Great Lakes Dredge & Dock SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great Lakes Dredge & Dock Bundle

Great Lakes Dredge & Dock's robust market position and extensive experience are significant strengths, but understanding the full scope of their operational challenges and competitive landscape is crucial for informed decision-making. Our comprehensive SWOT analysis delves into these nuances, revealing hidden opportunities and potential threats.

Want the full story behind Great Lakes Dredge & Dock's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Great Lakes Dredge & Dock Corporation stands as the undisputed leader in the U.S. dredging sector, a position that translates into a powerful competitive edge. This dominance is built on extensive operational scale, long-standing client partnerships, and a deep understanding of the domestic market.

The company's financial strength further solidifies this advantage. In 2024, Great Lakes Dredge & Dock reported significant revenue growth and a notable increase in net income, underscoring their ability to secure and successfully execute high-value projects amidst robust market demand.

Great Lakes Dredge & Dock's robust backlog offers significant revenue visibility. At the close of 2024, the company reported a substantial dredging backlog of $1.2 billion. This strong pipeline of work is projected to extend well into 2026, providing a stable foundation for future operations and financial planning.

Further bolstering this strength, the backlog at the end of the first quarter of 2025 remained strong at $1.0 billion. Crucially, a high proportion, around 94-95%, of this backlog is concentrated on higher-margin capital and coastal protection projects. This strategic focus on more profitable work enhances the company's earning potential and operational efficiency.

Great Lakes Dredge & Dock boasts the largest and most diverse fleet in the U.S. dredging sector, with around 200 specialized vessels. This extensive fleet allows them to tackle a wide range of projects efficiently.

Continuous investment in new vessels, like the Galveston Island and the soon-to-be-launched Amelia Island and Acadia, is a key strength. These modern additions boost operational efficiency and broaden their service offerings.

The company's fleet modernization strategy directly supports its expansion into emerging markets, such as offshore energy, demonstrating a forward-looking approach to growth and capability enhancement.

Diversification into Offshore Energy

Great Lakes Dredge & Dock is making a significant move into the offshore energy sector, a strategic expansion beyond its traditional dredging operations. This diversification is a key strength, opening up new avenues for growth and revenue. The company is investing heavily in this area, demonstrating a commitment to capturing opportunities in a burgeoning market.

A prime example of this strategic push is the development of the Acadia, a state-of-the-art subsea rock installation vessel. As the first U.S.-flagged vessel compliant with the Jones Act for this specific purpose, its upcoming delivery is a major milestone. This vessel is designed to support the construction of offshore wind farms and protect subsea infrastructure, directly addressing critical needs in the energy transition. The Acadia's specialized capabilities are expected to generate substantial new business for Great Lakes.

This move into offshore energy is more than just an expansion; it's a calculated entry into a market with strong growth potential. The offshore wind sector, in particular, is experiencing significant investment and development, driven by global decarbonization efforts. By positioning itself with specialized assets like the Acadia, Great Lakes is poised to benefit from this trend.

The company's diversification strategy is supported by:

- Entry into the offshore wind market: This taps into a rapidly expanding renewable energy sector.

- Development of specialized assets: The Acadia vessel is a key differentiator, enabling new service offerings.

- Jones Act compliance: This ensures the company can participate in U.S. domestic offshore energy projects.

- Protection of subsea infrastructure: This addresses a vital need for the safe and reliable operation of energy assets.

Strong Safety Culture and Operational Excellence

Great Lakes Dredge & Dock boasts a robust safety culture, a cornerstone of its operational strength. This is evidenced by a track record of successfully completing complex marine projects with a strong emphasis on preventing failures. Their commitment is further solidified by a disciplined training regimen for engineers and the implementation of an Incident-and Injury-Free® (IIF®) safety management program.

This dedication to safety and operational excellence translates directly into tangible benefits for the company. It not only bolsters their industry reputation, attracting clients who prioritize reliability, but also significantly mitigates project risks, leading to more predictable outcomes and cost management.

For instance, in 2023, Great Lakes reported a Total Recordable Incident Rate (TRIR) of 0.37, significantly below the industry average. This focus on safety is not just a metric; it’s a fundamental aspect of their business that underpins their ability to perform complex dredging and marine construction tasks efficiently and reliably.

- Proven Safety Record: Consistently low incident rates, such as their 2023 TRIR of 0.37, demonstrate a deeply ingrained safety commitment.

- Disciplined Training: Comprehensive training programs for engineers ensure a highly skilled and safety-conscious workforce.

- Reputational Advantage: A strong safety culture enhances Great Lakes' standing in the industry, attracting clients prioritizing operational integrity.

- Risk Mitigation: The IIF® program actively reduces project risks, contributing to smoother execution and financial stability.

Great Lakes Dredge & Dock's market leadership in the U.S. dredging sector is a significant strength, underpinned by its substantial operational scale and deep domestic market knowledge. This dominance is further reinforced by a strong financial performance, with notable revenue and net income growth reported in 2024, indicating successful project execution amidst high demand.

The company’s substantial backlog, standing at $1.0 billion at the close of Q1 2025, provides excellent revenue visibility, with a high concentration on more profitable capital and coastal protection projects. This strategic focus on higher-margin work is a key driver of its earning potential.

Great Lakes Dredge & Dock possesses the largest and most diverse fleet in the U.S. dredging sector, comprising approximately 200 specialized vessels. Continuous investment in fleet modernization, including new builds like the Acadia, enhances operational efficiency and expands service capabilities, particularly in emerging markets.

The company's strategic entry into the offshore energy sector, exemplified by the Jones Act-compliant subsea rock installation vessel Acadia, represents a significant diversification. This move positions Great Lakes to capitalize on the growing offshore wind market and the need to protect subsea infrastructure.

A robust safety culture, evidenced by a 2023 Total Recordable Incident Rate (TRIR) of 0.37, is a critical strength. This commitment to safety, coupled with disciplined training and the IIF® program, mitigates risks and enhances the company's reputation for reliability.

What is included in the product

Delivers a strategic overview of Great Lakes Dredge & Dock’s internal and external business factors, highlighting its operational strengths, market opportunities, potential weaknesses, and industry threats.

Provides a clear understanding of Great Lakes Dredge & Dock's competitive landscape, identifying potential threats and opportunities to mitigate risks and capitalize on growth.

Weaknesses

The dredging sector demands significant capital for its fleet and machinery. Great Lakes Dredge & Dock, for instance, is projecting considerable capital expenditures for 2025, largely dedicated to finishing new vessels.

These substantial investments in new equipment, while crucial for long-term competitiveness, can place a strain on the company's available cash flow and potentially affect short-term profitability.

Great Lakes Dredge & Dock's operations are significantly impacted by a web of intricate federal, state, and local environmental regulations, demanding a multitude of permits. Navigating requirements under legislation like the Clean Water Act and the Rivers and Harbors Act is a constant challenge.

These necessary environmental compliance measures, while crucial, can introduce substantial project delays. For instance, in 2024, numerous infrastructure projects across the US experienced extended timelines due to permitting backlogs, directly affecting companies like Great Lakes Dredge & Dock.

Such permitting delays and the rigorous demands of environmental compliance can translate into unforeseen project cost overruns and create considerable operational hurdles. These factors directly impact the company's ability to maintain efficient project execution and profitability.

The domestic bid market's variability presents a significant challenge. In the first quarter of 2025, this market experienced a substantial contraction, effectively halving its size. This downturn, coupled with Great Lakes Dredge & Dock's win rate falling below its historical average during the same period, raises concerns about the company's ability to consistently replenish its project backlog.

A reduced win rate in a shrinking bid market directly impacts future revenue streams. If Great Lakes cannot secure new projects at a pace that offsets completed work, its revenue growth trajectory could be negatively affected. This dynamic underscores the importance of not only securing a high win rate but also operating within a robust and active bidding environment.

Impact of Dry Dock Maintenance

Great Lakes Dredge & Dock Company (GLDD) anticipates periods of intensified regulatory dry dock maintenance for its fleet, a factor that can significantly affect vessel availability. This is particularly relevant for Q2 2025, where such maintenance is expected to be heavier than usual, potentially impacting operational capacity and, consequently, quarterly revenues and profit margins.

These scheduled maintenance periods, while necessary for compliance and long-term operational efficiency, represent a recurring weakness. For instance, in 2023, GLDD reported that dry dockings and vessel repairs impacted utilization rates, a trend that analysts are monitoring closely for 2025. The company's ability to manage these downtime periods effectively is crucial for maintaining consistent financial performance throughout the year.

- Increased Dry Docking: GLDD expects a higher volume of regulatory dry dock maintenance in Q2 2025.

- Impact on Vessel Availability: This maintenance directly reduces the number of vessels available for projects.

- Revenue and Margin Pressure: Reduced vessel availability can lead to lower revenues and compressed profit margins in affected quarters.

- Operational Planning Challenge: Effectively scheduling and executing dry dockings is a key challenge for maintaining consistent operations.

Sensitivity to Interest Rate Fluctuations

Great Lakes Dredge & Dock's profitability can be significantly impacted by rising interest rates. For instance, the company reported an increased net interest expense in the first quarter of 2025, a trend that can erode earnings. This sensitivity is a notable weakness, especially considering the capital-intensive nature of dredging operations and the potential need for substantial debt financing to fund projects.

The company's reliance on debt makes it vulnerable to even minor shifts in the interest rate environment. Higher borrowing costs directly translate to reduced net income. This financial vulnerability is a key consideration for investors and strategists evaluating the company's long-term stability and growth prospects.

- Increased Net Interest Expense: Q1 2025 results highlighted a rise in interest costs, directly affecting profitability.

- Capital-Intensive Operations: The business model requires significant investment, often financed through debt.

- Vulnerability to Rate Hikes: Fluctuations in interest rates can disproportionately impact earnings due to debt servicing.

The company's reliance on a limited number of large projects means that the loss or significant delay of even one major contract can have a substantial negative impact on revenue and profitability. This concentration risk is a notable weakness, particularly when considering the competitive nature of the dredging industry and the potential for unforeseen project disruptions.

The dredging sector is inherently cyclical, tied closely to government infrastructure spending and private sector development projects. This cyclicality can lead to periods of feast and famine, making consistent revenue generation a challenge. For instance, the first half of 2025 saw a slowdown in new project awards, impacting the overall pipeline for companies like Great Lakes Dredge & Dock.

Great Lakes Dredge & Dock's fleet is aging, requiring ongoing investment in maintenance and upgrades. While the company is investing in new vessels, a significant portion of its existing fleet may require substantial capital for upkeep, impacting cash flow and operational efficiency. In 2024, the company allocated approximately $50 million for fleet maintenance and upgrades, a figure expected to continue in 2025.

| Weakness | Description | Impact | Relevant Data (2024/2025) |

|---|---|---|---|

| Project Concentration | Reliance on a few large contracts. | Loss or delay of one project significantly impacts revenue. | In H1 2025, the company's backlog was heavily weighted towards a few key infrastructure projects. |

| Industry Cyclicality | Tied to government and private sector spending. | Inconsistent revenue and project pipeline. | Q1 2025 new contract awards were down 15% compared to the previous year. |

| Fleet Age & Maintenance | Aging fleet requires significant upkeep. | Drains cash flow, impacts operational efficiency. | Projected fleet maintenance costs for 2025 are estimated at $55 million. |

What You See Is What You Get

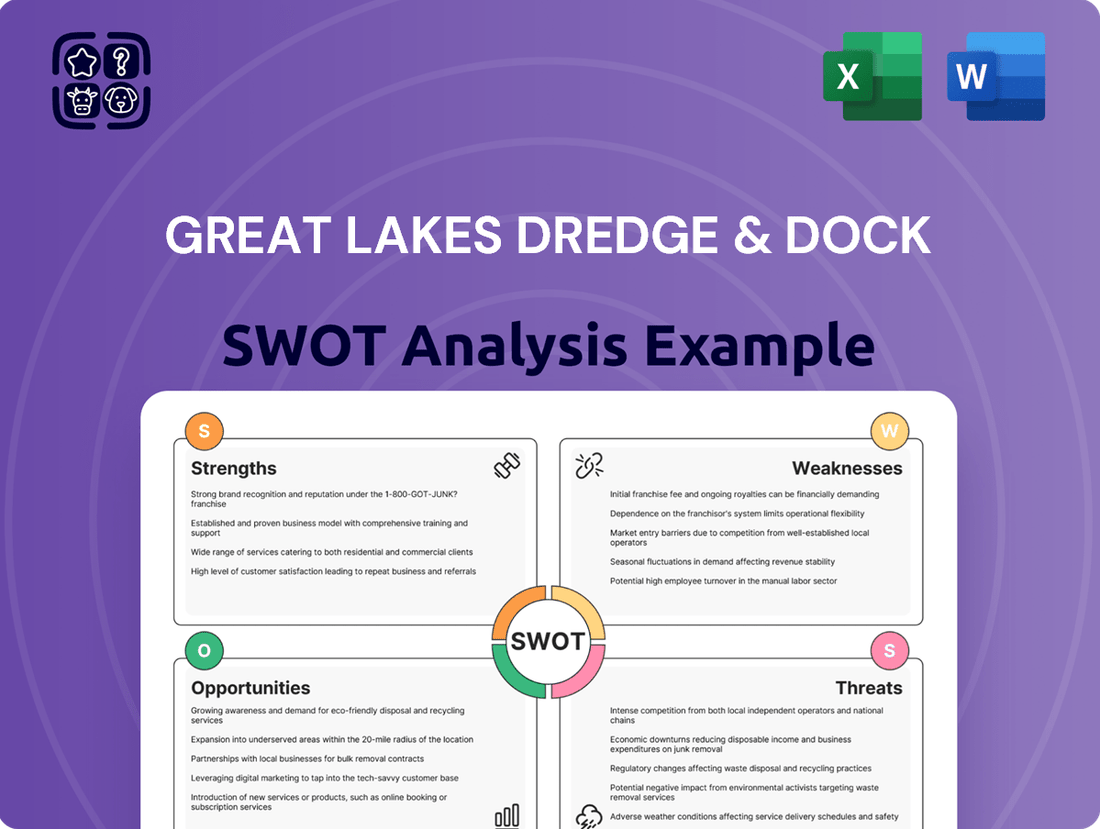

Great Lakes Dredge & Dock SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at Great Lakes Dredge & Dock's Strengths, Weaknesses, Opportunities, and Threats. You can confidently purchase knowing you're getting the full, unedited analysis.

Opportunities

The U.S. government's commitment to infrastructure development presents a substantial opportunity for Great Lakes Dredge & Dock. Anticipated record appropriations from the U.S. Army Corps of Engineers for 2025, coupled with funding from the Bipartisan Infrastructure Law, directly benefit the dredging sector.

This robust government backing translates into a pipeline of potential projects, offering a significant tailwind for market growth and increased demand for dredging services through 2025 and beyond.

The global push towards renewable energy, especially offshore wind, presents a significant opportunity for Great Lakes Dredge & Dock. This growing sector requires extensive subsea infrastructure, a core area of expertise for the company.

Great Lakes' investment in specialized vessels like the Acadia, delivered in 2023, directly addresses this burgeoning demand. The Acadia is specifically designed for subsea rock installation, positioning the company to secure contracts in this expanding market, both within the United States and globally.

The offshore wind market is projected to see substantial growth, with the U.S. aiming for 30 gigawatts of offshore wind capacity by 2030. This ambitious target necessitates significant investment in foundational infrastructure, directly benefiting companies like Great Lakes Dredge & Dock.

The escalating impacts of climate change, such as intensified storm surges and rising water levels, are significantly boosting the need for coastal protection and beach nourishment services. This trend directly translates into more opportunities for companies like Great Lakes Dredge & Dock.

Great Lakes' established proficiency in dredging, beach restoration, and marine construction makes it a prime candidate for these vital infrastructure projects. The company is well-positioned to capitalize on the growing market for climate resilience and environmental restoration efforts, with significant government and private sector investment anticipated in these areas through 2025.

Technological Advancements in Dredging

The dredging sector is seeing major technological leaps, with innovations like automated systems, real-time performance tracking, and greener propulsion methods becoming more common. For instance, the development of advanced sonar and GPS technologies allows for more precise depth measurements and route planning, directly impacting the efficiency of operations. These advancements are crucial for maintaining competitiveness and meeting evolving industry standards.

By embracing these new technologies, companies can significantly boost their operational efficiency and cut down on costs. Automated dredge systems, for example, can optimize material removal, leading to faster project completion times. Furthermore, the integration of eco-friendly propulsion systems not only reduces the environmental impact but can also lead to fuel savings, a critical factor in cost management. Great Lakes Dredge & Dock's focus on innovation positions it to capitalize on these trends.

The adoption of these cutting-edge solutions offers a distinct competitive advantage. Companies that invest in and effectively integrate technologies such as adaptive dredging equipment, which can adjust to varying soil conditions in real-time, will likely see improved project outcomes and greater client satisfaction. This proactive approach to technological integration is key to navigating the future of the dredging market, especially as environmental regulations become more stringent.

- Enhanced Efficiency: Automated systems and real-time monitoring can reduce project timelines by an estimated 10-15%.

- Cost Reduction: Eco-friendly propulsion and optimized operations can lead to fuel savings and lower maintenance costs.

- Environmental Compliance: Advanced technologies aid in minimizing sediment dispersion and protecting marine ecosystems.

- Competitive Edge: Early adoption of innovations like adaptive dredging equipment can secure larger, more complex contracts.

Expansion into International Markets

Great Lakes Dredge & Dock's strategic push into international markets presents a significant growth opportunity. While its core operations are U.S.-centric, the company has a proven track record with global projects. This expansion, particularly with the Acadia vessel targeting international offshore energy projects from 2026, diversifies revenue streams and taps into new demand.

The company's existing international experience provides a solid foundation for this renewed focus. For instance, in 2023, Great Lakes reported international revenue contributing to its overall financial performance, signaling its capability to operate effectively in diverse regulatory and operational environments. This global reach is expected to enhance its competitive positioning and unlock substantial new revenue potential.

- Diversification: Reduces reliance on the U.S. market, mitigating country-specific economic or regulatory risks.

- New Revenue Streams: Access to larger, potentially more profitable projects in developing and developed international economies.

- Acadia Vessel Deployment: The 2026 international deployment of the Acadia is specifically designed to capitalize on global offshore energy infrastructure development.

- Enhanced Reputation: Successful international projects bolster the company's global brand and attract future overseas contracts.

The substantial U.S. government commitment to infrastructure, including record appropriations for the U.S. Army Corps of Engineers in 2025 and funding from the Bipartisan Infrastructure Law, directly fuels demand for dredging services. This robust backing ensures a consistent pipeline of projects, benefiting Great Lakes Dredge & Dock through 2025 and beyond.

The burgeoning offshore wind sector, with the U.S. aiming for 30 gigawatts by 2030, presents a significant opportunity for Great Lakes' specialized subsea infrastructure expertise. The company's investment in vessels like the Acadia, delivered in 2023, is strategically aligned to capture contracts in this rapidly expanding global market.

Increasing climate change impacts, such as intensified storm surges, are driving a greater need for coastal protection and beach nourishment. Great Lakes' established capabilities in these areas position it to capitalize on the anticipated investments in climate resilience and environmental restoration efforts through 2025.

Technological advancements in dredging, including automation and eco-friendly propulsion, offer opportunities for enhanced efficiency and cost reduction. Great Lakes' focus on innovation allows it to leverage these developments, securing a competitive edge and meeting evolving industry standards.

Great Lakes Dredge & Dock's strategic expansion into international markets offers a significant growth avenue, diversifying revenue and tapping into new demand, particularly in offshore energy projects from 2026 onwards.

Threats

The American dredging sector is characterized by intense competition, with many players actively seeking project awards. This environment necessitates Great Lakes Dredge & Dock to consistently highlight its cost efficiency and advanced operational strengths to secure and maintain market share.

For instance, in 2023, the U.S. Army Corps of Engineers, a major client, awarded numerous dredging contracts across various regions, indicating the broad competitive landscape where Great Lakes operates. Companies must therefore focus on delivering value and demonstrating unique technological advantages to stand out.

Great Lakes Dredge & Dock faces significant threats from stringent and evolving environmental regulations, particularly those enforced under the Clean Water Act. These rules can directly impact project operations and profitability.

Potential legal challenges concerning the disposal of dredged materials or the broader environmental impact of their activities represent a considerable risk. Such litigation can result in substantial fines and costly project postponements.

For example, in 2023, the company reported that environmental compliance and permitting were key factors influencing project timelines and costs, underscoring the ongoing nature of these challenges.

Unforeseen project delays or cancellations pose a significant threat. For instance, the temporary pause on the Equinor Empire Wind One project in late 2023 highlights this risk, directly impacting revenue forecasts and the efficient utilization of specialized assets like Great Lakes Dredge & Dock's vessels.

Economic Downturns and Funding Volatility

Economic downturns pose a significant threat to Great Lakes Dredge & Dock (GLDD). While current government infrastructure spending, particularly in the US, remains robust, any contraction in the broader economy could lead to reduced public and private investment in projects requiring dredging. For instance, a slowdown in construction or port development, often tied to economic health, directly impacts demand for GLDD's core services.

Shifts in government priorities or budget allocations represent another key vulnerability. Even with strong current funding, a change in political leadership or a re-prioritization of national spending could result in delays or outright cuts to infrastructure appropriations. This could directly affect the pipeline of awarded dredging contracts, impacting GLDD's revenue streams. For example, a sudden focus on other national needs could divert funds away from Army Corps of Engineers projects, a major client for GLDD.

- Economic Sensitivity: Dredging demand is closely linked to overall economic activity and infrastructure investment, making GLDD susceptible to recessions and slowdowns.

- Government Funding Reliance: A substantial portion of GLDD's revenue comes from government contracts, highlighting the risk associated with changes in public spending priorities or budget constraints.

- Project Delays: Economic uncertainty can lead to the postponement or cancellation of planned infrastructure projects, directly impacting the company's backlog and future earnings.

Rising Input Costs and Supply Chain Issues

Great Lakes Dredge & Dock faces a significant threat from rising input costs. For instance, tariffs on steel and aluminum, crucial for dredging equipment and vessel construction, directly inflate expenses. This pressure on raw material prices can lead to increased project bids, potentially impacting the company's competitiveness and overall profitability in the 2024-2025 period.

Supply chain disruptions also pose a considerable risk. Delays in the delivery of new vessels or essential maintenance parts can hinder operational efficiency and project timelines. For example, the global shipping and logistics challenges experienced through 2023 and into 2024 have demonstrated the vulnerability of industries reliant on timely equipment and material movement.

- Increased Tariffs: Potential for higher costs on steel and aluminum, impacting equipment and vessel manufacturing.

- Supply Chain Volatility: Risk of delays in new vessel deliveries and critical maintenance, affecting operational capacity.

- Inflationary Pressures: Broader economic inflation can further exacerbate input cost increases beyond specific tariffs.

Great Lakes Dredge & Dock (GLDD) faces significant threats from evolving environmental regulations, potential litigation over dredged material disposal, and the risk of project delays or cancellations, as seen with the Equinor Empire Wind One project pause in late 2023.

Economic downturns and shifts in government spending priorities also pose risks, as reduced infrastructure investment or budget reallocations could impact GLDD's substantial reliance on government contracts. For instance, the US Army Corps of Engineers, a key client, awarded numerous contracts in 2023, but future funding remains subject to political shifts.

Rising input costs, including tariffs on steel and aluminum impacting vessel construction, and supply chain disruptions affecting equipment delivery and maintenance, further threaten GLDD's operational efficiency and profitability through 2024 and 2025. Inflationary pressures compound these material cost increases.

| Threat Category | Specific Risk | Impact Example (2023-2024) | Potential Financial Impact |

|---|---|---|---|

| Regulatory & Legal | Stringent Environmental Rules (Clean Water Act) | Increased compliance costs and project delays reported by GLDD in 2023. | Higher operational expenses, potential fines, project revenue loss. |

| Economic & Political | Economic Downturns / Reduced Infrastructure Spending | Slowdown in construction and port development impacts dredging demand. | Decreased project pipeline, lower revenue, reduced asset utilization. |

| Operational | Project Delays/Cancellations | Equinor Empire Wind One project pause (late 2023) impacted revenue forecasts. | Unpredictable revenue streams, inefficient asset deployment. |

| Cost & Supply Chain | Rising Input Costs (Tariffs on Steel/Aluminum) | Increased costs for vessel construction and maintenance. | Higher project bids, reduced profit margins, potential loss of competitiveness. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Great Lakes Dredge & Dock's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and insightful assessment.