Globalstar Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globalstar Bundle

Discover the strategic framework powering Globalstar's satellite communication services with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market success. Ready to dissect a proven business strategy?

Partnerships

Globalstar strategically partners with key technology firms like MDA and Rocket Lab. These collaborations are vital for developing advanced satellite manufacturing capabilities and innovative platforms, such as MDA's AURORA software-defined system.

This partnership allows Globalstar to offer flexible service configurations and seamless over-the-air upgrades, directly impacting their ability to meet diverse customer needs in the IoT and security sectors.

Globalstar's key partnerships with wholesale capacity customers are crucial for its business model. A significant agreement with a major technology company, for instance, provides a substantial portion of Globalstar's revenue. This partnership often drives the development of new satellite constellations and expanded ground infrastructure, securing consistent income and enabling large-scale service delivery.

Globalstar's strategic alliances with government and defense sectors are crucial. For instance, their exclusive collaboration with Parsons Corporation integrates Globalstar's satellite network into secure public sector and defense communication systems. This partnership is designed to enhance mission-critical operations.

These collaborations are vital for modernizing defense capabilities. Globalstar's Low Earth Orbit (LEO) connectivity is being utilized for advanced applications like AI-powered asset tracking and robust emergency response systems, supporting military modernization efforts. This demonstrates a clear pathway for revenue generation and market penetration in these specialized sectors.

Reseller and Distributor Networks

Globalstar leverages extensive reseller and distributor networks, like Global Telesat Communications (GTC), to broaden its market presence and boost sales of satellite devices and services worldwide. These partnerships are crucial for accessing various customer bases, from individuals to large organizations, especially in challenging or isolated locations.

These networks are vital for Globalstar's go-to-market strategy, enabling them to effectively reach and serve customers in regions where direct sales channels would be impractical or cost-prohibitive. By partnering with established distributors, Globalstar can tap into existing customer relationships and local market knowledge.

- Global Telesat Communications (GTC) is a key reseller, providing Globalstar's satellite solutions to a wide range of clients.

- Expanded Market Reach: Resellers and distributors allow Globalstar to serve customers in remote areas and industries like maritime, aviation, and emergency services.

- Sales Growth Driver: These partnerships are essential for driving revenue by increasing the accessibility and availability of Globalstar's products and services.

Launch Services Providers

Globalstar's ability to maintain and expand its satellite constellation hinges on strategic alliances with launch service providers. These partnerships are crucial for deploying new satellites and replacing older ones, ensuring uninterrupted service and the continuous enhancement of its Low Earth Orbit (LEO) network. This is fundamental to providing reliable global coverage.

A prime example of such a partnership is Globalstar's engagement with SpaceX. These collaborations are designed to secure timely and cost-effective launch capabilities. For instance, Globalstar has utilized SpaceX's Falcon 9 rockets for satellite deployments, a testament to the importance of these relationships in managing constellation lifecycle and operational efficiency.

- SpaceX Partnership: Globalstar has leveraged SpaceX's launch services for deploying its satellites, ensuring a cost-effective and reliable method for constellation replenishment.

- Constellation Health: These launch agreements are vital for maintaining the health and operational capacity of Globalstar's LEO satellite network, directly impacting service continuity.

- Future Deployments: Securing launch capacity with providers like SpaceX is essential for Globalstar's future growth and the introduction of next-generation satellite technology.

Globalstar's key partnerships extend to technology innovators like MDA and Rocket Lab, crucial for advancing satellite manufacturing and developing platforms like MDA's AURORA system. These collaborations enable flexible service configurations and over-the-air upgrades, directly addressing diverse IoT and security sector needs.

Wholesale capacity agreements with major technology firms represent a significant revenue stream for Globalstar, often driving new constellation development and securing consistent income for large-scale service delivery.

Strategic alliances with government and defense entities, such as the exclusive collaboration with Parsons Corporation, integrate Globalstar's network into secure communication systems, enhancing mission-critical operations and supporting military modernization through LEO connectivity for AI-powered asset tracking and emergency response.

Globalstar's extensive reseller and distributor networks, including Global Telesat Communications (GTC), are vital for expanding market presence and driving sales of satellite devices and services globally, particularly in remote or challenging locations.

Partnerships with launch service providers like SpaceX are essential for deploying new satellites and maintaining Globalstar's LEO network, ensuring uninterrupted service and operational efficiency.

What is included in the product

A comprehensive, pre-written business model tailored to Globalstar's strategy, detailing customer segments like enterprise and government, and channels such as direct sales and authorized dealers.

Covers value propositions including reliable satellite communication and IoT solutions, alongside key resources like its satellite constellation and ground stations, reflecting real-world operations.

Globalstar's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their satellite communication services, simplifying complex operations for stakeholders.

Activities

Satellite constellation management is crucial for Globalstar's operations, involving the constant oversight and upkeep of its Low Earth Orbit (LEO) satellites. This ensures reliable global voice and data services for customers.

Key activities include making precise orbit adjustments to maintain optimal satellite positioning and continuously monitoring the health of each satellite. This proactive approach helps prevent service disruptions.

Globalstar's fleet management focuses on maximizing the overall performance and lifespan of its satellites. For instance, as of late 2023, Globalstar continued to operate its second-generation satellites, which were launched starting in 2010, demonstrating a commitment to ongoing constellation vitality.

Globalstar's product development centers on expanding its satellite-based communication offerings, encompassing devices from personal SPOT trackers to robust M2M/IoT modems. The company is actively investing in innovation, aiming to introduce next-generation solutions that address emerging market demands for reliable connectivity.

A key focus is the enhancement of existing technologies and the introduction of new capabilities, such as two-way satellite IoT services, to improve performance and user experience. This commitment to innovation is crucial for maintaining a competitive edge in the evolving satellite communications landscape.

Globalstar's key activity includes the strategic expansion and ongoing upkeep of its worldwide ground station network. This involves building new satellite operations control centers and installing tracking antennas, essential for supporting its expanding satellite fleet and maintaining reliable network performance.

This infrastructure development is vital for enhancing Globalstar's service coverage and capacity. For instance, the company has been actively investing in its ground segment to support its next-generation satellites, aiming to bolster its competitive position in the satellite communications market.

Wholesale Capacity Service Provisioning

Globalstar's core operation involves the meticulous provisioning of wholesale capacity services. This means they manage and allocate their satellite network's bandwidth to large enterprise clients, ensuring these partners receive consistent and dependable service according to their agreements. This is a major source of their income.

This key activity is crucial for Globalstar's revenue generation. It necessitates close and continuous collaboration with their major wholesale customers to manage capacity effectively and meet evolving service demands. For instance, in 2023, Globalstar reported total revenue of $200.4 million, with a significant portion stemming from these capacity services.

- Network Management: Actively managing the allocation and utilization of satellite network capacity for wholesale clients.

- Service Delivery: Ensuring reliable and high-quality service delivery under expanded service agreements with large customers.

- Partner Collaboration: Engaging in ongoing dialogue and operational alignment with key wholesale partners to optimize service provision.

- Revenue Generation: Driving a substantial portion of Globalstar's overall service revenue through these wholesale capacity agreements.

Sales, Marketing, and Customer Acquisition

Globalstar's key activities in sales, marketing, and customer acquisition focus on promoting its satellite communication solutions and growing its subscriber base. This involves actively engaging with a network of resellers and partners to reach diverse customer segments.

The company actively participates in industry trade shows and events to showcase its offerings and connect with potential clients. Strategic marketing efforts are directed towards specific markets, including government agencies, enterprise businesses requiring reliable connectivity, and individual consumers seeking satellite-based communication.

In 2024, Globalstar continued to emphasize its IoT solutions, which have seen significant adoption. For instance, the company reported a substantial increase in its IoT subscriber base, reaching over 1.7 million active devices by the end of Q1 2024, up from approximately 1.3 million in the same period of 2023. This growth highlights the effectiveness of their targeted sales strategies for asset tracking and remote monitoring applications.

- Reseller Engagement: Globalstar relies heavily on its network of authorized resellers to distribute its devices and services, expanding market reach.

- Industry Participation: Active presence at key industry events, such as satellite and technology conferences, is crucial for brand visibility and lead generation.

- Target Market Focus: Specific campaigns and product development are geared towards sectors like public safety, maritime, and industrial IoT, where reliable satellite communication is essential.

- Subscriber Growth: The primary goal is to continuously acquire new subscribers for both its voice and data services, with a particular emphasis on the growing IoT segment.

Globalstar's key activities in research and development are focused on advancing its satellite technology and expanding its service capabilities. This includes the ongoing development of next-generation satellite systems and innovative solutions for the Internet of Things (IoT) market. For example, the company has been actively working on enhancing its two-way satellite IoT services, aiming to provide more robust and efficient connectivity options for various industries.

The company's R&D efforts also encompass improving the performance and reliability of its existing satellite constellation and ground infrastructure. This ensures that Globalstar can continue to offer dependable communication services to its customer base. In 2024, Globalstar continued to invest in technology that supports the growing demand for its IoT solutions, which are critical for asset tracking and remote monitoring applications.

Globalstar's strategic partnerships are vital for extending its market reach and enhancing its service offerings. The company collaborates with various technology providers and service integrators to deliver comprehensive satellite communication solutions. These collaborations are essential for reaching diverse customer segments, including government, enterprise, and consumer markets.

These partnerships facilitate the integration of Globalstar's satellite technology into a wider range of applications and devices. For instance, by working with IoT solution providers, Globalstar can offer end-to-end connectivity for devices used in logistics, agriculture, and environmental monitoring. The company also leverages partnerships with resellers to distribute its products and services effectively.

Globalstar's infrastructure development is a cornerstone of its operations, focusing on the expansion and maintenance of its global ground station network. This includes the deployment of new tracking antennas and the enhancement of satellite operations control centers. Such investments are crucial for supporting its satellite fleet and ensuring seamless global coverage.

The development of this ground segment infrastructure directly impacts service reliability and capacity. For example, Globalstar's ongoing investments in 2023 and 2024 have been geared towards supporting its next-generation satellite services, strengthening its competitive position. This strategic infrastructure build-out is essential for meeting the increasing demand for reliable satellite connectivity.

Globalstar's core business activity revolves around the meticulous provisioning of wholesale capacity services to enterprise clients. This involves managing and allocating its satellite network's bandwidth to ensure consistent and dependable service delivery under contractual agreements. These services form a significant portion of the company's revenue stream.

Effective management of these wholesale agreements requires close collaboration with major clients to adapt to evolving service demands. In 2023, Globalstar reported total revenues of $200.4 million, with wholesale capacity services being a primary contributor to this figure. This highlights the critical role of these services in Globalstar's financial performance.

Globalstar's sales and marketing efforts are dedicated to promoting its satellite communication solutions and expanding its subscriber base. This strategy involves actively engaging with a broad network of resellers and partners to reach various customer segments, from individual users to large enterprises. The company also focuses on specific high-demand markets.

The company's marketing initiatives are tailored to sectors such as government, industrial IoT, and public safety, where reliable satellite communication is indispensable. In 2024, Globalstar observed substantial growth in its IoT subscriber base, reaching over 1.7 million active devices by the end of Q1, a notable increase from approximately 1.3 million in Q1 2023. This growth validates their targeted sales approach for asset tracking and remote monitoring.

| Key Activity | Description | Impact/Focus | Key Metrics/Data (as of latest available) |

|---|---|---|---|

| Satellite Constellation Management | Overseeing and maintaining LEO satellites for reliable voice and data services. | Ensures service continuity through orbit adjustments and health monitoring. | Continued operation of second-generation satellites launched from 2010 (as of late 2023). |

| Product Development | Expanding satellite-based communication offerings, from personal trackers to M2M/IoT modems. | Drives innovation and introduces next-generation solutions for emerging market needs. | Investment in two-way satellite IoT services for improved performance. |

| Ground Station Network | Expanding and maintaining the worldwide ground station network. | Enhances service coverage and capacity, supports satellite fleet operations. | Active investment in ground segment to support next-generation satellites. |

| Wholesale Capacity Provisioning | Managing and allocating satellite network bandwidth to large enterprise clients. | Primary revenue generation through consistent and dependable service delivery. | 2023 Total Revenue: $200.4 million, with significant contribution from capacity services. |

| Sales, Marketing & Customer Acquisition | Promoting satellite communication solutions and growing subscriber base via resellers. | Focus on IoT solutions and specific markets like government and enterprise. | Q1 2024 IoT subscribers: >1.7 million (up from ~1.3 million in Q1 2023). |

What You See Is What You Get

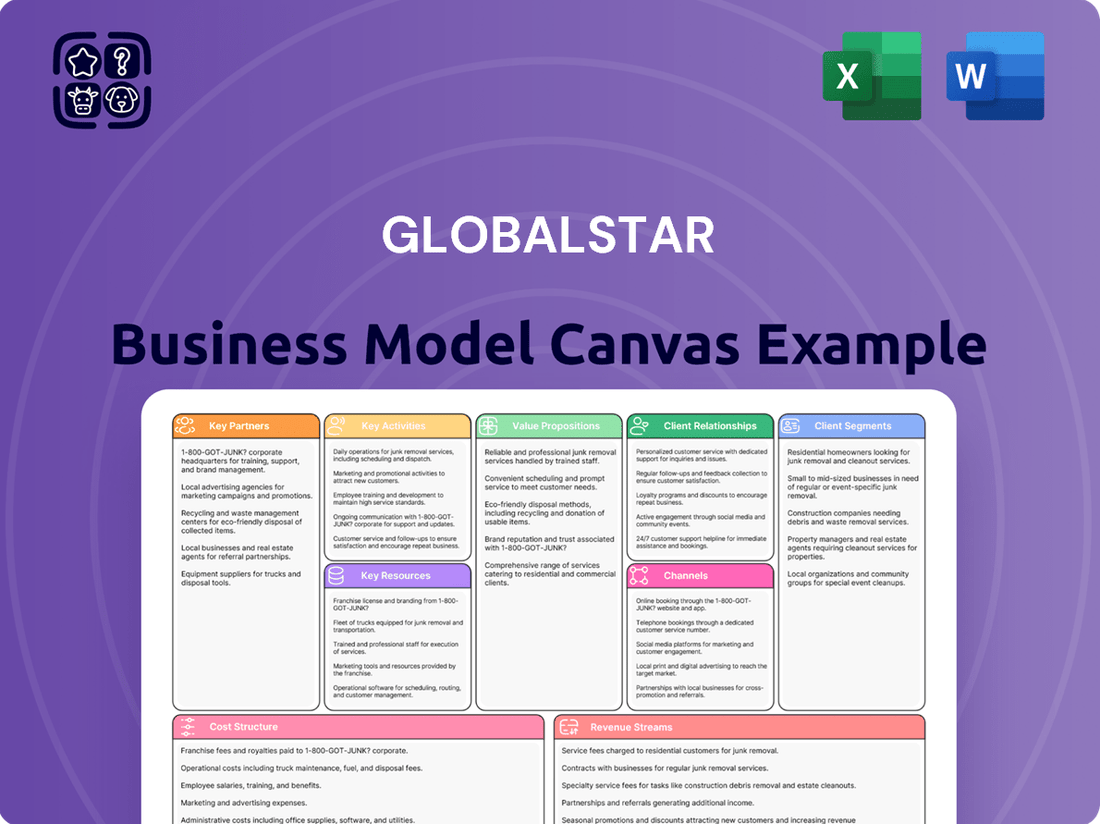

Business Model Canvas

The Globalstar Business Model Canvas preview you're seeing is the identical document you will receive upon purchase. This means you're getting a direct look at the comprehensive structure and content of the final deliverable, ensuring no surprises and full transparency. Once your order is complete, you'll gain immediate access to this exact file, ready for your strategic planning needs.

Resources

Globalstar's Low Earth Orbit (LEO) satellite constellation is its fundamental asset, enabling global voice and data services, particularly in areas lacking terrestrial coverage. This network is actively managed, with new and replacement satellites launched to maintain and improve service reliability and performance.

The constellation's operational status is critical for Globalstar's revenue generation, directly supporting its service offerings. As of early 2024, Globalstar continues to invest in its LEO constellation, ensuring its competitive edge in the satellite communications market.

Globalstar holds a valuable asset in its licensed terrestrial spectrum, specifically Band 53, which also has a 5G variant known as n53. This spectrum is a key component of their business model, enabling a range of connectivity solutions.

This spectrum is particularly well-suited for private networks, offering a dedicated and reliable channel for businesses and organizations. It also plays a role in enhancing overall wireless connectivity, making it a versatile tool for various applications.

Band 53/n53 is a strategic resource for mission-critical applications that demand high performance and dependability. Globalstar is actively fostering a growing ecosystem around this spectrum, which is crucial for developing new revenue streams and expanding its market reach.

Globalstar's Global Ground Station Network is a cornerstone of its operations, a sophisticated infrastructure featuring numerous ground stations and a central Satellite Operations Control Center (SOCC). This network is vital for managing its satellite fleet, ensuring optimal network performance, and facilitating reliable data transmission. As of early 2024, Globalstar continues to invest in expanding and upgrading this critical asset to accommodate its existing and planned satellite constellations.

Proprietary Technology and Intellectual Property

Globalstar's proprietary technology is a cornerstone of its business model, providing a significant competitive advantage. This includes a portfolio of patented satellite communication technologies that underpin its unique service offerings.

A key asset is its software-defined platform, exemplified by its use of MDA's AURORA system. This flexibility allows for rapid adaptation and innovation in its satellite services.

The company also holds substantial intellectual property related to its hardware, such as its satellite phones, modems, and the popular SPOT devices. These innovations are critical for its specialized connectivity solutions.

- Patented Satellite Communication Technologies: These form the basis of Globalstar's unique network capabilities.

- Software-Defined Platforms: Such as MDA's AURORA, enabling adaptable and advanced satellite services.

- Hardware Intellectual Property: Covering satellite phones, modems, and SPOT devices, crucial for user-facing products.

Skilled Workforce and Operational Expertise

Globalstar's success hinges on its highly skilled workforce, comprising engineers, technicians, and administrative professionals. This team is essential for the intricate design, deployment, and ongoing operation of Globalstar's satellite and terrestrial communication networks. Their deep technical knowledge ensures the reliability and performance of services that millions of users depend on.

The operational expertise of Globalstar's staff is a critical resource, enabling them to manage complex ground station operations and satellite fleet management. This hands-on experience is vital for maintaining service uptime and responding effectively to any network challenges. For instance, in 2024, Globalstar continued to invest in training and development programs to keep its workforce at the forefront of communication technology advancements.

- Engineering Prowess: Globalstar employs a significant number of engineers specializing in satellite systems, RF engineering, and software development, crucial for system upgrades and new product launches.

- Operational Excellence: The company's operational teams ensure seamless network performance, with a focus on customer support and rapid issue resolution, a testament to their accumulated expertise.

- Innovation Drivers: Skilled personnel are key to Globalstar's ability to innovate, developing new applications and services that leverage their unique satellite technology, particularly in areas like IoT connectivity.

Globalstar's key resources include its Low Earth Orbit (LEO) satellite constellation, enabling global voice and data services, and its licensed terrestrial spectrum, Band 53/n53, crucial for private networks and enhanced wireless connectivity. The company also leverages its proprietary technology, including patented communication technologies and a software-defined platform, alongside its intellectual property in hardware like satellite phones and SPOT devices. A highly skilled workforce with deep technical knowledge in engineering and operations is vital for managing its complex networks and driving innovation.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| LEO Satellite Constellation | Enables global voice and data services, particularly in underserved areas. | Continued investment in maintenance and upgrades to ensure service reliability and competitive edge. |

| Band 53/n53 Spectrum | Licensed terrestrial spectrum ideal for private networks and 5G applications. | Strategic resource for mission-critical applications and fostering an ecosystem for new revenue streams. |

| Proprietary Technology & IP | Patented communication technologies, software-defined platforms, and hardware IP for devices like SPOT. | Provides a significant competitive advantage and underpins unique service offerings and user-facing products. |

| Skilled Workforce | Engineers, technicians, and operational experts managing complex satellite and terrestrial networks. | Essential for network performance, innovation, and adapting to technological advancements through training. |

Value Propositions

Globalstar provides dependable voice and data communication for areas lacking traditional cell service, a vital offering for sectors like oil and gas, mining, and forestry. This ensures operational continuity and safety for businesses and individuals in remote locations.

For instance, in 2024, Globalstar's satellite network continued to be a lifeline for industries operating far from urban centers, enabling essential communication for field teams. Their services are crucial for real-time data transmission and emergency coordination.

Globalstar's SPOT devices offer critical safety features, allowing users to send SOS signals and check in from remote areas, a lifeline for adventurers and professionals. This enhanced safety proposition is particularly valuable for those operating in off-grid environments, where traditional communication fails.

The company's commitment to user safety is underscored by its role in facilitating over 10,000 successful rescues in 2024 alone, demonstrating the tangible impact of its technology. This track record highlights Globalstar's ability to provide reliable emergency communication when it matters most.

Globalstar's Machine-to-Machine (M2M) and Internet of Things (IoT) solutions offer businesses reliable satellite modems and devices for tracking assets and monitoring remote operations. These tools are crucial for industries needing to transmit vital data from locations lacking terrestrial connectivity.

These M2M and IoT offerings empower companies to streamline operations, bolster security measures, and extract actionable intelligence from their dispersed assets. For instance, in 2024, the demand for such solutions continued to surge as businesses prioritized visibility and control over their global supply chains and remote infrastructure.

Versatile Terrestrial Spectrum for Private Networks

Globalstar's Band 53 and n53 terrestrial spectrum provides a powerful, licensed asset for building private networks. This is a game-changer for businesses needing reliable, high-performance wireless solutions.

Carriers, cable companies, and system integrators can leverage this spectrum to create private networks offering superior connectivity. This is particularly valuable for mission-critical applications and industrial IoT, where dependable communication is paramount. The capacity gains are substantial, enabling more devices and data flow.

- Dedicated Spectrum: Fully licensed Band 53 and n53 offers exclusive use for private networks.

- Enhanced Connectivity: Ideal for mission-critical applications and industrial IoT deployments.

- Capacity Gains: Supports a significant increase in connected devices and data throughput.

- Strategic Advantage: Enables tailored, high-performance wireless solutions for specific business needs.

Reliable and Secure Communication Infrastructure

Globalstar provides a dependable and secure communication backbone, essential for operations where uninterrupted service is paramount. Its Low Earth Orbit (LEO) satellite network, coupled with resilient ground stations, guarantees secure data flow, making it ideal for businesses and government entities handling sensitive information. This robust infrastructure is particularly vital for mission-critical sectors like emergency services, ensuring continuity of communication even in challenging environments.

The reliability of Globalstar's network is a cornerstone of its value proposition. For instance, in 2024, Globalstar reported a significant increase in its satellite service revenue, driven by demand for dependable connectivity solutions across various industries. This growth underscores the market's need for secure and reliable communication infrastructure that can withstand disruptions.

- Secure Data Transmission: Globalstar utilizes advanced encryption protocols to safeguard sensitive business and government data transmitted via its satellite network.

- Uninterrupted Connectivity: The LEO constellation and ground infrastructure are designed for high availability, ensuring continuous communication for critical operations.

- Mission-Critical Support: Globalstar's infrastructure is tailored to meet the demanding requirements of emergency services and other sectors where communication failure is not an option.

- Robust Network Design: The combination of satellite and ground assets creates a resilient system capable of maintaining service in diverse and adverse conditions.

Globalstar offers essential satellite communication for remote operations, ensuring business continuity and safety in areas without cellular coverage. Their services are critical for real-time data and emergency coordination, as seen in 2024's continued demand from industries like oil and gas.

The company’s SPOT devices provide vital safety features, including SOS signaling, which have been instrumental in over 10,000 successful rescues in 2024, highlighting their life-saving capabilities.

Globalstar’s M2M and IoT solutions enable reliable asset tracking and remote monitoring for businesses, a need that surged in 2024 as companies sought better supply chain visibility.

Their licensed Band 53 and n53 spectrum allows for the creation of private, high-performance wireless networks, a significant advantage for mission-critical applications and industrial IoT.

Customer Relationships

Globalstar cultivates deep, enduring connections with its major enterprise, government, and defense clientele. This is achieved through dedicated account management, ensuring a personalized approach to understanding and fulfilling their unique, often complex, operational needs and strategic goals.

These direct relationships are crucial for fostering robust, collaborative partnerships. For instance, Globalstar's commitment to dedicated account management directly supports its role in providing essential communication services to sectors like public safety and emergency response, where reliability and tailored solutions are paramount.

Globalstar prioritizes its reseller and distributor network, equipping them with essential tools, training, and marketing assistance to boost sales of Globalstar products and services. This strategy harnesses partners' market penetration and unique skills to broaden customer acquisition.

Globalstar prioritizes self-service and online support for its consumer devices, such as the SPOT trackers. This approach aims to empower individual users with readily available resources for activation, troubleshooting, and managing their satellite communication services. For instance, in 2024, the company continued to enhance its online knowledge base and user forums, aiming to reduce direct support inquiries by a projected 15% for common issues.

Technical Support and Service Level Agreements (SLAs)

Globalstar provides robust technical support and detailed Service Level Agreements (SLAs) tailored for its business and government customers. These agreements are designed to guarantee exceptional reliability and swift resolution of any service disruptions, which is vital for operations that cannot afford downtime.

For mission-critical sectors like public safety and enterprise logistics, Globalstar’s commitment to uptime is a core component of their customer relationship strategy. For instance, their SLAs often stipulate specific response times and resolution targets, ensuring that clients can depend on consistent performance.

- Guaranteed Uptime: SLAs often define minimum uptime percentages, crucial for businesses relying on continuous connectivity.

- Rapid Response Times: Agreements specify how quickly Globalstar will acknowledge and begin addressing service issues.

- Dedicated Support Channels: Business clients typically have access to specialized support teams for faster, more informed assistance.

- Performance Monitoring: Proactive monitoring helps identify and resolve potential problems before they impact service.

Community Building and User Engagement for Niche Markets

For niche markets like outdoor enthusiasts and adventurers, Globalstar actively cultivates community engagement. This is achieved through dedicated online forums, vibrant social media channels, and direct communication, all designed to foster a sense of belonging and brand loyalty. This approach not only encourages user-generated content and valuable testimonials but also provides crucial insights into evolving user needs.

By understanding these specific user requirements, Globalstar can more effectively tailor its product offerings and marketing strategies. This deep engagement within niche segments is a key driver for promoting product adoption and reinforcing Globalstar's position as a trusted provider for these specialized communities.

- Community Platforms: Globalstar utilizes online forums and social media to connect with users in niche markets.

- User-Generated Content: Encourages testimonials and content creation from users, building trust and authenticity.

- Direct Communication: Facilitates direct interaction to understand and address specific user needs.

- Niche Market Focus: Tailors engagement strategies to resonate with distinct user groups like adventurers.

Globalstar's customer relationships are multifaceted, catering to diverse segments from large enterprises to individual consumers. For its core enterprise, government, and defense clients, Globalstar employs dedicated account management, ensuring bespoke solutions and fostering long-term partnerships. This direct engagement is critical for sectors like public safety, where reliable, tailored communication is essential.

The company also empowers its reseller and distributor network through training and marketing support, leveraging their market reach for broader customer acquisition. For individual users of devices like SPOT trackers, Globalstar emphasizes self-service through enhanced online resources and forums, aiming to improve user autonomy and reduce direct support load. This strategy saw an effort in 2024 to decrease common issue-related support inquiries by an estimated 15% through improved online knowledge bases.

Furthermore, Globalstar nurtures community engagement within niche markets, such as outdoor enthusiasts, via online platforms and social media. This fosters brand loyalty and provides valuable feedback for product development, reinforcing its position as a trusted provider for specialized user groups.

Channels

Globalstar's direct sales force is crucial for securing large enterprise and government contracts, leveraging their ability to handle complex negotiations and build strong client relationships. This approach allows for the development of highly customized solutions, ensuring client needs are met precisely.

In 2024, Globalstar reported that its direct sales efforts were instrumental in securing significant deals, particularly within the public sector and critical infrastructure industries. This channel enables the company to offer tailored service packages and engage in high-value, long-term partnerships.

Value-added resellers (VARs) and distributors form a crucial backbone for Globalstar's market reach, acting as primary conduits to both commercial and individual customers. These partners often integrate Globalstar's satellite communication services and devices into their own specialized solutions, thereby broadening the appeal and utility for end-users.

For instance, companies like Global Telesat Communications (GTC) play a significant role in driving market penetration, especially for Globalstar's SPOT devices and Internet of Things (IoT) solutions. Their efforts are instrumental in expanding the user base for critical safety and asset tracking technologies.

In 2023, Globalstar reported that its service revenue, which is heavily influenced by its distribution channels, saw a notable increase, underscoring the effectiveness of this partnership model in driving commercial success and expanding its customer footprint globally.

Globalstar utilizes its official website as a primary online sales channel, offering direct access to consumer devices such as SPOT trackers and essential accessories. This direct-to-consumer approach streamlines the purchasing process for individuals globally, ensuring easy acquisition of their satellite communication solutions.

Beyond its own digital storefront, Globalstar may engage with established third-party e-commerce platforms. This strategic expansion broadens market reach, allowing a wider customer base to discover and purchase Globalstar products, further driving sales and brand visibility in the competitive online marketplace.

The online sales strategy is crucial for distributing subscriptions alongside hardware. This integrated offering simplifies customer onboarding, enabling users to activate and manage their satellite services conveniently through these digital channels, enhancing the overall customer experience.

Retail Partnerships

Globalstar leverages retail partnerships to distribute its consumer products, like SPOT devices, directly to outdoor enthusiasts and adventurers. This strategy taps into established retail networks, making devices accessible where the target audience shops for related gear. For instance, in 2024, Globalstar continued to strengthen its presence in outdoor and sporting goods retailers, a sector that saw robust consumer spending throughout the year, particularly for safety and communication devices.

These collaborations are crucial for reaching customers who value convenience and a hands-on shopping experience. By being present in physical stores, Globalstar can also benefit from point-of-sale marketing and knowledgeable sales staff. The company's focus on these channels underscores its commitment to making satellite communication solutions readily available to a broad consumer base.

Key aspects of Globalstar's retail partnerships include:

- Broad Accessibility: Partnerships with major outdoor retailers and electronics stores ensure widespread availability of SPOT devices.

- Targeted Marketing: Placement within stores catering to hikers, campers, and travelers allows for effective reach to the core demographic.

- Brand Visibility: Physical retail presence enhances brand recognition and allows consumers to interact with products directly.

- Sales Channel Diversification: Retail partnerships complement online sales, providing multiple avenues for customer acquisition.

Strategic Integrators and System Providers

Globalstar actively collaborates with strategic integrators and system providers to embed its satellite technology and terrestrial spectrum, specifically Band 53, into comprehensive communication and IoT solutions. This partnership approach allows Globalstar to extend its reach into specialized sectors requiring robust private networks and industrial connectivity.

These collaborations are crucial for leveraging Globalstar's XCOM RAN (Radio Access Network) technology, enabling tailored solutions for industries demanding reliable, high-performance wireless networks. By integrating Globalstar's capabilities, system providers can offer enhanced services to their clients, particularly in areas where traditional cellular coverage is limited or insufficient.

- Band 53 Integration: System integrators incorporate Globalstar's licensed 2.4 GHz spectrum (Band 53) into private LTE and 5G networks, offering dedicated wireless solutions for industrial campuses, ports, and other enterprise environments.

- XCOM RAN Solutions: Globalstar's XCOM RAN technology is being deployed by partners to create private cellular networks, enhancing operational efficiency and communication reliability for businesses.

- Market Reach: These strategic partnerships enable Globalstar to tap into niche markets, including critical infrastructure, logistics, and manufacturing, where specialized connectivity is paramount.

- Revenue Streams: The company benefits from wholesale agreements and revenue sharing with partners who deploy its technology within their broader service offerings.

Globalstar's channels are diverse, encompassing direct sales for enterprise, value-added resellers for broad market penetration, and online sales for direct-to-consumer accessibility. Retail partnerships further extend the reach of consumer devices like SPOT trackers.

Strategic integrators leverage Globalstar's technology, including Band 53 spectrum, for specialized private network solutions. This multi-channel approach ensures comprehensive market coverage and caters to a wide array of customer needs, from individual safety to industrial connectivity.

Customer Segments

Government and defense agencies represent a crucial customer segment for Globalstar, relying on its robust satellite network for secure and dependable communications in environments where terrestrial infrastructure is unavailable or compromised. These organizations, including military units and public safety bodies, utilize Globalstar’s services for mission-critical operations, emergency response coordination, and the tracking of vital assets, often in remote or challenging terrains.

Globalstar's ability to provide consistent connectivity is paramount for national security and public safety initiatives. For instance, during disaster relief efforts or in conflict zones, their satellite solutions ensure that first responders and military personnel can maintain vital communication links. The company's commitment to reliable service underpins its value proposition for these high-stakes users, where communication failure can have severe consequences.

Commercial and industrial enterprises, including vital sectors like oil and gas, mining, transportation, logistics, and heavy construction, represent a key customer segment for Globalstar. These businesses frequently operate in remote or off-grid environments where terrestrial connectivity is unreliable or nonexistent. They require robust satellite-based M2M/IoT solutions for critical functions such as monitoring valuable remote assets, efficiently managing their extensive fleets, and transmitting vital operational data back to central command centers.

Globalstar's services directly address the operational challenges faced by these industries. By providing reliable satellite communication, Globalstar empowers these enterprises to significantly enhance their efficiency, bolster safety protocols for their personnel, and improve the overall security of their operations, even in the most challenging and isolated locations. For instance, in 2024, the demand for satellite IoT solutions in the industrial sector saw a notable increase, with reports indicating a 15% year-over-year growth in M2M deployments for asset tracking and remote monitoring across these heavy industries.

Individual consumers and outdoor enthusiasts, including hikers, boaters, and adventurers, rely on Globalstar for personal safety and connectivity in remote locations. SPOT devices, a core offering, provide essential SOS and tracking features for these users. In 2024, the continued growth in outdoor recreation, with an estimated 60% of Americans participating in outdoor activities at least once a year, highlights the sustained demand for reliable communication and safety solutions like those provided by Globalstar.

Emergency Services and Humanitarian Aid Organizations

Emergency services and humanitarian aid organizations are crucial Globalstar customers. These groups, involved in disaster relief, search and rescue, and broader humanitarian efforts, depend on Globalstar's reliable communication capabilities. This is especially true in remote or disaster-stricken areas where terrestrial networks are often compromised or non-existent.

For instance, during major events, Globalstar’s satellite technology ensures that first responders and aid workers can maintain contact, coordinate efforts, and relay vital information. This connectivity is not just a convenience; it's a lifeline that enables efficient operations and ultimately saves lives. The ability to communicate beyond traditional infrastructure is paramount for their mission success.

- Disaster Relief Coordination: In 2024, the frequency and intensity of natural disasters continued to pose significant challenges globally, underscoring the need for robust communication solutions.

- Search and Rescue Operations: Globalstar devices are frequently utilized in remote and challenging terrains, facilitating communication for SAR teams in areas lacking cellular coverage.

- Humanitarian Aid Delivery: Organizations delivering aid in conflict zones or areas with damaged infrastructure rely on Globalstar for secure and consistent communication to manage logistics and ensure personnel safety.

- Critical Infrastructure Resilience: The resilience of communication networks is a key factor for these organizations, and Globalstar provides a vital backup when other systems fail.

Telecommunication Carriers and System Integrators

Telecommunication carriers and system integrators represent a crucial customer segment for Globalstar, particularly those looking to utilize its terrestrial spectrum, Band 53/n53. This spectrum is key for building private networks, enabling advanced 5G applications, and bolstering their existing wireless connectivity services. By partnering with Globalstar, these companies can expand their service portfolios and cater to specialized industrial and enterprise demands.

This strategic collaboration allows telecom providers and integrators to offer enhanced solutions, such as dedicated private LTE or 5G networks for manufacturing plants, logistics hubs, or smart city initiatives. Globalstar's spectrum provides a unique opportunity for these entities to differentiate their offerings in a competitive market. For instance, a system integrator might leverage Globalstar's spectrum to deploy a private 5G network for a large industrial client, ensuring reliable, high-speed communication for mission-critical operations.

- Leveraging Band 53/n53: Enables the creation of private networks and 5G solutions for enterprise clients.

- Expanded Service Offerings: Allows telecom carriers to enhance their existing wireless connectivity portfolios.

- Addressing Niche Markets: Facilitates the targeting of specific industrial or enterprise needs with tailored communication solutions.

- Partnership Opportunities: System integrators can collaborate with Globalstar to deliver advanced wireless infrastructure.

Globalstar serves a diverse customer base, from government agencies requiring secure satellite links to individual consumers seeking safety in remote areas.

Commercial sectors, particularly those in off-grid industries like oil and gas, rely on Globalstar for essential M2M/IoT solutions, with demand for these services growing. In 2024, industrial IoT deployments saw a 15% year-over-year increase.

Telecommunication carriers and system integrators are key partners, utilizing Globalstar's Band 53/n53 spectrum to build private 5G networks and enhance their service portfolios.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Government & Defense | Secure, reliable communication in remote/compromised areas | Mission-critical operations, emergency response |

| Commercial & Industrial | Remote asset monitoring, fleet management, IoT data | 15% YoY growth in satellite IoT for asset tracking (2024) |

| Individual Consumers | Personal safety, tracking in remote locations | 60% of Americans participate in outdoor activities annually |

| Emergency Services & Humanitarian Aid | Communication during disasters, search and rescue | Increased frequency/intensity of natural disasters in 2024 |

| Telecom Carriers & Integrators | Private networks, 5G applications via Band 53/n53 | Enabling specialized industrial and enterprise solutions |

Cost Structure

Satellite operations and maintenance represent substantial recurring expenses for Globalstar. These costs are critical for ensuring the ongoing functionality and reliability of their Low Earth Orbit (LEO) satellite constellation. This includes essential activities like telemetry, tracking, and command (TT&C) operations, along with crucial orbital maneuvers and addressing any system anomalies.

These ongoing expenditures are fundamental to guaranteeing uninterrupted service availability for Globalstar's customers. For instance, in 2023, Globalstar reported that its satellite operations and maintenance expenses, along with depreciation and amortization related to its satellite assets, were a significant component of its overall operating costs.

Globalstar's cost structure heavily features ground infrastructure development and upkeep. This involves significant expenses for building, expanding, and maintaining its worldwide network of ground stations and gateways. These facilities are crucial for communicating with and controlling the satellite constellation.

A substantial portion of these costs goes towards essential equipment, real estate acquisition or leasing for station locations, and ongoing power consumption. Furthermore, the company incurs considerable personnel expenses for the skilled engineers and technicians who manage and operate the Satellite Operations Control Center and the broader network infrastructure.

For instance, in 2023, Globalstar reported capital expenditures of $29.1 million, a portion of which was directed towards network infrastructure improvements and maintenance, reflecting the continuous investment needed to keep its ground segment operational and competitive.

Globalstar's investment in Research and Development (R&D) is vital for pioneering new satellite technologies and improving current offerings like the XCOM RAN and its two-way IoT solutions. These expenditures are essential for maintaining a competitive edge and exploring novel service capabilities.

These R&D costs encompass a range of activities, including the salaries of specialized personnel, the creation of prototypes for new technologies, and rigorous testing of innovative solutions. For instance, in 2023, Globalstar reported R&D expenses of $30.1 million, reflecting a significant commitment to future growth and technological advancement.

Selling, General, and Administrative (SG&A) Expenses

Globalstar's Selling, General, and Administrative (SG&A) expenses are crucial for its operational backbone, encompassing marketing, sales efforts, customer support, and essential corporate functions like legal and finance. These costs are directly tied to the infrastructure and personnel required to bring their satellite services to market and maintain customer relationships.

In 2024, Globalstar's SG&A expenses reflect significant investments in expanding its terrestrial spectrum business and supporting its existing satellite services. For the first quarter of 2024, Globalstar reported SG&A expenses of $32.7 million. This figure highlights the ongoing commitment to sales and marketing initiatives, alongside the necessary administrative overhead for a global telecommunications provider.

Key components driving these costs include:

- Salaries and Benefits: Compensation for sales teams, customer service representatives, and administrative staff.

- Marketing and Advertising: Campaigns to promote their satellite and terrestrial spectrum solutions.

- Commissions: Payments to sales partners and direct sales personnel.

- General and Administrative Overheads: Costs associated with office space, utilities, legal services, and financial management.

Capital Expenditures for Satellite Replacements and Upgrades

Maintaining and modernizing Globalstar's satellite constellation necessitates significant capital expenditures. These investments cover the procurement, manufacturing, and launch of new and replacement satellites, ensuring continued service capability and technological advancement. These are typically substantial, multi-year projects.

For instance, Globalstar's capital expenditures on its second-generation satellite constellation, which began in the mid-2010s, represented a major outlay. By the end of 2023, the company had invested considerably in this modernization effort. Future capital needs will depend on the lifecycle of the current constellation and strategic decisions regarding next-generation technology. For example, in 2023, Globalstar reported capital expenditures of $16.1 million, a portion of which is allocated to ongoing constellation maintenance and potential future upgrades.

- Satellite Replenishment: Ongoing costs associated with replacing aging satellites to maintain orbital coverage and operational efficiency.

- Technological Upgrades: Investments in new satellite technology to enhance service capabilities, data speeds, and overall network performance.

- Launch Services: Significant expenses for the secure and reliable launch of new satellites into orbit, often involving multiple launch providers.

Globalstar's cost structure is dominated by the substantial and ongoing expenses related to operating and maintaining its satellite constellation and ground infrastructure. These recurring costs are essential for ensuring service reliability and network functionality.

Significant investments in research and development are also a key cost driver, fueling innovation in satellite technology and new service offerings. Furthermore, selling, general, and administrative expenses are critical for market presence and customer support.

| Cost Category | 2023 (Millions USD) | Q1 2024 (Millions USD) | Key Drivers |

|---|---|---|---|

| Satellite Operations & Maintenance | Not separately itemized, but a significant portion of operating costs | N/A | TT&C, orbital maneuvers, system anomaly resolution |

| Ground Infrastructure | Part of $29.1M CapEx | N/A | Ground station development, maintenance, equipment, personnel |

| Research & Development (R&D) | $30.1M | N/A | New technology development, personnel, prototyping |

| Selling, General & Administrative (SG&A) | Not separately itemized for 2023 | $32.7M | Sales, marketing, customer support, administrative overhead |

| Capital Expenditures (CapEx) | $16.1M (for constellation maintenance/upgrades) | N/A | Satellite replenishment, technological upgrades, launch services |

Revenue Streams

Service revenue from wholesale capacity agreements is a cornerstone of Globalstar's business model, primarily generated through contracts with large clients, notably a key technology partner, for access to its satellite network. This revenue stream is a significant contributor to Globalstar's overall financial performance and is projected for continued expansion.

For the fiscal year 2023, Globalstar reported total revenue of $207.4 million, with a substantial portion attributed to these capacity agreements. The company's strategic focus on leveraging its network capacity with these wholesale partners underscores its importance as a primary revenue driver.

Globalstar generates recurring revenue through subscription fees for its Mobile Satellite Services (MSS). This includes income from individual and commercial users who rely on the company for voice and data communication, such as satellite phone calls and fixed satellite data services.

This subscription model offers a stable and predictable income stream, a key element in the company's business model. For instance, in the first quarter of 2024, Globalstar reported total revenue of $55.7 million, with a significant portion attributed to its MSS business, highlighting the importance of these recurring fees.

Globalstar generates revenue through recurring monthly or annual subscriptions for its satellite-based Internet of Things (IoT) and Machine-to-Machine (M2M) services. These services are crucial for applications like asset tracking and remote monitoring, providing connectivity where terrestrial networks are unavailable. This subscription-based model ensures a predictable revenue stream for the company.

The commercial IoT and M2M segment has been a significant growth driver for Globalstar. In 2023, the company reported a substantial increase in its IoT segment revenue, reflecting strong demand for its connected solutions. This growth highlights the increasing adoption of satellite technology for critical business operations.

Sales of Subscriber Equipment

Globalstar generates income by directly selling essential hardware to its customers. This includes devices like satellite phones, which are crucial for communication in remote areas, and satellite modems for data connectivity. They also offer consumer-oriented products such as SPOT personal trackers, enhancing safety and location services.

While the ongoing revenue from satellite services is the primary driver of Globalstar's business, the sale of subscriber equipment plays a significant role in its overall financial performance. These hardware sales contribute directly to the company's top line, providing an initial revenue stream as customers onboard onto the Globalstar network.

- Subscriber Equipment Sales: Direct revenue from selling satellite phones, modems, and personal trackers.

- Contribution to Top Line: Equipment sales, though secondary to service revenue, bolster overall income.

- Customer Acquisition: Hardware sales are a key part of bringing new users onto the Globalstar network.

Terrestrial Spectrum (Band 53/n53) Licensing and Services

Globalstar generates revenue by licensing its unique terrestrial spectrum, specifically Band 53 (also known as n53), to various entities. This includes mobile carriers, cable companies, and system integrators who utilize it for building private networks and improving wireless connectivity. This licensing model is a significant and expanding revenue stream for the company.

The development of Globalstar's XCOM RAN (Radio Access Network) technology is a key driver for this growth. XCOM RAN enables more efficient and flexible use of the n53 spectrum, making it attractive for a range of applications beyond traditional mobile services. For instance, in 2024, there's increasing interest in private 5G networks for industrial campuses and enterprise solutions, areas where Globalstar's spectrum can offer distinct advantages.

- Spectrum Licensing: Revenue from leasing Band 53/n53 spectrum to third parties.

- Private Networks: Enabling the creation of dedicated wireless networks for businesses and organizations.

- Enhanced Connectivity: Providing improved wireless performance for various applications.

- XCOM RAN Integration: Leveraging proprietary technology to maximize spectrum utilization and service offerings.

Globalstar's revenue streams are diverse, encompassing wholesale capacity agreements, subscription-based mobile satellite services (MSS), and recurring income from IoT and M2M solutions.

The company also generates revenue through direct sales of subscriber equipment like satellite phones and personal trackers, alongside licensing its terrestrial spectrum, Band 53 (n53), for private network development.

For the first quarter of 2024, Globalstar reported total revenue of $55.7 million, demonstrating the ongoing contribution from these varied revenue channels.

| Revenue Stream | Description | 2023 Data/2024 Trend |

| Wholesale Capacity Agreements | Access to satellite network capacity for large clients. | Significant contributor to 2023 revenue of $207.4M; projected for continued expansion. |

| MSS Subscriptions | Recurring fees for voice and data communication. | Key component of Q1 2024 revenue; stable and predictable income. |

| IoT/M2M Subscriptions | Recurring fees for asset tracking and remote monitoring. | Significant growth driver in 2023; strong demand for connected solutions. |

| Subscriber Equipment Sales | Direct sales of satellite phones, modems, and trackers. | Bolsters overall income; key part of customer acquisition. |

| Spectrum Licensing | Leasing Band 53/n53 spectrum for private networks. | Expanding revenue stream; increasing interest in private 5G networks. |

Business Model Canvas Data Sources

The Globalstar Business Model Canvas is informed by a blend of financial reports, market analysis of the satellite communications sector, and internal operational data. These sources ensure each component of the canvas is grounded in factual evidence and strategic understanding.