Great Lakes Dredge & Dock Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great Lakes Dredge & Dock Bundle

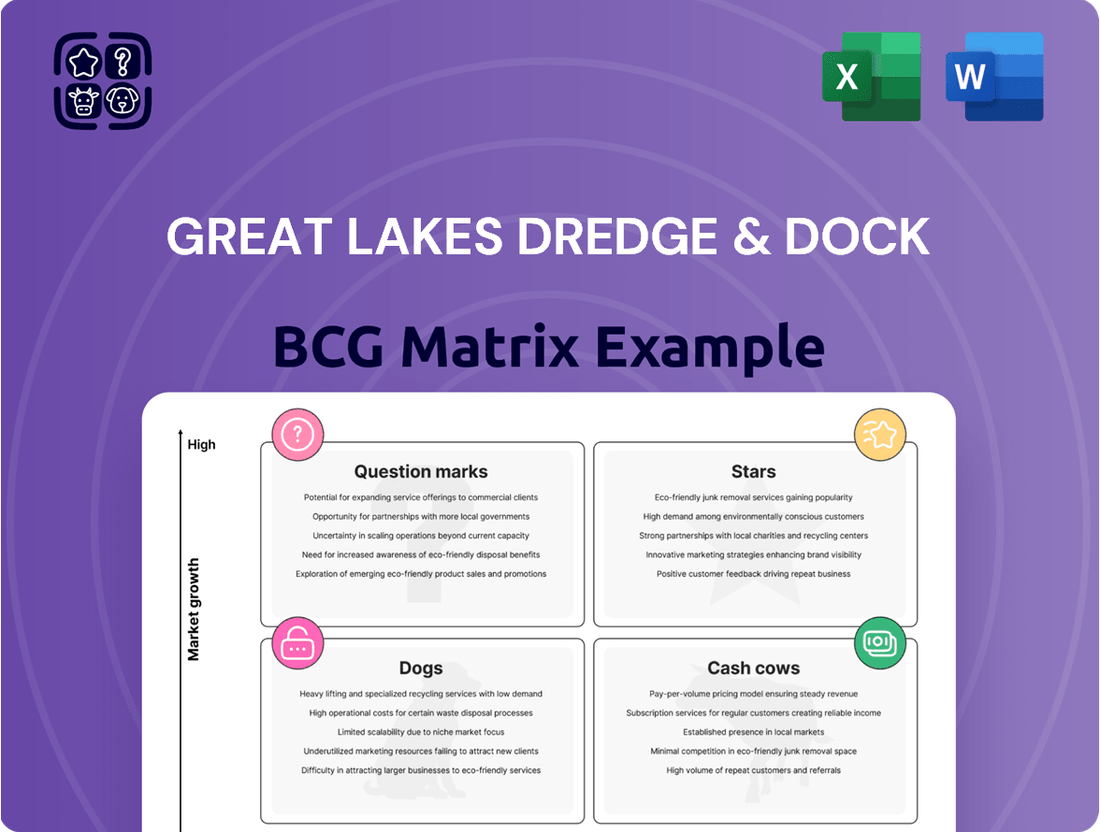

Great Lakes Dredge & Dock's BCG Matrix reveals a dynamic portfolio, with some segments showing strong growth potential and others requiring careful resource allocation. Understanding these positions is crucial for strategic decision-making.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Offshore wind subsea rock installation is a burgeoning sector where Great Lakes Dredge & Dock (GLDD) is making significant strides. The company's strategic investment in this area, particularly with its specialized rock installation services, positions it as a key player in the developing U.S. offshore wind market. This segment is anticipated to be a high-growth area for GLDD.

The introduction of GLDD's new vessel, the *Acadia*, is a pivotal development. As the first U.S.-flagged, Jones Act-compliant subsea rock installation vessel, it is purpose-built to support the foundational needs of offshore wind turbines and associated cabling. This capability directly addresses a critical requirement for the expanding U.S. offshore wind industry.

GLDD has already secured substantial contracts for multiple offshore wind projects, underscoring the market demand for its services. These projects are slated to commence operations in 2025, with ongoing work expected through 2026 and into subsequent years. This robust contract pipeline highlights the company's early success and future growth potential in this specialized niche.

Large-scale capital dredging projects, like the Sabine-Neches Contract 6 Deepening and significant LNG infrastructure development for Port Arthur LNG Phase 1 and Next Decade Corporation's Rio Grande LNG, represent Great Lakes Dredge & Dock's (GLDD) Stars in the BCG Matrix. These ventures leverage GLDD's strong U.S. market share, often securing a dominant position and contributing to higher project margins.

GLDD's strategic focus on these capital-intensive projects is evident in its 2024 performance, where the company secured a considerable number of these bids. This success translates into a robust backlog extending into 2026, underscoring their position as a market leader in these high-growth, high-demand areas.

Coastal Protection and Restoration Initiatives are a clear Star for Great Lakes Dredge & Dock (GLDD). The demand for these projects is soaring, fueled by rising sea levels and increased storm intensity, making it a high-growth market. GLDD's strong performance in securing coastal protection contracts in 2024, winning a substantial portion of available bids, underscores their leading market share in this segment.

This segment is not only growing but also highly profitable for GLDD. The complex nature of coastal protection and land reclamation projects often translates to better profit margins, significantly boosting the company's overall revenue and its robust project backlog. For instance, GLDD's backlog for coastal and environmental projects saw a notable increase in early 2024, reflecting the strong demand.

New Build Hopper Dredges (e.g., *Galveston Island* & *Amelia Island*)

The deployment of new, high-capacity hopper dredges, such as the *Galveston Island* which became operational in Q1 2024, signifies a Star in the Great Lakes Dredge & Dock (GLDD) BCG Matrix. These advanced vessels are designed to boost GLDD's operational capacity and efficiency, immediately contributing to high-margin backlog projects.

The *Amelia Island*, slated for deployment in Q3 2025, further solidifies this Star position. This strategic investment in fleet modernization is crucial for maintaining GLDD's market leadership and capitalizing on the increasing demand for large-scale dredging projects.

- Fleet Modernization: The introduction of vessels like the *Galveston Island* and *Amelia Island* enhances GLDD's competitive edge.

- Efficiency Gains: New dredges offer improved fuel efficiency and higher dredging capacities, leading to better project economics.

- Market Demand: GLDD is well-positioned to meet the growing demand for infrastructure development and coastal protection projects.

- Financial Impact: These assets are expected to generate significant revenue and contribute positively to GLDD's profitability in the coming years.

Diversification into International Offshore Energy

Great Lakes Dredge & Dock (GLDD) is strategically diversifying its operations by targeting international offshore energy markets with its Acadia vessel. This move aims to capitalize on a global undersupply of rock placement vessels, a critical component for offshore wind, oil and gas pipeline, and power/telecommunications cable protection projects.

This expansion into new territories represents a significant growth avenue for GLDD, allowing them to leverage their specialized assets beyond the traditional U.S. market. The demand for such services is robust, with projections indicating continued expansion in offshore energy infrastructure worldwide.

- Target Markets: International offshore wind, oil and gas pipeline, and power/telecommunications cable protection.

- Key Asset: Acadia vessel, designed for specialized rock placement.

- Market Opportunity: Global undersupply of rock placement vessels.

- Strategic Advantage: Leveraging specialized assets in high-growth international sectors.

Great Lakes Dredge & Dock's (GLDD) large-scale capital dredging projects, such as the Sabine-Neches Contract 6 Deepening and LNG infrastructure for Port Arthur LNG Phase 1, are strong Stars. These projects leverage GLDD's dominance in the U.S. market, leading to higher profit margins. The company's success in securing these capital-intensive bids in 2024 has built a backlog extending into 2026, solidifying its leadership in these high-demand sectors.

Coastal protection and restoration initiatives are also Stars for GLDD, driven by rising sea levels and increased storm intensity. GLDD's strong performance in winning coastal protection contracts in 2024 demonstrates their leading market share. These complex projects often yield better profit margins, significantly boosting GLDD's revenue and backlog, as evidenced by the notable increase in this segment's backlog in early 2024.

The deployment of new, high-capacity hopper dredges, like the *Galveston Island* (operational Q1 2024) and the upcoming *Amelia Island* (Q3 2025), positions fleet modernization as a Star. These vessels enhance GLDD's capacity and efficiency, contributing to high-margin projects and maintaining market leadership in response to growing infrastructure and coastal protection demands.

| Segment | BCG Category | Key Drivers | 2024 Performance Highlight | Future Outlook |

| Capital Dredging (LNG, Deepening) | Star | Strong U.S. market share, high project margins | Secured significant bids, robust backlog into 2026 | Continued demand for infrastructure development |

| Coastal Protection & Restoration | Star | Rising sea levels, increased storm intensity, high profit margins | Won substantial portion of available bids, increased backlog | Sustained growth due to climate change impacts |

| Fleet Modernization (New Dredges) | Star | Enhanced capacity & efficiency, competitive edge | *Galveston Island* operational, *Amelia Island* deployment 2025 | Meeting growing demand for large-scale projects |

What is included in the product

The Great Lakes Dredge & Dock BCG Matrix provides a tailored analysis of their business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework highlights which units to invest in, hold, or divest to optimize their portfolio.

The Great Lakes Dredge & Dock BCG Matrix offers a strategic roadmap, clarifying which business units require investment and which can be leveraged for cash, easing the burden of resource allocation decisions.

Cash Cows

Great Lakes Dredge & Dock's maintenance dredging of established waterways is a prime example of a Cash Cow. This segment consistently generates strong, reliable revenue streams, even if the growth potential isn't as explosive as newer ventures.

The ongoing need to maintain existing navigation channels and harbors ensures a steady demand for GLDD's services. This stability is crucial for predictable cash flow, allowing the company to fund other, higher-growth areas of its business.

GLDD holds a substantial position in this mature market, leveraging its expertise and established infrastructure. For instance, in 2024, the company continued to secure contracts for routine maintenance dredging across various Great Lakes ports, underscoring the segment's consistent activity.

Routine river and lake dredging, much like essential maintenance dredging, functions as a Cash Cow for Great Lakes Dredge & Dock (GLDD). These projects, vital for keeping waterways navigable, managing flood risks, and improving environmental conditions, represent a consistent and dependable revenue source.

While not typically characterized by explosive growth, the predictable nature of these recurring projects provides a stable foundation for GLDD's operations. The company's extensive fleet and well-established operational expertise allow for efficient execution, ensuring a steady and reliable cash flow from these essential services.

Great Lakes Dredge & Dock's (GLDD) demolition services, primarily targeting commercial and industrial structures, are likely a Cash Cow within their business portfolio. This segment offers consistent revenue streams, as the demand for infrastructure decommissioning and site preparation remains a constant necessity.

This division benefits from GLDD's established operational capabilities and specialized equipment, contributing reliably to the company's financial performance without requiring substantial new investment for growth. For instance, in 2023, GLDD reported a significant backlog in its demolition and marine services, indicating a stable demand for these offerings.

Aggregate Production

Great Lakes Dredge & Dock's aggregate production segment, often a natural byproduct of its core dredging operations, functions as a classic Cash Cow. This involves the extraction and sale of sand and gravel, materials with consistent demand in the construction sector. Once the necessary equipment and permits are secured, the ongoing operational costs are manageable, leading to stable and predictable cash flows with minimal need for reinvestment.

The company's aggregate operations are intrinsically linked to its dredging services, particularly in coastal and waterway projects where dredged material can be processed into saleable aggregates. This synergy allows for efficient resource utilization. For instance, in 2023, the company reported significant contributions from its marine and inland dredging segments, which indirectly support its aggregate business by providing raw materials and infrastructure. While specific aggregate revenue figures are often consolidated, the consistent demand for construction materials in infrastructure development projects, especially those involving waterway improvements and land reclamation, underpins the stability of this segment.

- Consistent Demand: Aggregates like sand and gravel are fundamental to construction, infrastructure projects, and land reclamation efforts, ensuring a steady market.

- Low Investment Needs: Post-establishment, the infrastructure for aggregate production requires relatively low additional capital expenditure, focusing on operational efficiency.

- Synergistic Operations: Dredging activities often yield materials suitable for aggregate processing, creating cost efficiencies and integrated revenue streams.

- Stable Cash Flow Generation: The predictable demand and manageable costs translate into reliable and consistent cash generation for the company.

Specialized Dredging Equipment Utilization

Great Lakes Dredge & Dock's (GLDD) specialized dredging equipment, comprising around 200 vessels, consistently operates at high utilization rates. This extensive and diverse fleet is deployed across numerous projects, ensuring maximum revenue generation from existing assets. The company's ability to efficiently utilize this fleet, with minimal need for further significant capital investment once acquired, directly translates into robust profit margins, solidifying its Cash Cow status.

The high utilization of GLDD's fleet is a key driver of its Cash Cow designation within the BCG matrix. For instance, in 2023, the company reported strong operational performance, with its dredging segment contributing significantly to overall profitability. This sustained demand for their specialized services means their substantial investment in equipment is continuously working to generate consistent returns, requiring less reinvestment compared to growth-oriented business units.

- Fleet Size: Approximately 200 specialized dredging vessels.

- Utilization: Consistently high across diverse projects.

- Capital Expenditure: Relatively low additional capex required once assets are acquired.

- Profitability: High profit margins due to efficient asset deployment and operation.

Great Lakes Dredge & Dock's (GLDD) maintenance dredging of established waterways is a prime example of a Cash Cow, consistently generating strong, reliable revenue streams. This segment benefits from a stable demand, as the ongoing need to maintain existing navigation channels and harbors ensures predictable cash flow, allowing GLDD to fund other growth areas.

GLDD holds a substantial position in this mature market, leveraging its expertise and established infrastructure. In 2024, the company continued to secure contracts for routine maintenance dredging across various Great Lakes ports, underscoring the segment's consistent activity and its role as a dependable revenue source.

Routine river and lake dredging, vital for keeping waterways navigable and managing flood risks, functions as a Cash Cow for GLDD. The predictable nature of these recurring projects provides a stable foundation, with the company's extensive fleet and operational expertise ensuring efficient execution and reliable cash flow.

GLDD's demolition services, targeting commercial and industrial structures, are also a Cash Cow, offering consistent revenue streams due to the constant necessity for infrastructure decommissioning. This division benefits from GLDD's established capabilities and specialized equipment, contributing reliably to financial performance without substantial new investment for growth.

| Segment | BCG Category | Key Characteristics |

| Maintenance Dredging | Cash Cow | Stable demand, predictable cash flow, mature market. |

| Demolition Services | Cash Cow | Consistent revenue, established capabilities, low growth investment. |

| Aggregate Production | Cash Cow | Synergistic with dredging, steady construction demand, manageable costs. |

| Fleet Utilization | Cash Cow | High asset utilization, robust profit margins, low additional capex. |

Delivered as Shown

Great Lakes Dredge & Dock BCG Matrix

The Great Lakes Dredge & Dock BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, ensuring complete transparency and immediate utility. This comprehensive analysis, meticulously crafted, will be delivered to you exactly as presented, free from any watermarks or placeholder content, ready for your strategic application. You are seeing the final, professionally formatted BCG Matrix report, which means no further editing or revisions will be necessary before you can leverage its insights for your business planning and decision-making processes. This preview guarantees that the purchased file is the complete and accurate representation of the strategic analysis you need, providing immediate access to actionable market intelligence for Great Lakes Dredge & Dock. Rest assured, the document you are currently reviewing is the exact BCG Matrix report you will download, offering a clear and ready-to-use strategic roadmap for Great Lakes Dredge & Dock.

Dogs

Older dredging equipment that is inefficient or costly to maintain due to age and technological limitations would fall into the Dog category for Great Lakes Dredge & Dock (GLDD). These assets likely have low utilization rates and contribute little to the company's overall revenue, especially in the context of modern, high-demand dredging projects. For instance, if a vessel requires frequent, expensive repairs, as might be common with equipment over 20 years old, its operational costs could outweigh its earnings.

Such underperforming assets represent a drain on resources and capital, hindering GLDD's ability to invest in more profitable ventures or newer, more efficient technologies. The company's ongoing new build program, which aims to replace older vessels with state-of-the-art equipment, directly addresses this issue by phasing out these Dogs. This strategic move is crucial for maintaining competitiveness in a market that increasingly favors advanced dredging capabilities and environmental compliance.

Projects facing unexpected scope creep, regulatory roadblocks, or significant delays, especially those with fixed-price agreements, can quickly turn into Dogs within the BCG Matrix. These challenges escalate costs, diminish operational efficiency, and directly harm profit margins, effectively immobilizing capital without generating sufficient returns.

The cancellation of the Empire Wind II offshore wind project by Equinor in late 2023 serves as a pertinent example of a project that likely became a Dog for Great Lakes Dredge & Dock. This cancellation, attributed to rising costs and supply chain issues, meant Great Lakes Dredge & Dock would not realize the expected revenue from this substantial contract, impacting their project pipeline and resource allocation.

Highly competitive, low-margin niche dredging projects represent a challenging segment for Great Lakes Dredge & Dock (GLDD). These opportunities often involve smaller-scale operations in commoditized markets where GLDD's significant size and specialized equipment offer little competitive advantage. In 2023, the dredging industry saw continued demand, but intense competition in certain segments kept profit margins tight.

GLDD's participation in these niche areas would likely result in a low market share and minimal growth potential. The profitability on such projects is typically thin, potentially yielding only single-digit profit margins, which could divert critical resources and management attention away from higher-return ventures within GLDD's portfolio.

Non-Core, Underperforming Ancillary Services

Great Lakes Dredge & Dock's (GLDD) ancillary services that are not central to their core business and consistently underperform would be categorized as Dogs in the BCG Matrix. These services likely exhibit low market share and minimal growth potential, demanding significant resources for limited returns.

For instance, imagine GLDD offering specialized environmental consulting related to dredging operations that, while complementary, has seen very little client uptake. In 2024, such a service might have only contributed a fraction of a percent to the company's overall revenue, perhaps less than $1 million, while still requiring dedicated staff and equipment.

- Low Market Share: These services represent a tiny portion of the overall market for specialized dredging-related consulting or niche equipment rental.

- Negligible Growth Prospects: Demand for these non-core offerings is not expected to increase significantly in the foreseeable future.

- Resource Drain: The cost of maintaining and marketing these underperforming services outweighs the revenue they generate, impacting profitability.

- Example Scenario: A hypothetical niche service, like specialized marine debris removal not directly tied to dredging projects, might have seen only a handful of contracts in 2024, generating minimal revenue and requiring specialized, infrequently used equipment.

Regional Markets with Limited Dredging Demand

Certain regions within the U.S. might present limited dredging demand, potentially categorizing them as Dogs in the BCG matrix for Great Lakes Dredge & Dock (GLDD). These areas could be characterized by consistently low project volumes or intense local competition, hindering GLDD's ability to secure substantial market share or achieve profitability.

For instance, areas with minimal major port infrastructure development or those heavily reliant on smaller, localized dredging needs might fall into this category. These markets are unlikely to contribute significantly to GLDD's overall growth or revenue streams.

- Limited Infrastructure Projects: Regions with fewer large-scale federal navigation projects or private port expansions would naturally have lower dredging requirements.

- High Local Competition: Areas with established, smaller regional dredging companies may make it difficult for a national player like GLDD to compete effectively on price or project acquisition.

- Low Economic Activity: Geographies experiencing economic stagnation or decline may see reduced investment in infrastructure, leading to less dredging demand.

- Environmental Restrictions: Certain areas might have stringent environmental regulations that limit the scope or frequency of dredging activities.

Underperforming assets, such as older, inefficient dredging equipment with low utilization rates, are considered Dogs for Great Lakes Dredge & Dock (GLDD). These assets, requiring frequent costly repairs, contribute little to revenue and drain resources. GLDD's strategic new build program aims to phase out these older vessels, enhancing competitiveness. For example, if a vessel over 20 years old incurs $500,000 in annual maintenance with minimal revenue generation, it's a clear Dog.

Projects that encounter significant delays, cost overruns, or regulatory hurdles, especially fixed-price contracts, can become Dogs. The cancellation of the Empire Wind II project by Equinor in late 2023, due to rising costs, exemplifies this, impacting GLDD's expected revenue and resource allocation. Such projects tie up capital without delivering expected returns.

Highly competitive, low-margin niche dredging projects represent another Dog category for GLDD. These markets offer little competitive advantage for larger firms, resulting in minimal growth and thin profit margins, potentially single digits. In 2023, intense competition in certain segments kept profit margins tight across the industry.

Ancillary services that are not core to GLDD's business and consistently underperform are also Dogs. These services have low market share and growth potential, consuming resources for limited returns. A hypothetical niche service, like specialized marine debris removal, might have generated less than $1 million in revenue in 2024, while still requiring dedicated resources.

| Asset/Project Type | BCG Category | Key Characteristics | Example Data Point (Illustrative) |

| Older Dredging Vessels | Dog | Low utilization, high maintenance costs, outdated technology | Annual maintenance cost > $500k, utilization < 30% |

| Cancelled Projects (e.g., Empire Wind II) | Dog | Cost overruns, regulatory issues, revenue loss | Lost contract value: $100M+ |

| Niche, Low-Margin Projects | Dog | Intense competition, minimal growth, thin profit margins | Profit margin: < 5% |

| Underperforming Ancillary Services | Dog | Low market share, negligible growth, resource drain | Annual revenue: < $1M |

Question Marks

Early-stage offshore wind projects where Great Lakes Dredge & Dock (GLDD) has secured initial contracts but the client's final investment decision (FID) is still pending are considered Question Marks in the BCG matrix. These projects represent a high-growth potential market, but also carry significant risk due to the pending FID. For instance, the cancellation of the Empire Wind II project by Equinor in late 2023, despite initial agreements, highlights the volatility of this sector. GLDD's investment in bidding and planning for these projects consumes resources without a guaranteed revenue stream, placing them in a precarious position.

Great Lakes Dredge & Dock's (GLDD) ambition to deploy its Acadia vessel into new, untested international offshore energy markets positions it squarely as a Question Mark in the BCG Matrix. These markets, while promising significant growth, present considerable unknowns for GLDD.

The company's current market share in these nascent international arenas is minimal, underscoring the inherent risks. Success hinges on GLDD's ability to effectively manage diverse regulatory frameworks, intense competition, and unforeseen operational hurdles in these unfamiliar territories.

For context, the global offshore wind market alone was projected to reach over $150 billion by 2027, indicating the scale of opportunity, but also the competitive intensity GLDD will face. GLDD's strategic move requires careful evaluation of its resources and capabilities against these emerging international demands.

Investing in novel dredging technologies or significantly upgrading existing methods represents a strategic move into a high-growth potential sector, driven by technological innovation. These ventures, while currently holding a low market share due to their unproven nature, demand substantial capital outlay with an uncertain path to commercial viability.

Entry into Adjacent Marine Construction Niches

Great Lakes Dredge & Dock (GLDD) might consider expanding into adjacent marine construction niches, such as offshore wind foundation installation or specialized marine infrastructure projects like bridge foundations. These areas represent potentially high-growth markets, but would require substantial upfront investment and a strategic approach to build market share from a currently low position.

In 2024, the offshore wind sector, a prime example of an adjacent niche, saw significant investment. For instance, the US offshore wind pipeline included projects with a combined capacity exceeding 30 gigawatts, signaling robust demand for specialized marine construction capabilities. GLDD's entry would mean competing with established players, necessitating a focused strategy to gain traction.

- High Growth Potential: Niches like offshore wind foundation installation offer substantial revenue opportunities, driven by global energy transition initiatives.

- Low Initial Market Share: Entering these new segments means GLDD would start with a minimal presence, requiring aggressive market penetration strategies.

- Significant Investment Required: Acquiring specialized equipment, training personnel, and securing contracts in new niches will demand considerable capital outlay.

- Strategic Partnerships: Collaborating with experienced firms in these adjacent markets could accelerate GLDD's entry and reduce initial risks.

Large-Scale Environmental Remediation Projects with High Complexity

Large-scale environmental remediation dredging projects, especially those employing novel or untested methodologies, would likely be classified as Question Marks in the BCG Matrix. These ventures present significant technical hurdles, intricate regulatory landscapes, and the inherent possibility of unexpected complications, leading to elevated risk profiles. Consequently, they often begin with a limited guaranteed market share and uncertain profitability, despite the overall expansion of the environmental restoration sector.

The environmental remediation market is indeed experiencing growth, with projections indicating a continued upward trend. For instance, the global environmental consulting market was valued at approximately $35 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030. However, the specific segment of large-scale, complex dredging remediation projects faces unique challenges that temper immediate returns.

- High Technical Risk: Projects involving new or unproven dredging techniques carry inherent uncertainties in execution and effectiveness.

- Regulatory Hurdles: Navigating complex and evolving environmental regulations can lead to delays and increased costs.

- Unforeseen Site Conditions: Discovering unexpected contaminants or geological formations can significantly impact project scope and budget.

- Initial Low Market Share: Due to their specialized nature and high risk, these projects may initially attract fewer bidders, limiting immediate market penetration.

Great Lakes Dredge & Dock's (GLDD) involvement in early-stage offshore wind projects, where client final investment decisions are pending, firmly places them in the Question Mark category of the BCG matrix. These ventures represent a high-growth market with substantial revenue potential, but also carry significant risk due to the uncertainty of project commencement. For example, the cancellation of Equinor's Empire Wind II project in late 2023 underscores the sector's volatility, highlighting the capital GLDD might invest without guaranteed returns.

The company's strategic push into new, untested international offshore energy markets with its Acadia vessel also categorizes it as a Question Mark. These markets offer considerable growth prospects, but GLDD's minimal existing market share in these areas signifies high risk. Success will depend on navigating diverse regulations and intense competition, a challenge amplified by the global offshore wind market's projected growth past $150 billion by 2027.

GLDD's exploration of adjacent marine construction niches, such as offshore wind foundation installation or specialized marine infrastructure, also fits the Question Mark profile. These areas, while offering high growth, demand significant upfront investment and a strategy to build market share from a low initial position. The US offshore wind pipeline alone, exceeding 30 gigawatts in 2024, indicates robust demand but also intense competition for GLDD.

| BCG Category | GLDD Business Area | Market Growth | Relative Market Share | Key Considerations |

| Question Mark | Early-stage Offshore Wind Projects (Pending FID) | High | Low | Client FID uncertainty, project cancellation risk (e.g., Empire Wind II) |

| Question Mark | New International Offshore Energy Markets (Acadia Vessel) | High | Low | Unfamiliar regulatory environments, competitive intensity, operational unknowns |

| Question Mark | Adjacent Marine Niches (e.g., Foundation Installation) | High | Low | Substantial capital outlay, need for specialized equipment, competing with established players |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Great Lakes Dredge & Dock's financial reports, industry-specific market research, and official regulatory filings to accurately assess business unit performance and market dynamics.