Globalstar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globalstar Bundle

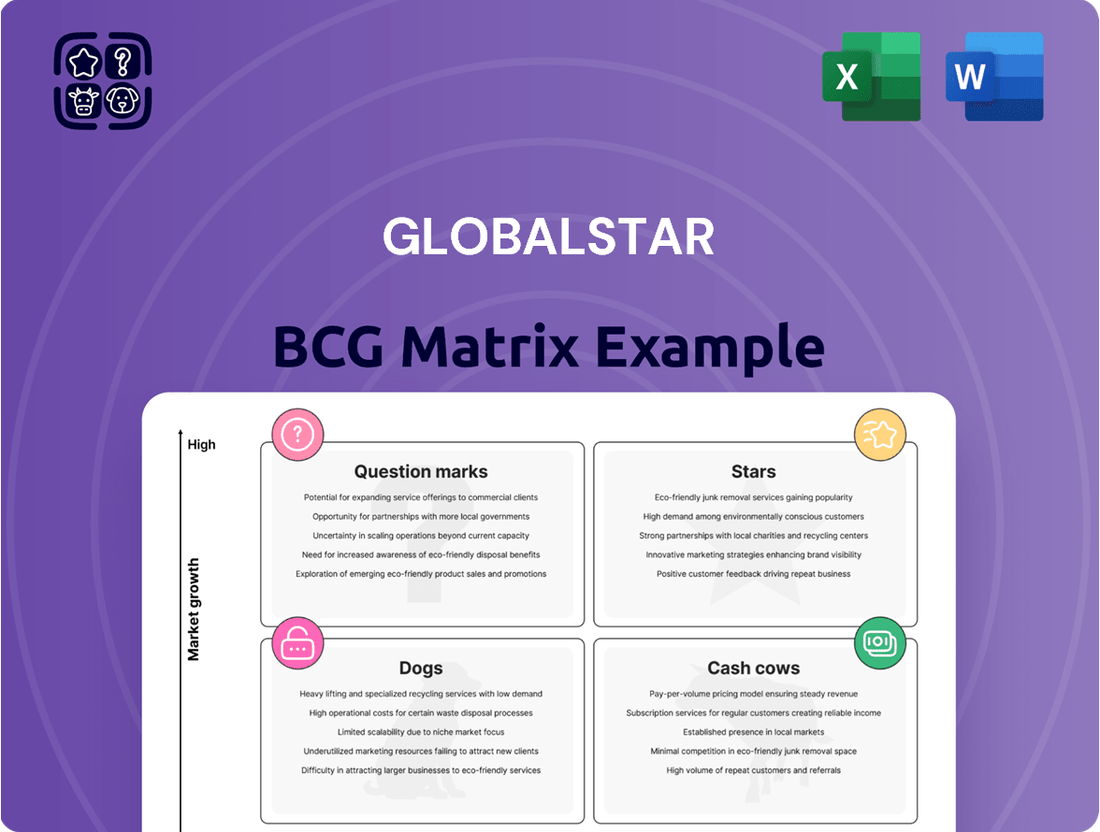

Curious about Globalstar's strategic product positioning? Our BCG Matrix analysis reveals which of their offerings are market leaders (Stars), steady income generators (Cash Cows), resource drains (Dogs), or potential growth opportunities (Question Marks). This glimpse is just the beginning of understanding their competitive edge.

Unlock the full potential of this analysis by purchasing the complete Globalstar BCG Matrix. Gain detailed quadrant placements, data-driven insights, and actionable recommendations to optimize your investment and product development strategies.

Don't miss out on the complete picture. The full BCG Matrix provides a clear roadmap to understanding Globalstar's market performance and making informed strategic decisions for future success. Invest in clarity today.

Stars

Globalstar's wholesale capacity services are a significant player in the satellite communications market. In the fourth quarter of 2024, this segment experienced robust growth, fueled by a substantial new contract. This surge led to an 18% increase in Q4 2024, underscoring its importance to the company's overall performance.

The strength in wholesale capacity services was the main engine behind Globalstar's impressive 16% service revenue growth for the entirety of 2024. This segment's success directly contributed to Globalstar achieving a record annual adjusted EBITDA of $135.3 million in 2024. This financial milestone highlights the segment's high market share within the expanding wholesale satellite capacity sector.

The SPOT product line, encompassing devices like the SPOT Gen4, SPOT X, and SPOT Trace, demonstrated robust performance in 2024. Sales in the UK alone saw a substantial 35% increase, reaching over 10,800 units through a major reseller.

This impressive device sales growth, combined with Globalstar's satellite technology facilitating 10,000 rescues in 2024, underscores the SPOT line's strong position. It suggests a significant market share within the expanding personal safety and tracking device sector.

Globalstar's commercial IoT solutions are a significant growth driver, evidenced by a 25% year-over-year increase in service revenue during Q2 2024. This surge is attributed to a growing subscriber base and higher average revenue per user.

With around 481,000 active commercial IoT devices currently deployed, Globalstar is well-positioned within a substantial $2.4 billion total addressable market. This indicates a strong current market presence and considerable future expansion opportunities for their IoT offerings.

Band n53 Terrestrial Spectrum

Globalstar's Band n53 terrestrial spectrum is a significant asset, currently deployed across 12 countries and reaching close to 1 billion Points of Presence (POPs). This includes comprehensive 100% coverage throughout the United States, Canada, and Mexico, positioning it strongly for terrestrial wireless services.

The successful completion of the first live 5G data call utilizing n53 spectrum in conjunction with XCOM RAN, achieving impressive speeds of 100 Mbps download and 60 Mbps upload, underscores its substantial growth potential.

- Strategic Deployment: Band n53 covers nearly 1 billion Points of Presence (POPs) across 12 countries, with 100% coverage in the U.S., Canada, and Mexico.

- 5G Capabilities: The first live 5G data call achieved 100/60 Mbps speeds using n53 and XCOM RAN.

- Market Potential: High growth potential exists in the terrestrial wireless market, particularly for mission-critical applications and private networks.

Partnership with Apple for Direct-to-Device Services

Globalstar's partnership with Apple, solidified by an expanded agreement in November 2024, marks a pivotal moment for its direct-to-device satellite services. This collaboration significantly bolsters capabilities for Emergency SOS, Roadside Assistance, Messages, and the Find My feature, directly leveraging Globalstar's network.

Apple's commitment is substantial, involving an investment of up to $1.1 billion. This capital infusion is designated for the construction of new satellites and the enhancement of ground infrastructure, crucial for expanding service reach and reliability. Apple also secured a passive 20% equity interest in Globalstar, underscoring the strategic importance of this alliance.

- Apple's Investment: Up to $1.1 billion for satellite and infrastructure development.

- Equity Stake: Apple holds a passive 20% equity interest in Globalstar.

- Service Expansion: Enhanced direct-to-device capabilities for Emergency SOS, Roadside Assistance, Messages, and Find My.

- Market Potential: Positions Globalstar in a high-growth segment driven by consumer demand for ubiquitous connectivity.

Globalstar's wholesale capacity services are a significant player in the satellite communications market. In the fourth quarter of 2024, this segment experienced robust growth, fueled by a substantial new contract. This surge led to an 18% increase in Q4 2024, underscoring its importance to the company's overall performance.

The strength in wholesale capacity services was the main engine behind Globalstar's impressive 16% service revenue growth for the entirety of 2024. This segment's success directly contributed to Globalstar achieving a record annual adjusted EBITDA of $135.3 million in 2024. This financial milestone highlights the segment's high market share within the expanding wholesale satellite capacity sector.

The SPOT product line, encompassing devices like the SPOT Gen4, SPOT X, and SPOT Trace, demonstrated robust performance in 2024. Sales in the UK alone saw a substantial 35% increase, reaching over 10,800 units through a major reseller.

This impressive device sales growth, combined with Globalstar's satellite technology facilitating 10,000 rescues in 2024, underscores the SPOT line's strong position. It suggests a significant market share within the expanding personal safety and tracking device sector.

Globalstar's commercial IoT solutions are a significant growth driver, evidenced by a 25% year-over-year increase in service revenue during Q2 2024. This surge is attributed to a growing subscriber base and higher average revenue per user.

With around 481,000 active commercial IoT devices currently deployed, Globalstar is well-positioned within a substantial $2.4 billion total addressable market. This indicates a strong current market presence and considerable future expansion opportunities for their IoT offerings.

Globalstar's Band n53 terrestrial spectrum is a significant asset, currently deployed across 12 countries and reaching close to 1 billion Points of Presence (POPs). This includes comprehensive 100% coverage throughout the United States, Canada, and Mexico, positioning it strongly for terrestrial wireless services.

The successful completion of the first live 5G data call utilizing n53 spectrum in conjunction with XCOM RAN, achieving impressive speeds of 100 Mbps download and 60 Mbps upload, underscores its substantial growth potential.

- Strategic Deployment: Band n53 covers nearly 1 billion Points of Presence (POPs) across 12 countries, with 100% coverage in the U.S., Canada, and Mexico.

- 5G Capabilities: The first live 5G data call achieved 100/60 Mbps speeds using n53 and XCOM RAN.

- Market Potential: High growth potential exists in the terrestrial wireless market, particularly for mission-critical applications and private networks.

Globalstar's partnership with Apple, solidified by an expanded agreement in November 2024, marks a pivotal moment for its direct-to-device satellite services. This collaboration significantly bolsters capabilities for Emergency SOS, Roadside Assistance, Messages, and the Find My feature, directly leveraging Globalstar's network.

Apple's commitment is substantial, involving an investment of up to $1.1 billion. This capital infusion is designated for the construction of new satellites and the enhancement of ground infrastructure, crucial for expanding service reach and reliability. Apple also secured a passive 20% equity interest in Globalstar, underscoring the strategic importance of this alliance.

- Apple's Investment: Up to $1.1 billion for satellite and infrastructure development.

- Equity Stake: Apple holds a passive 20% equity interest in Globalstar.

- Service Expansion: Enhanced direct-to-device capabilities for Emergency SOS, Roadside Assistance, Messages, and Find My.

- Market Potential: Positions Globalstar in a high-growth segment driven by consumer demand for ubiquitous connectivity.

Globalstar's wholesale capacity services are considered a Star in the BCG matrix due to their strong revenue growth, evidenced by an 18% increase in Q4 2024 and a 16% service revenue growth for the full year 2024. This segment's performance directly contributed to a record annual adjusted EBITDA of $135.3 million in 2024, demonstrating high market share in a growing sector.

The SPOT product line also exhibits Star characteristics, with significant sales growth, such as a 35% increase in UK sales for the SPOT Gen4, SPOT X, and SPOT Trace devices. The technology's role in facilitating 10,000 rescues in 2024 further solidifies its strong market position in personal safety and tracking.

Globalstar's direct-to-device services, particularly through its partnership with Apple, represent a significant emerging Star. Apple's substantial investment of up to $1.1 billion for satellite development and infrastructure, alongside a passive 20% equity stake, highlights the immense market potential and strategic importance of these enhanced connectivity features.

The Band n53 terrestrial spectrum is a clear Star, with extensive deployment across 12 countries and 100% coverage in the US, Canada, and Mexico, reaching close to 1 billion Points of Presence. The successful 5G data call achieving 100 Mbps download and 60 Mbps upload speeds points to substantial growth potential in the terrestrial wireless market.

| Segment | 2024 Performance | Market Position | BCG Category |

| Wholesale Capacity | 16% Service Revenue Growth, Record $135.3M Adj. EBITDA | High Market Share in Growing Sector | Star |

| SPOT Product Line | 35% UK Sales Growth, 10,000 Rescues Facilitated | Strong Position in Personal Safety/Tracking | Star |

| Direct-to-Device (Apple Partnership) | Up to $1.1B Apple Investment, 20% Equity Stake | High Growth Potential in Ubiquitous Connectivity | Star |

| Band n53 Spectrum | 1B POPs Coverage, 100 Mbps/60 Mbps 5G Speeds | Significant Growth Potential in Terrestrial Wireless | Star |

What is included in the product

The Globalstar BCG Matrix analyzes its satellite services, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides investment decisions, focusing on growth opportunities and resource allocation for each service.

A clear BCG Matrix visualizes Globalstar's portfolio, easing the pain of unclear strategic focus.

Cash Cows

Globalstar's existing satellite voice and data services function as a Cash Cow in its BCG Matrix. These established mobile satellite services (MSS) offer dependable communication in areas lacking cellular coverage, catering to a dedicated customer base.

Despite operating in a mature market, these services consistently generate substantial cash flow. This stability is bolstered by a strong distribution network and a well-recognized brand, particularly within the outdoor and adventure sectors.

The SmartOne C satellite IoT transmitter exemplifies a classic cash cow for Globalstar. Its consistent demand, highlighted by a recent large purchase for oil and gas pipeline monitoring, underscores its mature market position and reliable revenue generation. This product is a significant contributor to Globalstar's Commercial IoT segment, which achieved record annual service revenue, demonstrating its ability to generate substantial cash flow with minimal investment.

Globalstar's long-standing government and defense contracts, particularly its exclusive partnership with Parsons for public sector and defense applications announced in December 2024, represent a significant cash cow. This stable, predictable revenue stream from a major government contractor underpins Globalstar's financial stability.

Legacy Duplex Subscriber Base

The legacy Duplex subscriber base, while seeing some expected customer attrition, has been a consistent source of revenue for Globalstar. This segment, though characterized by low growth, still generates valuable cash flow. Crucially, it demands very little in terms of new investment for marketing or expanding its reach.

This segment acts as a classic cash cow within Globalstar's business portfolio. Its stability allows the company to allocate resources to more promising growth areas. For instance, in 2024, Globalstar's focus has been on expanding its SPOT and Sat-Fi product lines, leveraging the cash generated from established services like Duplex.

Key aspects of the Legacy Duplex Subscriber Base:

- Historical Revenue Contribution: The Duplex service has a proven track record of generating revenue for Globalstar over many years.

- Low Growth, Stable Cash Flow: While not a growth engine, this segment reliably produces cash with minimal need for reinvestment.

- Minimal Investment Required: Marketing and operational expenses for maintaining the Duplex base are relatively low.

- Strategic Importance: The cash generated supports investment in higher-potential Globalstar offerings.

Satellite Network Infrastructure (Existing Constellation)

Globalstar's existing satellite network infrastructure, a constellation of LEO satellites, functions as a robust cash cow. This established asset provides reliable global connectivity, underpinning current service revenues and offering a stable platform for future service expansion.

The operational maintenance of this constellation, while an ongoing cost, is outweighed by its consistent revenue generation. In 2024, Globalstar reported service revenue of $177.9 million, a significant portion of which is directly attributable to its existing satellite network.

- Existing Constellation: Globalstar's LEO satellite network serves as its primary cash-generating asset.

- Revenue Generation: The infrastructure supports existing services, contributing significantly to overall revenue.

- Foundation for Growth: It provides a stable base for introducing new services and expanding market reach.

- 2024 Financials: Service revenue in 2024 reached $177.9 million, highlighting the network's income-producing capability.

Globalstar's established mobile satellite services (MSS) are its core cash cows, providing dependable communication where cellular coverage is absent. These services, particularly for outdoor enthusiasts and remote industries, generate consistent revenue with minimal need for further investment. The SmartOne C transmitter, a key product in the Commercial IoT segment, exemplifies this, contributing to record annual service revenue in 2024.

The company's legacy Duplex subscriber base, while experiencing some attrition, continues to be a stable revenue source. This segment requires very little in terms of marketing or expansion, allowing Globalstar to reallocate capital to growth areas like SPOT and Sat-Fi. Furthermore, Globalstar's existing LEO satellite constellation, which generated a substantial portion of the $177.9 million in service revenue reported for 2024, acts as a foundational cash cow, supporting current operations and future service development.

| Product/Service | BCG Category | Key Characteristics | 2024 Relevance |

| Mobile Satellite Services (MSS) | Cash Cow | Mature market, stable revenue, low investment | Core revenue driver, supports growth initiatives |

| SmartOne C Transmitter | Cash Cow | Consistent demand, reliable IoT revenue | Record annual service revenue contribution |

| Legacy Duplex Subscribers | Cash Cow | Low growth, high cash flow, minimal reinvestment | Funds investment in new product lines |

| Existing Satellite Network | Cash Cow | Provides infrastructure for services, stable income | Underpins $177.9 million service revenue |

Preview = Final Product

Globalstar BCG Matrix

The Globalstar BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis. You can confidently use this preview as an accurate representation of the complete BCG Matrix file that will be delivered to you, enabling immediate application in your business planning and decision-making processes.

Dogs

Globalstar's older generation satellite phones, while historically important, are likely positioned as Dogs in the BCG matrix. These devices are experiencing a decline in market relevance as newer technologies offer more features and better integration, leading to shrinking market share.

These legacy products are characterized by low growth and low market share, potentially generating minimal revenue or even requiring ongoing investment to maintain. For instance, as of late 2023, the satellite communication market is increasingly dominated by LEO constellations offering higher bandwidth and lower latency, making older satellite phone technology less competitive.

Globalstar's satellite network, while robust, faces the challenge of underutilized capacity outside of its burgeoning IoT segment and wholesale agreements. This excess capacity, if not strategically monetized, represents a potential 'dog' in the BCG matrix, indicating an asset with low market share and low growth prospects.

For instance, if a significant portion of Globalstar's satellite bandwidth remains unsold or unallocated to revenue-generating services, it directly impacts the company's return on investment for that capacity. While Globalstar has been investing in its terrestrial spectrum and expanding its IoT offerings, any satellite capacity not contributing to these growth areas or wholesale revenue streams is essentially a dormant asset.

Globalstar's legacy services, beyond the expected decline in Duplex, are experiencing a notable contraction in their subscriber base. These are services where investment for revival is unlikely to be fruitful, indicating a strategic shift away from these offerings.

While specific legacy service names are not detailed, the overall trend points to a shrinking demand for older technologies or applications within Globalstar's portfolio. This decline is sustained and lacks a clear strategy for revitalization.

Non-strategic or Outdated Ground Station Infrastructure

Non-strategic or outdated ground station infrastructure within Globalstar's portfolio can be categorized as 'dogs' in the BCG matrix. These are facilities or equipment not slated for current strategic upgrades or expansions, such as those planned for Japan, Canada, and Spain. Their utility for future high-growth services is limited, potentially leading to ongoing maintenance expenses without substantial revenue generation or strategic advantage.

These assets represent a drain on resources. For instance, if a ground station facility built in the early 2000s for a legacy service is no longer critical to Globalstar's evolving satellite network, it falls into this category. The company must carefully assess the cost of maintaining such infrastructure against its minimal contribution to current or future revenue streams.

- Limited Future Utility: Assets not aligned with strategic growth areas like advanced IoT solutions or next-generation satellite services.

- Maintenance Costs: Ongoing expenses for facilities or equipment that do not generate significant revenue.

- Resource Allocation: Potential to reallocate capital and personnel from these 'dog' assets to more promising ventures.

Certain Niche, Low-Demand Data Services

Certain niche, low-demand data services within Globalstar's portfolio likely fall into the Dogs category of the BCG Matrix. These are services that have struggled to gain significant market traction, perhaps due to being outpaced by newer technologies or failing to capture a substantial user base. For instance, older, low-speed data transmission services that aren't integral to the burgeoning IoT or direct-to-device markets would fit this description.

These offerings typically exhibit both low market share and low growth prospects. They consume valuable resources, including capital and personnel, without generating commensurate returns. This ties up assets that could be better allocated to more promising ventures within Globalstar's business. As of 2024, many legacy satellite communication services face this challenge as the industry rapidly innovates.

- Low Market Share: These services likely represent a very small percentage of Globalstar's overall revenue, potentially in the low single digits.

- Low Growth Prospects: The market for these specific niche services is not expanding, and in many cases, is likely contracting as better alternatives emerge.

- Resource Drain: Maintaining and supporting these offerings diverts resources from higher-potential areas like advanced satellite IoT solutions.

- Limited Competitive Advantage: They may lack a clear differentiator in a market increasingly focused on speed, efficiency, and specialized applications.

Globalstar's older generation satellite phones and legacy services are prime examples of "Dogs" in the BCG matrix. These products, facing declining relevance and shrinking subscriber bases, represent low market share and low growth within the evolving satellite communication landscape. As of 2024, the rapid advancement in LEO constellations has further diminished the competitive edge of these older technologies.

These 'dog' assets, including underutilized satellite capacity and non-strategic ground station infrastructure, consume resources without generating significant returns. For instance, if a substantial portion of Globalstar's bandwidth remains unsold, it directly impacts the return on investment for that capacity. The company's strategy increasingly focuses on reallocating capital and personnel from these underperforming areas to more promising ventures like advanced IoT solutions.

Niche, low-demand data services also fall into this category, characterized by minimal market traction and limited competitive advantage. These offerings, often in the low single digits of revenue contribution, divert resources from higher-potential areas, highlighting the need for careful assessment of maintenance costs versus revenue generation.

Globalstar's focus is shifting towards leveraging its network for high-growth segments, implying a strategic divestment or minimal investment in these 'dog' assets to optimize resource allocation.

Question Marks

Globalstar's XCOM RAN, launched in early 2024, is positioned as a potential star in the BCG matrix. This terrestrial wireless solution is designed for high-demand indoor settings and difficult radio frequency areas, targeting sectors like industrial 4.0, manufacturing, ports, and logistics.

The XCOM RAN shows significant promise, evidenced by a major global retailer's planned deployment in 2025 and successful 5G data calls. However, as a nascent product with a low initial market share, it necessitates substantial strategic investment to capture a larger portion of the market.

Globalstar's new two-way satellite IoT module, slated for a Q2 2025 launch, is positioned as a "question mark" in the BCG matrix. This strategic move targets the burgeoning global IoT market, which is projected to reach $1.5 trillion, offering significant growth potential.

The module's introduction into this rapidly expanding sector signifies high growth prospects. However, as a nascent product with minimal initial market penetration, it requires substantial investment to build brand awareness and secure market share, characteristic of a question mark.

Globalstar's C-3 system deployment is a significant undertaking, with satellite launches slated for late 2025 and 2026. This ambitious expansion aims to bolster their ground infrastructure and introduce third-generation mobile satellite capabilities. While promising enhanced direct-to-device services, the substantial upfront investment and uncertain future market share position this initiative as a question mark within the BCG matrix.

The C-3 system represents a substantial capital expenditure for Globalstar, with ongoing costs associated with its development and deployment. Although the future capacity and service enhancements are clear benefits, the realization of returns is still some time away. This high cash consumption, coupled with the developing market penetration for these new services, places the C-3 system firmly in the question mark category.

Expansion into New Geographies/Market Verticals for IoT/D2D

Globalstar's strategic push into new geographies and market verticals, such as warehouse automation and fleet management, positions these initiatives as potential Stars in the BCG matrix. These are high-growth areas where Globalstar likely has a relatively low current market share, necessitating substantial investment in marketing and product development to capture significant market penetration. For instance, the global IoT market was projected to reach over $1.1 trillion in 2024, with significant growth expected in industrial and automotive applications.

- High-Growth Potential: Targeting rapidly expanding sectors like automotive IoT and animal tracking offers substantial revenue opportunities.

- Market Penetration Challenges: Entering these new verticals requires significant upfront investment in sales, marketing, and infrastructure to build brand awareness and customer base.

- Capacity Expansion: Globalstar's commitment to increasing mobile satellite coverage and capacity directly supports its ability to serve these new, growing markets effectively.

- Strategic Investment: The company's focus on these areas indicates a strategic allocation of resources to capitalize on emerging trends and secure future growth.

Direct-to-Cellular Messaging and Data Services (beyond Apple partnership)

While Globalstar's partnership with Apple for satellite-based messaging is a significant asset, its broader direct-to-cellular (DTC) messaging and data services outside this exclusive agreement represent a question mark in the BCG matrix. This emerging sector is experiencing rapid growth, with numerous new players entering the market. For Globalstar to effectively compete and capture market share in this wider DTC landscape, substantial investment will be necessary to develop and enhance its offerings.

Globalstar's ability to secure additional partnerships with other mobile network operators for its DTC services is crucial for its growth potential in this segment. The company's 2024 revenue from its service segment, which includes these broader offerings, will be a key indicator of its progress. As of the first quarter of 2024, Globalstar reported a service revenue of $49.2 million, demonstrating an ongoing revenue stream from its existing services.

- Market Growth: The DTC satellite communication market is projected to grow significantly in the coming years, driven by increasing demand for connectivity in remote areas and for IoT applications.

- Competitive Landscape: Several companies are investing heavily in DTC technology, creating a competitive environment that requires continuous innovation and strategic partnerships for Globalstar.

- Investment Needs: Expanding DTC services beyond the Apple partnership will likely necessitate considerable capital expenditure for network upgrades, technology development, and marketing efforts.

- Partnership Strategy: Securing agreements with other mobile network operators is vital for Globalstar to scale its DTC offerings and achieve broader market penetration.

Globalstar's new two-way satellite IoT module, launched in Q2 2025, targets the rapidly expanding global IoT market, projected to reach $1.5 trillion. Despite this high-growth potential, its nascent status and minimal initial market penetration necessitate substantial investment in brand awareness and market share acquisition, characteristic of a question mark.

The C-3 system deployment, with satellite launches in late 2025 and 2026, aims to enhance direct-to-device services. However, the significant upfront investment and uncertain future market share for these new capabilities position it as a question mark, requiring substantial capital expenditure with returns not yet realized.

Globalstar's broader direct-to-cellular (DTC) messaging and data services, beyond its exclusive Apple partnership, represent a question mark. This emerging sector is experiencing rapid growth, but capturing market share requires substantial investment in developing and enhancing offerings, with securing additional partnerships being crucial.

| Initiative | Market Growth | Market Share | Investment Needs | BCG Category |

| Two-way Satellite IoT Module | High (Global IoT market $1.5T) | Low | High | Question Mark |

| C-3 System Deployment | High (Enhanced DTC services) | Uncertain | High (Capital Expenditure) | Question Mark |

| Broader DTC Services | High (Emerging Sector) | Low | High | Question Mark |

BCG Matrix Data Sources

Our Globalstar BCG Matrix is informed by a comprehensive blend of financial disclosures, market growth projections, and competitive analysis. This ensures accurate positioning of Globalstar's offerings within the satellite communications industry.