Gildan Activewear Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gildan Activewear Bundle

Curious about Gildan Activewear's product portfolio performance? This glimpse into their BCG Matrix reveals a strategic landscape of potential Stars, Cash Cows, Dogs, and Question Marks. Don't settle for a partial view; purchase the full report to unlock detailed quadrant placements and actionable insights that can guide your investment and product development decisions.

Stars

Gildan's North American activewear segment is a powerhouse, consistently expanding its market presence. This division, encompassing wholesale blank apparel and branded merchandise, demonstrated robust growth, with sales up 9% in Q1 2025 and revenue climbing 12% in Q2 2025.

This segment is the backbone of Gildan's operations, representing roughly 90% of the company's total sales. Its dominance is fueled by strategic advantages like vertical integration and technological advancements, such as their proprietary Soft Cotton Technology.

Comfort Colors, a brand under Gildan Activewear, is a star performer. Its sales surged by 40% in 2024, a testament to its strong market position. The brand's appeal lies in its high-quality, pigment-dyed apparel known for its comfort and durability.

Gildan's robust infrastructure, including its advanced dyeing technology and extensive distribution network, significantly supports Comfort Colors' growth trajectory. This synergy allows the brand to efficiently meet increasing consumer demand for its distinctive products.

Furthermore, Comfort Colors' emphasis on sustainable practices and eco-friendly dyeing resonates with a growing segment of environmentally aware consumers. This commitment to sustainability not only enhances brand reputation but also drives sales in the competitive activewear market.

Gildan Activewear's fleece and ring-spun products are performing exceptionally well within the activewear sector. These items are experiencing robust sales growth driven by the enduring athleisure trend and a rising demand for comfortable, versatile apparel in the wholesale market. This segment is a significant contributor to Gildan's overall success.

Strategic Partnerships and New Program Launches

Gildan Activewear actively pursues strategic partnerships and new program launches to fuel its expansion. This forward-thinking strategy is designed to bolster market share and ensure sustained growth across its core product lines, allowing the company to effectively adapt to changing market dynamics.

These carefully cultivated alliances and innovative programs are projected to deliver mid-single-digit revenue growth and enhance profitability in 2025.

- Strategic Partnerships: Gildan has historically engaged in partnerships to expand its distribution and product offerings. For instance, collaborations with retailers and athletic organizations have been key to reaching new customer segments.

- New Program Launches: The introduction of new product lines, such as sustainable activewear collections, demonstrates Gildan's commitment to innovation and catering to evolving consumer preferences.

- Market Share Gains: By focusing on these growth drivers, Gildan aims to solidify its position in competitive markets, particularly in the growing athleisure and performance wear segments.

- Projected Growth: The company's guidance for 2025 anticipates these initiatives contributing to a mid-single-digit increase in revenue and improved earnings.

Vertically Integrated Manufacturing Model

Gildan Activewear's vertically integrated manufacturing model is a significant competitive advantage, allowing for cost leadership and robust supply chain control.

This integration helps Gildan manage raw material costs effectively and speeds up product delivery, directly impacting its strong gross profit margins.

For instance, in 2023, Gildan reported a gross profit margin of 36.5%, a testament to the efficiency of its operational structure.

This operational efficiency is key to maintaining market share and driving growth in the dynamic apparel sector.

- Vertically Integrated Manufacturing: Controls the entire production process from yarn spinning to finished goods.

- Cost Leadership: Achieved through efficient operations and economies of scale.

- Supply Chain Control: Mitigates disruptions and ensures timely product availability.

- Risk Mitigation: Manages raw material price volatility and enhances predictability.

Gildan's activewear segment, particularly brands like Comfort Colors, are clear Stars in the BCG Matrix. Comfort Colors saw a remarkable 40% sales increase in 2024, demonstrating high market share in a growing market.

This strong performance is supported by Gildan's robust infrastructure and commitment to sustainability, appealing to a broad consumer base. The overall North American activewear segment also showed significant growth, with sales up 9% in Q1 2025 and revenue up 12% in Q2 2025.

These factors indicate that Gildan's core activewear offerings possess both high growth potential and a dominant market position, solidifying their status as Stars.

| Category | Brand/Product Line | Market Share | Market Growth | BCG Status |

|---|---|---|---|---|

| Activewear | Comfort Colors | High | High | Star |

| Activewear | Fleece & Ring-spun | High | High | Star |

| Activewear | North American Segment | High | High | Star |

What is included in the product

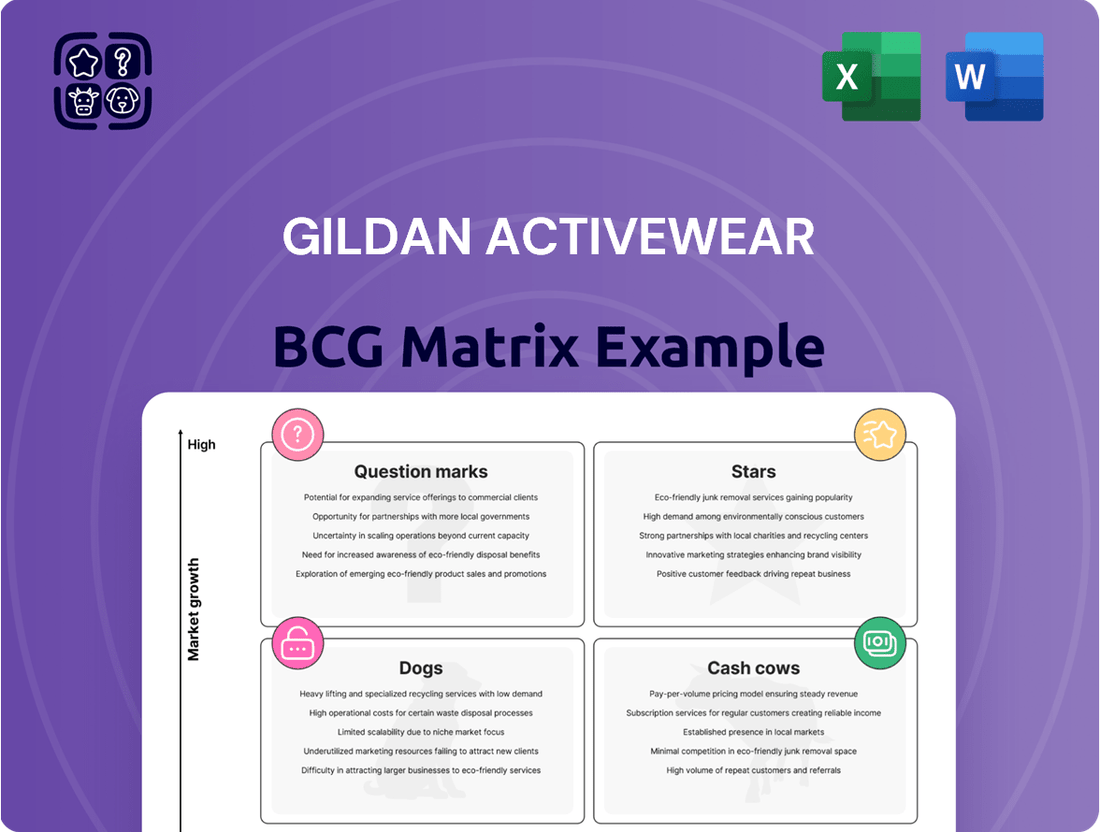

Gildan Activewear's BCG Matrix analysis would detail its product lines as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

This framework helps Gildan strategically allocate resources, focusing on high-growth, high-share products and managing others for optimal returns.

This Gildan Activewear BCG Matrix overview instantly clarifies which business units need attention, relieving the pain of strategic uncertainty.

Cash Cows

Gildan's core activewear, primarily blank apparel sold to wholesale distributors, is a significant cash cow. These foundational products, which saw revenue of approximately $3.4 billion in 2023, benefit from a dominant market share in a mature but consistent industry.

The company's established network of retail and distributor relationships underpins the steady demand and reliable cash flow generated by these activewear staples. This strong market position allows Gildan to leverage its scale and operational efficiency effectively.

Gildan's extensive wholesale distribution network is a cornerstone of its operations, acting as a significant cash cow. This network efficiently serves screen printers and other embellishers, providing a consistent and reliable source of revenue through recurring orders for Gildan's blank apparel products.

The stability of this revenue stream is further bolstered by Gildan's strong position in the market and its reputation for quality. This established channel, coupled with the company's renowned low-cost manufacturing capabilities, translates directly into high profit margins and robust cash flow generation, reinforcing its status as a cash cow.

Gildan Activewear's long-standing relationships with its national account customers and North American distributors act as a significant cash cow. These established connections provide a consistent and reliable sales base, insulating the company from the volatility often seen in more competitive markets.

This stability means Gildan doesn't need to pour significant resources into aggressive promotional activities for these segments. Instead, it can passively generate substantial revenue, effectively milking the gains from these loyal customer groups.

For instance, in 2023, Gildan reported strong performance in its Printwear segment, which heavily relies on these established distribution channels. This segment consistently contributes to the company's overall profitability, demonstrating the enduring value of these customer relationships.

Efficient Supply Chain and Cost Leadership

Gildan's relentless focus on supply chain optimization and cost leadership is the bedrock of its cash cow status. This strategic advantage allows the company to maintain industry-leading margins, a testament to its operational prowess.

The company's vertically integrated manufacturing model, coupled with stringent operational discipline, grants it exceptional cost control. This efficiency translates directly into generating substantial cash flow, exceeding the capital required for its core operations.

- Cost Leadership: Gildan's commitment to efficient production and distribution enables it to offer competitive pricing while sustaining strong profitability.

- Vertical Integration: Owning key stages of the production process, from yarn spinning to finished garment manufacturing, provides significant cost advantages and control.

- Operational Discipline: A consistent emphasis on lean manufacturing principles and continuous improvement drives down expenses and boosts output.

In 2023, Gildan reported a net sales increase to $3.09 billion, with its Activewear segment demonstrating robust performance, a key indicator of its cash cow strength. This segment's ability to generate consistent profits underpins the company's overall financial health.

Mature Product Lines

Gildan's established activewear lines, like their basic t-shirts and fleece, are prime examples of cash cows. These products operate in mature markets, meaning the overall demand isn't growing rapidly, but Gildan holds a significant chunk of that market. This strong market share translates into consistent, reliable cash generation for the company.

These mature product lines are crucial for Gildan's financial health. They generate substantial and predictable cash flows, often referred to as the company's "cash cows." For instance, in 2023, Gildan's net sales reached $3.09 billion, with a significant portion likely attributable to these high-volume, established products. This consistent revenue stream allows for flexibility in capital allocation.

- Stable Cash Generation: Mature product lines provide a predictable and consistent inflow of cash, underpinning the company's financial stability.

- Reinvestment Opportunities: The cash generated can be strategically reinvested in growth areas, such as research and development for new products or expanding into emerging markets.

- Shareholder Returns: Alternatively, these cash flows can be returned to shareholders through dividends or share buybacks, enhancing shareholder value.

- Market Dominance: Gildan's strong market share in these mature segments ensures continued demand and profitability, even in slower-growing industries.

Gildan's core activewear segment, primarily blank apparel, functions as its most significant cash cow. These products, which generated approximately $3.4 billion in revenue in 2023, benefit from a dominant market share in a mature yet consistently demanding industry.

The company's established wholesale distribution network, serving screen printers and embellishers, provides a reliable and recurring revenue stream. This network's efficiency, combined with Gildan's low-cost manufacturing, translates into strong profit margins and robust cash flow.

Gildan's strategic focus on cost leadership, achieved through vertical integration and operational discipline, underpins its cash cow status. This allows for industry-leading margins and substantial cash generation that exceeds operational needs.

These mature product lines are vital for Gildan's financial stability, providing predictable cash inflows that can be reinvested or returned to shareholders. In 2023, Gildan's net sales reached $3.09 billion, with a significant portion coming from these high-volume, established products.

| Segment | 2023 Revenue (Approx.) | Key Characteristics |

| Activewear (Blank Apparel) | $3.4 billion | Dominant market share, mature industry, stable demand, strong distribution. |

| Printwear | (Part of Activewear) | Relies on established distribution channels, consistent profitability. |

What You See Is What You Get

Gildan Activewear BCG Matrix

The Gildan Activewear BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase, offering a complete strategic analysis ready for immediate use. This comprehensive report, meticulously crafted to provide actionable insights, will be delivered in its final, fully formatted state, ensuring no surprises and enabling direct application to your business planning. You're not just seeing a sample; you're viewing the actual BCG Matrix file that will be instantly downloadable, allowing you to leverage Gildan's market positioning for your strategic decision-making without any delay. This preview accurately represents the professional-grade analysis you'll acquire, empowering you to confidently present Gildan's product portfolio performance to stakeholders.

Dogs

Gildan's underwear and hosiery segment, following the discontinuation of its Under Armour partnership, has seen a marked downturn. This category experienced a 17% sales decrease in 2024, further declining by 38% in the first quarter of 2025 and 23.3% in the second quarter of 2025.

With both a low market share and limited growth potential, this segment aligns with the characteristics of a 'Dog' in the BCG matrix. Such a classification suggests that Gildan must carefully consider its strategy for this category, potentially including divestment to reallocate resources more effectively.

Gildan's international sales in regions like Latin America and Asia have presented challenges, with a notable decline of 2.5% year-over-year in Q1 2025. This softness suggests these markets may currently offer low growth potential and represent a smaller market share for the company.

Given this performance, Latin America and Asia could be considered question marks or potentially dogs in Gildan's BCG matrix. A strategic re-evaluation or a reduction in investment might be warranted for these underperforming international segments.

Niche or outdated apparel styles, such as retro graphic tees or specific vintage cuts, fall into the Dogs category for Gildan Activewear. These items likely possess a low market share and are in stagnant or declining growth segments, meaning they consume resources without generating substantial returns. For instance, while athleisure wear saw a significant surge, items not aligning with this trend might struggle to gain traction.

Less Profitable Licensed Brands

Less profitable licensed brands, those with limited market share and growth prospects akin to the discontinued Under Armour partnership, are likely positioned in the Dogs quadrant of the BCG Matrix. These brands represent potential cash traps, consuming resources without generating substantial returns.

For instance, if Gildan's portfolio includes licensed brands that saw a decline in revenue or profitability in 2024, and these trends are projected to continue, they would fit this category.

- Cash Drain: Brands that require ongoing investment but yield minimal profit, potentially tying up capital that could be better allocated.

- Low Market Share: Licensed products that have failed to capture significant consumer interest or compete effectively in their respective markets.

- Stagnant Growth: Brands with little to no projected increase in sales or market penetration, indicating a lack of future potential.

- Divestiture Candidates: Such brands may be considered for sale or the non-renewal of licensing agreements to streamline operations and focus on more promising ventures.

Inefficient Production Lines for Specific Products

Inefficiencies in certain production lines, even within Gildan's vertically integrated model, can become a drag. If older lines are dedicated to products with waning consumer interest or incur disproportionately high operating expenses, they represent a drain on resources. For instance, if a specific line for a niche apparel item saw its market share decline by 15% in 2023, while its operational costs increased by 8% due to outdated machinery, it would fit this category.

These underperforming segments consume capital and labor that could be better allocated to more profitable ventures. Gildan's 2024 strategy likely involves a rigorous review of all production units to identify and address such inefficiencies. Decisions might range from modernization to outright divestment of these less productive assets, aiming to optimize the company's overall operational footprint and financial performance.

- Low Market Demand: Products from these lines might be experiencing a significant drop in sales volume, potentially by more than 10% year-over-year.

- High Operational Costs: Older machinery or less optimized processes could lead to energy consumption or waste levels that are 20% higher than newer facilities.

- Resource Drain: These lines may tie up working capital and management attention without contributing proportionally to Gildan's revenue or profit targets.

Gildan's underwear and hosiery segment, following the discontinuation of its Under Armour partnership, experienced a 17% sales decrease in 2024 and continued declines in early 2025. This segment, characterized by low market share and limited growth prospects, fits the 'Dog' profile in the BCG matrix, suggesting potential divestment to reallocate resources. Similarly, certain international markets like Latin America and Asia, which saw a 2.5% decline in international sales in Q1 2025, may also be considered Dogs due to low growth and market share, warranting strategic re-evaluation.

Niche apparel styles and less profitable licensed brands with declining revenue in 2024 also fall into the Dogs category. These segments consume resources without substantial returns, making them candidates for divestiture or non-renewal of agreements. For instance, production lines with waning consumer interest and high operating costs, potentially seeing a 15% market share decline and 8% cost increase in 2023 for a niche item, represent a resource drain and require optimization or divestment.

| Segment/Product Line | BCG Classification | Key Characteristics | 2024/2025 Performance Data |

|---|---|---|---|

| Underwear & Hosiery | Dog | Low Market Share, Low Growth Potential | 17% sales decrease (2024), 38% Q1 2025, 23.3% Q2 2025 |

| Certain International Markets (e.g., Latin America, Asia) | Dog/Question Mark | Low Market Share, Low Growth Potential | 2.5% year-over-year decline in international sales (Q1 2025) |

| Niche Apparel Styles/Outdated Lines | Dog | Low Market Share, Stagnant/Declining Growth | Potential 15% market share decline & 8% cost increase (example for niche item in 2023) |

| Less Profitable Licensed Brands | Dog | Low Market Share, Low Growth Prospects | Declining revenue/profitability in 2024 (example) |

Question Marks

Gildan's foray into direct-to-consumer (DTC) marketing, including online sales of branded apparel, positions it as a Question Mark in the BCG matrix. This segment is experiencing robust growth, with projections indicating it could reach $1 trillion globally by 2025, demonstrating substantial year-over-year increases for many brands.

While the DTC channel offers significant upside, Gildan's presence here is relatively nascent. Consequently, its current market share is likely modest, necessitating substantial investment to build brand recognition and capture a meaningful slice of this expanding market. Success in DTC could transform this into a Star category for Gildan.

Recently introduced innovations like Gildan's new Soft Cotton Technology are positioned as potential Stars. While these products show promise and have received positive market responses, their ultimate market share and growth trajectory are still developing. For instance, Gildan reported a 2023 net sales increase of 1.5% to $3.09 billion, indicating overall company growth that these innovations aim to bolster.

Significant investment in marketing and distribution will be necessary to ensure these innovations can capture substantial market share and evolve into Stars. The company's focus on product differentiation, as seen with Soft Cotton, is crucial in a competitive apparel market where brands constantly seek to capture consumer attention and loyalty.

Gildan Activewear's expansion into new international markets outside North America, where its market share is currently low but growth potential is high, positions these ventures as Stars in the BCG Matrix. These markets represent significant future opportunities, but success hinges on substantial investment in market entry, infrastructure development, and brand awareness initiatives.

Sustainability-focused Product Lines

Gildan's sustainability-focused product lines, like those using organic cotton or recycled polyester, tap into a rapidly expanding consumer market. This aligns with a global trend where consumers increasingly prioritize environmentally conscious purchases. For instance, the global sustainable apparel market was valued at approximately $6.3 billion in 2022 and is projected to reach $13.6 billion by 2030, showcasing significant growth potential.

While these initiatives position Gildan to capture future growth, they likely represent a smaller portion of its current overall sales. This means they are probably in the "question mark" category of the BCG matrix. Significant investment will be needed to build brand awareness, scale production efficiently, and gain a competitive edge in this evolving niche.

- Growing Market Segment: The demand for sustainable apparel is a key growth driver.

- Investment Required: These lines need substantial capital for development and market penetration.

- Potential for Future Growth: Success here could lead to significant future market share.

- Competitive Landscape: Gildan faces established and emerging players in the eco-friendly space.

Digital Sales Channels and E-commerce Expansion

Gildan's move into digital sales channels and e-commerce, including social commerce, places it in the Question Mark category of the BCG matrix. This strategic pivot aims to capture a growing online apparel market, which saw global e-commerce sales reach an estimated $5.7 trillion in 2023.

To capitalize on this, Gildan must commit substantial investment to its digital infrastructure, online marketing efforts, and direct-to-consumer (DTC) capabilities. The DTC e-commerce apparel market is expected to continue its upward trajectory, with projections indicating further robust growth in the coming years.

- Market Potential: The global online apparel market is experiencing rapid expansion, offering significant opportunities for brands that can effectively engage consumers digitally.

- Investment Needs: Gildan requires significant investment in digital marketing, website development, and supply chain optimization to support its e-commerce ambitions.

- Competitive Landscape: The digital space is highly competitive, demanding innovative strategies to differentiate Gildan and build brand loyalty online.

- Growth Strategy: Successful expansion into digital channels will be crucial for Gildan to diversify revenue streams and achieve sustainable long-term growth.

Gildan's emerging ventures, such as its expansion into the activewear segment through acquisitions or the development of entirely new product lines, are likely positioned as Question Marks. These areas possess high growth potential but currently hold a relatively small market share for Gildan.

Significant investment is required to nurture these nascent businesses, aiming to increase their market share and transform them into Stars. For example, Gildan's 2023 performance showed a net sales increase of 1.5% to $3.09 billion, indicating a stable foundation from which to launch new initiatives.

The success of these Question Mark initiatives will depend on Gildan's ability to effectively compete, innovate, and capture consumer interest in potentially crowded markets.

The company's strategic investments will be crucial in determining whether these ventures can achieve the scale and market penetration needed for future growth.

BCG Matrix Data Sources

Our Gildan Activewear BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.