Gildan Activewear Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gildan Activewear Bundle

Gildan Activewear navigates a competitive landscape shaped by moderate buyer power and intense rivalry among existing players. While the threat of new entrants is somewhat tempered by economies of scale, the availability of substitutes presents a constant challenge.

The complete report reveals the real forces shaping Gildan Activewear’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gildan Activewear's extensive vertical integration, from yarn spinning to finished apparel, significantly dampens the bargaining power of its suppliers. By controlling a substantial portion of its production process internally, Gildan reduces its dependence on external sources for critical inputs.

This internal production capability means Gildan is less susceptible to price hikes or supply disruptions from external raw material providers, as it manufactures many of its own components. For instance, in 2023, Gildan's vertically integrated model allowed it to manage its input costs effectively, contributing to its gross profit margin of 31.7%, a testament to its supply chain control.

While Gildan Activewear benefits from vertical integration, it still relies on external sourcing for key raw materials like cotton. The company's strategic use of a substantial volume of U.S. cotton and yarn offers a degree of insulation from certain international trade disruptions and diversifies its supply base away from sole reliance on any single region.

The increasing consumer preference for sustainable and ethically produced apparel places greater bargaining power on suppliers of specialized materials like organic cotton and recycled polyester. Gildan Activewear's strategic shift towards sourcing more sustainable cotton and alternative fibers highlights the growing importance of these niche suppliers in the company's supply chain.

Labor Costs and Regulations

Gildan Activewear's reliance on its manufacturing facilities means that labor costs and regulations in key production areas significantly influence its operational expenses. The company's primary manufacturing hubs are in Central America, the Caribbean, North America, and Bangladesh. These regions present varying labor cost structures and regulatory environments, directly impacting Gildan's cost of goods sold.

Labor availability and the associated costs are critical considerations. For instance, changes in minimum wage laws or the presence of strong labor unions in these regions can shift the bargaining power of the workforce, effectively treating labor as a key supplier to Gildan's operations. This dynamic can lead to increased operational costs if labor demands are not met.

- Labor Costs: In 2024, average manufacturing wages in Bangladesh were significantly lower than in North America, highlighting the cost-saving benefits of operating in certain regions.

- Regulatory Impact: Minimum wage increases in Central American countries, for example, can directly add to Gildan's production expenses.

- Availability: A tight labor market in any of Gildan's operating regions could necessitate higher wages or incentives to attract and retain workers, thereby increasing labor costs.

Technology and Equipment Providers

Gildan Activewear's reliance on specialized technology and equipment providers is a key factor in its operational efficiency. These suppliers offer advanced machinery crucial for Gildan's large-scale, automated manufacturing processes, which are central to its cost leadership strategy. For instance, companies providing high-speed knitting machines or advanced dyeing technologies can hold significant sway.

The bargaining power of these technology and equipment providers stems from the proprietary nature of certain machinery and the limited number of suppliers capable of meeting Gildan's stringent quality and volume requirements. This can impact Gildan's capital expenditure decisions and its ability to scale production seamlessly. In 2024, the global textile machinery market saw continued innovation, with suppliers focusing on energy efficiency and automation, potentially increasing the cost of acquiring and maintaining state-of-the-art equipment.

- Specialized Machinery Dependence: Gildan requires highly specific equipment for its vertically integrated model, limiting supplier options.

- Proprietary Technology: Unique or patented machinery from certain providers can create a dependency, granting them leverage.

- Market Concentration: A small number of high-quality equipment manufacturers exist, concentrating bargaining power.

- Impact on Capital Expenditure: Supplier pricing and terms directly influence Gildan's investment in production capacity and technological upgrades.

While Gildan's vertical integration reduces reliance on external raw material suppliers, its substantial need for cotton, particularly U.S. cotton, still gives these suppliers some leverage. The company's scale in purchasing cotton in 2023, for example, provided some buying power, but global cotton prices remain a significant factor. Furthermore, the growing demand for sustainable materials like organic cotton means suppliers of these niche inputs possess increasing influence.

Labor in Gildan's manufacturing regions acts as a critical supplier. In 2024, wage differentials between regions like Bangladesh and North America directly impact Gildan's cost structure. For instance, a 5% increase in average manufacturing wages in Central America could significantly affect Gildan's cost of goods sold, highlighting the power of labor availability and cost in these locations.

Providers of specialized manufacturing equipment are key suppliers to Gildan, influencing its operational efficiency and capital expenditure. The limited number of manufacturers offering advanced, high-volume textile machinery means these suppliers can command higher prices and dictate terms, a trend continuing into 2024 with a focus on automation.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Gildan | 2023/2024 Data Point |

| Raw Material (Cotton) | Global supply and demand, quality, sustainability certifications | Input cost volatility, potential for supply chain disruptions | Global cotton prices fluctuated, averaging around $0.85/lb in late 2023. |

| Labor | Wage rates, labor availability, regulatory environment | Direct impact on cost of goods sold, operational efficiency | Average manufacturing wages in Bangladesh were approximately $0.50-$1.00/hour in 2024. |

| Specialized Equipment | Proprietary technology, market concentration, service and maintenance agreements | Capital expenditure decisions, production capacity, technological advancement | The global textile machinery market experienced growth in 2024, driven by demand for advanced automation. |

What is included in the product

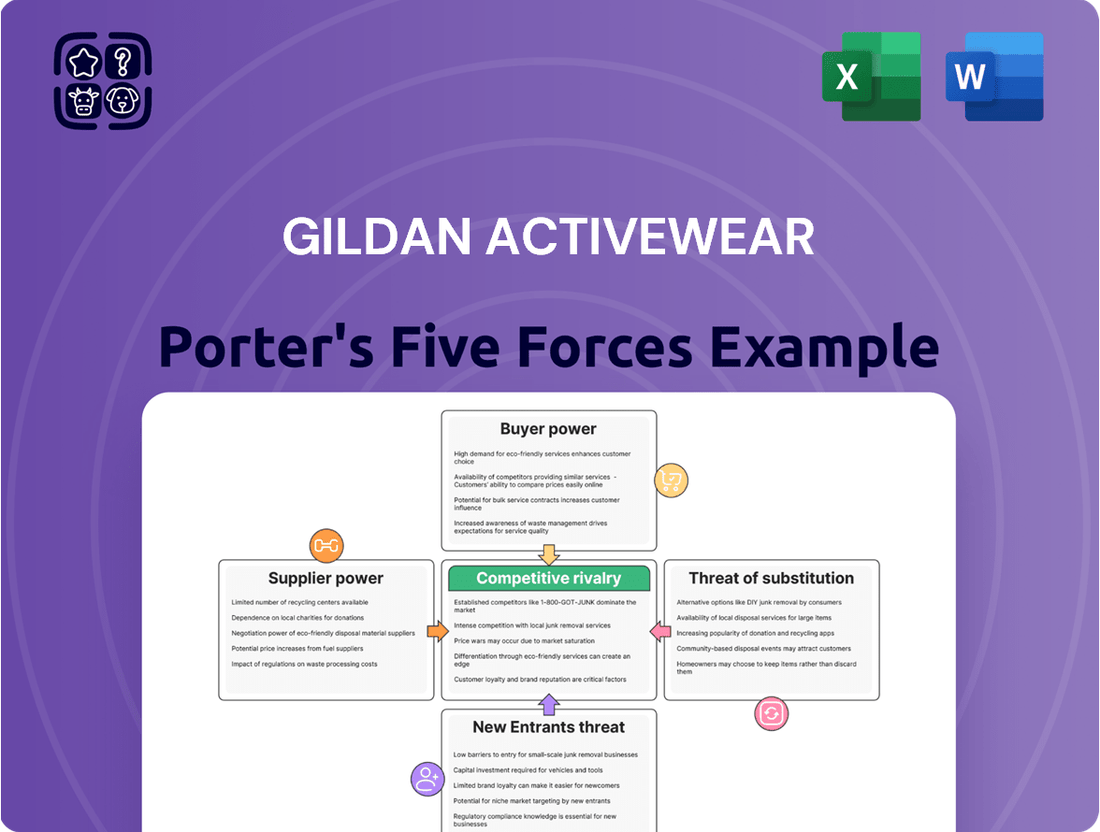

This analysis delves into the competitive landscape for Gildan Activewear, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the apparel industry.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, highlighting Gildan's strategic positioning for informed decision-making.

Customers Bargaining Power

Gildan Activewear's wholesale distributors hold considerable bargaining power. These customers, including large-volume screen printers and embellishers, often place substantial orders, giving them leverage to negotiate pricing and favorable terms. The competitive landscape of the blank apparel market further amplifies this power, as distributors can readily switch suppliers if Gildan's offerings are not sufficiently competitive.

The market for basic blank apparel is intensely price-sensitive. Customers, particularly in the wholesale segment, frequently prioritize cost when selecting suppliers, making them highly likely to switch for better deals. This characteristic directly translates into significant bargaining power for these customers.

Gildan Activewear's success in this environment hinges on its ability to maintain low-cost production. In 2023, Gildan reported net sales of $7.06 billion, demonstrating the scale at which they operate and the importance of cost efficiency to maintain competitiveness against rivals who can also leverage economies of scale.

Gildan's expansion into direct-to-consumer (DTC) channels significantly shifts the balance of power. By selling branded apparel directly, Gildan can better manage pricing and cultivate direct customer relationships, thereby diminishing the leverage previously held by traditional wholesale customers. This move allows for greater control over the customer experience, fostering brand loyalty through personalization and convenience.

Brand Recognition and Loyalty

Gildan's owned brands, including Gildan, American Apparel, and Comfort Colors, benefit from significant brand recognition and deep-rooted customer loyalty. This strong brand equity allows Gildan to command a degree of pricing power, as consumers often prioritize trusted names over lower-cost alternatives. For instance, in 2023, Gildan reported that its premium brands, such as Comfort Colors, continued to show robust growth, indicating sustained consumer preference.

This loyalty translates into a reduced sensitivity to price changes among a segment of Gildan's customer base. When customers are loyal, they are less likely to switch to competitors solely based on minor price differences, thereby lessening their overall bargaining power. The company's consistent marketing efforts and product quality reinforce this customer attachment.

- Brand Equity: Gildan's portfolio of well-established brands like Gildan, American Apparel, and Comfort Colors fosters consumer trust and preference.

- Consumer Loyalty: Established customer loyalty reduces price sensitivity, making consumers less inclined to switch to competitors based on price alone.

- Market Position: Strong brand recognition allows Gildan to maintain a solid market position, even when faced with competitive pressures.

- Premium Pricing Potential: Loyalty to premium brands like Comfort Colors supports the ability to maintain or increase prices, mitigating customer bargaining power.

Impact of Market Weakness

When the overall market weakens, customers gain more sway. This was evident for Gildan Activewear when its hosiery and underwear sales saw a dip, a clear indicator of reduced consumer spending. In such environments, suppliers often find themselves needing to offer better prices and more favorable terms to attract buyers, thereby increasing customer bargaining power.

This dynamic intensifies competition among suppliers, forcing them to be more accommodating to secure sales. For instance, during periods of economic slowdown, consumers are more price-sensitive, making it harder for companies like Gildan to maintain premium pricing without facing significant pushback from buyers.

- Increased Price Sensitivity: Consumers become more focused on price during economic downturns, demanding lower costs from suppliers.

- Supplier Competition: Weak market conditions compel suppliers to compete more aggressively on price and terms to capture sales.

- Reduced Demand Impact: A general decline in consumer demand, as seen in Gildan's hosiery segment, directly translates to greater customer leverage.

- Negotiating Leverage: Buyers can more effectively negotiate better deals when suppliers are eager to move inventory in a slow market.

Gildan's customers, particularly wholesale distributors and large-volume printers, possess significant bargaining power due to the price-sensitive nature of the basic apparel market. This leverage is amplified when the overall market weakens, forcing suppliers to offer more competitive pricing and terms to secure sales.

Gildan's expansion into direct-to-consumer channels and its strong brand equity in premium lines like Comfort Colors help to mitigate this power by fostering customer loyalty and allowing for greater pricing control. In 2023, Gildan's net sales reached $7.06 billion, underscoring the importance of managing customer relationships across diverse segments.

The competitive landscape of blank apparel means customers can easily switch suppliers, intensifying the need for Gildan to maintain cost efficiency. For example, during economic downturns, increased consumer price sensitivity directly translates into greater negotiating leverage for buyers.

| Customer Segment | Bargaining Power Factors | Gildan's Mitigation Strategies |

|---|---|---|

| Wholesale Distributors/Printers | Price sensitivity, ability to switch suppliers, large order volumes | Cost-efficient production, strong brand portfolio |

| End Consumers (DTC) | Brand loyalty, preference for quality/style | Direct customer relationships, marketing investment, premium brand development |

| Overall Market Conditions | Economic downturns, reduced consumer spending | Maintaining competitive pricing, diversifying product offerings |

Full Version Awaits

Gildan Activewear Porter's Five Forces Analysis

This preview showcases the complete Gildan Activewear Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the apparel industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. This comprehensive breakdown will equip you with the insights needed to understand Gildan's market position and potential challenges.

Rivalry Among Competitors

Gildan Activewear faces intense competition in the apparel industry, a market populated by a vast number of companies. Major global brands such as Hanesbrands and Fruit of the Loom are significant rivals, alongside a multitude of smaller regional manufacturers and private label brands that compete directly in the blank apparel space.

This crowded competitive landscape, particularly in the foundational segment of basic apparel, significantly escalates the rivalry among players. For instance, the global activewear market was valued at approximately $350 billion in 2023 and is projected to grow, indicating ample opportunity but also fierce competition for market share.

The basic apparel market, where Gildan Activewear primarily operates, is intensely competitive, with price serving as a crucial differentiator. This commodity-like nature means customers often prioritize cost when making purchasing decisions.

Gildan's established strategy of large-scale, vertically integrated manufacturing is a powerful asset in this price-sensitive landscape. By controlling its supply chain from yarn production to finished goods, Gildan can achieve significant cost efficiencies.

For instance, in its fiscal year 2023, Gildan reported net sales of $2.9 billion, demonstrating its ability to compete effectively on price and volume. This scale allows them to absorb cost fluctuations and offer competitive pricing, a key factor in maintaining market share.

Gildan Activewear actively competes beyond just price by focusing on product differentiation and innovation. A prime example is their introduction of 'Soft Cotton Technology,' a key innovation designed to enhance product appeal and customer comfort. This, coupled with the strength of their established brands, helps Gildan stand out in a crowded marketplace by catering to shifting consumer tastes and preferences.

Vertical Integration as a Barrier

Gildan Activewear's deep vertical integration is a formidable barrier to entry, making it incredibly challenging for competitors to match its cost efficiency and operational scale. This strategic advantage creates a significant moat, deterring new players from entering the market.

The company's control over its supply chain, from raw materials to finished goods, allows for unparalleled cost management and production speed. For instance, in 2024, Gildan continued to leverage its extensive network of company-owned manufacturing facilities, which significantly reduces reliance on third-party suppliers and their associated price fluctuations.

- Extensive Vertical Integration: Gildan controls a significant portion of its value chain, from yarn spinning to garment manufacturing and distribution.

- Operational Scale: Its massive production capacity, estimated in the hundreds of millions of units annually, allows for substantial economies of scale.

- Cost Structure Advantage: This integration and scale translate into a lower cost per unit compared to less integrated competitors.

- Barrier to Entry: The capital investment and operational expertise required to replicate Gildan's integrated model are prohibitive for most potential new entrants.

Market Share Dynamics and Growth Outlook

Gildan Activewear has been actively gaining market share, especially within the growing activewear segment. This strategic advantage positions them well for continued sales expansion. For instance, in the first quarter of 2024, Gildan reported a 10% increase in net sales for its Activewear segment, reaching $663 million.

Despite a generally subdued outlook for the broader fashion industry in 2024 and 2025, Gildan's ability to secure market share highlights its competitive strength. The company anticipates this positive trajectory to continue, projecting further sales growth into 2025. This resilience suggests effective strategies for navigating a crowded and often challenging market.

- Market Share Gains: Gildan has successfully increased its share in crucial growth areas like activewear.

- Growth Projections: The company expects continued sales growth through 2025.

- Industry Context: This performance stands out against generally sluggish fashion industry growth forecasts for 2024-2025.

- Competitive Navigation: Gildan's results demonstrate an adeptness at managing competitive pressures.

Competitive rivalry within the apparel industry, particularly in the basic and activewear segments where Gildan operates, is exceptionally high. The market is characterized by numerous global and regional players, with price often being a primary decision factor for consumers.

Gildan's substantial vertical integration and operational scale provide a significant cost advantage, allowing it to compete effectively on price. For example, its control over the supply chain, from yarn to finished goods, enables cost efficiencies that are difficult for competitors to replicate. This scale is evident in its 2023 net sales of $2.9 billion.

Despite the intense price competition, Gildan also differentiates itself through product innovation, such as its Soft Cotton Technology, and the strength of its brands. The company has demonstrated an ability to gain market share, with its Activewear segment sales increasing by 10% in Q1 2024, reaching $663 million, indicating resilience in a crowded market.

| Key Competitors | Market Position | Gildan's Advantage |

| Hanesbrands | Major Global Player | Vertical Integration & Scale |

| Fruit of the Loom | Major Global Player | Cost Efficiency |

| Regional Manufacturers | Niche/Local Markets | Price Sensitivity |

| Private Label Brands | Retailer-Specific | Brand Differentiation |

SSubstitutes Threaten

The threat of substitutes for Gildan Activewear's basic apparel is significant. Consumers and businesses can easily opt for specialized performance wear, fashion-forward clothing, or even unbranded generic garments from a multitude of other manufacturers. This wide availability across the apparel market means alternatives exist for virtually every need and budget, impacting Gildan's market share.

The growing secondhand and vintage market presents a significant threat of substitutes for Gildan Activewear. Consumers are increasingly drawn to pre-owned and upcycled clothing, often motivated by sustainability and the appeal of unique, retro styles. This trend directly competes for consumer dollars that might otherwise be spent on new apparel.

This shift is fueled by a growing environmental consciousness. For instance, the global secondhand apparel market was valued at approximately $177 billion in 2023 and is expected to reach $351 billion by 2027, showcasing a clear and substantial diversion of consumer spending. This robust growth indicates that a significant portion of the apparel market is now served by alternatives to new production.

Fast fashion brands present a significant threat of substitutes for basic apparel manufacturers like Gildan Activewear. These brands, such as Shein and Temu, offer extremely trendy clothing at remarkably low prices, directly competing for the attention of price-sensitive consumers. In 2024, the fast fashion market continued its rapid expansion, with companies like Shein reportedly achieving revenues exceeding $30 billion, demonstrating their ability to capture market share from more traditional players.

This intense price competition forces Gildan to consider how its value proposition of durability and ethical sourcing stacks up against the immediate gratification and affordability of fast fashion. Consumers increasingly prioritize cost over longevity, making these readily available, on-trend alternatives a powerful substitute for basic, everyday wear.

DIY and Customized Clothing

The growing popularity of do-it-yourself (DIY) and customized clothing presents a significant threat of substitutes for Gildan Activewear. Consumers are increasingly personalizing apparel, often using blank garments as a base. This trend allows individuals to create unique items, bypassing the need to purchase pre-designed, branded clothing.

While Gildan benefits from supplying the blank apparel itself, the end product of a customized garment serves as a direct substitute for Gildan's own branded offerings or those of its customers. This shift empowers consumers to become creators, potentially reducing demand for mass-produced activewear.

- DIY Customization Growth: The global custom t-shirt printing market was valued at approximately $4.5 billion in 2023 and is projected to grow, indicating a strong consumer interest in personalized apparel.

- Impact on Brands: For brands relying on Gildan's blank apparel, the DIY trend means their finished products compete directly with unique, consumer-created items.

- Digital Platforms: Online platforms and social media further facilitate this DIY movement, making it easier for consumers to access customization tools and inspiration.

Non-Clothing Solutions

While Gildan Activewear primarily deals in physical apparel, the emergence of digital and virtual alternatives presents a potential, albeit nascent, threat. In certain contexts, particularly within the metaverse and for highly fashion-conscious demographics, digital avatars and virtual fashion could begin to substitute demand for physical clothing. This trend, while still developing, could impact the market for certain types of apparel over the long term.

The adoption rate of virtual fashion is a key indicator to monitor. For instance, by mid-2024, the global metaverse market was projected to reach hundreds of billions of dollars, with a significant portion allocated to digital goods and experiences. While this doesn't directly translate to reduced physical apparel sales yet, it signifies a growing consumer willingness to engage with non-physical forms of self-expression and identity, which could eventually spill over into broader apparel consumption patterns.

- Nascent Threat: Digital avatars and virtual fashion in the metaverse represent a developing substitute for physical apparel, particularly for fashion-forward consumers.

- Limited Impact on Basic Apparel: For foundational activewear and basics, this threat is currently minimal as functionality and practicality remain paramount.

- Market Growth: The metaverse market's expansion, with significant investment in digital goods, indicates a growing acceptance of non-physical consumption that could influence future apparel demand.

The threat of substitutes for Gildan Activewear is substantial, encompassing a wide range of alternatives from performance gear to secondhand clothing and even digital fashion. The rise of fast fashion, exemplified by brands like Shein which reported revenues exceeding $30 billion in 2024, directly challenges Gildan's market by offering trend-driven items at extremely low price points. Furthermore, the burgeoning secondhand market, valued at approximately $177 billion in 2023, presents a sustainable and cost-effective alternative for consumers.

The increasing consumer interest in do-it-yourself (DIY) customization, with the custom t-shirt printing market alone valued at around $4.5 billion in 2023, also poses a threat. While Gildan supplies blank apparel for this market, the end-user customized product acts as a substitute for branded items. Even the nascent metaverse market, projected to reach hundreds of billions of dollars by mid-2024, introduces virtual fashion as a potential long-term substitute for physical apparel, particularly for younger, fashion-forward demographics.

| Substitute Category | Key Players/Trends | Estimated Market Size/Growth | Impact on Gildan |

|---|---|---|---|

| Fast Fashion | Shein, Temu | Shein revenues > $30 billion (2024) | Price competition, demand for trendy, low-cost items |

| Secondhand/Vintage | ThredUp, Depop, local markets | $177 billion (2023), projected $351 billion by 2027 | Reduced demand for new basic apparel, sustainability focus |

| DIY & Customization | Online printing services, craft influencers | Custom t-shirt printing market ~$4.5 billion (2023) | End-product competition, potential shift from mass-produced to unique items |

| Virtual Fashion/Metaverse | Digital avatar clothing, virtual experiences | Metaverse market hundreds of billions (mid-2024 projection) | Nascent threat, potential long-term impact on physical apparel demand |

Entrants Threaten

Gildan Activewear's significant vertical integration, from yarn spinning to sewing, demands a massive capital outlay. This extensive operational control and scale represent a substantial barrier, making it incredibly difficult for newcomers to match Gildan's cost structure and production capacity. For instance, establishing similar integrated facilities would likely require billions of dollars in upfront investment, a figure that deters most potential competitors.

Gildan Activewear benefits from significant economies of scale in its manufacturing processes, allowing it to maintain a highly competitive low-cost structure for basic apparel production. For instance, in 2023, Gildan reported net sales of $3.08 billion, a testament to its massive production volumes and operational efficiencies.

New entrants would face immense difficulty replicating Gildan's cost advantages. Achieving comparable cost efficiencies would require substantial upfront investment in large-scale production facilities and sophisticated integrated operations, a significant barrier to entry in the apparel market.

Gildan Activewear benefits from deeply entrenched distribution networks, serving both wholesale and retail markets across the globe. These established channels are critical for reaching a wide customer base efficiently.

For any new entrant, replicating Gildan's extensive logistical infrastructure would demand substantial capital investment and time. This makes it difficult for newcomers to match Gildan's market reach and speed of delivery.

Brand Recognition and Customer Relationships

Gildan's established brands, such as American Apparel and Comfort Colors, coupled with its long-standing position in the wholesale blank apparel sector, have cultivated significant brand recognition and deep customer loyalty. Newcomers would need to invest heavily in marketing and brand building to even approach the level of trust and market acceptance Gildan currently enjoys.

The threat of new entrants is somewhat mitigated by the high cost of establishing comparable brand equity. For instance, in 2023, Gildan's marketing and selling expenses were approximately $700 million, a figure that new entrants would need to match or exceed to gain traction.

- Brand Loyalty: Decades of consistent quality and marketing have fostered strong customer relationships.

- Marketing Investment: New entrants require substantial capital to build brand awareness against established players.

- Market Penetration: Overcoming Gildan's entrenched market share in the blank apparel segment is a significant hurdle.

Regulatory and ESG Compliance Complexities

The textile industry faces escalating global scrutiny on Environmental, Social, and Governance (ESG) factors, presenting significant regulatory and compliance hurdles for newcomers. Gildan's established leadership in ESG, evidenced by its numerous certifications and long-term commitments, establishes a high entry barrier.

New entrants may struggle to match Gildan's existing infrastructure and practices, potentially incurring substantial initial costs to achieve comparable ESG standards. For instance, as of 2023, the fashion industry's carbon footprint was estimated to be around 4-10% of global greenhouse gas emissions, highlighting the pressure for sustainable practices that new companies must address.

- High Capital Investment: Meeting stringent ESG regulations often requires significant upfront investment in sustainable materials, ethical labor practices, and waste reduction technologies, which can be prohibitive for smaller, new entrants.

- Brand Reputation Risk: Failure to comply with evolving ESG standards can lead to severe reputational damage, impacting consumer trust and market access, a risk Gildan has largely mitigated through proactive initiatives.

- Supply Chain Complexity: Ensuring ethical and sustainable sourcing across a complex global supply chain is a considerable challenge, demanding robust oversight and auditing capabilities that new entrants may lack initially.

The threat of new entrants into Gildan Activewear's market is considerably low due to substantial barriers. These include the immense capital required for vertical integration and achieving economies of scale, which Gildan has mastered. Furthermore, established distribution networks and strong brand loyalty, cultivated through years of marketing, present significant hurdles for any newcomer aiming to compete effectively.

New entrants face the daunting task of matching Gildan's cost efficiencies, which stem from its massive production volumes and integrated operations. For example, in 2023, Gildan's net sales reached $3.08 billion, underscoring its scale. Replicating this level of output and cost advantage would demand billions in upfront investment, a prohibitive cost for most potential competitors.

| Barrier to Entry | Impact on New Entrants | Gildan's Advantage |

|---|---|---|

| Capital Investment (Vertical Integration) | Extremely High | Billions invested in yarn spinning to sewing facilities |

| Economies of Scale | Significant Disadvantage | $3.08 billion in net sales (2023) demonstrates massive production volume |

| Distribution Networks | Difficult to Replicate | Established global wholesale and retail channels |

| Brand Equity & Loyalty | Challenging to Build | Strong brand recognition for American Apparel, Comfort Colors |

| ESG Compliance | Costly and Complex | Proactive initiatives and certifications mitigate risk |

Porter's Five Forces Analysis Data Sources

Our analysis of Gildan Activewear's competitive landscape is built upon a foundation of robust data, including Gildan's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld.

We also leverage insights from financial news outlets, competitor disclosures, and macroeconomic data to provide a comprehensive understanding of the forces impacting Gildan.