GFL Environmental Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFL Environmental Bundle

Unlock the strategic blueprint behind GFL Environmental's success with our comprehensive Business Model Canvas. This detailed analysis reveals their key customer segments, value propositions, and revenue streams, offering a clear roadmap for their market dominance. Discover how GFL Environmental builds and maintains its competitive edge.

Dive deeper into GFL Environmental’s operational genius with the full Business Model Canvas. This downloadable resource breaks down their core activities, key resources, and cost structure, providing invaluable insights for anyone looking to understand their growth strategy. Get the complete picture to inform your own business planning.

Partnerships

GFL Environmental's partnerships with municipalities and government agencies are foundational, securing essential long-term contracts for vital services like waste collection, recycling, and broader environmental management. These collaborations are key to serving residential and public sectors, ensuring GFL's operational footprint is deeply integrated within communities.

Working directly with local governments, GFL manages waste programs, a critical function that necessitates strict adherence to environmental regulations and public service expectations. For instance, in 2024, GFL continued to expand its municipal contracts, reflecting ongoing trust and the essential nature of its services in maintaining public health and environmental standards across numerous jurisdictions.

These governmental relationships are not just about service provision; they are the bedrock of GFL's stable revenue streams. The predictable nature of these contracts, often spanning many years, provides significant operational reach and financial predictability, allowing for strategic planning and investment in infrastructure and technology.

GFL Environmental collaborates with a broad spectrum of commercial and industrial businesses, ranging from local shops to major manufacturing plants, to handle their varied waste disposal needs. This partnership is crucial for GFL's revenue generation, with commercial services representing a significant portion of their operations.

These partnerships often involve specialized services such as the safe disposal of hazardous materials, environmental remediation of contaminated soil, and the management of liquid waste. In 2023, GFL reported substantial revenue from its commercial and industrial segments, underscoring the importance of these client relationships.

The success of these key partnerships hinges on GFL's ability to offer customized waste management solutions and consistently reliable service. This focus on client needs ensures long-term engagement and repeat business, a cornerstone of GFL's business model.

GFL Environmental actively partners with technology and innovation providers to advance its sustainable waste management solutions. These collaborations are crucial for integrating cutting-edge recycling processes and renewable energy technologies into GFL's operations. For instance, partnerships can facilitate the development of advanced sorting equipment or the implementation of cleaner fuel systems for their fleet, thereby boosting efficiency and reducing environmental footprint.

Acquired Companies and Integration Partners

GFL Environmental's growth strategy heavily relies on acquiring and integrating smaller environmental services companies. These partnerships are crucial for expanding their service offerings and geographic reach. For instance, the acquisition of Angelo's Recycled Materials in April 2024 demonstrates this ongoing commitment to consolidation within the industry.

The success of these acquisitions hinges on effective integration with the leadership and teams of the acquired businesses. This collaboration ensures continuity in operations, preserves valuable customer relationships, and unlocks potential synergies. By bringing these entities into GFL's established network, they can leverage economies of scale and best practices.

- Strategic Acquisitions: GFL Environmental has a proven track record of acquiring and integrating smaller players in the environmental services sector.

- Integration Partnerships: Collaboration with the leadership and employees of acquired companies is vital for seamless transitions and operational efficiency.

- Synergy Realization: These partnerships aim to achieve operational synergies, enhance customer service, and expand market presence.

- Example Acquisition: The acquisition of Angelo's Recycled Materials in April 2024 exemplifies GFL's continued pursuit of strategic growth through M&A activities.

Suppliers and Equipment Manufacturers

GFL Environmental relies heavily on its suppliers and equipment manufacturers to maintain operational excellence. These partnerships are fundamental to securing the collection vehicles, advanced processing machinery, and essential parts that power GFL's extensive service network. For instance, in 2024, GFL continued to invest in its fleet, including vehicles powered by alternative fuels like compressed natural gas (CNG) and renewable natural gas (RNG), underscoring the importance of suppliers capable of meeting these evolving environmental standards.

The strength of these relationships directly impacts GFL's ability to deliver consistent and reliable services across North America. A robust supply chain ensures that GFL can access critical components, fuel, and specialized equipment without interruption, which is vital for meeting customer demands and maintaining service uptime. This dependency highlights the strategic value of cultivating strong, long-term alliances with key industry partners.

- Fleet Modernization: GFL's ongoing fleet upgrades in 2024, incorporating more fuel-efficient and environmentally friendly vehicles, necessitate close collaboration with truck and equipment manufacturers.

- Parts and Maintenance: Securing a steady supply of replacement parts for its diverse fleet and processing facilities is critical for minimizing downtime and ensuring operational continuity.

- Fuel Sourcing: Partnerships with fuel providers, particularly for CNG and RNG, are essential for GFL's commitment to reducing its carbon footprint and operating more sustainably.

GFL Environmental's key partnerships extend to technology providers and innovators, driving advancements in sustainable waste management. These collaborations are vital for integrating advanced recycling techniques and renewable energy solutions into their operational framework. For instance, partnerships can accelerate the deployment of sophisticated sorting machinery or the adoption of cleaner propulsion systems for their vehicle fleet, thereby enhancing efficiency and reducing environmental impact.

The company's strategic growth is significantly bolstered by acquiring and integrating smaller environmental services firms. These alliances are instrumental in broadening GFL's service portfolio and extending its geographical reach. A prime example of this ongoing consolidation strategy is the acquisition of Angelo's Recycled Materials in April 2024, which underscores GFL's commitment to expanding its market presence through mergers and acquisitions.

Successful integration of these acquired entities relies on effective collaboration with their existing leadership and teams. This cooperative approach ensures operational continuity, preserves valuable client relationships, and unlocks synergistic potential. By incorporating these businesses into GFL's established network, the company leverages economies of scale and disseminates best practices across its expanded operations.

What is included in the product

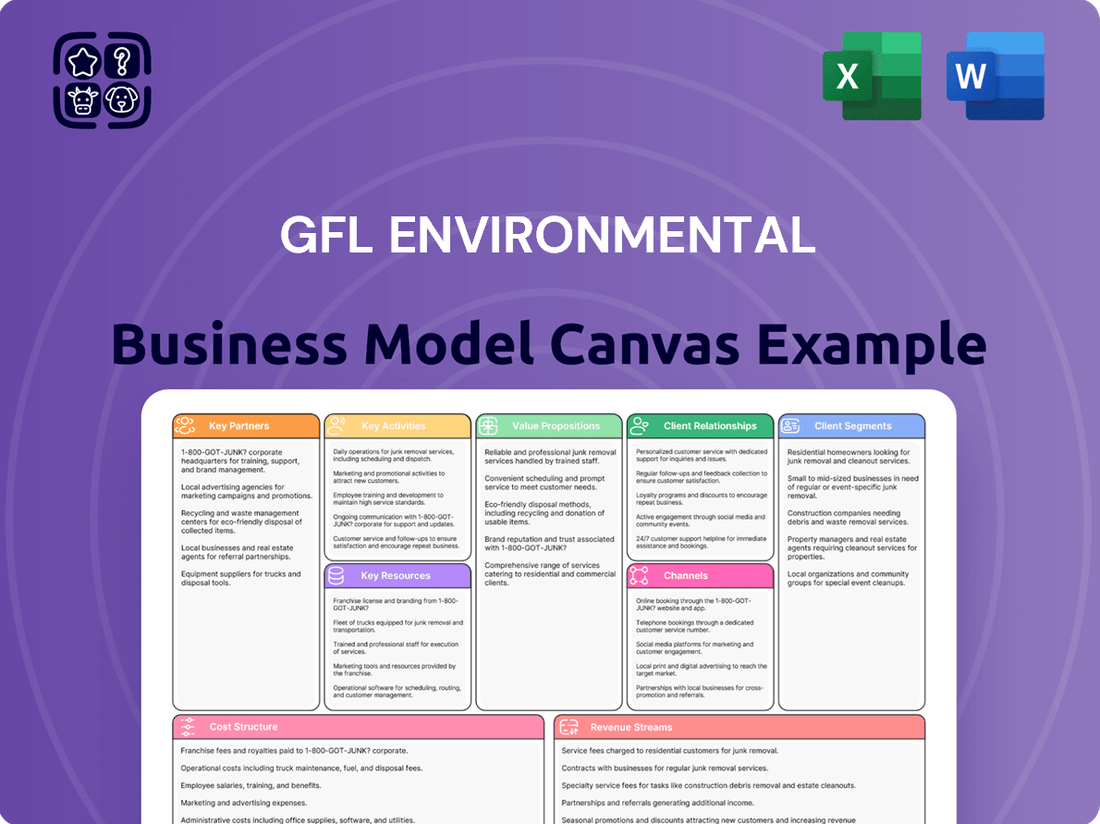

This Business Model Canvas outlines GFL Environmental's strategy for providing integrated waste management services, focusing on diverse customer segments and efficient operational channels to deliver environmental solutions.

GFL Environmental's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex waste management operations, simplifying understanding and strategic alignment.

By condensing GFL's multifaceted environmental services into a digestible format, the Business Model Canvas effectively addresses the pain point of information overload for stakeholders.

Activities

GFL Environmental's primary focus is the collection, transportation, recycling, and disposal of non-hazardous solid waste for a wide range of customers, including homes, businesses, and industries. This foundational service is the backbone of their operations, ensuring efficient waste handling across their service areas.

This segment includes routine curbside collection, special pickups for large items, and the management of transfer stations and landfills, which are crucial nodes in the waste management chain. These activities are essential for maintaining public health and environmental standards.

The non-hazardous solid waste business is GFL's largest revenue generator, underscoring its significance to the company's financial performance. In 2024, GFL reported strong performance in its solid waste operations, contributing significantly to its overall financial health and market position.

GFL Environmental's Infrastructure and Soil Remediation segment focuses on critical environmental services. This includes processing and treating diverse soil types, often destined for reuse in construction and development projects, alongside undertaking significant environmental cleanup operations.

This division actively supports a circular economy by diverting substantial volumes of waste from landfills and refining materials for beneficial reuse. For instance, in 2023, GFL processed millions of tons of soil, a significant portion of which was remediated and returned to the economy.

GFL Environmental's key activities in liquid waste management encompass the entire lifecycle of handling various liquid waste streams. This includes the meticulous collection, safe transportation, efficient processing, and responsible disposal of materials like automotive waste fluids, commercial hazardous waste, and wastewater. These services are crucial for environmental protection and regulatory compliance.

The company provides specialized services such as vacuum truck operations, vital for maintaining septic tanks and managing other liquid waste removal needs. Furthermore, GFL offers oil refining services, demonstrating a commitment to resource recovery and circular economy principles within its liquid waste segment. This addresses a critical need for specialized and environmentally sound waste handling.

In 2024, GFL Environmental continued to be a significant player in the North American liquid waste market. While specific segment revenue for liquid waste isn't always broken out separately in public reports, the company’s overall strong performance in its environmental services division, which includes liquid waste, underscores its operational capacity. For instance, GFL reported total revenue of approximately $6.0 billion for the fiscal year 2023, indicating a substantial infrastructure and service network supporting its liquid waste operations.

Recycling and Resource Recovery Operations

GFL Environmental's core activities revolve around robust recycling and resource recovery. This involves not only collecting recyclables but also operating advanced materials recovery facilities (MRFs) designed to significantly reduce landfill dependency. They are actively expanding into processing a wider array of materials and implementing programs for organic waste, including composting initiatives.

The company is making strategic investments in cutting-edge resource recovery technologies. A key focus is the beneficial reuse of landfill gas, transforming it into a source of renewable energy. This dual approach of waste diversion and energy generation underscores their commitment to a circular economy.

- Collection and Processing: GFL manages the collection of various recyclable materials and operates MRFs to sort and process them.

- Organics and Composting: Development and operation of programs for organic waste diversion and composting.

- Resource Recovery Investment: Investing in technologies and infrastructure for advanced resource recovery.

- Landfill Gas to Energy: Utilizing landfill gas as a renewable energy source, contributing to sustainability goals.

Strategic Acquisitions and Integration

A core activity for GFL Environmental involves actively seeking out, purchasing, and integrating other companies in the environmental services sector. This approach is key to growing their market presence, broadening the range of services they provide, and achieving cost savings through operational efficiencies.

GFL maintains a strong pipeline of potential acquisitions and intends to boost its investment in this area, with a particular focus on acquiring solid waste management businesses. For instance, in 2023, GFL completed several acquisitions, including the purchase of the solid waste operations of TransForce Inc. for approximately $1.4 billion, significantly expanding its footprint in Canada.

- Market Expansion: Acquiring companies in new geographic regions or service areas allows GFL to reach more customers and diversify its revenue streams.

- Service Enhancement: GFL can integrate specialized services from acquired companies, offering a more comprehensive suite of environmental solutions to its clients.

- Synergy Realization: By combining operations, GFL aims to achieve economies of scale, optimize logistics, and reduce overhead costs, leading to improved profitability.

- Strategic Focus on Solid Waste: The company's stated intention to increase spending on solid waste assets highlights a strategic priority to consolidate and grow its position in this essential segment of the environmental services market.

GFL Environmental's key activities are centered around providing comprehensive waste management solutions. This includes the collection, transportation, recycling, and disposal of non-hazardous solid waste, which forms the bedrock of their operations and is their largest revenue generator. They also engage in infrastructure and soil remediation, processing and treating soil for reuse and undertaking environmental cleanup projects, diverting millions of tons of waste from landfills annually. Furthermore, GFL manages the entire lifecycle of liquid waste, from collection to disposal, including specialized services like vacuum truck operations and oil refining.

The company is also heavily invested in recycling and resource recovery, operating advanced materials recovery facilities and exploring opportunities in organic waste processing and landfill gas to energy projects. A significant strategic activity is the continuous acquisition of other environmental service companies, particularly in solid waste management, to expand market reach and enhance service offerings. For example, in 2023, GFL completed acquisitions totaling approximately $1.4 billion, notably the solid waste operations of TransForce Inc.

| Key Activity | Description | 2023/2024 Data Highlight |

|---|---|---|

| Solid Waste Management | Collection, transportation, recycling, and disposal of non-hazardous solid waste. | Largest revenue generator; strong performance in 2024. |

| Infrastructure & Soil Remediation | Processing, treating, and reusing soil; environmental cleanup. | Processed millions of tons of soil in 2023 for beneficial reuse. |

| Liquid Waste Management | Collection, transportation, processing, and disposal of liquid waste streams. | Part of environmental services division contributing to overall ~$6.0 billion 2023 revenue. |

| Recycling & Resource Recovery | Operating MRFs, processing recyclables, organic waste programs, landfill gas to energy. | Strategic investments in advanced resource recovery technologies. |

| Mergers & Acquisitions | Acquiring companies to expand market presence and service offerings. | Acquired TransForce Inc. solid waste operations for ~$1.4 billion in 2023. |

Full Document Unlocks After Purchase

Business Model Canvas

The GFL Environmental Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive, ready-to-use business model canvas, allowing you to immediately apply its insights to your strategic planning.

Resources

GFL Environmental boasts an extensive fleet, a cornerstone of its operations, encompassing a wide array of collection vehicles and specialized equipment. This includes a significant number of solid waste collection trucks, crucial for their residential and commercial services.

The company also deploys vacuum trucks for liquid waste management and specialized machinery for environmental remediation projects. This diverse fleet enables GFL to offer comprehensive services across its North American footprint, ensuring efficient and reliable waste management solutions.

As of recent reports, GFL continues to invest in modernizing its fleet, with a notable focus on alternative fuel vehicles. For instance, the company is actively incorporating Compressed Natural Gas (CNG) and Renewable Natural Gas (RNG) trucks into its operations, aligning with sustainability goals and reducing environmental impact.

GFL Environmental's strategically located network of physical assets, including landfills, transfer stations, material recovery facilities, and liquid waste processing plants, is the core of its business. This extensive infrastructure allows GFL to offer a full spectrum of waste management services, from initial collection all the way through to final disposal or the recovery of valuable materials.

In 2024, GFL continued to leverage this network, which is crucial for managing diverse waste streams efficiently. The company's operations are significantly bolstered by its ability to handle everything from household garbage to industrial liquid waste, ensuring compliance and environmental responsibility at every stage.

Furthermore, GFL actively engages in landfill gas-to-energy projects, transforming a waste byproduct into a renewable energy source. This initiative not only adds an environmental benefit but also creates an additional revenue stream, demonstrating a commitment to sustainable practices and resource optimization within their operational framework.

GFL Environmental’s success hinges on its substantial workforce, numbering between 15,000 and 20,000 dedicated individuals. This team includes essential roles like drivers, operators, engineers, and environmental specialists, whose combined skills ensure safe and efficient service delivery.

The specialized knowledge of these employees is paramount for maintaining compliance with environmental regulations and for driving the development of new, sustainable waste management solutions. GFL actively invests in employee engagement and retention programs to foster this critical expertise.

Proprietary Technology and Digital Infrastructure

GFL Environmental's proprietary technology and digital infrastructure are crucial assets. The company actively invests in digital systems to enhance operational efficiency, streamline data management, and elevate customer service. This commitment is evident in their sophisticated route optimization software and real-time tracking capabilities, which also extend to back-office functions.

Innovation in technology is a cornerstone of GFL's strategy, particularly in their efforts to reduce environmental impact. For instance, by optimizing collection routes, GFL can significantly cut down on fuel consumption and emissions. In 2024, GFL continued to refine its digital platforms, aiming for greater data analytics to identify further efficiencies and sustainability improvements across its diverse service offerings.

- Digital Infrastructure Investment: GFL prioritizes advanced digital systems for route optimization, tracking, and back-office operations.

- Operational Efficiency: Technology enables streamlined processes, leading to cost savings and improved service delivery.

- Environmental Impact Reduction: Technological innovation supports GFL's sustainability goals through optimized resource utilization.

- Data-Driven Insights: Continuous refinement of digital platforms allows for enhanced data analytics and strategic decision-making.

Municipal Contracts and Commercial Client Relationships

GFL Environmental's business model heavily relies on its long-term contracts with municipalities. These agreements, often spanning many years, provide a predictable and stable revenue base, insulating the company from short-term market fluctuations. For instance, in 2024, GFL continued to secure and renew these essential municipal contracts across North America, solidifying its market position.

Beyond municipal services, GFL cultivates deep-seated relationships with a diverse array of commercial and industrial clients. These established partnerships are crucial, offering consistent demand for its waste management and environmental solutions. The breadth of this client base, ranging from small businesses to large industrial operations, diversifies revenue streams and enhances GFL's resilience.

- Municipal Contracts: These long-term agreements offer predictable revenue and operational stability.

- Commercial Client Base: A broad spectrum of industrial and commercial clients ensures diversified income.

- Relationship Management: Sustaining and growing these client and municipal relationships is key to GFL's ongoing success and expansion.

GFL Environmental's intellectual property, including proprietary waste processing technologies and operational methodologies, forms a critical resource. This expertise underpins their ability to offer specialized environmental solutions and maintain a competitive edge. The company also leverages its established brand reputation, built on reliability and comprehensive service offerings, which is invaluable for customer acquisition and retention.

Value Propositions

GFL Environmental offers a truly unique 'one-stop shop' experience, consolidating diverse environmental services under one roof. This means clients can access everything from non-hazardous solid waste management to complex infrastructure and soil remediation, as well as liquid waste services, all through a single, integrated provider.

This comprehensive approach significantly simplifies waste management for businesses. Instead of juggling multiple vendors, clients benefit from streamlined operations and a unified point of contact, making the entire process more efficient and cost-effective. GFL’s extensive service portfolio is designed to meet a wide array of environmental needs, from routine waste collection to specialized industrial cleanup.

In 2024, GFL Environmental continued to expand its reach, solidifying its position as a leader in the North American environmental services sector. The company’s commitment to providing integrated solutions saw strong demand, particularly as regulatory landscapes and corporate sustainability initiatives increasingly favor consolidated service providers. This strategy allows GFL to capture a larger share of client spending by offering a more complete and convenient environmental management package.

GFL Environmental is deeply committed to providing sustainable waste management solutions, actively investing in advanced technologies to minimize its environmental footprint. This dedication is crucial for attracting and retaining customers who prioritize eco-friendly practices.

The company's efforts include significant reductions in greenhouse gas emissions and the expansion of recycling and composting initiatives. For instance, GFL aims to divert millions of tons of waste from landfills annually, a tangible measure of their environmental commitment.

Furthermore, GFL's focus on converting waste into energy showcases its innovative approach to resource recovery. This strategy not only reduces landfill reliance but also contributes to cleaner energy generation, aligning with global sustainability goals and appealing to environmentally aware stakeholders.

GFL Environmental prioritizes offering dependable waste management solutions, underscored by a commitment to stringent safety protocols for its workforce and the public. This focus on reliability ensures consistent service delivery that customers can count on.

Operational efficiency is a cornerstone of GFL's approach, enabling them to manage resources effectively and maintain high service standards. In 2023, GFL reported a significant improvement in its safety performance, with a 10% reduction in its Total Recordable Incident Rate (TRIR) compared to the previous year.

Adherence to all environmental and legislative requirements is paramount, guaranteeing that GFL's operations are not only safe but also compliant. This dedication to regulatory standards reinforces the trust placed in their services by communities and stakeholders alike.

Extensive North American Presence and Scalability

GFL Environmental's extensive North American footprint is a cornerstone of its business model, providing a significant competitive advantage. With operations spanning Canada and the United States, the company leverages a network of strategically positioned facilities to serve a vast customer base.

This broad geographic coverage translates directly into scalability, allowing GFL to adapt its service offerings to meet the varying demands of different markets and customer sizes. The ability to efficiently manage logistics across this wide area is crucial for cost-effectiveness and timely service delivery.

For instance, GFL's 2024 operational data highlights its capacity to handle substantial waste volumes, supported by its numerous transfer stations, landfills, and processing facilities. This infrastructure is key to their ability to scale operations up or down as needed.

- Extensive Network: GFL operates over 200 facilities across North America.

- Service Reach: The company serves millions of households and businesses.

- Scalability: GFL's infrastructure supports growth and adaptation to market demands.

- Logistical Efficiency: Strategically located assets reduce transportation costs and improve service times.

Tailored Solutions for Diverse Customer Segments

GFL Environmental excels at providing highly customized waste management solutions that cater to a wide array of customer segments. This adaptability is key to their business model, ensuring that each client, whether a municipality, a household, a commercial enterprise, or an industrial facility, receives services precisely aligned with their unique needs.

Their approach recognizes that waste management isn't a one-size-fits-all scenario. For instance, GFL might offer regular curbside collection for residential areas, while simultaneously managing complex hazardous waste streams for industrial partners. This granular level of customization is a significant value proposition.

- Municipal Services: Tailored collection and disposal programs for cities and towns.

- Residential Solutions: Convenient curbside pickup for households, including recycling.

- Commercial & Industrial Needs: Specialized waste handling, including hazardous materials and large-scale disposal for businesses.

- Environmental Compliance: Ensuring all services meet stringent regulatory requirements for diverse client types.

GFL Environmental's core value proposition centers on its integrated, one-stop-shop approach to environmental services. This consolidation simplifies waste management for clients, offering a single point of contact for diverse needs ranging from solid waste and recycling to liquid waste and soil remediation. The company's extensive North American footprint, encompassing over 200 facilities, ensures scalability and logistical efficiency, allowing for tailored solutions across millions of households and businesses. This broad operational reach, combined with a commitment to sustainability and operational reliability, positions GFL as a comprehensive and dependable partner in the environmental services sector.

Customer Relationships

GFL Environmental employs dedicated sales and account management teams to cultivate direct relationships with its diverse client base, encompassing commercial, industrial, and municipal sectors. These specialized teams focus on delivering personalized service, understanding and addressing unique client requirements, and ensuring strict adherence to contractual obligations, all aimed at maximizing client satisfaction.

This hands-on approach is instrumental in fostering strong client loyalty and building enduring, long-term partnerships for GFL. For instance, in 2024, GFL reported a significant portion of its revenue derived from recurring commercial and industrial contracts, underscoring the success of its relationship-focused sales strategy.

GFL Environmental operates customer service centers and online portals to manage relationships with its diverse clientele. These touchpoints are crucial for handling service requests, billing inquiries, and providing general information, ensuring efficient communication for both residential and smaller commercial customers.

In 2024, GFL continued to invest in its digital infrastructure, aiming to enhance the user experience across its online platforms. This focus on accessibility through call centers and web portals allows GFL to effectively manage a large volume of customer interactions, fostering loyalty and operational efficiency.

GFL Environmental actively engages with communities by offering environmental education programs focused on waste management, recycling, and sustainability. These initiatives aim to raise public awareness and foster a deeper understanding of responsible environmental practices. For instance, in 2024, GFL continued its efforts to educate over 50,000 individuals across its service areas through workshops and online resources, highlighting the tangible impact of community outreach.

Long-Term Municipal Contracts

GFL Environmental's customer relationships with municipalities are largely built on long-term, multi-year contracts. These agreements provide a foundation of stability and predictability for both parties, fostering enduring partnerships.

These municipal contracts often include provisions for regular performance reviews. This allows for ongoing collaboration and ensures that GFL's services are optimized to meet evolving community needs, with opportunities for renegotiation built into the framework.

- Contract Duration: Many contracts extend for 5 to 15 years, providing significant revenue visibility.

- Performance Metrics: Contracts typically define key performance indicators (KPIs) related to service reliability and environmental compliance.

- Renegotiation Clauses: These allow for adjustments based on market conditions, regulatory changes, or service expansion opportunities.

Feedback Mechanisms and Continuous Improvement

GFL Environmental actively seeks customer insights through various channels. This includes formal methods like post-service surveys and informal approaches such as direct communication with account managers.

The company uses this collected feedback to drive continuous improvement across its operations. For instance, feedback on collection efficiency might lead to route optimization, directly impacting service quality and reducing operational costs.

- Formal Feedback: Post-service surveys and online feedback forms.

- Informal Feedback: Direct communication with sales representatives and customer service.

- Data Utilization: Feedback data informs service enhancements and operational adjustments.

- Impact: Aims to boost customer satisfaction and operational efficiency, contributing to GFL's environmental performance goals.

GFL Environmental cultivates robust customer relationships through dedicated account management for commercial and industrial clients, ensuring personalized service and contract adherence. For residential and smaller commercial customers, efficient communication is maintained via customer service centers and online portals, with ongoing digital infrastructure investments in 2024 enhancing user experience.

Long-term municipal contracts, often spanning 5 to 15 years, form a cornerstone of GFL's customer engagement, providing stability and opportunities for performance reviews and renegotiations. The company actively gathers customer insights through surveys and direct communication, utilizing this feedback for continuous operational improvements and enhanced customer satisfaction.

| Relationship Type | Key Engagement Channels | Focus |

| Commercial/Industrial | Dedicated Sales & Account Management Teams | Personalized Service, Contract Adherence, Long-Term Partnerships |

| Residential/Small Commercial | Customer Service Centers, Online Portals | Efficient Service Requests, Billing Inquiries, General Information |

| Municipal | Long-Term Contracts (5-15 years) | Stability, Performance Reviews, Service Optimization |

Channels

GFL Environmental's direct sales force and business development teams are pivotal for acquiring new commercial, industrial, and municipal clients. These teams actively engage in direct outreach, crafting tailored proposals, and negotiating comprehensive service agreements. This channel is particularly effective for securing large-scale contracts, driving significant revenue growth.

In 2024, GFL continued to invest in these teams, recognizing their importance in expanding market share across its diverse service offerings, including solid waste, liquid waste, and environmental services. The company’s strategic focus on direct client relationships allows for a deeper understanding of customer needs and the development of customized solutions, a key differentiator in a competitive landscape.

GFL Environmental leverages its corporate website as a central hub for information, service inquiries, and account management. This digital platform is crucial for reaching a broad customer base, offering convenience for residential and small business clients to access services and support. In 2024, GFL continued to invest in its digital infrastructure to streamline customer interactions and provide easy access to waste management solutions.

GFL Environmental operates a robust network of local facilities, such as collection depots, transfer stations, and regional offices. These sites are crucial for delivering services directly to customers and fostering local engagement.

This widespread physical footprint is key to GFL's efficient logistics and its ability to quickly address the specific needs of communities it serves. For instance, as of the first quarter of 2024, GFL managed over 400 facilities across North America, underscoring the scale of its local operational channels.

Industry Conferences and Trade Shows

GFL Environmental actively participates in industry conferences and trade shows, serving as a crucial channel for showcasing its comprehensive waste management and environmental solutions. These events are vital for building brand recognition and fostering relationships within the sector.

In 2024, GFL's presence at key industry gatherings like WasteExpo provided opportunities to connect with potential customers, suppliers, and regulatory bodies. This direct engagement helps GFL understand evolving market needs and present its innovative service offerings, from collection and processing to disposal and recycling.

- Brand Visibility: Conferences enhance GFL's profile as a leader in environmental services.

- Business Development: Networking at these events leads to new client acquisition and partnership opportunities.

- Market Intelligence: GFL gains insights into emerging technologies and competitive strategies.

- Service Showcase: Demonstrating solutions like advanced recycling technologies attracts attention and business.

Acquired Companies' Existing Networks

When GFL Environmental acquires other environmental services companies, it immediately taps into their existing customer relationships and operational infrastructure. This is a powerful channel that accelerates market penetration and integrates new revenue streams swiftly.

For instance, in 2024, GFL continued its strategic acquisition path, integrating several regional waste management and environmental solutions providers. These acquisitions not only expanded GFL's geographic footprint but also brought with them established client lists, ranging from municipal contracts to commercial and industrial accounts.

- Customer Acquisition: GFL inherits established customer bases, reducing the cost and time associated with organic customer acquisition.

- Market Access: Acquired networks provide immediate access to new geographic markets and customer segments.

- Synergies: Integration of acquired operational networks allows for efficiency gains and cross-selling opportunities.

- Revenue Diversification: New customer relationships contribute to a broader and more stable revenue base.

GFL Environmental utilizes its extensive network of local facilities, including transfer stations and collection depots, as a direct channel for service delivery and customer interaction. This widespread physical presence, with over 400 facilities across North America by Q1 2024, ensures efficient logistics and localized service. These sites are critical for managing waste streams and engaging with the communities they serve.

The company's direct sales and business development teams are instrumental in securing large commercial, industrial, and municipal contracts, driving significant revenue. In 2024, GFL continued to bolster these teams to expand market share, focusing on tailored proposals and comprehensive service agreements.

GFL's corporate website acts as a vital digital channel for information dissemination, service inquiries, and account management, catering to a broad customer base. Continued investment in digital infrastructure in 2024 aimed to streamline customer interactions and enhance accessibility to waste management solutions.

Strategic acquisitions in 2024 allowed GFL to immediately leverage the customer relationships and operational infrastructure of acquired companies, accelerating market penetration and integrating new revenue streams. This channel proved effective in expanding geographic reach and diversifying its client portfolio.

Industry conferences and trade shows serve as key channels for GFL to showcase its environmental solutions, build brand visibility, and gather market intelligence. Participation in events like WasteExpo in 2024 facilitated connections with potential clients and regulatory bodies, highlighting GFL's innovative offerings.

| Channel | 2024 Focus/Activity | Impact |

|---|---|---|

| Direct Sales & Business Development | Acquiring commercial, industrial, municipal clients; tailored proposals | Securing large contracts, driving revenue growth |

| Corporate Website | Information hub, service inquiries, account management | Broad customer reach, digital convenience |

| Local Facilities Network | Service delivery, local engagement, efficient logistics | Over 400 facilities by Q1 2024, localized solutions |

| Strategic Acquisitions | Integrating acquired customer bases and infrastructure | Accelerated market penetration, revenue diversification |

| Industry Conferences/Trade Shows | Showcasing solutions, networking, market intelligence | Brand visibility, new client acquisition |

Customer Segments

Municipalities and government entities, such as cities and counties, are key customers for GFL Environmental. These governmental bodies contract GFL for essential services like residential waste collection, recycling initiatives, and support for public infrastructure projects. In 2024, GFL's commitment to these sectors remained strong, focusing on delivering dependable, compliant, and budget-conscious solutions to serve their populations effectively.

Individual households form a substantial customer segment for GFL's residential waste and recycling services. In 2024, GFL served millions of these households across North America, highlighting the sheer scale of this market.

This group prioritizes reliable, consistent curbside pickup and easy-to-understand guidelines for sorting recyclables. Customer satisfaction often hinges on the convenience and predictability of GFL's operations in their neighborhoods.

For instance, GFL's focus on customer communication, including online portals and service alerts, directly addresses the needs of residential customers seeking clarity and ease in managing their waste. This segment represents a stable, recurring revenue stream for the company.

Commercial businesses, a broad category encompassing everything from small local shops and bustling restaurants to large office complexes, rely heavily on GFL Environmental for their waste and recycling needs. These enterprises generate a consistent stream of waste, often with diverse materials and fluctuating volumes that require tailored service plans.

In 2024, GFL continued to serve a significant portion of this segment, with contracts for commercial waste management representing a substantial revenue driver. For instance, the company's focus on providing reliable collection schedules and advanced recycling solutions helps these businesses maintain operational efficiency and meet their sustainability goals.

Industrial Clients

Industrial clients, encompassing heavy industries, manufacturing plants, and construction companies, represent a crucial segment for GFL Environmental. These businesses have highly specialized environmental needs, often involving hazardous waste management, complex soil remediation projects, and significant volumes of liquid waste disposal.

GFL provides these clients with tailored, compliant, and sophisticated environmental solutions designed to meet stringent regulatory requirements and operational demands. The company's ability to handle diverse waste streams and deliver specialized services is key to serving this segment effectively.

- Hazardous Waste Management: GFL offers comprehensive solutions for the safe collection, transportation, treatment, and disposal of hazardous materials generated by industrial processes.

- Soil Remediation: For construction and manufacturing sites, GFL provides expertise in cleaning up contaminated soil, ensuring environmental compliance and site redevelopment.

- Liquid Waste Services: This includes the management of industrial wastewater, sludges, and other liquid byproducts, often requiring specialized treatment and disposal methods.

- Regulatory Compliance: A core offering is ensuring that all waste management activities adhere to local, provincial, and federal environmental regulations, mitigating risk for industrial clients.

Homeowners Associations (HOAs) and Multi-Family Properties

Homeowners Associations (HOAs) and managers of multi-family properties are key customers for GFL Environmental. These groups often require comprehensive waste and recycling solutions for entire communities, making them a distinct and valuable segment. GFL offers customized service packages designed to meet the collective needs of these residential developments.

For instance, in 2024, GFL continued to serve numerous HOAs across its operating regions, providing reliable collection and disposal services. These contracts often involve managing waste streams for hundreds or even thousands of individual units within a single development, demonstrating the scale of GFL's engagement with this customer base.

- Consolidated Service Needs: HOAs and multi-family property managers seek a single provider for efficient waste and recycling management across their entire community.

- Tailored Solutions: GFL designs service plans that address the specific volume, frequency, and recycling requirements of residential complexes.

- Community-Wide Impact: Successful waste management for these segments directly impacts the living environment and satisfaction of a large number of residents.

- Potential for Scale: Securing contracts with large HOAs or multi-family property portfolios offers significant revenue potential and operational efficiency for GFL.

GFL Environmental serves a diverse customer base, from individual households to large industrial clients. Municipalities and government entities rely on GFL for essential public services, while commercial businesses and industrial sectors require specialized waste management solutions. In 2024, GFL continued to solidify its relationships across these segments, demonstrating its broad service capabilities.

Cost Structure

GFL Environmental's cost structure heavily relies on operational and fleet maintenance. This includes the significant expenses of fuel, regular repairs, and the depreciation of their large collection vehicle fleet. For instance, in 2023, GFL reported approximately $1.3 billion in selling, general, and administrative expenses, a portion of which directly relates to fleet operations and maintenance.

To mitigate these ongoing costs and align with sustainability goals, GFL is actively investing in alternative fuel vehicles. This strategic move aims to reduce reliance on traditional fuels, thereby managing long-term operational expenditures and environmental impact.

Labor and personnel expenses represent a significant portion of GFL Environmental's cost structure. As a service-intensive business, the company relies heavily on its workforce, which includes drivers, operators, and administrative personnel. These costs encompass salaries, wages, comprehensive benefits packages, and ongoing training to ensure operational efficiency and safety.

For instance, in 2023, GFL reported total employee compensation and benefits expenses amounting to approximately $1.9 billion. This figure underscores the substantial investment required to maintain a skilled and engaged workforce, which is crucial for delivering its environmental services effectively.

Strategic investments in employee engagement and retention programs are vital for GFL. These initiatives aim to reduce turnover, enhance productivity, and foster a positive work environment, ultimately contributing to long-term cost management and operational stability.

GFL Environmental incurs significant expenses for operating and maintaining its extensive network of landfills, transfer stations, recycling facilities, and liquid waste processing plants. These costs are fundamental to the business model, ensuring efficient waste management services.

Environmental compliance and permitting are substantial components of these operating costs, reflecting the stringent regulatory landscape. For instance, in 2023, GFL reported that its environmental services segment, which includes landfill operations, generated approximately $2.5 billion in revenue, underscoring the scale of these operational expenditures.

Furthermore, the company must account for potential post-closure care liabilities associated with landfills, a long-term financial commitment. These ongoing costs are crucial for maintaining operational integrity and environmental stewardship.

Acquisition and Integration Costs

GFL Environmental's aggressive growth strategy is heavily funded by acquisitions, leading to significant upfront costs for purchasing target companies. These acquisition costs are a major component of their operational expenditures. For instance, in the first quarter of 2024, GFL reported acquisition and integration costs totaling $15.6 million, reflecting the ongoing investment in expanding its market presence through mergers and buyouts.

Beyond the initial purchase price, integrating acquired businesses involves substantial ongoing expenses. These include harmonizing IT systems, consolidating operational platforms, and aligning human resources. GFL anticipates these integration costs to continue to rise as they execute their planned mergers and acquisitions (M&A) activities throughout 2024 and beyond.

- Acquisition Costs: Significant upfront capital required to purchase other companies as part of the growth strategy.

- Integration Expenses: Ongoing costs associated with merging operations, IT systems, and personnel of acquired entities.

- Q1 2024 Impact: Reported $15.6 million in acquisition and integration costs, highlighting their substantial nature.

- Future Outlook: Anticipated increase in these costs due to planned future M&A activities.

Environmental Compliance and Regulatory Costs

GFL Environmental navigates a complex web of environmental regulations across North America, which translates into substantial operational expenses. These costs are tied to ongoing monitoring of emissions and waste streams, meticulous reporting to various governmental bodies, and securing and maintaining necessary permits for all its facilities and operations. For instance, in 2023, GFL reported that its environmental, social, and governance (ESG) initiatives and compliance efforts are integral to its business strategy, reflecting the significant investment required to stay ahead of evolving standards.

The company's dedication to environmental stewardship also necessitates proactive investments in advanced, sustainable technologies. These investments are aimed at minimizing its environmental footprint, which includes upgrading equipment for better efficiency and reduced emissions. For example, GFL has been investing in electric and alternative fuel vehicles for its collection fleets, a move that, while costly upfront, aligns with long-term sustainability goals and regulatory pressures. Potential penalties for non-compliance further underscore the importance of robust environmental management systems, making these costs a critical component of GFL's overall cost structure.

- Regulatory Adherence: Costs associated with monitoring, reporting, and permitting across diverse North American jurisdictions.

- Compliance Risk: Potential financial penalties for failing to meet stringent environmental standards.

- Sustainable Technology Investment: Capital expenditure on eco-friendly solutions to reduce operational impact.

- Environmental Stewardship: Ongoing operational costs to maintain and improve environmental performance.

GFL Environmental's cost structure is significantly influenced by its extensive fleet operations, encompassing fuel, maintenance, and depreciation. In 2023, the company's selling, general, and administrative expenses were approximately $1.3 billion, with a notable portion dedicated to fleet management. To manage these expenditures and environmental impact, GFL is investing in alternative fuel vehicles.

Labor costs are another major component, reflecting the company's reliance on drivers, operators, and administrative staff. In 2023, employee compensation and benefits totaled around $1.9 billion, highlighting the investment in a skilled workforce essential for service delivery.

Operating and maintaining its network of facilities, including landfills and recycling plants, represents a substantial cost. Environmental compliance and permitting are critical elements of these expenses, as demonstrated by the $2.5 billion revenue generated by its environmental services segment in 2023, indicating the scale of these operational outlays.

Acquisitions are a key growth driver, leading to significant upfront and integration costs. In Q1 2024 alone, GFL reported $15.6 million in acquisition and integration expenses, with expectations for these costs to continue as M&A activity progresses throughout 2024.

| Cost Category | 2023 Expense (Approx.) | Key Drivers | Strategic Initiatives |

|---|---|---|---|

| Fleet Operations & Maintenance | Part of $1.3B SG&A | Fuel, repairs, depreciation | Investment in alternative fuel vehicles |

| Labor & Personnel | $1.9B (Compensation & Benefits) | Salaries, wages, benefits, training | Employee engagement and retention programs |

| Facility Operations & Maintenance | Integral to $2.5B Environmental Services Revenue | Landfill, transfer station, recycling plant operations | Environmental compliance, permitting, post-closure care |

| Acquisitions & Integration | $15.6M (Q1 2024) | Purchase of target companies, system harmonization | Ongoing M&A activity |

Revenue Streams

GFL Environmental's core revenue is generated from fees for collecting, transporting, and disposing of non-hazardous solid waste. This covers services for homes, businesses, and industries.

These fees are often recurring for regular services, supplemented by charges for using GFL's landfill facilities. In 2024, GFL reported significant revenue from its solid waste operations, reflecting the consistent demand for these essential services.

GFL Environmental generates revenue by collecting and processing recyclable materials. This core activity is complemented by the sale of recovered commodities, such as aluminum, paper, and plastic, on the open market.

The financial performance of this stream is directly tied to commodity market prices, which can be volatile. For instance, in the first quarter of 2024, GFL reported a 2.6% increase in revenue from its Waste and Services segment, which includes recycling operations, reaching $763.3 million.

GFL Environmental generates revenue through specialized liquid waste management services. This includes collecting, treating, and disposing of both hazardous and non-hazardous liquids, alongside operations in oil refining and wastewater treatment. These services often command higher prices due to their technical demands.

In 2024, GFL's liquid waste segment demonstrated significant contribution to its overall financial performance. The company reported substantial revenue growth in this area, driven by increased demand for environmentally compliant disposal solutions. For instance, the company's strategic acquisitions in the liquid waste sector throughout 2023 and early 2024 are expected to bolster these revenue streams further.

Soil Remediation and Infrastructure Project Fees

GFL Environmental generates revenue through fees collected from infrastructure and soil remediation projects, primarily serving industrial and construction clients. These engagements often involve significant scale and require specialized technical capabilities and advanced equipment.

These specialized services are crucial for managing environmental impact and regulatory compliance. For example, GFL's infrastructure services include the maintenance and repair of underground utilities, while soil remediation tackles contaminated sites.

- Infrastructure Project Fees: Revenue from services like sewer and water main rehabilitation, pipeline maintenance, and storm drain management.

- Soil Remediation Fees: Income derived from treating and disposing of contaminated soil generated from construction sites, industrial spills, or legacy waste.

- Clientele: Primarily serves municipalities, industrial facilities, and construction companies needing environmental solutions.

- Project Scope: Projects can range from routine maintenance to complex, large-scale environmental cleanups, often involving significant capital investment and specialized expertise.

Renewable Energy and Carbon Credit Sales

GFL Environmental generates revenue by selling electricity produced from landfill gas, an increasingly valuable commodity as the world transitions to cleaner energy sources. This also includes the sale of carbon credits, which are generated as the company reduces greenhouse gas emissions.

In 2023, GFL's Renewable Energy segment reported significant growth, with Adjusted EBITDA increasing by 18.3% compared to 2022, reaching $161.3 million. This demonstrates the growing profitability of their investments in sustainable energy solutions.

- Landfill Gas-to-Energy Projects: GFL operates numerous facilities that capture methane gas from landfills, converting it into electricity.

- Carbon Credit Generation: The reduction of methane emissions through these projects allows GFL to generate and sell carbon credits.

- Market Demand: Increasing global demand for renewable energy and carbon offsets directly benefits this revenue stream.

- Sustainability Alignment: This segment directly supports GFL's commitment to environmental stewardship and provides a competitive advantage.

GFL Environmental's revenue streams are diversified, encompassing essential waste management services and emerging renewable energy initiatives. The company's core operations in solid and liquid waste collection, processing, and disposal form the bedrock of its income. This is further augmented by its growing presence in infrastructure services and soil remediation, catering to specialized environmental needs.

The sale of recovered commodities from recycling operations and electricity generated from landfill gas represent significant growth areas. In 2024, GFL continued to see strong performance across its segments, with the Waste and Services segment, which includes recycling, reporting robust revenue figures. The company's strategic focus on expanding its renewable energy portfolio, including landfill gas-to-energy projects, is also a key driver of its financial success.

GFL Environmental's financial performance in 2024 highlights the stability of its traditional waste services and the increasing contribution of its environmental solutions and renewable energy segments. For instance, the company's Adjusted EBITDA for its Renewable Energy segment saw substantial growth in the preceding year, underscoring the profitability of its sustainability-focused ventures.

| Revenue Stream | Description | 2024 Financial Highlight (Illustrative) |

| Solid Waste Services | Collection, transportation, and disposal of non-hazardous waste for residential, commercial, and industrial clients. Includes landfill fees. | Consistent strong revenue, reflecting essential service demand. |

| Recycling Services | Collection and processing of recyclable materials, with revenue from selling recovered commodities. | Revenue growth influenced by commodity prices; Q1 2024 saw a 2.6% increase in the Waste and Services segment. |

| Liquid Waste Management | Collection, treatment, and disposal of hazardous and non-hazardous liquids, oil refining, and wastewater treatment. | Significant revenue contribution driven by demand for compliant disposal; strategic acquisitions bolstering this segment. |

| Infrastructure & Soil Remediation | Fees from projects like utility maintenance, pipeline repair, and treating contaminated soil for industrial and construction clients. | Revenue from large-scale environmental projects and specialized cleanup services. |

| Renewable Energy | Sale of electricity from landfill gas and carbon credits. | Growing profitability; Adjusted EBITDA for Renewable Energy increased 18.3% in 2023. |

Business Model Canvas Data Sources

The GFL Environmental Business Model Canvas is informed by a blend of internal operational data, market analysis reports, and financial performance metrics. These sources provide a comprehensive view of customer needs, competitive landscapes, and revenue generation strategies.