Global Payments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

Unlock the critical external forces shaping Global Payments's trajectory, from evolving regulations to shifting economic landscapes. Our comprehensive PESTLE analysis provides the strategic foresight you need to navigate this dynamic industry. Download the full version now to gain actionable intelligence and stay ahead of the curve.

Political factors

Governments globally are tightening their grip on the payments sector, with a strong focus on safeguarding consumers, bolstering data security, and ensuring overall financial system stability. These evolving regulations directly influence operational expenses and the strategies needed to enter new markets.

For Global Payments, adhering to a diverse range of national and international rules is paramount. For instance, in 2024, the European Union's Digital Operational Resilience Act (DORA) imposed significant cybersecurity and IT risk management requirements on financial entities, impacting compliance costs and operational frameworks.

Navigating this intricate regulatory landscape is crucial for Global Payments to sustain its worldwide operations and pursue expansion. Failure to comply can lead to substantial fines and reputational damage, as seen with various financial institutions facing penalties for data breaches or non-compliance with anti-money laundering (AML) directives in recent years.

Geopolitical instability, including ongoing conflicts and trade disputes, directly impacts global payment systems. For instance, the Russia-Ukraine war, which intensified in early 2022, led to widespread sanctions and the withdrawal of major payment networks like Visa and Mastercard from Russia. This resulted in a significant disruption of cross-border transactions and a need for alternative payment solutions.

Global Payments, operating internationally, faces direct exposure to such events. The company's ability to facilitate transactions can be hindered in regions affected by conflict or trade restrictions, potentially impacting revenue streams. For example, sanctions imposed in 2024 on certain entities could necessitate changes in how Global Payments routes transactions or manages its presence in affected markets.

The company's adaptability is key. In 2024, many financial institutions reported increased investment in compliance and risk management to navigate evolving sanctions regimes and trade policies. Global Payments must remain agile, ready to adjust its operational strategies and payment processing capabilities to ensure business continuity amidst fluctuating political landscapes.

Governments worldwide are actively promoting financial inclusion, with a significant focus on expanding access to digital payment systems. For instance, India's Unified Payments Interface (UPI) has seen remarkable growth, processing over 120 billion transactions in 2023, demonstrating the impact of government-backed digital payment infrastructure. This trend creates substantial opportunities for companies like Global Payments to tap into previously unbanked and underbanked segments, particularly in emerging markets.

Taxation Policies on Digital Transactions

Governments worldwide are increasingly scrutinizing digital transactions, leading to the potential imposition of new taxes or levies. For instance, the European Union has been discussing a digital services tax, which, if implemented broadly, could affect cross-border payment providers like Global Payments. These fiscal policies directly influence revenue streams and pricing strategies by increasing the cost of doing business.

Such taxation can impact Global Payments' competitiveness, potentially forcing adjustments to merchant fees or service pricing. For example, countries like India have introduced equalization levies on digital services, demonstrating a trend towards taxing the digital economy. This necessitates careful financial planning and proactive strategy to mitigate potential revenue erosion.

- Impact on Revenue: New taxes on digital transactions can directly reduce net revenue for payment processors.

- Pricing Adjustments: Increased tax burdens may necessitate higher fees for merchants or consumers.

- Competitive Landscape: Tax disparities between regions can alter the competitive positioning of payment services.

- Regulatory Monitoring: Staying abreast of evolving tax legislation globally is crucial for strategic adaptation.

Regulatory Sandbox and Innovation Policies

Governments worldwide are actively creating regulatory sandboxes and innovation hubs to encourage fintech growth. For instance, the UK’s Financial Conduct Authority (FCA) sandbox has seen over 1,000 firms apply since its inception, with many successfully launching innovative products. These controlled environments allow companies like Global Payments to test new payment technologies and services under regulatory supervision, potentially speeding up their journey to market.

These initiatives offer Global Payments a significant opportunity to gain a competitive advantage by being an early adopter of novel solutions. By participating in these programs, the company can also gather valuable insights that will shape its approach to future regulatory frameworks and compliance strategies, ensuring it stays ahead of the curve in the evolving payments landscape.

- Regulatory Sandboxes: Facilitate controlled testing of new financial technologies.

- Innovation Hubs: Provide support and guidance for fintech startups and established players.

- Market Entry Acceleration: Reduce time-to-market for innovative payment solutions.

- Competitive Edge: Early engagement can lead to first-mover advantages in new payment areas.

Governments are increasingly focused on payment system stability and consumer protection, leading to stricter regulations. For example, the European Union's Digital Operational Resilience Act (DORA), implemented in 2024, mandates robust cybersecurity and IT risk management for financial entities, impacting operational costs and market entry strategies for companies like Global Payments.

Geopolitical events, such as trade disputes and conflicts, directly disrupt cross-border transactions. Sanctions imposed in 2024 on specific entities have already forced payment networks to alter operations, highlighting the need for Global Payments to adapt its routing and market presence strategies to ensure continuity.

Governments are actively promoting financial inclusion through digital payment initiatives, with India's UPI processing over 120 billion transactions in 2023. This trend presents significant opportunities for Global Payments to expand into unbanked segments, particularly in emerging markets.

What is included in the product

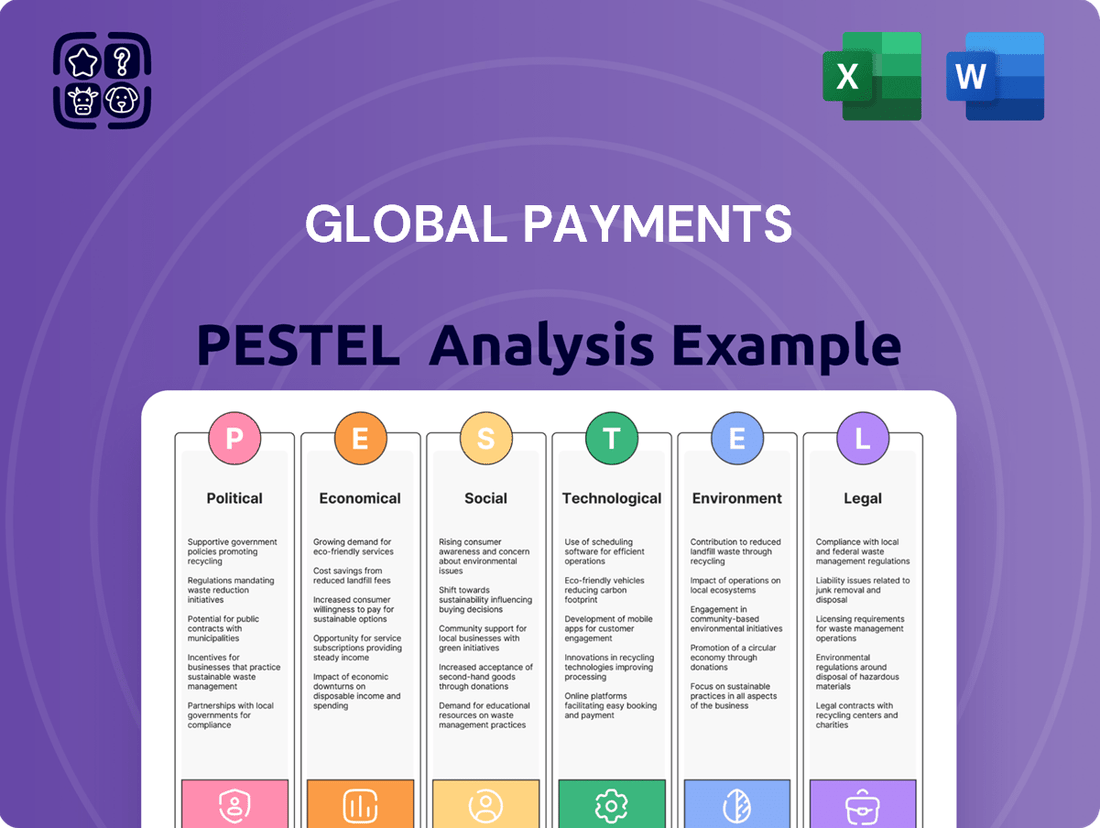

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Global Payments industry, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying emerging trends, potential risks, and opportunities within the global payments landscape.

A clear, actionable Global Payments PESTLE analysis that cuts through complexity, enabling faster, more confident strategic decisions by highlighting key external drivers of change and potential disruptions.

Economic factors

Global economic expansion is a key driver for Global Payments, as a robust economy typically translates to increased consumer spending and business transactions. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 3.1% in 2023, indicating a generally supportive environment for payment processing volumes.

Consumer spending patterns directly impact Global Payments' revenue streams. When consumers feel confident about the economy, they tend to spend more on goods and services, leading to higher transaction volumes. In 2024, consumer spending in developed economies was expected to grow moderately, supported by easing inflation and resilient labor markets, which bodes well for payment providers.

Conversely, economic slowdowns or recessions can significantly dampen transaction activity. A contraction in economic output often results in reduced disposable income for consumers and lower sales for businesses, directly affecting the number and value of payments processed. For example, if global growth forecasts were to be revised downwards significantly, it would likely pressure Global Payments' revenue growth.

Rising inflation in 2024 and projected into 2025 directly impacts Global Payments' operational expenses. For instance, increased costs for cloud services, data centers, and employee compensation can squeeze profit margins if not offset by price adjustments. This necessitates a proactive approach to managing expenditures and evaluating service pricing strategies.

Interest rate volatility presents a dual challenge for Global Payments. Higher rates in 2024 could increase the cost of borrowing for expansion or technology upgrades, while also potentially slowing merchant transaction volumes as consumer spending tightens. Conversely, a rapid shift to lower rates might impact the profitability of their cash management services, which often benefit from higher yield environments.

Navigating these economic currents demands robust financial planning. For example, if inflation pushes operating costs up by an estimated 3-5% in key markets during 2024, Global Payments must strategically adjust its pricing models for merchant services and payment processing fees to preserve its net interest margins and overall profitability.

Currency exchange rate volatility presents a significant challenge for Global Payments, particularly impacting its cross-border transaction volumes and the translation of international revenues into its reporting currency. For instance, in the first quarter of 2024, the US dollar strengthened against several major currencies, which could have reduced the reported value of Global Payments' non-US revenue streams.

These fluctuations can directly affect Global Payments' reported financial performance, as seen when international earnings are converted back to US dollars. Managing this risk is crucial, and the company likely employs hedging strategies, such as forward contracts, to lock in exchange rates for future transactions. Diversifying its international presence across various currency zones also helps to naturally offset some of these impacts.

E-commerce Growth and Digital Economy Expansion

The relentless growth of e-commerce and the expanding digital economy are creating substantial economic tailwinds for Global Payments. As businesses increasingly establish an online presence and consumers gravitate towards digital transactions, the need for sophisticated payment processing and point-of-sale solutions escalates. This dynamic fuels volume expansion and incentivizes innovation in digital payment technologies.

Consider these key statistics illustrating this economic shift:

- Global e-commerce sales are projected to reach $7.5 trillion by 2025, up from $5.7 trillion in 2023.

- Digital payments are expected to account for over 70% of all payment transactions by 2025.

- The digital economy's contribution to global GDP is anticipated to exceed 50% by 2025.

This sustained expansion directly translates into increased transaction volumes for payment processors like Global Payments, driving revenue and providing a fertile ground for the adoption of new digital payment solutions and services.

Small and Medium-sized Enterprise (SME) Business Health

The economic vitality of Small and Medium-sized Enterprises (SMEs) is a cornerstone for Global Payments, as these businesses form a significant segment of its clientele. Factors such as the availability of financing, consumer sentiment, and government initiatives aimed at bolstering SMEs directly impact their operational capacity and sales performance, consequently influencing the transaction volumes processed by Global Payments. Supporting SME expansion is a key component of Global Payments' economic approach.

In 2024, the SME sector continues to be a critical driver of economic activity. For instance, in the United States, SMEs accounted for approximately 99.9% of all businesses, employing nearly half of the private sector workforce. Their ability to thrive, often supported by accessible credit and positive consumer spending, directly translates to increased transaction activity for payment processors like Global Payments.

- SME Contribution to GDP: SMEs are projected to contribute significantly to global GDP growth in 2024-2025, with estimates often placing their share at over 40% in many developed economies.

- Access to Finance: A recent survey indicated that a notable percentage of SMEs still face challenges in securing adequate credit, a factor that can constrain their growth and, by extension, their transaction volumes.

- Consumer Spending Impact: Fluctuations in consumer confidence directly affect SME sales. For example, a 5% dip in consumer confidence can lead to a measurable decrease in retail transaction volumes processed by payment networks.

- Government Support Programs: Initiatives like tax credits or grants for SMEs, which saw a surge during previous economic downturns, are expected to continue playing a role in supporting their resilience and growth trajectory in 2024-2025.

Global economic expansion in 2024 and 2025 is a primary driver for Global Payments, with projected global growth around 3.2% in 2024. This growth fuels consumer spending and business transactions, directly increasing payment processing volumes. However, economic slowdowns can reduce disposable income and sales, negatively impacting transaction activity and revenue for payment providers.

Inflation and interest rate volatility in 2024-2025 pose challenges by increasing operational costs and potentially affecting borrowing expenses and transaction volumes. Global Payments must manage these economic factors through strategic pricing and financial planning to maintain profitability.

The expanding digital economy and e-commerce growth are significant tailwinds, with global e-commerce sales projected to reach $7.5 trillion by 2025. This trend increases demand for sophisticated payment solutions, driving volume and innovation for Global Payments.

The economic health of SMEs is crucial, as they represent a large client segment. SME growth, supported by factors like access to finance and consumer spending, directly translates to higher transaction volumes for Global Payments. SMEs are expected to contribute over 40% to GDP in many developed economies during 2024-2025.

Full Version Awaits

Global Payments PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Global Payments PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors shaping the industry. Gain actionable insights to inform your strategic decisions.

Sociological factors

Consumer preferences are rapidly shifting towards digital, mobile, and contactless payments, a trend accelerated by convenience and widespread technological adoption. For instance, a significant portion of global e-commerce transactions in 2024 are expected to be completed via mobile devices, highlighting the urgency for payment providers to cater to this.

Global Payments must continuously innovate its services to support this evolving landscape, integrating a diverse range of payment solutions across online, in-app, and physical retail environments. Failure to adapt quickly could see market share erode as nimble competitors capture this growing demand.

The ongoing shift towards digital lifestyles, evident in the surge of online shopping and app-based services, directly fuels demand for electronic payment solutions. This trend means more transactions are happening digitally, which is a boon for companies like Global Payments that facilitate these exchanges. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, underscoring the massive volume of digital commerce.

Consumers are increasingly worried about how their financial data is handled, which directly impacts their willingness to use payment services. A 2024 survey revealed that 68% of individuals cite data privacy as a top concern when choosing a payment provider. This heightened awareness means companies like Global Payments must invest heavily in safeguarding sensitive information.

To maintain trust and adhere to new regulations, Global Payments needs to implement cutting-edge cybersecurity and be upfront about its data policies. For instance, the General Data Protection Regulation (GDPR) fines for breaches can be substantial, underscoring the financial risk of non-compliance. Transparency in data usage builds essential customer loyalty.

Financial Literacy and Digital Inclusion

Financial literacy remains a significant hurdle, with a 2024 report indicating that only 57% of adults in the US feel confident managing their finances. This directly impacts the adoption of advanced payment technologies, as consumers need to understand the benefits and security of digital solutions. Global Payments can actively participate in educational programs to boost this confidence.

Digital inclusion is also critical; while smartphone penetration reached 87% globally by early 2025, access to reliable internet and digital payment platforms varies widely. Bridging this gap, for instance, by supporting initiatives that provide digital literacy training in underserved communities, could unlock substantial new market segments for Global Payments. This expansion is vital as emerging markets show rapid growth in digital payment adoption.

- Global Financial Literacy: Approximately 60% of the world's adults are financially literate, a figure that highlights the potential for growth through education.

- Digital Payment Adoption: By 2025, over 75% of global e-commerce transactions are expected to be conducted via digital payment methods.

- Emerging Market Potential: Countries like India and Brazil are projected to see double-digit growth in digital payment volumes in the coming years, driven by increasing smartphone access and government initiatives.

- Security Concerns: A 2024 survey revealed that 40% of consumers cite security concerns as a primary reason for not adopting new digital payment methods.

Impact of Gig Economy and Freelance Work

The expansion of the gig economy and the growing number of freelance professionals are fundamentally reshaping payment requirements. These individuals and the platforms that connect them increasingly demand instant payouts and adaptable payment methods, moving away from traditional, slower cycles. For instance, by early 2024, it was estimated that over 60 million Americans participated in gig work, highlighting a significant and growing demographic with distinct financial needs.

Global Payments can capitalize on this societal trend by developing and offering specialized payment processing services. These services should be designed to specifically address the unique demands of independent contractors and the digital marketplaces they utilize. This represents a substantial growth opportunity within the broader payments market.

- Gig Economy Growth: The number of individuals engaged in freelance or gig work continues to rise globally, creating a larger customer base for specialized payment solutions.

- Demand for Speed: Freelancers often require immediate access to their earnings, making instant payout capabilities a critical feature for payment providers.

- Platform Integration: Online platforms facilitating gig work need seamless integration with payment processors to manage payouts efficiently to their workers.

- Market Opportunity: The evolving nature of work presents a growing market for financial technology companies that can offer flexible and responsive payment services.

Societal shifts are profoundly influencing payment behaviors, with a strong preference for digital, mobile, and contactless options becoming the norm. This trend is further amplified by the expansion of the gig economy, where independent workers require swift and flexible payment solutions. For instance, by early 2025, over 60 million Americans were estimated to be involved in gig work, underscoring a significant demographic with evolving financial needs.

Consumer trust is increasingly tied to data security and privacy, making robust cybersecurity paramount for payment providers like Global Payments. A 2024 survey indicated that 68% of individuals consider data privacy a key factor when selecting a payment service. This necessitates substantial investment in safeguarding sensitive financial information to maintain customer loyalty and comply with regulations such as GDPR.

Financial literacy and digital inclusion remain critical challenges, impacting the adoption of advanced payment technologies. While smartphone penetration is high, access to reliable internet and digital payment education varies. Global Payments can address this by supporting digital literacy initiatives, particularly in underserved communities, to unlock new market segments as emerging markets show rapid digital payment growth.

| Sociological Factor | Impact on Global Payments | Key Data Point (2024/2025) |

|---|---|---|

| Digital Lifestyle Adoption | Increased demand for electronic payment solutions. | Global e-commerce sales projected to reach $7.4 trillion by 2025. |

| Data Privacy Concerns | Need for enhanced cybersecurity and transparent data policies. | 68% of individuals cite data privacy as a top concern. |

| Gig Economy Growth | Demand for instant payouts and adaptable payment methods. | Over 60 million Americans engaged in gig work by early 2024. |

| Financial Literacy | Hurdle for advanced payment technology adoption. | 57% of US adults feel confident managing finances. |

Technological factors

Artificial intelligence and machine learning are fundamentally changing how payments work. These technologies are making fraud detection much smarter, offering customers more tailored experiences, and streamlining operations. For instance, in 2024, many payment processors are reporting significant reductions in false positives for fraud alerts thanks to AI, sometimes by as much as 30%.

Global Payments can harness these AI and ML advancements to bolster transaction security, sift through massive amounts of data for actionable insights, and automate routine tasks. This not only improves efficiency but also allows for a deeper understanding of customer behavior and market trends, which is vital in today's fast-paced financial landscape.

The ongoing investment in AI and ML capabilities is not just about staying current; it's about securing a competitive advantage. Companies that effectively integrate these tools are better positioned to offer innovative services and maintain a leading edge in the global payments market, with projections suggesting the AI in fintech market could reach over $25 billion by 2025.

Blockchain and Distributed Ledger Technology (DLT) are poised to revolutionize cross-border payments by significantly reducing transaction costs and bolstering transparency and security. While widespread adoption in the payments sector is still nascent, Global Payments needs to actively monitor and investigate the applications of these emerging technologies for potential integration into its existing infrastructure.

Understanding and actively experimenting with DLT can strategically position Global Payments for substantial long-term innovation and operational efficiency improvements. For instance, the total value of cross-border payments is projected to reach $156 trillion by 2022, highlighting the immense market ripe for disruption by more efficient DLT solutions.

The demand for real-time payments (RTP) and instant settlement is surging, compelling payment providers like Global Payments to enhance their technological infrastructure. This shift requires significant investment in systems that enable immediate fund transfers, aligning with consumer and business expectations for speed.

By adopting technologies that support instant transactions, Global Payments can meet these evolving demands. For instance, the adoption of RTP networks globally is accelerating, with many countries now having established or developing their own systems, such as the Faster Payments System in the UK or the FedNow service in the United States, which launched in 2023.

Offering robust real-time payment solutions is no longer just an option but a crucial factor for differentiation in the highly competitive payments market. Companies that can provide seamless, instant payment experiences are better positioned to attract and retain customers.

Cybersecurity Threats and Data Protection Technologies

The increasing complexity of cyber threats demands ongoing investment in advanced cybersecurity and data protection technologies. Global Payments, managing crucial financial information, must implement state-of-the-art encryption, tokenization, and threat intelligence solutions to secure transactions and customer data. In 2024, the financial services sector saw a 15% increase in reported cyber incidents, highlighting the critical need for robust defenses.

Maintaining strong cybersecurity is more than a regulatory obligation; it is a cornerstone of customer trust and uninterrupted business operations. For instance, in the first half of 2025, companies with demonstrably strong data protection measures experienced 20% less downtime due to security breaches compared to those with weaker protocols.

- Escalating Threat Landscape: Cybercriminals are constantly evolving their tactics, from sophisticated ransomware attacks to advanced phishing schemes targeting financial institutions.

- Investment in Advanced Technologies: Companies like Global Payments are allocating significant resources to technologies such as AI-powered threat detection, zero-trust architecture, and quantum-resistant encryption.

- Data Protection as a Competitive Advantage: Demonstrating a commitment to safeguarding sensitive financial data builds customer loyalty and differentiates businesses in a crowded market.

- Regulatory Compliance and Penalties: Non-compliance with data protection regulations, such as GDPR or CCPA, can result in substantial fines, with average penalties for data breaches in the financial sector exceeding $5 million in 2024.

Cloud Computing and Scalable Infrastructure

Global Payments benefits significantly from the adoption of cloud computing, which offers a scalable, flexible, and cost-efficient infrastructure. This allows the company to adeptly manage fluctuating transaction volumes and quickly introduce new services to the market.

By leveraging cloud technologies, Global Payments can expand its global presence, bolster system resilience, and speed up innovation. This approach minimizes the need for substantial upfront capital investments, a crucial advantage in the dynamic payments sector.

- Scalability: Cloud infrastructure allows Global Payments to scale resources up or down based on demand, ensuring smooth operations during peak transaction periods. For instance, during major shopping events in 2024, cloud resources enabled seamless processing of a surge in digital payments.

- Cost Efficiency: Shifting to cloud services reduces the need for on-premises hardware and maintenance, leading to significant operational cost savings. Many financial institutions reported a 15-20% reduction in IT infrastructure costs after migrating to the cloud in the 2023-2024 period.

- Agility and Innovation: Cloud-native solutions empower Global Payments with the agility to rapidly develop and deploy new payment solutions and features, staying ahead of market trends and competitor offerings.

- Global Reach and Resilience: Cloud platforms provide a robust and distributed infrastructure that enhances Global Payments' ability to serve customers worldwide while ensuring high availability and disaster recovery capabilities.

Technological advancements are reshaping the payments landscape, with AI and machine learning driving enhanced fraud detection and personalized customer experiences. Blockchain and DLT offer potential for more secure and cost-effective cross-border transactions, while the demand for real-time payments necessitates infrastructure upgrades. Robust cybersecurity is paramount given escalating cyber threats, and cloud computing provides the scalability and agility needed to innovate and manage operations efficiently.

| Technology | Impact on Payments | 2024/2025 Data/Trends |

|---|---|---|

| AI & Machine Learning | Improved fraud detection, personalized services, operational efficiency | 30% reduction in fraud alert false positives; AI in fintech market projected to exceed $25 billion by 2025 |

| Blockchain & DLT | Secure, transparent, and cost-effective cross-border payments | Total value of cross-border payments projected to reach $156 trillion by 2022 (pre-2025 data, highlighting potential) |

| Real-Time Payments (RTP) | Instant fund transfers, meeting consumer and business expectations | Accelerating adoption globally, with systems like FedNow (US) launched in 2023 |

| Cybersecurity | Protection against evolving threats, data security, customer trust | 15% increase in reported cyber incidents in financial services (2024); 20% less downtime for companies with strong data protection (H1 2025) |

| Cloud Computing | Scalability, flexibility, cost efficiency, global reach | 15-20% reduction in IT infrastructure costs for financial institutions post-cloud migration (2023-2024) |

Legal factors

Global Payments navigates a complex web of international data privacy laws, including Europe's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations dictate how customer data is collected, processed, and stored, demanding strict adherence to protect sensitive financial information.

Meeting these legal obligations requires significant investment in secure data infrastructure and transparent consent mechanisms. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Failure to comply not only exposes Global Payments to hefty penalties but also severely damages its reputation and erodes customer trust, which is essential in the financial services sector. In 2023, companies globally faced billions in data privacy fines, highlighting the escalating enforcement of these laws.

Global Payments must navigate a complex web of Anti-Money Laundering (AML) and Know Your Customer (KYC) laws worldwide. These regulations demand robust customer identification, verification processes, and ongoing transaction monitoring to combat financial crime. For instance, by the end of 2023, financial institutions globally were investing billions in compliance technology and expertise to meet these evolving standards, with fines for non-compliance reaching hundreds of millions for major payment processors.

Adherence to AML/KYC is not merely a legal obligation but a critical operational necessity for Global Payments. The company's investment in advanced compliance solutions, including AI-powered transaction monitoring and identity verification platforms, is essential to prevent the misuse of its payment networks for illicit purposes. Failure to maintain stringent compliance can result in substantial financial penalties, reputational damage, and increased regulatory oversight, impacting its ability to operate freely in key markets.

Global Payments, as a provider of payment technology and software, navigates a complex web of national and international regulations. These rules, covering areas like capital reserves and customer complaint handling, are crucial for its operations. For instance, in 2024, financial institutions globally faced increased scrutiny on operational resilience following cybersecurity incidents, impacting how companies like Global Payments manage their systems.

Maintaining the correct licenses in every jurisdiction is absolutely essential for Global Payments to legally operate and offer its services. Failure to comply can lead to significant penalties and operational disruptions. The company's 2023 annual report highlighted ongoing efforts to ensure compliance across its diverse markets, reflecting the dynamic nature of regulatory landscapes.

Consumer Protection Laws in Financial Services

Global Payments must navigate a complex web of consumer protection laws worldwide, ensuring transparency in its fee structures and robust dispute resolution processes. For instance, in the European Union, the Payment Services Directive 2 (PSD2) mandates clear communication of charges and enhanced security measures, impacting how Global Payments operates across member states. Failure to comply, such as through misleading advertising or inadequate complaint handling, can result in significant fines and reputational damage, as seen in past regulatory actions against financial institutions for unfair practices.

Key aspects of consumer protection that Global Payments must address include:

- Disclosure Requirements: Ensuring all fees, exchange rates, and terms are clearly and prominently displayed to customers before transactions are finalized.

- Dispute Resolution: Establishing efficient and accessible mechanisms for customers to report and resolve transaction disputes, often with defined timelines for resolution.

- Data Privacy and Security: Adhering to regulations like GDPR (General Data Protection Regulation) in Europe, which govern how customer data is collected, stored, and used, and mandating strong security protocols to prevent fraud.

- Fair Treatment: Prohibiting discriminatory practices and ensuring all customers receive equitable service, regardless of their background or transaction volume.

Antitrust and Competition Laws

Global Payments, as a significant entity in the global payments arena, operates under stringent antitrust and competition laws. These regulations are specifically designed to foster a level playing field, prevent monopolistic practices, and ensure fair competition within the market. For instance, the European Union's Directorate-General for Competition actively monitors mergers and acquisitions to ensure they do not unduly harm competition, a factor that directly impacts Global Payments' strategic growth opportunities.

These legal frameworks significantly shape Global Payments' strategic decisions regarding mergers, acquisitions, and even everyday partnership agreements. Pricing strategies are also under scrutiny, as regulators aim to prevent anti-competitive pricing that could disadvantage smaller players or consumers. The company must meticulously ensure its operations and market strategies do not create dominant positions that could invite regulatory intervention or penalties, as seen in past antitrust cases involving other large payment processors.

Key areas of regulatory focus for Global Payments include:

- Merger and acquisition approvals: Ensuring that proposed deals do not lead to excessive market concentration.

- Partnership agreements: Verifying that collaborations do not create exclusive arrangements that hinder competitors.

- Pricing practices: Demonstrating that pricing models are fair and do not constitute predatory behavior.

- Data sharing and interoperability: Adhering to regulations that promote open access and prevent data gatekeeping.

Global Payments must navigate a complex landscape of financial regulations, including capital requirements and licensing, to operate legally across diverse markets. In 2024, regulators worldwide continued to emphasize operational resilience and robust risk management frameworks, impacting how payment providers like Global Payments structure their operations and safeguards.

Adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations remains paramount, with significant investments in compliance technology by financial institutions globally to combat financial crime. By the end of 2023, these investments were in the billions, reflecting the critical need to prevent illicit activities on payment networks.

Consumer protection laws worldwide demand transparency in fee structures and effective dispute resolution, with directives like PSD2 in the EU setting clear standards for communication and security. Non-compliance can lead to substantial fines and reputational damage.

Antitrust and competition laws are crucial, shaping strategic decisions regarding mergers and acquisitions to prevent market concentration. Global Payments must ensure its pricing and partnership strategies foster fair competition, avoiding practices that could invite regulatory intervention.

Environmental factors

Stakeholder demand for robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting is significantly shaping Global Payments' operations and public perception. Investors and consumers alike are scrutinizing companies for their commitment to sustainability and ethical conduct, influencing brand loyalty and investment decisions. For instance, in 2024, a significant majority of institutional investors globally indicated that ESG factors are material to their investment decisions, with many actively divesting from companies with poor ESG performance.

Global Payments faces increasing pressure to showcase its dedication to sustainable practices, fair labor, and community engagement, moving beyond traditional financial metrics. Demonstrating a strong ESG profile is becoming a competitive advantage, attracting capital from a growing pool of socially conscious investors. Companies with transparent and impactful ESG reporting, like Global Payments, are better positioned to enhance their brand reputation and build long-term trust with all stakeholders.

Global Payments' reliance on extensive data centers and IT infrastructure for processing transactions demands substantial energy, directly impacting its carbon footprint. In 2023, the global IT sector's energy consumption was estimated to be around 1.5% of total global electricity use, a figure that continues to grow with increasing digital activity. This significant energy draw contributes to greenhouse gas emissions, a critical environmental concern for the company.

Consequently, Global Payments is under growing pressure from regulators, investors, and customers to mitigate its environmental impact. This involves a strategic shift towards adopting renewable energy sources to power its operations, enhancing data center energy efficiency through advanced cooling and server management, and integrating sustainable practices across its entire IT infrastructure. By 2025, many large corporations aim to power their data centers with 100% renewable energy, setting a benchmark for companies like Global Payments.

The lifecycle of payment hardware, like point-of-sale terminals and network equipment, inherently creates electronic waste. Global Payments must implement robust waste management, including recycling and sustainable sourcing for its hardware.

By addressing e-waste, Global Payments can significantly reduce environmental pollution and foster a circular economy within its operational framework.

Climate Change Adaptation and Resilience

While Global Payments isn't directly tied to physical resource extraction like some industries, climate change adaptation and resilience are crucial for its global operations. The company must ensure its data centers, which are vital for processing transactions, can withstand extreme weather events, a growing concern with climate change. For instance, the increased frequency of severe storms and heatwaves can strain power grids and cooling systems, potentially disrupting services.

Assessing and mitigating the environmental impact of business travel is another key consideration. As global travel becomes more unpredictable due to climate-related disruptions, optimizing travel strategies and exploring virtual alternatives can enhance operational continuity. Building this resilience against climate risks is not just about environmental responsibility; it directly contributes to the long-term stability and reliability of Global Payments' services.

- Data Center Resilience: Global Payments must invest in infrastructure that can withstand extreme weather, such as enhanced cooling systems and backup power, to prevent service interruptions.

- Supply Chain Stability: While not a physical supply chain in the traditional sense, the reliability of internet infrastructure and energy sources supporting its operations is paramount and can be affected by climate events.

- Business Travel Impact: Reducing the carbon footprint of business travel and preparing for potential disruptions to travel routes are important for operational continuity and sustainability goals.

Sustainability in Supply Chain and Vendor Practices

Global Payments faces increasing scrutiny regarding its environmental impact, particularly within its extensive supply chain. This includes the sourcing of hardware, software, and various services essential for its operations. There's a significant push from stakeholders, including investors and consumers, for companies like Global Payments to actively assess and foster sustainability among its vendors. This means encouraging responsible sourcing of materials, ensuring ethical labor practices throughout the supply chain, and driving a reduction in the overall environmental footprint of its partners.

By integrating sustainability into its supply chain management, Global Payments can enhance its corporate responsibility profile. This proactive approach is becoming a critical differentiator in the market. For instance, many large corporations are now setting specific sustainability targets for their suppliers. In 2024, it's estimated that over 70% of major companies are actively engaging with their suppliers on environmental, social, and governance (ESG) criteria, a trend that directly impacts payment processors like Global Payments.

- Vendor ESG Audits: Global Payments is increasingly expected to conduct regular environmental, social, and governance audits of its key suppliers.

- Sustainable Sourcing Targets: Setting and monitoring targets for suppliers to use recycled materials or reduce energy consumption in their production processes.

- Supply Chain Carbon Footprint: Measuring and working to reduce the carbon emissions associated with the transportation and manufacturing of goods and services procured by Global Payments.

- Ethical Labor Verification: Ensuring that all suppliers adhere to strict ethical labor standards, including fair wages and safe working conditions, as part of their vendor agreements.

Global Payments' significant reliance on data centers and IT infrastructure means a substantial energy footprint, contributing to greenhouse gas emissions. By 2025, many leading companies aim for 100% renewable energy for their data centers, setting a benchmark for Global Payments to follow. The company must also manage the electronic waste generated by payment hardware like POS terminals, emphasizing recycling and sustainable sourcing.

PESTLE Analysis Data Sources

Our Global Payments PESTLE Analysis is meticulously constructed using a diverse array of authoritative data sources, including reports from the World Bank, IMF, and various central banks, alongside industry-specific market intelligence from leading financial research firms and regulatory updates from governmental bodies worldwide.