Genesco Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genesco Bundle

Genesco's marketing mix is a finely tuned engine, driving its success across diverse retail landscapes. From its curated product assortments to strategic pricing and expansive distribution, every element plays a crucial role in connecting with its target audience.

Uncover the intricate details of Genesco's product strategy, pricing architecture, place in the market, and promotional efforts that solidify its brand presence. This comprehensive analysis is your key to understanding their winning formula.

Ready to gain a competitive edge? Access the full, editable 4Ps Marketing Mix Analysis for Genesco and unlock actionable insights for your own strategic planning.

Product

Genesco's diverse product portfolio is a cornerstone of its marketing strategy, featuring a broad spectrum of footwear, apparel, and accessories. This variety allows the company to effectively target different customer segments through its specialized retail banners.

Journeys, for instance, focuses on trendy fashion footwear appealing to teens and young adults, while Johnston & Murphy caters to affluent consumers with premium footwear, apparel, and accessories. This segmentation ensures broad market reach.

The company further enhances its product offering by designing, sourcing, and marketing footwear under its proprietary brands and through licensing agreements with well-known names like Levi's and Dockers. This approach diversifies its product mix and leverages established brand equity.

For the fiscal year 2024, Genesco reported net sales of $2.2 billion, with its footwear segment being a significant contributor, reflecting the strength and breadth of its product lines across various categories and price points.

Genesco's brand strategy centers on distinct customer targeting. Journeys is positioned for youth culture, emphasizing on-trend fashion footwear. In the fiscal year 2024, Journeys continued to be a significant contributor to Genesco's overall sales.

Schuh and Little Burgundy cater to different fashion-forward demographics, offering a curated selection of branded athletic and casual footwear. Johnston & Murphy, conversely, appeals to a more mature, professional audience. This brand offers a broader product mix that now includes casual athletic styles and apparel, moving beyond its traditional dress shoe foundation.

Genesco's "Product" strategy heavily emphasizes innovation and value, aiming for marketplace differentiation. This is particularly evident in their Journeys brand, where increased investment in key fashion, athletic, and casual brands drives product leadership. For the fiscal year ending February 3, 2024, Genesco reported total sales of $2.25 billion, with Journeys being a significant contributor.

Johnston & Murphy exemplifies this focus by developing innovative comfort technology and relevant product lines designed to attract a broader customer base. This commitment to enhancing product value is crucial for maintaining a competitive edge in the evolving footwear market.

Private Label and Licensed Brands

Genesco's Brands Group significantly expands its market reach by designing, developing, and selling moderately priced footwear through exclusive licensing agreements. This strategy involves partnerships with prominent brand and apparel companies such as Levi's, Dockers, Starter, and PONY.

This approach diversifies Genesco's product portfolio and opens up additional distribution channels beyond its owned retail footprint. For instance, in fiscal year 2024, Genesco's licensed brands contributed to its overall sales mix, allowing them to tap into established consumer bases and leverage the brand equity of their partners.

- Brand Partnerships: Collaborations with Levi's, Dockers, Starter, and PONY provide access to established consumer recognition.

- Product Diversification: Offers a range of moderately priced footwear, broadening the appeal beyond Genesco's core retail concepts.

- Distribution Expansion: Utilizes partner channels to reach consumers who may not frequent Genesco's owned stores.

- Revenue Stream: Generates revenue through the sale of licensed products, complementing sales from proprietary brands.

Sustainability in Sourcing

Genesco's commitment to sustainability is evident through brands like Little Burgundy, which prioritizes stocking and developing product lines made from sustainable materials. This approach aligns with a broader market trend towards environmentally conscious fashion choices.

Little Burgundy is actively curating collections that incorporate organic cotton and other eco-friendly materials, demonstrating a tangible effort to reduce its environmental footprint. This strategy aims to attract consumers who prioritize ethical sourcing and sustainable production practices.

The company's focus on sustainability in sourcing reflects a strategic response to increasing consumer demand for eco-friendly products. This is a critical element in maintaining brand relevance and market share in the evolving retail landscape.

- Brand Focus: Little Burgundy actively seeks out and promotes sustainably made brands.

- Material Innovation: Enhancing collections with organic materials like cotton is a key strategy.

- Market Alignment: This approach caters to the growing consumer demand for conscious and environmentally responsible fashion.

Genesco's product strategy is built on a foundation of diverse offerings, catering to distinct customer segments through its specialized retail banners. This approach, evident in fiscal year 2024 sales of $2.25 billion, allows the company to effectively capture market share across various demographics.

The company actively manages its product mix by designing, sourcing, and marketing proprietary brands alongside licensed products from partners like Levi's and Dockers. This dual strategy diversifies its revenue streams and leverages established brand recognition.

Innovation and value are central to Genesco's product development, particularly within its Journeys banner, which saw continued strong performance in fiscal year 2024. Johnston & Murphy, meanwhile, focuses on enhancing comfort and expanding its apparel and casual footwear lines to appeal to a broader audience.

Genesco's commitment to sustainability is increasingly reflected in its product assortment, with brands like Little Burgundy prioritizing eco-friendly materials and ethically sourced products, aligning with growing consumer demand for conscious fashion.

| Retail Banner | Target Demographic | Key Product Focus | Fiscal Year 2024 Sales Contribution (Illustrative) |

|---|---|---|---|

| Journeys | Teens and Young Adults | Trendy Fashion Footwear, Athletic & Casual | Significant Contributor |

| Johnston & Murphy | Affluent Consumers, Professionals | Premium Footwear, Apparel, Accessories, Comfort Tech | Key Segment |

| Schuh | Fashion-Forward Youth | Branded Athletic & Casual Footwear | Important Component |

| Little Burgundy | Fashion-Conscious Consumers | Curated Footwear & Apparel, Sustainable Materials | Growing Focus |

| Licensed Brands (e.g., Levi's, Dockers) | Broad Consumer Base | Moderately Priced Footwear | Diversifying Revenue |

What is included in the product

This analysis offers a comprehensive examination of Genesco's marketing mix, detailing its product portfolio, pricing strategies, distribution channels, and promotional activities.

It provides actionable insights into Genesco's market positioning and competitive landscape, ideal for strategic planning and performance benchmarking.

Simplifies Genesco's complex marketing strategy into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Genesco's 4Ps, easing the burden of deciphering intricate marketing plans for cross-functional teams.

Place

Genesco leverages an extensive brick-and-mortar retail network, a cornerstone of its marketing strategy. As of early 2024, the company operated between 1,278 and 1,490 physical stores across key markets including the U.S., Canada, the UK, and the Republic of Ireland.

These locations are strategically curated to provide immersive brand experiences, resonating with the specific preferences of each brand's target customer base. This physical presence allows for direct customer interaction and brand visibility.

Genesco leverages robust e-commerce platforms for each of its brands, such as journeys.com, schuh.co.uk, and johnstonmurphy.com, to complement its brick-and-mortar presence. These digital channels are vital for customer convenience and expanding sales reach, contributing significantly to overall revenue. In fiscal year 2024, Genesco reported that digital sales represented a substantial portion of its business, highlighting the importance of these online investments.

Genesco's commitment to omnichannel capabilities is evident in its strategy to blend physical stores with online platforms, creating a unified customer journey. This integration allows customers to seamlessly shop, browse, and pick up items across different channels, boosting convenience.

For instance, during the first quarter of fiscal 2025, Genesco reported that its digital channels accounted for approximately 19% of total sales, highlighting the significant role e-commerce plays in their omnichannel approach and its contribution to overall revenue streams.

Wholesale Distribution Channels

Genesco leverages wholesale distribution channels to extend the reach of its brands, notably Johnston & Murphy, beyond its direct-to-consumer retail footprint. This strategy allows its footwear, including licensed brands like Dockers and Levi's, to be available in a wider array of retail environments.

These wholesale partnerships are critical for accessing diverse customer segments. Genesco's products are supplied to various outlets, including major department stores, established shoe chains, independent specialty retailers, and online e-commerce platforms. This multi-channel approach diversifies revenue streams and enhances brand visibility.

For fiscal year 2024, Genesco's wholesale segment contributed significantly to its overall sales, reflecting the importance of these partnerships in its marketing mix. The company aims to optimize its wholesale relationships to ensure brand integrity and efficient product placement across the market.

- Wholesale Brands: Johnston & Murphy, Trask, Dockers, Levi's footwear.

- Distribution Partners: Department stores, shoe chains, specialty stores, online retailers.

- Strategic Importance: Expands market reach and diversifies revenue.

- Fiscal Year 2024 Impact: Wholesale operations played a key role in the company's sales performance.

Strategic Store Portfolio Optimization

Genesco actively refines its physical footprint, a key element of its marketing strategy. This involves a dynamic approach of opening new stores, relocating underperforming ones, and strategically closing locations to maintain a lean and efficient operational structure.

This portfolio optimization directly supports the Place aspect of the 4Ps by ensuring Genesco's brands are accessible in the most advantageous retail environments. For example, Johnston & Murphy has focused on enhancing its presence in airport retail, a high-traffic location ideal for its target demographic.

In fiscal year 2024 (ending February 3, 2024), Genesco operated 1,445 stores across its various brands. The company's ongoing efforts to optimize this store base are crucial for adapting to evolving consumer shopping habits and driving sales performance.

- Store Count: Genesco operated 1,445 stores as of February 3, 2024.

- Strategic Closures: Underperforming locations are regularly evaluated for closure to improve overall profitability.

- New Openings & Relocations: The company invests in new store openings and relocations to capture growth opportunities and enhance customer accessibility.

- Airport Retail Focus: Brands like Johnston & Murphy are specifically targeting airport locations for reimagined retail experiences.

Genesco's physical store network, a critical component of its 'Place' strategy, is actively managed to align with market demands and brand positioning. As of the end of fiscal year 2024 (February 3, 2024), the company operated 1,445 stores, demonstrating a commitment to a robust brick-and-mortar presence. This network is strategically optimized through openings, relocations, and closures to ensure accessibility and enhance customer engagement.

The company's omnichannel approach seamlessly integrates these physical locations with its growing e-commerce operations. In fiscal year 2025, digital channels contributed approximately 19% of total sales, underscoring the importance of online platforms in reaching a wider customer base and offering convenience. This blend of physical and digital touchpoints is key to Genesco's distribution strategy.

Furthermore, Genesco utilizes wholesale channels to broaden its market reach. By supplying products to department stores, specialty retailers, and online platforms, the company diversifies its revenue streams and increases brand visibility. This multi-channel distribution is crucial for capturing diverse consumer segments and reinforcing brand presence across various retail environments.

| Distribution Channel | Key Brands/Examples | Fiscal Year 2024 Data/Notes |

|---|---|---|

| Brick-and-Mortar Retail | Journeys, Schuh, Johnston & Murphy | 1,445 stores operated as of Feb 3, 2024; focus on strategic optimization. |

| E-commerce | journeys.com, schuh.co.uk, johnstonmurphy.com | Approx. 19% of total sales in Q1 FY2025; vital for convenience and reach. |

| Wholesale | Johnston & Murphy, Dockers footwear, Levi's footwear | Partnerships with department stores, shoe chains, specialty retailers, online platforms; expands market reach. |

Same Document Delivered

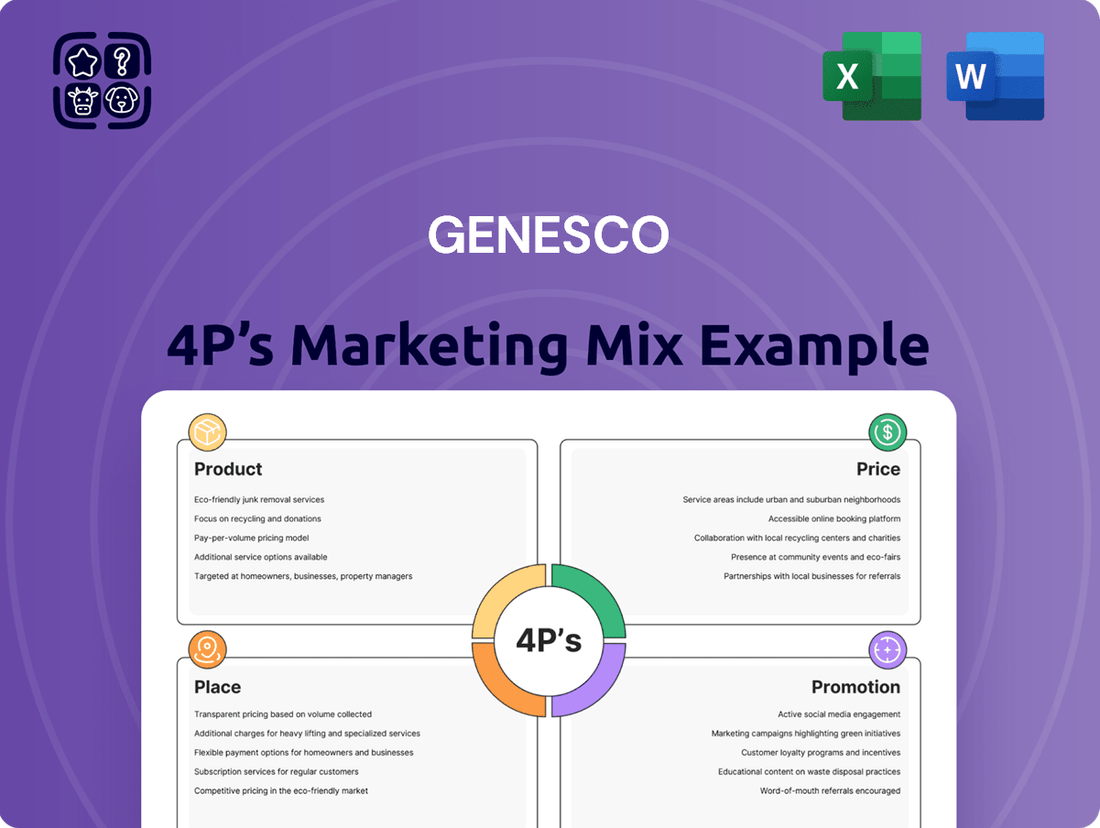

Genesco 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Genesco 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain valuable insights into how Genesco positions its brands and engages with its target audience.

Promotion

Genesco's brands employ targeted promotional strategies to resonate with specific consumer segments. Johnston & Murphy's 'Not Your Dad's Shoe Company' initiative successfully broadened its appeal, aiming to attract a younger demographic. This campaign reflects a strategic shift to modernize the brand's image and connect with a new generation of consumers.

Schuh, on the other hand, leverages its 'Same, but different' platform to engage the 16-24-year-old demographic. This approach encourages individuality and self-expression, aligning with the values of its core audience. This focus on personal identity is crucial for building brand loyalty within this age group.

Genesco actively utilizes digital marketing and social media, with platforms like TikTok, Instagram, and YouTube being key for reaching its younger demographic. This strategy aims to connect with consumers where they spend their time, effectively communicating product benefits and driving engagement.

In 2023, Genesco reported that digital sales represented a significant portion of its overall revenue, underscoring the importance of these channels. Their social media campaigns often feature user-generated content and influencer collaborations, fostering authenticity and persuasion.

Genesco leverages traditional advertising, including linear TV and out-of-home placements, to reach a broad audience. Schuh's recent return to UK television after a ten-year hiatus exemplifies this strategy, aiming to reinforce its high-street presence and revitalize its brand image.

Public relations efforts complement these advertising campaigns, focusing on earned media and brand storytelling. This integrated approach helps Genesco's brands maintain visibility and connect with consumers through established channels.

Enhanced In-Store and Online Experience

Genesco's commitment to enhancing customer experience spans both physical and digital realms. This includes updating brand messaging and visuals to ensure a consistent narrative across all touchpoints, aiming to resonate more deeply with consumers.

The company is actively working on boosting social and digital visibility within its physical stores. This strategy is designed to raise awareness for its core brands and create a more engaging in-store environment.

For instance, during fiscal year 2024, Genesco reported a 3% increase in comparable store sales for its Specialty Brands segment, indicating positive customer reception to these experiential improvements.

Key initiatives include:

- Refreshed in-store visuals and messaging

- Increased focus on social media integration in physical locations

- Development of a cohesive brand story across online and offline channels

- Efforts to drive customer engagement through digital touchpoints

Community Building and Loyalty Programs

Genesco is focusing on community building and loyalty programs within its brand portfolio, particularly evident at Journeys. This strategy aims to cultivate deeper customer relationships and encourage repeat purchases through tailored engagement. For instance, personalized marketing campaigns and well-structured loyalty programs are key components being explored to foster brand advocacy.

These initiatives are designed to create a sense of belonging and reward loyal customers, thereby driving sustained sales and brand loyalty. Genesco's commitment to enhancing customer experience through these programs is a critical element of its marketing mix. This approach is particularly relevant in the current retail landscape where customer retention is paramount for long-term success.

- Personalized Marketing: Tailoring communications based on customer preferences and purchase history.

- Loyalty Programs: Offering rewards and exclusive benefits to frequent shoppers.

- Community Engagement: Fostering interaction and a sense of belonging among customers.

- Repeat Business Focus: Strategies aimed at increasing customer lifetime value.

Genesco's promotional strategies are diverse, aiming to connect with distinct customer bases through digital, traditional, and community-focused efforts. Digital marketing, especially on platforms like TikTok and Instagram, is crucial for reaching younger demographics, as evidenced by Genesco's significant digital sales in fiscal year 2023. Simultaneously, traditional advertising, like Schuh's return to UK television, reinforces brand presence. Community building and loyalty programs, exemplified by Journeys, foster repeat business and customer advocacy.

| Brand Initiative | Target Demographic | Key Channels | Fiscal Year 2024 Impact (Example) |

|---|---|---|---|

| Johnston & Murphy: Not Your Dad's Shoe Company | Younger demographic | Digital marketing, social media | Broadened appeal, modernized image |

| Schuh: Same, but different | 16-24 year olds | TikTok, Instagram, TV advertising | Encourages individuality, reinforces high-street presence |

| Journeys: Loyalty Programs | Existing customer base | Personalized marketing, community engagement | Cultivates customer relationships, drives repeat purchases |

| Overall Digital Sales | All demographics | E-commerce, social media | Significant portion of overall revenue (FY23) |

Price

Genesco's pricing strategies aim to position its brands, such as Journeys and Lids, as competitive and appealing within their respective youth-focused markets. This means carefully balancing perceived value with affordability, ensuring that price points reflect the quality and brand image while remaining accessible to their target demographics.

The company actively monitors competitor pricing to ensure its offerings remain attractive. For instance, understanding the price ranges of similar footwear or licensed sports merchandise from rivals allows Genesco to make informed decisions about its own pricing, potentially utilizing promotional pricing or value bundles to capture market share.

In fiscal year 2024, Genesco's total net sales reached $2.1 billion, reflecting the success of its pricing and promotional activities in driving consumer demand. This overall revenue figure underscores the effectiveness of their approach in making products accessible and competitively priced across their diverse brand portfolio.

Genesco's value proposition is strategically segmented across its brand portfolio, with price serving as a key differentiator. Journeys targets a younger demographic with fashion-forward footwear and accessories, typically priced to be accessible to teens and young adults. This allows them to capture a broad segment of the youth market, which is often price-sensitive but highly attuned to current trends.

In contrast, Johnston & Murphy occupies a higher price tier, offering premium footwear, apparel, and accessories. This brand's value proposition centers on quality craftsmanship, sophisticated design, and a more mature aesthetic, appealing to consumers who prioritize durability and classic style, willing to invest more for perceived long-term value and status.

This tiered pricing strategy, evident in the distinct market positioning of brands like Journeys and Johnston & Murphy, allows Genesco to maximize market penetration and revenue. For fiscal year 2024, Genesco reported total sales of $2.1 billion, demonstrating the success of its multi-brand, multi-price point approach in reaching a wide array of consumers.

Effective inventory management directly impacts Genesco's pricing by ensuring optimal sales and efficient logistics. By reducing excess stock, the company gains more flexibility in its pricing and promotional strategies.

For instance, Genesco's efforts to decrease inventory levels, as seen in their focus on supply chain optimization, allow for quicker responses to market demand and potentially more competitive pricing. This strategic approach helps avoid markdowns on aging stock and supports maintaining healthier profit margins.

Consideration of Economic Conditions

Genesco's pricing strategies are significantly shaped by the prevailing economic climate and consumer spending patterns. The company's ability to maintain healthy gross margins and drive net sales, even during periods of economic uncertainty, demonstrates a capacity for effective cost management and strategic pricing across its diverse product offerings. For instance, during the fiscal year ending February 3, 2024, Genesco reported a consolidated gross margin of 39.7%, reflecting their pricing power and operational efficiencies despite inflationary pressures and shifts in consumer demand.

Several factors influence Genesco's pricing decisions:

- Economic Outlook: Broader economic conditions, such as inflation rates, unemployment levels, and consumer confidence, directly impact discretionary spending on apparel and accessories, influencing how Genesco sets its prices.

- Market Demand: The demand for specific product categories and brands within Genesco's portfolio dictates pricing flexibility; strong demand allows for premium pricing, while weaker demand may necessitate markdowns.

- Competitive Landscape: Pricing decisions are also made with an eye on competitors' pricing strategies to remain competitive while maximizing profitability.

- Cost of Goods Sold: Fluctuations in the cost of raw materials, manufacturing, and logistics directly affect Genesco's cost structure, which in turn influences their pricing to maintain target gross margins.

Discounts and Promotional Offers

Discounts and promotional offers are a key lever for Genesco to drive sales and customer acquisition. While detailed promotional calendars are proprietary, it's common for retailers to employ strategies like seasonal sales, loyalty program discounts, and limited-time offers to stimulate demand. For instance, during the 2024 holiday season, many apparel retailers saw significant success with Black Friday and Cyber Monday promotions, a trend likely mirrored by Genesco's brands.

These tactics are particularly effective in capturing customers during the consideration and purchase phases of their buying journey. Offering competitive pricing through discounts can directly influence a consumer's decision to choose one brand over another. Genesco's ability to effectively manage these promotions can impact its overall revenue and market share, especially in a competitive retail landscape.

Furthermore, financing options, though not always explicitly advertised, can also serve as a promotional tool by making purchases more accessible. This could include buy-now-pay-later services or store credit cards, which can encourage larger basket sizes and repeat purchases. For example, many Gen Z consumers, a key demographic for brands like Journeys, are increasingly utilizing flexible payment options.

- Seasonal Sales: Genesco brands likely participate in major seasonal sales events, such as back-to-school and holiday promotions, to boost traffic and conversions.

- Loyalty Programs: Implementing or enhancing loyalty programs can offer exclusive discounts and rewards, fostering customer retention and encouraging repeat business.

- Targeted Promotions: Utilizing customer data to offer personalized discounts to specific segments can increase the effectiveness of promotional campaigns.

- Financing Options: Exploring partnerships with buy-now-pay-later providers or offering store credit can make purchases more affordable and appealing to a wider customer base.

Genesco's pricing strategy is a dynamic blend of competitive positioning and value segmentation across its diverse brand portfolio. The company aims to make its offerings attractive and accessible to its target demographics, particularly the youth market served by brands like Journeys and Lids. This involves a careful balance between perceived value, brand image, and affordability, ensuring price points resonate with consumers while remaining competitive.

The company actively monitors competitor pricing to maintain market attractiveness. For fiscal year 2024, Genesco reported total net sales of $2.1 billion, indicating that its pricing and promotional strategies effectively drive consumer demand across its brands.

Genesco's pricing is influenced by economic conditions, market demand, competitive pressures, and the cost of goods sold. For instance, during the fiscal year ending February 3, 2024, the company achieved a consolidated gross margin of 39.7%, demonstrating effective cost management and pricing power amidst inflationary challenges.

| Metric | Value (FY 2024) | Significance |

|---|---|---|

| Total Net Sales | $2.1 billion | Reflects overall market reception and sales volume driven by pricing and promotions. |

| Consolidated Gross Margin | 39.7% | Indicates effective pricing and cost control, allowing for profitability. |

4P's Marketing Mix Analysis Data Sources

Our Genesco 4P's Marketing Mix Analysis leverages a comprehensive blend of data, including official company filings, investor relations materials, and publicly available financial reports. We also incorporate insights from retail performance data and industry-specific market research to ensure a robust understanding of Genesco's strategies.