GFL Environmental PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFL Environmental Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping GFL Environmental's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to navigate industry complexities and identify emerging opportunities. Download the full version now to gain actionable intelligence and secure your competitive advantage.

Political factors

Government regulations are a major force shaping GFL Environmental's business, especially in waste management and environmental services. For instance, evolving policies around landfill operations and recycling targets directly affect how GFL operates and invests in its infrastructure.

Shifts in environmental policy, such as proposed changes to methane emission standards for landfills or expanded producer responsibility schemes for packaging in 2024 and 2025, could increase GFL's compliance costs. These regulatory changes necessitate ongoing adaptation of operational strategies and technology investments to maintain market leadership and meet new environmental benchmarks.

Extended Producer Responsibility (EPR) legislation is gaining significant traction across Canada, fundamentally altering how products are managed at their end-of-life. This regulatory shift places the financial and operational burden of managing waste and recycling squarely on the shoulders of the producers themselves.

GFL Environmental is strategically positioned to benefit from this trend, actively participating in various EPR programs. These initiatives are not just about compliance; they represent a substantial opportunity for GFL to generate new revenue streams and drive volume growth, especially within the Canadian market. For instance, in British Columbia, the new EPR framework for electronics, introduced in 2024, aims to increase recycling rates and producer accountability.

The success of GFL in securing and effectively managing these EPR contracts is a critical political-economic factor influencing its operational landscape. The company's ability to navigate these evolving regulations and demonstrate efficient service delivery under EPR mandates will be key to its sustained growth and market leadership in environmental services.

International trade policies and tariffs, though not directly targeting waste management services, can indirectly influence GFL Environmental. For instance, tariffs on imported machinery or components used in waste processing equipment could raise capital expenditure costs. This might impact GFL's ability to invest in newer, more efficient technologies or to modernize its fleet in 2024 and 2025.

The cost of fuel, a significant operational expense for GFL, is also susceptible to global trade dynamics and energy policies. Fluctuations in oil prices, driven by geopolitical events and trade agreements, can directly affect GFL's transportation and logistics costs. Effective supply chain management and hedging strategies become crucial to mitigate these impacts.

Political Stability and Government Spending on Infrastructure

Political stability in North America is a crucial element for GFL Environmental, directly impacting government spending on infrastructure and soil remediation. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021, allocated approximately $1.2 trillion to upgrade roads, bridges, public transit, and water systems, with a significant portion dedicated to environmental initiatives. This increased public works investment translates into substantial opportunities for companies like GFL that offer waste management and environmental services essential for these projects.

The Canadian federal government's infrastructure plan also highlights a commitment to environmental sustainability. In 2023, Canada announced significant investments in green infrastructure, including projects focused on climate change adaptation and clean energy. These initiatives directly benefit GFL's soil remediation and hazardous waste management services, as many infrastructure upgrades require the cleanup and proper disposal of contaminated materials. The stability of these government commitments underpins GFL's revenue streams from these sectors.

Conversely, any political uncertainty or shifts in government priorities could lead to a slowdown in infrastructure development and environmental cleanup projects. A reduction in government spending, perhaps due to fiscal constraints or changes in political leadership, would directly affect the demand for GFL's core services. For example, if a new administration re-evaluates or cuts funding for existing environmental programs, GFL could see a decrease in contract opportunities. The company's performance is therefore closely tied to the continuity and scale of government investment in these areas.

Key political factors influencing GFL Environmental include:

- Government investment in infrastructure projects: Increased spending on roads, bridges, and utilities directly drives demand for GFL's waste management services.

- Environmental regulations and funding: Policies supporting soil remediation and hazardous waste disposal create opportunities for GFL's specialized services.

- Political stability and policy continuity: Predictable government spending and consistent environmental policies are vital for GFL's long-term planning and revenue forecasting.

Local Government Contracts and Relationships

GFL Environmental's operations are deeply intertwined with local government contracts, forming the bedrock of its revenue streams. The company's ability to secure and maintain these agreements with municipalities and residential customers directly impacts its market position and financial stability. Effective negotiation and strong relationships with local authorities are paramount for sustained growth.

The critical nature of these political ties was underscored in late 2023 and early 2024 with significant contract renegotiations in key markets. For instance, GFL's ongoing discussions regarding its waste management services in Toronto, a major metropolitan area, demonstrate the direct influence of local government decisions on the company's operational landscape and future revenue projections. These negotiations often involve complex discussions on service levels, pricing, and environmental compliance, directly affecting GFL's profitability and service delivery capacity in these vital urban centers.

- Municipal Contracts: GFL's business model relies heavily on securing long-term contracts with municipalities for waste collection and disposal services.

- Relationship Management: Maintaining positive and collaborative relationships with local government officials is essential for contract renewals and new business opportunities.

- Contract Renegotiations: The company's financial performance can be significantly impacted by the outcomes of renegotiations, as seen with recent discussions in major Canadian cities.

- Regulatory Compliance: Adherence to local environmental regulations and service standards stipulated in government contracts is a key operational requirement.

Government policies and political stability are critical for GFL Environmental, influencing everything from infrastructure investment to waste management regulations. For example, the US Bipartisan Infrastructure Law, with its substantial funding for environmental initiatives, directly benefits GFL by creating demand for its services. Similarly, Canada's commitment to green infrastructure projects in 2023 supports GFL's soil remediation and hazardous waste management operations.

What is included in the product

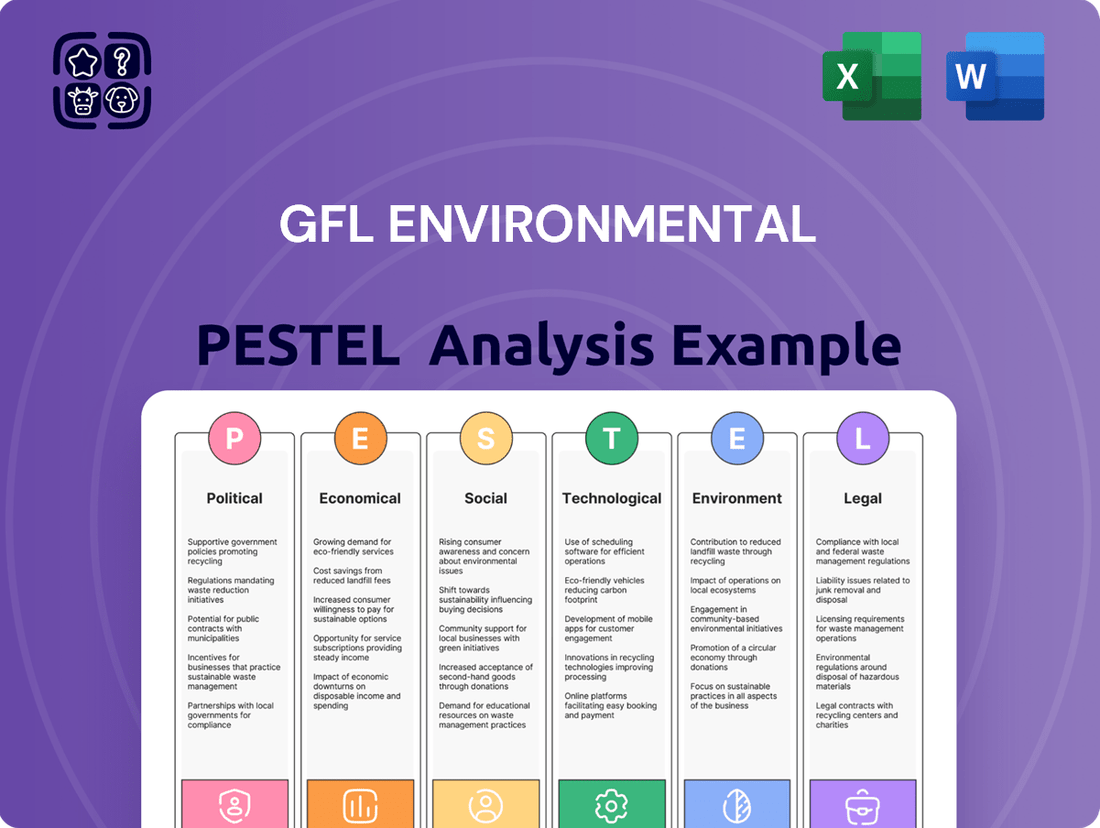

This GFL Environmental PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

It provides actionable insights for stakeholders to navigate the complex external landscape and capitalize on emerging opportunities within the environmental services sector.

A concise, PESTLE-driven summary of GFL Environmental's external landscape, designed to quickly identify and address potential market disruptions and opportunities.

Economic factors

North America's economic growth significantly impacts GFL Environmental's business. For instance, in the first quarter of 2024, the U.S. economy grew at an annualized rate of 1.3%, indicating a moderate pace that supports consistent waste generation from businesses and households. This steady economic activity translates to a stable demand for GFL's waste management and environmental services.

Consumer spending is a key driver for residential waste volumes. In May 2024, U.S. retail sales saw a modest increase, suggesting that consumers are continuing to spend, which in turn contributes to the amount of waste GFL handles. A stronger economy with higher consumer spending typically means more waste, directly benefiting GFL's operational volume and revenue streams.

Conversely, economic slowdowns or recessions pose challenges. During an economic downturn, businesses often reduce operations, leading to lower commercial waste volumes. Similarly, decreased consumer spending can result in less residential waste. This can put pressure on GFL's pricing and overall revenue, as seen during past economic contractions where waste volumes typically decline.

Fluctuations in commodity prices, especially for recycled materials like old corrugated containers (OCC) and other fibers, significantly influence GFL Environmental's recycling revenue streams. For instance, the average price for OCC saw considerable volatility throughout 2023 and into early 2024, impacting profitability for recycling operations.

While some fiber commodities may experience price declines, increases in non-fiber commodities like certain metals or plastics can offer a partial offset. This dynamic requires careful management to mitigate the overall impact on GFL's financial performance.

Effectively managing exposure to this commodity price volatility remains a persistent economic challenge for GFL, requiring strategic sourcing and sales agreements to stabilize earnings.

GFL Environmental is navigating significant inflationary pressures impacting fuel, labor, and supply chain costs. These rising expenses directly affect operational expenditures. Successfully passing these costs onto customers through price adjustments is therefore critical for GFL's financial health.

The company demonstrated resilience in 2023, achieving core pricing growth of 5.2%, which helped offset some of these inflationary headwinds and supported its adjusted EBITDA margins. This ability to implement price increases is a key factor in maintaining profitability amidst a challenging economic landscape.

Effective cost management remains paramount for GFL. By controlling expenditures related to its fleet, workforce, and procurement, the company can better protect its profit margins and ensure sustained financial performance, especially as inflation trends continue into 2024 and beyond.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact GFL Environmental's cost of borrowing, a critical consideration given its substantial debt. As of the first quarter of 2024, GFL reported a total debt of approximately $5.2 billion, underscoring the sensitivity of its financial performance to interest rate movements. Higher rates translate to increased interest expenses, potentially squeezing profit margins and limiting capital availability for growth initiatives.

GFL's strategic decision to divest its Environmental Services business in late 2023 for $1.0 billion was a significant move aimed at bolstering its financial health. A primary objective of this divestiture was to reduce its overall debt burden and improve its net leverage ratio. This deleveraging strategy is crucial for enhancing GFL's financial flexibility, making it easier and more cost-effective to access capital markets for future investments and potential acquisitions in its core solid waste and infrastructure sectors.

- Debt Reduction: The divestiture proceeds were largely earmarked for paying down existing debt, thereby lowering GFL's interest expenses.

- Improved Leverage: By reducing debt, GFL aims to lower its net leverage ratio, a key metric watched by investors and lenders.

- Enhanced Access to Capital: A stronger balance sheet and lower leverage typically improve a company's credit rating, facilitating access to capital at more favorable terms.

- Strategic Focus: The divestiture allowed GFL to concentrate resources and capital on its core, higher-margin businesses.

Mergers and Acquisitions (M&A) Activity

GFL Environmental’s economic strategy is heavily reliant on mergers and acquisitions (M&A) to fuel its growth. The company consistently targets acquisitions to broaden its market presence and enhance its service capabilities, which are critical for revenue expansion.

GFL maintains a strong M&A pipeline and intends to continue its aggressive acquisition approach, particularly within the solid waste collection sector. This strategy is further supported by its use of divestiture proceeds to finance these growth opportunities.

- Market Consolidation: GFL’s M&A activity is a primary driver for consolidating the fragmented environmental services market, increasing its competitive standing.

- Revenue Growth: Strategic acquisitions have demonstrably contributed to GFL's revenue. For instance, in the first quarter of 2024, the company reported a 5.4% increase in revenue year-over-year, partly attributed to contributions from acquired businesses.

- Capital Allocation: The company utilizes proceeds from asset sales, such as its planned divestiture of certain collection and processing operations in 2024, to fund future M&A endeavors.

GFL Environmental's financial performance is closely tied to macroeconomic trends, including economic growth and consumer spending. In Q1 2024, the U.S. economy expanded at a 1.3% annualized rate, supporting consistent waste generation. Consumer spending, as indicated by retail sales in May 2024, continues to be a driver for residential waste volumes.

Inflationary pressures remain a significant economic factor, impacting fuel, labor, and supply chain costs for GFL. The company's ability to implement price increases, such as the 5.2% core pricing growth achieved in 2023, is crucial for offsetting these rising expenses and maintaining profitability.

Interest rates directly affect GFL's substantial debt burden, which stood at approximately $5.2 billion in Q1 2024. Higher rates increase borrowing costs, impacting margins and capital availability. The company's strategic divestitures, like the $1.0 billion sale of its Environmental Services business in late 2023, aim to reduce debt and improve its leverage ratio.

GFL's growth strategy heavily relies on mergers and acquisitions (M&A), with a focus on the solid waste sector. This approach contributed to a 5.4% year-over-year revenue increase in Q1 2024. The company utilizes proceeds from asset sales to fund these strategic acquisitions, aiming for market consolidation and revenue expansion.

Same Document Delivered

GFL Environmental PESTLE Analysis

The GFL Environmental PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting GFL Environmental.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

Sociological factors

Public awareness of environmental issues like climate change and pollution is significantly shaping the demand for sustainable waste management. Consumers and communities are increasingly prioritizing services that minimize ecological footprints, directly impacting the waste management sector.

GFL Environmental's focus on sustainable solutions, including recycling and waste-to-energy initiatives, resonates strongly with these evolving societal values. This alignment enhances GFL's brand image and customer loyalty, as demonstrated by the growing market share in green services.

This heightened public sentiment often translates into policy changes and influences consumer purchasing decisions, creating both opportunities and challenges for companies like GFL. For instance, a 2024 survey indicated that 70% of consumers consider a company's environmental practices when making purchasing decisions.

North America's population is projected to reach over 500 million by 2025, with a significant portion concentrating in urban centers. This demographic trend fuels an escalating demand for comprehensive waste management solutions, directly benefiting companies like GFL Environmental. The increasing density of urban populations translates to higher waste generation volumes, requiring more sophisticated collection, processing, and disposal services.

As cities grow, so does the complexity of waste streams, including more specialized materials and liquids. GFL's diversified service offerings, encompassing solid waste, liquid waste, and soil remediation, are well-positioned to address these evolving urban needs. For instance, the expansion of metropolitan areas often leads to brownfield development, increasing the demand for soil remediation services that GFL provides.

GFL Environmental's success hinges on robust community engagement across its North American operations, crucial for maintaining its social license to operate. Positive relationships built through addressing local concerns and supporting community initiatives, such as waste reduction education, pave the way for smoother project approvals and expansions.

Labor Availability and Workforce Dynamics

GFL Environmental's operations heavily rely on a robust labor pool, particularly for skilled roles like drivers and operational staff. The availability and cost of this workforce are critical sociological considerations. In 2024, the environmental services sector, like many others, is experiencing labor shortages and upward pressure on wages, directly impacting GFL's operational efficiency and overall costs.

Managing a workforce that, as of recent reports, numbers between 15,000 and 20,000 employees, is a significant undertaking for GFL. Effective human capital management, encompassing comprehensive training programs and strong retention strategies, is paramount to maintaining service quality and controlling labor expenses.

- Labor Shortages: The environmental services industry faces ongoing challenges in attracting and retaining qualified drivers and operational personnel.

- Wage Inflation: Rising wage expectations across various sectors are increasing labor costs for companies like GFL.

- Workforce Size: GFL's substantial employee base necessitates significant investment in training, development, and retention initiatives.

- Skill Gaps: A potential shortage of specialized skills within the workforce could hinder GFL's ability to adopt new technologies or expand services.

Health and Safety Standards

Societal expectations and regulatory mandates regarding worker health and safety are critically important in the waste management sector. GFL Environmental's dedication to providing secure work environments and implementing forward-thinking health and safety protocols, as detailed in its Supplier Code of Conduct, is vital for employee welfare, uninterrupted operations, and a favorable public perception.

These standards directly impact GFL's operational costs and risk management strategies. For instance, in 2023, the waste management industry in North America saw significant investment in safety training and equipment, with companies like GFL prioritizing compliance with evolving OSHA and provincial regulations. This focus is not just about avoiding fines but also about fostering a culture that values employee well-being, which can reduce turnover and improve productivity.

- Industry Focus on Safety: The waste management sector is inherently high-risk, making robust health and safety protocols non-negotiable for companies like GFL.

- Regulatory Compliance: Adherence to stringent government regulations, such as those from OSHA in the US and similar bodies in Canada, is a core requirement.

- Employee Well-being: GFL's commitment to safe working conditions directly contributes to employee morale, retention, and overall operational efficiency.

- Reputational Impact: Strong safety performance enhances GFL's public image, attracting talent and building trust with communities and stakeholders.

Societal emphasis on ethical business practices and corporate responsibility is increasingly influencing GFL Environmental's operational strategies and stakeholder relationships. Consumers and investors alike are scrutinizing companies for their commitment to social good, impacting brand perception and investment decisions.

GFL's proactive engagement in community development and its adherence to ethical labor practices, as evidenced by its workforce development programs, are crucial for maintaining its social license to operate. These efforts foster goodwill and can lead to smoother regulatory approvals and enhanced community support for its projects.

The waste management sector, including GFL, faces significant labor market dynamics. As of early 2024, the industry experienced a notable shortage of skilled drivers and operational staff, leading to increased wage pressures. GFL, with its workforce estimated between 15,000 and 20,000 employees, must navigate these challenges through competitive compensation and robust retention strategies to ensure operational continuity and service quality.

| Sociological Factor | Impact on GFL Environmental | Supporting Data/Observation (2024-2025) |

|---|---|---|

| Public Awareness of Sustainability | Increased demand for eco-friendly waste solutions; enhanced brand image for GFL's green initiatives. | 70% of consumers consider environmental practices in purchasing (2024 survey). |

| Urbanization and Population Growth | Higher waste generation volumes in urban centers; increased need for GFL's comprehensive services. | North American population projected over 500 million by 2025, with urban concentration. |

| Labor Market Dynamics | Challenges in attracting/retaining skilled labor; upward pressure on wages impacting operational costs. | Industry-wide labor shortages and wage inflation noted in early 2024. |

| Health and Safety Expectations | Critical for operational efficiency, employee morale, and public perception; regulatory compliance essential. | Significant investment in safety training and equipment in the waste management sector (2023). |

Technological factors

GFL Environmental actively invests in cutting-edge waste processing and recycling technologies to boost efficiency and reduce its environmental footprint. This commitment is evident in their advanced Material Recycling Facilities (MRFs) and specialized organics processing plants.

These facilities are designed to recover valuable materials and transform organic waste into beneficial products like compost and fertilizers, thereby enhancing resource recovery rates. For instance, in 2023, GFL reported significant increases in the volume of recyclables processed across its network, contributing to a more circular economy.

GFL Environmental is making substantial investments in renewable natural gas (RNG) projects, a technology that captures biogas from landfills and transforms it into usable clean energy. This strategic move directly addresses environmental concerns by significantly reducing greenhouse gas emissions, a key factor in today's climate-conscious world.

The development of RNG projects not only generates a valuable renewable energy source but also offers GFL a cleaner alternative fuel for its own fleet operations. This dual benefit supports the company's overarching sustainability objectives and simultaneously opens up new avenues for revenue generation through the sale of this green fuel.

GFL has set an ambitious target to double its beneficial use of biogas by the year 2030, underscoring the growing importance of this technology in its long-term business strategy and its commitment to environmental stewardship.

GFL Environmental is making significant strides in fleet modernization, with a key focus on transitioning to compressed natural gas (CNG) and other alternative fuel vehicles. This technological shift is designed to slash direct greenhouse gas emissions and lessen the company's dependence on conventional diesel fuel.

This strategic move not only supports environmental objectives but also holds the potential for long-term fuel cost reductions. GFL has committed to a clear target: at least 50% of its annual diesel solid waste vehicle replacements will be with CNG or alternative fuel options, signaling a strong commitment to a greener fleet by 2024-2025.

Data Analytics and Operational Efficiency

Data analytics and digital tools are increasingly vital for optimizing waste management operations. For GFL Environmental, this translates to smarter collection routes, leading to reduced fuel consumption and labor costs. For instance, companies in the waste management sector have reported efficiency gains of up to 15% by implementing route optimization software.

Improved waste sorting through advanced analytics can also enhance GFL's resource recovery efforts, potentially increasing revenue from recycled materials. The global waste management market is projected to reach $674.7 billion by 2032, with technology adoption being a key growth driver.

Leveraging technology for better logistics and resource management offers significant cost savings and improved service delivery. GFL's investment in digital transformation is expected to yield substantial operational efficiencies, aligning with industry trends that emphasize data-driven decision-making.

- Route Optimization: Digital tools can cut collection times and fuel usage by up to 15% in the waste management sector.

- Waste Sorting Enhancement: Analytics can improve the accuracy and efficiency of waste sorting, boosting resource recovery.

- Cost Savings: Technology adoption in logistics and resource management directly contributes to reduced operational expenses.

- Market Growth: The waste management market's growth is increasingly tied to technological advancements and data utilization.

Infrastructure and Soil Remediation Technologies

GFL Environmental's infrastructure and soil remediation services are heavily dependent on advanced technological solutions for effective waste management and site restoration. The company's ability to handle contaminated soil and hazardous waste hinges on its adoption of specialized equipment and processes.

Continued investment in and development of innovative remediation techniques are crucial for GFL to maintain its competitive advantage. For instance, advancements in chemical oxidation or bioremediation technologies can significantly improve cleanup efficiency and reduce environmental impact, directly benefiting their diverse clientele across North America.

In 2024, the environmental services sector saw increased demand for sophisticated soil remediation technologies. GFL's focus on these areas is underscored by:

- Investment in R&D: Ongoing allocation of capital towards developing and acquiring cutting-edge remediation processes.

- Technology Adoption: Integration of advanced techniques like in-situ stabilization and thermal desorption for complex contamination challenges.

- Regulatory Compliance: Ensuring all deployed technologies meet or exceed stringent environmental regulations, a key driver for service demand.

- Efficiency Gains: Technological upgrades aim to improve processing speeds and reduce the overall cost of remediation projects, enhancing GFL's service offering.

GFL Environmental's technological strategy centers on enhancing efficiency and sustainability through advanced waste processing and recycling. Their investment in Material Recycling Facilities (MRFs) and organics processing plants aims to maximize resource recovery, as seen in their 2023 report of increased recyclables processed.

The company is also a leader in renewable natural gas (RNG) technology, capturing biogas from landfills to produce clean energy and a cleaner fuel for their fleet. GFL has a clear goal to double biogas utilization by 2030, reflecting a strong commitment to environmental stewardship and new revenue streams.

Furthermore, GFL is modernizing its fleet, with a target for at least 50% of its solid waste vehicle replacements by 2024-2025 to be CNG or alternative fuel options, directly reducing greenhouse gas emissions and operational costs.

Data analytics and digital tools are integral to optimizing operations, improving route efficiency and waste sorting, which can lead to significant cost savings and increased revenue from recycled materials. The global waste management market's growth, projected to reach $674.7 billion by 2032, is significantly driven by such technological adoption.

Legal factors

GFL Environmental navigates a stringent environmental legal landscape in both Canada and the United States. This includes adherence to regulations governing waste disposal, air emissions, and the handling of hazardous materials. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which dictates how hazardous waste is managed from creation to disposal. GFL's commitment to compliance is a cornerstone of its business, necessitating ongoing investment in technology and processes to meet these evolving standards and avoid costly legal repercussions.

The company's corporate environmental policy underscores its dedication to meeting all legal compliance obligations. This proactive approach is crucial, as environmental non-compliance can lead to significant fines, operational disruptions, and reputational damage. For example, in 2024, several waste management companies faced substantial penalties for violations related to improper landfill operations and emissions. GFL's continuous monitoring and reporting systems are designed to mitigate these risks, ensuring that its operations align with the latest environmental mandates.

GFL Environmental operates under a complex web of permitting and licensing mandates, crucial for its waste management and environmental services. Obtaining and maintaining these approvals for collection, transfer stations, landfills, and remediation sites is a fundamental legal requirement. For instance, in 2024, the company continued to navigate varying state-level environmental permitting processes across the United States, which can involve lengthy review periods and public comment stages.

Delays or denials in securing these essential permits can directly hinder GFL's ability to expand its operations or even maintain existing service levels. The company's success hinges on its capacity to effectively manage and comply with these diverse regulatory landscapes, which span local ordinances, provincial or state-specific environmental laws, and federal regulations, ensuring continuous operational authorization.

GFL Environmental's operations are deeply intertwined with contractual obligations, particularly long-term agreements with municipalities. These contracts dictate pricing, service standards, and renewal terms, forming the bedrock of the company's revenue stability and growth prospects. For instance, the renewal of GFL's collection contract with the City of Toronto in 2024, valued at approximately $170 million annually, underscores the financial significance of these municipal partnerships.

Corporate Governance and Securities Regulations

As a dual-listed entity on the NYSE and TSX, GFL Environmental navigates a complex web of corporate governance and securities regulations. This necessitates meticulous adherence to rules governing financial reporting, transparency in operations, and compliance with directives on share buybacks and investor communications. For instance, GFL's commitment to these standards is evident in its comprehensive Annual Information Forms and other periodic filings submitted to Canadian and U.S. securities regulators, ensuring stakeholders have access to crucial, up-to-date information.

These regulatory frameworks mandate specific disclosures and operational practices. For 2024, companies like GFL are expected to continue focusing on robust ESG (Environmental, Social, and Governance) reporting, a trend amplified by regulatory bodies. For example, the SEC's proposed climate disclosure rules, though subject to ongoing review and potential adjustments, signal a future where environmental impact reporting becomes increasingly standardized and legally required. GFL's proactive approach to sustainability reporting positions it favorably within this evolving regulatory landscape.

- Financial Reporting: GFL must comply with GAAP/IFRS and SEC/OSC filing requirements, including quarterly (10-Q, 51-101F1) and annual (10-K, AIF) reports.

- Shareholder Communications: Adherence to proxy circular regulations and rules governing annual general meetings is critical for maintaining investor confidence.

- Insider Trading and Disclosure: Strict compliance with rules on reporting beneficial ownership and trading by insiders is paramount.

- Securities Offerings: Any future debt or equity issuances must follow prospectus requirements and registration statements.

Labor Laws and Employment Regulations

GFL Environmental operates under a complex web of labor laws and employment regulations across its various operating regions, impacting everything from minimum wage requirements to workplace safety standards. For instance, in 2024, many U.S. states and Canadian provinces saw adjustments to their minimum wage laws, directly affecting GFL's operational costs and employee compensation structures. Compliance with these evolving legal frameworks is paramount to avoid costly penalties and reputational damage.

The company's commitment to fair labor practices, as outlined in its Supplier Code of Conduct, extends to ensuring safe working conditions and upholding human rights throughout its operations and supply chain. Failure to adhere to these standards can lead to significant legal challenges, including labor disputes and potential litigation, which could disrupt business continuity. In 2025, the focus on ESG (Environmental, Social, and Governance) factors by investors and regulators continues to place a spotlight on companies' labor practices.

- Wage and Hour Laws: GFL must comply with federal, state, and local laws dictating minimum wages, overtime pay, and record-keeping for its substantial workforce.

- Workplace Safety Regulations: Adherence to OSHA (Occupational Safety and Health Administration) standards in the U.S. and similar bodies in Canada is critical for preventing accidents and ensuring employee well-being.

- Anti-Discrimination and Equal Opportunity: GFL is bound by laws prohibiting discrimination based on race, gender, age, religion, and other protected characteristics in hiring and employment practices.

- Union Relations and Collective Bargaining: Where applicable, GFL must navigate regulations surrounding unionization and engage in collective bargaining processes with employee representatives.

GFL Environmental operates within a highly regulated sector, necessitating strict adherence to environmental laws in both Canada and the U.S. These cover waste management, emissions, and hazardous materials handling, with agencies like the EPA actively enforcing regulations such as RCRA. Compliance requires continuous investment in technology and processes to meet evolving standards and avoid penalties.

The company's operations depend on securing and maintaining numerous permits and licenses for various facilities, a process that can involve lengthy reviews and public comment periods. Delays or denials in obtaining these essential approvals can significantly impede GFL's ability to expand or even sustain its current service levels, highlighting the critical nature of navigating diverse regulatory landscapes.

GFL's business model relies heavily on long-term contracts with municipalities, which dictate pricing, service standards, and renewal terms, ensuring revenue stability. For example, the renewal of its collection contract with the City of Toronto in 2024, valued at approximately $170 million annually, demonstrates the substantial financial importance of these municipal partnerships.

As a dual-listed company, GFL faces stringent corporate governance and securities regulations, demanding meticulous compliance with financial reporting, transparency, and investor communication rules. The company's proactive approach to ESG reporting, influenced by regulatory trends like the SEC's proposed climate disclosure rules, positions it favorably in the current environment.

Environmental factors

Climate change is a major environmental concern influencing GFL Environmental's operations and strategic goals. The company is actively working to reduce its greenhouse gas (GHG) emissions, recognizing the urgency of this global issue.

GFL has set an ambitious target to achieve a 30% absolute reduction in its Scope 1 and 2 emissions by 2030, using 2021 as its baseline year. This goal is designed to align with established science-based pathways for emission reduction.

Key initiatives supporting this target include enhancing landfill gas capture systems to mitigate methane release and transitioning its fleet to utilize alternative fuel vehicles, thereby lowering its carbon footprint.

GFL Environmental's strategy heavily emphasizes increasing waste diversion and recycling rates, a core component of its environmental commitment. The company's investments in material recovery and advanced recycling technologies are crucial for achieving this, as they directly contribute to diverting significant volumes of waste away from traditional landfill disposal.

In 2023, GFL reported diverting over 4.5 million tons of waste from landfills through its recycling operations, showcasing the tangible impact of its environmental initiatives. This focus is not merely about compliance; it's a proactive response to escalating societal expectations and increasingly stringent regulations pushing for a more circular economy.

Effective landfill management, including biogas capture, is a cornerstone of GFL Environmental's strategy. This process mitigates methane emissions, a potent greenhouse gas, by converting it into a valuable renewable energy source. GFL aims to double its beneficial biogas utilization by 2030, underscoring its dedication to sustainable landfill operations and environmental stewardship.

Water and Soil Contamination Risks

GFL Environmental's extensive operations, especially in liquid waste management and soil remediation, present inherent risks of water and soil contamination. The company's commitment to strict environmental protocols and investment in advanced remediation technologies are crucial for preventing pollution, ensuring responsible waste handling, and safeguarding natural resources. GFL's environmental policy explicitly prioritizes pollution prevention.

In 2023, GFL spent $215 million on environmental compliance and sustainability initiatives, a 12% increase from 2022, reflecting a strong focus on mitigating these risks. The company's soil remediation services directly address existing contamination, aiming to restore affected land.

- $215 million invested in environmental compliance and sustainability in 2023.

- 12% increase in sustainability investment from 2022 to 2023.

- Soil remediation services actively combat existing water and soil contamination.

Resource Conservation and Circular Economy Initiatives

GFL Environmental is deeply invested in resource conservation and championing the circular economy. This commitment translates into tangible actions such as prioritizing reuse and recycling programs, which directly reduce the demand for virgin raw materials. For instance, in 2023, GFL processed over 10 million tons of recyclable materials, diverting them from landfills and giving them new life.

The company actively explores and implements innovative strategies aimed at minimizing waste generation across its operations. This includes developing advanced sorting technologies and finding value in byproducts that might otherwise be discarded. GFL's focus on resource efficiency not only benefits the environment but also creates economic opportunities by transforming waste into valuable commodities.

GFL also emphasizes collaboration with various stakeholders, including government agencies, industry partners, and community groups, to foster collective progress in resource management. This collaborative approach is vital for advancing knowledge and implementing scalable solutions that support a more sustainable future. Their partnerships aim to drive innovation and share best practices in waste reduction and recycling.

- Resource Conservation: GFL's operations in 2023 processed over 10 million tons of recyclable materials.

- Circular Economy Focus: Initiatives include reuse programs and exploring value in waste byproducts.

- Waste Minimization: Investment in advanced sorting technologies contributes to reducing landfill waste.

- Stakeholder Collaboration: Partnerships are key to advancing knowledge and implementing sustainable practices.

GFL Environmental's environmental strategy is deeply intertwined with addressing climate change and promoting a circular economy. The company is actively working to reduce its greenhouse gas emissions, with a target of a 30% absolute reduction in Scope 1 and 2 emissions by 2030 from a 2021 baseline, through initiatives like enhanced landfill gas capture and fleet modernization.

A significant focus is placed on increasing waste diversion and recycling rates, evidenced by the diversion of over 4.5 million tons of waste in 2023 through its recycling operations. This commitment extends to resource conservation, with GFL processing over 10 million tons of recyclable materials in 2023, thereby reducing the demand for virgin raw materials.

The company also prioritizes effective landfill management, aiming to double its beneficial biogas utilization by 2030, which mitigates methane emissions and generates renewable energy. GFL's investments in environmental compliance and sustainability initiatives saw a 12% increase from 2022 to 2023, totaling $215 million, underscoring its dedication to pollution prevention and responsible waste handling.

| Environmental Factor | GFL Environmental's Actions & Data (2023/2024-2025 Outlook) | Impact/Goal |

| Climate Change Mitigation | Target: 30% absolute reduction in Scope 1 & 2 GHG emissions by 2030 (vs. 2021 baseline). Initiatives: landfill gas capture, alternative fuel vehicles. | Reduced carbon footprint, alignment with science-based pathways. |

| Waste Diversion & Recycling | Diverted over 4.5 million tons of waste from landfills in 2023. Processed over 10 million tons of recyclable materials in 2023. | Promoting circular economy, reducing reliance on virgin materials. |

| Resource Conservation | Focus on reuse programs, exploring value in waste byproducts, advanced sorting technologies. | Minimizing waste generation, creating economic value from waste. |

| Landfill Management & Biogas | Aiming to double beneficial biogas utilization by 2030. | Mitigating methane emissions, generating renewable energy. |

| Environmental Compliance & Risk Management | Invested $215 million in environmental compliance & sustainability in 2023 (12% increase from 2022). Soil remediation services. | Pollution prevention, safeguarding natural resources, mitigating contamination risks. |

PESTLE Analysis Data Sources

Our PESTLE analysis for GFL Environmental is informed by a comprehensive blend of data sources, including government environmental regulations, economic indicators from reputable financial institutions, and industry-specific market research reports. We also incorporate insights from technological advancement forecasts and socio-political trend analyses to ensure a holistic view.