Genesco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genesco Bundle

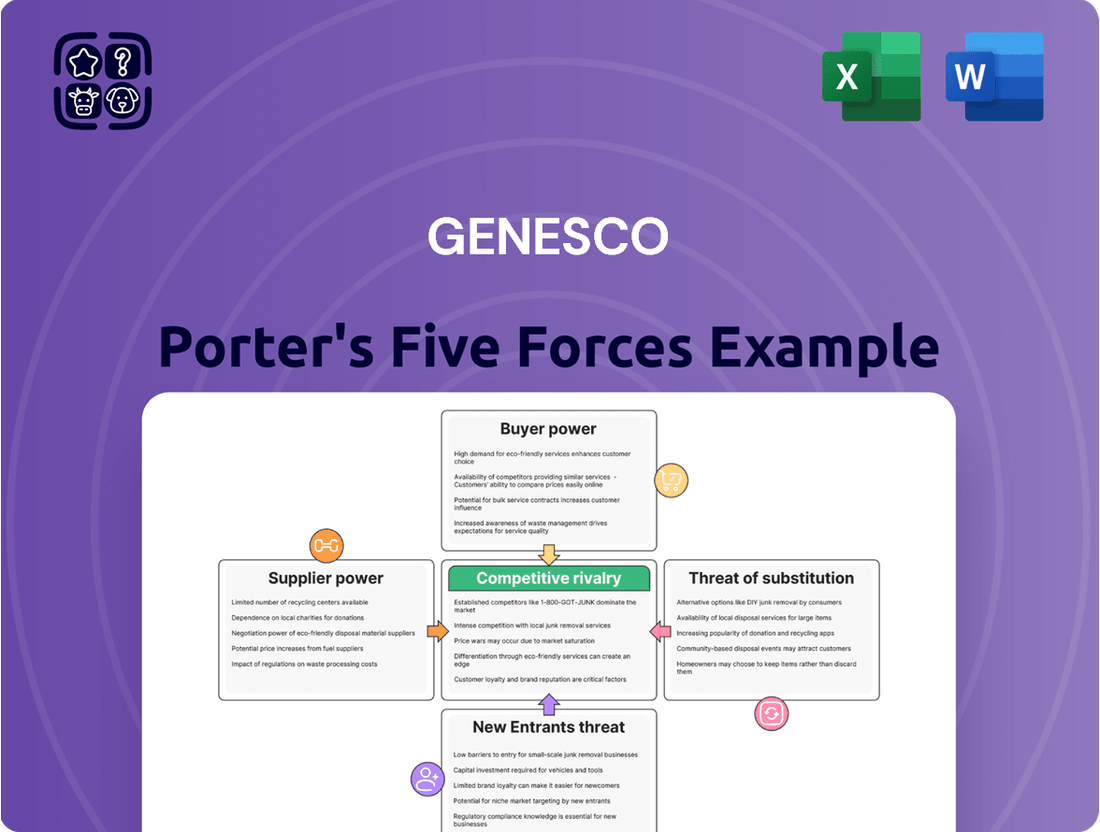

Genesco's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants, which can significantly impact profitability. Understanding these dynamics is crucial for any strategic planning.

The complete report reveals the real forces shaping Genesco’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Genesco, especially for its Johnston & Murphy line and some licensed brands, often depends on a select few providers for specialized materials like premium leathers and unique fabrics. This reliance can empower these suppliers, giving them leverage to potentially increase their prices, impacting Genesco's cost of goods sold.

For instance, the global leather market saw a notable increase in prices during 2023 and early 2024 due to factors like reduced cattle herds and strong demand from various industries. If Genesco's key leather suppliers are part of this trend, it could directly affect their sourcing costs, especially for high-quality materials essential for their premium product lines.

Genesco's reliance on overseas manufacturing, particularly in countries like Vietnam, Bangladesh, and China, significantly amplifies supplier bargaining power. This global sourcing strategy, common in the footwear and apparel sectors, means suppliers in these regions hold considerable sway due to their specialized production capabilities and established infrastructure.

This dependency exposes Genesco to a range of risks that further empower suppliers. Geopolitical shifts, the imposition of trade tariffs, and unforeseen supply chain disruptions can all lead to increased costs or delays, giving overseas manufacturers leverage in negotiations. For instance, in 2023, ongoing trade tensions and rising shipping costs highlighted the vulnerability of such extended supply chains.

While switching suppliers for Genesco can incur expenses like ensuring quality compliance, negotiating new contracts, and building fresh relationships, these costs are generally considered moderate. For instance, in 2023, Genesco's cost of goods sold was $1.3 billion, indicating the scale of their sourcing operations, but the availability of multiple manufacturers for common components prevents any single supplier from wielding excessive leverage.

Impact of Raw Material Price Volatility

The prices of essential raw materials for Genesco, such as leather, rubber, and various synthetic fabrics, are prone to significant fluctuations. This volatility directly impacts the company's manufacturing expenses and, consequently, its gross profit margins. For instance, a surge in global leather prices, driven by factors like increased demand or supply chain disruptions, can force Genesco to either absorb the higher costs or pass them on to consumers.

Suppliers of these critical inputs wield considerable bargaining power when their own input costs escalate. They can effectively leverage this situation to pass on these increased costs to manufacturers like Genesco. This dynamic can squeeze Genesco's profitability, especially if they have limited ability to adjust their retail pricing in response to rising production expenses.

- Raw Material Cost Impact: Genesco's gross margin can be directly affected by the price of leather, rubber, and synthetic materials.

- Supplier Leverage: Suppliers gain power when their costs rise, enabling them to increase prices for Genesco.

- 2024 Data Consideration: Analyzing Genesco's 2024 financial reports will reveal trends in cost of goods sold related to raw material inputs. For example, if Genesco's cost of goods sold increased by a notable percentage in 2024 while revenue growth was slower, it could indicate pressure from raw material price volatility.

Sustainability Demands on Suppliers

Genesco faces increasing supplier bargaining power driven by sustainability demands. Growing consumer and regulatory pressure for ethically sourced and environmentally friendly products means Genesco must partner with suppliers adhering to specific standards. This can limit the available supplier pool, giving those who meet these criteria more leverage.

For instance, in 2024, reports indicated a significant rise in consumer willingness to pay a premium for sustainable goods, with some studies showing over 60% of consumers considering sustainability a key factor in purchasing decisions. This trend directly translates to Genesco's supply chain, as suppliers capable of meeting these stringent environmental, social, and governance (ESG) criteria become more valuable and thus possess greater bargaining power.

- Increased Supplier Scrutiny: Genesco's need to verify supplier compliance with sustainability mandates adds complexity and cost to sourcing, strengthening supplier positions.

- Specialized Capabilities: Suppliers offering certified sustainable materials or ethical labor practices often have unique capabilities, reducing the number of viable alternatives and enhancing their negotiating strength.

- Supply Chain Resilience: Companies prioritizing sustainability often seek long-term partnerships, which can empower suppliers with greater influence over terms and pricing.

- Regulatory Compliance Costs: Suppliers investing in sustainability may pass on these costs, impacting Genesco's procurement expenses and reinforcing supplier leverage.

Genesco's reliance on a concentrated supplier base for specialized materials, like premium leathers, grants these providers significant bargaining power. This is exacerbated by global sourcing complexities and rising raw material costs, as seen with leather price increases in 2023 and early 2024. The need to meet evolving sustainability demands further concentrates this power among compliant suppliers, potentially increasing Genesco's procurement expenses.

The bargaining power of Genesco's suppliers is influenced by the availability of alternative suppliers, the cost of switching, and the importance of the supplier's product to Genesco. While switching costs are moderate, the limited pool of suppliers for specialized or sustainable materials can give them considerable leverage. For instance, in 2024, the emphasis on ESG compliance meant fewer suppliers could meet stringent requirements, thus strengthening their negotiating position.

The company's dependence on overseas manufacturing, particularly in regions like Southeast Asia, means suppliers there hold substantial sway due to specialized capabilities and infrastructure. Geopolitical factors and trade tensions, evident in 2023, can further empower these suppliers by increasing supply chain risks and costs for Genesco.

| Factor | Impact on Genesco | 2023-2024 Trend Example |

| Specialized Materials (e.g., premium leather) | Increased supplier leverage, potential price hikes | Global leather prices rose due to herd reduction and demand. |

| Global Sourcing & Manufacturing | Supplier power from specialized capabilities and infrastructure | Trade tensions and rising shipping costs highlighted supply chain vulnerabilities. |

| Sustainability Demands | Limited supplier pool for ESG-compliant partners, enhanced leverage | Consumer willingness to pay for sustainable goods increased, valuing compliant suppliers. |

| Raw Material Price Volatility | Suppliers pass on increased costs, impacting Genesco's margins | Fluctuations in leather, rubber, and synthetic fabric prices directly affect manufacturing expenses. |

What is included in the product

This analysis dissects the competitive forces impacting Genesco, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and the intensity of rivalry within the apparel and footwear industry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces with an intuitive, interactive dashboard.

Customers Bargaining Power

Genesco's core customer base, primarily teens and young adults shopping at brands like Journeys and Schuh, exhibits significant price sensitivity. This demographic actively researches and compares prices across various online platforms, amplifying their bargaining power and compelling Genesco to maintain competitive pricing and frequent promotional activities to attract and retain these shoppers.

Consumers today enjoy an unprecedented breadth of choices in footwear and apparel, a trend amplified by the continuous expansion of e-commerce. This accessibility means shoppers can easily compare prices, styles, and brands across numerous online platforms and physical stores, significantly increasing their leverage.

The sheer volume of available alternatives, from established brands with extensive retail networks to nimble online-only sellers, empowers customers. For instance, in 2024, the global e-commerce market for apparel and footwear is projected to reach hundreds of billions of dollars, underscoring the vastness of consumer options and their ability to seek out the best deals or unique products.

The rapid evolution of fashion, amplified by social media, significantly boosts customer bargaining power. Consumers can instantly spot and demand the latest styles, giving them considerable sway over what retailers like Genesco stock.

This trend-driven environment means Genesco must be agile, quickly adjusting its inventory to meet fleeting consumer desires. Failure to do so can lead to unsold merchandise and lost revenue, as seen in the retail sector's ongoing challenges with inventory management, with many retailers reporting significant markdowns in 2024 to clear excess stock.

Low Switching Costs for Customers

For consumers, the cost of switching from one footwear or apparel brand or retailer to another is typically quite low. This ease of transition means customers can readily explore alternatives if they find similar products or better pricing elsewhere, directly impacting Genesco.

This low switching cost significantly enhances the bargaining power of customers. Without strong brand loyalty or unique product offerings, consumers have little incentive to remain with a particular retailer, allowing them to easily shift their spending to competitors who may offer more attractive terms or value propositions. For instance, in the competitive athletic footwear market, a customer might easily switch from one brand to another based on a sale or a new product release, demonstrating this low friction.

- Low Switching Costs: Customers can easily move between retailers and brands in the apparel and footwear sector.

- Price Sensitivity: Consumers often prioritize price and value, readily switching for better deals.

- Brand Loyalty Factor: While brand loyalty exists, it's often not strong enough to overcome significant price differences or superior competitor offerings.

- Competitive Landscape: The presence of numerous competitors offering similar products amplifies customer power.

Demand for Omnichannel Experience and Personalization

Modern consumers are increasingly demanding a unified shopping journey, expecting to transition effortlessly between online platforms and brick-and-mortar stores. This desire for an omnichannel experience, coupled with a strong preference for tailored recommendations and individualized services, significantly amplifies customer bargaining power. Retailers that can master this intricate balance often see improved loyalty, but the very existence of this demand highlights consumers' ability to dictate terms.

The drive for personalization means customers are less likely to accept generic offerings, pushing businesses to invest in data analytics and customer relationship management. For instance, in 2024, e-commerce personalization efforts are projected to drive over $2.9 trillion in global retail sales, a testament to how much consumers value tailored experiences and are willing to shift their spending accordingly.

- Consumer expectation for seamless online-to-offline integration

- Demand for personalized product recommendations and services

- Increased customer loyalty for retailers meeting these demands

- The role of data analytics in fulfilling personalized experiences

Customers in the apparel and footwear market possess substantial bargaining power due to the vast array of choices available. This is further amplified by low switching costs, meaning consumers can easily shift their spending to competitors offering better prices or styles, a trend evident in 2024's competitive retail landscape where markdowns are common to clear inventory.

The digital age, with its emphasis on price comparison and trend-driven demand fueled by social media, empowers consumers to dictate terms. Genesco, like its peers, must remain agile, offering competitive pricing and personalized experiences to retain this increasingly discerning customer base, a strategy crucial in a market where global e-commerce for apparel and footwear is projected to reach hundreds of billions in 2024.

| Factor | Impact on Genesco | Supporting Data (2024 Projections/Trends) |

|---|---|---|

| Price Sensitivity | High | Consumers actively compare prices online, leading to frequent promotions by retailers. |

| Availability of Substitutes | High | Vast e-commerce expansion provides numerous alternatives, increasing consumer leverage. |

| Switching Costs | Low | Customers can easily switch brands/retailers for better deals or styles. |

| Information Availability | High | Social media and online platforms provide extensive product and price information. |

Preview the Actual Deliverable

Genesco Porter's Five Forces Analysis

This preview displays the complete Genesco Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the retail industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no hidden content or variations. You can confidently proceed with your acquisition, knowing you are getting the full, professionally formatted analysis ready for immediate use.

Rivalry Among Competitors

Genesco faces intense competition across its diverse retail and wholesale segments. The company contends with global sportswear titans like Nike and Adidas, alongside numerous specialty retailers and agile fast-fashion brands, all vying for consumer attention and spending. This crowded landscape significantly amplifies competitive rivalry.

In 2023, the global athletic footwear market alone was valued at over $200 billion, highlighting the sheer scale and number of participants. Genesco's footwear division, including brands like Journeys, directly competes within this massive and fragmented market, where differentiation and efficient operations are critical for survival and growth.

Genesco's strategy of operating a diverse portfolio, including brands like Journeys, Schuh, Little Burgundy, and Johnston & Murphy, positions it to appeal to a wide range of consumers, from teenagers to affluent adults. This broad market approach, however, intensifies competitive rivalry. For instance, Journeys competes directly with specialized teen footwear retailers, while Johnston & Murphy faces off against established premium men's shoe brands, fragmenting Genesco's competitive landscape across multiple distinct market segments.

The rise of e-commerce has dramatically reshaped retail, forcing companies like Genesco to adapt or risk falling behind. This shift means that competition is no longer confined to physical stores; it now extends to the digital realm, where reach and convenience are paramount.

Genesco's investment in its digital infrastructure is crucial. In fiscal year 2024, the company saw continued growth in its direct-to-consumer (DTC) channel, which includes its e-commerce operations. This channel's performance directly impacts its ability to compete with online-native retailers and other brands with strong digital presences.

Furthermore, the integration of online and offline experiences, known as omnichannel strategy, is vital. Customers expect seamless transitions, whether they are browsing online and picking up in-store or returning online purchases to a physical location. Genesco's success hinges on its ability to provide this integrated experience, which requires significant operational and technological investment, thereby intensifying the competitive landscape.

Price Competition and Promotional Activity

In the footwear and apparel retail sector, consumers are quite sensitive to price, and there are many options available. This leads to a lot of price competition and promotional efforts from companies. Genesco has seen its gross margin squeezed by this, especially at its Schuh brand, which highlights the intense pressure on pricing within the industry.

For instance, during fiscal year 2024, Genesco's consolidated gross profit margin decreased to 34.7% from 36.3% in the prior year. This decline was partly attributed to increased promotional activity aimed at driving sales in a challenging retail environment. The company’s strategy often involves markdowns and special offers to attract customers, a common tactic when facing rivals with similar product assortments.

- Increased Promotional Activity: Genesco experienced a dip in gross margin in fiscal year 2024, reaching 34.7%, down from 36.3% in fiscal year 2023, largely due to heightened promotional efforts.

- Consumer Price Sensitivity: The market for footwear and apparel is characterized by consumers who actively seek deals, forcing retailers like Genesco to engage in frequent sales and discounts.

- Competitive Landscape: The abundance of choices in the retail space intensifies rivalry, compelling companies to compete aggressively on price to capture market share.

Rapidly Evolving Consumer Preferences and Trends

Genesco operates in a dynamic market where consumer tastes shift at a remarkable pace, especially for its brands targeting younger demographics. This constant evolution necessitates agility in product development and marketing, fueling fierce competition among players striving for relevance and speed in bringing new styles to market.

The pressure to stay ahead of rapidly changing fashion trends intensifies rivalry. For instance, in 2023, the athleisure trend continued its strong influence, requiring companies like Genesco to constantly refresh their offerings in sneakers and casual wear to capture consumer interest.

- Fashion Cycle Speed: The fast-paced nature of fashion means companies must constantly innovate and update their product lines, often within months, to align with emerging trends.

- Impact on Inventory: Rapid trend shifts can lead to obsolescence of existing inventory, increasing the risk of markdowns and impacting profit margins for retailers like Genesco.

- Marketing Relevance: Brands must continually adapt their marketing messages and channels to resonate with evolving consumer preferences, particularly on social media platforms popular with younger audiences.

- Innovation Race: Companies are in a constant race to introduce unique designs, sustainable materials, and engaging brand experiences to differentiate themselves in a crowded marketplace.

Genesco operates in a highly competitive retail environment, facing pressure from large global brands, specialty retailers, and agile fast-fashion players. The company’s diverse brand portfolio, including Journeys and Johnston & Murphy, means it contends with rivals across various market segments, from teen footwear to premium men's shoes. This broad exposure intensifies the overall competitive rivalry.

The increasing importance of e-commerce and omnichannel strategies means competition extends beyond physical stores into the digital realm, where convenience and reach are paramount. Genesco's performance in its direct-to-consumer channel, which grew in fiscal year 2024, directly impacts its ability to compete with online-native businesses.

Consumers in Genesco's markets are highly price-sensitive, leading to significant promotional activity across the industry. This is evident in Genesco's consolidated gross profit margin, which decreased to 34.7% in fiscal year 2024 from 36.3% in fiscal year 2023, partly due to increased markdowns.

The rapid pace of fashion trends, particularly in the youth-focused segments served by brands like Journeys, fuels fierce competition. Companies must constantly innovate and adapt their product lines and marketing to remain relevant, a challenge that can impact inventory and profit margins.

| Metric | Fiscal Year 2023 | Fiscal Year 2024 |

|---|---|---|

| Consolidated Gross Profit Margin | 36.3% | 34.7% |

| Global Athletic Footwear Market Value (2023 Estimate) | Over $200 billion | N/A |

SSubstitutes Threaten

The threat of substitutes for Genesco is significant due to the wide array of alternative footwear and apparel options available to consumers. For instance, a consumer looking for casual shoes might choose sneakers from a sportswear brand, sandals, or even comfortable loafers, all of which serve a similar purpose but come from different market segments.

Furthermore, consumers can divert their spending from footwear altogether to other apparel categories like activewear, outerwear, or accessories such as bags and hats. This broadens the competitive landscape considerably. In 2023, the global footwear market was valued at approximately $400 billion, with apparel markets being even larger, highlighting the vast number of substitute spending opportunities for consumers.

The rise of fast fashion and budget-friendly alternatives presents a significant threat of substitutes for Genesco. Brands like Shein and Temu, known for their rapid trend cycles and exceptionally low prices, directly compete for the same youth demographic Genesco targets with brands like Journeys and Johnston & Murphy. These fast fashion players often offer clothing and footwear at price points substantially lower than traditional retailers, making them an attractive option for increasingly price-conscious consumers, especially Gen Z and Millennials.

The increasing consumer focus on sustainability and the environmental footprint of fashion is a significant factor. This has fueled a preference for pre-owned, vintage, or environmentally conscious clothing and footwear options. This trend represents a growing substitute threat that can divert sales from new product offerings.

For instance, the global second-hand apparel market was valued at approximately $177 billion in 2023 and is projected to reach $350 billion by 2027, showcasing a substantial shift in consumer behavior. This growth directly impacts traditional retailers by offering consumers alternative purchasing avenues.

Do-It-Yourself (DIY) and Customization Trends

The rise of do-it-yourself (DIY) fashion and the increasing availability of customized footwear present a subtle but growing threat of substitutes for traditional retailers like Genesco. Consumers increasingly value uniqueness and personalization, leading some to explore creating their own apparel or modifying existing items. This trend can divert demand from mass-produced goods.

For instance, the global custom apparel market is projected to grow significantly. Reports suggest the custom t-shirt printing market alone was valued at over $3.5 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of around 9% through 2030. This indicates a substantial consumer interest in personalized fashion options.

- DIY Fashion Growth: The increasing accessibility of crafting tools, online tutorials, and affordable materials empowers consumers to create unique clothing and accessories, bypassing traditional retail channels.

- Customization Platforms: Online platforms offering personalized shoe design and manufacturing are gaining traction, allowing consumers to specify materials, colors, and even fit, directly competing with off-the-shelf offerings.

- Value Proposition: For a segment of consumers, the appeal of a one-of-a-kind item or the satisfaction of creating something themselves outweighs the convenience and immediate availability of retail purchases.

Shifting Lifestyles and Priorities

Shifting consumer lifestyles, particularly a growing emphasis on comfort and the widespread adoption of athleisure wear, directly impact purchasing decisions for footwear and apparel. Genesco's brands, including Journeys and Schuh, are positioned to capitalize on these trends, but a more pronounced move towards purely functional or athletic-focused attire could present a substitution threat. For instance, the global athleisure market was valued at approximately $296 billion in 2023 and is projected to reach $404 billion by 2028, indicating a substantial consumer preference for comfort-driven apparel that may divert spending from fashion-oriented footwear.

This evolving consumer preference means that while Genesco offers stylish options, a significant pivot by consumers towards prioritizing durability and athletic performance over fashion could diminish the appeal of their core offerings. For example, if consumers increasingly opt for specialized athletic shoes for everyday wear, this directly substitutes for the fashion-centric sneakers and boots typically sold by Genesco. The rise of direct-to-consumer athletic brands, which often emphasize performance and comfort, further exacerbates this substitution risk.

The threat of substitutes is amplified by the increasing accessibility of comfort-focused and athletic alternatives. Genesco's sales for the fiscal year ended February 3, 2024, were $2.14 billion, with a significant portion coming from its footwear segment. However, if consumers increasingly view athletic footwear as a suitable substitute for casual or fashion footwear, this could erode Genesco's market share. The convenience and perceived value of athletic brands in meeting both comfort and style needs present a compelling alternative.

Key considerations regarding this threat include:

- Increased consumer demand for comfort-driven apparel and footwear.

- The growing popularity of athleisure wear as a lifestyle choice.

- The potential for athletic footwear to replace fashion-oriented footwear in everyday use.

The threat of substitutes for Genesco is substantial, stemming from the vast array of alternative footwear and apparel choices available. Consumers can easily shift spending from Genesco's offerings to other fashion categories or even entirely different product types that fulfill similar needs. The global apparel market, significantly larger than the footwear market valued at around $400 billion in 2023, underscores the breadth of these substitution opportunities.

Fast fashion brands like Shein and Temu present a direct substitute threat by offering trendy apparel and footwear at significantly lower price points, appealing strongly to Genesco's target youth demographic. Furthermore, the growing second-hand market, valued at approximately $177 billion in 2023, and the rise of DIY fashion cater to consumers seeking unique or value-driven alternatives, diverting potential sales from traditional retail.

The increasing consumer preference for comfort and athleisure wear also poses a substitution risk. If consumers increasingly opt for athletic footwear for everyday use, this directly competes with Genesco's fashion-focused product lines. The athleisure market, valued at $296 billion in 2023, demonstrates this significant shift in consumer priorities.

| Substitute Category | Market Value (2023 Estimate) | Key Drivers | Genesco Impact |

| Fast Fashion Apparel & Footwear | Varies (Global Apparel Market >$1.5 Trillion) | Low Price, Trend Responsiveness | Direct competition for youth market |

| Second-hand Apparel & Footwear | $177 Billion | Sustainability, Affordability, Uniqueness | Reduces demand for new items |

| Athleisure & Athletic Footwear | $296 Billion | Comfort, Performance, Lifestyle | Potential to replace fashion footwear |

Entrants Threaten

Establishing a substantial brick-and-mortar retail footprint, as Genesco does with brands like Journeys and Schuh, demands significant upfront capital. This includes the costs associated with prime real estate leases, extensive inventory stocking, and the personnel needed to operate each store. For instance, securing prime retail locations in 2024 can involve leasehold improvements and security deposits that easily run into hundreds of thousands of dollars per store.

The sheer scale of investment required for physical stores acts as a formidable barrier. A new entrant would need to replicate this widespread presence to compete effectively, a feat that is financially prohibitive for many. Consider that in 2024, the average cost to open a medium-sized retail store, encompassing rent, fit-out, and initial stock, can exceed $250,000, making it a deterrent for smaller or less capitalized competitors.

Genesco enjoys significant advantages due to the strong brand recognition and loyalty it has cultivated for its core brands, especially Journeys and Johnston & Murphy. This established presence makes it difficult for newcomers to gain traction.

New entrants must overcome the considerable hurdle of building brand trust and convincing consumers to switch from established, preferred brands. For instance, in 2023, Genesco reported that its Journeys segment continued to be a significant contributor to its revenue, highlighting the strength of its loyal customer base.

Developing strong omnichannel capabilities and navigating intricate global supply chains are major barriers for newcomers. Genesco's established infrastructure and expertise in sourcing and distribution provide a distinct advantage, making it difficult for new players to compete on a similar scale.

Access to Distribution Channels and Supplier Relationships

Newcomers often face significant hurdles in securing prime shelf space and establishing reliable partnerships with key footwear suppliers. Established companies, such as Genesco, benefit from decades-long relationships that are not easily replicated by new market entrants.

These established networks provide a critical competitive advantage, allowing incumbents to negotiate better terms and ensure consistent product availability. For instance, in 2023, Genesco reported that its top 10 vendors accounted for a substantial portion of its cost of goods sold, highlighting the importance of these supplier relationships.

- Distribution Channel Access: New entrants struggle to secure favorable placement in desirable retail locations or online marketplaces already dominated by established players.

- Supplier Relationships: Building trust and securing reliable supply agreements with reputable footwear manufacturers can be time-consuming and costly for newcomers.

- Economies of Scale in Sourcing: Existing firms often achieve lower per-unit costs due to higher purchasing volumes, making it difficult for new entrants to compete on price.

- Brand Loyalty and Reputation: Genesco's established brands benefit from existing customer loyalty, which new entrants must work hard to overcome through marketing and product differentiation.

Intense Competition from Existing Players

The threat of new entrants for Genesco is significantly influenced by the intense competition already present in the footwear and apparel retail sector. Established players have built strong brand recognition and loyalty, making it difficult for newcomers to capture market share. For instance, in 2024, the global athletic footwear market alone was valued at over $90 billion, demonstrating the scale of existing operations that new entrants must contend with.

New companies entering this space immediately confront formidable rivalry from numerous well-entrenched companies. These existing businesses possess economies of scale, established supply chains, and significant marketing budgets, creating substantial barriers to entry. Without a unique value proposition or a considerable competitive edge, new entrants struggle to gain traction and achieve profitability.

- High Market Saturation: The footwear and apparel market is characterized by a large number of existing brands and retailers, leading to a highly saturated environment.

- Brand Loyalty and Recognition: Established companies benefit from years of building brand equity and customer loyalty, which new entrants find difficult to replicate quickly.

- Economies of Scale: Existing players often operate at a scale that allows for lower per-unit costs in production and distribution, a cost advantage new entrants lack.

- Capital Requirements: Launching a retail business in this sector requires substantial capital for inventory, marketing, and physical or online infrastructure, posing a significant hurdle for new entrants.

The threat of new entrants for Genesco is moderate, largely due to the substantial capital required to establish a physical retail presence and build brand recognition. For instance, in 2024, securing prime retail locations and stocking inventory can easily cost hundreds of thousands of dollars per store, acting as a significant deterrent.

Genesco's established brands, like Journeys, benefit from strong customer loyalty cultivated over years, making it challenging for newcomers to gain market share. In 2023, Journeys remained a key revenue driver for Genesco, underscoring the difficulty new entrants face in replicating this established customer base.

New entrants also struggle to match Genesco's established distribution networks and supplier relationships. Securing favorable shelf space and reliable partnerships with footwear manufacturers, as Genesco has, requires time and significant investment, further limiting new competition.

| Barrier to Entry | Impact on New Entrants | Genesco's Advantage |

|---|---|---|

| Capital Investment (Retail Footprint) | High; requires significant upfront costs for real estate, inventory, and staffing. | Established network of physical stores. |

| Brand Loyalty & Recognition | High; needs substantial marketing to overcome existing customer preference. | Strong brand equity in key segments like Journeys. |

| Distribution & Supplier Access | Moderate to High; difficult to secure prime locations and reliable supply chains. | Long-standing relationships with suppliers and established distribution channels. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, investor presentations, and industry-specific market research from leading firms. We also leverage insights from trade publications and government economic data to provide a comprehensive understanding of the competitive landscape.