Great Lakes Dredge & Dock Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great Lakes Dredge & Dock Bundle

Discover how Great Lakes Dredge & Dock masterfully crafts its market presence through a strategic blend of product innovation, competitive pricing, expansive distribution, and targeted promotion. This analysis provides a clear roadmap of their success.

Unlock the full potential of this insightful analysis. Gain access to a comprehensive, editable 4Ps Marketing Mix report that details their product offerings, pricing strategies, distribution channels, and promotional activities, empowering your own business strategies.

Product

Great Lakes Dredge & Dock (GLDD) positions its dredging services as the premier solution for U.S. marine construction needs. Their offerings encompass vital capital dredging for port expansions and channel deepening, directly impacting commercial navigation and economic growth. A prime example is their $235 million Sabine-Neches Contract 6 Deepening project, highlighting their capacity for large-scale infrastructure development.

Great Lakes Dredge & Dock (GLDD) excels in coastal protection and restoration, a crucial service for preserving shorelines against erosion and severe weather. Their expertise involves relocating sand from the seabed to beaches, fostering both environmental recovery and community resilience.

These vital projects are actively underway, with significant undertakings like the Fire Island Inlet Dredging Project in New York and the Barnegat Inlet to Little Egg Inlet Beach Renourishment Project in New Jersey scheduled for completion or significant progress through 2024 and 2025. These initiatives underscore GLDD's commitment to enhancing natural defenses and supporting coastal communities.

Great Lakes Dredge & Dock (GLDD) actively engages in land reclamation, a crucial aspect of their product offering. This involves creating new land or improving existing areas, often for commercial or residential development. For instance, their projects contribute to expanding waterfront access and developing new urban spaces.

The company's trench digging services are integral to developing essential infrastructure. This includes excavating channels for pipelines, subsea cables, and tunnels, vital for energy, telecommunications, and transportation networks. In 2023, GLDD reported significant activity in these areas, supporting the build-out of critical energy infrastructure.

Through these land reclamation and trench digging efforts, GLDD plays a substantial role in broader infrastructure development. Their work directly addresses the needs of both public and private sectors, facilitating everything from port expansions to the installation of renewable energy components. This demonstrates GLDD's evolution into a key player in major civil engineering endeavors.

Offshore Wind Energy Support

Great Lakes Dredge & Dock (GLDD) is strategically leveraging its dredging expertise to enter the burgeoning offshore wind energy sector. This expansion focuses on critical support services, including the installation of subsea rock for stabilizing wind turbine foundations and protecting vital power cables. This move aligns with the significant growth anticipated in U.S. offshore wind development.

A cornerstone of GLDD's offshore wind strategy is its new vessel, the Acadia. As the first U.S.-flagged, Jones Act-compliant subsea rock installation vessel, the Acadia is poised to be a crucial asset for major projects. It is slated for delivery in 2025 and is already earmarked for significant contracts, such as supporting the Empire Wind I and Sunrise Wind projects.

- Subsea Rock Installation: Essential for foundation stability and cable protection in offshore wind farms.

- Jones Act Compliance: The Acadia is the first U.S.-flagged vessel of its kind, enabling participation in domestic offshore wind projects.

- Project Commitments: Secured work for major projects like Empire Wind I and Sunrise Wind, demonstrating market traction.

- Capacity Expansion: The Acadia's 2025 delivery signifies GLDD's commitment to building specialized capacity for this growing market.

Specialized Marine Construction and Environmental Services

Great Lakes Dredge & Dock (GLDD) extends its expertise beyond traditional dredging, offering a suite of specialized marine construction and environmental services. This diversification includes aggregate production for infrastructure projects and demolition services for marine structures. In 2023, GLDD reported its marine construction segment revenue grew by 17.6% year-over-year, reaching $155.4 million, showcasing strong demand for these broader capabilities.

Environmental stewardship is a cornerstone of GLDD's operations. The company actively employs methods designed to lessen ecological impact and engages in habitat restoration initiatives. This focus is critical as regulatory bodies and clients increasingly prioritize sustainable practices. For instance, GLDD's environmental services segment saw a revenue increase of 25% in 2023, reflecting the growing market for these specialized offerings.

Central to all GLDD's activities is an unwavering commitment to safety, driven by its Incident-and-Injury-Free® (IIF®) program. This dedication not only protects its workforce but also ensures operational efficiency and client confidence. GLDD's safety performance in 2023 remained industry-leading, with a Total Recordable Incident Rate (TRIR) significantly below the industry average, reinforcing its reputation.

- Marine Construction Expansion: Diversified services include aggregate production and demolition, contributing to a 17.6% revenue increase in this segment for 2023.

- Environmental Focus: Emphasis on minimizing ecological disruption and habitat restoration projects, leading to a 25% revenue growth in environmental services in 2023.

- Safety Excellence: The IIF® program underpins all operations, maintaining a strong safety record well below industry benchmarks.

Great Lakes Dredge & Dock (GLDD) offers a comprehensive suite of marine construction services, including capital dredging for port improvements and coastal protection through beach renourishment. Their product portfolio is expanding into specialized areas like subsea rock installation for offshore wind farms, a market expected to see significant growth through 2025.

GLDD's product strategy emphasizes diversification and specialized capabilities. Key offerings include essential infrastructure support through trench digging for pipelines and cables, and land reclamation for development. Their commitment to environmental services and safety underpins all these operations, driving client trust and market demand.

The company's investment in new assets, such as the Acadia vessel for offshore wind projects, highlights its product development focus. This strategic move positions GLDD to capitalize on emerging energy infrastructure needs, with the Acadia slated for delivery in 2025 and already contracted for major projects.

GLDD's product mix is designed to address critical infrastructure and environmental needs, from deepening waterways to protecting coastlines and supporting renewable energy development. This broad product range, coupled with a strong safety record and environmental focus, solidifies their market position.

| Product Area | Key Services | 2023/2024/2025 Data Points |

| Dredging & Marine Construction | Capital Dredging, Coastal Protection, Trench Digging, Land Reclamation | Sabine-Neches Contract 6 ($235M), Fire Island Inlet Dredging, Barnegat Inlet Beach Renourishment (ongoing 2024-2025), Marine Construction Segment Revenue +17.6% (2023) |

| Offshore Wind Support | Subsea Rock Installation, Cable Protection | Acadia vessel delivery (2025), Contracts for Empire Wind I & Sunrise Wind |

| Environmental Services | Habitat Restoration, Minimizing Ecological Impact | Environmental Services Segment Revenue +25% (2023) |

What is included in the product

This analysis offers a comprehensive examination of Great Lakes Dredge & Dock's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Great Lakes Dredge & Dock's market positioning and competitive advantages.

This analysis translates Great Lakes Dredge & Dock's 4Ps into actionable strategies that directly address and alleviate client pain points, such as project delays and environmental concerns.

It serves as a clear, concise guide for stakeholders to understand how the company's product, price, place, and promotion are designed to solve industry challenges.

Place

Great Lakes Dredge & Dock strategically positions itself along the U.S. East, West, and Gulf Coasts, areas that represent the nexus of marine construction and dredging activity. This geographic focus is crucial, as evidenced by their significant involvement in projects like the Delaware River Deepening project and ongoing maintenance dredging contracts on the Mississippi River. Their extensive portfolio, including work on vital ports and waterways, underscores their commitment to these key maritime corridors.

Great Lakes Dredge & Dock (GLDD) primarily engages clients directly, bidding on and winning contracts with government entities and private companies. This direct project engagement model is crucial in their specialized industry, enabling them to offer customized solutions and foster robust client relationships.

This direct approach is clearly demonstrated by GLDD's significant project backlog. As of the first quarter of 2024, their backlog stood at an impressive $1.2 billion, with a substantial portion stemming from contracts with the U.S. Army Corps of Engineers, highlighting the success of their direct engagement strategy.

Great Lakes Dredge & Dock leverages its extensive and diverse fleet of roughly 200 specialized vessels to meet project demands. This includes a variety of hydraulic, hopper, and mechanical dredges, all strategically deployed to ensure efficiency and timely project completion.

The company's fleet deployment is meticulously planned, matching vessel capabilities to specific project needs, thereby guaranteeing product accessibility precisely when and where it's required. This approach is crucial for their market presence and ability to serve diverse geographical locations and project types.

Recent investments in fleet modernization, exemplified by the delivery of the Galveston Island in 2023 and the planned addition of the Amelia Island, underscore their commitment to enhancing operational capacity and technological advancement. These new vessels are designed for greater efficiency and environmental performance, reflecting industry trends and client expectations for 2024 and beyond.

Expansion into Offshore Energy Hubs

Great Lakes Dredge & Dock (GLDD) is strategically positioning itself within the burgeoning offshore energy sector, with a keen focus on offshore wind development. This expansion targets critical regions, notably the U.S. East Coast, which is experiencing significant investment in renewable energy infrastructure. By entering these markets, GLDD aims to leverage its expertise in marine construction and project execution to capture new revenue streams.

The introduction of the Acadia, a state-of-the-art subsea rock installation vessel, underscores GLDD's commitment to serving these specialized offshore markets. This vessel is purpose-built to meet the demands of offshore wind farm construction, including the crucial task of foundation stabilization. The Acadia's deployment signifies a deliberate distribution strategy, ensuring GLDD can efficiently deliver its services to project sites.

- Market Focus: U.S. East Coast offshore wind development zones.

- Key Asset: The Acadia, a new subsea rock installation vessel.

- Strategic Objective: Diversification beyond traditional dredging into offshore energy services.

- Industry Growth: The U.S. offshore wind market is projected to install 30 GW by 2030, requiring substantial marine construction support.

International Project Capabilities

Great Lakes Dredge & Dock (GLDD) has a well-established track record of executing complex projects beyond its core U.S. operations, showcasing its global reach and adaptability. This international presence underscores their ability to leverage their extensive resources and specialized knowledge in diverse geographical markets, effectively broadening their 'place' in the global dredging and marine construction landscape.

The company’s strategic international engagements are a testament to its robust operational capabilities. For example, the planned international deployment of the Acadia vessel for offshore energy developments highlights GLDD's commitment to pursuing global growth opportunities. This strategic positioning allows them to capitalize on international demand for specialized dredging and marine services.

- Global Project Execution: Demonstrates capacity to manage projects worldwide, not just within the U.S.

- Strategic International Deployment: Vessels like the Acadia are earmarked for international offshore energy projects, signaling global market focus.

- Resource & Expertise Mobility: Ability to deploy specialized equipment and skilled personnel across continents for diverse marine construction needs.

Great Lakes Dredge & Dock's "Place" in the marketing mix is defined by its strategic geographic presence and the deployment of its extensive fleet. They are heavily concentrated along the U.S. East, West, and Gulf Coasts, key areas for marine construction. Their recent expansion into the offshore wind sector, particularly on the U.S. East Coast, further solidifies this strategic placement. The company also demonstrates a capacity for international project execution, leveraging its specialized vessels like the Acadia for global opportunities.

| Geographic Focus | Key Projects/Sectors | Fleet Deployment Strategy | International Presence |

| U.S. East, West, Gulf Coasts | Delaware River Deepening, Mississippi River maintenance dredging | Matching vessel capabilities to project needs | Planned international deployment of Acadia |

| U.S. East Coast Offshore Wind | Foundation stabilization for wind farms | Strategic deployment for efficiency and accessibility | Global pursuit of offshore energy developments |

| Global Markets | Diverse marine construction needs | Mobility of specialized equipment and personnel | Showcasing robust operational capabilities |

Preview the Actual Deliverable

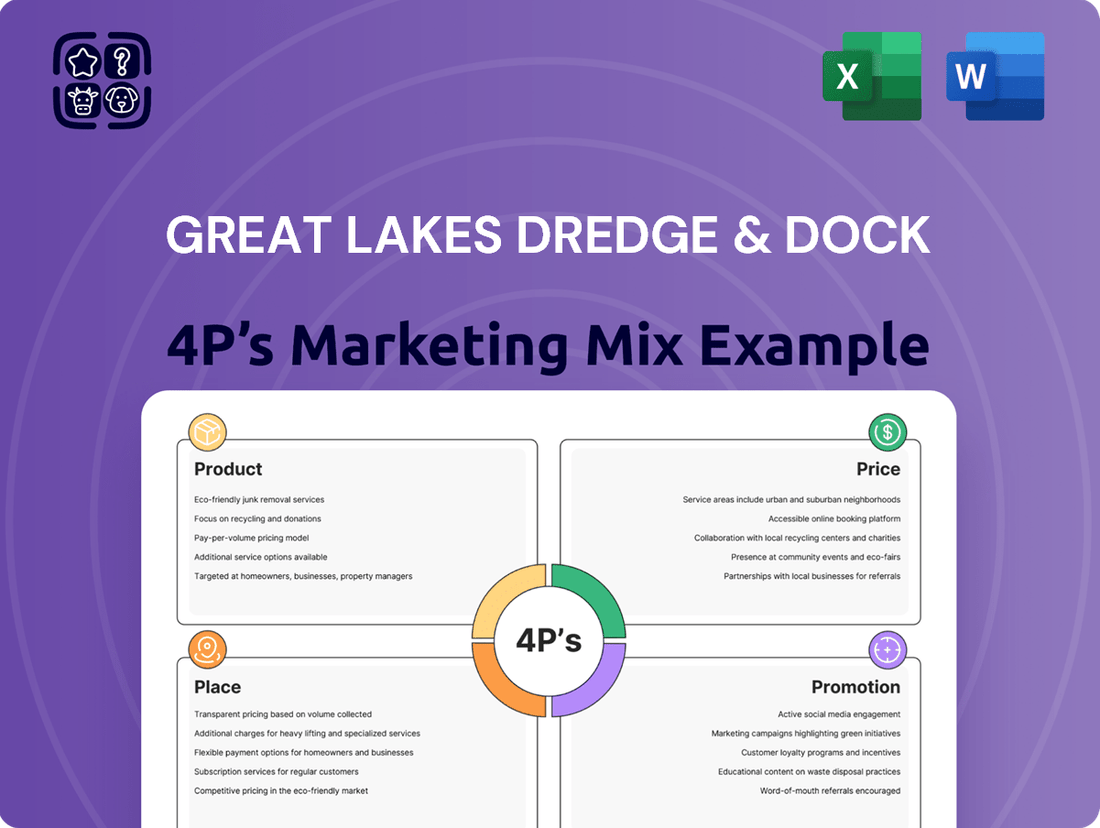

Great Lakes Dredge & Dock 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Great Lakes Dredge & Dock 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need.

Promotion

Great Lakes Dredge & Dock (GLDD) prominently features its status as the largest dredging services provider in the U.S. and its unbroken 135-year track record of project completion as core promotional elements. This deep well of experience and proven reliability is a significant differentiator, underscoring their commitment and capability in the marine construction sector.

This established industry leadership and unwavering reputation for successful project execution are consistently communicated through investor relations materials and corporate messaging. For instance, in their 2024 investor presentations, GLDD emphasizes their consistent ability to deliver on complex marine projects, a testament to their operational excellence and deep industry knowledge.

Great Lakes Dredge & Dock (GLDD) actively engages in public relations and industry events to bolster its market presence. Their participation in conferences like NobleCon20, where leadership shares insights on market trends and strategic directions, is a key component of this strategy.

The company also leverages press releases to disseminate crucial information, such as financial performance updates, significant contract wins, and vessel achievements, like the recent launch of the Acadia. These announcements serve to inform stakeholders and highlight GLDD's operational successes and forward-looking plans.

Great Lakes Dredge & Dock (GLDD) actively engages its stakeholders through a comprehensive investor relations program. This includes readily accessible financial reports, detailed earnings call transcripts, and strategic presentations tailored for investors, analysts, and business strategists.

This commitment to transparency fosters investor confidence, particularly by highlighting GLDD's solid financial performance. For instance, in the first quarter of 2024, GLDD reported a net income of $28.3 million, demonstrating operational strength.

The company effectively communicates its robust backlog, which stood at $1.3 billion at the end of Q1 2024, and its strategic growth initiatives. Key among these is the ongoing new build program, designed to enhance fleet efficiency and capacity, further solidifying its market position.

Safety and Environmental Stewardship Initiatives

Great Lakes Dredge & Dock (GLDD) champions its Incident-and-Injury-Free® (IIF®) safety program as a cornerstone of its operations, underscoring a deep commitment to its workforce. This focus on safety is not just a policy but a core value that permeates every project. In 2023, GLDD reported a Total Recordable Incident Rate (TRIR) of 0.79, significantly below the industry average, demonstrating the effectiveness of their safety culture.

Beyond internal safety, GLDD actively pursues environmental stewardship. This includes rigorous compliance with environmental regulations and a proactive approach to minimizing operational impact. For instance, the company frequently engages in habitat restoration projects as part of its dredging activities, contributing positively to marine ecosystems. Their commitment to sustainability is a key differentiator, enhancing their reputation as a responsible industry leader.

- IIF® Program: Drives a culture of zero incidents, aiming for the well-being of all personnel.

- Environmental Compliance: Adherence to stringent environmental standards and regulations is paramount.

- Habitat Restoration: Active participation in projects that benefit and restore marine environments.

- Safety Performance: GLDD's 2023 TRIR of 0.79 highlights their dedication to a safe working environment.

Strategic Partnerships and Project Showcasing

Great Lakes Dredge & Dock (GLDD) actively promotes its expertise through strategic partnerships, particularly with governmental agencies like the U.S. Army Corps of Engineers. These collaborations underscore GLDD's role in crucial national infrastructure development.

GLDD showcases its successful project completions, highlighting their contribution to national infrastructure and energy security goals. This tangible demonstration of value serves as a potent promotional tool, building credibility and trust.

- Infrastructure Impact: GLDD's projects, such as those supporting the U.S. Army Corps of Engineers, directly contribute to national infrastructure resilience and economic growth.

- Emerging Sectors: Partnerships in the LNG and offshore wind sectors demonstrate GLDD's adaptability and forward-looking strategy, aligning with national energy transition objectives.

- Project Visibility: Showcasing completed projects, like the recent deepening of the Corpus Christi Ship Channel, provides concrete evidence of GLDD's capabilities and impact. In 2023, GLDD reported a backlog of approximately $1.1 billion, reflecting ongoing demand for its services.

Great Lakes Dredge & Dock (GLDD) heavily promotes its extensive experience and consistent project success, emphasizing its position as the largest U.S. dredging provider. This narrative is reinforced through investor relations, highlighting operational excellence and a strong industry reputation, as seen in their 2024 presentations.

The company actively participates in industry events and utilizes press releases to announce key achievements, such as contract wins and vessel launches, like the Acadia, to maintain market visibility and inform stakeholders.

GLDD's promotional efforts also focus on its commitment to safety through its Incident-and-Injury-Free® (IIF®) program, evidenced by a 2023 Total Recordable Incident Rate (TRIR) of 0.79, well below industry averages, and its dedication to environmental stewardship and habitat restoration.

Strategic partnerships, particularly with entities like the U.S. Army Corps of Engineers, and showcasing completed infrastructure projects, such as the Corpus Christi Ship Channel deepening, serve to validate GLDD's capabilities and impact on national development.

| Key Promotional Aspect | Supporting Data/Fact | Impact |

|---|---|---|

| Industry Leadership & Experience | Largest U.S. dredging provider; 135-year track record | Establishes credibility and proven reliability |

| Operational Excellence & Financial Strength | Q1 2024 Net Income: $28.3 million; Backlog: $1.3 billion (end Q1 2024) | Demonstrates financial health and ongoing demand |

| Safety Commitment | 2023 TRIR: 0.79 (below industry average) | Underscores dedication to workforce well-being and operational integrity |

| Strategic Growth & Partnerships | Focus on LNG and offshore wind sectors; Projects with U.S. Army Corps of Engineers | Highlights adaptability and contribution to national infrastructure and energy goals |

Price

Great Lakes Dredge & Dock's pricing strategy for major marine projects hinges on competitive bidding. They submit comprehensive proposals and cost breakdowns to government entities and private clients, a standard practice in securing large contracts.

The company must carefully balance securing contracts with ensuring profitability in a highly competitive dredging sector. This requires strategic pricing that reflects project scope, material costs, and market conditions. For instance, in 2023, the U.S. Army Corps of Engineers awarded numerous dredging contracts, with bid prices reflecting these competitive pressures.

For highly specialized services like subsea rock installation for offshore wind, Great Lakes Dredge & Dock (GLDD) can implement value-based pricing. This strategy reflects the unique capabilities, advanced technology, and specialized expertise that GLDD brings to projects, such as those utilizing its Acadia vessel.

These complex projects, requiring a specialized fleet and advanced engineering, often result in higher profit margins. GLDD's ability to deploy assets like the Acadia, a state-of-the-art vessel capable of precise rock placement, allows them to command a premium that aligns with the project's value and GLDD's exclusive offerings.

Great Lakes Dredge & Dock (GLDD) benefits significantly from government funding, with a substantial portion of its revenue stemming from projects awarded by entities like the U.S. Army Corps of Engineers. This reliance on public sector contracts provides a predictable and stable income source, insulating the company from some of the volatility seen in purely private sector markets. For instance, in 2023, GLDD secured several key awards from the Army Corps, contributing to its robust backlog.

The pricing strategy for these government contracts is intrinsically linked to federal appropriations and multi-year funding initiatives, such as the Infrastructure Investment and Jobs Act. This framework not only dictates project costs but also offers GLDD enhanced revenue visibility, as funding is often secured well in advance of project commencement. This structure substantially mitigates the risk of payment defaults, ensuring a more reliable financial outlook.

Cost Management and Operational Efficiency

Great Lakes Dredge & Dock's (GLDD) success hinges on its cost management and operational efficiency, directly influencing its pricing power and bottom line. By investing in fleet modernization, like their newer, more fuel-efficient dredges, GLDD aims to slash operational expenses and boost project execution. This focus on efficiency allows them to submit competitive bids while simultaneously widening their profit margins.

The company's commitment to keeping costs in check is evident in its strategic fleet upgrades. For instance, the introduction of advanced dredging equipment is designed to consume less fuel and require less maintenance, translating into significant savings over time. This proactive approach to cost control is crucial in an industry where project margins can be tight.

- Fleet Modernization Investments: GLDD continues to invest in its fleet to improve fuel efficiency and reduce maintenance costs, enhancing overall operational performance.

- Operational Efficiency Gains: Investments in new, more efficient dredges are projected to lower per-unit operating costs, supporting competitive bidding.

- Project Performance and Utilization: Strong project execution and high vessel utilization rates are key drivers for improving gross margins.

- Cost Control Measures: GLDD actively manages project-specific costs, including labor, materials, and equipment, to ensure profitability.

Backlog and Market Demand Influence

Great Lakes Dredge & Dock's significant backlog, which reached around $1 billion by the close of Q1 2025, offers strong revenue visibility. This substantial backlog directly informs their pricing strategies for upcoming projects, allowing for more confident and potentially higher bid prices.

The market's current strength, fueled by increased government investment in infrastructure and coastal resilience, creates a favorable environment for dredging services. This robust demand translates into better pricing power and improved margin potential for Great Lakes Dredge & Dock, particularly in capital and coastal protection projects.

- $1 Billion: Approximate dredging backlog at the end of Q1 2025.

- Increased Government Funding: A key driver for robust bid market activity.

- Favorable Pricing Conditions: Enabled by healthy demand for coastal protection and infrastructure projects.

Great Lakes Dredge & Dock's pricing is heavily influenced by competitive bidding for government contracts, where detailed proposals are submitted. However, for specialized services like subsea rock installation, they employ value-based pricing, reflecting their unique capabilities and advanced technology, such as their Acadia vessel.

The company's pricing strategy is also shaped by government funding initiatives like the Infrastructure Investment and Jobs Act, offering revenue visibility and mitigating payment risks. This is supported by a substantial backlog, which stood at approximately $1 billion by the end of Q1 2025, enabling more confident pricing for future projects amidst strong market demand for coastal protection and infrastructure work.

| Pricing Factor | Impact on GLDD | Data Point (as of Q1 2025) |

|---|---|---|

| Competitive Bidding | Standard for securing large government contracts. | N/A (process-dependent) |

| Value-Based Pricing | Applied to specialized services, commanding premiums. | Acadia vessel deployment for subsea rock installation. |

| Government Funding | Provides predictable revenue, influences contract pricing. | Infrastructure Investment and Jobs Act. |

| Backlog Strength | Enables confident, potentially higher bid prices. | ~$1 Billion backlog. |

| Market Demand | Favorable conditions for coastal protection projects. | Increased government investment. |

4P's Marketing Mix Analysis Data Sources

Our Great Lakes Dredge & Dock 4P's Marketing Mix Analysis is constructed using a blend of official corporate disclosures, industry-specific market research, and competitive intelligence reports. We meticulously gather data on their service offerings, bidding strategies, project locations, and client engagement methods.