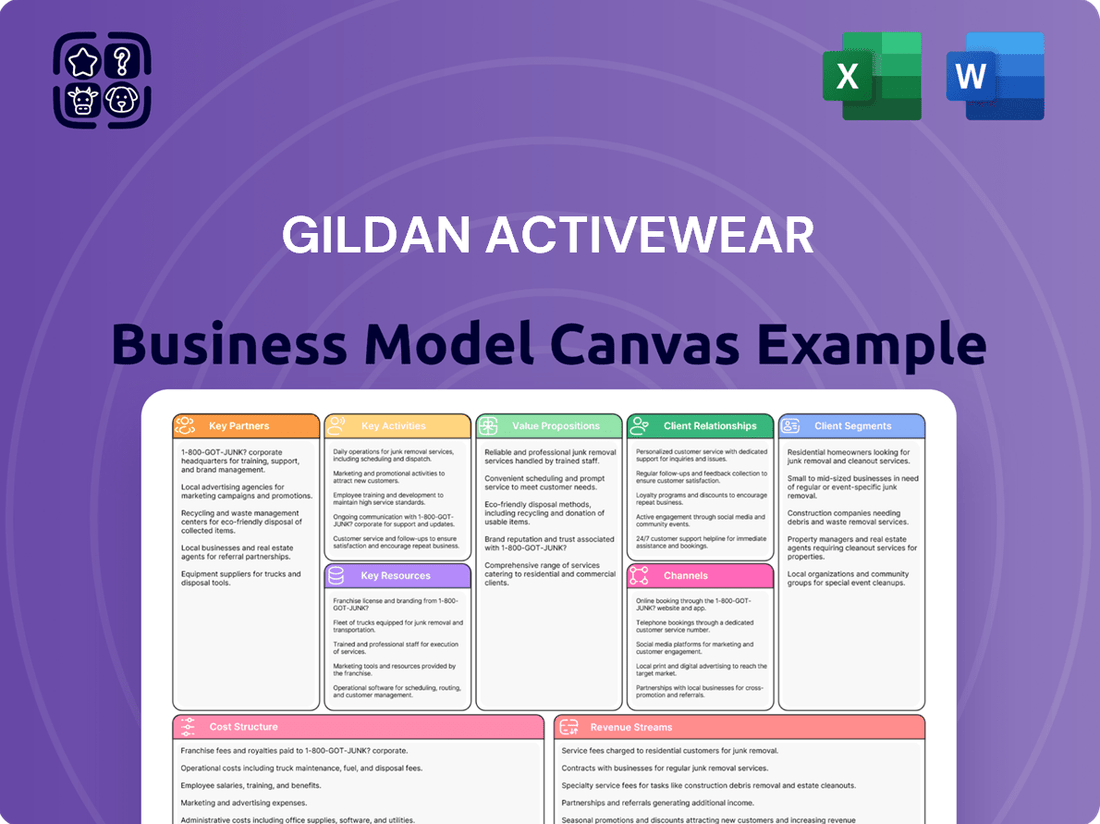

Gildan Activewear Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gildan Activewear Bundle

Discover the strategic engine behind Gildan Activewear's dominance with our comprehensive Business Model Canvas. This detailed breakdown reveals their efficient manufacturing, vast distribution network, and value-driven product offerings.

Unlock the full strategic blueprint behind Gildan Activewear's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Gildan Activewear's business model heavily relies on a robust network of wholesale distributors. These partners are crucial for getting Gildan's blank apparel to the end-users, primarily screen printers and decorators who add their own designs. This partnership allows Gildan to maintain its focus on large-scale, efficient manufacturing.

In 2023, Gildan reported net sales of $3.1 billion, a testament to the effectiveness of its distribution channels in reaching a vast market. These distributors act as a vital link, ensuring Gildan's products are readily available for customization, thereby supporting the company's significant market share in the activewear sector.

Screen printers and embellishers are vital partners for Gildan Activewear. They are Gildan's direct customers, purchasing blank apparel to then customize with unique designs, logos, and prints. This customization is a critical step, transforming Gildan's products into finished goods ready for the end consumer. Gildan's commitment to producing high-quality, consistent blank apparel makes it an ideal canvas for these businesses.

Gildan actively collaborates with a wide array of brick-and-mortar retailers and prominent e-commerce platforms to distribute its branded apparel directly to consumers. This strategic approach broadens their market penetration, moving beyond traditional wholesale relationships and fostering direct consumer engagement.

Through these retail partnerships, Gildan effectively elevates brand awareness for its owned labels, such as American Apparel and Comfort Colors, by making them accessible to a wider audience. For instance, in 2023, Gildan reported that its direct-to-consumer (DTC) segment, which includes these retail channels, contributed significantly to its overall sales, demonstrating the growing importance of this channel for brand visibility and revenue.

Global Lifestyle Brand Companies

Gildan Activewear strategically partners with prominent global lifestyle brands, notably securing exclusive licensing agreements for specific distribution channels. A prime example is the Champion brand's printwear segment, which allows Gildan to tap into the brand's established consumer recognition and market demand.

These collaborations are crucial for expanding Gildan's reach and diversifying its product portfolio. By associating with well-recognized lifestyle brands, Gildan effectively leverages their existing brand equity to enhance its own market presence and appeal to a broader customer base. This strategy was evident in Gildan's 2023 performance, where branded apparel sales contributed significantly to its overall revenue, underscoring the value of these partnerships.

- Champion Licensing: Exclusive agreements for printwear, leveraging brand recognition.

- Market Expansion: Partnerships broaden Gildan's reach into new consumer segments.

- Brand Equity Leverage: Utilizing the established recognition of global lifestyle brands.

Sustainable Sourcing Initiatives

Gildan Activewear actively collaborates with various organizations and initiatives dedicated to promoting sustainable cotton sourcing and overall environmental responsibility. This strategic approach directly supports their Environmental, Social, and Governance (ESG) objectives.

These partnerships are crucial for Gildan's goal to significantly increase the proportion of sustainable cotton and recycled fibers incorporated into their product lines. For instance, by 2023, Gildan reported that 43% of their cotton was sourced through more sustainable methods, a figure they aim to grow.

- Partnerships for Sustainable Cotton: Collaborations with organizations like the Better Cotton Initiative (BCI) and the U.S. Cotton Trust Protocol ensure that cotton is grown with reduced water usage, fewer pesticides, and improved soil health.

- Environmental Stewardship Programs: Gildan works with environmental groups and industry consortia to implement best practices in water management, energy efficiency, and waste reduction across its operations.

- Recycled Fiber Integration: Key partnerships are being forged with suppliers and innovators in textile recycling to increase the availability and quality of recycled polyester and cotton for use in Gildan products.

- Transparency and Traceability: Working with technology providers and industry standards bodies, Gildan aims to enhance the traceability of its raw materials, ensuring adherence to sustainable sourcing commitments.

Gildan Activewear's key partnerships are foundational to its operational efficiency and market reach. These collaborations span across its value chain, from raw material sourcing to final product distribution and brand enhancement.

Crucial relationships include wholesale distributors who are essential for delivering blank apparel to decorators, and screen printers and embellishers who are direct customers transforming these blanks into customized products. Gildan also strategically partners with retailers and e-commerce platforms for direct-to-consumer sales, boosting brand visibility for labels like American Apparel and Comfort Colors.

Furthermore, licensing agreements with prominent lifestyle brands, such as Champion for its printwear segment, allow Gildan to leverage established consumer recognition. The company also engages in partnerships focused on sustainable cotton sourcing and environmental responsibility, aiming to increase the use of recycled fibers and improve overall ESG performance.

| Partner Type | Role in Gildan's Business Model | Impact/Example (2023 Data) |

|---|---|---|

| Wholesale Distributors | Facilitate broad distribution of blank apparel to decorators. | Gildan's net sales of $3.1 billion in 2023 highlight the effectiveness of these channels. |

| Screen Printers & Embellishers | Direct customers who customize Gildan's blank apparel. | Key to transforming basic garments into finished, branded products. |

| Retailers & E-commerce Platforms | Enable direct-to-consumer sales and brand engagement. | Boosted visibility for brands like Comfort Colors, contributing to overall revenue. |

| Lifestyle Brands (e.g., Champion) | Licensing agreements for specific segments like printwear. | Leverage established brand equity and consumer demand. |

| Sustainability Organizations | Promote sustainable cotton sourcing and ESG initiatives. | Helped achieve 43% of cotton sourced sustainably by 2023. |

What is included in the product

Gildan Activewear's Business Model Canvas focuses on mass production of affordable, basic apparel, leveraging efficient supply chains and large-scale manufacturing to serve wholesale distributors and private label brands.

This model emphasizes cost leadership and operational efficiency, targeting a broad customer base through a robust distribution network and a commitment to sustainable manufacturing practices.

Gildan's Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of their operations, allowing for quick identification of core components and saving hours of formatting for strategic adaptation.

Activities

Gildan's primary key activity revolves around its robust vertically integrated manufacturing. This means they control the entire production chain, from spinning raw fibers into yarn all the way through to creating the final garment. This comprehensive oversight is central to their operational strategy.

This end-to-end manufacturing model is a cornerstone of Gildan's ability to achieve cost leadership in the activewear market. By managing each stage internally, they can optimize processes, reduce reliance on external suppliers, and maintain tight control over expenses, which is crucial for their competitive pricing.

In 2023, Gildan's integrated model contributed to their strong financial performance, with net sales reaching $3.1 billion. This vertical integration allows them to maintain consistent quality standards across their wide range of products, from t-shirts to fleece, ensuring customer satisfaction and brand reliability.

Managing its extensive global supply chain is a core activity for Gildan Activewear. This involves sourcing raw materials, manufacturing finished goods across multiple continents, and distributing them to customers worldwide, all while aiming for efficiency and reliability.

Gildan's operational flexibility is key to navigating supply chain complexities. For instance, in 2024, the company continued to leverage its vertically integrated model, controlling much of its production process from yarn spinning to finished garment sewing, which helps in responding to demand shifts and managing costs.

Mitigating risks of disruption is paramount. Gildan's strategy includes diversifying its manufacturing footprint and supplier base to reduce reliance on any single region, a practice that proved valuable in 2024 amidst ongoing geopolitical and logistical uncertainties.

Gildan's commitment to product innovation is a cornerstone of its operations. The company actively invests in research and development to create new products and enhance existing ones. For example, their Soft Cotton Technology aims to improve the feel and performance of their apparel.

This focus on innovation directly addresses evolving consumer demands for comfort and quality. By developing advanced fabric technologies, Gildan ensures its products offer superior softness and printability, making them attractive to both end-consumers and businesses that customize apparel.

In 2023, Gildan reported significant investments in its manufacturing capabilities and product development, underscoring the importance of this key activity. These efforts are designed to maintain a competitive edge and drive future growth in the activewear market.

Wholesale Distribution and Sales

Gildan Activewear's core operation revolves around the wholesale distribution and sales of its extensive range of blank apparel. This is where the bulk of their revenue is generated, serving decorators, screen printers, and other businesses that customize their products. The company's success hinges on its ability to efficiently manage these large-scale sales and ensure timely delivery across its vast distribution network.

In 2023, Gildan reported net sales of $3.09 billion, with a significant portion attributed to its wholesale activewear segment. This segment is crucial for maintaining their market leadership, requiring sophisticated logistics and a strong sales force to manage relationships with numerous wholesale partners. Their business model relies heavily on volume, making efficient distribution a paramount activity.

- Wholesale Distribution: Gildan's extensive network ensures efficient delivery of millions of units of blank apparel annually to distributors worldwide.

- Sales Operations: The company employs a dedicated sales team focused on building and maintaining relationships with wholesale clients, driving consistent order volumes.

- Product Portfolio: A wide array of t-shirts, fleece, and other basic apparel items are offered, catering to diverse customer needs within the wholesale market.

- Logistics Management: Sophisticated supply chain and inventory management systems are critical for fulfilling large, recurring orders from distributors.

Brand Marketing and Management

Gildan actively cultivates its owned brands, such as Gildan, American Apparel, and Comfort Colors, through dedicated marketing and management efforts. This includes targeted advertising and promotional campaigns designed to enhance brand recognition and foster customer loyalty across various retail and direct-to-consumer platforms.

- Brand Portfolio: Gildan manages a diverse portfolio including Gildan, American Apparel, and Comfort Colors.

- Marketing Strategy: Focuses on building consumer awareness and loyalty through strategic advertising and promotions.

- Channel Focus: Engages consumers in both traditional retail and growing direct-to-consumer markets.

- Brand Equity: Investments in brand marketing aim to strengthen the perceived value and desirability of its products.

Gildan's key activities include managing its vertically integrated manufacturing, which spans yarn spinning to garment production, ensuring cost efficiency and quality control. They also focus on extensive wholesale distribution and sales of blank apparel, serving a broad customer base of decorators and printers.

Furthermore, the company actively cultivates its owned brands, such as Gildan, American Apparel, and Comfort Colors, through targeted marketing and management to build consumer recognition and loyalty.

In 2023, Gildan reported net sales of $3.1 billion, with its integrated manufacturing contributing to strong financial performance and consistent product quality.

Their operational flexibility in 2024, leveraging this vertical integration, allowed them to respond to market demands and manage costs effectively amidst global uncertainties.

| Key Activity | Description | 2023 Impact |

| Vertical Manufacturing | End-to-end control from fiber to garment | Contributed to $3.1B net sales, ensured quality |

| Wholesale Distribution & Sales | Supplying blank apparel to decorators | Core revenue driver, required efficient logistics |

| Brand Management | Marketing Gildan, American Apparel, Comfort Colors | Aimed to enhance consumer recognition and loyalty |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Gildan Activewear that you are previewing is the exact document you will receive upon purchase. This means you're seeing a direct snapshot of the comprehensive analysis and strategic framework that will be delivered to you, ensuring no discrepancies or missing information.

What you see here is not a simplified sample or a conceptual mockup; it's a genuine preview of the complete Gildan Activewear Business Model Canvas. Once your purchase is complete, you will gain full access to this identical, professionally structured document, ready for your immediate use and adaptation.

Resources

Gildan's vertically integrated manufacturing facilities are a cornerstone of its business model. The company owns and operates extensive production sites across Central America, the Caribbean, North America, and Bangladesh. This vast physical asset base allows for significant control over the entire production process, from yarn spinning to finished garment assembly.

This integration is key to Gildan's cost leadership. For instance, in 2023, Gildan continued to leverage its manufacturing footprint to manage input costs effectively, contributing to its strong performance in the activewear market. Owning these facilities, rather than relying on third-party manufacturers, provides greater flexibility and efficiency in meeting demand.

Gildan Activewear's strength lies in its diverse portfolio of owned brands, including household names like Gildan, American Apparel, Comfort Colors, GOLDTOE, and Peds. These brands are significant intangible assets, bolstering market presence and consumer recognition.

In 2023, Gildan's activewear segment, driven by its core Gildan brand, saw continued demand, contributing significantly to its overall revenue. This brand equity allows for premium pricing and strong customer loyalty.

The acquisition and integration of brands like American Apparel and Comfort Colors have further diversified Gildan's customer base and product offerings, enhancing its competitive edge in various market segments.

Gildan Activewear’s skilled global workforce is a cornerstone of its operations, with approximately 50,000 employees worldwide. This vast team is instrumental in driving the company's success and achieving its ambitious Environmental, Social, and Governance (ESG) goals.

The engagement and expertise of these individuals are critical for maintaining high standards in production and innovation. Their collective skills ensure operational efficiency and contribute significantly to Gildan's ability to meet its sustainability commitments.

Proprietary Technologies and Processes

Gildan Activewear's proprietary technologies are a cornerstone of its competitive edge, focusing on manufacturing innovations that enhance both efficiency and product appeal. For example, their advanced dyeing processes significantly reduce water consumption, a critical factor in sustainable apparel production. In 2023, Gildan reported a 10% reduction in water intensity across its operations compared to 2020 benchmarks, showcasing the tangible impact of these proprietary methods.

These technological investments translate directly into superior product attributes, such as enhanced fabric softness, which is a key differentiator in the activewear market. Gildan's commitment to research and development in this area allows them to consistently deliver high-quality garments that meet evolving consumer demands. The company’s ongoing efforts in process optimization are designed to maintain cost leadership while elevating product performance.

- Water Reduction Technologies: Proprietary dyeing and finishing techniques that lower water usage per garment.

- Fabric Softening Innovations: Patented processes that improve the feel and comfort of activewear fabrics.

- Manufacturing Efficiency Systems: Advanced automation and process controls that optimize production speed and reduce waste.

- Sustainability Integration: Technologies embedded within manufacturing to minimize environmental impact, aligning with ESG goals.

Extensive Distribution Network

Gildan's extensive distribution network is a cornerstone of its operations, ensuring efficient product flow to a diverse customer base. This network spans North America, Europe, Asia Pacific, and Latin America, facilitating broad market reach.

The company leverages a robust logistics infrastructure, including strategically located distribution centers and strong relationships with third-party logistics providers. This allows for timely and cost-effective delivery of its wide array of activewear and apparel basics.

- Global Reach: Serves customers across North America, Europe, Asia Pacific, and Latin America.

- Logistical Efficiency: Utilizes strategically placed distribution centers and third-party logistics partners.

- Product Availability: Ensures consistent availability of its extensive product catalog.

Gildan's key resources are its vast, vertically integrated manufacturing facilities and its portfolio of strong, recognizable brands. These assets, coupled with a skilled global workforce and proprietary technologies, form the bedrock of its operational efficiency and market competitiveness. The company's extensive distribution network ensures these resources translate into widespread product availability.

| Resource Category | Key Components | Significance |

|---|---|---|

| Manufacturing Assets | Owned production sites across multiple continents, vertically integrated operations | Cost leadership, production control, efficiency |

| Brand Portfolio | Gildan, American Apparel, Comfort Colors, GOLDTOE, Peds | Market presence, consumer recognition, premium pricing potential |

| Human Capital | Approximately 50,000 employees worldwide | Operational efficiency, innovation, ESG goal achievement |

| Intellectual Property | Proprietary manufacturing technologies (e.g., water reduction, fabric softening) | Enhanced product quality, sustainability, cost advantage |

| Distribution Network | Global reach, strategically located distribution centers, logistics partnerships | Product availability, market access, customer service |

Value Propositions

Gildan Activewear’s core value proposition is delivering everyday basic apparel at highly competitive prices. This is achieved through a low-cost, large-scale, vertically integrated manufacturing approach, which is a cornerstone of their business strategy.

This efficient production model allows Gildan to offer significant value to both its wholesale distributors and retail partners. For instance, in 2023, Gildan reported net sales of $3.08 billion, demonstrating the scale at which they operate and the demand for their cost-effective products.

Gildan's vertically integrated approach provides deep control over its supply chain, from sourcing raw materials like cotton to manufacturing finished apparel. This integration, a cornerstone of their business model, allows for meticulous oversight at every stage. For instance, in 2023, Gildan operated numerous company-owned facilities, which significantly reduces reliance on third-party suppliers and mitigates risks of disruption.

This comprehensive control directly translates into consistent product quality and enhanced efficiency. By managing the entire production process, Gildan can implement stringent quality checks, ensuring that their activewear meets high standards. This operational advantage was evident in their ability to maintain production levels and deliver products reliably throughout various market conditions in 2023.

Gildan's core strength lies in offering blank apparel, a canvas for creativity. This makes their products incredibly versatile for screen printers, embroiderers, and other embellishment businesses who rely on high-quality, customizable garments to meet their clients' unique design needs.

This focus on customization directly fuels the success of their B2B customers. For instance, in 2023, Gildan reported net sales of $3.07 billion, a significant portion of which is driven by these very businesses that transform their blank apparel into branded merchandise and promotional items.

Strong Brand Recognition and Variety

Gildan leverages its portfolio of company-owned brands, including Gildan, American Apparel, and Comfort Colors, to offer a wide array of recognized products. This brand diversity allows Gildan to appeal to various consumer preferences and market segments.

The company's strong brand recognition translates into customer loyalty and trust, simplifying purchasing decisions for consumers. This variety ensures that Gildan can meet the needs of a broad customer base, from budget-conscious shoppers to those seeking premium or niche apparel.

- Gildan Activewear's brand strength: In 2023, Gildan reported net sales of $3.09 billion, demonstrating the significant market presence and demand for its diverse product offerings.

- Brand portfolio catering to different segments: The Gildan brand is known for its value and wide availability, while American Apparel targets a more fashion-forward and ethically conscious consumer, and Comfort Colors appeals to those seeking a vintage, soft-washed aesthetic.

- Customer choice and market penetration: This multi-brand strategy allows Gildan to capture market share across different price points and style preferences, enhancing overall sales volume and brand equity.

Commitment to Sustainable Practices

Gildan Activewear places a strong emphasis on its commitment to industry-leading labor, environmental, and governance (ESG) practices across its entire supply chain. This dedication is a core part of their value proposition, ensuring responsible manufacturing.

This focus on sustainability is increasingly important to consumers and investors alike. In 2024, Gildan continued to report on its progress in areas like water stewardship and carbon emissions reduction, demonstrating tangible efforts to minimize its environmental footprint. For example, the company aims to reduce its greenhouse gas intensity by 30% by 2030 compared to a 2018 baseline.

- Responsible Manufacturing: Gildan’s commitment to ethical labor standards and environmental protection enhances its brand image and appeals to a growing segment of socially conscious consumers.

- Stakeholder Trust: Transparent reporting on ESG initiatives builds trust with investors, employees, and the communities in which it operates.

- Competitive Advantage: Proactive sustainability efforts differentiate Gildan in the apparel market, attracting business partners who prioritize ethical sourcing.

- Long-Term Viability: By integrating ESG principles, Gildan aims to ensure the long-term resilience and success of its operations.

Gildan Activewear's value proposition centers on providing high-quality, basic apparel at accessible price points, driven by an efficient, vertically integrated manufacturing model. This operational structure allows for cost control and consistent product standards, benefiting wholesale and retail partners alike. In 2023, the company achieved net sales of $3.08 billion, underscoring the significant market demand for their offerings.

Customer Relationships

Gildan Activewear cultivates deep, enduring connections with its wholesale partners, including distributors and screen printers. These relationships are built on a foundation of direct sales engagement and specialized account management, ensuring a keen understanding of their unique requirements for large-volume purchases and personalized product offerings.

Gildan actively cultivates brand loyalty for its direct-to-consumer (DTC) offerings through targeted marketing. For instance, in 2023, Gildan continued to invest in digital marketing initiatives aimed at enhancing consumer engagement and brand recognition across its various product lines.

The company's online presence is a key channel for fostering a direct connection with end-users, facilitating feedback and building community. This focus on consumer interaction is crucial for differentiating its branded apparel in a competitive market.

Gildan actively fosters trust with its stakeholders, including customers, by openly sharing its Environmental, Social, and Governance (ESG) efforts. This commitment to transparency is crucial for building lasting relationships in today's conscious market.

Their regular ESG reports, which detail progress and dedication to responsible operations, serve as a key touchpoint. For instance, Gildan's 2023 ESG report highlighted a 20% reduction in greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress.

Customer Service and Support

Gildan Activewear prioritizes robust customer service to manage inquiries and resolve issues for its diverse customer base, encompassing both wholesale distributors and individual retail buyers. This focus aims to ensure a seamless and positive purchasing journey for everyone.

Effective support is key to maintaining strong relationships, especially given Gildan's significant global reach. In 2023, the company reported net sales of $3.06 billion, underscoring the importance of efficient customer interactions across its vast operations.

- Dedicated Support Channels: Gildan offers various avenues for customer assistance, including online portals, email, and phone support, catering to different preferences and needs.

- Order Management Efficiency: Streamlined processes for order placement, tracking, and fulfillment are critical for customer satisfaction, particularly for large wholesale orders.

- Issue Resolution: Prompt and effective handling of any product or delivery issues builds trust and encourages repeat business.

- Feedback Integration: Customer feedback is actively sought and used to improve service delivery and product offerings.

Innovation-Driven Loyalty

Gildan actively cultivates customer loyalty through a commitment to product innovation. By consistently introducing advancements like their Soft Cotton Technology, they aim to delight and retain their customer base. This focus on enhancing comfort and performance directly addresses evolving consumer demands, ensuring customers return for superior quality.

This strategy is crucial for maintaining market share. For instance, in 2023, Gildan's activewear segment continued to be a significant contributor to their overall revenue, underscoring the importance of customer satisfaction driven by product quality and innovation.

- Innovation as a Loyalty Driver: Gildan's introduction of technologies like Soft Cotton enhances the customer experience, encouraging repeat purchases.

- Meeting Evolving Preferences: The company’s focus on comfort and performance aligns with current consumer trends, making their products more appealing.

- Customer Retention and Acquisition: By consistently delivering on quality and innovation, Gildan strengthens its bond with existing customers and attracts new ones.

Gildan Activewear fosters strong relationships with its wholesale partners through dedicated account management and direct sales engagement. For its direct-to-consumer (DTC) business, the company invests in digital marketing and online presence to build brand loyalty and community, as seen in its continued digital marketing investments throughout 2023.

Transparency in Environmental, Social, and Governance (ESG) efforts, such as the 20% reduction in greenhouse gas emissions intensity reported in their 2023 ESG report, builds trust with all stakeholders.

Gildan's commitment to product innovation, exemplified by technologies like Soft Cotton, is a key driver for customer retention and satisfaction, contributing significantly to their 2023 net sales of $3.06 billion.

| Customer Relationship Aspect | Key Activities/Strategies | Impact/Data Point (2023 unless otherwise specified) |

|---|---|---|

| Wholesale Partner Engagement | Direct Sales, Account Management | Supports large-volume purchases and personalized offerings. |

| Direct-to-Consumer (DTC) Loyalty | Digital Marketing, Online Presence | Enhances consumer engagement and brand recognition. |

| Trust Building | ESG Transparency, Regular ESG Reports | Demonstrated by a 20% reduction in greenhouse gas emissions intensity (vs. 2019 baseline). |

| Customer Service | Multiple Support Channels, Issue Resolution | Ensures a positive purchasing journey across $3.06 billion in net sales. |

| Product Innovation | Introduction of new technologies (e.g., Soft Cotton) | Drives customer retention and satisfaction in the activewear segment. |

Channels

Gildan's primary sales avenue is its vast wholesale distribution network. This channel is crucial for getting their blank apparel to a wide array of businesses that decorate the garments.

These distributors act as the vital link, ensuring Gildan's products reach thousands of screen printers, embroiderers, and other businesses that customize apparel. In 2023, Gildan reported net sales of $3.09 billion, highlighting the significant volume moved through these wholesale partnerships.

This extensive network allows Gildan to maintain a strong presence in the business-to-business market, serving a diverse customer base that relies on consistent availability of quality blank apparel.

Gildan maintains direct sales channels to major screen printers and embellishers, complementing its distributor network. This direct approach fosters deeper relationships, enabling Gildan to offer customized product solutions and gain valuable insights into the specific needs of these significant business clients.

In 2024, Gildan’s focus on direct relationships with large-scale decorators like screen printers and embellishers is crucial for understanding evolving market demands. For instance, the apparel decoration industry, a key customer segment, saw continued growth in demand for customized apparel, with projections indicating a steady upward trend through 2025, driven by e-commerce and personalized fashion.

Gildan Activewear leverages physical retail stores to showcase its branded apparel, including popular lines like American Apparel and Comfort Colors. This direct-to-consumer channel offers significant visibility for their finished goods, allowing customers to experience the quality and feel of the garments firsthand.

E-commerce Platforms

Gildan Activewear actively utilizes a multi-channel e-commerce strategy, selling its branded apparel directly to consumers and through various online marketplaces. This digital approach is crucial for reaching a wide customer base and capitalizing on the increasing preference for online purchasing. In 2024, e-commerce sales continued to be a significant growth driver for apparel companies, with global online retail sales projected to reach trillions of dollars.

By leveraging platforms like Amazon, Walmart.com, and its own direct-to-consumer website, Gildan expands its market presence beyond traditional brick-and-mortar retail. This strategy not only broadens accessibility but also allows for direct engagement with consumers, gathering valuable data on purchasing habits and preferences. The company's investment in digital infrastructure supports this expanding online footprint.

- Direct-to-Consumer (DTC) Website: Gildan operates its own e-commerce site, offering a curated selection of its products and fostering brand loyalty.

- Online Marketplaces: The company partners with major online retailers, significantly increasing product visibility and sales volume.

- Digital Marketing Integration: E-commerce efforts are supported by robust digital marketing campaigns to drive traffic and conversions.

Sales to Global Lifestyle Brand Companies

Gildan actively engages with major global lifestyle brand companies, acting as a direct apparel supplier. These partnerships are typically governed by specific contractual agreements, ensuring tailored product offerings and consistent quality. This business-to-business channel is a cornerstone of Gildan's sales strategy, leveraging its extensive manufacturing capabilities.

For instance, in 2023, Gildan continued to solidify its relationships with prominent brands, contributing significantly to their product lines. The company's ability to produce large volumes of high-quality activewear makes it an attractive partner for brands seeking reliable supply chains. This channel allows these brands to focus on design, marketing, and distribution, while relying on Gildan for manufacturing excellence.

- Direct Supply Agreements: Gildan enters into direct supply contracts with global lifestyle brands, providing them with a consistent and reliable source of apparel.

- Brand Partnerships: These relationships are crucial, enabling lifestyle brands to outsource their manufacturing needs to a trusted and experienced provider.

- Volume and Quality Focus: Gildan's capacity for high-volume production and commitment to quality are key selling points for these large-scale brand collaborations.

- 2024 Outlook: The company anticipates continued growth in this segment, driven by ongoing demand from established and emerging lifestyle brands seeking efficient and cost-effective apparel manufacturing solutions.

Gildan's channels are diverse, encompassing wholesale, direct sales to decorators, retail, e-commerce, and direct supply to lifestyle brands. This multi-faceted approach ensures broad market penetration and caters to different customer segments.

The wholesale distribution network remains a powerhouse, moving significant volume. Direct sales to large decorators offer deeper customer insights, while physical retail and e-commerce provide direct consumer engagement. Supplying lifestyle brands leverages Gildan's manufacturing scale.

In 2023, Gildan's net sales reached $3.09 billion, underscoring the effectiveness of its extensive distribution and sales channels. The company's 2024 strategy continues to emphasize strengthening these relationships and expanding its digital presence.

| Channel | Key Activity | 2023 Impact | 2024 Focus |

|---|---|---|---|

| Wholesale Distribution | Supplying blank apparel to decorators | Significant sales volume | Maintaining strong partnerships |

| Direct Sales to Decorators | Building relationships with large clients | Valuable market insights | Tailored product solutions |

| Physical Retail | Showcasing branded apparel | Brand visibility | Enhancing customer experience |

| E-commerce | Direct-to-consumer and marketplace sales | Growth driver | Expanding online footprint |

| Direct Supply to Brands | Contract manufacturing for lifestyle brands | Core sales strategy | Continued growth in segment |

Customer Segments

Wholesale distributors are a cornerstone of Gildan Activewear's strategy, acting as high-volume purchasers who then supply Gildan's blank apparel to a diverse range of businesses. These entities are vital links in Gildan's distribution network, facilitating extensive market reach and ensuring efficient product flow to numerous end-users.

Screen printers and embellishers are a core customer segment for Gildan Activewear. These businesses, ranging from small local shops to larger production houses, rely on Gildan's extensive catalog of blank apparel as the canvas for their customization services. They cater to a wide array of clients, including businesses needing branded uniforms, sports leagues requiring team jerseys, and organizations seeking promotional merchandise.

In 2024, the demand for customized apparel remained robust, driven by a continued emphasis on brand identity and team spirit across various sectors. Screen printers and embellishers are significant purchasers of Gildan's foundational products like t-shirts, sweatshirts, and hoodies, utilizing them for printing logos, graphics, and slogans. Their operations are critical in transforming basic garments into marketable items.

Retail consumers are individuals who directly purchase Gildan's everyday apparel, like t-shirts, activewear, underwear, and socks, from various retail outlets or online stores. They are looking for comfortable, reliable basics for their personal wardrobes.

In 2024, Gildan continued to see strong demand from this segment, particularly for its core t-shirt and activewear offerings, which are staples for many consumers. The company's focus on value and widespread availability through numerous retail partners makes it a go-to brand for everyday wear.

Global Lifestyle Brand Companies

Global lifestyle brand companies represent a key B2B customer segment for Gildan Activewear. These international apparel and lifestyle entities may partner with Gildan for product sourcing, potentially through manufacturing agreements or licensing arrangements. This signifies a strategic partnership focus, where Gildan's manufacturing capabilities are leveraged by other established brands.

For instance, major global brands often seek reliable, high-volume production partners to meet demand for their own branded apparel lines. Gildan's extensive global footprint and efficient production processes make it an attractive option for these companies looking to expand their reach or introduce new product categories. In 2024, the global apparel market continued its growth trajectory, with many lifestyle brands actively seeking to diversify their supply chains and enhance production efficiency.

- Strategic Sourcing: Lifestyle brands utilize Gildan for manufacturing their own branded activewear or casual wear.

- Licensing Opportunities: Brands may license their designs or intellectual property to Gildan for production.

- Global Reach: Gildan's international presence supports the expansion plans of these global lifestyle brands.

- Market Demand: In 2024, the demand for private label and co-branded apparel remained strong, benefiting companies like Gildan.

Promotional Products Industry

Businesses in the promotional products industry are a key customer segment for Gildan Activewear. They purchase blank apparel to create branded merchandise, corporate giveaways, and event-specific clothing. This sector relies on Gildan's offerings for cost-effective and customizable apparel solutions.

In 2024, the promotional products industry continued to be a significant market. For instance, the industry's overall sales reached an estimated $25.8 billion in the US, with apparel remaining a dominant product category, accounting for a substantial portion of these sales.

- Target Market: Businesses seeking branded apparel for marketing, employee recognition, and corporate events.

- Product Usage: Gildan's blank t-shirts, hoodies, and other activewear are used as a base for printing logos and custom designs.

- Value Proposition: Cost-effectiveness, consistent quality, and a wide range of styles suitable for customization.

- Market Size Indicator: The promotional products industry's reliance on apparel highlights Gildan's crucial role in supplying this vibrant sector.

Gildan Activewear serves a diverse customer base, primarily through wholesale distributors who then supply a wide array of businesses, including screen printers and embellishers. These B2B clients transform Gildan's blank apparel into customized items for various markets, from corporate branding to sports teams. Additionally, Gildan directly reaches retail consumers seeking everyday basics and partners with global lifestyle brands for sourcing and potential licensing. The promotional products industry also represents a significant segment, leveraging Gildan's offerings for branded merchandise and corporate giveaways.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Wholesale Distributors | High-volume purchasers, broad market reach | Essential for efficient product flow to numerous end-users. |

| Screen Printers & Embellishers | Customize blank apparel for diverse clients | Core customers relying on Gildan's extensive catalog for printing logos and graphics. Demand for customized apparel remained robust in 2024. |

| Retail Consumers | Individuals buying everyday apparel for personal use | Strong demand for staples like t-shirts and activewear, valued for comfort and widespread availability. |

| Global Lifestyle Brands | Seek product sourcing and manufacturing partners | Leverage Gildan's global footprint and production for their own branded lines; global apparel market growth in 2024 supported this. |

| Promotional Products Industry | Purchase blank apparel for branded merchandise | Significant market; apparel is a dominant category in the US promotional products industry, which saw robust activity in 2024. |

Cost Structure

Raw material procurement, especially for cotton and synthetic fibers, represents a substantial component of Gildan Activewear's cost structure. The company's vertically integrated model, which includes yarn spinning and fabric manufacturing, aims to provide greater control over these expenses.

Despite these efforts, Gildan remains exposed to the volatility of global commodity markets, where price swings in cotton can directly affect its profitability. For instance, in 2023, cotton prices experienced significant fluctuations, impacting input costs for apparel manufacturers worldwide.

Operating Gildan's large-scale, vertically integrated manufacturing facilities involves significant costs. These include substantial outlays for energy consumption, ongoing machinery maintenance, and general factory overhead.

In 2023, Gildan reported Cost of Goods Sold (COGS) of approximately $2.4 billion, reflecting these extensive manufacturing expenses. The company's strategic decision to shift a portion of its production to locations like Bangladesh is a direct effort to optimize these operational costs and improve cost efficiency.

Gildan Activewear's workforce of roughly 50,000 individuals worldwide makes labor costs a significant component of its overall expenses. This substantial employee base necessitates careful management of wages and benefits to ensure operational efficiency and competitive positioning.

The company's commitment to fair and responsible compensation practices directly influences its wage structure. This focus on ethical labor standards, while potentially increasing direct labor expenses, aligns with broader corporate social responsibility goals and contributes to employee retention and productivity.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses for Gildan Activewear encompass crucial operational costs like marketing, sales efforts, distribution logistics, and corporate overhead. These functions are vital for maintaining brand presence and ensuring products reach consumers efficiently. For instance, in 2023, Gildan's SG&A expenses were approximately $831 million, reflecting investments in these areas.

Gildan consistently strives for operational efficiency, but ongoing business activities and strategic growth initiatives naturally contribute to SG&A. These investments are designed to support long-term profitability and market position. The company's commitment to vertical integration helps manage some of these costs, but external market dynamics and planned expansions still necessitate significant SG&A spending.

- Marketing and Sales: Costs associated with advertising, promotions, and sales team operations.

- Distribution: Expenses related to warehousing, transportation, and managing the supply chain.

- General and Administrative: Overhead costs including executive salaries, IT, legal, and human resources.

- Strategic Initiatives: Investments in new market development, product innovation, and efficiency improvements.

Capital Expenditures (CapEx)

Gildan Activewear's commitment to capital expenditures is a cornerstone of its operational strategy. In 2024, the company continued its focus on enhancing manufacturing capabilities and expanding its global footprint. These investments are vital for maintaining Gildan's position as a low-cost producer and supporting its ambitious growth targets.

The company's CapEx strategy in 2024 was largely directed towards modernizing existing facilities and investing in new, efficient production lines. This ensures that Gildan can meet increasing demand while optimizing its cost structure. For instance, significant portions were allocated to automation and technology upgrades to improve output and reduce waste.

- Capacity Expansion: Investments in new facilities and expansion of existing ones to meet growing market demand.

- Technological Advancements: Upgrading machinery and implementing new technologies to improve efficiency and product quality.

- Sustainability Initiatives: Capital outlays for environmentally friendly upgrades and processes, aligning with corporate responsibility goals.

- Infrastructure Maintenance: Ongoing investments to ensure the reliability and longevity of its extensive manufacturing and distribution network.

Gildan's cost structure is heavily influenced by its raw material procurement, particularly cotton and synthetic fibers. The company's vertically integrated model aims to mitigate some of this volatility, although global commodity market fluctuations, like those seen with cotton in 2023, remain a factor.

Operating its extensive manufacturing facilities incurs significant costs, including energy, maintenance, and overhead. In 2023, Gildan's Cost of Goods Sold (COGS) was approximately $2.4 billion, underscoring these operational expenses. Strategic shifts to locations like Bangladesh aim to optimize these costs.

Labor costs are substantial given Gildan's global workforce of around 50,000 employees. Selling, General & Administrative (SG&A) expenses, which include marketing, sales, and distribution, also represent a significant investment, totaling approximately $831 million in 2023.

| Cost Component | Approximate 2023 Impact | Key Drivers |

| Cost of Goods Sold (COGS) | $2.4 billion | Raw materials (cotton, synthetics), manufacturing operations (energy, labor, overhead) |

| Selling, General & Administrative (SG&A) | $831 million | Marketing, sales, distribution, corporate overhead |

| Capital Expenditures (CapEx) | Ongoing investments in 2024 | Capacity expansion, technological advancements, infrastructure maintenance |

Revenue Streams

Gildan Activewear's main income source is selling large quantities of unadorned clothing, like t-shirts, underwear, and socks, to businesses. These customers include wholesale distributors, companies that print designs on apparel, and those who add embellishments. This business-to-business approach is the core of how they make money.

In 2023, Gildan reported net sales of $3.09 billion, with a significant portion derived from these wholesale operations. The company's strategy relies on high-volume sales to a broad base of commercial clients.

Gildan Activewear generates significant revenue through the direct sale of its popular brands like Gildan, American Apparel, and Comfort Colors. These sales occur across a wide array of retail locations and their own e-commerce sites, offering consumers direct access to their products. This strategy diversifies Gildan's income streams beyond wholesale.

Activewear segment sales are a cornerstone of Gildan's business, consistently driving significant revenue. This segment encompasses a broad range of products, including popular t-shirts, comfortable sweatshirts, and other athletic apparel.

In 2023, Gildan reported that its Printwear segment, which largely comprises activewear, generated approximately $2.1 billion in sales. This demonstrates the substantial contribution of these everyday apparel items to the company's financial performance.

Underwear and Socks Segment Sales

Gildan Activewear generates revenue through its underwear and socks segment, a significant part of its diverse product offering. While this category has historically been a stable contributor, it has experienced shifts. For instance, the company has strategically phased out certain licensed products, such as those associated with the Under Armour brand, to streamline its portfolio and focus on core competencies.

This strategic adjustment reflects a dynamic approach to market demands and brand partnerships. Despite these changes, the underwear and socks segment continues to be a revenue driver for Gildan. The company's ability to adapt its product mix, including its branded apparel lines, is crucial for maintaining consistent sales performance in this competitive market.

Key revenue drivers within this segment include:

- Sales of basic and fashion underwear styles for men, women, and children.

- Revenue from a wide range of sock products, including athletic, casual, and specialty socks.

- The ongoing development and marketing of proprietary brands within the underwear and socks categories.

Licensing and Other Agreements

Gildan Activewear diversifies its income through strategic licensing arrangements, allowing other companies to utilize its well-recognized brands. This includes agreements like the one for the Champion brand in the printwear sector, expanding its market reach without direct operational involvement in those specific segments.

Furthermore, Gildan enters into supply contracts with various global lifestyle brands, providing them with products under specific terms. These agreements represent a significant revenue stream, leveraging Gildan's manufacturing capabilities and scale to serve a broader customer base.

- Brand Licensing: Generating revenue by allowing other entities to use Gildan's brand names, such as Champion, for specific product categories like printwear.

- Product Supply Contracts: Earning income by manufacturing and supplying apparel to other global lifestyle brands under contractual agreements.

Gildan's revenue primarily stems from its wholesale business, selling unadorned apparel like t-shirts and underwear to decorators and distributors. This B2B model focuses on high-volume sales, a strategy that yielded substantial results. In 2023, Gildan reported net sales of $3.09 billion, with a significant portion attributed to these wholesale channels.

The company also generates income through direct-to-consumer sales of its popular brands, including Gildan, American Apparel, and Comfort Colors, via retail and e-commerce. Additionally, licensing agreements, such as the one for the Champion brand in printwear, and supply contracts with other lifestyle brands contribute to its diverse revenue streams.

| Revenue Source | Description | 2023 Contribution (Approx.) |

| Wholesale Activewear | Sales of blank t-shirts, sweatshirts, etc., to decorators and distributors. | $2.1 billion (Printwear segment) |

| Branded Apparel Sales | Direct sales of Gildan, American Apparel, Comfort Colors through retail and e-commerce. | Significant portion of total sales |

| Underwear & Socks | Sales of underwear and socks, including branded lines. | Stable contributor, subject to strategic adjustments. |

| Licensing & Supply Contracts | Revenue from allowing others to use brands (e.g., Champion) and supplying other lifestyle brands. | Diversified income streams |

Business Model Canvas Data Sources

The Gildan Activewear Business Model Canvas is built upon a foundation of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of Gildan's performance, market position, and strategic direction.