Globalstar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globalstar Bundle

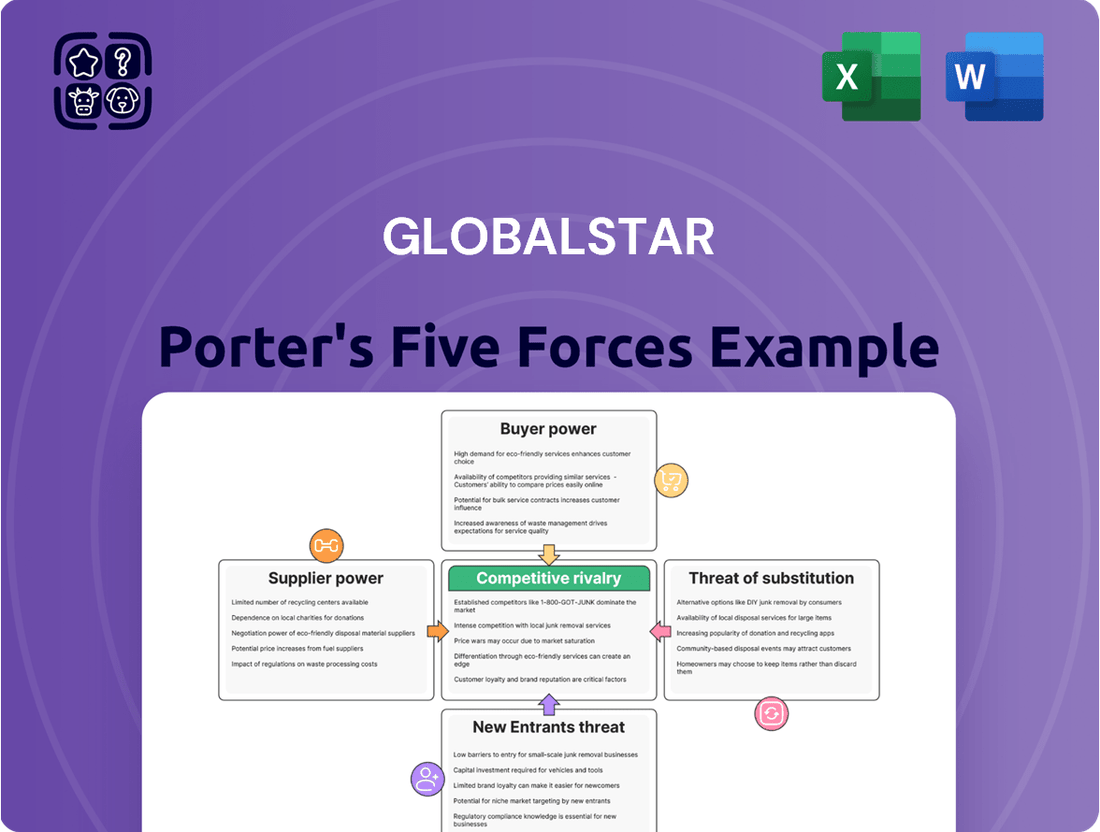

Globalstar operates in a dynamic satellite communications landscape, facing moderate threats from new entrants due to high capital requirements and established network effects. Buyer power is present, particularly from large enterprise clients, while supplier power is somewhat limited by the niche nature of satellite technology.

The threat of substitutes, such as terrestrial mobile networks, remains a key consideration, though Globalstar's unique remote coverage offers a distinct advantage. Competitive rivalry within the satellite communications sector is intensifying, demanding strategic differentiation and cost management.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Globalstar’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Globalstar's reliance on a small number of specialized satellite and ground segment technology manufacturers, like MDA Space and Thales Alenia Space, significantly boosts supplier bargaining power. These suppliers offer critical, hard-to-replace components and services essential for Globalstar's operations.

The specialized nature of satellite manufacturing, a market valued at $27.8 billion in 2023, means these few qualified suppliers hold considerable market sway. This concentration limits Globalstar's options and strengthens the suppliers' ability to dictate terms.

Globalstar faces significant supplier bargaining power due to high switching costs. Transitioning from one satellite manufacturer or launch service provider to another necessitates extensive system redesigns, rigorous retesting for compatibility, and the negotiation of entirely new contractual frameworks. These considerable hurdles make it challenging for Globalstar to readily pivot to alternative suppliers, even when facing less favorable terms.

The components and services Globalstar relies on, like satellite transponders and launch services, are absolutely vital for keeping its mobile satellite network running. If a supplier faces disruptions or quality issues, it directly affects Globalstar's service delivery, giving those suppliers significant bargaining power.

Dominance of Launch Service Providers

The bargaining power of suppliers in the satellite industry, particularly for launch services, is considerable. Companies like SpaceX, which are capable of deploying Low Earth Orbit (LEO) constellations, wield significant influence. SpaceX alone executed over 90 launches in 2024, highlighting its dominant position in the market.

This concentration of specialized launch capabilities means that satellite operators, such as Globalstar, face limited options. The scarcity of providers adept at these complex deployments directly affects Globalstar's operational costs and the timelines for introducing new or replacing existing satellites.

- Launch Service Dominance: SpaceX's substantial launch volume in 2024 underscores its control over the launch market.

- Limited Alternatives: The restricted number of providers capable of LEO constellation deployment grants them leverage.

- Cost and Schedule Impact: Globalstar's satellite deployment plans are directly influenced by the pricing and availability offered by these powerful launch providers.

Technological Expertise and Intellectual Property

Globalstar's suppliers often hold significant technological expertise and intellectual property, particularly in areas like satellite design, manufacturing, and launch services. This specialized knowledge makes it challenging and costly for Globalstar to replicate these capabilities internally, thus heightening its dependence on these key suppliers.

The proprietary nature of this advanced technology allows suppliers to command premium pricing. For instance, companies specializing in complex satellite components or unique launch solutions can leverage their intellectual property to negotiate more favorable terms, impacting Globalstar's cost structure.

- Proprietary Technology: Suppliers possess unique knowledge in satellite systems, making in-house development difficult for Globalstar.

- Barriers to Entry: This expertise creates a barrier, limiting Globalstar's options and increasing reliance on existing suppliers.

- Pricing Power: Advanced technological capabilities enable suppliers to charge higher prices for their specialized products and services.

Globalstar's bargaining power with suppliers is constrained by the industry's high concentration and the specialized nature of its needs. Key suppliers of satellite technology and launch services, such as MDA Space and SpaceX, hold significant leverage due to limited alternatives and high switching costs for Globalstar.

The satellite manufacturing market's $27.8 billion valuation in 2023 and the dominance of a few providers in launch services, exemplified by SpaceX's over 90 launches in 2024, illustrate this supplier strength. This scarcity directly impacts Globalstar's operational costs and deployment schedules.

Furthermore, suppliers' proprietary technology and specialized expertise create substantial barriers for Globalstar to develop capabilities internally, further empowering them to dictate terms and pricing.

| Supplier Characteristic | Impact on Globalstar | Supporting Data/Fact |

|---|---|---|

| Limited Number of Specialized Providers | Reduced negotiation options for Globalstar | Satellite manufacturing market dominated by a few key players. |

| High Switching Costs | Increased dependence on existing suppliers | System redesigns and retesting required for supplier changes. |

| Proprietary Technology & Expertise | Higher pricing power for suppliers | Difficult and costly for Globalstar to replicate advanced satellite tech internally. |

| Launch Service Concentration | Influence over Globalstar's deployment timelines and costs | SpaceX's significant launch volume in 2024 (over 90 launches). |

What is included in the product

This analysis delves into the competitive forces impacting Globalstar, examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the satellite communications market.

Easily visualize Globalstar's competitive landscape with a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

Globalstar's customer base is quite varied, encompassing individuals, businesses, government agencies, and crucial emergency services. These diverse groups rely on Globalstar for everything from basic phone calls and data to more specialized applications like machine-to-machine communication and personal tracking devices.

This wide spectrum of users, each with distinct requirements, generally means that no single customer segment holds significant sway over Globalstar. The company’s revenue is spread across these different user groups, which naturally limits the bargaining power any one customer or group can exert.

For customers in remote locations without cellular service, Globalstar's satellite connectivity is often a necessity, not a luxury. This essential nature of the service, particularly for critical operations like emergency response or managing remote infrastructure, significantly limits their power to negotiate lower prices. For instance, industries relying on remote asset monitoring, such as mining or oil and gas, depend on this constant communication link, making price a secondary concern to reliability.

While not as high as Globalstar's supplier switching costs, customers using Globalstar's specialized satellite phones, modems, or SPOT trackers may incur some costs to switch to a competitor. These could include purchasing new hardware, adapting existing systems, or retraining personnel, which can slightly reduce customer bargaining power.

Price Sensitivity in Certain Segments

While Globalstar's satellite services are crucial for many, certain customer groups, especially individual consumers and some Internet of Things (IoT) deployments, exhibit a notable price sensitivity. This means that the cost of Globalstar's offerings directly impacts their purchasing decisions, particularly when compared to more established terrestrial options.

Globalstar's financial performance in 2024 reflects this. The company reported an average revenue per user (ARPU) of around $30, a figure that underscores how pricing plays a significant role in customer acquisition and retention within these more price-conscious segments. This sensitivity creates a dynamic where competitive pricing is a key factor for market share.

- Price Sensitivity: Consumers and certain commercial IoT applications are sensitive to the cost of satellite services.

- ARPU Indicator: Globalstar's 2024 ARPU of approximately $30 highlights the impact of pricing on customer value.

- Competitive Landscape: Terrestrial alternatives often present a lower-cost option, intensifying price pressure on Globalstar.

Potential for Large-Scale Contracts with Key Customers

Globalstar's strategic partnerships with major clients, like the wholesale capacity agreement that contributed substantially to its Q1 2025 revenue, highlight the potential for large-scale contracts. This reliance on significant customer volumes, however, can amplify customer bargaining power.

A single large customer, by virtue of its substantial commitment, can exert considerable influence to negotiate more advantageous pricing or service terms. This dynamic means that while these relationships are revenue drivers, they also present a concentration risk where a key client's leverage could impact profitability.

- Revenue Dependence: Globalstar's Q1 2025 results were bolstered by significant revenue from wholesale capacity services, indicating the importance of large customer contracts.

- Leverage through Volume: The sheer volume of business provided by these key customers grants them considerable leverage in price and term negotiations.

- Potential for Margin Pressure: Increased customer bargaining power can lead to reduced profit margins for Globalstar if concessions are made to retain these large accounts.

Globalstar's customer base is diverse, ranging from individuals to governments, with no single segment dominating. This broad user base generally limits the bargaining power of any one customer. However, customers in remote areas or those requiring critical communication, such as emergency services, have limited alternatives, thus reducing their negotiation leverage.

While some customers, particularly individual consumers and IoT users, are price-sensitive, Globalstar's average revenue per user (ARPU) in 2024 was around $30, indicating the importance of pricing. Switching costs, though present for users of specialized hardware, are generally not prohibitive enough to significantly curb customer power.

Large clients, such as those involved in wholesale capacity agreements, can wield considerable bargaining power due to their substantial business volume. For example, a significant portion of Globalstar's Q1 2025 revenue stemmed from such large-scale contracts, granting these clients leverage in negotiating terms and pricing, potentially impacting Globalstar's margins.

| Customer Segment | Dependence on Globalstar | Bargaining Power | Key Considerations |

| Individuals/Consumers | Low to Moderate | Moderate | Price sensitivity, availability of alternatives |

| Businesses (IoT, M2M) | Moderate to High | Moderate to High | Switching costs, service reliability, pricing |

| Government/Emergency Services | High | Low | Critical need, limited alternatives, reliability paramount |

| Wholesale Capacity Clients | High | High | Volume of business, contract terms, potential for concessions |

Same Document Delivered

Globalstar Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Globalstar Porter's Five Forces Analysis details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the satellite communications industry. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing you with actionable insights for strategic decision-making.

Rivalry Among Competitors

The satellite communication industry is intensely competitive, with established giants like Iridium Communications and Inmarsat directly challenging Globalstar. These companies vie for customers across voice, data, and the burgeoning M2M/IoT markets.

For instance, Iridium reported approximately $687 million in revenue for 2023, showcasing its significant market presence. Inmarsat, while privately held, is a major player with substantial infrastructure and a broad service offering, further intensifying the competitive landscape for Globalstar.

Globalstar faces escalating competition from emerging Low Earth Orbit (LEO) satellite constellations and massive mega-constellations. Companies like SpaceX with its Starlink and Amazon's Project Kuiper are significantly increasing satellite capacity and delivering high-speed internet services. This surge in advanced offerings directly challenges Globalstar's established service portfolio.

These new LEO ventures are poised to disrupt the satellite communications market by offering lower latency and higher bandwidth than traditional geostationary (GEO) satellites. For instance, Starlink aims to deploy tens of thousands of satellites, a scale far exceeding Globalstar's current operational fleet, potentially capturing a substantial market share in broadband and enterprise solutions.

The satellite communications sector is defined by a relentless innovation race. Companies are pouring resources into research and development, aiming to deliver enhanced services, reduced latency, and more affordable options. This constant push for technological superiority intensifies rivalry among established players and emerging disruptors.

Globalstar is actively participating in this innovation race. Their strategic focus on two-way satellite IoT solutions and the ongoing expansion of their C-3 constellation are crucial steps designed to bolster their competitive standing and meet evolving market demands for connectivity.

Price Competition and ARPU Pressures

Price competition is a major force in the satellite communications market, as companies actively seek to win over subscribers through attractive pricing. This dynamic directly impacts average revenue per user (ARPU), creating constant pressure for providers to optimize their offerings.

Globalstar's ARPU stood at approximately $30 in 2024. In contrast, a key competitor like Iridium reported an ARPU of around $60 during the same period. This significant difference highlights the varied pricing strategies employed within the industry and the ongoing challenge of customer acquisition and retention.

- Price Competition: Intense rivalry among satellite service providers to offer the most compelling pricing to attract and retain customers.

- ARPU Variation: Globalstar's 2024 ARPU of ~$30 compared to Iridium's ~$60 demonstrates differing market positioning and pricing power.

- Customer Acquisition Pressure: The need to offer competitive rates puts pressure on profitability as companies vie for market share.

Strategic Partnerships and Niche Market Focus

Companies are increasingly forging strategic partnerships to bolster their market standing and broaden their operational scope. Globalstar exemplifies this by collaborating with key players to access specialized markets. For instance, its partnership with Apple for Emergency SOS via Satellite technology integrated into iPhones showcases a move into consumer safety services, a significant niche.

Furthermore, Globalstar's alliance with Parsons Corporation targets defense sector applications, underscoring a deliberate strategy to concentrate on high-value, specialized markets. This focus on niche segments, including the burgeoning Internet of Things (IoT) sector and government services, allows Globalstar to differentiate itself from larger, more generalized competitors.

- Strategic Alliances: Globalstar's partnerships are crucial for market penetration and technological advancement.

- Niche Market Dominance: Focus on IoT and defense sectors provides specialized revenue streams.

- Differentiation Strategy: Collaborations like the one with Apple for Emergency SOS via Satellite set Globalstar apart.

- Revenue Diversification: These partnerships contribute to a more robust and diversified revenue base, moving beyond traditional satellite phone services.

Competitive rivalry in the satellite communications sector is fierce, driven by established players and disruptive newcomers. Globalstar faces direct competition from companies like Iridium, which reported approximately $687 million in revenue for 2023, and Inmarsat, a significant player with extensive infrastructure. The emergence of Low Earth Orbit (LEO) constellations, such as SpaceX's Starlink and Amazon's Project Kuiper, further intensifies this rivalry by offering advanced, high-speed internet services that challenge Globalstar's existing offerings.

| Competitor | 2023 Revenue (Approx.) | Key Offerings |

| Iridium Communications | $687 million | Voice, data, IoT, satellite phones |

| Inmarsat | Private (Major Player) | Broadband, M2M, IoT, maritime, aviation |

| SpaceX (Starlink) | N/A (Private) | High-speed broadband, direct-to-cell |

| Amazon (Project Kuiper) | N/A (Private) | Broadband, IoT |

SSubstitutes Threaten

Terrestrial cellular and broadband networks represent the most significant substitute for Globalstar's satellite-based communication services. These land-based networks offer extensive coverage and, in many populated areas, a more cost-effective solution for users. As these terrestrial infrastructures continue to grow, particularly with the ongoing rollout of 5G technology, they can directly diminish the need for satellite services in regions where terrestrial coverage is readily available and reliable. For instance, by the end of 2023, 5G network coverage in major developed countries had reached substantial penetration, making it a compelling alternative for many users previously reliant on satellite for mobile connectivity.

While Globalstar utilizes Low Earth Orbit (LEO) satellites, other satellite technologies like Geostationary Earth Orbit (GEO) and Medium Earth Orbit (MEO) satellites present viable substitutes for specific applications. Companies such as Inmarsat and SES, for instance, provide GEO-based services, offering alternative connectivity options for various use cases.

The burgeoning trend of direct-to-device (D2D) satellite connectivity presents a significant threat of substitutes for Globalstar. This emerging technology allows smartphones to connect directly to satellites, bypassing traditional satellite phones or specialized devices. Companies like Apple, with its Emergency SOS via satellite feature, are already pioneering this space, indicating a potential shift in how consumers access satellite communication.

Hybrid Network Models

The rise of hybrid network models, which blend terrestrial and satellite communication, poses a significant threat of substitution for traditional satellite-only services. These integrated solutions offer customers enhanced coverage and potentially more adaptable service packages, drawing users away from single-technology providers.

For instance, by mid-2024, several major telecommunications companies were actively expanding their terrestrial networks while simultaneously forging partnerships for satellite backhaul and direct-to-device connectivity. This strategic convergence allows them to offer a more robust and ubiquitous service, directly competing with standalone satellite operators.

- Hybrid models offer seamless connectivity across diverse geographies.

- This integration can lead to more competitive pricing structures.

- Customers benefit from the combined reliability of terrestrial and satellite infrastructure.

Alternative IoT and M2M Connectivity Solutions

For M2M and IoT applications, terrestrial connectivity options represent a significant threat of substitutes. These include cellular IoT technologies like NB-IoT and LTE-M, as well as low-power wide-area networks (LPWAN) such as LoRaWAN. These alternatives offer competitive solutions, particularly in areas with established ground infrastructure.

While Globalstar's strength lies in its satellite-based network, which provides coverage in remote or underserved regions, these terrestrial alternatives are often more cost-effective and readily available in urban and suburban environments. For instance, the global cellular IoT market was projected to reach over $100 billion by 2024, highlighting the scale of these competing technologies.

- Cellular IoT (NB-IoT, LTE-M): Leverages existing cellular networks, offering good bandwidth and established infrastructure in many areas.

- LPWAN Technologies (e.g., LoRaWAN): Designed for low-power, long-range communication, suitable for specific IoT use cases where high bandwidth isn't critical.

- Cost-Effectiveness: Terrestrial solutions can often be cheaper to deploy and operate in areas with existing network coverage compared to satellite services.

The threat of substitutes for Globalstar is substantial, primarily driven by the continued expansion and improvement of terrestrial communication networks. As cellular and broadband technologies, particularly 5G, become more pervasive and cost-effective, they directly compete with satellite services, especially in populated areas. The increasing adoption of direct-to-device satellite capabilities by major tech players also presents a significant substitution threat, potentially bypassing traditional satellite hardware altogether.

Hybrid network models that integrate terrestrial and satellite capabilities offer a more comprehensive and potentially more attractive alternative for many users, blurring the lines between distinct service offerings. Furthermore, for Machine-to-Machine (M2M) and Internet of Things (IoT) applications, established terrestrial technologies like NB-IoT, LTE-M, and LPWANs provide cost-efficient and readily available substitutes where satellite coverage is not strictly essential.

| Substitute Technology | Key Characteristics | Competitive Advantage | Market Penetration/Growth (Illustrative Data) |

|---|---|---|---|

| 5G Cellular Networks | High bandwidth, low latency, extensive coverage in urban/suburban areas | Cost-effectiveness, ubiquity in developed regions | Global 5G subscriptions projected to exceed 2 billion by end of 2024 |

| Direct-to-Device (D2D) Satellite | Smartphone integration, emergency communication focus | Convenience, no specialized hardware needed for basic functions | Apple's Emergency SOS via satellite active in over 15 countries by early 2024 |

| IoT Terrestrial (NB-IoT, LTE-M, LPWAN) | Low power, long range, cost-efficient for data transmission | Lower operational costs for large-scale deployments | Global cellular IoT connections estimated to reach over 1.5 billion by end of 2024 |

Entrants Threaten

The satellite communication industry, especially for Low Earth Orbit (LEO) constellations, demands immense capital. Building and launching these complex systems, from manufacturing satellites to establishing ground stations, requires billions of dollars. For instance, the cost to launch a single satellite can easily range from $10 million to over $100 million, a substantial hurdle for any potential newcomer.

New entrants into the satellite communications market, like Globalstar operates in, confront significant regulatory barriers. Obtaining necessary licenses and spectrum allocation from bodies such as the Federal Communications Commission (FCC) is a complex and lengthy undertaking.

These regulatory processes are not only time-consuming but also incredibly expensive. For instance, spectrum auctions can cost billions of dollars, presenting a formidable financial challenge for any new company attempting to enter this space.

Established players like Globalstar, Iridium, and Inmarsat possess significant advantages through their extensive satellite infrastructure, robust ground networks, and strong brand recognition cultivated over many years. Globalstar's subscriber base, which reached approximately 2 million in 2024, underscores the trust and loyalty it has built with its customers.

Newcomers face a considerable hurdle in matching this entrenched position, necessitating massive investments in marketing and customer acquisition to even begin competing. Overcoming the established infrastructure and brand loyalty of incumbents represents a substantial barrier to entry for potential new satellite communication service providers.

Technological Complexity and Expertise

The threat of new entrants in the satellite communication sector, particularly for a company like Globalstar, is significantly mitigated by the immense technological complexity and the specialized expertise required. Building and maintaining a global satellite network involves intricate knowledge of satellite design, orbital mechanics, ground station operations, and sophisticated network management systems. This steep learning curve and the substantial investment in research and development act as a formidable barrier.

New players must also contend with the high capital expenditure associated with launching and operating satellites. For instance, the cost of a single modern communication satellite can range from tens of millions to hundreds of millions of dollars, not including launch costs, which can add another significant sum. Globalstar itself has invested billions in its constellation, demonstrating the scale of financial commitment needed.

- High R&D Investment: Companies need to invest heavily in research and development to create cutting-edge satellite technology.

- Specialized Engineering Talent: Access to engineers with expertise in areas like RF engineering, propulsion systems, and satellite software is crucial and often scarce.

- Regulatory Hurdles: Navigating international regulations for satellite operation and spectrum allocation adds another layer of complexity and cost.

- Long Development Cycles: The time from concept to a fully operational satellite network can span many years, requiring sustained commitment and capital.

Potential for Retaliation from Existing Players

Established players in the satellite communications sector, like Intelsat and SES, are well-positioned to retaliate against newcomers. For instance, Intelsat, a major player, reported revenues of approximately $1.8 billion in 2023, demonstrating significant financial capacity to engage in price wars or ramp up marketing efforts. This financial muscle means new entrants could face substantial barriers if they attempt to gain market share without a distinct competitive advantage.

The threat of retaliation can significantly deter new entrants. Existing companies might leverage their established customer relationships and brand loyalty, coupled with aggressive pricing, to make it difficult for new companies to gain a foothold. For example, a new satellite service provider might find it challenging to compete on price with established operators who have already amortized their infrastructure costs and benefit from economies of scale.

Rapid innovation is another tactic existing companies can employ. Companies like SpaceX, with its Starlink constellation, are continuously launching new satellites and improving service capabilities. This pace of innovation can quickly render the offerings of a new entrant obsolete or less competitive, thereby raising the stakes and the investment required for a successful market entry.

- Established players possess significant financial resources, as evidenced by Intelsat's 2023 revenues of around $1.8 billion, to fund aggressive market defense strategies.

- New entrants may face retaliatory pricing and intensified marketing campaigns from incumbents with established customer bases.

- Companies like SpaceX are driving rapid innovation in satellite technology, posing a threat to new entrants that cannot match the pace of development.

The threat of new entrants into the satellite communications sector, particularly for Globalstar, is considerably low due to the immense capital requirements and technological complexity. Building and launching satellite constellations demands billions of dollars, with individual satellite launches costing tens to hundreds of millions. For instance, the development and deployment of a new LEO constellation can easily exceed $10 billion, a prohibitive cost for most potential competitors.

| Barrier Type | Description | Example Data Point |

| Capital Requirements | Massive upfront investment needed for satellite manufacturing, launch, and ground infrastructure. | Estimated cost for a new LEO constellation: $10 billion+ |

| Technological Complexity | Requires specialized expertise in satellite design, orbital mechanics, and network management. | Years of R&D and specialized engineering talent are essential. |

| Regulatory Hurdles | Obtaining licenses and spectrum allocation from bodies like the FCC is time-consuming and costly. | Spectrum auction costs can run into billions of dollars. |

| Economies of Scale & Brand Loyalty | Established players benefit from amortized costs and existing customer bases. | Globalstar's ~2 million subscribers in 2024 demonstrate established trust. |

Porter's Five Forces Analysis Data Sources

Our Globalstar Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including Globalstar's SEC filings, annual reports, and investor presentations. We also incorporate industry-specific market research reports and analyses from reputable telecommunications sector analysts to provide a comprehensive view of the competitive landscape.