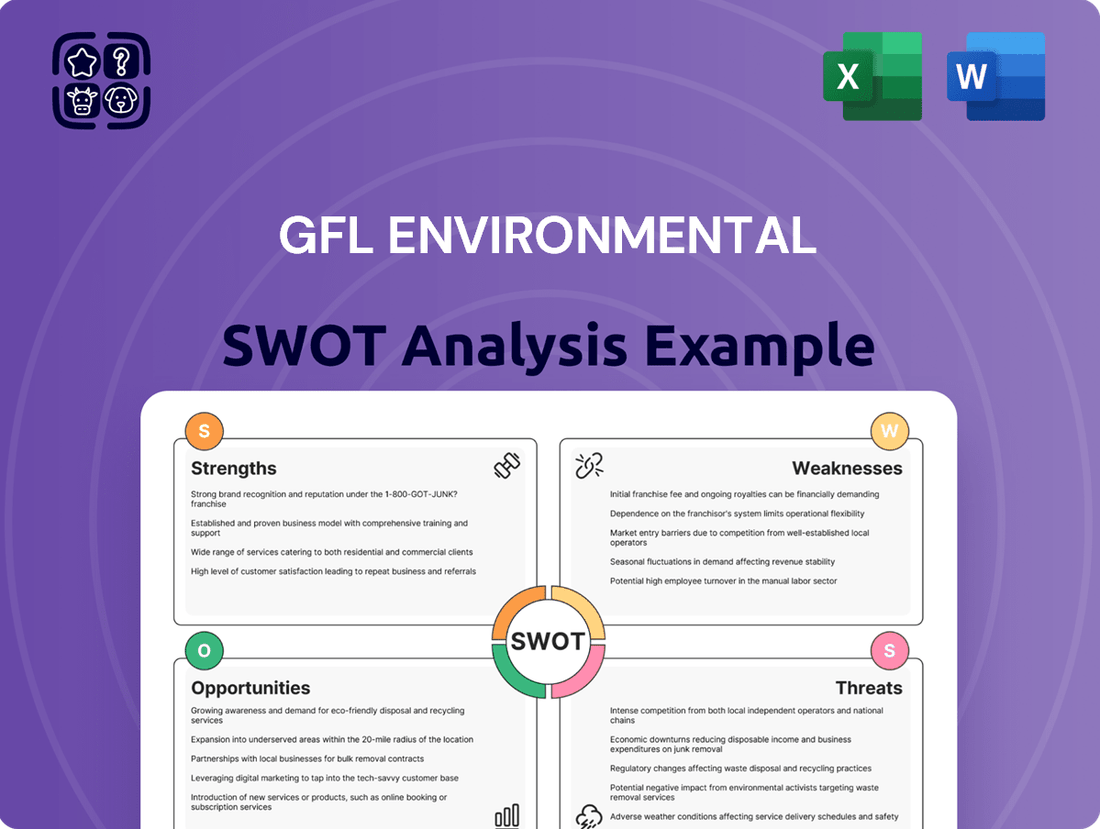

GFL Environmental SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFL Environmental Bundle

GFL Environmental demonstrates significant strengths in its integrated waste management services and a strong North American presence. However, potential weaknesses include reliance on acquisitions and operational costs. Understanding these dynamics is crucial for navigating the competitive environmental services landscape.

Want the full story behind GFL Environmental's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GFL Environmental boasts a remarkably diversified service portfolio, encompassing non-hazardous solid waste management, infrastructure and soil remediation, and liquid waste management. This broad offering allows them to cater to a wide array of clients, from municipalities and residences to commercial and industrial sectors. In 2023, GFL reported revenue of approximately $7.0 billion, a testament to the broad market reach their diversified services provide, reducing dependence on any single segment and fostering greater financial resilience.

GFL Environmental has showcased impressive financial strength, with revenue climbing to $1.68 billion in Q2 2025, exceeding market forecasts. This robust top-line growth was complemented by a reported net income of $276.3 million for the same period. The company's performance highlights a consistent upward trajectory in its financial results.

Further underscoring this strength, GFL Environmental raised its full-year 2025 Adjusted EBITDA guidance. This upward revision signals strong organic financial performance and confidence in continued operational efficiency and market demand. The company's ability to consistently grow revenue and profitability points to a solid financial foundation.

GFL's growth strategy is heavily reliant on strategic acquisitions, which have been instrumental in expanding its geographical reach and service capabilities across North America. This approach has allowed the company to consolidate market share and diversify its revenue streams.

A significant development occurred in March 2025 with the sale of its Environmental Services business for $8 billion. This strategic divestiture substantially reduced GFL's debt levels, improving its financial flexibility and providing ample capital to pursue further acquisitions within its core solid waste and recycling operations.

Commitment to Sustainability and Innovation

GFL Environmental demonstrates a strong commitment to sustainability by setting ambitious environmental goals. The company has raised its target for reducing greenhouse gas emissions, aiming for an absolute reduction of 30% in Scope 1 and 2 emissions by 2030. This dedication is further evidenced by their significant investments in renewable natural gas (RNG) projects and state-of-the-art material recovery facilities (MRFs).

These investments are geared towards diverting more waste from landfills and simultaneously generating clean energy, showcasing GFL's innovative approach to waste management. For instance, their expansion into RNG projects positions them to capitalize on the growing demand for sustainable fuel sources. The advancements in their MRFs are designed to improve recycling rates and extract more value from waste streams.

- Increased GHG Reduction Target: Aiming for a 30% absolute reduction in Scope 1 and 2 emissions by 2030.

- Investment in RNG: Actively developing renewable natural gas projects to create clean energy from waste.

- Advanced MRFs: Enhancing material recovery facilities to boost recycling efficiency and waste diversion.

Operational Efficiency and Margin Expansion

GFL Environmental has made significant strides in boosting operational efficiency, a key strength that translates directly into improved profitability. This focus on cost optimization and streamlined processes has allowed the company to consistently expand its Adjusted EBITDA margins.

A prime example of this success is GFL's performance in the second quarter of 2025, where they achieved a record-high solid waste EBITDA margin of 34.7%. This impressive figure was primarily fueled by strategic core pricing increases and a healthy uptick in volume growth across their operations.

- Record Q2 2025 Solid Waste EBITDA Margin: 34.7%

- Drivers of Margin Expansion: Core pricing increases and volume growth

- Strategic Focus: Ongoing commitment to operational efficiency and cost optimization

GFL's diversified service model, covering solid waste, infrastructure, and liquid waste, provides a robust foundation, as evidenced by its $7.0 billion revenue in 2023. This breadth reduces reliance on any single market segment, enhancing financial stability and resilience. The company's strategic acquisitions have also been a significant strength, enabling market consolidation and revenue diversification across North America.

Financially, GFL demonstrated strong performance in Q2 2025, reporting $1.68 billion in revenue and $276.3 million in net income, surpassing expectations. This upward trend is further supported by an increased full-year 2025 Adjusted EBITDA guidance, reflecting operational efficiency and sustained market demand. The divestiture of its Environmental Services business in March 2025 for $8 billion significantly deleveraged the company, bolstering financial flexibility for future strategic moves.

GFL's commitment to sustainability is a notable strength, highlighted by its goal to reduce Scope 1 and 2 greenhouse gas emissions by 30% by 2030. Investments in renewable natural gas projects and advanced material recovery facilities (MRFs) underscore this dedication, positioning the company to benefit from the growing demand for clean energy and improved recycling practices.

Operational efficiency is a core strength, leading to improved profitability. GFL achieved a record solid waste EBITDA margin of 34.7% in Q2 2025, driven by strategic pricing and volume growth. This focus on cost optimization and streamlined processes continues to expand their EBITDA margins.

| Metric | Q2 2025 Value | Significance |

|---|---|---|

| Revenue | $1.68 billion | Demonstrates strong market penetration and demand. |

| Net Income | $276.3 million | Indicates robust profitability and operational success. |

| Solid Waste EBITDA Margin | 34.7% | Record high, showcasing effective cost management and pricing strategies. |

| Environmental Services Divestiture | $8 billion | Significantly reduced debt, enhancing financial flexibility and strategic capacity. |

What is included in the product

Delivers a strategic overview of GFL Environmental’s internal and external business factors, highlighting key growth drivers and operational gaps.

GFL Environmental's SWOT analysis provides a structured framework to identify and address critical operational challenges and market vulnerabilities.

Weaknesses

GFL Environmental's operating margins have lagged behind some of its larger waste management competitors. For instance, in the third quarter of 2023, GFL reported an Adjusted EBITDA margin of 23.2%, while Waste Management, a key competitor, posted a higher margin of 28.5% during the same period. This disparity suggests potential challenges in pricing power or higher operational expenses.

Despite a reported net income of $30.1 million in Q2 2025, GFL Environmental faced a significant net loss of $737.7 million for the entirety of 2024. This trend continued into the first half of 2024, with a net loss from continuing operations reaching $727.7 million.

These substantial past losses highlight a period of financial strain for the company. While recent performance in Q2 2025 shows improvement, these historical figures underscore the importance of continued scrutiny of GFL's financial health and its ability to sustain profitability.

GFL Environmental's financial performance is sensitive to swings in commodity prices, particularly those related to used motor oil and other non-fiber materials. These fluctuations can directly impact the company's top line and profitability, complicating financial planning and making it harder to predict future earnings.

For instance, a downturn in the selling price of recycled commodities, as seen in periods of economic slowdown, can put pressure on GFL's revenue streams. While the company benefits when these prices rise, the inherent volatility means that unpredictable market shifts can negatively affect margins, creating a challenging operating environment.

Integration Risks from Acquisitions

While GFL Environmental pursues growth through strategic acquisitions, these moves inherently introduce integration risks. Successfully absorbing new companies, their operational systems, and distinct corporate cultures is a complex undertaking. Failure to manage this process effectively can result in disruptions and unexpected expenses, potentially hindering the realization of anticipated synergies. For example, in 2023, GFL completed several acquisitions, and the ongoing integration of these entities presents a continuous challenge to operational efficiency and cost management.

Key integration challenges include:

- Systems Compatibility: Merging disparate IT, accounting, and operational platforms can be technically demanding and costly.

- Cultural Alignment: Reconciling differing company cultures and employee expectations is crucial for smooth transitions and employee retention.

- Synergy Realization: Achieving projected cost savings and revenue enhancements from acquisitions requires meticulous planning and execution.

Sensitivity to Foreign Exchange Rates

GFL Environmental's extensive operations across North America expose it to the vagaries of foreign exchange rates, primarily between the US Dollar (USD) and the Canadian Dollar (CAD). This currency mismatch can create headwinds for the company's financial reporting.

Fluctuations in these exchange rates directly impact GFL's reported revenues and Adjusted EBITDA. For instance, a stronger USD relative to the CAD can boost reported USD earnings when translated back into CAD, and vice versa. This sensitivity was highlighted in their financial updates throughout 2024, where management provided guidance that factored in potential currency translation impacts.

- Currency Exposure: GFL operates in both the US and Canada, leading to significant exposure to USD/CAD exchange rate fluctuations.

- Impact on Financials: Changes in the exchange rate can distort reported revenues and Adjusted EBITDA, making year-over-year comparisons more complex.

- Guidance Adjustments: The company's financial guidance often includes assumptions about currency movements, underscoring the material nature of this risk.

GFL's integration of acquisitions presents ongoing challenges, as seen with its 2023 acquisitions, which require careful management of systems compatibility and cultural alignment to realize projected synergies. Furthermore, the company's operating margins, such as the 23.2% Adjusted EBITDA margin in Q3 2023, have historically trailed competitors like Waste Management, which reported 28.5% in the same period, indicating potential inefficiencies or pricing power limitations.

The company's significant net loss of $737.7 million in 2024, despite a $30.1 million net income in Q2 2025, underscores past financial strain and the need for sustained profitability improvements. GFL's reliance on volatile commodity prices, like those for used motor oil, directly impacts revenue and profitability, creating forecasting difficulties.

Same Document Delivered

GFL Environmental SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at GFL Environmental's strategic positioning.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, detailing GFL Environmental's Strengths, Weaknesses, Opportunities, and Threats.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, providing actionable insights for GFL Environmental.

Opportunities

GFL Environmental is set to pursue an aggressive mergers and acquisitions strategy, especially within the solid waste and recycling sectors. This approach is further supported by the capital generated from its Environmental Services divestiture, providing a strong financial base for these strategic moves.

This M&A focus offers a substantial opportunity for GFL to expand its geographical reach, enhance its market share, and broaden its portfolio of services. For instance, in 2023, GFL completed 12 acquisitions, adding approximately $150 million in annualized revenue, demonstrating the tangible impact of this strategy.

GFL Environmental is strategically investing in Renewable Natural Gas (RNG) facilities and Extended Producer Responsibility (EPR) programs, which represent significant avenues for future growth. The company anticipates these initiatives will contribute substantially to its overall performance.

By the end of 2024, GFL plans to have 15 RNG facilities operational, a testament to its commitment to this expanding market. Furthermore, the company is poised to benefit from secured Canadian EPR contracts, further solidifying its position in the circular economy.

GFL Environmental is actively integrating advanced technologies like AI for route optimization, aiming to streamline collection and disposal processes. This focus on technological adoption is expected to drive significant cost savings and improve the overall efficiency of their operations.

Investments in sophisticated waste sorting systems are also a key part of GFL's strategy, enhancing material recovery and potentially opening new revenue streams. These technological upgrades are designed to boost service quality and ultimately increase profitability.

Deleveraging and Improved Financial Flexibility

The sale of GFL Environmental's Environmental Services business for $8 billion has been a game-changer, dramatically cutting its net leverage. This strategic move significantly boosts GFL's financial flexibility, bringing it closer to achieving an investment-grade credit rating.

This enhanced financial footing opens up exciting avenues for growth. GFL can now more confidently allocate capital towards expanding its operations organically, pursuing strategic mergers and acquisitions, and potentially returning value to its shareholders.

- Reduced Net Leverage: The $8 billion sale has substantially lowered GFL's debt burden.

- Path to Investment Grade: This deleveraging accelerates GFL's journey towards an investment-grade credit profile.

- Increased Capital Flexibility: Greater financial freedom allows for strategic investments in growth and shareholder returns.

Increasing Demand for Sustainable Solutions

The global market for sustainable waste management is experiencing significant growth, driven by increasing environmental awareness and stricter regulations. GFL Environmental is well-positioned to capitalize on this trend. For instance, in Q1 2024, GFL reported a 9.6% increase in revenue from its environmental services segment, which heavily features sustainable solutions like hazardous waste treatment and recycling. This growth reflects a broader market shift where companies are actively seeking partners committed to waste diversion and reducing their carbon footprint.

GFL's strategic focus on services such as landfill diversion, recycling, and the reduction of greenhouse gas emissions directly addresses the rising demand from environmentally conscious clients. This alignment allows GFL to attract and secure contracts with businesses and municipalities prioritizing sustainability. The company’s continued investment in advanced recycling technologies and waste-to-energy projects, which saw a 12% increase in capital expenditure in 2023, further solidifies its competitive advantage in this expanding market.

- Growing Market: The global waste management market is projected to reach over $2 trillion by 2030, with a significant portion attributed to sustainable solutions.

- GFL's Alignment: GFL's service portfolio, including recycling and waste diversion, directly meets the needs of environmentally conscious customers.

- Revenue Growth: GFL's environmental services segment demonstrated robust growth, indicating successful penetration into the sustainable solutions market.

- Investment in Sustainability: Increased capital expenditure on recycling and waste-to-energy projects underscores GFL's commitment to this opportunity.

GFL Environmental's strategic divestiture of its Environmental Services business for $8 billion significantly bolsters its financial flexibility, paving the way for an investment-grade credit rating. This deleveraging allows for increased capital allocation towards organic growth and strategic acquisitions.

The company's aggressive M&A strategy, evidenced by 12 acquisitions in 2023 adding $150 million in annualized revenue, presents a clear opportunity for market share expansion and service portfolio enhancement. Furthermore, GFL's substantial investments in Renewable Natural Gas (RNG) facilities, with 15 planned by the end of 2024, and secured Canadian Extended Producer Responsibility (EPR) contracts position it to capitalize on the growing demand for sustainable waste management solutions.

| Metric | 2023 Data | 2024 Outlook |

|---|---|---|

| Environmental Services Revenue Growth | 9.6% (Q1 2024) | Continued growth driven by sustainable solutions |

| RNG Facilities Operational | N/A | 15 by end of 2024 |

| Acquisitions Completed | 12 (2023) | Ongoing |

| Annualized Revenue from Acquisitions | ~$150 million (2023) | Expected increase |

Threats

GFL Environmental operates within a landscape of significant macroeconomic uncertainty. The company directly acknowledges that softness in key sectors like construction and industrial activity can directly reduce waste volumes, a primary driver of their business. This is a critical threat, as a slowdown in these areas can lead to lower revenue and impact overall financial performance.

These external economic headwinds pose a tangible risk to GFL's profitability. A sustained downturn in industrial output or a prolonged slump in new construction projects could compress operating margins and force a revision of growth forecasts. For instance, a 5% decline in construction waste volumes, a significant portion of GFL's business, could translate to millions in lost revenue.

The environmental services sector is a crowded marketplace, with numerous companies actively competing for business. GFL Environmental operates within this dynamic landscape, facing pressure from both established, large-scale competitors and smaller, specialized firms. This intense competition can impact GFL's ability to secure new contracts and may lead to downward pressure on pricing, potentially affecting profit margins.

Stricter environmental regulations, such as those concerning landfill emissions or waste diversion targets, could increase GFL's compliance costs. For instance, the company’s 2023 sustainability report highlights ongoing investments in emission control technologies for its facilities.

Adapting to evolving compliance standards, like potential new mandates for plastic recycling or hazardous waste management, may necessitate significant capital expenditures and operational adjustments. These changes could impact GFL's profitability and require strategic planning to mitigate financial burdens.

Labor and Supply Chain Constraints

GFL Environmental, like many in the waste management sector, faces significant headwinds from labor shortages and ongoing supply chain disruptions. These challenges can directly translate into higher operational expenses and difficulties in maintaining consistent service levels, impacting overall efficiency.

For instance, the trucking and logistics sector, crucial for GFL's operations, has been grappling with a persistent driver shortage. In 2024, the American Trucking Associations reported a shortage of over 78,000 drivers, a figure that continued to strain companies relying on timely transportation of materials and equipment.

- Labor Shortages: Difficulty in recruiting and retaining skilled workers, particularly drivers and technicians, can lead to increased wage pressures and reduced operational capacity.

- Supply Chain Disruptions: Delays in receiving essential equipment, parts for vehicle maintenance, and processing materials can impede service delivery and increase costs.

- Transportation Constraints: Limited availability of trucking services and rising fuel costs directly impact GFL's ability to efficiently collect and transport waste, potentially affecting profitability and customer satisfaction.

Interest Rate and Fuel Price Fluctuations

Changes in interest rates present a significant challenge for GFL Environmental. With substantial debt levels, even after recent deleveraging efforts, rising rates directly increase financing costs, potentially squeezing profitability. For instance, a 1% increase in interest rates on their outstanding debt could add tens of millions to annual interest expenses.

Fuel price volatility is another critical threat. GFL operates a vast fleet of vehicles for waste collection and transportation, making fuel a substantial operating expense. An unexpected surge in fuel prices, such as a 15% increase in diesel costs, could directly impact margins across their service lines, especially if these costs cannot be fully passed on to customers.

- Increased financing costs due to rising interest rates impacting profitability.

- Higher operating expenses from volatile fuel prices affecting margins.

- Potential erosion of profitability if cost increases cannot be offset by pricing adjustments.

GFL Environmental faces significant competition from both large, established players and smaller, niche firms, which can lead to pricing pressures and challenges in securing new contracts. Furthermore, evolving environmental regulations, such as stricter emissions standards or increased waste diversion mandates, necessitate ongoing capital investment and operational adjustments, potentially impacting profitability. For example, the company's 2023 sustainability report detailed significant investments in upgrading landfill gas capture systems to meet new regulatory requirements.

Economic downturns, particularly in construction and industrial sectors, directly reduce waste volumes, a core revenue driver for GFL. A slowdown in these key areas can lead to lower revenues and compressed operating margins. For instance, a 5% contraction in construction waste generation, a significant segment for GFL, could result in millions in lost revenue.

Labor shortages, especially for drivers and technicians, coupled with persistent supply chain disruptions, increase operational costs and can hinder service delivery. The trucking industry, vital for GFL's logistics, experienced a shortage of over 78,000 drivers in 2024, impacting timely transportation. Rising fuel prices also directly affect GFL's substantial fleet operating expenses, with a 15% increase in diesel costs potentially eroding margins if not passed on.

| Threat | Description | Impact |

| Intense Competition | Presence of numerous large and small competitors in the environmental services sector. | Pressure on pricing, difficulty in contract acquisition, potential margin erosion. |

| Regulatory Changes | Stricter environmental laws and waste diversion targets. | Increased compliance costs, need for capital investment in upgrades, operational adjustments. |

| Economic Slowdown | Reduced activity in construction and industrial sectors. | Lower waste volumes, decreased revenue, compressed operating margins. |

| Operational Costs | Labor shortages and volatile fuel prices. | Higher wage pressures, increased transportation expenses, potential service delivery disruptions. |

SWOT Analysis Data Sources

This GFL Environmental SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring a robust and data-driven perspective.