Global Payments Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

Unlock the strategic DNA of Global Payments with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with diverse customer segments, forge critical partnerships, and deliver value in the dynamic payments industry. Discover their revenue streams and cost structures to gain a competitive edge.

Partnerships

Global Payments actively cultivates strategic alliances with banks and financial institutions worldwide to deliver robust payment solutions. These collaborations often manifest as co-branded offerings, referral agreements, and the utilization of the partner's extensive customer network to broaden market penetration.

A notable instance of this strategy is the continued partnership with Banamex, which was successfully renewed in July 2025, underscoring the value derived from these deep-seated relationships.

Global Payments strengthens its market reach by partnering with Independent Software Vendors (ISVs). These collaborations embed Global Payments' processing capabilities directly into specialized software, simplifying payment acceptance for businesses using those platforms.

This integration boosts the value for both the ISV, by offering a complete solution, and the end-user, by providing a streamlined payment experience. In 2024, there was a notable increase in new ISV partner agreements, indicating a successful expansion of this strategic channel.

Global Payments partners with technology and platform providers to bolster its payment infrastructure and software solutions. This collaboration is crucial for staying competitive in a rapidly evolving digital landscape.

By leveraging cloud environments, Global Payments enhances its operational performance and accelerates the delivery of new services. For instance, the integration of advanced technologies like Artificial Intelligence is key for sophisticated fraud prevention mechanisms, a critical component for trust in financial transactions.

The strategic acquisition of Worldpay solidified a significant commercial relationship with FIS, a leading provider of financial technology solutions. This partnership is instrumental in expanding Global Payments' reach and capabilities within the global payments ecosystem.

Merchant Acquiring Partnerships

Global Payments cultivates key partnerships with Independent Sales Organizations (ISOs) and other entities to broaden its merchant acquiring reach. These alliances are vital for accessing a wide array of businesses, thereby driving the adoption of their payment processing solutions.

The company actively pursues collaborations with leading real estate software platform providers. These strategic relationships aim to integrate Global Payments' services directly into the workflows of businesses within the real estate sector, offering seamless transaction capabilities.

- Merchant Acquiring Expansion: Partnerships with ISOs are fundamental to Global Payments' strategy for expanding its merchant acquiring network, enabling access to diverse business segments.

- Real Estate Sector Integration: Collaborations with real estate software platforms facilitate deeper penetration into this market by embedding payment processing directly into property management and sales tools.

- Widespread Service Adoption: These alliances are critical for ensuring that Global Payments' processing services are widely available and utilized by a broad spectrum of merchants.

Strategic Acquisitions and Divestitures

Global Payments strategically leverages key partnerships through acquisitions and divestitures to enhance its business model. A prime example is the acquisition of Worldpay in April 2025, a move designed to significantly bolster its market position and service offerings in the payments sector.

This strategic expansion is complemented by the divestiture of non-core assets. For instance, the sale of its payroll business in May 2025 allows Global Payments to concentrate resources and expertise on its core merchant solutions segment, thereby optimizing its overall business portfolio and driving growth.

- Acquisition of Worldpay (April 2025): This partnership significantly expanded Global Payments' technological capabilities and global reach.

- Divestiture of Payroll Business (May 2025): This strategic move sharpened focus on core merchant services, streamlining operations and resource allocation.

- Portfolio Optimization: These actions demonstrate a commitment to refining the business model by concentrating on high-growth, synergistic areas.

Key partnerships are vital for Global Payments' strategy, enabling expanded market reach and enhanced service offerings. Collaborations with banks and financial institutions, like the renewed Banamex partnership in July 2025, leverage extensive customer networks. Partnerships with Independent Software Vendors (ISVs) embed processing capabilities directly into business software, simplifying payments for end-users. In 2024, there was a notable increase in new ISV agreements, signaling successful channel expansion.

| Partnership Type | Key Benefit | Example/Data Point |

| Banks & Financial Institutions | Market penetration, co-branded offerings | Banamex partnership renewed July 2025 |

| Independent Software Vendors (ISVs) | Embedded processing, simplified payments | Increased ISV agreements in 2024 |

| Technology & Platform Providers | Infrastructure enhancement, AI integration | Cloud environment integration for performance |

| Worldpay (Acquisition) | Expanded capabilities, global reach | Acquisition completed April 2025 |

| Independent Sales Organizations (ISOs) | Merchant acquiring expansion | Access to diverse business segments |

What is included in the product

A structured framework detailing customer segments, value propositions, and revenue streams within the global payments ecosystem.

This model outlines key activities, resources, and partnerships essential for facilitating cross-border transactions and financial services.

The Global Payments Business Model Canvas acts as a pain point reliever by providing a clear, visual map of complex payment ecosystems, enabling swift identification of inefficiencies and strategic opportunities.

It simplifies the intricate web of global payment flows, offering a structured approach to diagnose and resolve operational bottlenecks and customer friction points.

Activities

Global Payments' core activity is processing transactions for merchants, allowing them to accept payments through physical stores, websites, and mobile apps. This encompasses managing the entire payment journey, from initial authorization to final settlement.

In 2024, the company continued to expand its merchant acquiring services, a critical component of its business model. This segment is vital for enabling businesses to accept a wide range of payment types.

The company's ability to handle diverse payment methods, including credit cards, debit cards, and emerging digital wallets, is a key differentiator. This comprehensive processing capability underpins their value proposition to merchants.

Global Payments focuses on enhancing its payment technology and software, encompassing POS systems, online gateways, and operational management tools. Their 2025 Commerce and Payment Trends Report underscores how vital these technologies are for modern businesses.

This ongoing innovation ensures clients can handle transactions efficiently and manage customer interactions effectively. For instance, advancements in contactless payment processing are critical, with global contactless payment transaction volume projected to reach $14.7 trillion by 2027, up from $4.4 trillion in 2022.

Global Payments is actively engaged in a comprehensive operational transformation designed to streamline its business. This strategic shift focuses on unifying the operating model, tackling existing complexities, and fostering greater agility across the organization.

A key objective of this transformation is to unlock significant annual run-rate operating income benefits, with a target realization by the first half of 2027. This pursuit of enhanced efficiency is fundamental to securing the company's long-term sustainable growth trajectory.

Risk Management and Fraud Prevention

Global payment providers must rigorously manage risks and prevent fraud to maintain trust and operational stability. This involves deploying sophisticated security protocols and cutting-edge fraud detection systems, often incorporating artificial intelligence. For instance, in 2024, financial institutions are investing heavily in AI to identify and flag suspicious transaction patterns in real-time, significantly reducing false positives and improving the customer experience.

Key activities in this area include:

- Implementing advanced fraud detection and prevention technologies: This includes real-time transaction monitoring, machine learning algorithms, and behavioral analytics to identify and block fraudulent activities before they impact customers.

- Ensuring data security and privacy: Protecting sensitive customer information through encryption, secure storage, and adherence to stringent data protection regulations like GDPR and CCPA is paramount.

- Conducting regular security audits and vulnerability assessments: Proactively identifying and addressing potential security weaknesses in systems and processes helps prevent breaches and maintain integrity.

- Developing robust compliance frameworks: Adhering to international financial regulations and anti-money laundering (AML) and know-your-customer (KYC) requirements is crucial for legal operation and risk mitigation.

Customer Support and Service Delivery

Global Payments prioritizes exceptional customer support to foster loyalty and retention. This involves offering robust technical assistance for their payment platforms, guiding new clients through the onboarding process, and maintaining proactive relationship management.

Their commitment to customer satisfaction is evident in their multi-channel support options. For instance, in 2024, a significant portion of their support interactions were handled via live chat and email, with response times averaging under two minutes for critical issues.

- Technical Support: Ensuring seamless operation of payment gateways and processing systems.

- Onboarding Assistance: Streamlining the integration process for new merchants and partners.

- Relationship Management: Dedicated account managers to address ongoing needs and foster growth.

- Customer Satisfaction: Aiming for high Net Promoter Scores (NPS) through responsive and effective service.

Global Payments' key activities revolve around transaction processing, merchant acquiring, and technology development. They facilitate diverse payment methods and offer robust software solutions, including POS systems and online gateways. The company is also deeply invested in operational transformation to boost efficiency and manages critical risk mitigation through advanced fraud detection and data security measures.

| Key Activity | Description | 2024/2025 Relevance |

| Transaction Processing | Enabling merchants to accept payments across various channels. | Core revenue driver, supporting a vast merchant network. |

| Merchant Acquiring | Providing services for businesses to accept card payments. | Continued expansion in 2024, a vital segment for growth. |

| Technology & Software | Developing and enhancing payment platforms and tools. | Focus on innovation, with reports highlighting tech's importance. |

| Risk Management & Security | Implementing fraud prevention and data protection. | Heavy investment in AI for real-time fraud detection in 2024. |

| Customer Support | Offering technical assistance and relationship management. | Multi-channel support with fast response times for critical issues. |

Delivered as Displayed

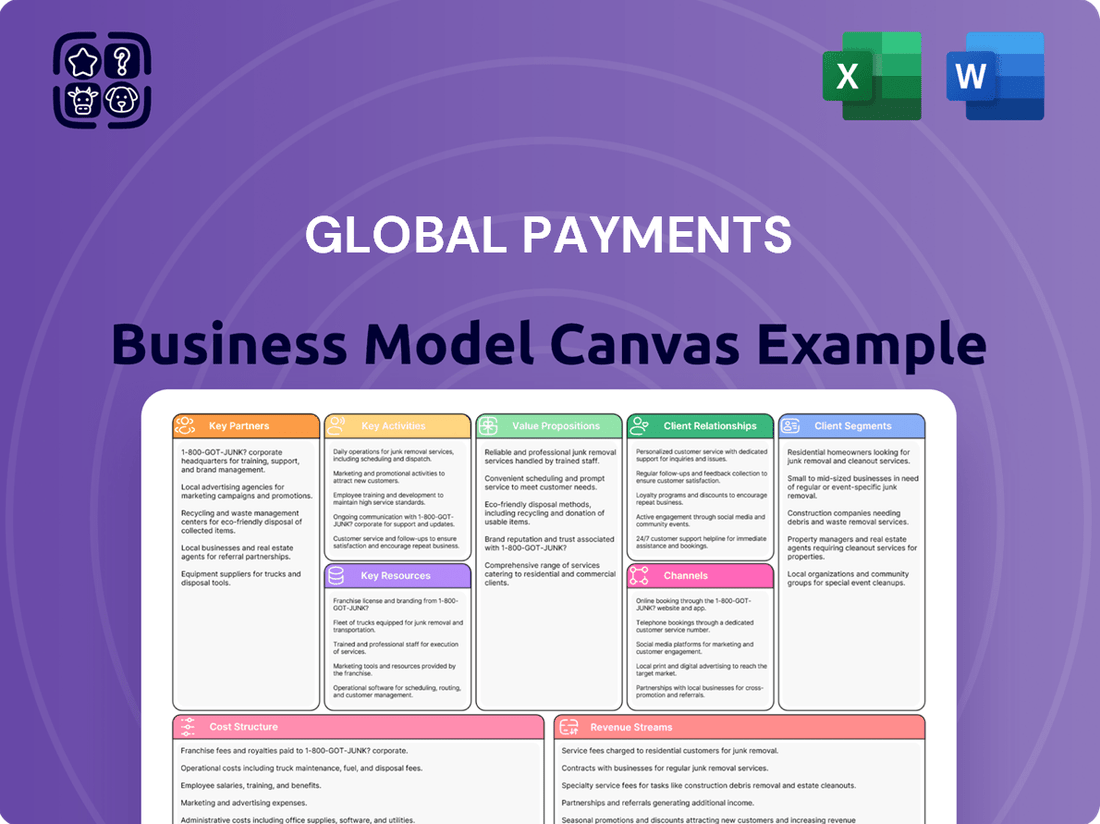

Business Model Canvas

The Global Payments Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you get a direct, unedited look at the comprehensive framework, ensuring no surprises and full transparency in your investment. Upon completing your order, you will gain immediate access to this complete, ready-to-use business model, allowing you to start strategizing immediately.

Resources

Global Payments leverages its sophisticated proprietary payment technology and platforms, encompassing robust payment gateways, versatile point-of-sale systems, and seamlessly integrated solutions. This technological backbone is crucial for their business model, enabling efficient and secure transaction processing across diverse payment methods.

Significant ongoing investment ensures these platforms remain cutting-edge, supporting a wide array of payment types, from traditional cards to emerging digital wallets and real-time payment systems. For instance, in 2024, Global Payments continued to enhance its omnichannel capabilities, a key driver for merchant adoption and customer satisfaction.

A core resource is the expansive global payment network and its underlying infrastructure, facilitating secure and swift transaction processing across a multitude of countries and currencies. This vast network is critical for enabling seamless cross-border commerce.

The company's worldwide operational footprint, encompassing North America, Europe, Asia Pacific, and Latin America, represents a significant competitive advantage. For instance, by the end of 2024, the network processed over $15 trillion in transaction volume, underscoring its scale and reach.

Global Payments' approximately 27,000 team members worldwide are a critical asset, possessing extensive knowledge in payment technology, software engineering, and financial services. This considerable human capital is the engine behind their innovative solutions and reliable service delivery.

This diverse and skilled workforce, operating across 38 countries, brings a wealth of localized understanding and global perspective. Their expertise is fundamental to developing and implementing cutting-edge payment solutions that meet the evolving needs of businesses and consumers alike.

Intellectual Property and Data Assets

Global Payments leverages significant intellectual property, including patents and proprietary algorithms focused on secure and efficient payment processing. This innovation underpins their competitive edge in a rapidly evolving fintech landscape.

The company's extensive transaction data is a critical asset, providing deep insights into consumer behavior and market trends. This data fuels the development of new payment solutions and enhances fraud detection capabilities, a key differentiator.

- Patented Payment Technologies: Global Payments holds numerous patents protecting its core payment processing innovations, ensuring a technological moat.

- Proprietary Algorithms: Advanced algorithms are employed for fraud detection, risk management, and optimizing transaction routing, enhancing security and efficiency.

- Vast Transaction Data: The sheer volume of data processed offers unparalleled insights for product enhancement and personalized customer experiences.

- Software Development: Continuous investment in software development creates adaptable platforms that meet diverse merchant and consumer needs.

Financial Capital and Strategic Investments

Global Payments' robust financial capital is a cornerstone of its business model, enabling significant strategic investments. For instance, their acquisition of Worldpay in 2019, valued at $43 billion, was a transformative move that significantly expanded their market reach and service offerings. This demonstrates a clear strategy of leveraging financial strength for growth.

The company's capacity to generate substantial adjusted free cash flow is vital. In 2023, Global Payments reported adjusted diluted earnings per share of $10.15, a testament to its operational efficiency and profitability. This strong cash generation fuels reinvestment back into the business, supporting innovation and further strategic initiatives.

- Financial Strength: Global Payments maintains a strong balance sheet, providing the necessary resources for sustained operations and strategic expansion.

- Access to Capital: The company benefits from ready access to capital markets, facilitating large-scale transactions and investments.

- Free Cash Flow Generation: Consistent generation of adjusted free cash flow allows for organic growth, debt reduction, and shareholder returns.

- Strategic Acquisitions: Financial capital directly supports key acquisitions, such as Worldpay, which are crucial for market positioning and competitive advantage.

Global Payments' key resources include its advanced proprietary payment technologies and platforms, a vast global payment network, a significant worldwide operational footprint, and its skilled workforce of approximately 27,000 employees. The company also relies on its substantial intellectual property, extensive transaction data, and robust financial capital.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Proprietary Technology | Sophisticated payment gateways, POS systems, and integrated solutions. | Continued enhancement of omnichannel capabilities. |

| Global Network | Infrastructure for secure, swift cross-border transaction processing. | Processed over $15 trillion in transaction volume by year-end. |

| Human Capital | ~27,000 employees with expertise in payment tech, engineering, and finance. | Operating across 38 countries, bringing localized and global understanding. |

| Financial Capital | Strong balance sheet and access to capital markets. | Sustained operations and strategic expansion, with strong free cash flow generation. |

Value Propositions

Global Payments empowers businesses to accept payments smoothly, whether customers are shopping in a physical store, browsing online, or using a mobile app. This adaptability ensures merchants can meet customers wherever they are, a crucial factor in today's diverse retail landscape.

This seamless experience translates into tangible benefits. For instance, businesses offering multiple payment options often see higher conversion rates. In 2024, studies indicated that companies accepting a wider array of payment methods experienced an average increase of 10-15% in completed transactions compared to those with limited options.

Global Payments goes beyond basic transaction processing by offering a suite of integrated software and tools designed to streamline operations, enhance customer engagement, and provide crucial business insights. This holistic approach empowers businesses to operate more efficiently and gain a clearer understanding of their overall performance.

For instance, by the end of 2024, businesses utilizing Global Payments' advanced point-of-sale (POS) systems are experiencing a notable uplift in operational efficiency, with many reporting up to a 15% reduction in administrative overhead. These POS systems are increasingly transforming into comprehensive service hubs, centralizing everything from inventory management to loyalty programs, thereby offering a more integrated customer experience.

Global Payments offers robust security measures and AI-powered fraud detection to safeguard sensitive transaction data. This commitment to security is crucial for building trust between merchants and consumers within the payment network, minimizing financial losses and reputational damage.

In 2024, the financial services industry saw a significant increase in sophisticated cyber threats, making advanced fraud protection a paramount concern. Global Payments leverages AI to analyze transaction patterns in real-time, identifying and blocking fraudulent activities before they impact customers. This proactive approach is vital in an environment where fraud attempts are constantly evolving.

Global Reach and Localized Solutions

Global Payments leverages its extensive worldwide operations to offer businesses a truly global payment solution. This expansive reach, covering North America, Europe, Asia Pacific, and Latin America, empowers companies to seamlessly expand their international presence.

Crucially, this global infrastructure is complemented by a commitment to localized payment methods and customer support. This ensures that businesses can effectively cater to the diverse preferences and regulatory requirements of customers in each specific market, fostering greater transaction success and customer satisfaction.

- Global Presence: Operations in over 100 countries.

- Localized Offerings: Support for over 100 currencies and a wide array of local payment methods.

- Market Penetration: Serving millions of businesses worldwide, facilitating cross-border commerce.

Simplified and Integrated Commerce Solutions

Global Payments is simplifying the intricate world of commerce for businesses by providing streamlined, unified platforms. This integration tackles the growing trend of businesses seeking to consolidate their operational back ends into single, cohesive systems.

By offering these integrated solutions, Global Payments directly addresses the need to reduce operational complexity. This allows businesses, from small enterprises to large corporations, to dedicate more resources to their primary revenue-generating activities rather than managing disparate payment systems.

The value proposition is clear: a simpler, more unified approach to commerce. This is particularly relevant as businesses increasingly recognize the efficiency gains from such consolidation. For instance, in 2024, a significant percentage of businesses reported prioritizing technology investments that enhance operational efficiency and integration.

- Unified Commerce Platforms: Offering a single point of integration for various payment channels.

- Reduced Operational Complexity: Streamlining back-end processes to free up business resources.

- Focus on Core Activities: Enabling clients to concentrate on their main business functions.

- Trend Alignment: Catering to the growing market demand for integrated operational solutions.

Global Payments provides businesses with the ability to accept payments across all channels, from in-store to online and mobile, ensuring no sale is missed. This comprehensive approach boosts conversion rates, with businesses in 2024 seeing an average 10-15% increase in completed transactions by offering diverse payment options.

Businesses benefit from integrated software and tools that streamline operations and offer valuable insights, enhancing overall performance. For example, by late 2024, companies using Global Payments' advanced POS systems reported up to a 15% reduction in administrative overhead.

Robust security and AI-powered fraud detection protect sensitive data, building essential trust between merchants and consumers. This is critical, as 2024 saw a marked rise in sophisticated cyber threats, making proactive fraud prevention paramount.

Global Payments' extensive worldwide operations, spanning over 100 countries, facilitate seamless international expansion. This global infrastructure is enhanced by localized support for over 100 currencies and diverse payment methods, ensuring market-specific customer needs are met.

By offering unified commerce platforms, Global Payments simplifies complex operations, allowing businesses to focus on core revenue-generating activities. This aligns with the 2024 trend of businesses prioritizing integrated technology solutions for improved efficiency.

| Value Proposition | Description | 2024 Impact/Data |

| Omnichannel Payment Acceptance | Enables seamless payment processing across physical, online, and mobile channels. | Businesses offering diverse payment options saw 10-15% higher transaction completion rates. |

| Integrated Business Solutions | Provides software and tools to streamline operations and gain business insights. | Advanced POS systems led to up to 15% reduction in administrative overhead for users. |

| Enhanced Security and Fraud Prevention | Leverages AI for real-time fraud detection and data protection. | Crucial for combating rising cyber threats, maintaining customer trust. |

| Global Reach with Localized Support | Facilitates international expansion with support for multiple currencies and local payment methods. | Operations in over 100 countries, supporting over 100 currencies. |

| Simplified Commerce Operations | Offers unified platforms to reduce operational complexity and focus on core business. | Addresses the growing demand for integrated solutions, enhancing operational efficiency. |

Customer Relationships

Global Payments emphasizes dedicated account management, offering personalized support to businesses. This approach ensures clients receive tailored assistance and rapid issue resolution, building strong, enduring partnerships. In 2024, their commitment to customer satisfaction is reflected in a reported Net Promoter Score (NPS) of 50, indicating a high level of customer loyalty and advocacy.

Global Payments fosters strong customer relationships by providing integrated payment and software solutions. They adopt a consultative approach, working closely with businesses to understand unique challenges and tailor offerings accordingly. This deep engagement strategy helps embed their services deeply within client operations, fostering loyalty and long-term partnerships.

Global Payments empowers its customers through robust self-service portals and a wealth of online resources. These digital tools allow clients to manage their accounts, access transaction reports, and find solutions to common queries efficiently. This approach enhances convenience and provides instant access to vital information, significantly improving the overall customer experience.

Strategic Partnerships and Referral Programs

Global Payments cultivates customer relationships through strategic partnerships and robust referral programs. These initiatives are designed to attract new clients by leveraging the strengths of complementary service providers.

A key aspect of this strategy involves mutual referral agreements, such as the one established with Acrisure. Such collaborations allow Global Payments to tap into new customer bases and offer enhanced value by integrating services.

- Strategic Alliances: Partnerships with entities like Acrisure expand customer reach and service offerings.

- Referral Programs: Incentivized programs encourage existing customers and partners to bring in new business.

- Value Addition: Complementary services offered through partnerships increase the overall value proposition for customers.

Continuous Innovation and Adaptation

Global Payments fosters strong customer relationships through a commitment to continuous innovation and adaptation. They proactively identify and respond to changing market needs and customer preferences, ensuring their solutions remain relevant and valuable.

A key driver of this customer-centric innovation is their annual Commerce and Payment Trends Report. This report, which in 2024 highlighted a significant increase in cross-border e-commerce transactions and a growing demand for embedded payment solutions, provides Global Payments with crucial insights. These insights directly inform their product development, allowing them to anticipate future trends and offer cutting-edge services that empower their clients.

- Innovation Driver: Annual Commerce and Payment Trends Report informs product development.

- Market Insight: 2024 report indicated rising cross-border e-commerce and demand for embedded payments.

- Customer Focus: Adapting offerings to meet evolving market demands and customer expectations.

Global Payments cultivates deep customer loyalty through a multi-faceted approach focusing on personalized service and robust digital tools. Their dedication to client success is evident in their 2024 Net Promoter Score of 50, underscoring a strong base of satisfied and advocating customers.

| Customer Relationship Strategy | Key Initiatives | Impact/Data (2024) |

|---|---|---|

| Dedicated Account Management | Personalized support, rapid issue resolution | NPS of 50 |

| Integrated Solutions & Consultative Approach | Tailoring offerings to unique business challenges | Deep client integration |

| Self-Service Portals & Online Resources | Empowering clients with account management and information access | Enhanced convenience and customer experience |

| Strategic Partnerships & Referrals | Leveraging alliances (e.g., Acrisure) for expanded reach | Access to new customer bases |

| Customer-Centric Innovation | Responding to market trends (e.g., cross-border e-commerce) | Commerce and Payment Trends Report insights |

Channels

Global Payments leverages a dedicated direct sales force to cultivate relationships with major corporations and key strategic clients. This approach is crucial for delivering highly customized payment solutions and fostering deep integration with enterprise systems.

This direct channel is particularly effective for complex sales cycles, enabling the team to thoroughly understand client needs and present sophisticated, multi-faceted payment processing strategies. For instance, in 2024, Global Payments continued to invest in its direct sales teams, recognizing their importance in securing high-value, long-term contracts that often involve intricate technical and operational requirements.

Global Payments leverages its extensive network of partnerships with banks and other financial institutions as a crucial channel to access a vast merchant base. These collaborations often involve financial institutions referring their business clients to Global Payments for payment processing solutions. For instance, in 2024, Global Payments renewed a key strategic partnership with Banamex, reinforcing its reach within Mexico's financial ecosystem.

The Independent Software Vendor (ISV) ecosystem is a crucial channel for Global Payments, enabling the integration of their payment solutions directly into software used across diverse industries. This strategy allows Global Payments to tap into businesses through the very tools they rely on daily for operations.

In 2024, Global Payments saw a substantial increase in new ISV partner signings, indicating a growing reliance on this embedded approach to reach a wider customer base and streamline payment processing for merchants.

Online Platforms and Digital Marketing

Global Payments leverages its corporate website and targeted digital marketing campaigns as primary channels for customer acquisition and engagement. These platforms are essential for educating potential clients about their payment processing solutions and fostering lead generation. In 2024, the company continued to invest in SEO and content marketing, aiming to capture a larger share of online searches for payment services.

The online presence serves as a vital hub, offering comprehensive details on their product suite, industry insights, and customer support resources. This accessibility is key to attracting a diverse range of businesses, from small enterprises to large corporations. For instance, in the first half of 2024, Global Payments reported a significant increase in website traffic, directly correlating with their enhanced digital advertising spend.

- Website as a Lead Generation Tool: Global Payments' corporate site functions as a primary source for new business inquiries, with dedicated sections for service inquiries and contact forms.

- Digital Marketing Campaigns: The company utilizes pay-per-click advertising, social media marketing, and email campaigns to reach and convert potential customers.

- Content Marketing and Education: Online resources, including blog posts, white papers, and webinars, are used to educate the market and establish thought leadership in the payments industry.

- Data-Driven Optimization: In 2024, Global Payments reported a 15% year-over-year improvement in lead conversion rates through refined digital marketing strategies.

Independent Sales Organizations (ISOs) and Resellers

Independent Sales Organizations (ISOs) and resellers are crucial for Global Payments to expand its footprint, especially among small and medium-sized businesses. These partners leverage their existing sales networks to distribute and implement Global Payments' diverse range of payment processing solutions.

In 2024, Global Payments continued to rely on its robust network of ISOs and resellers to drive merchant acquisition. This channel is particularly effective for reaching niche markets and businesses that prefer localized sales support. The company's strategy emphasizes providing these partners with competitive compensation and comprehensive training to ensure effective product representation.

- Extended Market Reach: ISOs and resellers grant Global Payments access to a broader customer base, particularly SMBs, by utilizing established sales channels.

- Solution Distribution: These partners act as key distributors, facilitating the sale and deployment of Global Payments' payment processing and technology solutions.

- Partner Ecosystem Growth: Global Payments actively cultivates its partner ecosystem, offering incentives and support to foster growth and enhance service delivery.

Global Payments utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales teams focus on large enterprises, while partnerships with financial institutions and Independent Software Vendors (ISVs) extend reach into broader markets. Digital channels, including the corporate website and targeted marketing, drive lead generation and customer engagement. Independent Sales Organizations (ISOs) and resellers are vital for penetrating the small and medium-sized business (SMB) segment.

| Channel | Target Audience | 2024 Focus/Data |

|---|---|---|

| Direct Sales Force | Large Corporations, Strategic Clients | Securing high-value, long-term contracts; investing in team expertise for complex solutions. |

| Financial Institution Partnerships | Businesses referred by banks | Renewing key strategic partnerships (e.g., Banamex) to expand merchant base. |

| ISV Ecosystem | Businesses using integrated software | Increasing ISV partner signings for embedded payment solutions; substantial growth in this channel. |

| Website & Digital Marketing | Broad customer acquisition | Investing in SEO, content marketing, and digital advertising; reported a 15% YoY improvement in lead conversion rates in H1 2024. |

| ISOs & Resellers | Small and Medium-sized Businesses (SMBs) | Driving merchant acquisition through established sales networks; offering competitive incentives and training. |

Customer Segments

Small and Medium-sized Businesses (SMBs) are a cornerstone of Global Payments' customer base, relying on the company for critical payment processing and business management solutions. These businesses, spanning diverse industries, typically seek payment solutions that are both user-friendly and cost-effective to manage their daily transactions and operations.

In 2024, the SMB sector continues to be a significant driver of economic activity, with millions of businesses worldwide seeking to streamline their payment acceptance. Global Payments offers these businesses the tools they need to easily accept various payment methods, from credit cards to digital wallets, thereby enhancing their customer experience and sales potential.

Large enterprises and multinational corporations represent a key customer segment, demanding robust and scalable payment solutions. These businesses, often processing millions of transactions annually, require seamless integration with their existing ERP systems, like SAP or Oracle, to manage complex financial workflows efficiently.

For these clients, global reach and sophisticated reporting are paramount. In 2024, the global cross-border B2B payments market was valued at an estimated $37.5 trillion, highlighting the significant need for payment providers that can facilitate international transactions with ease and provide detailed analytics on these flows.

Global Payments has historically partnered with financial institutions, offering them issuer processing services. This segment was crucial for managing card programs and authorizing transactions for banks.

However, Global Payments announced plans in 2023 to divest its issuer processing business to FIS. This strategic move is intended to sharpen the company's focus on its merchant solutions segment.

Independent Software Vendors (ISVs) and Developers

Independent Software Vendors (ISVs) and developers represent a crucial customer segment for Global Payments. These partners integrate Global Payments' robust payment processing capabilities directly into their software solutions, enabling them to offer seamless transaction experiences to their own clientele. This strategic integration fosters a powerful ecosystem for embedded payments, where financial services become an inherent part of the software's functionality.

By partnering with Global Payments, ISVs can enhance their product offerings with advanced payment features, driving customer acquisition and retention. This collaboration is particularly impactful in 2024, as the demand for integrated payment solutions continues to surge across various industries. For instance, the global embedded finance market was projected to reach $7.2 trillion by 2030, with a significant portion of this growth driven by software integrations.

- ISVs as Channel Partners: Developers leverage Global Payments' APIs to embed payment acceptance, processing, and management directly into their SaaS platforms, ERP systems, or point-of-sale software.

- Ecosystem Growth: This segment fuels an ecosystem where businesses can easily adopt sophisticated payment solutions without needing to build them from scratch, increasing adoption rates for Global Payments.

- Revenue Sharing and Value Addition: ISVs often benefit from revenue-sharing models and can command higher subscription fees for their software by including value-added payment services.

- Market Reach Expansion: Global Payments gains access to a wider customer base through the distribution channels established by its ISV partners, reaching businesses that might otherwise be difficult to acquire directly.

Specific Vertical Markets

Global Payments focuses on specific vertical markets, understanding that industries like retail, restaurants, healthcare, education, and petroleum have distinct payment and operational requirements. This targeted approach enables them to develop specialized solutions that resonate with each sector's unique challenges.

By tailoring their offerings, Global Payments can achieve deeper market penetration and provide a more customized service experience. For instance, in 2024, the company continued to expand its presence in the healthcare sector, offering integrated payment solutions designed to streamline patient billing and improve revenue cycle management, a critical need for providers facing evolving reimbursement models.

- Retail: Providing omnichannel payment solutions to support both in-store and online sales, with a focus on reducing checkout friction.

- Restaurants: Offering integrated POS systems and mobile payment options to enhance table turnover and customer convenience.

- Healthcare: Developing secure payment gateways and patient financing tools to manage medical expenses efficiently.

- Petroleum: Delivering specialized solutions for gas stations, including fleet card processing and pay-at-the-pump capabilities.

Global Payments serves a diverse customer base, from small businesses needing simple payment solutions to large enterprises requiring complex, global transaction capabilities. The company also partners with Independent Software Vendors (ISVs) to embed payment services into their software, expanding its reach. Furthermore, Global Payments targets specific industries, tailoring solutions for sectors like retail, healthcare, and petroleum.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Small and Medium-sized Businesses (SMBs) | User-friendly, cost-effective payment processing | Millions of businesses worldwide seeking streamlined payment acceptance. |

| Large Enterprises/Multinationals | Scalable, global payment solutions, ERP integration, cross-border capabilities | Global B2B cross-border payments market valued at ~$37.5 trillion in 2024. |

| Independent Software Vendors (ISVs) | APIs for embedded payments, ecosystem growth, market reach expansion | Global embedded finance market projected to reach $7.2 trillion by 2030. |

| Vertical Markets (Retail, Healthcare, etc.) | Industry-specific solutions, specialized features (e.g., patient billing, fleet cards) | Continued expansion in healthcare for patient billing and revenue cycle management. |

Cost Structure

Global Payments dedicates substantial resources to the research, development, and ongoing maintenance of its sophisticated payment technology platforms and software solutions. These investments are crucial for ensuring the security, efficiency, and scalability of their global processing infrastructure.

A significant portion of this cost structure involves maintaining and upgrading cloud environments, which are essential for handling high transaction volumes and providing reliable service. Furthermore, continuous investment in new product innovation is vital to stay competitive in the rapidly evolving payments landscape.

For instance, in 2024, companies in the fintech sector, including payment processors, saw R&D spending increase by an average of 15% year-over-year, reflecting the intense focus on technological advancement and infrastructure enhancement to support expanding digital payment ecosystems.

Global payment processors incur significant operational and processing costs. These include fees for network access, the expense of running data centers to handle transaction flows, and the ongoing investment in robust security infrastructure. For instance, in 2024, major payment networks like Visa and Mastercard continued to see transaction processing volumes rise, directly impacting the operational expenses for companies facilitating these exchanges.

Compliance with evolving payment industry regulations, such as those related to data privacy and anti-money laundering, adds another layer of substantial cost. These expenses are directly tied to the volume of transactions processed, meaning as more payments are made globally, these operational burdens increase proportionally.

Global Payments' significant investment in its workforce, comprising around 27,000 employees globally, forms a substantial part of its cost structure. This encompasses competitive salaries, comprehensive benefits packages, and ongoing training programs designed to maintain a skilled and motivated team across all critical functions.

The personnel costs are distributed across various departments, including technology development, sales and marketing, operational support, and customer service. These expenses are crucial for delivering innovative payment solutions and maintaining high service standards.

Sales, Marketing, and Customer Acquisition

Global Payments invests heavily in its sales force, encompassing salaries, commissions, and bonuses to drive merchant acquisition and retention. In 2024, companies in the fintech sector often allocate a substantial portion of their revenue, sometimes exceeding 20%, to sales and marketing efforts to capture market share in this competitive landscape.

Marketing campaigns, both digital and traditional, are crucial for brand visibility and attracting new customers. This includes advertising, content creation, and public relations initiatives aimed at highlighting Global Payments' value proposition to potential merchants. These expenditures are essential for building brand awareness and generating leads.

Customer acquisition strategies, such as onboarding incentives and referral programs, directly impact the cost of acquiring new merchants. Global Payments likely employs a mix of direct sales teams and strategic partnerships to reach a broader merchant base, with associated costs for channel development and management.

- Sales Force Compensation: Includes salaries, commissions, and benefits for direct sales teams.

- Marketing Campaigns: Covers digital advertising, content marketing, and brand building initiatives.

- Customer Acquisition Costs (CAC): Encompasses incentives, onboarding support, and partnership fees.

- Market Share Expansion: Investments in strategies to attract new merchants and increase transaction volumes.

Merger, Acquisition, and Integration Expenses

Global Payments faces significant costs associated with strategic growth through mergers and acquisitions. A prime example is their acquisition of Worldpay, which involved substantial integration expenses to combine operations and systems effectively. These costs also encompass legal fees, advisory services, and the financing required to complete such large-scale transactions.

The company actively pursues operational transformation initiatives post-acquisition to realize cost efficiencies. This includes streamlining processes, optimizing technology platforms, and consolidating infrastructure. By focusing on these areas, Global Payments aims to leverage the scale and capabilities of acquired businesses to drive profitability and enhance competitive positioning.

- Merger & Acquisition Expenses: Costs related to acquiring businesses like Worldpay, including integration, legal, and financing.

- Operational Transformation: Investments in streamlining operations and technology post-acquisition to achieve cost synergies.

- Integration Costs: Expenses incurred to merge systems, cultures, and operational processes of acquired entities.

- Financing Costs: Interest and fees associated with debt or equity used to fund acquisitions.

Global Payments' cost structure is heavily influenced by its substantial investments in technology and infrastructure. This includes the ongoing maintenance and upgrades of its global payment processing platforms, cloud services, and robust security measures. For instance, in 2024, the fintech sector saw a notable increase in R&D spending, with some companies allocating over 15% of their budget to technological advancements to support expanding digital payment ecosystems.

Personnel costs represent a significant outlay, covering competitive salaries, benefits, and training for its extensive global workforce. Sales and marketing expenses are also considerable, driven by efforts to acquire new merchants and expand market share. In 2024, many fintech firms dedicated more than 20% of their revenue to sales and marketing to gain a competitive edge.

Strategic growth through mergers and acquisitions, such as the Worldpay acquisition, incurs substantial costs related to integration, legal, and financing. These investments are crucial for expanding capabilities and achieving operational efficiencies, with the goal of driving profitability and enhancing market positioning.

Revenue Streams

Merchant acquiring fees represent a core revenue driver for Global Payments, stemming from the processing of various electronic transactions. These fees are generally structured as a percentage of the transaction value or a fixed charge per transaction.

In 2024, Global Payments' Merchant Solutions segment demonstrated robust performance, with revenues reflecting the substantial volume of transactions processed. This segment’s financial results underscore the significance of acquiring fees as a fundamental component of the company's overall revenue generation strategy.

Revenue streams from payment processing services are a cornerstone for companies like Global Payments. This involves charging fees for the authorization, clearing, and settlement of transactions across various payment methods. These fees can differ based on the type of payment, transaction volume, and any additional value-added services offered, such as fraud prevention or data analytics.

In 2024, Global Payments demonstrated robust growth in this area, reporting adjusted net revenues that saw consistent increases. For instance, the company's adjusted net revenues grew by approximately 10% year-over-year for the first quarter of 2024, highlighting the sustained demand for its core processing capabilities.

Global Payments generates a significant portion of its income through recurring revenue from subscriptions and licensing fees for its diverse software and technology solutions. These offerings include advanced point-of-sale (POS) systems, comprehensive business management tools, and secure online payment gateways, catering to a wide range of business needs.

This subscription model provides a stable and predictable revenue stream, underpinning the company's financial resilience. For instance, in the first quarter of 2024, Global Payments reported that its software and information services segment, which heavily relies on these subscriptions, saw a notable increase in revenue, reflecting strong customer adoption and retention.

Value-Added Services and Analytics

Global Payments generates revenue beyond basic transaction processing by offering a suite of value-added services. These include advanced fraud prevention tools, sophisticated data analytics for merchant insights, and customer loyalty program management. Additionally, the company provides business funding solutions, acting as a financial partner for its clients.

These ancillary services are designed to deepen customer relationships and create recurring revenue streams. For instance, in 2024, the demand for robust fraud detection services saw significant growth, with cybersecurity spending in the financial sector projected to increase by 11% globally. Global Payments leverages this trend by offering specialized analytics that help businesses reduce chargebacks and improve operational efficiency.

- Fraud Prevention: Advanced analytics and machine learning to combat payment fraud.

- Data Analytics: Insights into customer behavior and sales trends for merchants.

- Loyalty Programs: Tools to build and manage customer retention initiatives.

- Business Funding: Offering working capital and financing solutions to businesses.

Interchange and Network Fees (Net)

Global Payments earns revenue from the net economics of interchange and network fees, primarily as a merchant acquirer. While a substantial portion of these fees are passed through, the company retains a portion as profit.

The acquisition of Worldpay in 2019 was a significant move, expected to bolster its revenue streams. For the fiscal year ending December 31, 2023, Global Payments reported adjusted net revenue of $9.36 billion, a 5% increase compared to the previous year. This growth reflects the combined strength and expanded market reach following the Worldpay integration.

- Interchange Fees: Fees charged by card-issuing banks for processing transactions.

- Network Fees: Fees paid to card networks like Visa and Mastercard for facilitating transactions.

- Net Revenue: The portion of these fees Global Payments retains after passing through associated costs.

- Worldpay Acquisition Impact: Expected to significantly enhance pro forma annual adjusted net revenue through increased transaction volume and broader service offerings.

Global Payments also generates revenue from providing technology solutions and software to businesses. This includes point-of-sale systems, business management tools, and online payment gateways, often on a subscription or licensing basis.

In 2024, the company continued to emphasize its software and information services, noting strong performance in this segment. This recurring revenue model offers stability and predictability, contributing significantly to the company's financial health.

Global Payments' revenue streams are diversified, including merchant acquiring fees, payment processing services, software subscriptions, and value-added services like fraud prevention and data analytics. The company also earns from the net economics of interchange and network fees.

For the first quarter of 2024, Global Payments reported adjusted net revenues of $2.38 billion, an increase of 10% year-over-year, demonstrating the broad success across its various revenue channels.

| Revenue Stream | Description | 2024 Performance Indicator |

|---|---|---|

| Merchant Acquiring Fees | Fees from processing electronic transactions. | Core driver of Merchant Solutions segment revenue. |

| Payment Processing Services | Fees for authorization, clearing, and settlement. | Adjusted net revenues grew ~10% YoY in Q1 2024. |

| Software & Technology Subscriptions | Recurring revenue from POS systems, business tools, etc. | Strong customer adoption and retention noted in Q1 2024. |

| Value-Added Services | Fraud prevention, data analytics, loyalty programs, business funding. | Growing demand, especially for fraud detection services. |

| Interchange & Network Fees (Net) | Retained portion of fees after pass-through costs. | Bolstered by Worldpay acquisition; contributed to $9.36B adjusted net revenue in FY23. |

Business Model Canvas Data Sources

The Global Payments Business Model Canvas is built upon a foundation of extensive market research, financial transaction data, and regulatory compliance reports. These diverse sources ensure each component of the canvas accurately reflects the complex global payments landscape.