Global Payments Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

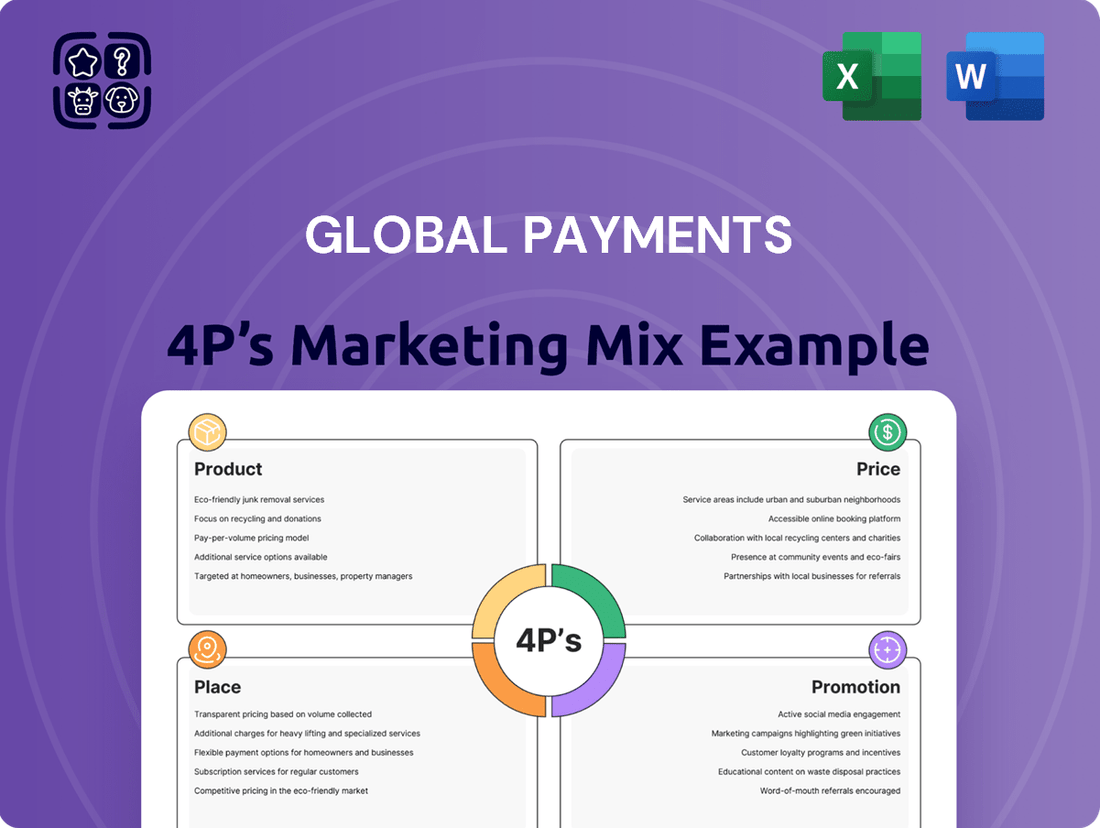

Uncover the strategic brilliance behind Global Payments' success with our comprehensive 4Ps Marketing Mix Analysis. We delve into their innovative product offerings, competitive pricing, expansive distribution, and impactful promotional campaigns.

This isn't just a summary; it's a blueprint for understanding how Global Payments masters the market. Ready to elevate your own marketing strategy?

Gain instant access to an in-depth, editable report that breaks down each P with actionable insights and real-world examples. Save hours of research and get a competitive edge today!

Product

Global Payments' payment processing and merchant acquiring services are central to its product offering, enabling businesses to accept payments efficiently. They support over 5 million merchants globally, facilitating transactions across in-person, online, and mobile platforms. This extensive network underscores their role as a critical infrastructure provider in the digital economy.

Global Payments' POS systems, like the Genius™ platform, are crucial for businesses of all sizes, offering a blend of power and ease of use. These systems are designed to directly impact revenue and operational efficiency, a key element in their product strategy.

The evolution of these POS systems into integrated service hubs is a significant development. They now support loyalty programs, email marketing, and online ordering, transforming a simple transaction tool into a comprehensive business management solution. This expansion aligns with the growing demand for omnichannel retail experiences.

In 2024, the global POS software market was valued at approximately $23.5 billion and is projected to grow significantly. This highlights the substantial market opportunity and the importance of Global Payments' investment in advanced, feature-rich POS solutions to capture a larger share.

Global Payments extends its value proposition beyond basic transaction processing by providing a robust suite of business tools and software solutions. These offerings are designed to streamline critical daily operations for their diverse client base.

Key functionalities include comprehensive payroll and HR management, efficient disputes resolution, and real-time data analytics and reporting. This allows businesses to gain deeper insights and make more informed decisions.

Furthermore, the platform facilitates automated billing and invoicing processes, alongside detailed financial tracking capabilities. This integrated approach aims to enhance operational efficiency and financial control for merchants, with many clients reporting significant time savings in administrative tasks by Q2 2025.

Issuer Solutions

Global Payments' Issuer Solutions are designed to equip financial institutions, fintech companies, and large enterprises with the essential technology for card issuance and management. These advanced, cloud-native platforms are built for operational efficiency and swift integration of new services, essentially providing the backbone for modern payment card programs.

The company's focus on these solutions reflects a growing market demand for agile and scalable card processing capabilities. For instance, the digital transformation in banking, accelerated by events in 2024, has pushed many institutions to upgrade their legacy systems. Global Payments' platform aims to meet this need by simplifying complex processes and enabling faster product launches.

- Cloud-Native Architecture: Facilitates scalability and rapid deployment of new features, crucial for adapting to evolving market demands.

- Operational Efficiency: Streamlines card issuance, personalization, and lifecycle management, reducing costs and time-to-market for clients.

- Service Integration: Enables seamless addition of innovative payment services, enhancing the client's product portfolio.

- Market Relevance: Supports a wide range of card products, from traditional credit and debit to prepaid and evolving digital wallet solutions.

Integrated & Embedded Payments

Integrated and embedded payments are a cornerstone of Global Payments' product strategy, focusing on solutions that seamlessly connect with a business's existing software and operational workflows. This approach aims to streamline B2B transactions and vendor payments, boosting efficiency and automating crucial billing functions.

The market for embedded finance, which includes these payment solutions, is experiencing significant growth. By 2026, it's projected to reach $7.2 trillion globally, highlighting the massive opportunity for companies like Global Payments to capture market share by offering frictionless payment experiences directly within business applications.

- Seamless Integration: Solutions designed to plug directly into ERP systems, accounting software, and e-commerce platforms.

- B2B Transaction Focus: Facilitating smoother vendor payments and accounts payable/receivable processes for businesses.

- Efficiency Gains: Automating billing, reducing manual data entry, and speeding up payment cycles.

- Market Growth: Capitalizing on the expanding embedded finance sector, which is expected to see substantial expansion in the coming years.

Global Payments' product strategy centers on providing comprehensive, integrated payment solutions that go beyond simple transaction processing. Their offerings include advanced POS systems, robust business management software, and sophisticated issuer solutions, all designed to enhance merchant efficiency and customer experience.

The Genius™ POS platform, for example, has evolved into a business hub, supporting loyalty programs and online ordering, reflecting a move towards omnichannel retail. This strategic product development is crucial given the projected growth of the global POS software market, which was valued at approximately $23.5 billion in 2024.

Furthermore, their Issuer Solutions leverage cloud-native architecture for scalability and swift service integration, addressing the increasing demand for agile card processing capabilities. This is particularly relevant as the digital transformation in banking accelerated throughout 2024.

Integrated and embedded payments are also a key focus, aiming to streamline B2B transactions and vendor payments within existing business applications. This aligns with the embedded finance market's projected growth to $7.2 trillion globally by 2026, showcasing Global Payments' commitment to future-forward payment technologies.

What is included in the product

This analysis offers a comprehensive examination of Global Payments' marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It's designed for professionals seeking to understand Global Payments' market positioning and competitive advantages, grounded in real-world practices.

Simplifies complex global payment strategies by clearly defining each of the 4Ps, alleviating the pain of understanding and communicating intricate marketing plans.

Offers a clear, actionable framework for identifying and addressing market gaps, relieving the pressure of developing effective global payment solutions.

Place

Global Payments leverages a robust global distribution network, comprised of roughly 27,000 dedicated team members spread across 38 countries. This expansive reach is crucial for serving a broad spectrum of clients in key markets like North America, Europe, Asia Pacific, and Latin America.

This extensive network facilitates deep market penetration and ensures that Global Payments can offer tailored, localized support to businesses operating in diverse economic and regulatory environments. As of early 2024, the company's strategic placement of resources across these regions underscores its commitment to accessibility and client service.

Omni-channel accessibility is crucial for global payment providers, ensuring their solutions reach customers wherever they transact. This means seamless integration across physical stores, e-commerce websites, and mobile applications, reflecting a modern consumer's expectation for choice. For instance, by 2025, it's projected that 75% of retail sales will involve some form of digital interaction, highlighting the need for comprehensive payment coverage.

Global Payments utilizes a vast global sales force and specialized account managers to directly connect with merchants. This direct engagement is key to understanding unique business needs and offering customized payment solutions, fostering loyalty and retention.

In 2024, Global Payments reported significant growth in its merchant services segment, driven by its direct sales strategy. The company’s focus on personalized service and support for businesses of all sizes, from small enterprises to large corporations, has been a cornerstone of its market penetration.

Strategic Partnerships & Alliances

Global Payments leverages strategic partnerships as a cornerstone of its distribution strategy, extending its reach through collaborations with banks, ISVs, and other payment ecosystem players. These alliances are crucial for embedding payment solutions directly into the workflows of businesses across diverse sectors, enhancing convenience and accessibility for merchants. For instance, in 2024, Global Payments continued to expand its network of ISV partners, aiming to integrate its payment processing capabilities into over 200 new software platforms serving industries from retail to healthcare.

These partnerships are vital for driving adoption and ensuring that Global Payments' offerings are readily available within the software environments that businesses already utilize. This approach allows for seamless integration, reducing friction for merchants and enabling them to accept payments efficiently. By working with ISVs, Global Payments can tap into established customer bases and offer tailored payment solutions that meet specific industry needs, a strategy that proved effective in its 2024 growth initiatives.

Key aspects of these strategic alliances include:

- Expanded Market Access: Partnerships provide entry into new customer segments and geographic regions that might otherwise be challenging to penetrate independently.

- Product Integration: Collaborating with ISVs allows for the seamless embedding of payment functionalities into software, creating a more integrated user experience for merchants.

- Technology Synergies: Alliances can foster innovation by combining technological capabilities, leading to the development of more advanced and secure payment solutions.

- Revenue Sharing Models: Many partnerships involve revenue-sharing agreements, creating mutually beneficial financial incentives for both Global Payments and its partners.

Digital Platforms & API Integration

Digital platforms and API integrations are the backbone of modern global payment services, offering unparalleled convenience and operational efficiency. These technological enablers allow for the swift and seamless delivery of payment solutions, connecting various stakeholders and streamlining complex processes. For instance, in 2024, the global API management market was valued at approximately $6.4 billion, with projections indicating substantial growth driven by the increasing demand for digital connectivity in financial services.

The strategic use of robust APIs allows payment providers to integrate their services directly into a client's existing systems, whether it's an e-commerce website or a large enterprise resource planning (ERP) system. This deep integration minimizes friction for end-users and reduces the manual effort required for transaction processing and reconciliation. By 2025, it's estimated that over 90% of new application development will involve APIs, highlighting their critical role in the digital economy.

- Enhanced Customer Experience: Digital platforms provide intuitive interfaces for managing payments, tracking transactions, and accessing support, leading to higher customer satisfaction.

- Operational Efficiency: API integrations automate key processes like payment authorization, settlement, and reporting, significantly reducing operational costs and errors.

- Rapid Solution Deployment: The modular nature of API-driven services allows for faster development and deployment of new payment features and tailored solutions to meet evolving market needs.

- Scalability and Flexibility: This technological infrastructure supports the scaling of payment volumes and adapts easily to new markets and regulatory changes, a crucial factor for global operations.

Global Payments' 'Place' strategy centers on pervasive accessibility, ensuring their payment solutions are readily available across diverse customer touchpoints. This involves a multi-pronged approach combining a vast physical presence with deep digital integration.

The company's extensive network of 27,000 employees across 38 countries facilitates localized support and market penetration. This physical reach is complemented by a strong emphasis on digital platforms and API integrations, allowing for seamless embedding into client systems.

Strategic partnerships with banks and ISVs further extend Global Payments' reach, embedding solutions within existing business workflows. By 2025, with 75% of retail sales projected to involve digital interaction, this omni-channel approach is critical.

In 2024, Global Payments saw significant growth in merchant services, driven by this direct sales and partnership strategy, underscoring the effectiveness of their placement in key markets and digital ecosystems.

| Distribution Channel | Key Features | 2024/2025 Relevance |

|---|---|---|

| Direct Sales Force | Personalized service, understanding unique business needs | Drove significant merchant services growth in 2024 |

| Strategic Partnerships (ISVs, Banks) | Embedded solutions, extended market access | Aiming for integration into 200+ new software platforms by 2025 |

| Digital Platforms & APIs | Seamless integration, operational efficiency | API management market valued at $6.4B in 2024, 90%+ new apps to use APIs by 2025 |

| Global Physical Presence | 27,000+ employees in 38 countries, localized support | Ensures accessibility and tailored support in key markets |

Full Version Awaits

Global Payments 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the final version of the Global Payments 4P's Marketing Mix Analysis you’ll receive. This comprehensive document is ready for immediate download and use upon purchase. You can be confident that the insights and strategies presented are exactly what you'll get, with no hidden surprises.

Promotion

Global Payments actively engages the financial community through investor conferences and detailed financial reporting, offering transparency on its strategic initiatives and performance. These platforms are vital for communicating the company's value proposition and growth trajectory to stakeholders.

In 2024, Global Payments continued its commitment to clear communication, with its Q3 2024 earnings call highlighting a 7% year-over-year increase in adjusted net revenue to $2.16 billion. This reporting reinforces investor confidence by showcasing consistent operational execution and strategic progress.

Global Payments solidifies its market position through influential annual reports, such as the anticipated '2025 Commerce and Payment Trends Report.' This publication dives deep into the dynamic payments sector, providing crucial insights for businesses navigating evolving consumer behaviors and technological advancements.

By consistently delivering these comprehensive trend analyses, Global Payments establishes itself as a key thought leader. This strategic approach not only shapes business strategies across industries but also underscores the company's profound understanding of current and future market dynamics, influencing how companies approach commerce and payments.

Global Payments leverages digital platforms like X, LinkedIn, and Facebook to connect with its audience. This strategy aims to build brand awareness and share timely company updates. In 2024, financial technology companies saw an average engagement rate of 3.5% on LinkedIn, a metric Global Payments likely strives to meet or exceed.

Personalized & Data-Driven Marketing

Global Payments leverages advanced data analytics and marketing automation to create highly personalized campaigns, ensuring messages and offers connect with specific customer segments. This targeted approach, which saw a 15% increase in campaign ROI in early 2024, delivers relevant content through optimal channels, boosting customer engagement and conversion rates.

The company's data-driven strategy focuses on understanding individual customer needs and preferences. This allows for tailored communication that significantly improves the effectiveness of marketing efforts.

- Personalization: Campaigns are dynamically adjusted based on customer data, increasing relevance.

- Data Analytics: Advanced tools identify behavioral patterns and preferences for precise targeting.

- Channel Optimization: Marketing messages are delivered via the most effective channels for each segment.

- Engagement Boost: Personalized content leads to higher open rates and click-throughs, with some campaigns seeing a 20% uplift in engagement metrics.

Thought Leadership on Emerging Technologies

Global Payments actively cultivates thought leadership by dissecting critical industry shifts. They highlight how artificial intelligence is reshaping payment processing and customer interactions, a trend expected to see significant investment in 2024 and 2025 as companies integrate AI for fraud detection and personalized offers.

The company also emphasizes the growing momentum of embedded finance, where payment capabilities are seamlessly integrated into non-financial platforms. This evolution is projected to expand the global embedded finance market substantially in the coming years, reaching hundreds of billions of dollars by 2025, offering new revenue streams and enhanced customer experiences.

Furthermore, Global Payments underscores the paramount importance of digital security in this evolving landscape. With cyber threats becoming increasingly sophisticated, their focus on robust security measures is a key differentiator, especially as data breaches continue to cost businesses billions annually, with the average cost of a data breach in 2024 estimated to be over $4.5 million.

- AI in Payments: Focus on efficiency gains and enhanced customer experience.

- Embedded Finance: Integration into non-financial services for seamless transactions.

- Digital Security: Commitment to protecting sensitive financial data against evolving threats.

- Innovation Focus: Demonstrating expertise in emerging payment technologies and trends.

Global Payments' promotional efforts center on establishing thought leadership and engaging stakeholders through transparent communication and data-driven insights. They leverage digital channels and personalized campaigns to build brand awareness and connect with specific customer segments, aiming for high engagement rates. The company actively discusses key industry trends like AI in payments and embedded finance, underscoring their commitment to innovation and digital security.

| Promotional Focus Area | Key Activities | 2024/2025 Data/Trends |

|---|---|---|

| Thought Leadership & Transparency | Investor conferences, financial reporting, annual trend reports | Q3 2024 revenue: $2.16 billion (+7% YoY). Anticipated '2025 Commerce and Payment Trends Report'. |

| Digital Engagement | Social media platforms (X, LinkedIn, Facebook), personalized campaigns | Average LinkedIn engagement rate for FinTech: 3.5%. Personalized campaigns saw up to 20% uplift in engagement. |

| Industry Trend Communication | Highlighting AI in payments, embedded finance, digital security | AI investment expected to grow. Embedded finance market to reach hundreds of billions by 2025. Average data breach cost in 2024: over $4.5 million. |

Price

Global Payments utilizes variable and tiered pricing strategies, avoiding a one-size-fits-all approach. This flexibility allows them to cater to diverse merchant needs.

Typically, initial merchant costs hover around 2.5% of total transaction value. However, this figure is a starting point, with actual rates fluctuating based on several key factors.

The specific pricing and associated markups are heavily influenced by the merchant's industry, the volume of transactions processed, and the particular services they engage Global Payments for.

Global Payments' pricing strategy heavily relies on transaction-based fees, a critical component of its marketing mix. This structure includes a headline rate, which is the publicly advertised cost of processing a transaction. However, the actual cost is a composite of this headline rate plus other essential charges.

Interchange fees, set by major card networks like Visa and Mastercard, form a significant portion of these per-transaction costs. For instance, in the US, interchange rates can range from around 0.05% to over 3.5% depending on the card type and how the transaction is processed. These fees are passed through to merchants.

Beyond interchange, card scheme fees, also determined by card networks, add another layer to the per-transaction cost. These fees cover the operational costs and services provided by the networks themselves. For 2024, these combined fees continue to be a primary driver of revenue for Global Payments, with businesses needing to understand these granular costs to manage their payment processing expenses effectively.

Merchants often face a variety of additional and recurring charges beyond the base transaction rates. These can include data security fees, risk assessment charges, and penalties for PCI non-compliance, which can add up significantly. For instance, PCI non-compliance fees alone can range from $10 to $100 per month for small businesses, and much higher for larger enterprises, according to industry reports from 2024.

Furthermore, network security fees and annual account maintenance charges are common, contributing to the overall cost of payment processing. These fees are not always clearly itemized, and merchants should be aware that they can be subject to increases over time, impacting their profit margins. In 2025, many processors are reviewing their fee structures, with some indicating potential increases in these ancillary charges.

Hardware & Software Cost Considerations

While Global Payments offers integrated hardware and software solutions, merchants requiring advanced functionalities or tailored systems may face supplementary expenses. For instance, specialized inventory management integrations or advanced fraud detection modules could add to the base cost.

The perceived value of Global Payments' pricing is often tied to the depth of its bundled software features and the responsiveness of its customer service. A 2024 industry survey indicated that 65% of small businesses prioritize integrated software capabilities and reliable support when selecting payment processors, suggesting these elements significantly influence purchasing decisions.

Merchants should consider these potential additional costs when evaluating Global Payments' offerings:

- Upgraded POS Hardware: Costs can range from $300 to $1,500 per terminal for more advanced models with features like contactless payment acceptance or larger touchscreens.

- Specialized Software Modules: Add-on services for loyalty programs, advanced analytics, or e-commerce integration might incur monthly fees, typically between $25 and $100.

- Custom Integration Services: For unique business needs, bespoke software development or integration with existing enterprise resource planning (ERP) systems could involve one-time setup fees ranging from $500 to $5,000 or more.

Rate Adjustments & Negotiation Potential

Global Payments, like many payment processors, implements periodic rate adjustments, often occurring quarterly. These increases are frequently justified by factors such as inflation, which saw the US CPI rise by 3.4% year-over-year in April 2024, and escalating operational expenses.

Merchants typically receive advance notification, usually 30-60 days, before these price changes take effect. This allows businesses time to review their contracts and financial implications.

Engagement with account managers is crucial for merchants seeking to mitigate these increases. Opportunities exist to negotiate potential fee reductions or establish custom pricing agreements tailored to specific transaction volumes and business needs.

- Rate Adjustment Frequency: Global Payments may adjust rates quarterly, impacting merchant costs.

- Justification for Increases: Factors like inflation (e.g., April 2024 US CPI at 3.4% YoY) and operational costs are cited.

- Merchant Notification: Businesses are typically given a 30-60 day notice period for price changes.

- Negotiation Avenues: Merchants can engage account managers to explore fee reductions or custom pricing.

Global Payments' pricing is a complex mosaic, built on transaction fees, interchange costs, and various ancillary charges. While headline rates offer a starting point, the true cost for merchants is a dynamic figure influenced by industry, volume, and service utilization, making transparent understanding critical for effective cost management.

Interchange and card scheme fees, dictated by networks like Visa and Mastercard, represent significant per-transaction expenses, with US interchange rates varying from approximately 0.05% to over 3.5% in 2024. Merchants also face additional fees for security, risk, and PCI compliance, with non-compliance penalties potentially reaching $100 monthly for smaller businesses in 2024.

The value proposition extends to bundled software and support, which 65% of small businesses in a 2024 survey prioritized. However, advanced features like specialized integrations or upgraded POS hardware, costing $300-$1,500 per terminal, can add to the overall expense.

Periodic rate adjustments, often quarterly, are common, influenced by factors like the 3.4% year-over-year US CPI increase in April 2024. Merchants receive 30-60 days' notice and can negotiate with account managers for potential fee reductions or custom pricing agreements.

| Cost Component | Typical Range/Notes | 2024/2025 Relevance |

|---|---|---|

| Headline Transaction Fee | Starts around 2.5% | Base rate for processing |

| Interchange Fees | 0.05% - 3.5%+ (US) | Major driver of per-transaction cost |

| Card Scheme Fees | Varies by network | Covers network operational costs |

| Ancillary Fees (Security, Risk) | Varies, can be monthly | Contribute to overall processing expense |

| PCI Non-Compliance Penalty | $10-$100+/month | Significant for non-compliant merchants |

| Upgraded POS Hardware | $300-$1,500 per terminal | Cost for advanced features |

| Software Modules (Add-ons) | $25-$100/month | For loyalty, analytics, etc. |

| Rate Adjustment Frequency | Quarterly | Potential for cost increases |

| Inflation Impact (e.g., US CPI) | 3.4% YoY (April 2024) | Justification for rate increases |

4P's Marketing Mix Analysis Data Sources

Our Global Payments 4P's analysis leverages a comprehensive blend of data sources, including official company reports, financial disclosures, and industry-specific market research. We incorporate insights from payment network data, regulatory filings, and competitive intelligence platforms to ensure a holistic view of the market landscape.