Global Payments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

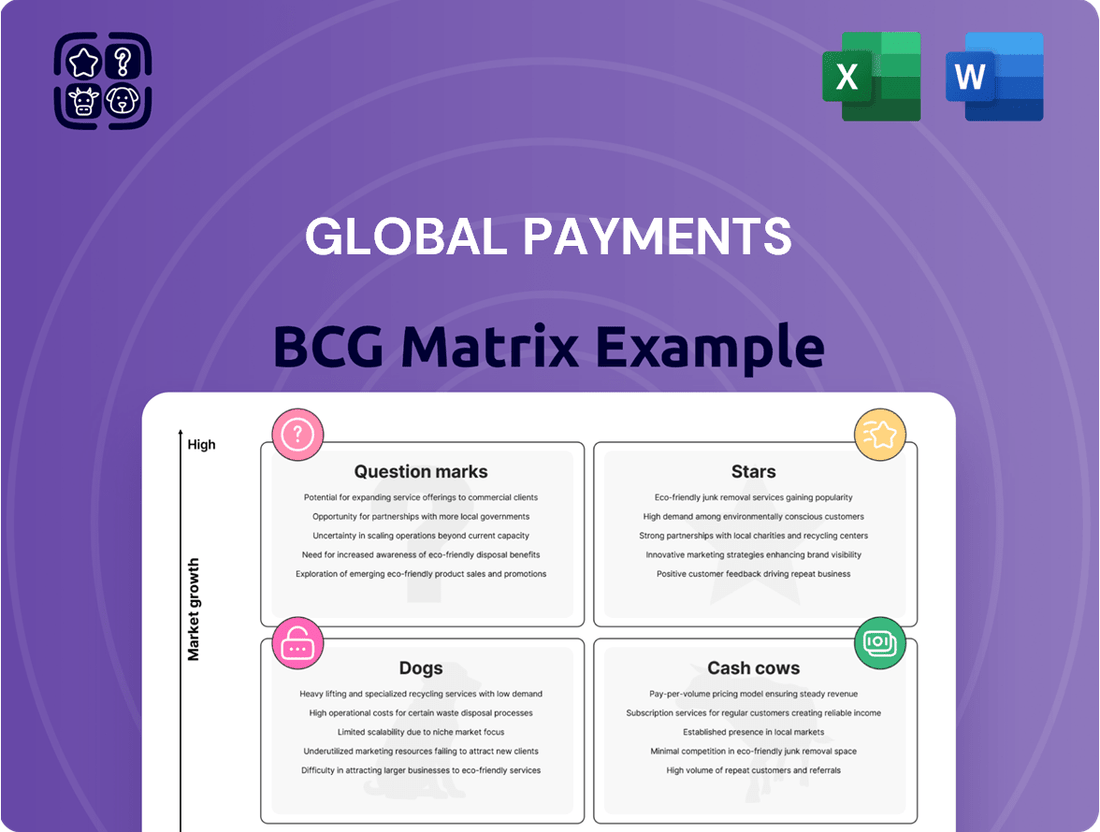

Curious about where global payment solutions stand in the market? Our preview offers a glimpse into the strategic positioning of key players, categorizing them into Stars, Cash Cows, Dogs, and Question Marks.

Unlock a comprehensive understanding of the global payments landscape by purchasing the full BCG Matrix. Gain actionable insights into market share and growth potential, empowering your investment and product development decisions.

Don't miss out on the complete strategic roadmap. Secure your copy of the full BCG Matrix today and transform your approach to navigating the dynamic world of global payments.

Stars

Global Payments views B2B embedded payments as a prime growth engine, anticipating substantial expansion through 2025. This sector is experiencing rapid adoption as businesses seek to streamline transactions directly within their operational software.

The embedded finance market is poised for considerable growth, with projections indicating a compound annual growth rate that underscores its strategic importance. Global Payments is channeling investments into this space to boost efficiency and automate the billing processes for its B2B clients.

This strategic focus on B2B embedded payments positions Global Payments as a leader in a rapidly evolving market. For instance, the B2B embedded payments market alone was valued at over $25 billion in 2023 and is expected to reach $80 billion by 2028, demonstrating the significant opportunity.

Global Payments' 2025 Commerce and Payment Trends Report underscores AI's role as a key value driver, particularly in fortifying fraud prevention and digital security. The company is actively integrating AI, biometrics, and tokenization to counter increasingly complex fraudulent activities, providing robust security solutions essential for the dynamic digital payment ecosystem.

This strategic focus places Global Payments squarely in a high-growth market, where its advanced security offerings are experiencing substantial demand and adoption. The increasing sophistication of cyber threats necessitates these cutting-edge solutions, positioning AI-driven fraud prevention as a significant growth area for the company.

Global Payments is consolidating its point-of-sale (POS) offerings under the unified Genius brand. This strategic move aims to create integrated service hubs that streamline back-end operations and enhance customer experiences. This focus on unified commerce platforms is particularly relevant for small and mid-sized businesses (SMBs) and mid-market companies, a segment showing increased investment in these solutions.

The Genius platform is positioned to capture growth in the expanding market for integrated POS and commerce solutions. As of 2024, the global retail POS market is projected to reach over $25 billion, with unified commerce platforms being a key driver of this expansion. Global Payments' investment in Genius reflects a strategy to gain significant market share in this high-growth area by offering comprehensive, end-to-end solutions.

Global Merchant Acquiring Services

Global Payments has a commanding presence in the burgeoning global merchant acquiring sector. Their merchant services division saw robust growth in Q4 2024, underscoring their substantial market share in an environment fueled by the global surge in digital and e-commerce activity.

The company is actively expanding its footprint through strategic acquisitions and a dedicated focus on delivering integrated payment solutions.

- Market Growth: The global merchant acquiring market is experiencing significant expansion, driven by the increasing adoption of digital payments and e-commerce.

- Q4 2024 Performance: Global Payments' merchant business exhibited strong growth in the fourth quarter of 2024, indicating sustained momentum.

- Strategic Focus: The company prioritizes strategic acquisitions and the development of integrated payment solutions to solidify its market position.

- Competitive Landscape: This segment is characterized by high market share concentration and is heavily influenced by global transaction trends.

E-commerce Payment Solutions

E-commerce payment solutions are a key component of the Global Payments BCG Matrix, situated in a high-growth market. The digital goods payment sector is anticipated to double between 2024 and 2029, with digital payments already forming a significant and increasing portion of all online transactions.

Global Payments offers robust solutions that allow businesses to process payments across a wide array of online platforms. This capability is crucial as the e-commerce landscape continues its rapid expansion.

- Market Growth: E-commerce payments for digital goods are projected to double between 2024 and 2029.

- Digital Dominance: Digital payments represent a substantial and growing share of online transactions.

- Global Payments' Role: The company provides comprehensive solutions for accepting payments across diverse online channels.

- Competitive Advantage: Seamless online payment experiences position Global Payments as a leader in this expanding sector.

Stars represent high-growth, high-market-share segments. Global Payments' B2B embedded payments and e-commerce solutions for digital goods are prime examples of these Star segments. These areas exhibit substantial growth potential, driven by technological advancements and evolving consumer behavior, with Global Payments strategically positioned to capitalize on this momentum.

| Segment | Growth Rate | Market Share | Key Drivers | Global Payments' Position |

|---|---|---|---|---|

| B2B Embedded Payments | High | High | Streamlined transactions, operational software integration | Leader, investing in efficiency and automation |

| E-commerce Payments (Digital Goods) | High (projected to double 2024-2029) | High | Digitalization of commerce, increasing online transactions | Provider of robust, cross-platform solutions |

What is included in the product

The Global Payments BCG Matrix analyzes payment products by market growth and share, guiding investment.

The Global Payments BCG Matrix offers a clear, visual map of your portfolio, simplifying complex strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

Global Payments' Issuer Solutions segment functions as a cash cow within its BCG matrix. This division consistently delivers robust revenue streams, underpinning the company's financial stability. In Q4 2024, this segment experienced a growth of 3%, highlighting its ongoing contribution.

Issuer Solutions provides critical services to financial institutions, operating within a mature yet stable market. The high barriers to entry in this sector ensure a predictable and steady cash flow for Global Payments, solidifying its position as a reliable revenue generator.

Traditional in-store payment processing for large enterprises continues to be a bedrock for Global Payments, even as digital channels expand. This segment represents a stable, high-volume business with established client bases, contributing significantly to the company's overall revenue. In 2024, Global Payments maintained a strong presence in this mature market, leveraging its robust infrastructure and long-standing enterprise relationships.

Established credit and debit card processing represents a classic Cash Cow for Global Payments. These payment methods remain the backbone of commerce worldwide, with transaction volumes consistently high. In 2024, it's estimated that over 70% of all consumer transactions globally are conducted using cards, a testament to their enduring dominance and widespread acceptance.

Global Payments' robust infrastructure and deep-seated merchant relationships in this sector give it a significant market share. While the growth rate for card processing might be considered mature, the sheer volume of transactions ensures a steady and substantial cash flow. This segment reliably generates considerable profits, allowing Global Payments to fund investments in other, higher-growth areas of its business.

Mature North American Merchant Acquiring Base

The mature North American merchant acquiring base is a cornerstone of Global Payments' business, acting as a significant cash cow. This established market, characterized by its high penetration of electronic payments, provides a substantial and consistent revenue stream for the company.

Despite lower growth rates compared to emerging markets, the sheer volume of transactions processed in North America ensures stable, predictable cash flows. In 2024, Global Payments continued to leverage its strong market share in this region, benefiting from long-standing relationships and a robust infrastructure.

Key aspects of this mature segment include:

- Dominant Market Position: Global Payments holds a leading position in North American merchant acquiring, processing a vast number of transactions for businesses of all sizes.

- Stable Revenue Generation: The mature nature of the market translates into reliable and consistent revenue, underpinning the company's overall financial stability.

- High Cash Flow Contribution: This segment is a primary generator of free cash flow, which can be reinvested in growth initiatives or returned to shareholders.

- Operational Efficiency: Years of experience and investment in technology have led to highly efficient operations in this segment, maximizing profitability.

Global Network Infrastructure

Global Payments' extensive global network infrastructure, operating in 38 countries with 27,000 employees, serves as a significant cash cow. This well-established operational footprint and broad client base in established markets generate substantial and consistent cash flow.

- Network Reach: Operations spanning 38 countries.

- Workforce: 27,000 dedicated team members.

- Market Position: High market share in established territories.

- Cash Generation: Leverages existing assets for strong, consistent cash flow.

Global Payments' Issuer Solutions segment represents a prime cash cow, consistently generating substantial revenue within a mature market. Its strong position in providing essential services to financial institutions ensures a steady and predictable cash flow for the company.

Established credit and debit card processing, a core business for Global Payments, continues to be a reliable cash cow. With over 70% of global consumer transactions still conducted via cards in 2024, this segment's high volume and widespread acceptance guarantee consistent profitability.

The North American merchant acquiring base, characterized by high electronic payment penetration, acts as another significant cash cow. Despite mature growth rates, the sheer volume of transactions processed in this region provides stable, predictable cash flows, reinforcing Global Payments' financial stability.

| Segment | BCG Matrix Category | 2024 Data Point | Key Characteristic | Cash Flow Impact |

|---|---|---|---|---|

| Issuer Solutions | Cash Cow | 3% Q4 2024 Growth | Mature, stable market, high barriers to entry | Robust and consistent revenue |

| Card Processing | Cash Cow | >70% of global transactions (2024) | High volume, widespread acceptance | Substantial and steady cash generation |

| North American Merchant Acquiring | Cash Cow | Strong market share | High electronic payment penetration, established relationships | Stable, predictable cash flows |

What You See Is What You Get

Global Payments BCG Matrix

The Global Payments BCG Matrix preview you are seeing is the exact, fully formatted document you will receive upon purchase, ensuring no surprises and immediate usability.

This comprehensive BCG Matrix report, meticulously crafted for strategic insights into the global payments landscape, will be delivered to you precisely as it appears in this preview, ready for your immediate business planning.

Rest assured, the Global Payments BCG Matrix you are currently viewing is the final, unwatermarked version you will download immediately after completing your purchase, offering direct access to actionable market analysis.

What you see here is the authentic Global Payments BCG Matrix document that will be yours once purchased, providing you with a professional and analysis-ready tool for strategic decision-making.

Dogs

Global Payments' decision to divest its payroll business in May 2025 strongly suggests this segment falls into the Dogs category of the BCG Matrix. This move implies the payroll operations were likely characterized by low market share and low growth potential, making them a less attractive investment compared to other business units. By divesting, Global Payments can sharpen its focus on core, high-growth areas, potentially improving overall profitability and strategic alignment.

Global Payments' strategic exit from several subscale markets in the Asia-Pacific region in 2024 reflects a deliberate effort to shed underperforming assets. These divested markets, characterized by limited growth prospects and Global Payments' low market share, were classified as 'dogs' within the company's portfolio. This move is expected to streamline operations and enhance overall profitability.

Global Payments' legacy, non-integrated software solutions represent its 'dogs' in the BCG matrix. These are older systems, often with a low market share and minimal growth prospects, that haven't been brought into the company's broader strategy of unifying point-of-sale (POS) operations under the Genius brand.

These disparate offerings may be costly to maintain and offer limited functionality compared to newer, integrated platforms. For instance, in 2023, Global Payments continued its efforts to migrate clients from these legacy systems to more modern, cloud-based solutions, signaling a strategic divestment or phasing out of these less competitive products.

Outdated Payment Terminal Hardware

Outdated payment terminal hardware, those that haven't kept pace with technological advancements, are firmly in the 'dog' category of the Global Payments BCG Matrix. These terminals often lack essential features like AI integration, unified commerce capabilities, or seamless cloud connectivity, which are becoming standard in modern point-of-sale (POS) systems.

The standalone market share for such legacy hardware is in steady decline. For instance, while the overall global POS market was projected to reach over $120 billion by 2024, a significant portion of this growth is driven by smart, connected terminals. Older, non-smart terminals are becoming increasingly irrelevant.

Businesses clinging to this outdated hardware may find themselves investing disproportionately in maintenance and support for diminishing returns. The cost of keeping these systems operational often outweighs the value they provide in today's fast-evolving retail and payment landscape.

- Declining Market Share: Legacy payment terminals are losing ground as newer, feature-rich solutions gain traction.

- Lack of Modern Features: These devices typically miss out on AI, unified commerce, and cloud integration crucial for modern business operations.

- High Maintenance Costs: Supporting outdated hardware can become a significant expense with minimal return on investment.

- Limited Functionality: They struggle to support evolving customer expectations and integrated business processes.

Segments Heavily Reliant on Declining Payment Methods

Within Global Payments, segments still heavily dependent on declining payment methods like traditional check processing or cash-heavy businesses in digitally advancing economies would be categorized as 'dogs.' These operations face dim growth potential and shrinking market share, necessitating minimal investment or eventual discontinuation.

For instance, if Global Payments still maintains a significant portfolio focused on physical check clearing, a service that saw a substantial decline globally, this would represent a 'dog' segment. In 2023, the value of checks processed in many developed nations continued its downward trend, with some estimates suggesting a year-over-year decrease of over 10% in transaction volume for certain legacy systems.

- Declining Check Processing: Segments focused on traditional check processing are likely 'dogs' due to a persistent global decline in check usage.

- Cash-Intensive Operations: Businesses within Global Payments that rely heavily on cash transactions in markets rapidly shifting to digital payments also fall into this category.

- Low Growth Prospects: These 'dog' segments exhibit minimal to negative growth potential, making them unattractive for further investment.

- Strategic Divestment: Companies often consider divesting or phasing out 'dog' business units to reallocate resources to more promising areas of their portfolio.

Global Payments’ decision to divest its payroll business in May 2025 positions it as a 'dog' in the BCG Matrix, indicating low market share and growth. Similarly, exiting subscale Asia-Pacific markets in 2024 also reflects a strategic move away from 'dog' segments with limited prospects. Legacy, non-integrated software solutions and outdated payment hardware are also classified as 'dogs' due to their declining market share and high maintenance costs.

| BCG Category | Global Payments Segment Example | Characteristics | Rationale |

|---|---|---|---|

| Dogs | Divested Payroll Business (May 2025) | Low Market Share, Low Growth Potential | Strategic divestment to focus on core, high-growth areas. |

| Dogs | Subscale Asia-Pacific Markets (Exited 2024) | Limited Growth Prospects, Low Market Share | Streamlining operations and enhancing overall profitability. |

| Dogs | Legacy Software Solutions | Low Market Share, Minimal Growth | Costly to maintain, limited functionality compared to modern platforms. |

| Dogs | Outdated Payment Terminals | Declining Market Share, High Maintenance Costs | Lack modern features like AI, unified commerce; becoming irrelevant. |

| Dogs | Traditional Check Processing | Shrinking Market Share, Dim Growth Potential | Global decline in check usage; e.g., over 10% year-over-year decrease in transaction volume for some legacy systems in 2023. |

Question Marks

Real-time payments (RTP) are experiencing explosive growth globally, with many countries actively implementing or expanding their RTP infrastructure. For instance, by the end of 2023, over 70 countries had launched or were in the process of launching real-time payment systems, facilitating instant fund transfers. Global Payments, a major player in payment processing, is well-positioned to capitalize on this trend.

While Global Payments supports a broad range of payment functionalities, its dedicated investment and market penetration in developing novel, standalone RTP solutions beyond standard processing capabilities may still be in its early stages. This presents a significant opportunity in a high-growth sector where substantial investment is crucial for capturing a larger market share and driving innovation in instant payment technologies.

Cryptocurrency payment adoption is experiencing rapid growth, with the global crypto market capitalization reaching over $2.5 trillion in early 2024, signaling a high-potential but still developing sector. This surge is largely fueled by blockchain's capacity for financial innovation, making it a key area for future payment solutions.

Global Payments' current market share in facilitating these novel transactions is likely modest, reflecting its early-stage involvement. However, the company's strategic investments and development in this area could position it to capture significant future growth, mirroring the trajectory of other emerging payment technologies.

Global Payments is strategically targeting niche verticals such as education, healthcare, and real estate for expansion. Their approach involves embedding payment solutions directly into software, aiming for increased customer loyalty and higher attachment rates in these specialized markets. This focus on integration is key to differentiating their offerings.

While these verticals present significant growth opportunities, Global Payments may currently possess a smaller market share within them. Consequently, substantial investment will likely be necessary to establish a more dominant presence and capitalize on the inherent potential of these sectors. For instance, the global healthcare payments market alone was projected to reach over $2.5 trillion by 2024, highlighting the scale of these opportunities.

Advanced Generative AI Applications (Beyond Fraud)

While generative AI is making waves in fraud detection, its application in broader client services and predictive analytics for merchants at Global Payments is still nascent. These advanced uses, though holding significant future potential for efficiency and customer engagement, currently represent a small fraction of the company's deployed AI solutions.

These emerging generative AI applications are in early development, meaning their market share within Global Payments is minimal. However, they are poised to become key drivers for future growth by enhancing merchant services and customer interactions.

- Predictive Analytics for Merchants: Leveraging generative AI to forecast sales trends, optimize inventory, and personalize offers for Global Payments' merchant clients.

- Enhanced Client Services: Developing AI-powered chatbots and virtual assistants for more sophisticated customer support and personalized financial advice.

- Innovative Marketing: Utilizing generative AI to create targeted marketing campaigns and personalized content for different customer segments.

- Operational Efficiency: Automating complex back-office processes and generating insights from large datasets to streamline operations.

Social Commerce Payment Enablement

Global Payments' 2025 report highlights the growing significance of social commerce, where consumers are making purchases directly within social media environments. This represents a new and expanding market for payment providers.

The company is actively investigating opportunities in this sector. Given that social commerce is a developing area, Global Payments' current market share in facilitating these direct in-platform payments is likely minimal.

This low existing market share, combined with the high-growth potential of social commerce, positions it as a 'question mark' within the BCG matrix. This classification suggests that while the market is promising, significant investment may be required to establish a strong position.

- Growing Market: Social commerce is projected to reach $2.9 trillion globally by 2026, up from $1.2 trillion in 2021.

- Technological Demands: Seamless integration and secure payment processing are critical for success in social commerce.

- Investment Consideration: Global Payments' entry into this space will likely require substantial R&D and strategic partnerships.

- Potential Upside: Capturing even a small percentage of this rapidly expanding market could yield significant future revenue.

Social commerce, where purchases happen directly within social media platforms, is a rapidly expanding frontier. Global Payments is exploring this dynamic space, recognizing its significant growth potential.

Currently, Global Payments likely holds a minimal market share in facilitating these direct social commerce payments, reflecting its early stage of engagement in this evolving sector.

This combination of a nascent market position and high growth trajectory places social commerce squarely in the 'question mark' category for Global Payments.

Substantial investment will be crucial for the company to build a strong presence and effectively compete in this burgeoning market.

| Category | Market Size (Est. 2026) | Global Payments' Current Share (Est.) | Investment Need | Growth Potential |

|---|---|---|---|---|

| Social Commerce Payments | $2.9 Trillion | Minimal | High | Very High |

BCG Matrix Data Sources

Our Global Payments BCG Matrix leverages comprehensive data from financial statements, industry reports, and market trend analysis to provide a clear strategic overview.