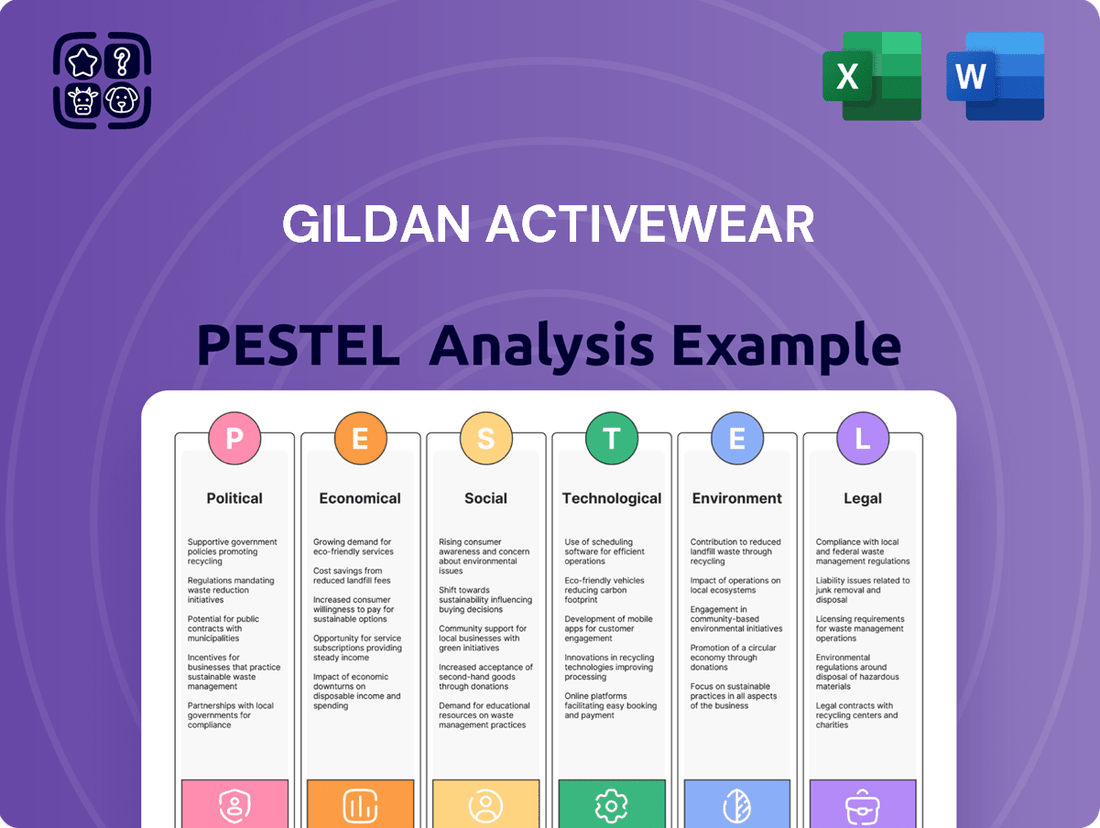

Gildan Activewear PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gildan Activewear Bundle

Gildan Activewear operates within a dynamic global landscape, influenced by evolving political regulations, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential growth opportunities or risks. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence.

Gain a competitive edge by leveraging our expertly crafted PESTLE Analysis for Gildan Activewear. Discover how political stability, economic trends, social shifts, technological innovations, environmental concerns, and legal frameworks are shaping its operational environment. Download the full version now to unlock critical insights and inform your strategic decisions.

Political factors

Gildan Activewear's extensive global manufacturing presence, particularly in regions like Central America and the Caribbean Basin, makes it highly sensitive to evolving trade policies and international agreements. These shifts directly influence the cost of essential raw materials and the overall manufacturing process.

Changes in tariffs and trade agreements can significantly impact Gildan's final product pricing, thereby affecting its market competitiveness and overall profitability. For instance, a sudden imposition of tariffs on cotton imports or finished apparel could increase operating expenses. In 2023, the apparel industry continued to navigate complex trade landscapes, with ongoing discussions around trade facilitation and market access agreements impacting global supply chains.

To maintain efficient supply chains and secure market access, Gildan must actively monitor and adapt to these dynamic trade policy changes. This strategic agility is vital for ensuring that the cost of goods sold remains manageable and that the company can effectively compete in international markets.

Gildan Activewear's manufacturing footprint, particularly in regions like Honduras and Nicaragua, is directly influenced by political stability. For instance, while specific recent government changes in these nations might not directly impact Gildan's 2024-2025 operations, any significant political instability or civil unrest could disrupt production lines and labor availability, as seen in past regional challenges.

The company's reliance on these locations for a substantial portion of its production means that political shifts, policy changes, or social disturbances can create significant supply chain risks. These events can lead to temporary shutdowns or impact the efficient movement of goods, directly affecting Gildan's ability to meet demand and maintain its competitive pricing strategy.

Mitigating these geopolitical risks is crucial for Gildan's operational resilience. The company likely employs strategies to monitor political climates and diversify sourcing where feasible, aiming to buffer against potential disruptions that could impact its 2024-2025 financial performance.

Government regulations significantly impact Gildan's manufacturing and export processes. For instance, labor laws in countries like Honduras, where Gildan has substantial operations, dictate working conditions and minimum wages, directly affecting operational costs. Changes in trade policies or tariffs in key markets such as the United States or Canada can also alter Gildan's competitive landscape.

Subsidies and incentives play a crucial role in Gildan's strategic planning. Governments may offer tax breaks or grants for companies investing in renewable energy or adopting more sustainable manufacturing practices. In 2023, for example, various countries continued to explore incentives for green manufacturing, a trend that could influence Gildan's capital expenditure decisions for its facilities.

Labor Laws and International Relations

Political pressure and the complex web of international relations significantly shape labor laws and their enforcement in countries where Gildan Activewear operates its manufacturing facilities. These external forces can directly impact operational costs and compliance requirements.

Adherence to fair labor practices and international labor standards is paramount, extending beyond mere legal obligation to become a cornerstone of brand reputation and a shield against scrutiny from human rights advocates and a discerning consumer base. For instance, in 2023, reports from various NGOs highlighted ongoing concerns regarding working conditions in some apparel manufacturing hubs, putting pressure on brands to demonstrate robust oversight.

- International Scrutiny: Increased global attention on supply chain ethics, particularly following events in 2023 and early 2024, can lead to stricter labor law enforcement and potential boycotts if standards are not met.

- Trade Agreements: Changes or negotiations in international trade agreements, such as potential revisions to agreements involving Central American manufacturing countries, could introduce new labor-related stipulations or tariffs.

- Reputational Risk: Non-compliance with evolving labor standards can result in significant reputational damage, impacting consumer trust and potentially leading to restricted market access, as seen with some brands facing backlash in 2024.

National Security and Supply Chain Resiliency

Governments worldwide are increasingly prioritizing national security, which directly influences supply chain policies. This focus can lead to mandates for increased diversification and resilience, especially in industries deemed critical, such as apparel manufacturing. For Gildan Activewear, a company known for its vertically integrated model, this could translate into pressure to reassess its sourcing and production locations. For instance, the US government’s focus on nearshoring critical manufacturing, as seen in initiatives aimed at reducing reliance on specific regions, could impact Gildan’s operational footprint.

Geopolitical tensions and evolving national security priorities can necessitate strategic adjustments. Gildan's vertically integrated structure, which provides significant control over its production process, might be challenged by these external pressures. This could prompt the company to consider diversifying its manufacturing base or sourcing raw materials from a wider array of countries to mitigate risks associated with trade disputes or security concerns. Such considerations are vital for long-term strategic investment and operational planning in the current global landscape.

The emphasis on supply chain resiliency is not merely theoretical. For example, the COVID-19 pandemic highlighted vulnerabilities, leading many governments to re-evaluate their reliance on single-country sourcing for essential goods. Gildan, like many apparel manufacturers, operates within a global network, and shifts in government policy towards onshoring or friend-shoring production could necessitate significant capital expenditure and strategic realignments to maintain competitive advantages and comply with new regulations.

- Government initiatives promoting domestic manufacturing in North America could impact Gildan's production cost structures.

- Increased scrutiny on labor practices and environmental standards in sourcing countries may arise due to national security and ethical supply chain concerns.

- Gildan's ability to adapt its vertically integrated model to meet evolving national security demands will be a key determinant of its future operational flexibility.

Political stability in Gildan's key manufacturing regions, like Central America, directly impacts operational continuity. Any significant unrest or policy shifts can disrupt production and labor availability, affecting the company's ability to meet global demand. For instance, while specific recent government changes in these nations might not directly impact Gildan's 2024-2025 operations, past regional challenges demonstrate the potential for such disruptions.

Government regulations, including labor laws and trade policies, are critical. In 2023, evolving labor standards and trade agreement discussions continued to shape the apparel industry, influencing operational costs and market access for companies like Gildan. Changes in tariffs or import/export regulations can significantly alter Gildan's competitive pricing and overall profitability.

International scrutiny on supply chain ethics and labor practices is intensifying. In 2023 and early 2024, heightened awareness from NGOs and consumers has put pressure on apparel manufacturers to ensure fair labor standards, impacting brand reputation and market access. Gildan's commitment to these standards is crucial for maintaining consumer trust and avoiding potential boycotts.

National security concerns are increasingly driving supply chain policies, encouraging diversification and resilience. This trend could lead to mandates for nearshoring or friend-shoring production, potentially impacting Gildan's vertically integrated model and necessitating strategic realignments in its manufacturing footprint to comply with evolving regulations and mitigate risks.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Gildan Activewear, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to help stakeholders identify strategic opportunities and mitigate potential threats within the activewear industry.

A concise Gildan Activewear PESTLE analysis that cuts through complexity, offering actionable insights to navigate market shifts and mitigate potential disruptions.

Economic factors

Gildan's core business, basic apparel, thrives on robust global economic growth and healthy consumer spending. When economies are doing well, people and businesses have more disposable income, leading to increased purchases of items like Gildan's blank activewear, often used for printing and customization.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from 2023 but still indicating expansion. This growth underpins consumer confidence and the willingness to spend on non-essential items, directly benefiting Gildan's sales volumes.

Conversely, economic slowdowns or recessions significantly dampen demand. During such periods, consumers tend to cut back on discretionary spending, and businesses may reduce inventory or promotional activities, directly impacting Gildan's revenue and profitability.

Raw material price volatility, especially for cotton, directly affects Gildan Activewear's cost of goods sold. Recent data from the U.S. Department of Agriculture (USDA) projects that global cotton production for the 2024/2025 marketing year could see shifts influenced by weather and planting decisions, potentially impacting prices. For instance, a significant drought in a major cotton-producing region in 2023 led to a price surge, highlighting the sensitivity of Gildan's input costs to these external factors.

Fluctuations in cotton prices, driven by global supply and demand, weather events, and agricultural policies, pose a significant challenge. For example, the ICE cotton futures contract (CT) experienced considerable swings in 2024, trading within a range that underscored this inherent market instability. Gildan's ability to navigate these price swings through robust hedging strategies or optimized inventory management is crucial for preserving its profit margins and ensuring competitive pricing for its products.

Gildan Activewear, with its global manufacturing footprint and sales across numerous countries, faces significant exposure to currency exchange rate fluctuations. For example, a strengthening U.S. dollar can increase the cost of Gildan's exports to international markets, potentially impacting sales volume.

Conversely, a weaker dollar can diminish the value of profits earned in foreign currencies when converted back into U.S. dollars. This dynamic directly affects Gildan's reported earnings and overall profitability. For instance, in Q1 2024, Gildan reported that foreign currency movements had a modest negative impact on its net sales.

Effective currency risk management strategies are therefore crucial for Gildan to mitigate these impacts and safeguard its financial performance. This often involves hedging techniques to lock in exchange rates for future transactions.

Inflationary Pressures and Operating Costs

Rising inflation significantly impacts Gildan Activewear by increasing its operating expenses. Costs for essential inputs like raw materials, energy, and logistics have seen notable upticks. For instance, the Consumer Price Index (CPI) in the United States, a key market for Gildan, rose by 3.4% year-over-year in April 2024, indicating persistent inflationary pressures that translate directly to higher manufacturing and distribution costs.

These escalating costs can put a strain on Gildan's profit margins. If the company cannot fully pass these increased expenses onto consumers through higher product prices, its profitability will be squeezed. The company's ability to effectively manage and absorb these cost increases, perhaps through operational efficiencies or strategic sourcing, is therefore critical for maintaining its financial health and competitive positioning in the activewear market.

- Increased Input Costs: Wages, energy, and transportation expenses are rising due to inflation.

- Margin Erosion Risk: Higher operating costs can reduce profit margins if not offset by price increases.

- Operational Efficiency: Gildan's capacity to absorb or mitigate these cost pressures is vital for financial performance.

- Consumer Price Sensitivity: The extent to which Gildan can pass on costs depends on market demand and competitor pricing.

Interest Rates and Access to Capital

Changes in interest rates significantly impact Gildan Activewear's financial flexibility. For instance, a rise in rates, as seen with the US Federal Reserve's tightening cycle through 2023 and into early 2024, can increase the cost of borrowing for essential activities like funding new manufacturing facilities or managing inventory levels. This directly affects Gildan's operational expenses and profitability.

Conversely, periods of lower interest rates, such as those experienced in earlier years, present opportunities for more cost-effective expansion and refinancing of existing debt. The availability of affordable capital is a critical enabler for Gildan's long-term growth strategies and its ability to invest in new technologies and market penetration.

Considering Gildan's substantial capital expenditures, which in 2023 were reported around $500 million, the cost of financing these investments is directly tied to prevailing interest rates. For example, if Gildan were to finance a portion of this through debt, a 1% increase in interest rates could add millions to their annual interest expense.

- Borrowing Costs: Higher interest rates increase the cost of capital for Gildan's investments in production capacity and inventory.

- Financial Expenses: Elevated rates can lead to higher interest payments, potentially reducing net income.

- Investment Opportunities: Lower rates make it more attractive for Gildan to pursue expansion projects and refinance debt at favorable terms.

- Capital Access: The overall cost and availability of capital directly influence Gildan's capacity for strategic growth and long-term investments.

Global economic growth directly influences Gildan's sales volume, as robust economies correlate with higher consumer and business spending on apparel. The IMF's projection of 3.2% global growth for 2024 indicates continued, albeit moderate, expansion, which supports demand for Gildan's products.

Raw material costs, particularly cotton, are a significant factor. Cotton futures experienced volatility in 2024, with prices influenced by factors like weather impacting the 2024/2025 USDA production estimates, directly affecting Gildan's cost of goods sold.

Currency exchange rate fluctuations impact Gildan's international sales and profit repatriation. For example, a stronger U.S. dollar can make Gildan's exports more expensive abroad, as noted with a modest negative impact on Q1 2024 net sales due to currency movements.

Inflationary pressures, exemplified by the 3.4% year-over-year CPI increase in the U.S. as of April 2024, raise Gildan's operating costs for wages, energy, and logistics, potentially squeezing profit margins if not passed on to consumers.

Interest rate changes affect Gildan's cost of capital. The Federal Reserve's tightening cycle through early 2024 increases borrowing costs for investments, contrasting with earlier periods of lower rates that facilitated expansion.

| Economic Factor | Impact on Gildan | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives sales volume and consumer spending. | IMF projects 3.2% global growth in 2024. |

| Raw Material Prices (Cotton) | Affects cost of goods sold. | Cotton futures showed volatility in 2024; USDA estimates for 2024/2025 production are key. |

| Currency Exchange Rates | Impacts international sales and profit conversion. | Q1 2024 saw a modest negative impact from currency movements. |

| Inflation | Increases operating expenses (wages, energy, logistics). | U.S. CPI was 3.4% year-over-year in April 2024. |

| Interest Rates | Influences cost of borrowing for investments. | Federal Reserve maintained higher rates through early 2024. |

Same Document Delivered

Gildan Activewear PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gildan Activewear PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain detailed insights into market trends and strategic considerations.

Sociological factors

Consumers increasingly favor apparel made responsibly, impacting their buying choices. A 2024 report indicated that 65% of Gen Z and 58% of Millennials consider a brand's sustainability efforts when purchasing clothing. This trend directly affects the apparel industry, pushing companies to adopt more ethical and eco-friendly practices to remain competitive and appealing to a growing segment of the market.

Gildan's focus on responsible manufacturing, encompassing fair labor and environmental care, strengthens its brand image and resonates with these ethically-minded shoppers. The company's sustainability report for 2023 highlighted a 15% reduction in water usage in its manufacturing facilities compared to 2020, a tangible metric that appeals to conscious consumers.

Supply chain transparency and clear sustainability reporting are paramount for building trust with this consumer base. Gildan's ongoing efforts to map and disclose its supply chain, aiming for full traceability by 2025, are crucial for demonstrating its commitment to ethical sourcing and production, further enhancing its appeal.

Societal shifts are increasingly favoring comfortable and casual clothing, a trend that directly benefits Gildan Activewear. The rise of remote work, for instance, has amplified demand for the very types of basic apparel and activewear that form Gildan's product base. This ongoing casualization means more people are opting for Gildan's core offerings for everyday wear.

However, the dynamic nature of fashion means Gildan must remain agile. Rapidly changing fashion trends require constant adaptation in product design and inventory management to ensure continued relevance. For example, while athleisure remains strong, the specific styles within it can shift quickly, impacting what consumers seek.

Societal expectations regarding labor practices are intensifying, with consumers and stakeholders demanding greater transparency and ethical treatment of workers throughout global supply chains. For Gildan, a significant employer, this translates to heightened scrutiny on wages, working conditions, and adherence to human rights. In 2024, reports highlighted that companies with robust ethical sourcing policies often see improved brand loyalty and reduced risk of consumer backlash.

Maintaining high standards for worker welfare is not just a matter of compliance but a strategic imperative to safeguard Gildan's reputation and prevent potential consumer boycotts. As of early 2025, several apparel brands faced significant negative publicity due to labor concerns, underscoring the financial and reputational costs of failing to meet evolving worker welfare expectations.

Demographic Shifts and Market Segmentation

Demographic shifts significantly shape apparel demand. For instance, an aging population in developed markets might increase demand for comfortable, easy-care activewear, while a growing youth segment, particularly Gen Z and Alpha, prioritizes sustainable and ethically produced clothing. Gildan must analyze these evolving consumer bases to refine its market segmentation and product development.

Understanding these demographic trends is crucial for Gildan's strategic planning. For example, by 2025, the global population aged 65 and over is projected to reach over 750 million, presenting a growing market for comfort-focused apparel. Conversely, the increasing purchasing power of younger generations, who are highly attuned to social and environmental issues, necessitates a focus on transparency and sustainability in Gildan's supply chain and marketing efforts.

- Aging Population Growth: Global population aged 65+ expected to exceed 750 million by 2025, impacting demand for comfort-oriented apparel.

- Youth Market Influence: Gen Z and Alpha consumers increasingly value sustainability and ethical production, influencing purchasing decisions.

- Household Structure Changes: Evolving family units and single-person households can alter consumption patterns for apparel.

- Urbanization Trends: Increasing urban populations may drive demand for versatile and functional activewear suitable for city living.

Social Media and Brand Perception

Social media's pervasive influence means consumer perceptions of Gildan, its brands, and its practices can be shaped rapidly and widely. Positive engagement and transparent communication about sustainability and social responsibility build brand loyalty, while negative publicity can quickly harm reputation. Gildan's proactive social media management is essential to navigate this landscape effectively.

In 2024, for example, companies across industries saw significant shifts in brand perception driven by social media campaigns and viral content. Gildan's engagement on platforms like Instagram and X (formerly Twitter) directly impacts how consumers view its commitment to ethical sourcing and environmental initiatives, crucial for its target demographics.

- Brand Sentiment Monitoring: Gildan actively monitors social media sentiment to gauge public opinion on its products, labor practices, and sustainability efforts.

- Influencer Marketing: Collaborations with influencers who align with Gildan's values can amplify positive messaging and reach new consumer segments.

- Crisis Communication: A robust social media strategy allows for rapid response to negative publicity, mitigating potential damage to brand perception.

Societal values are increasingly prioritizing ethical consumption and corporate responsibility, directly impacting consumer choices in the apparel sector. Gildan's commitment to sustainability, including its 2023 report detailing a 15% reduction in water usage since 2020, resonates with consumers who actively seek brands with strong environmental and social governance. This alignment is crucial for maintaining brand loyalty and market share, especially among younger demographics.

The growing demand for casual and comfortable attire, fueled by trends like remote work, plays to Gildan's strengths in basic apparel and activewear. However, the company must remain adaptable to evolving fashion trends, ensuring its product offerings stay relevant. As of early 2025, the financial consequences for brands failing to address labor concerns, exemplified by negative publicity faced by competitors, underscore the strategic importance of robust ethical labor practices for Gildan's reputation and financial stability.

Demographic shifts, such as an aging global population projected to exceed 750 million by 2025, present opportunities for comfort-focused apparel, while the influence of younger consumers emphasizes the need for transparency in sustainability and ethical sourcing. Gildan's active monitoring of social media sentiment in 2024 highlights the critical role of digital platforms in shaping brand perception and the necessity of proactive communication regarding its practices.

Technological factors

Advances in automation and robotics are poised to significantly boost Gildan's production efficiency. By integrating these technologies, the company can expect a reduction in labor costs and a marked improvement in product consistency across its vast manufacturing operations.

Gildan's strategic investment in cutting-edge machinery and the optimization of its production lines through automation offers a clear competitive edge. This focus on technological advancement is designed to lower unit costs and expand overall output capacity, crucial for meeting growing market demand.

For instance, the global textile manufacturing automation market was valued at approximately $2.1 billion in 2023 and is projected to reach over $3.5 billion by 2028, indicating a strong trend towards increased adoption of these technologies by industry leaders like Gildan.

Gildan's supply chain is increasingly benefiting from digitization. By implementing technologies like the Internet of Things (IoT) for real-time inventory tracking and artificial intelligence (AI) for predictive demand forecasting, the company can significantly enhance efficiency. This digital transformation is crucial for managing its complex global operations.

The adoption of big data analytics allows Gildan to optimize logistics, leading to reduced lead times and lower operational costs. For instance, improved visibility across its network, which spans numerous manufacturing facilities and distribution centers, enables quicker responses to market shifts. In 2024, advancements in AI-powered route optimization are expected to contribute to further fuel savings and delivery speed improvements.

Gildan's branded apparel sales and wholesale operations are significantly impacted by the ongoing expansion of e-commerce. The company's ability to leverage digital sales channels is key to reaching a broader customer base, especially for its direct-to-consumer (DTC) initiatives.

In 2023, global e-commerce sales were projected to reach $6.3 trillion, highlighting the immense potential for brands like Gildan to capture market share online. Investing in user-friendly websites and effective digital marketing is therefore paramount for driving growth and enhancing customer engagement.

New Material Science and Product Innovation

Advancements in material science offer Gildan significant opportunities for product innovation. The development of sustainable fibers, like recycled polyester or organic cotton, aligns with growing consumer demand for eco-friendly apparel. For instance, Gildan's 2023 sustainability report highlighted a 10% increase in the use of recycled materials across its product lines, demonstrating a tangible step towards this trend.

Performance fabrics, such as moisture-wicking or antimicrobial textiles, can enhance the functionality of Gildan's activewear, appealing to a broader customer base. Smart textiles, incorporating technology for health monitoring or temperature regulation, represent a more futuristic avenue for product differentiation. Gildan's investment in R&D for new material applications is crucial for staying competitive in a market increasingly driven by technological integration and enhanced product features.

The integration of these new materials can directly impact product attributes. Enhanced durability can lead to longer product lifespans, reducing waste and appealing to value-conscious consumers. Improved comfort through advanced textiles can elevate the user experience, driving brand loyalty. Gildan's focus on these material innovations is key to capturing new market segments and reinforcing its brand image as a forward-thinking apparel provider.

Cybersecurity and Data Protection

Gildan's increasing reliance on digital systems for manufacturing, supply chain, and sales makes robust cybersecurity essential. Protecting sensitive data, intellectual property, and customer information from cyber threats is critical for maintaining trust and operational continuity.

The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the significant financial and reputational risks involved. For Gildan, a breach could disrupt production, compromise proprietary designs, and erode customer confidence.

- Cybersecurity Investment: Companies like Gildan must invest in advanced security solutions, including threat detection and response systems.

- Data Protection Compliance: Adherence to regulations like GDPR and CCPA is vital, requiring stringent data handling and privacy protocols.

- Supply Chain Vulnerabilities: Ensuring the security of digital touchpoints across the entire supply chain is paramount to prevent cascading breaches.

- Intellectual Property Protection: Safeguarding design archives and manufacturing process data from industrial espionage is a key concern.

Technological advancements are reshaping Gildan's operational landscape, driving efficiency through automation and robotics in manufacturing. The company's strategic adoption of these tools is critical for cost reduction and product quality enhancement.

Digitization, including IoT and AI, is optimizing Gildan's supply chain for better inventory management and demand forecasting. This digital transformation is key to navigating complex global operations and improving logistics efficiency.

Material science innovations offer Gildan opportunities for product differentiation, particularly with sustainable and performance fabrics. These advancements are crucial for meeting evolving consumer preferences and staying competitive.

The company's reliance on digital systems necessitates robust cybersecurity measures to protect data and intellectual property, given the escalating global threat landscape.

| Technology Area | Impact on Gildan | Key Data/Trends (2023-2025) |

| Automation & Robotics | Increased production efficiency, reduced labor costs, improved product consistency | Global textile automation market valued at ~$2.1B in 2023, projected to exceed $3.5B by 2028. |

| Digitization (IoT, AI) | Optimized supply chain, real-time inventory, predictive demand forecasting | AI-powered route optimization expected to improve fuel savings and delivery speeds in 2024. |

| E-commerce | Expanded market reach, enhanced customer engagement, growth in DTC | Global e-commerce sales projected to reach $6.3 trillion in 2023. |

| Material Science | Product innovation (sustainable, performance fabrics), enhanced product attributes | Gildan reported a 10% increase in recycled material usage in 2023. |

| Cybersecurity | Protection of data, IP, and customer information; operational continuity | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025. |

Legal factors

Gildan Activewear, operating globally, must meticulously adhere to a complex framework of international trade laws and customs regulations. These rules govern how its products move across borders, influencing everything from sourcing raw materials to delivering finished goods to consumers worldwide.

Fluctuations in trade policies, such as the imposition of anti-dumping duties or the erection of new trade barriers, can directly affect Gildan's operational costs and the logistical viability of its supply chain. For instance, a sudden tariff increase on cotton imports from a key supplier could significantly raise production expenses.

Strict compliance with these regulations is not optional; it's a critical necessity to prevent costly penalties, legal challenges, and potentially disruptive interruptions to its extensive global operations. In 2023, the World Trade Organization (WTO) reported that trade facilitation measures, which streamline customs procedures, can reduce trade costs by up to 14.3%.

Gildan Activewear, with its vast global workforce, must navigate a complex web of labor laws. This includes complying with varying minimum wage requirements, maximum working hours, and stringent health and safety standards across its operational countries. For instance, in 2024, many regions saw adjustments to minimum wages, impacting Gildan's labor costs.

Failure to adhere to these regulations, such as those concerning collective bargaining or fair dismissal practices, can result in significant legal penalties, including substantial fines and damage to Gildan's brand reputation. The company's commitment to ethical labor practices is therefore crucial for its operational stability and public image.

Environmental regulations are becoming stricter, affecting Gildan's manufacturing. This includes rules on water use, waste, air pollution, and chemicals. For instance, in 2023, Gildan reported its water withdrawal was 21.8 million cubic meters, highlighting the importance of water management regulations.

Complying with these laws is essential. Gildan must secure permits and invest in pollution control, like the $70 million capital expenditure on environmental initiatives reported in 2023. Failure to comply can lead to fines and damage its reputation as a responsible company.

Looking ahead, new environmental rules could mean more investment is needed. This might involve upgrading facilities or adopting new technologies to meet evolving standards for sustainability and emissions reduction.

Intellectual Property Rights and Brand Protection

Protecting Gildan's core brands, including Gildan, American Apparel, and Comfort Colors, from counterfeiting and intellectual property infringement presents an ongoing legal hurdle. This is crucial for maintaining brand integrity and market position.

Safeguarding these valuable trademarks and copyrights through diligent legal action and proactive monitoring is paramount. This ensures Gildan retains its competitive edge and brand equity in the apparel industry.

- Brand Protection Efforts: Gildan actively pursues legal avenues to combat counterfeit products bearing its brand names and designs.

- Trademark and Copyright Enforcement: The company invests in monitoring and legal defense to protect its intellectual property portfolio.

- Market Impact: Successful IP protection directly contributes to maintaining brand value and preventing market dilution by unauthorized goods.

Consumer Protection and Product Safety Laws

Gildan Activewear operates under a complex web of consumer protection and product safety laws across its global markets. These regulations mandate adherence to strict standards for product quality, ensuring materials are safe for use and free from harmful substances. For instance, in the United States, the Consumer Product Safety Improvement Act (CPSIA) sets stringent limits on lead and phthalates in children's apparel, a category Gildan serves. Similarly, the European Union's General Product Safety Regulation (GPSR) requires all products placed on the market to be safe, with specific directives covering textile flammability and chemical content.

Compliance extends to accurate labeling, detailing fiber content, care instructions, and country of origin, crucial for consumer information and market access. Gildan must also ensure its advertising claims regarding durability, performance, or ethical sourcing are truthful and substantiated, avoiding deceptive practices that could lead to regulatory action or consumer lawsuits. In 2024, regulatory bodies globally have increased scrutiny on supply chain transparency and product safety, with fines for non-compliance potentially reaching millions of dollars, impacting brand reputation and financial performance.

- Product Safety Compliance: Adherence to regulations like CPSIA in the US and GPSR in the EU regarding chemical content and flammability.

- Labeling Requirements: Accurate disclosure of fiber content, care instructions, and origin in all sales regions.

- Advertising Standards: Ensuring all marketing claims are truthful and verifiable to prevent deceptive practices.

- Risk of Non-Compliance: Potential for product recalls, significant fines, and damage to consumer trust, impacting sales and market standing.

Gildan Activewear's global operations are significantly shaped by international trade laws and fluctuating trade policies, impacting sourcing and delivery costs. For instance, the World Trade Organization (WTO) noted in 2023 that trade facilitation can reduce costs by up to 14.3%, underscoring the financial implications of navigating these regulations effectively.

Labor laws vary widely across Gildan's operational countries, necessitating strict adherence to minimum wage, working hour, and health and safety standards. Many regions saw minimum wage adjustments in 2024, directly affecting the company's labor expenses and operational planning.

Environmental regulations are increasingly stringent, requiring Gildan to invest in compliance measures like pollution control. The company reported $70 million in capital expenditures for environmental initiatives in 2023, illustrating the financial commitment needed to meet evolving standards.

Protecting intellectual property, including trademarks and copyrights for brands like Gildan and Comfort Colors, is a continuous legal challenge. This effort is vital for maintaining brand integrity and preventing market dilution from counterfeit products.

Environmental factors

Gildan Activewear, like many in the textile sector, faces significant environmental scrutiny regarding its water footprint. The company's operations are inherently water-intensive, making water scarcity and the efficient management of this resource a paramount concern. For instance, by 2024, the apparel industry's global water consumption was estimated to be substantial, with dyeing and finishing processes being particularly demanding. Gildan's commitment to sustainable water management means investing in technologies that can recycle water and minimize discharge.

Responsible wastewater treatment is a key focus for Gildan to mitigate its environmental impact and adhere to evolving water quality standards. As of early 2025, many regions are implementing stricter regulations on industrial wastewater discharge, requiring advanced treatment processes to remove pollutants. Gildan's proactive approach involves upgrading its wastewater treatment facilities to ensure compliance and reduce the ecological burden of its manufacturing activities. This focus on sustainable water practices is not just about regulatory adherence but also about long-term operational resilience in areas facing water stress.

Gildan Activewear's extensive manufacturing network, a cornerstone of its business, inherently demands substantial energy. This large-scale consumption directly translates into a significant carbon footprint, a factor increasingly scrutinized by all stakeholders.

The global push towards decarbonization is intensifying, with regulators, investors, and consumers alike demanding tangible reductions in greenhouse gas emissions. For instance, by 2024, many jurisdictions are implementing stricter emissions reporting standards, and investor focus on ESG (Environmental, Social, and Governance) performance, particularly carbon intensity, is at an all-time high, impacting access to capital and company valuations.

To address this, Gildan is exploring strategic investments in renewable energy sources to power its facilities and upgrading to more energy-efficient machinery across its plants. Optimizing logistics and supply chain routes also plays a crucial role in minimizing fuel consumption and associated emissions, thereby bolstering its sustainability profile and potentially improving operational efficiency.

The textile sector is a significant contributor to waste, encompassing manufacturing byproducts and discarded clothing. Gildan must navigate the complexities of reducing its waste footprint and embracing circularity, which includes exploring textile recycling and creating durable goods. For instance, in 2023, Gildan reported a 7% reduction in waste sent to landfill compared to 2022, a step towards better environmental stewardship.

Sustainable Sourcing of Raw Materials

The environmental toll of sourcing raw materials, especially cotton, presents a considerable challenge. Issues like pesticide use, substantial water consumption, and land degradation are significant concerns within the apparel industry.

Gildan's proactive approach to sourcing more sustainable cotton, such as through initiatives like the Better Cotton Initiative (BCI), and its exploration of alternative fibers are vital steps. These efforts directly address its upstream environmental impact and are key to meeting growing stakeholder demands for eco-conscious practices.

For instance, the BCI reported that its members cultivated 23% of the world's cotton in the 2021-2022 season, signaling a growing industry trend towards more responsible farming. Gildan’s participation in such programs demonstrates a commitment to reducing the environmental footprint associated with its primary raw material.

- Environmental Concerns: Cotton cultivation is linked to high pesticide use, water scarcity, and soil degradation.

- Sustainable Cotton Initiatives: Gildan's engagement with programs like the Better Cotton Initiative (BCI) aims to mitigate these impacts.

- Fiber Innovation: Exploring alternative, more sustainable fibers is a strategic move to diversify and reduce environmental risk.

Climate Change Impacts on Supply Chain

Climate change presents significant environmental challenges for Gildan Activewear's global supply chain. Extreme weather events, such as prolonged droughts or intense rainfall, directly threaten cotton cultivation, a key raw material. For instance, the 2023 cotton season saw varied impacts across major growing regions, with some experiencing reduced yields due to unseasonal weather patterns, potentially affecting raw material availability and pricing for Gildan.

These climatic shifts also contribute to increased operational costs. Higher temperatures can lead to greater demand for energy to cool manufacturing facilities, while altered weather patterns can disrupt transportation networks, leading to delays and increased shipping expenses. Gildan's reliance on global logistics means that infrastructure damage from severe weather, like flooding impacting port operations in Asia, could create significant bottlenecks.

To mitigate these risks, Gildan is increasingly focused on building supply chain resilience. This involves strategies like:

- Diversifying Sourcing Locations: Reducing dependence on single geographic regions for raw materials to buffer against localized climate impacts.

- Investing in Water-Efficient Technologies: Implementing advanced irrigation and water management systems in cotton farming partnerships to combat drought conditions.

- Enhancing Logistics Flexibility: Developing alternative transportation routes and modes to navigate potential disruptions caused by extreme weather.

- Climate Risk Mapping: Conducting thorough assessments of potential climate-related disruptions across all tiers of the supply chain to inform proactive adaptation planning.

Gildan's environmental strategy heavily addresses its substantial water footprint, particularly in dyeing and finishing processes. By 2024, the apparel industry's water consumption was significant, making efficient water management critical for Gildan's operations. The company is investing in water recycling technologies and advanced wastewater treatment to comply with increasingly stringent global water quality standards by early 2025.

The company's extensive manufacturing operations result in a considerable carbon footprint, a key area of focus due to growing decarbonization demands. By 2024, emissions reporting standards are tightening, and investor scrutiny on ESG performance, including carbon intensity, is intensifying. Gildan is addressing this by investing in renewable energy and energy-efficient machinery, alongside optimizing logistics to reduce fuel consumption.

Waste reduction and the adoption of circular economy principles are paramount for Gildan, given the textile sector's significant waste generation. In 2023, Gildan reported a 7% reduction in waste sent to landfill compared to 2022, demonstrating progress in its environmental stewardship efforts.

The environmental impact of raw material sourcing, especially cotton, remains a challenge due to pesticide use, water consumption, and land degradation. Gildan's engagement with initiatives like the Better Cotton Initiative (BCI), which cultivated 23% of the world's cotton in the 2021-2022 season, and its exploration of alternative fibers are key to mitigating these upstream impacts and meeting stakeholder expectations for eco-conscious practices.

PESTLE Analysis Data Sources

Our Gildan Activewear PESTLE Analysis is built on a comprehensive review of publicly available data, including government reports, industry publications, and financial news outlets. We also incorporate insights from market research firms and economic forecasting agencies to ensure a well-rounded perspective.