Great Lakes Dredge & Dock Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great Lakes Dredge & Dock Bundle

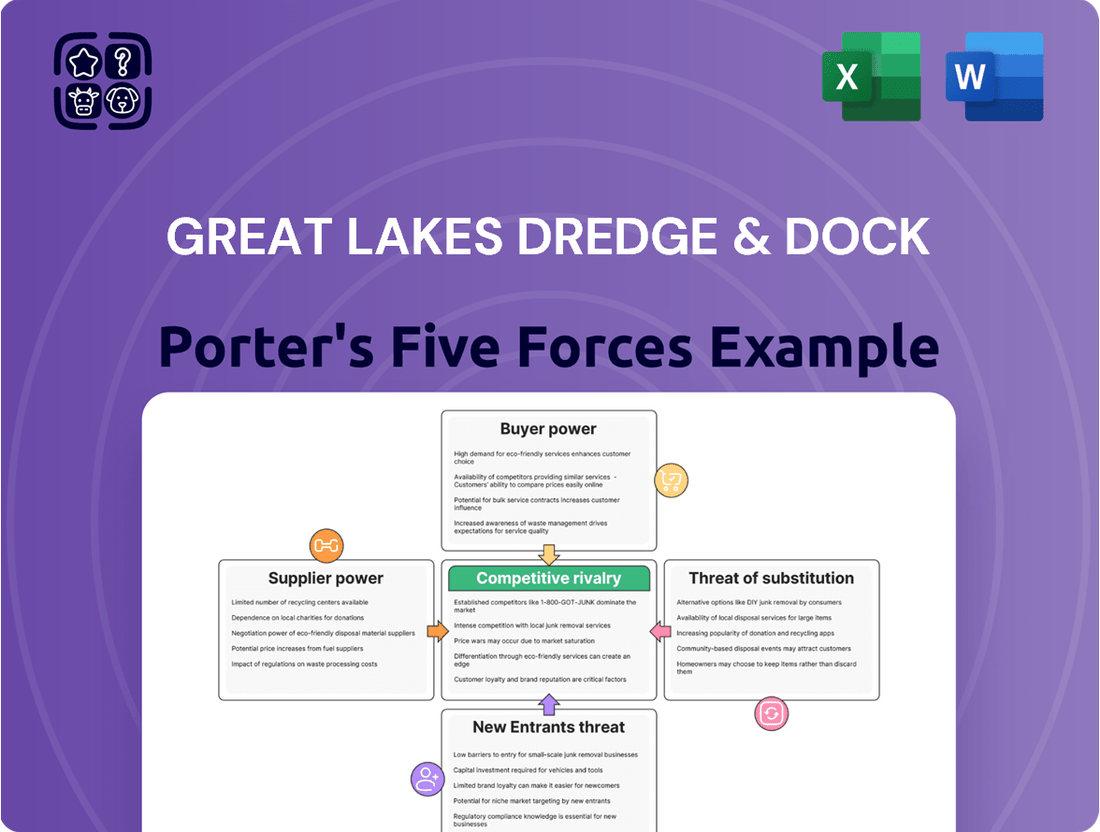

Great Lakes Dredge & Dock faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being particularly influential forces. Understanding these dynamics is crucial for any stakeholder in this specialized industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Great Lakes Dredge & Dock’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for highly specialized dredging equipment, like large cutter suction or hopper dredges, is considerable for Great Lakes Dredge & Dock. Globally, there are very few manufacturers capable of producing these custom-built vessels, which necessitates extensive research and development, thereby limiting viable alternatives for Great Lakes Dredge & Dock.

The substantial investment and extended timelines associated with constructing new dredging vessels further enhance the leverage held by these specialized equipment suppliers. For instance, the lead time for a new large hopper dredge can easily extend to several years, increasing dependence on existing or available specialized units.

Fuel and energy are critical inputs for Great Lakes Dredge & Dock, representing a substantial portion of their operating costs. The volatility of global commodity markets directly influences these expenses, as seen in the fluctuating prices of bunker fuel, a primary energy source for their fleet. For instance, in early 2024, global crude oil prices experienced notable swings, impacting the cost of fuel for marine operations.

While the company sources fuel from various providers, the immense volume of fuel required for extensive dredging projects grants significant leverage to major energy suppliers. Even minor increases in fuel prices can have a considerable impact on Great Lakes Dredge & Dock's bottom line, underscoring the suppliers' bargaining power in dictating market rates for this essential commodity.

The dredging industry, including companies like Great Lakes Dredge & Dock, depends on a workforce possessing niche skills. This includes licensed marine engineers, experienced dredge operators, and project managers with specialized knowledge in hydrographic surveying and marine construction. These professionals are not easily replaced.

The limited pool of individuals with the necessary certifications and extensive training translates into significant leverage for these skilled workers. They can command higher wages, better benefits packages, and more favorable working conditions due to their critical role in project execution and the inherent demand for their expertise.

Raw Material Suppliers for Aggregates

For Great Lakes Dredge & Dock's (GLDD) aggregate production, the bargaining power of raw material suppliers is significantly influenced by the local availability and quality of suitable deposits. When alternative sources for sand, gravel, or stone are scarce in a particular region where GLDD operates, these suppliers gain considerable leverage in dictating prices and contract terms.

This localized dependency means that the cost of essential raw materials for GLDD's dredging and marine construction projects can fluctuate based on regional supply-demand dynamics. For instance, in areas with high construction activity and limited aggregate reserves, suppliers can command higher prices, directly impacting GLDD's project profitability.

- Limited Local Reserves: In regions with few viable aggregate sources, suppliers of sand and gravel can exert strong pricing power.

- Quality and Specifications: Suppliers providing high-quality aggregates meeting specific project requirements may have increased leverage.

- Transportation Costs: The cost and availability of transporting aggregates also play a role; if transportation is expensive or limited, local suppliers gain an advantage.

- GLDD's Sourcing Strategy: GLDD's ability to secure long-term supply contracts or develop its own aggregate sources can mitigate supplier power.

Technology and Software Providers

Technology and software providers, such as those offering advanced navigation systems, hydrographic surveying equipment, and specialized dredging software, exert moderate bargaining power over Great Lakes Dredge & Dock. While the market for some components may be competitive, the reliance on proprietary technologies or integrated solutions that significantly boost operational efficiency and precision can lead to higher switching costs for Great Lakes Dredge & Dock. This dependence can translate into increased leverage for these suppliers, potentially influencing pricing and contract terms.

For instance, specialized software for real-time data analysis and predictive maintenance in dredging operations, if highly effective and difficult to replicate, could command premium pricing. Companies that develop and maintain these niche technological solutions often face limited direct competition for their unique offerings. This situation can be observed in the market for advanced sonar and lidar systems used in detailed seabed mapping, where a few key innovators often dominate. The ability of Great Lakes Dredge & Dock to readily substitute these specialized systems with comparable alternatives is often limited, thereby strengthening the suppliers' position.

- Moderate Supplier Power: Technology and software providers hold moderate bargaining power due to the specialized nature of their products.

- Proprietary Technologies: Unique or integrated solutions that enhance efficiency and precision can create supplier dependence.

- Switching Costs: High switching costs associated with adopting new, potentially less efficient, systems limit Great Lakes Dredge & Dock's ability to change suppliers easily.

- Market Dynamics: Limited competition for highly specialized dredging software and equipment reinforces supplier leverage.

The bargaining power of suppliers for Great Lakes Dredge & Dock is significant, particularly for specialized dredging equipment and critical inputs like fuel. The limited number of manufacturers for large, custom-built dredges and the essential nature of fuel, subject to global market volatility, grant these suppliers considerable leverage. Furthermore, the scarcity of highly skilled labor in the dredging sector allows these professionals to negotiate favorable terms, impacting operational costs and project timelines.

| Supplier Category | Impact on GLDD | Key Factors Influencing Power | 2024 Data/Trends |

|---|---|---|---|

| Specialized Dredging Equipment Manufacturers | High | Few global manufacturers, high R&D costs, long lead times (years for new large dredges) | Continued demand for advanced dredging technology, supply chain constraints impacting new vessel delivery. |

| Fuel and Energy Suppliers | High | Volatility of global commodity markets, high volume consumption by GLDD's fleet | Global crude oil prices experienced fluctuations in early 2024, impacting bunker fuel costs; geopolitical events continue to influence energy markets. |

| Skilled Labor (e.g., Dredge Operators, Engineers) | High | Niche skill sets, limited pool of certified professionals, high demand | Ongoing shortage of experienced maritime personnel, leading to competitive wage and benefit packages. |

| Aggregate Suppliers (for production) | Moderate to High (regionally dependent) | Local availability and quality of deposits, transportation costs | Regional construction booms can strain local aggregate supplies, increasing prices in high-demand areas. |

| Technology and Software Providers | Moderate | Proprietary technologies, high switching costs, specialized functionalities | Increasing reliance on advanced navigation and data analysis software for efficiency, with a few key innovators dominating niche markets. |

What is included in the product

This analysis dissects the competitive landscape for Great Lakes Dredge & Dock, examining the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes.

Visualize competitive intensity with a dynamic, interactive model that highlights key industry pressures for Great Lakes Dredge & Dock.

Customers Bargaining Power

Great Lakes Dredge & Dock’s primary customers are often government entities, including the U.S. Army Corps of Engineers and various state departments of transportation. These significant buyers leverage competitive bidding processes and detailed project specifications, allowing them to strongly influence contract terms. For instance, in 2023, the U.S. Army Corps of Engineers awarded hundreds of millions of dollars in dredging contracts, highlighting the substantial value and influence these agencies wield.

Port authorities and maritime administrations hold significant bargaining power as major clients for dredging services, particularly for navigation channel maintenance and port expansion. These entities often manage critical public infrastructure projects, which are subject to rigorous regulatory scrutiny and public funding, giving them substantial leverage in negotiations.

Their ability to influence project scope, dictate timelines, and set pricing parameters is considerable. For instance, in 2024, major port development projects across the Great Lakes region, such as upgrades to facilities in Chicago and Cleveland, involved extensive competitive bidding processes where the port authorities could negotiate favorable terms due to the essential nature of these infrastructure improvements.

Commercial and private developers, particularly those undertaking land reclamation and private infrastructure, represent a significant customer segment for Great Lakes Dredge & Dock. These clients, while perhaps engaging in smaller individual projects compared to government entities, still exert considerable bargaining power. They actively seek competitive pricing and dependable project completion, and their ability to select from a limited pool of major dredging contractors allows them to negotiate terms based on project scope and prevailing market dynamics.

Environmental Restoration Initiatives

Customers engaged in environmental restoration projects, like those focused on coastal resilience or habitat creation, often operate under specific funding limitations and stringent environmental compliance mandates. This focus on achieving project goals and adhering to precise ecological standards grants them leverage in negotiating contract terms and ensuring that dredging companies like Great Lakes Dredge & Dock meet all environmental objectives.

For instance, government agencies or non-profit organizations overseeing these restoration efforts might allocate funds with strict performance metrics tied to ecological outcomes. In 2023, federal funding for coastal restoration projects in the United States saw significant investment, with initiatives like the Bipartisan Infrastructure Law providing billions for environmental improvements, underscoring the importance of these customer segments.

- Funding Constraints: Restoration customers often have fixed budgets, making price a significant negotiation point.

- Environmental Compliance: Strict adherence to ecological standards empowers customers to demand specific methodologies and outcomes.

- Project Specificity: The unique nature of restoration projects allows customers to tailor requirements, increasing their bargaining power.

- Reputational Risk: For entities involved in environmental work, choosing a dredging partner that fails to meet ecological goals can carry significant reputational damage, further strengthening customer leverage.

Aggregate Buyers and Construction Companies

The bargaining power of customers, primarily construction companies and concrete producers, is a significant factor for Great Lakes Dredge & Dock (GLDD) in its aggregate production segment. These buyers wield influence based on local supply and demand, the presence of competing aggregate suppliers, and the sheer volume of their orders. This allows them to negotiate pricing, often tying it to prevailing market rates and their own logistical advantages.

In 2024, the construction industry experienced varying demand across regions, directly impacting aggregate pricing. For instance, regions with robust infrastructure projects and limited local aggregate sources saw higher demand, potentially reducing customer bargaining power. Conversely, areas with an oversupply of aggregates or fewer large-scale projects gave customers more leverage to secure favorable pricing. GLDD's ability to serve diverse geographic markets helps mitigate the impact of localized shifts in customer power.

- Customer Concentration: The number of major buyers in a specific geographic area influences their collective bargaining strength.

- Switching Costs: The ease or difficulty for a construction company to switch to an alternative aggregate supplier affects their negotiation leverage.

- Price Sensitivity: The extent to which price, rather than product quality or delivery reliability, drives a customer's purchasing decision.

- Market Conditions: Overall economic health and the volume of construction activity directly shape the demand and supply dynamics for aggregates, impacting customer power.

The bargaining power of Great Lakes Dredge & Dock's customers is substantial, particularly with government entities like the U.S. Army Corps of Engineers who utilize competitive bidding for large contracts. Port authorities also exert significant influence by dictating project terms for essential infrastructure, as seen in 2024 port upgrades across the Great Lakes. Even private developers, though on a smaller scale, negotiate based on project scope and market rates, while environmental restoration clients leverage funding constraints and compliance mandates to their advantage.

| Customer Segment | Key Bargaining Factors | Example Influence |

| Government Agencies (e.g., USACE) | Competitive Bidding, Project Specifications | Awarding hundreds of millions in dredging contracts (2023) |

| Port Authorities | Infrastructure Importance, Regulatory Scrutiny | Negotiating terms for major port development (2024) |

| Private Developers | Project Scope, Market Dynamics | Securing competitive pricing for land reclamation |

| Environmental Restoration Clients | Funding Limits, Environmental Compliance | Dictating specific ecological methodologies |

Same Document Delivered

Great Lakes Dredge & Dock Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis of Great Lakes Dredge & Dock details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll gain a clear understanding of the strategic factors influencing Great Lakes Dredge & Dock's market position and profitability.

Rivalry Among Competitors

The dredging industry demands massive upfront investment in specialized, expensive equipment like dredges and support vessels, resulting in substantial fixed costs for operators. For instance, a modern hopper dredge can cost upwards of $100 million. This capital intensity fuels fierce competition, as firms must win enough contracts to keep their assets busy and cover these high overheads.

This constant pressure to utilize expensive equipment often leads to aggressive bidding wars. Companies, including Great Lakes Dredge & Dock, frequently engage in price competition to secure projects, impacting profit margins. In 2023, Great Lakes Dredge & Dock reported capital expenditures of $155.9 million, highlighting the ongoing investment required to maintain and expand their fleet.

The U.S. dredging market, especially for significant projects, is largely controlled by a handful of key companies, with Great Lakes Dredge & Dock holding the top position. This concentration means intense competition among these established entities for the limited number of high-value contracts, making it difficult for any single player to significantly increase their market share.

The project-based nature of demand in the dredging industry means companies like Great Lakes Dredge & Dock are perpetually competing for new contracts. This isn't like a subscription service; it's a constant cycle of bidding. For instance, in 2023, the U.S. Army Corps of Engineers, a major client, awarded numerous contracts across various projects, highlighting the project-specific nature of the work.

This episodic demand directly fuels intense competitive rivalry. Firms must consistently win bids to keep their equipment running and their workforce employed. A company's ability to secure these projects is paramount to its survival and growth, making every bid a critical battleground.

Differentiation Based on Fleet and Expertise

While dredging might appear straightforward, companies like Great Lakes Dredge & Dock actively distinguish themselves. This differentiation is primarily achieved through the sheer scale and adaptability of their dredging fleets, coupled with deep technical know-how for tackling intricate projects. Their commitment to safety and environmental stewardship also plays a crucial role in setting them apart from competitors.

This focus on specialized capabilities fuels intense rivalry within the industry. Firms are continually investing in cutting-edge technology and advanced training programs. The goal is to secure a competitive advantage, particularly for those high-stakes, complex, or environmentally sensitive dredging operations. For instance, Great Lakes Dredge & Dock reported a backlog of $951.9 million as of the first quarter of 2024, indicating strong demand for their specialized services.

- Fleet Size and Versatility: Companies compete on the breadth of their equipment, from smaller, specialized vessels to massive hopper dredges capable of large-scale projects.

- Technical Expertise: The ability to manage complex engineering challenges, navigate difficult environmental conditions, and execute projects with precision is a key differentiator.

- Safety and Environmental Records: A strong track record in safety and environmental compliance can be a significant advantage, especially when bidding on government contracts or projects with stringent regulations.

- Investment in Technology: Ongoing investment in new dredging technologies and operational efficiencies allows firms to improve performance and reduce costs, thereby enhancing their competitive standing.

Regulatory and Environmental Compliance

The dredging sector faces intense rivalry, particularly concerning regulatory and environmental compliance. Operating in this industry necessitates adherence to a complex web of environmental laws and the acquisition of numerous permits, creating a significant barrier to entry and a key area of competition. Companies differentiate themselves not just on cost and technical expertise but also on their demonstrated ability to manage environmental risks and maintain a strong compliance record. This focus on environmental stewardship becomes a critical factor in securing contracts and maintaining a competitive edge.

For instance, Great Lakes Dredge & Dock Company (GLDD) often highlights its robust environmental management systems and successful navigation of permitting processes in its bid proposals. In 2023, GLDD reported significant investments in environmental protection measures and compliance training, underscoring the industry's emphasis on these aspects. The ability to efficiently and effectively meet these stringent requirements can directly impact project timelines and profitability, intensifying the competitive landscape.

- Environmental Permits: Navigating the permitting process for dredging projects, which can involve multiple federal, state, and local agencies, is a critical competitive factor.

- Compliance Costs: The expenses associated with meeting environmental standards, including monitoring, mitigation, and reporting, contribute to the overall cost structure and competitive pricing.

- Risk Management: Companies with superior environmental risk management strategies are better positioned to avoid costly delays and penalties, thereby gaining a competitive advantage.

Competitive rivalry in the dredging sector is exceptionally high, driven by significant capital intensity and the project-based nature of demand. Great Lakes Dredge & Dock, a market leader, faces intense competition from a few other major players for lucrative contracts, often leading to aggressive bidding and squeezed profit margins.

Companies differentiate themselves through fleet size, technical expertise, and strong environmental compliance records. For example, Great Lakes Dredge & Dock's reported backlog of $951.9 million as of Q1 2024 demonstrates the constant pursuit of new projects, where every bid is critical for asset utilization and profitability.

| Key Competitor Metric | Great Lakes Dredge & Dock (GLDD) | Industry Trend |

| Capital Expenditures (2023) | $155.9 million | High, essential for fleet maintenance and expansion |

| Backlog (Q1 2024) | $951.9 million | Indicates strong demand and competitive bidding |

| Fleet Investment | Ongoing, crucial for technological advantage | Continuous investment in specialized equipment |

SSubstitutes Threaten

Non-dredging coastal protection solutions present a significant threat of substitutes for Great Lakes Dredge & Dock's core business. These alternatives, such as constructing seawalls, revetments, or employing natural methods like wetland restoration, can fulfill similar erosion control and coastal defense needs without requiring extensive dredging operations. While the scale and application may differ, the increasing adoption of these less dredging-intensive methods can directly siphon demand away from traditional dredging services. For instance, in 2023, the global coastal protection market, which includes these non-dredging alternatives, was valued at approximately $15 billion, indicating a substantial market that could bypass dredging entirely.

While hydraulic dredging is a core competency for Great Lakes Dredge & Dock, alternative land reclamation techniques exist. These include using terrestrial fill materials transported via trucks or conveyor systems, or employing structural solutions like seawalls and pilings to create usable land. The practicality of these substitutes is highly project-specific, influenced by factors such as the desired scale of reclamation, the site's geographical characteristics, and unique environmental or engineering demands.

Pipelines or overland transport, like conveyor belts and trucking, can serve as substitutes for marine-based dredging and transport, particularly for moving materials or producing aggregates. This substitution is most feasible when the origin and destination points are geographically proximate and well-suited for land-based logistics, bypassing the need for waterborne solutions.

Innovative Sediment Management Techniques

Emerging technologies in sediment management pose a threat by potentially reducing the demand for traditional dredging services. Innovations like in-situ treatment, advanced dewatering, and beneficial reuse without extensive transportation could offer alternative solutions for environmental remediation and maintenance projects.

For instance, the growing focus on sustainable practices means that methods turning dredged material into valuable resources, such as construction aggregate or soil amendments, are gaining traction. This shift could divert projects away from conventional dredging companies.

While these technologies often complement dredging, significant advancements could lessen the overall reliance on traditional methods for certain applications. For example, a 2024 report highlighted a pilot project successfully using treated dredged material for coastal dune restoration, reducing the need for imported sand.

- In-situ Sediment Treatment: Techniques that neutralize or stabilize contaminants directly in place, avoiding removal.

- Advanced Dewatering: Technologies that significantly reduce the volume and water content of dredged material, making it easier and cheaper to manage or reuse.

- Beneficial Reuse: Repurposing dredged material for applications like landfill cover, construction fill, or agricultural soil, reducing disposal costs and environmental impact.

- Reduced Transport Needs: Innovations that enable on-site processing or localized reuse, minimizing the logistical burden and cost associated with traditional dredging projects.

Relocation or Adaptation Instead of Infrastructure Expansion

The threat of substitutes for Great Lakes Dredge & Dock's core services, particularly navigation dredging, emerges when stakeholders opt for relocation or adaptation over infrastructure expansion. Instead of investing in costly port expansions or channel deepening, clients might explore alternative strategies.

For instance, businesses could adapt their existing facilities to handle shallower draft vessels or optimize their supply chain logistics to reduce reliance on deep-water ports. In some scenarios, companies might even consider relocating operations to naturally deeper waterways, bypassing the need for extensive dredging projects altogether. This could directly impact the demand for Great Lakes Dredge & Dock's services, as seen in the trend of some coastal industries re-evaluating their port dependencies.

- Adaptation of Existing Infrastructure: Companies may invest in lightering operations or smaller vessel fleets to access less-developed ports.

- Logistics Optimization: Improved intermodal transport and inventory management can reduce the need for direct port access via deep channels.

- Relocation of Operations: Businesses might shift to locations with natural deep-water access, avoiding dredging costs.

- Shifting Trade Patterns: Evolving global trade routes could favor ports requiring less extensive maintenance dredging.

The threat of substitutes for Great Lakes Dredge & Dock's services is multifaceted, encompassing alternative coastal protection methods and innovative material management techniques. Non-dredging coastal defenses like seawalls and wetland restoration offer direct competition, as seen in the $15 billion global coastal protection market in 2023. Furthermore, advancements in in-situ sediment treatment and beneficial reuse are gaining traction, potentially reducing the need for traditional dredging, with a 2024 pilot project demonstrating treated dredged material for dune restoration.

| Substitute Category | Examples | Market Context/Impact |

|---|---|---|

| Coastal Protection | Seawalls, Revetments, Wetland Restoration | Global market valued at ~$15 billion in 2023; offers erosion control without dredging. |

| Land Reclamation | Terrestrial Fill Transport, Structural Solutions | Project-specific viability based on scale, geography, and engineering needs. |

| Material Transport | Conveyor Belts, Trucking | Feasible for proximate origin/destination points, bypassing marine transport. |

| Sediment Management | In-situ Treatment, Advanced Dewatering, Beneficial Reuse | Emerging technologies reducing demand for traditional dredging; pilot projects in dune restoration (2024) show promise. |

| Navigation/Port Adaptation | Lightering, Smaller Vessels, Relocation | Clients may adapt infrastructure or relocate to avoid port expansion dredging costs. |

Entrants Threaten

The sheer cost of acquiring or building specialized dredging vessels presents a formidable barrier to new entrants. Modern cutter suction dredges and hopper dredges can easily run into the hundreds of millions of dollars, a sum that makes it incredibly difficult for new companies to establish a competitive presence in the market.

New entrants into the dredging industry, particularly for companies like Great Lakes Dredge & Dock, confront a formidable array of regulatory and permitting challenges. These include navigating complex environmental regulations, securing numerous permits, and adhering to compliance requirements from various federal, state, and local agencies. For instance, the U.S. Army Corps of Engineers, a primary client and regulator, imposes strict guidelines on dredging projects, often requiring extensive environmental impact studies.

The process of obtaining necessary licenses and approvals is both time-consuming and expensive. This can involve lengthy environmental reviews, public comment periods, and the development of mitigation plans, all of which add significant costs and delays. These substantial upfront investments and the intricate compliance landscape act as a significant barrier, deterring many potential new competitors from entering the market.

The dredging industry, including companies like Great Lakes Dredge & Dock (GLDD), requires a deep well of specialized technical expertise. This isn't a sector where just anyone can jump in; it demands engineers with a knack for marine construction, surveyors who understand the nuances of hydrographic data, and technicians skilled in maintaining complex, heavy-duty marine equipment. The barrier to entry here is substantial because developing this institutional knowledge and building a capable team takes considerable time and investment.

Established Relationships with Key Clients

Great Lakes Dredge & Dock leverages its history of successful project execution and deep-seated connections with key governmental bodies and port operators, a significant barrier for newcomers. These established relationships, built over years of reliable performance, translate into a strong competitive advantage, making it difficult for new entrants to gain traction and secure the substantial, ongoing projects that define the industry.

For instance, the company's extensive experience with entities like the U.S. Army Corps of Engineers, a primary client for dredging services, highlights the importance of trust and a proven track record. New competitors would face a steep uphill battle in replicating this level of established rapport and demonstrating the reliability necessary to win bids against incumbents.

- Incumbent Advantage: Great Lakes Dredge & Dock benefits from long-standing relationships with major government agencies and port authorities.

- Trust and Track Record: New entrants face challenges in building the trust and demonstrating the proven track record essential for securing large, recurring contracts.

- Client Loyalty: Established relationships foster client loyalty, making it difficult for new companies to penetrate the market and displace existing players.

- Contract Acquisition: The ability to secure significant, long-term contracts is heavily influenced by existing client relationships, posing a threat to new market entrants.

Limited Access to Deepwater Ports and Support Infrastructure

Operating large dredging vessels, essential for projects like those undertaken by Great Lakes Dredge & Dock, demands access to specialized repair facilities, dry docks, and robust logistical support typically found in deepwater ports. New companies entering this sector may face significant hurdles in securing consistent access to this critical infrastructure.

Existing players, like Great Lakes Dredge & Dock, often benefit from established relationships or direct ownership of these vital resources, creating a barrier for potential competitors. For instance, the extensive network of ports and specialized maritime services along the Great Lakes, where Great Lakes Dredge & Dock is a prominent operator, is not easily replicated.

- High Capital Investment: Establishing or securing access to deepwater port facilities and associated repair infrastructure requires substantial upfront capital, a significant deterrent for new entrants.

- Limited Availability: The number of deepwater ports with the necessary specialized facilities for large-scale dredging equipment is finite, leading to competition for access.

- Existing Relationships: Established companies often have long-standing, preferential agreements with port authorities and service providers, making it difficult for newcomers to secure comparable terms.

- Logistical Complexity: The sheer scale of operations for deepwater dredging necessitates complex logistical planning and support, which new entrants may struggle to develop efficiently.

The threat of new entrants in the dredging industry, particularly for a company like Great Lakes Dredge & Dock, is significantly mitigated by the immense capital required to acquire specialized vessels and the complex regulatory landscape. For example, a modern trailing suction hopper dredge can cost upwards of $100 million, and obtaining the necessary environmental permits can take years and millions more, effectively creating a high barrier to entry.

Furthermore, the industry demands deep technical expertise and established relationships with key clients like the U.S. Army Corps of Engineers, which new companies struggle to replicate. GLDD's long history and proven track record foster client loyalty, making it difficult for newcomers to secure the substantial, recurring contracts that are the lifeblood of the sector.

Access to critical infrastructure, such as specialized repair facilities and deepwater ports, also presents a challenge. Established players often have preferential agreements or ownership of these resources, creating another hurdle for potential competitors seeking to enter the market.

| Barrier Type | Description | Estimated Cost/Timeframe (Illustrative) |

|---|---|---|

| Capital Investment (Vessels) | Acquiring specialized dredging equipment like hopper dredges. | $50 million - $200 million+ per vessel |

| Regulatory & Permitting | Navigating environmental regulations and securing permits. | Years, with significant legal and consulting fees |

| Technical Expertise | Developing specialized engineering, surveying, and maintenance skills. | Ongoing investment in training and recruitment |

| Client Relationships | Building trust and a proven track record with major clients. | Decades of consistent performance |

| Infrastructure Access | Securing access to repair facilities and deepwater ports. | High fees or capital for ownership/long-term leases |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Great Lakes Dredge & Dock leverages data from their annual reports, SEC filings, and industry-specific trade publications. This ensures a robust understanding of competitive dynamics, supplier power, and customer influence within the dredging and marine construction sector.