a ready-made platform for these new services, avoiding the significant capital expenditure required for new entrants.

- Service Expansion: The ability to offer messaging and emergency SOS features directly to smartphones, without requiring specialized hardware, opens up a vast consumer market that was previously inaccessible.

Expansion into Government and Defense Sectors

Globalstar is making strategic moves to expand its reach into the government and defense sectors, recognizing the significant potential for its satellite technology. A key partnership with Parsons Corporation is a testament to this focus, aiming to integrate Globalstar's capabilities into public sector projects.

The company's satellite data solutions, particularly those designed for low probability of intercept and detection, are currently under evaluation for critical military applications. These include enhancing secure communications and enabling covert tracking, addressing the burgeoning military Internet of Things (IoT) market.

- Strategic Partnerships: Collaboration with entities like Parsons Corporation to penetrate government contracts.

- Military Applications: Focus on secure, covert communications and tracking solutions for defense needs.

- Market Growth: Tapping into the expanding military IoT sector, which is projected for substantial growth in the coming years.

Globalstar is well-positioned to capitalize on the burgeoning IoT market, projected to reach $342.10 billion in 2024. Its specialized satellite IoT solutions offer reliable connectivity for remote asset tracking and monitoring, aligning with the anticipated 20.4 billion connected IoT devices by 2025.

The company's exclusive Band 53 and n53 spectrum provides a unique advantage for developing private 4G/LTE and 5G networks, particularly for industrial sectors like manufacturing and logistics that demand robust wireless communication.

Furthermore, Globalstar's existing LEO constellation offers a significant head start in the emerging direct-to-cellular satellite communication market, which analysts predict will generate billions in revenue by the end of the decade, with strong growth anticipated in 2024 and 2025.

Strategic partnerships, such as the one with Parsons Corporation, are opening doors to the government and defense sectors, particularly for secure communications and tracking solutions within the expanding military IoT market.

Threats

The satellite communication landscape is rapidly evolving with new, heavily funded LEO constellations like SpaceX's Starlink, Eutelsat OneWeb, and Amazon Kuiper entering the fray. This influx of new players is significantly increasing available satellite bandwidth, creating a more competitive environment.

This heightened competition poses a direct threat to Globalstar, potentially impacting its market share and its ability to maintain current pricing structures. For instance, Starlink alone aims for a massive constellation, promising significant capacity increases that could pressure existing providers.

The satellite communications sector is characterized by relentless technological advancement, posing a significant threat of obsolescence for Globalstar. Continuous, substantial investment in research and development is crucial to keep pace with evolving satellite and terrestrial communication technologies, a challenge evident in the industry's high R&D spending trends throughout 2024 and projected into 2025.

Failure to adapt swiftly to these rapid innovations and shifting customer expectations could severely erode Globalstar's competitive edge. For instance, the increasing integration of 5G terrestrial networks alongside satellite capabilities demands constant system upgrades and the development of hybrid solutions, a market shift that could leave slower adopters behind.

Globalstar faces significant threats from evolving regulatory and licensing challenges across the diverse international markets it serves. Navigating these complex, country-specific rules is a constant hurdle, impacting operational continuity and market access.

Changes in licensing requirements, particularly concerning spectrum allocation, pose a direct risk to Globalstar's ability to maintain and expand its satellite network. For instance, shifts in national telecommunication policies could necessitate costly adjustments or even limit service offerings in key regions.

High Capital Expenditure Requirements for Network Upgrades

Globalstar faces a significant hurdle with the high capital expenditure needed for network upgrades. Maintaining and expanding its Low Earth Orbit (LEO) satellite constellation and ground infrastructure demands substantial ongoing investment. For instance, in 2023, Globalstar reported capital expenditures of $142 million, a notable increase from $89 million in 2022, primarily for the second-generation (SMG-2) satellite constellation deployment and ground station enhancements.

While the company has benefited from significant investments, particularly from its primary customer, the continuous need for network modernization presents a potential financial strain. Future upgrades, essential for maintaining competitive edge and service quality, require sustained funding. This could become a challenge if revenue growth doesn't consistently outpace these escalating capital demands, potentially impacting financial flexibility.

- Ongoing investment in LEO satellite constellation and ground infrastructure.

- Capital expenditures increased to $142 million in 2023 for network upgrades.

- Future network enhancements require continuous funding.

- Potential financial strain if revenue growth lags behind capital needs.

Geopolitical and Macroeconomic Risks

Globalstar's international presence makes it susceptible to geopolitical shifts. For instance, ongoing trade tensions between major economies could lead to new tariffs or restrictions, disrupting its supply chain for equipment or limiting its ability to operate in certain markets. The company's reliance on global manufacturing and distribution means that political instability in key regions could directly impact its operational efficiency and cost structure.

Macroeconomic conditions present another significant threat. Rising inflation in 2024 and 2025, for example, could increase the cost of components and services, squeezing profit margins. Fluctuations in interest rates might also affect Globalstar's borrowing costs and the investment capacity of its potential customers, thereby dampening demand for its satellite services.

- Trade Disputes: Escalating trade wars could impose tariffs on satellite hardware, increasing Globalstar's cost of goods sold.

- Inflationary Pressures: Persistent inflation in 2024-2025 could drive up operational expenses, from energy costs to component pricing.

- Interest Rate Hikes: Higher interest rates may reduce capital expenditure by customers and increase Globalstar's own financing costs.

- Economic Slowdowns: A global economic downturn could decrease demand for satellite communication services across various sectors.

The increasing competition from new LEO constellations like Starlink, Eutelsat OneWeb, and Amazon Kuiper poses a significant threat, potentially diluting Globalstar's market share and pricing power. Furthermore, rapid technological advancements in satellite and terrestrial communications necessitate continuous, substantial R&D investment to avoid obsolescence, a challenge underscored by industry spending trends in 2024-2025. Navigating complex and evolving international regulatory landscapes, particularly spectrum allocation, also presents ongoing hurdles to maintaining and expanding its network.

| Threat Category | Specific Threats | Impact on Globalstar | Relevant Data/Trends (2024-2025) |

| Increased Competition | New LEO Constellations (Starlink, Kuiper, OneWeb) | Market share erosion, pricing pressure | Starlink's massive planned constellation increases bandwidth capacity. |

| Technological Obsolescence | Rapid advancements in satellite and terrestrial tech | Need for constant R&D, risk of outdated services | High industry R&D spending in 2024-2025 to keep pace with innovation. |

| Regulatory & Licensing | Evolving international rules, spectrum allocation changes | Operational disruption, market access limitations | Country-specific rules can necessitate costly adjustments or service restrictions. |

| Capital Expenditure Demands | Network upgrades, LEO constellation expansion | Financial strain if revenue growth lags | Capital expenditures were $142 million in 2023, up from $89 million in 2022. |

| Geopolitical & Macroeconomic Factors | Trade tensions, inflation, economic slowdowns | Supply chain disruptions, increased costs, reduced demand | Inflation in 2024-2025 could raise component costs; trade disputes may impact hardware pricing. |

SWOT Analysis Data Sources

This Globalstar SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide a robust and informed perspective.