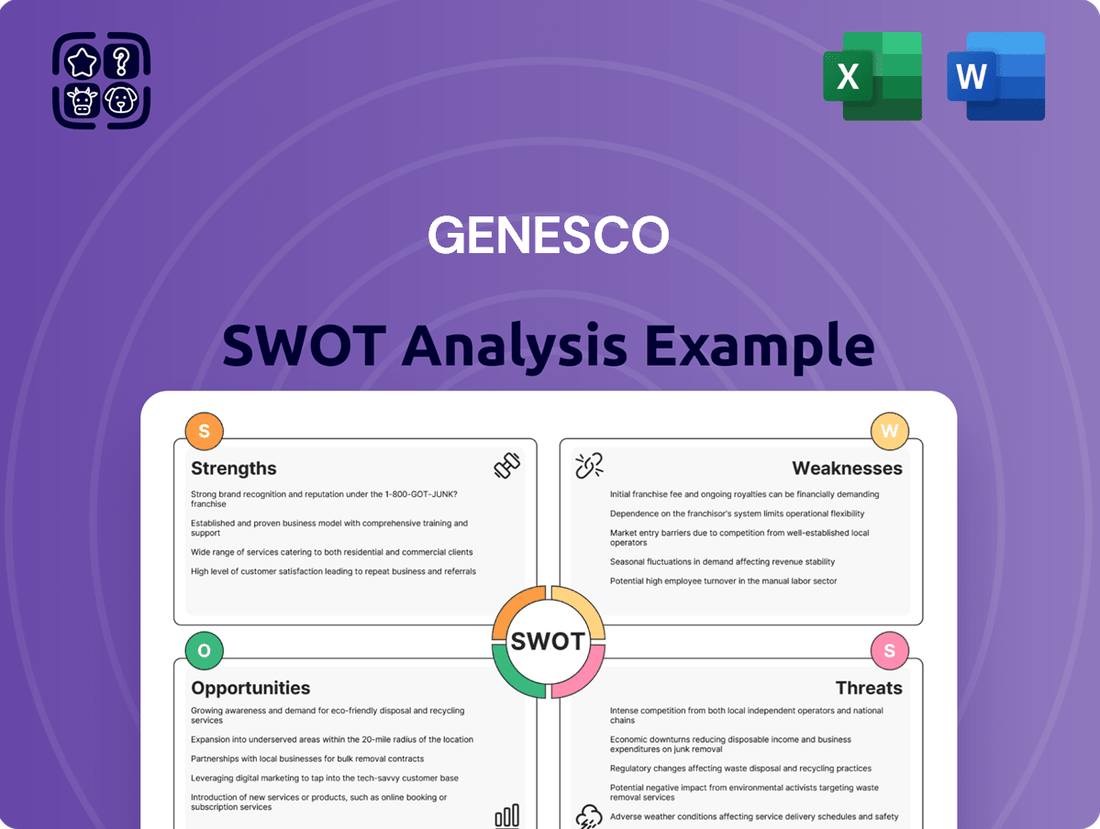

Genesco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genesco Bundle

Genesco's market position is defined by its diverse brand portfolio, but also faces challenges in adapting to evolving consumer trends and digital retail. Understanding these internal capabilities and external market forces is crucial for strategic planning.

Want the full story behind Genesco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Genesco's strength lies in its diverse brand portfolio, encompassing popular names like Journeys, Schuh, Little Burgundy, and Johnston & Murphy. This strategic diversification allows the company to cater to a wide array of customer segments, from fashion-conscious youth to those seeking premium, classic styles. For instance, Journeys is a dominant force in the teen and young adult footwear market, while Johnston & Murphy appeals to a more mature and affluent demographic. This broad market penetration helps mitigate risks associated with over-reliance on any single consumer group.

Genesco's strength lies in its well-developed omnichannel capabilities, seamlessly blending its physical stores with a strong e-commerce presence. This integration allows customers to shop how and when they prefer, whether browsing in-store or ordering online for delivery or pickup. This approach is vital in the current retail climate, enhancing customer convenience and accessibility.

The flagship Journeys chain has demonstrated a robust turnaround, achieving positive comparable sales growth in recent quarters. This success is attributed to strategic enhancements in product selection and a renewed focus on the customer experience.

Journeys is particularly well-positioned to capitalize on the growing demand for style-led footwear among young female consumers. This segment is outperforming the broader footwear market, presenting a significant avenue for continued expansion and market share gains for Genesco.

Cost Management and Operational Efficiency

Genesco has actively pursued cost management initiatives, targeting significant annualized savings. These programs, alongside strategic store rationalization which included closing underperforming locations, have streamlined operations. This focus on efficiency not only reduces expenses but also enhances the company's overall profitability and financial health.

For instance, in fiscal year 2024, Genesco achieved approximately $50 million in annualized savings through its ongoing efficiency programs. This was partly driven by the closure of around 100 underperforming stores. These actions contribute to a more focused and productive store portfolio, bolstering the company's balance sheet.

- Cost Reduction Programs: Genesco's commitment to cost management yielded substantial annualized savings in FY24.

- Store Rationalization: The closure of approximately 100 unproductive stores in FY24 contributed to operational efficiency.

- Leaner Operating Model: These efforts have fostered a more efficient and productive operational structure.

- Financial Strengthening: Improved profitability and a leaner model positively impact the company's balance sheet.

Strong Inventory Management

Genesco's strength in inventory management is notable, with the company actively working to reduce its stock levels. For instance, in the first quarter of fiscal 2024, Genesco reported a significant 16% decrease in total inventory compared to the prior year. This efficient control over inventory translates to lower carrying costs and fewer markdowns, ultimately boosting profitability and freeing up valuable working capital.

This focus on optimized inventory levels is a key financial advantage. By minimizing excess stock, Genesco can react more nimbly to changing consumer demand and reduce the risk of obsolescence. This proactive approach to inventory management directly supports improved cash flow and a healthier balance sheet, crucial for sustained financial performance.

The benefits of this strong inventory management are clear:

- Reduced Carrying Costs: Lower inventory levels mean less money tied up in storage, insurance, and potential damage.

- Minimized Markdowns: By having the right amount of stock, the need for heavy discounting to clear excess goods is reduced.

- Improved Cash Flow: Less capital invested in inventory means more cash available for other business needs or investments.

Genesco's diversified brand portfolio, including Journeys, Schuh, and Johnston & Murphy, allows it to appeal to a broad customer base, mitigating risks associated with any single demographic. Journeys, in particular, is a strong performer in the youth footwear market, while Johnston & Murphy serves a more mature audience, showcasing the company's ability to capture diverse market segments.

What is included in the product

Maps out Genesco’s market strengths, operational gaps, and risks, offering a comprehensive view of its strategic position.

Helps identify and address Genesco's strategic vulnerabilities by clearly outlining threats and weaknesses.

Weaknesses

Genesco's significant reliance on brands like Journeys, which cater primarily to teens and young adults, presents a notable weakness. This demographic's fashion tastes are notoriously fickle and subject to rapid shifts, making Genesco vulnerable to sudden changes in consumer preferences. For instance, if a particular style or brand favored by Gen Z falls out of favor, Journeys' sales could be significantly impacted, as was seen in some segments of the footwear market during late 2023 and early 2024 where retro styles briefly took precedence over newer trends.

While Genesco has seen improvements in its overall comparable sales, certain segments are still grappling with declining in-store sales. This suggests that some of their physical retail locations are struggling to attract customers and generate revenue, highlighting a need to re-evaluate and refine their brick-and-mortar strategy.

While Genesco is strategically closing underperforming stores, a significant reduction in its physical footprint, such as the reported closure of approximately 200 stores in fiscal year 2024, could diminish brand visibility and customer accessibility in certain markets. This necessitates a careful strategy to ensure continued brand presence and customer engagement, especially as they focus on a more curated retail experience.

Wholesale Segment Challenges

Genesco's wholesale segment, operating under the Genesco Brands Group, has faced a downturn in sales. For the fiscal year 2024, the company reported a 10% decrease in wholesale revenue, highlighting significant headwinds in this distribution channel. This decline suggests potential issues with product assortment, brand partnerships, or broader market shifts impacting wholesale demand.

These challenges in the wholesale market necessitate a strategic reassessment of Genesco's approach to this segment. The performance of their licensed brands within the wholesale channel, in particular, requires close examination to identify areas for improvement and potential repositioning. Addressing these weaknesses is crucial for enhancing the overall contribution of the wholesale business to the company's financial health.

- Decreased Wholesale Sales: Genesco Brands Group experienced a notable decline in wholesale revenue during fiscal year 2024.

- Brand Performance Concerns: The performance of licensed brands within the wholesale channel may be contributing to the segment's struggles.

- Market Headwinds: Broader market dynamics could be negatively impacting demand for Genesco's wholesale offerings.

- Strategic Review Needed: The company must analyze and potentially adjust its wholesale strategy to reverse the negative sales trend.

Vulnerability to Economic Headwinds

Genesco's position as a specialty retailer of footwear and apparel makes it particularly vulnerable to economic downturns. Factors like rising inflation and a general sense of economic uncertainty can lead consumers to cut back on non-essential spending, directly impacting Genesco's sales volumes. This cautious consumer behavior can put significant pressure on the company's profit margins as it may need to resort to promotions to drive demand.

For instance, during periods of high inflation, consumers often prioritize essential goods over discretionary purchases like fashion footwear and apparel. This shift in spending habits directly affects Genesco's revenue streams. The company's reliance on consumer discretionary spending means that any significant economic headwinds, such as a recession or persistent inflation, can lead to a noticeable slowdown in sales and profitability.

- Economic Sensitivity: Genesco's business model is inherently tied to consumer discretionary spending, making it susceptible to economic slowdowns.

- Inflationary Impact: Rising inflation erodes consumer purchasing power, potentially reducing demand for Genesco's products.

- Consumer Confidence: A decline in consumer confidence, often linked to economic uncertainty, can lead to decreased sales for retailers like Genesco.

Genesco's heavy reliance on the teen and young adult demographic, particularly through its Journeys brand, exposes it to the volatile nature of youth fashion trends. A sudden shift in preferences, as observed with the brief surge in retro styles impacting newer trends in late 2023 and early 2024, can significantly disrupt sales. This vulnerability necessitates constant adaptation to maintain relevance with a fast-changing consumer base.

Same Document Delivered

Genesco SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Genesco's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis is unlocked upon purchase.

Opportunities

The ongoing surge in e-commerce offers Genesco a prime chance to strengthen its digital presence. With online retail projected to grow steadily, Genesco can capitalize by enhancing its existing platforms and exploring new digital avenues.

Investing in cutting-edge digital tools, such as augmented reality for virtual try-ons and AI-driven personalization, can significantly elevate the customer experience. This focus on innovation, coupled with a smooth integration of online and physical store experiences, positions Genesco to attract and retain a broader customer base, potentially boosting online sales by an estimated 15-20% in the coming fiscal year.

Journeys sees a significant growth opportunity by focusing on teen girls, recognizing their strong influence on fashion trends. This segment represents a "mega-growth opportunity" for the brand.

By tailoring product selections and marketing campaigns specifically to the style preferences and needs of teen girls, Journeys can unlock substantial sales increases. This strategic focus aligns with the brand's "style-led" approach.

Genesco can significantly bolster its market position by pursuing strategic acquisitions of brands that complement its existing footwear and apparel portfolio. This approach allows for rapid market expansion and diversification of its product offerings. For instance, acquiring a popular athleisure brand could tap into a rapidly growing consumer segment.

Forming strategic partnerships, similar to the recent licensing agreement with Wrangler, presents another avenue for growth. These collaborations can provide access to new customer bases and distribution channels without the full commitment of an acquisition. Such alliances are crucial for staying competitive in the dynamic retail landscape.

Sustainability and Ethical Practices Focus

Genesco can capitalize on the growing consumer preference for sustainability by amplifying its eco-friendly and ethical practices. This includes showcasing the use of sustainable materials and transparent sourcing, appealing to a significant and expanding market of ethically-minded shoppers. For instance, by 2024, over 60% of consumers indicated they would pay more for products from sustainable brands.

This focus presents a clear opportunity to differentiate Genesco in a competitive retail landscape. By actively promoting its commitment to reduced environmental impact, the company can build stronger brand loyalty and attract new customers who prioritize corporate responsibility. Genesco's efforts in this area could lead to increased market share among younger demographics, who are particularly vocal about environmental concerns.

- Enhanced Brand Reputation: Promoting sustainability can significantly boost Genesco's public image.

- Attracting Conscious Consumers: A strong sustainability message appeals to a growing market segment.

- Competitive Differentiation: Ethical practices can set Genesco apart from competitors.

- Potential for Premium Pricing: Consumers are often willing to pay more for sustainable products.

International Market Expansion

Genesco can capitalize on its existing international footprint in the UK and Canada by strategically expanding into new, high-growth markets. Regions within the Asia-Pacific, for instance, are showing significant increases in consumer wealth and a rapid adoption of digital commerce, creating a fertile ground for Genesco's diverse brand offerings.

This expansion could be particularly effective for brands like Journeys and its associated private labels, which appeal to a broad demographic. By leveraging online sales channels and potentially localized physical retail strategies, Genesco can tap into the burgeoning middle class in these emerging economies.

- Targeted Market Entry: Focus on countries with robust e-commerce infrastructure and increasing disposable incomes, such as South Korea, Australia, or select Southeast Asian nations.

- Digital-First Approach: Prioritize online sales and digital marketing to reach a wider audience efficiently in new international territories.

- Brand Portfolio Diversification: Tailor brand offerings to suit local preferences and cultural nuances, maximizing appeal and market penetration.

Genesco can leverage the continued growth of e-commerce by enhancing its digital platforms and exploring new online avenues, aiming to increase online sales by an estimated 15-20% in the upcoming fiscal year. The company also sees a significant opportunity with Journeys to focus on teen girls, a demographic that strongly influences fashion trends, positioning this segment as a "mega-growth opportunity" for the brand.

Threats

The retail footwear and apparel sector is a crowded marketplace. Genesco faces a multitude of competitors, from giant department stores and mass-market brands to niche specialty shops and burgeoning online retailers. This crowded landscape often forces aggressive pricing strategies, squeezing profit margins and demanding continuous product development to stay relevant.

Genesco, particularly its prominent youth-focused brand Journeys, faces a significant threat from rapidly shifting consumer preferences and evolving fashion trends. For instance, in the fiscal year 2024, Genesco saw a 3% decrease in total sales, partly attributed to challenges in keeping pace with fast-changing youth fashion demands.

This dynamic environment means that a failure to adapt swiftly to new styles and emerging demands can quickly result in inventory that is no longer desirable. Such a lag can lead to increased markdowns to clear old stock, directly impacting profit margins and ultimately contributing to declining sales figures for the company.

Global events, such as geopolitical tensions and lingering pandemic effects, continue to pose a significant threat to Genesco's supply chain. These disruptions can manifest as raw material shortages and increased logistics expenses, impacting their ability to meet demand efficiently. For instance, the ongoing volatility in shipping costs, which saw significant spikes in 2021-2022, could continue to affect Genesco's cost of goods sold in 2024 and 2025, potentially squeezing profit margins.

Economic Volatility and Reduced Consumer Spending

Economic volatility remains a significant threat, with persistent inflation and higher interest rates in 2024 continuing to squeeze household budgets. This directly impacts consumer discretionary spending, especially on items like footwear and apparel, which are often considered non-essential. Genesco's reliance on fashion-driven sales makes it particularly vulnerable to these shifts in consumer sentiment and purchasing power.

The diminishing consumer savings rate, a trend observed throughout 2023 and into early 2024, further exacerbates this threat. As consumers prioritize essential goods and services, spending on apparel and accessories is likely to decline. For instance, retail sales growth for apparel and accessories has shown a more moderate pace compared to previous years, reflecting this cautious consumer behavior.

- Inflationary pressures continue to erode purchasing power for discretionary goods.

- Rising interest rates make borrowing more expensive, impacting consumer credit and spending.

- Declining consumer savings rates limit the capacity for non-essential purchases.

- Reduced discretionary spending directly translates to lower sales volumes for Genesco's product categories.

High E-commerce Return Rates and Cybersecurity Risks

The burgeoning e-commerce landscape, while a significant growth avenue, presents Genesco with the persistent challenge of high return rates, particularly within the fashion sector. These returns directly impact profitability by increasing reverse logistics costs and potentially leading to unsaleable inventory. For instance, fashion e-commerce return rates can hover around 20-30%, a figure that significantly strains operational budgets.

Furthermore, Genesco's expanded digital presence amplifies its exposure to cybersecurity threats. A data breach could result in substantial financial penalties, regulatory fines, and severe damage to the company's brand reputation. The increasing sophistication of cyberattacks means that robust security measures are not just a cost but a critical necessity for business continuity and customer trust.

- Increased Operational Costs: High return volumes in e-commerce, estimated to cost the retail industry billions annually, directly impact Genesco's bottom line through shipping, processing, and restocking expenses.

- Cybersecurity Vulnerabilities: As digital transactions grow, so does the risk of data breaches. In 2023, the average cost of a data breach for companies globally reached $4.45 million, a figure Genesco must actively mitigate.

- Reputational Damage: A significant cybersecurity incident or a consistently poor returns experience can erode customer loyalty and brand image, leading to long-term revenue loss.

Genesco faces intense competition across its diverse brand portfolio, from large national retailers to specialized online sellers. This crowded market necessitates aggressive pricing and continuous innovation to capture market share. For fiscal year 2024, Genesco reported a net sales decrease of 3%, highlighting the challenges in a highly competitive retail environment.

Shifting consumer preferences, particularly among its youth demographic, pose a significant threat. A failure to quickly adapt to emerging fashion trends can lead to outdated inventory and increased markdowns. For instance, the rapid evolution of sneaker culture and streetwear styles means that brands must constantly refresh their offerings to remain relevant.

Economic headwinds, including persistent inflation and higher interest rates, continue to dampen consumer discretionary spending. With household budgets tightening, purchases of non-essential items like fashion footwear and apparel are often curtailed. The declining consumer savings rate observed through 2023 and into early 2024 further limits the capacity for such spending.

Supply chain disruptions, stemming from global events and geopolitical instability, remain a concern. These can lead to raw material shortages and increased logistics costs, impacting Genesco's ability to meet demand efficiently and potentially squeezing profit margins. Shipping costs, which saw significant volatility in recent years, continue to be a factor.

The growing e-commerce segment brings challenges like high return rates, which increase operational costs and can lead to unsaleable inventory. Furthermore, Genesco's expanded digital footprint exposes it to cybersecurity threats, with data breaches carrying substantial financial and reputational risks. The average cost of a data breach globally reached $4.45 million in 2023, underscoring the critical need for robust security.

| Threat Category | Specific Challenge | Impact on Genesco | Example/Data Point |

| Competition | Crowded Retail Market | Pressure on pricing, reduced margins | Fiscal Year 2024 Net Sales Down 3% |

| Consumer Preferences | Rapidly Shifting Trends | Risk of obsolete inventory, increased markdowns | Youth fashion trends evolve quickly |

| Economic Factors | Inflation & Higher Interest Rates | Reduced discretionary spending | Declining consumer savings rates in 2023-2024 |

| Supply Chain | Global Disruptions | Increased logistics costs, potential shortages | Volatile shipping costs impacting cost of goods |

| E-commerce & Digital | High Return Rates & Cybersecurity | Increased operational costs, reputational risk | Average data breach cost $4.45 million (2023) |

SWOT Analysis Data Sources

This SWOT analysis for Genesco is built upon a foundation of robust data, including their latest financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a clear picture of Genesco's performance and its operating environment.