GFL Environmental Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFL Environmental Bundle

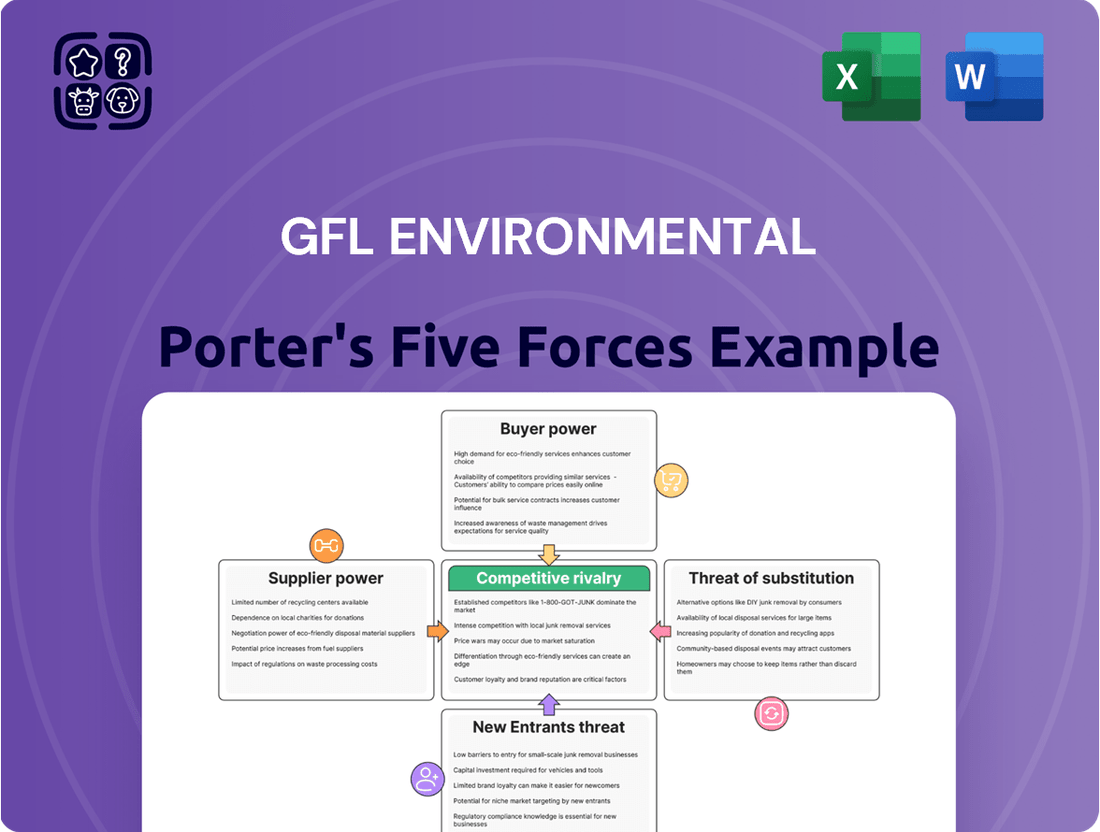

GFL Environmental navigates a complex landscape shaped by significant buyer power and the constant threat of new entrants, particularly in its diverse waste management sectors. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore GFL Environmental’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration in the waste management sector significantly impacts GFL Environmental's bargaining power. The industry's reliance on specialized equipment like collection trucks and recycling machinery means that if only a few manufacturers dominate the market for these essential inputs, they can dictate terms and prices to GFL. For instance, in 2024, the global waste management equipment market saw consolidation, with a few major players holding substantial market share, potentially increasing their leverage over large purchasers like GFL.

GFL Environmental's significant investment in specialized supplier technologies, such as advanced waste processing equipment or specific fleet management software, creates substantial switching costs. If these systems are deeply integrated into GFL's operational workflow, changing providers would necessitate not only acquiring new hardware and software but also retraining staff and potentially disrupting service delivery.

This deep integration means GFL faces considerable expense and operational friction when considering alternative suppliers, thereby enhancing the bargaining leverage of its current technology partners. For instance, if a key supplier's proprietary system underpins a significant portion of GFL's recycling sorting efficiency, the cost and time to transition to a competitor's system could be prohibitive.

Suppliers offering highly specialized or proprietary components, like advanced sorting technology for recycling or unique remediation chemicals, wield significant bargaining power. GFL Environmental would face considerable difficulty in finding comparable alternatives for such critical inputs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into GFL Environmental's waste management services market is a significant factor in their bargaining power. If suppliers, such as those providing specialized equipment or processing technologies, were to enter the market directly, they would become GFL's competitors, thereby increasing their negotiating leverage over GFL.

However, this threat is somewhat mitigated by the substantial barriers to entry within the waste management sector. The industry is characterized by high capital requirements for infrastructure and fleet, along with stringent regulatory compliance, which makes it difficult for many potential suppliers to realistically pursue forward integration.

For instance, establishing a new landfill or advanced processing facility can cost hundreds of millions of dollars, a significant hurdle for most equipment manufacturers or chemical suppliers. In 2024, the average capital expenditure for a new waste processing plant in North America was estimated to be upwards of $150 million, reflecting this high cost.

This high capital intensity and regulatory complexity means that while the theoretical threat of forward integration exists, its practical realization by most suppliers is limited, thus capping their ultimate bargaining power.

- High Capital Intensity: Significant investment needed for waste processing facilities and equipment limits supplier forward integration.

- Regulatory Hurdles: Complex environmental permits and compliance requirements act as a barrier for new entrants.

- Credible Threat: The potential for suppliers to become competitors grants them leverage in price and contract negotiations.

- Limited Practicality: Despite the threat, the financial and regulatory demands make widespread forward integration by suppliers unlikely in 2024.

Importance of GFL as a Customer to Suppliers

GFL Environmental's position as a customer significantly influences the bargaining power of its suppliers. If GFL represents a substantial portion of a supplier's overall sales, that supplier has less leverage. For instance, if a waste hauling equipment manufacturer relies on GFL for 20% of its annual revenue, they are less likely to push for unfavorable terms or price increases, as losing GFL's business would be a considerable blow.

Conversely, when GFL is a minor client to a large supplier, the supplier's bargaining power is amplified. Consider a fuel provider that serves thousands of customers; GFL's business, while important, might only be a small fraction of their total volume. In such a scenario, the fuel supplier can dictate terms and pricing more assertively, knowing that GFL's departure would have minimal impact on their operations.

- GFL's Revenue Share: Suppliers who depend heavily on GFL for revenue have reduced bargaining power.

- Supplier Concentration: If GFL is a small customer to a highly diversified supplier, the supplier's power increases.

- Contractual Terms: Long-term contracts with favorable terms for GFL can mitigate supplier power, but are subject to renewal negotiations.

- Market Dynamics: The overall availability of goods or services from alternative suppliers also plays a crucial role in determining GFL's leverage.

Suppliers of specialized waste management equipment and technology can exert considerable bargaining power over GFL Environmental, especially when these inputs are critical and difficult to substitute. The concentration of manufacturers in niche markets, such as advanced sorting machinery or specialized collection vehicles, means that a few dominant players can influence pricing and terms. For example, in 2024, the market for automated waste sorting systems saw increased dominance by a handful of European and North American firms, potentially giving them significant leverage over large buyers like GFL.

The threat of suppliers integrating forward into GFL's core business presents another avenue for their bargaining power. While high capital investment and stringent regulations in waste management present barriers, suppliers of essential technologies could theoretically become competitors. However, the substantial capital requirements, with new waste processing facilities often exceeding $150 million in 2024, make widespread forward integration by suppliers a limited practical threat, thus capping their ultimate leverage.

GFL Environmental's status as a customer also shapes supplier power. If GFL represents a significant portion of a supplier's revenue, the supplier's leverage diminishes. Conversely, when GFL is a smaller client to a large, diversified supplier, such as a major fuel distributor, that supplier gains more assertive pricing power. This dynamic highlights how GFL's purchasing volume and its importance to specific suppliers directly influence negotiation outcomes.

| Factor | Impact on GFL Environmental | Example Data (2024) |

| Supplier Concentration | Increases supplier bargaining power if few dominate key inputs. | Major players in automated sorting equipment held significant market share. |

| Switching Costs | High integration of proprietary tech increases supplier leverage. | Deep integration of specialized fleet management software creates significant switching costs. |

| Threat of Forward Integration | Potential for suppliers to become competitors enhances their power. | Barriers to entry, like $150M+ for new processing plants, limit this threat. |

| Customer Dependence | Supplier power is lower if GFL is a major customer; higher if GFL is a minor client. | A waste hauling equipment manufacturer relying on GFL for 20% of revenue has less leverage. |

What is included in the product

This analysis dissects the competitive landscape for GFL Environmental, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

GFL Environmental's Porter's Five Forces analysis provides a crucial roadmap for navigating competitive pressures, helping to identify and mitigate potential threats before they impact profitability.

Customers Bargaining Power

GFL Environmental serves a diverse customer base, encompassing municipal, residential, commercial, and industrial sectors. This broad reach generally dilutes individual customer power.

However, if a substantial portion of GFL's revenue is concentrated among a few large municipal or industrial clients, these key customers gain significant bargaining leverage. For example, if a single municipal contract represents over 10% of GFL's annual revenue, that municipality could negotiate more favorable terms.

Customer switching costs for GFL Environmental are generally low for residential and commercial clients. While there might be some administrative tasks or minor fees involved in changing waste management providers, these are typically not significant enough to deter customers from seeking better options, thus granting them a degree of bargaining power.

However, for larger, more complex contracts, such as those with industrial facilities or municipalities, switching costs can escalate. These higher costs stem from the need to re-establish infrastructure, manage new contractual obligations, and potentially incur early termination penalties, which can make it more challenging for these clients to switch.

Customer price sensitivity is a significant factor for GFL Environmental, particularly with its municipal and large commercial clients. These entities often operate under strict budget limitations, making them highly attuned to pricing. For instance, in 2023, many municipalities across North America faced increased fiscal pressures, driving a stronger focus on cost-efficiency in service contracts.

This sensitivity directly translates into competitive bidding processes for waste management and environmental services. GFL frequently encounters situations where clients solicit multiple bids, forcing the company to offer competitive pricing, especially for its more standardized offerings like collection and disposal. This dynamic can put downward pressure on profit margins for these services.

Availability of Substitutes for Customers

The availability of substitutes for waste management services, while not always direct, can still influence customer bargaining power. For instance, customers might invest more heavily in internal waste reduction strategies or enhanced recycling initiatives. These actions can lessen their reliance on external waste management providers, thereby increasing their leverage.

In 2024, the push towards circular economy principles has encouraged businesses to explore waste-to-energy solutions or advanced material recovery facilities. These alternatives, though not always a complete replacement, offer customers more options and can significantly impact the demand for traditional waste disposal services.

- Limited Direct Substitutes: True direct replacements for comprehensive waste management are scarce.

- Indirect Substitution: Customers can reduce waste volume through internal programs, lessening dependence on external services.

- Emerging Alternatives: Waste-to-energy and advanced recycling offer partial substitutes, increasing customer options.

- Impact on Bargaining Power: Greater availability of alternatives empowers customers to negotiate better terms with providers like GFL Environmental.

Information Availability to Customers

Customers today have unprecedented access to information about service providers and their pricing. This is largely driven by online reviews, comparison websites, and competitive bidding platforms. For instance, in 2023, over 80% of consumers reported reading online reviews before making a purchase decision, a trend that has continued to grow.

This increased transparency directly impacts GFL Environmental's bargaining power of customers. When customers can easily compare GFL's services and costs against competitors, they are better equipped to negotiate more favorable terms. This can manifest as demands for lower prices, improved service levels, or customized contract agreements.

- Customers can readily access detailed information on GFL's service offerings and pricing structures through various online channels.

- The proliferation of customer review sites and industry-specific forums allows for direct comparisons of GFL's performance against rivals.

- Platforms facilitating competitive bidding empower customers to solicit and evaluate multiple proposals, thereby strengthening their negotiation position.

- In 2024, the average consumer spent an estimated 15 hours per month researching products and services online, highlighting the depth of information available.

The bargaining power of GFL Environmental's customers is moderate, influenced by factors like customer concentration and price sensitivity. While many smaller clients have limited leverage, large municipal or industrial contracts can significantly shift power due to their revenue impact.

Switching costs are generally low for residential and commercial customers, but higher for larger, more complex contracts, creating a mixed dynamic. Price sensitivity is particularly acute among municipal clients, especially in 2023 when many faced budget constraints, driving demand for cost-efficiency.

The availability of indirect substitutes, such as waste reduction and recycling programs, also empowers customers. In 2024, the growing interest in waste-to-energy and advanced recycling offers further alternatives, enabling customers to negotiate better terms by reducing their reliance on traditional disposal.

| Factor | Impact on GFL | Example/Data Point |

|---|---|---|

| Customer Concentration | High for large clients, low for many small ones | A single municipal contract exceeding 10% of revenue grants significant leverage. |

| Switching Costs | Low for residential/commercial, high for industrial/municipal | Industrial clients face infrastructure and contractual hurdles when switching providers. |

| Price Sensitivity | High for municipal and large commercial clients | Fiscal pressures in 2023 made municipalities highly focused on cost-effective service contracts. |

| Availability of Substitutes | Moderate, increasing with new technologies | Waste-to-energy solutions in 2024 provide partial alternatives to traditional disposal. |

Same Document Delivered

GFL Environmental Porter's Five Forces Analysis

This preview showcases the complete GFL Environmental Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the waste management industry. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights without any alterations.

Rivalry Among Competitors

The North American waste management sector is quite consolidated, meaning a few big companies hold a significant share of the market. Firms like Waste Management Inc., Republic Services Inc., and Waste Connections Inc. are major players, alongside GFL Environmental. This concentration means there's strong competition among these dominant entities.

In 2023, Waste Management Inc. reported revenues of approximately $20.1 billion, while Republic Services Inc. saw revenues around $13.4 billion. These figures highlight the substantial scale of the leading competitors, intensifying the rivalry for market share.

The North American waste management sector is poised for significant expansion, with projections indicating a compound annual growth rate of 4.01% between 2025 and 2030. This healthy growth environment, however, doesn't necessarily dampen rivalry; rather, it often intensifies it.

Established, large-scale operators are likely to aggressively pursue market share within this expanding market. Their established infrastructure, customer bases, and operational efficiencies will enable them to capture a greater portion of the new opportunities, leading to heightened competition among existing major players.

While basic waste collection is often a price-driven commodity, GFL Environmental distinguishes itself by offering a broad spectrum of services. These include non-hazardous solid waste, infrastructure and soil remediation, and liquid waste management. This comprehensive approach, coupled with a focus on sustainability and advanced technologies, helps GFL move beyond simple price competition.

Exit Barriers

High capital investments in specialized infrastructure, such as landfills, recycling facilities, and dedicated vehicle fleets, present substantial exit barriers in the waste management sector. These significant upfront costs make it difficult and expensive for companies to leave the market, even when facing challenging economic conditions.

These substantial exit barriers compel companies to remain operational and continue competing, even through industry downturns. This persistence, driven by the difficulty of divesting large, specialized assets, naturally intensifies competitive rivalry as players are locked into the market.

- High Capital Outlay: Companies like GFL Environmental invest heavily in assets like landfills, transfer stations, and specialized collection fleets, often running into hundreds of millions of dollars. For instance, in 2023, GFL's capital expenditures were approximately $816 million, largely directed towards maintaining and expanding its infrastructure.

- Specialized Nature of Assets: The equipment and facilities used in waste management are highly specialized and have limited alternative uses, making them difficult to sell or repurpose if a company decides to exit.

- Regulatory Hurdles: Decommissioning landfills and obtaining permits for waste facilities involve complex and costly regulatory processes, further increasing the cost and time associated with exiting the market.

Strategic Objectives of Competitors

Major competitors in the environmental services sector are aggressively pursuing strategic investments, acquisitions, and expansion initiatives. These moves are designed to bolster their market share and broaden their service capabilities, creating a dynamic and challenging landscape for GFL Environmental.

GFL Environmental is actively participating in this competitive environment, maintaining a robust pipeline of mergers and acquisitions. The company's focus on operational efficiencies and strategic market selection further underscores the intense rivalry, where growth and service excellence are paramount.

- Market Share Expansion: Competitors are investing heavily in expanding their geographical reach and service portfolios to capture a larger segment of the waste management and environmental services market.

- Acquisition Strategies: Many players are actively acquiring smaller, specialized companies to integrate new technologies and service lines, thereby enhancing their competitive offering.

- Operational Efficiency Focus: Beyond M&A, competitors are also prioritizing internal operational improvements, aiming to reduce costs and increase service delivery efficiency to gain an edge.

- GFL's Competitive Stance: GFL's own aggressive M&A strategy and focus on operational optimization highlight the industry's drive for consolidation and enhanced service capabilities.

The competitive rivalry in the North American waste management sector is intense, driven by a few large, established players like Waste Management Inc. and Republic Services Inc., alongside GFL Environmental. These companies, with revenues in the billions, actively compete for market share in a growing industry. The sector's projected 4.01% CAGR from 2025 to 2030 fuels aggressive strategies, including acquisitions and operational enhancements, to capture new opportunities.

| Company | Approx. 2023 Revenue (USD Billions) | Approx. 2023 CapEx (USD Millions) |

|---|---|---|

| Waste Management Inc. | 20.1 | N/A (Specific figure not readily available for 2023 CapEx) |

| Republic Services Inc. | 13.4 | 1,480 (2023) |

| GFL Environmental | N/A (Reported CAD 5.7 billion in revenue for 2023) | 816 (2023) |

SSubstitutes Threaten

Growing environmental awareness and increasingly stringent regulations are pushing businesses and municipalities to adopt waste reduction and minimization strategies. These efforts, including source reduction and composting programs, directly decrease the volume of waste needing traditional collection and disposal services, thereby acting as a significant threat of substitutes for GFL Environmental.

For instance, many cities are expanding their organic waste diversion programs. In 2024, cities like San Francisco continued to lead in waste diversion rates, with over 80% of waste being diverted from landfills through recycling and composting, impacting the demand for landfill services.

Innovations in recycling technologies and the growing embrace of circular economy models present a significant threat to traditional waste disposal services. These advancements aim to keep materials in use longer, reducing the volume sent to landfills. For instance, advanced sorting technologies can recover a higher percentage of valuable materials from waste streams.

The push towards a circular economy means that companies are increasingly looking for ways to reuse and repurpose materials, thereby bypassing conventional disposal methods. This trend is supported by developments in biodegradable materials and sophisticated reprocessing techniques that can transform waste into new products. For example, as of early 2024, several major corporations have committed to increasing their use of recycled content, directly impacting the demand for virgin materials and, by extension, waste processing.

Waste-to-energy (WtE) solutions present a growing threat to traditional landfill services, as they offer an alternative for waste management by converting it into renewable energy. As these technologies advance, they become more efficient and cost-effective, potentially decreasing the demand for landfill capacity. For instance, in 2024, the global WtE market was valued at approximately $35 billion, with projections indicating continued growth, suggesting a tangible shift in waste disposal preferences.

In-house Waste Management by Large Generators

Large industrial and commercial entities, such as manufacturing plants or major retail chains, might consider managing their waste internally. This can involve setting up their own treatment facilities or contracting specialized disposal services directly, bypassing traditional waste management companies like GFL Environmental. This approach offers greater control over the entire waste lifecycle and can sometimes lead to cost savings.

For instance, a large chemical manufacturer might invest in on-site hazardous waste treatment to ensure compliance with stringent regulations and to manage byproducts efficiently. This direct control can be appealing, especially for businesses with complex or high-volume waste streams. Such in-house capabilities represent a direct substitute for the services offered by external waste management providers.

- Potential for Cost Savings: Businesses can sometimes reduce overall waste disposal expenses by managing operations internally.

- Enhanced Control: In-house management allows for greater oversight of waste handling, treatment, and disposal processes.

- Regulatory Compliance: Companies can ensure direct adherence to specific environmental regulations pertinent to their waste.

- Specialized Needs: Industries with unique waste streams may find in-house solutions more tailored to their requirements.

Policy and Regulatory Shifts

Policy and regulatory shifts significantly impact the threat of substitutes for GFL Environmental. Governments are increasingly implementing regulations that favor recycling, composting, and waste diversion. For instance, Extended Producer Responsibility (EPR) programs, which are gaining traction globally, place the onus on producers to manage the end-of-life of their products. This directly enhances the competitiveness of alternative waste management solutions over traditional landfilling.

These policy changes can fundamentally alter consumer and business behavior, steering them towards more sustainable waste management practices. For example, in 2024, several North American jurisdictions expanded their EPR schemes to include more product categories, such as electronics and packaging. This regulatory push makes services like GFL’s recycling and composting operations more appealing and economically viable compared to simply sending waste to landfills, thereby increasing the threat from these substitute methods.

- Government regulations promoting recycling and composting: Policies like EPR programs incentivize waste diversion.

- Shifting demand from traditional disposal: Regulations make alternative waste management more attractive.

- Impact on GFL Environmental's services: Increased viability of recycling and composting services.

- 2024 regulatory trends: Expansion of EPR schemes in North America.

The threat of substitutes for GFL Environmental is significant due to growing environmental awareness and regulatory pushes towards waste reduction. Initiatives like source reduction, composting, and advanced recycling technologies directly divert waste from traditional collection and disposal services. For example, in 2024, cities like San Francisco continued to achieve over 80% waste diversion rates, highlighting the impact of these substitutes on landfill demand.

Waste-to-energy (WtE) solutions also pose a growing threat, offering an alternative by converting waste into energy. The global WtE market was valued around $35 billion in 2024, with continued growth projected, indicating a shift in waste management preferences away from traditional methods.

Furthermore, large industrial clients may opt for in-house waste management or specialized third-party services, bypassing companies like GFL. This is driven by a desire for greater control, potential cost savings, and tailored solutions for unique waste streams, especially in highly regulated sectors.

Policy changes, such as Extended Producer Responsibility (EPR) programs, further bolster the threat of substitutes. These programs, expanding in North America in 2024 to cover more product categories, incentivize waste diversion and make recycling and composting more economically competitive against landfilling.

| Substitute Strategy | Impact on Traditional Waste Disposal | Example/Data Point |

| Source Reduction & Composting | Decreases volume of waste requiring collection/disposal | San Francisco's >80% waste diversion rate (2024) |

| Advanced Recycling Technologies | Recovers more materials, reducing landfill needs | Increased recovery rates from mixed waste streams |

| Waste-to-Energy (WtE) | Offers alternative to landfilling by generating energy | Global WtE market valued at ~$35 billion (2024) |

| In-house/Specialized Waste Management | Bypasses traditional providers for greater control/cost savings | Chemical manufacturers investing in on-site hazardous waste treatment |

| Extended Producer Responsibility (EPR) | Incentivizes waste diversion and alternative management | Expansion of EPR schemes in North America (2024) |

Entrants Threaten

The waste management sector demands considerable initial investment. Building and maintaining landfills, recycling plants, transfer stations, and a fleet of specialized trucks requires significant capital, creating a formidable hurdle for newcomers.

For instance, establishing a modern, compliant landfill can cost tens of millions of dollars, while a state-of-the-art recycling facility can easily run into the hundreds of millions. This high capital intensity effectively deters many potential competitors from entering the market.

The waste management sector, including GFL Environmental's operations, faces significant regulatory hurdles. Stringent environmental, health, and safety regulations, which differ across jurisdictions, are a major deterrent to new players. For instance, obtaining permits for landfill operations or advanced processing facilities is a complex, lengthy, and expensive undertaking, effectively raising the barrier to entry.

Established players like GFL Environmental leverage significant economies of scale in their operations, from waste collection to processing and final disposal. This cost advantage makes it challenging for newcomers to match their pricing structures. For instance, GFL's extensive network of facilities and fleet of vehicles allows for optimized routes and bulk purchasing of materials, driving down per-unit costs.

New entrants would face substantial hurdles in achieving comparable cost efficiencies without first building considerable market share. The capital investment required to replicate GFL's infrastructure and operational scale is immense. Without achieving a similar volume of waste processed, new companies would struggle to compete on price, a critical factor in the waste management industry.

Access to Landfill Capacity and Infrastructure

The difficulty in securing and developing new landfill sites due to environmental regulations, public opposition, and scarcity of suitable land acts as a significant barrier to entry. Existing companies like GFL Environmental often possess established landfill assets, which are critical competitive advantages. For instance, as of the first quarter of 2024, GFL reported operating a substantial network of disposal sites across North America, making it challenging for newcomers to replicate this infrastructure.

New entrants face substantial capital requirements and lengthy approval processes to establish their own landfill capacity. This hurdle is compounded by the fact that many prime locations are already controlled by established players.

- Limited Availability: Finding and obtaining permits for new landfill sites is a protracted and complex process.

- Public Opposition: NIMBY (Not In My Backyard) sentiment frequently hinders the development of new waste disposal facilities.

- Infrastructure Costs: The immense capital needed to build and maintain compliant landfill infrastructure is a major deterrent.

- Existing Assets: Companies with existing, permitted landfill capacity have a significant head start and cost advantage.

Brand Reputation and Customer Relationships

GFL Environmental has cultivated a robust brand reputation and nurtured enduring relationships across municipal, residential, commercial, and industrial sectors. This deep-seated trust and established service history present a significant barrier for potential new entrants. Building comparable credibility and securing the long-term contracts that underpin GFL's market position would require substantial time and investment.

Newcomers would struggle to replicate the service quality and reliability that GFL Environmental has demonstrated over years of operation. The capital expenditure required to match GFL's infrastructure and operational efficiency is considerable, further deterring new competition.

- Brand loyalty: GFL's established customer base is less likely to switch to an unproven provider.

- Contractual obligations: Many of GFL's relationships are cemented by long-term service agreements.

- Operational scale: New entrants would need to invest heavily to achieve comparable service levels and reach.

The threat of new entrants for GFL Environmental is moderately low due to significant capital requirements and regulatory complexities. Establishing waste management infrastructure, like landfills and processing plants, demands substantial upfront investment, often in the tens or hundreds of millions of dollars. Furthermore, navigating stringent environmental regulations and obtaining necessary permits is a time-consuming and costly process, acting as a considerable deterrent for potential newcomers. GFL's established economies of scale and existing network of disposal sites also present a significant competitive advantage, making it difficult for new players to match operational efficiency and pricing.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building landfills, recycling plants, and fleets costs millions. | High; deters entry due to immense upfront investment. |

| Regulatory Hurdles | Complex permits and compliance with environmental laws. | High; lengthy and expensive approval processes. |

| Economies of Scale | Established players have lower per-unit costs. | Moderate to High; newcomers struggle to match cost efficiencies. |

| Landfill Availability | Scarcity of suitable, permitted landfill sites. | High; existing assets held by companies like GFL are critical advantages. |

| Brand Reputation & Relationships | Trust and long-term contracts with customers. | Moderate; requires significant time and investment to build credibility. |

Porter's Five Forces Analysis Data Sources

Our GFL Environmental Porter's Five Forces analysis is built upon a foundation of verified data sources, including GFL's annual reports and SEC filings, alongside industry-specific market research reports and government regulatory databases.