Gildan Activewear Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gildan Activewear Bundle

Gildan Activewear excels by offering a diverse range of quality apparel at accessible price points, ensuring widespread availability through extensive distribution networks. Their promotional efforts focus on value and reliability, resonating with a broad consumer base.

Discover how Gildan's strategic product development, competitive pricing, broad distribution, and targeted promotions create a powerful marketing mix. Unlock the full analysis to understand their market dominance and gain actionable insights for your own strategy.

Product

Gildan Activewear's core offering centers on everyday basics like activewear, underwear, and socks. This foundational product line is the bedrock of their business, providing essential items for a broad consumer base.

The activewear segment, a key part of this core, showed robust growth, contributing significantly to Gildan's sales in 2024. This trend continued into the first quarter of 2025, highlighting sustained consumer demand for these fundamental apparel choices.

Gildan Activewear excels through its diverse brand portfolio, strategically marketing products under owned brands like Gildan, American Apparel, Comfort Colors, GOLDTOE, and Peds. This multi-brand strategy allows Gildan to effectively target a wide array of market segments and consumer preferences, significantly broadening its market reach.

Further strengthening its brand presence, Gildan holds an exclusive licensing agreement for the Champion brand specifically within the printwear channel. This allows them to leverage the strong recognition of a well-established athletic brand, complementing their existing offerings.

Gildan's product strategy centers on providing blank apparel, a crucial element for customization by wholesale distributors, screen printers, and embellishers. This B2B approach allows Gildan to reach a vast array of end markets, from schools and sports teams to promotional companies.

In 2023, Gildan's wholesale segment, which primarily supplies these blank customizable products, generated approximately $2.6 billion in net sales. This demonstrates the significant demand for their unbranded apparel as a canvas for diverse customization needs across various industries.

Continuous Innovation

Gildan Activewear demonstrates a strong commitment to continuous innovation, a key element of its marketing strategy. This is evident in the development of technologies like Soft Cotton Technology, which significantly improves garment softness, comfort, and suitability for printing. This focus ensures their products meet evolving consumer demands for quality and performance.

The company actively expands its product portfolio by introducing new styles and collections. For instance, the introduction of lightweight fleece options caters to diverse market needs and seasonal trends. This regular refresh of offerings, including the expansion of its popular Gildan Hammer line in 2024 with new colors and styles, keeps the brand competitive and appealing to its customer base.

Gildan's innovation efforts are supported by substantial investment. In 2024, the company allocated approximately $490 million towards capital expenditures, a significant portion of which fuels product development and process improvements. This investment underscores their dedication to staying ahead in a dynamic market.

- Soft Cotton Technology: Enhanced comfort and printability.

- New Styles and Collections: Introduction of lightweight fleece and expanded Gildan Hammer line in 2024.

- Capital Investment: Approximately $490 million in capital expenditures for 2024, supporting innovation.

- Market Relevance: Regular product updates ensure appeal to diverse customer segments.

Sustainable Development

Sustainable development is central to Gildan's product offerings. The company is making significant strides in its commitment to environmental responsibility. This focus is evident in their material sourcing and packaging initiatives, directly impacting the product itself.

Gildan's dedication to sustainable cotton sourcing is a key product differentiator. By 2024, they achieved 77.3% sustainable cotton usage, with an ambitious target of 100% by the end of 2025. This commitment enhances the product's appeal to environmentally conscious consumers.

- Sustainable Cotton: Reached 77.3% in 2024, aiming for 100% by end of 2025.

- Recycled Polyester: Increasing the use of recycled polyester in product lines.

- Sustainable Packaging: Implementing eco-friendly packaging solutions.

Beyond cotton, Gildan is actively increasing its use of recycled polyester, further reducing its environmental footprint. The company is also implementing sustainable packaging, ensuring that the product's presentation aligns with its core values of environmental stewardship.

Gildan Activewear's product strategy is rooted in providing essential, high-quality basics that serve a broad market. Their extensive range includes activewear, underwear, and socks, with a particular emphasis on the activewear segment which demonstrated strong sales performance throughout 2024 and into early 2025. This focus on foundational apparel ensures consistent demand and market penetration.

The company's product innovation is a continuous effort, exemplified by technologies like Soft Cotton Technology, enhancing garment comfort and printability. Furthermore, Gildan consistently refreshes its offerings, with the Gildan Hammer line seeing expansion in 2024, ensuring product relevance and appeal across diverse consumer segments. Significant capital investments, around $490 million in 2024, underscore their commitment to product development and process improvements.

Sustainability is deeply integrated into Gildan's product development, with a strong push towards sustainable cotton sourcing, reaching 77.3% in 2024 and targeting 100% by the end of 2025. This commitment extends to increasing the use of recycled polyester and implementing eco-friendly packaging, aligning their product with growing environmental consciousness among consumers.

| Product Focus | Key Innovations | Sustainability Metrics (2024/2025 Target) |

|---|---|---|

| Activewear, Underwear, Socks | Soft Cotton Technology, Gildan Hammer expansion (2024) | 77.3% Sustainable Cotton (100% by end 2025) |

| Blank Apparel for Customization | Focus on printability and quality | Increasing Recycled Polyester usage |

| Brand Portfolio (Gildan, American Apparel, etc.) | New styles and lightweight fleece introduction | Eco-friendly packaging initiatives |

What is included in the product

This analysis provides a comprehensive breakdown of Gildan Activewear's marketing mix, detailing their product offerings, competitive pricing strategies, extensive distribution channels, and promotional efforts.

Simplifies complex marketing strategies by presenting Gildan's 4Ps as actionable solutions to common apparel business challenges.

Provides a clear, concise overview of how Gildan's Product, Price, Place, and Promotion address market needs, alleviating pain points for retailers and consumers alike.

Place

Gildan Activewear's extensive wholesale distribution is a cornerstone of its marketing strategy, focusing heavily on business-to-business (B2B) channels. The company primarily supplies blank apparel to a vast network of distributors, screen printers, and decorators who then customize and resell the products. This approach ensures broad market penetration and accessibility for businesses that rely on Gildan's offerings for their customization needs.

This robust B2B network is critical for Gildan's operational efficiency and market reach. For instance, in 2023, Gildan reported net sales of $3.09 billion, with a significant portion of this revenue stemming from its wholesale operations. The company's ability to effectively manage and leverage these relationships with distributors and decorators is key to maintaining its position as a leading supplier in the activewear market.

Gildan Activewear extends its reach beyond wholesale by engaging consumers directly through a robust omni-channel retail presence. This strategy involves partnerships with major mass merchants, department stores, and national retail chains, ensuring broad availability of its products. In 2023, Gildan's sales to major retailers like Walmart and Target remained a significant driver of its revenue, reflecting the importance of these channels.

The company also leverages online platforms, including its own e-commerce sites and third-party marketplaces, to capture direct-to-consumer sales. This multi-pronged approach enhances customer convenience, allowing shoppers to purchase Gildan products through their preferred methods. By being present across diverse retail landscapes, Gildan optimizes its sales potential, meeting consumers wherever and whenever they choose to shop.

Gildan's vertically integrated supply chain, controlling everything from yarn spinning to finished apparel, is key to its distribution. This model, which they've honed over years, means they don't heavily depend on outside suppliers. This allows for smoother operations and keeps products readily available for customers.

This end-to-end control is a significant advantage, enabling Gildan to maintain consistent product quality and ensure reliable stock levels. For instance, in 2023, Gildan reported that its manufacturing facilities produced over 300 million units of activewear, a testament to the efficiency of its integrated model in meeting substantial demand.

Global Manufacturing and Market Reach

Gildan Activewear leverages a robust global manufacturing and distribution network to ensure widespread product availability. Its operations are anchored by substantial production facilities strategically positioned in Central America, the Caribbean, North America, and Bangladesh. This extensive manufacturing base allows Gildan to efficiently serve major consumer regions worldwide.

The company's market reach is truly global, encompassing key economic zones such as North America, Europe, Asia Pacific, and Latin America. This broad accessibility is a direct result of its integrated supply chain, which effectively bridges production with demand across diverse geographies.

- Manufacturing Hubs: Central America, Caribbean, North America, Bangladesh.

- Key Markets Served: North America, Europe, Asia Pacific, Latin America.

- Operational Scale: Supports global distribution through large-scale facilities.

- Strategic Advantage: Facilitates product accessibility and market penetration.

Strategic Market Expansion

Gildan Activewear is strategically broadening its market reach by cultivating deeper connections with both current and potential retail partners. This focus on strengthening relationships is a key component of its expansion strategy.

The company is also prioritizing growth in select international markets to complement its already robust North American operations. This dual approach is designed to enhance distribution networks and increase overall market penetration.

For instance, Gildan reported that its wholesale segment, which includes sales to retailers, saw a net sales increase of 4.7% in the first quarter of 2024 compared to the prior year, reaching $579.6 million. This demonstrates tangible progress in its retail partner engagement.

Looking ahead, Gildan's international expansion efforts are expected to leverage its established brand reputation and product quality to capture new market share. This strategic move is anticipated to drive significant future growth and diversify revenue streams.

- Deepened Retailer Relationships: Gildan is actively working to strengthen ties with existing and new retail partners, aiming for more integrated distribution and promotion.

- International Market Focus: The company is strategically expanding its presence in select international territories to build upon its strong North American foundation.

- Growth in Wholesale Segment: Gildan's wholesale net sales increased by 4.7% in Q1 2024, indicating successful engagement with its retail partners.

- Enhanced Distribution and Penetration: These initiatives are designed to broaden Gildan's distribution channels and achieve deeper market penetration globally.

Gildan's "Place" strategy centers on making its products readily available through multiple channels. This includes a strong B2B wholesale operation supplying decorators and printers, alongside direct-to-consumer sales via mass merchants, department stores, and online platforms. The company's vertically integrated supply chain, with significant manufacturing capacity like the over 300 million units produced in 2023, underpins this widespread accessibility.

Gildan's global manufacturing footprint, with key hubs in Central America, the Caribbean, North America, and Bangladesh, supports its extensive market reach across North America, Europe, Asia Pacific, and Latin America. This strategic positioning ensures products are accessible where consumers shop.

The company is actively deepening relationships with retail partners, evidenced by a 4.7% increase in its wholesale segment net sales to $579.6 million in Q1 2024. This focus on stronger distribution networks and international market expansion is key to its growth strategy.

Preview the Actual Deliverable

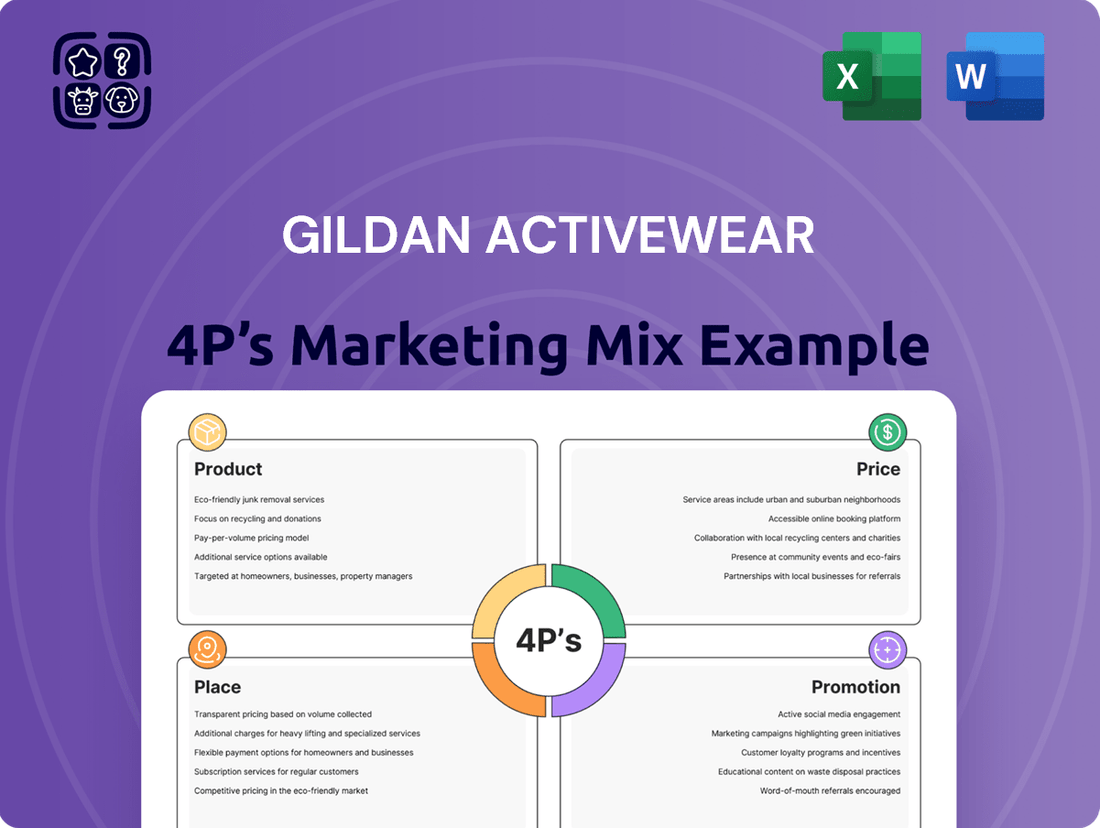

Gildan Activewear 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Gildan Activewear's 4 P's (Product, Price, Place, Promotion) is fully complete and ready for your immediate use.

Promotion

Gildan Activewear strategically targets different consumer segments through distinct marketing campaigns for its diverse brand portfolio. For instance, the Gildan brand utilizes the 'Just Smart' campaign, emphasizing value and practicality.

American Apparel focuses on its heritage and creative appeal with taglines like 'The 2001 and Only' and 'Craft the Culture.' This approach aims to connect with a younger, trend-conscious demographic.

Comfort Colors, known for its vintage aesthetic and soft feel, employs the 'Spread Good Vibes' campaign to foster a sense of community and relaxed lifestyle. These targeted efforts underscore Gildan's commitment to brand differentiation and consumer engagement, a strategy that has seen the company's revenue grow consistently, with reported net sales of $3.1 billion for the fiscal year ending in December 2023.

Gildan Activewear actively participates in and showcases its latest styles and product innovations at key industry events, such as the Impressions Expo. This direct engagement with screen printers, decorators, and other industry professionals is a vital promotional activity.

These showcases allow Gildan to highlight product features, such as their sustainable material options and new color palettes, directly to their B2B customer base. For instance, at the 2024 Impressions Expo, Gildan emphasized its commitment to eco-friendly practices, a growing concern for decorators and end consumers alike.

Gildan actively uses digital tools to streamline the customer journey. Their Product Locator App, for instance, allows users to easily pinpoint specific styles and colors available through their distribution network, simplifying the purchasing process.

This digital infrastructure not only improves customer convenience but also acts as a powerful sales support mechanism. By making product information readily accessible online, Gildan empowers both end-users and distributors, contributing to efficient order fulfillment and a positive brand experience.

Strategic Partnerships and Collaborations

Gildan leverages strategic partnerships to enhance brand perception and reach. For instance, American Apparel's 'Craft the Culture' campaign highlights collaborations with artists, fostering a connection with creative communities.

Serving as an official printwear partner for Live Nation festivals in 2024 and extending into 2025 further solidifies Gildan's presence within music and youth culture. This strategy aims to build brand relevance by aligning with influential cultural touchpoints and directly engaging with key consumer segments.

These collaborations are crucial for deepening demographic connections, particularly with individuals who value music and artistic expression.

- Artist Collaborations: American Apparel's 'Craft the Culture' campaign actively partners with artists to create unique product lines and content.

- Festival Partnerships: Gildan's role as an official printwear partner at Live Nation festivals (2024-2025) provides significant brand visibility.

- Demographic Engagement: These initiatives are designed to resonate with younger, culturally-aware consumers interested in music and art.

- Brand Relevance: Strategic alliances help maintain and elevate Gildan's position within relevant cultural movements.

ESG Communication and Transparency

Gildan's commitment to Environmental, Social, and Governance (ESG) principles is actively promoted through its comprehensive reporting and ongoing stakeholder communications. This transparency is a key element in building trust and enhancing the brand's reputation, particularly with consumers who prioritize sustainability and ethical practices.

The company's proactive approach to ESG not only demonstrates corporate responsibility but also functions as a powerful promotional strategy, resonating with a growing segment of the market. For instance, Gildan's 2023 ESG report detailed significant progress in reducing greenhouse gas emissions, with a 15% decrease compared to their 2020 baseline, showcasing tangible results of their environmental initiatives.

This focus on transparency allows Gildan to connect with a broader audience, including investors and business partners who increasingly evaluate companies based on their ESG performance. Their communication efforts highlight initiatives such as water conservation programs and fair labor practices, reinforcing their image as a responsible industry leader.

- ESG Reporting: Gildan publishes detailed annual ESG reports, providing stakeholders with quantifiable data on environmental and social performance.

- Stakeholder Engagement: The company actively communicates its ESG progress through various channels, fostering dialogue and transparency.

- Brand Perception: This commitment to responsible practices positively influences how consumers and investors view Gildan's brand.

- Sustainability Initiatives: Gildan's ongoing efforts in areas like emissions reduction and water stewardship are central to its promotional messaging.

Gildan Activewear employs a multi-faceted promotional strategy, tailoring campaigns to specific brands like Gildan, American Apparel, and Comfort Colors to resonate with distinct consumer segments. This includes digital tools such as their Product Locator App to enhance customer convenience and sales support.

Strategic partnerships, like American Apparel's artist collaborations and Gildan's role as an official printwear partner for Live Nation festivals through 2025, are key to building brand relevance and engaging with youth culture. These initiatives aim to connect with consumers who value music and artistic expression.

The company's strong emphasis on Environmental, Social, and Governance (ESG) principles, highlighted in their 2023 ESG report which noted a 15% reduction in greenhouse gas emissions from a 2020 baseline, serves as a powerful promotional tool. This transparency builds trust and appeals to increasingly sustainability-conscious consumers and investors.

Gildan's presence at industry events like the Impressions Expo in 2024 further supports its promotional efforts by showcasing new products and sustainable material options directly to its B2B customer base.

Price

Gildan Activewear's core strategy is cost leadership, deeply embedded in its vertically integrated, large-scale manufacturing. This operational backbone allows them to consistently offer competitive pricing in the apparel market, a key element of their product strategy.

This efficiency translates directly into affordability for consumers. For instance, in 2023, Gildan reported net sales of $3.07 billion, demonstrating their ability to move significant volume at attractive price points, thereby capturing a broad customer base.

Gildan Activewear employs a value-based pricing strategy, aiming to offer high-quality apparel at accessible price points. This positioning makes Gildan a smart choice for decorators and businesses looking for excellent value, balancing cost with dependable product performance.

The company's pricing reflects the perceived value customers receive from Gildan's consistent quality, extensive product selection, and streamlined, efficient manufacturing. For instance, Gildan reported net sales of $3.1 billion for the fiscal year ending December 31, 2023, underscoring the broad market acceptance of its value proposition.

Gildan Activewear demonstrated impressive flexibility with input costs in 2024, a key factor in its gross profit improvements. Despite a slight dip in net selling prices, the company saw its gross profit rise, largely due to a decrease in raw material and manufacturing expenses. This adaptability in its pricing strategy suggests Gildan can navigate cost fluctuations effectively, either by maintaining competitive prices or preserving profit margins.

Strong Profitability and Margin Management

Gildan Activewear demonstrates strong financial health, highlighted by its impressive profit margins. In the second quarter of 2025, the company achieved a gross profit margin of 31.5%, a testament to its effective pricing strategies and operational efficiencies. This performance underscores a commitment to maintaining industry-leading margins.

The company's focus on cost management continues to bolster its operating margins. These strong financial results are a direct outcome of Gildan's strategic prioritization of maintaining profitability through diligent cost control and smart price management across its product lines.

- Gross Profit Margin: 31.5% (Q2 2025)

- Key Strategic Focus: Maintaining industry-leading margins

- Drivers of Profitability: Effective price management and ongoing cost efficiencies

Stable Long-Term Financial Outlook

Gildan Activewear projects a stable financial future, anticipating mid-single-digit revenue growth for the long term. This growth is expected to be supported by consistent adjusted operating margins, indicating strong profitability.

The company's financial strategy focuses on maintaining operational efficiency and prudent cost management. This approach is designed to ensure sustained financial health and the ability to reinvest in growth initiatives.

- Projected Mid-Single-Digit Revenue Growth: Gildan anticipates steady expansion in its top line.

- Consistent Adjusted Operating Margins: The company expects to maintain healthy profitability throughout its operations.

- Focus on Operational Efficiency: A key element of their strategy involves optimizing internal processes.

- Prudent Financial Management: Gildan prioritizes careful spending and resource allocation to ensure stability.

Gildan's pricing strategy is fundamentally tied to its cost leadership, enabling competitive price points that drive high sales volumes. For instance, the company achieved net sales of $3.07 billion in 2023, reflecting the broad market appeal of its accessible pricing. This approach ensures that Gildan products offer excellent value, balancing quality with affordability for a wide customer base.

The company's ability to manage input costs, as seen in 2024 with improvements in gross profit despite slight net selling price dips, highlights pricing flexibility. This adaptability allows Gildan to maintain competitiveness while also protecting its profit margins, a crucial element of its financial strategy.

Gildan's commitment to strong profit margins, evidenced by a 31.5% gross profit margin in Q2 2025, underscores its effective price management. This focus on profitability, combined with operational efficiencies, positions Gildan for sustained financial health and future growth.

Looking ahead, Gildan projects mid-single-digit revenue growth supported by consistent adjusted operating margins. This forecast reflects a strategic emphasis on operational efficiency and prudent cost management, ensuring continued financial stability and the capacity for reinvestment.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Net Sales | $3.07 billion | 2023 | Demonstrates high sales volume at competitive prices. |

| Gross Profit Margin | 31.5% | Q2 2025 | Indicates effective pricing and operational efficiencies. |

| Projected Revenue Growth | Mid-single-digit | Long-term | Suggests sustained market acceptance and strategic planning. |

4P's Marketing Mix Analysis Data Sources

Our Gildan Activewear 4P's analysis is built upon a foundation of verified, up-to-date information. We meticulously review company actions, pricing models, distribution strategies, and promotional campaigns, referencing credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.