Genesco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genesco Bundle

Genesco operates within a dynamic retail landscape shaped by evolving political regulations, economic fluctuations, and shifting consumer behaviors. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights to guide your decisions. Unlock the full potential of your market strategy – download the complete Genesco PESTLE analysis now!

Political factors

Government trade policies are a critical consideration for Genesco, a company deeply involved in global sourcing. Changes in international trade agreements, tariffs, and import duties directly influence the cost of goods for footwear and accessories. For instance, shifts in trade relations between the US and key manufacturing countries could lead to increased import costs, impacting Genesco's profitability.

In 2024, the global trade landscape continues to evolve with ongoing negotiations and potential adjustments to existing agreements. Companies like Genesco must remain agile, ready to adapt sourcing strategies to mitigate the financial impact of fluctuating tariffs. This adaptability is crucial for maintaining competitive pricing and market share across its brand portfolio, which includes Journeys and Schuh.

Governments regularly implement new rules impacting retail, covering pricing, sales tactics, and even store hours. Genesco, operating numerous physical stores in places like the US (Journeys), UK (Schuh), and Canada (Little Burgundy), needs to stay on top of these diverse regulations.

Failing to comply can lead to significant penalties, legal battles, and harm to Genesco's reputation, all of which can disrupt operations. For instance, in 2024, the EU continued to refine consumer protection laws, requiring retailers to be transparent about pricing and sales promotions, a direct concern for brands like Genesco operating within the bloc.

Political stability in Genesco's key operating markets, such as the United States, is fundamental for consistent retail operations. In 2024, the US political landscape remained a significant factor, with ongoing policy discussions impacting consumer spending and business regulations.

Geopolitical tensions and potential policy shifts in manufacturing regions, often in Asia, can directly affect Genesco's supply chain reliability and product costs. For instance, trade policy changes announced in late 2024 could have influenced import duties on apparel, impacting Genesco's sourcing strategies.

Unforeseen political instability or significant policy changes in major markets like the UK or Canada, where Genesco also has a presence, can dampen consumer confidence and create operational uncertainties. This can deter new investments and complicate the execution of growth plans, as seen in the cautious approach taken by many retailers during periods of political flux in 2024.

Labor Laws and Employment Policies

Evolving labor laws, such as minimum wage hikes and updated worker rights, directly influence Genesco's operational expenses and how it manages its workforce. For instance, a potential federal minimum wage increase to $15 per hour, as has been discussed, could significantly raise payroll costs for Genesco's retail associates.

As a major employer with a presence across numerous retail brands and varying jurisdictions, Genesco must meticulously adhere to a complex web of labor standards. This includes navigating differences in state and local regulations regarding overtime, paid sick leave, and scheduling practices.

These regulatory shifts can impact Genesco's staffing strategies, the benefits offered to employees, and ultimately, its bottom line. For example, changes in unionization rules could affect collective bargaining agreements and associated labor costs.

- Minimum Wage Impact: A hypothetical 10% increase in the federal minimum wage could add tens of millions to Genesco's annual labor expenses, depending on the number of employees at or near the minimum wage.

- Worker Rights Expansion: Increased mandates for paid sick leave or predictable scheduling could require Genesco to adjust staffing models and potentially increase overall compensation packages.

- Unionization Trends: A rise in union activity within the retail sector could lead to higher wage demands and benefit negotiations for Genesco's employees, impacting profitability.

- Compliance Costs: Maintaining compliance with diverse state and local labor laws in 2024 and 2025 necessitates ongoing investment in HR systems and legal counsel.

Consumer Protection Laws

Governments worldwide are intensifying their focus on consumer protection, introducing legislation that governs everything from product safety and advertising integrity to the critical area of data privacy. For Genesco, a prominent retailer of footwear, apparel, and accessories, navigating this evolving landscape is paramount. Adhering to these rigorous consumer protection laws is essential for cultivating and sustaining consumer confidence across its diverse brand portfolio, including Journeys, Schuh, and Johnston & Murphy.

Non-compliance with these consumer protection mandates can have severe repercussions. These can range from costly product recalls and protracted legal battles to irreparable damage to brand reputation. For instance, in 2024, several major retailers faced significant fines for data privacy breaches, highlighting the financial and reputational risks associated with inadequate consumer data protection measures. Genesco's commitment to transparency and ethical business practices in its marketing and product offerings directly impacts its ability to thrive in these consumer-centric regulations.

Key areas of consumer protection that directly affect Genesco include:

- Product Safety Standards: Ensuring all footwear, apparel, and accessories meet established safety regulations, preventing potential harm to consumers.

- Advertising and Marketing Integrity: Adhering to truth-in-advertising laws and avoiding deceptive marketing practices to maintain consumer trust.

- Data Privacy and Security: Complying with regulations like GDPR and CCPA to protect customer personal information collected through online and in-store transactions.

- Return and Refund Policies: Implementing fair and transparent policies that align with consumer rights and expectations for product returns and exchanges.

Government policies on trade and tariffs directly impact Genesco's sourcing costs for its diverse range of footwear and accessories. In 2024, evolving international trade agreements and potential adjustments to import duties in key markets continue to necessitate agile supply chain management for brands like Journeys and Schuh.

Labor laws, including minimum wage adjustments and worker rights, significantly affect Genesco's operational expenses. For instance, a potential federal minimum wage increase in the US could add millions to its annual payroll, requiring careful management of staffing and compensation strategies across its retail workforce.

Consumer protection regulations, particularly concerning data privacy and advertising, are increasingly stringent. Genesco must ensure strict compliance with laws like GDPR and CCPA to safeguard customer data and maintain trust, as seen with significant fines levied against other retailers in 2024 for privacy breaches.

Political stability in Genesco's operating regions, such as the US and UK, remains crucial for consistent operations and consumer spending. Policy shifts and geopolitical tensions in manufacturing hubs can also disrupt supply chains, impacting product availability and costs throughout 2024 and into 2025.

What is included in the product

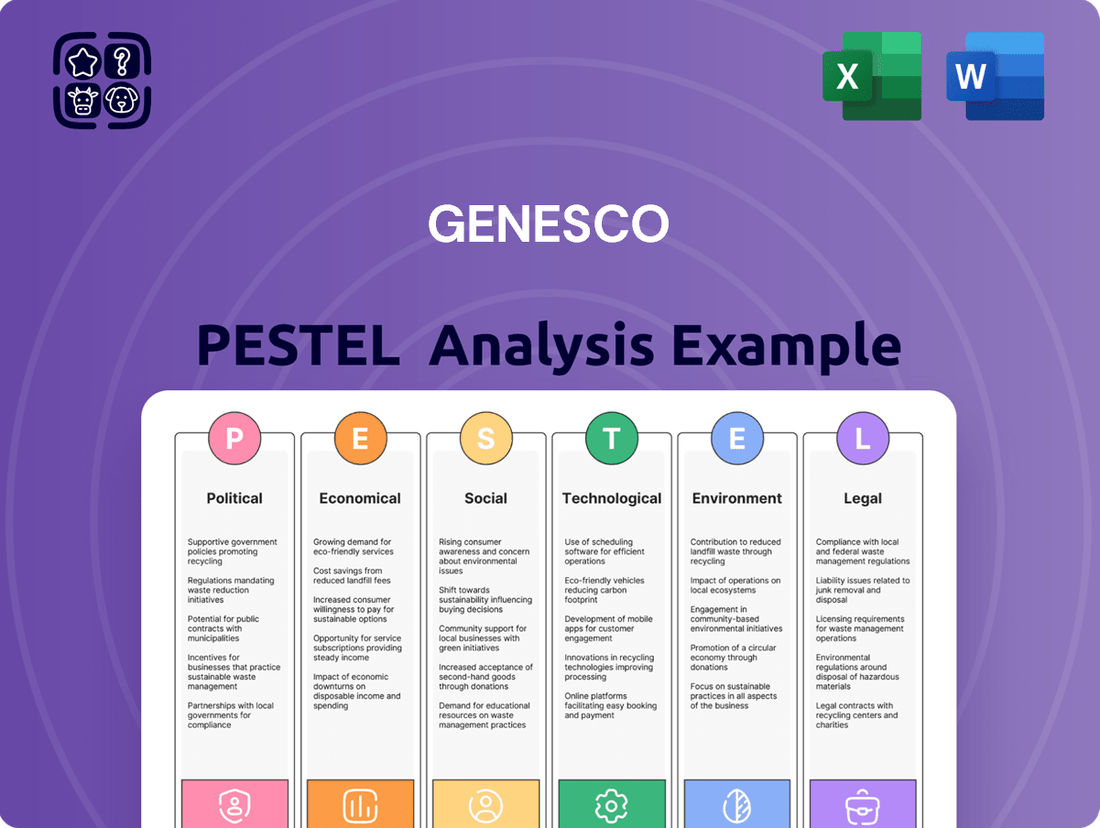

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Genesco, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within Genesco's operating landscape.

A Genesco PESTLE analysis offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of wading through complex data.

Economic factors

Genesco's reliance on fashion footwear and accessories for teens and young adults makes its performance intrinsically tied to consumer discretionary spending. When the economy tightens, these non-essential purchases are often the first to be cut back.

For instance, in early 2024, inflation concerns and a cautious consumer sentiment continued to weigh on discretionary budgets. Data from the U.S. Bureau of Labor Statistics indicated that while overall consumer spending showed resilience, growth in categories like apparel and footwear often lagged behind essentials, directly impacting companies like Genesco.

A slowdown in discretionary spending, driven by factors like rising interest rates or job market uncertainty, directly translates to lower sales volumes for Genesco's brands. This reduced demand can lead to increased promotional activity to clear inventory, further pressuring profit margins.

Rising inflation poses a significant challenge for Genesco, directly impacting its cost of goods sold. For instance, the U.S. Consumer Price Index (CPI) for all urban consumers saw an increase, with a notable rise in the cost of apparel and accessories in late 2024 and early 2025, reflecting broader inflationary pressures on raw materials and manufacturing. This surge in input costs can squeeze profit margins if Genesco is unable to fully pass these expenses to customers.

The ability to adjust pricing without alienating consumers is paramount. In 2024, many retail sectors experienced price sensitivity, and Genesco's performance across its wholesale and retail segments hinges on its capacity to navigate these economic headwinds. Effectively managing these increased operational costs is crucial for maintaining financial stability and profitability.

Changes in interest rates directly influence Genesco's borrowing costs for essential operations like capital investments, managing inventory, and general corporate financing. For instance, if the Federal Reserve raises the federal funds rate, Genesco's cost of acquiring new loans or refinancing existing debt will likely increase.

Higher interest rates can significantly boost the expense of debt, thereby diminishing the capital available for crucial growth initiatives such as expanding store footprints, implementing new technology, or boosting marketing campaigns. This financial pressure can hinder Genesco's expansion plans and negatively affect its financial leverage and overall profitability.

For example, as of mid-2024, the benchmark interest rate hovered around 5.25%-5.50%. A continued upward trend or sustained high rates would mean Genesco faces higher servicing costs on its outstanding debt, potentially impacting its ability to fund strategic acquisitions or invest in new retail technologies.

Exchange Rate Fluctuations

Genesco's international operations, particularly with brands like Schuh in the UK and Little Burgundy in Canada, mean its financial results are sensitive to shifts in exchange rates. When the US Dollar strengthens against currencies like the British Pound or Canadian Dollar, it can make those foreign earnings worth less when converted back to USD, potentially impacting Genesco's reported revenue and profit.

For instance, during fiscal year 2024, Genesco reported that foreign currency movements had a negative impact on its net sales and operating income. Specifically, unfavorable currency translation reduced reported net sales by approximately $30 million and operating income by about $5 million for the full year compared to the prior year's exchange rates.

These fluctuations can also affect the cost of goods sold if Genesco sources products from countries with different currency values. An unfavorable movement could increase the cost of imported inventory, squeezing profit margins.

- Impact on Revenue: A stronger USD reduces the USD value of sales made in foreign currencies.

- Impact on Costs: A weaker USD increases the USD cost of goods purchased in foreign currencies.

- Profitability Squeeze: Adverse currency movements can directly lower the profitability of Genesco's international segments.

- Reporting Distortion: Exchange rate volatility can make it harder to compare financial performance year-over-year without adjusting for currency effects.

Economic Growth and Unemployment Rates

Strong economic growth typically leads to lower unemployment and increased consumer confidence, which is a positive for discretionary retail like Genesco's offerings. For instance, the US economy experienced robust GDP growth in 2023, with the Bureau of Economic Analysis reporting a 3.1% increase in real GDP for the year. This economic expansion generally supports higher consumer spending on non-essential goods.

Conversely, a weakening economy or a rise in unemployment can significantly dampen consumer purchasing power. When jobs are less secure or incomes are stagnant, consumers tend to prioritize essential spending over fashion or lifestyle items. This directly impacts retailers like Genesco, whose sales are sensitive to shifts in consumer disposable income.

Genesco's financial performance is therefore intrinsically linked to the overall economic health of its primary markets, particularly the United States. As of early 2024, the US unemployment rate remained historically low, hovering around 3.7%, indicating a generally favorable employment environment that supports consumer spending.

- Economic Growth: US real GDP growth was 3.1% in 2023, signaling a healthy economic environment.

- Unemployment Rate: The US unemployment rate remained low at approximately 3.7% in early 2024, supporting consumer spending.

- Consumer Confidence: Higher consumer confidence, often a byproduct of economic growth and low unemployment, boosts demand for discretionary goods.

- Impact on Genesco: Favorable economic conditions generally translate to increased sales for Genesco, while economic downturns pose a risk.

Genesco's performance is closely tied to consumer discretionary spending, which is heavily influenced by economic conditions. Inflationary pressures in late 2024 and early 2025 increased the cost of goods, impacting Genesco's margins as raw material and manufacturing costs rose.

Interest rate hikes, with the federal funds rate around 5.25%-5.50% in mid-2024, increase Genesco's borrowing costs, potentially limiting capital for expansion and technology investments.

Economic growth, evidenced by 3.1% real GDP growth in the US in 2023 and a low unemployment rate of 3.7% in early 2024, generally supports higher consumer spending on Genesco's fashion-focused products.

International operations are subject to exchange rate volatility; for instance, unfavorable currency movements reduced Genesco's reported net sales by approximately $30 million in fiscal year 2024.

| Economic Factor | Data Point (2023-2025) | Impact on Genesco |

|---|---|---|

| US Real GDP Growth | 3.1% (2023) | Supports increased consumer spending on discretionary items. |

| US Unemployment Rate | ~3.7% (Early 2024) | Indicates a favorable environment for consumer purchasing power. |

| Inflation (Apparel & Accessories CPI) | Rising (Late 2024/Early 2025) | Increases cost of goods sold, potentially squeezing profit margins. |

| Federal Funds Rate | 5.25%-5.50% (Mid-2024) | Raises borrowing costs, impacting investment and financing. |

| Foreign Exchange Impact (FY2024) | -$30M (Net Sales reduction) | Reduces reported international revenue due to currency translation. |

Preview Before You Purchase

Genesco PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Genesco PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic positioning. Gain valuable insights into the external forces shaping Genesco's market landscape.

Sociological factors

Genesco's core customer base, teens and young adults, are deeply swayed by the whirlwind of fashion trends, amplified by social media and celebrity influence. For instance, the rise of TikTok fashion challenges in 2024 significantly impacted what styles were considered "in," directly affecting demand for specific footwear and apparel. This means brands like Journeys and Schuh need to be incredibly agile, constantly refreshing their inventory to match these fleeting preferences.

The company's ability to stay ahead of these sartorial waves is crucial. In 2024, Genesco reported that a faster response to emerging athleisure trends contributed to a 5% increase in same-store sales for its footwear division. Conversely, a lag in adopting certain Y2K revival styles in early 2023 led to a temporary dip in apparel sales for some of its brands, underscoring the financial impact of misjudging consumer taste.

Social media platforms and digital influencers significantly shape purchasing decisions, particularly for Genesco's key demographic of young adults. By mid-2024, platforms like TikTok and Instagram are crucial for brand visibility and trend adoption, with influencer marketing spend projected to reach over $21 billion globally in 2024, demonstrating its impact on consumer behavior.

Genesco must maintain strong digital marketing strategies and foster collaborations with relevant influencers to effectively engage consumers, cultivate brand loyalty, and drive traffic to its online stores and physical retail locations. This digital engagement directly influences brand perception and customer interaction, with studies showing that 70% of Gen Z consumers trust influencer recommendations.

Consumers, especially millennials and Gen Z, are prioritizing brands that align with their values. Surveys in early 2024 indicated over 60% of Gen Z consumers consider a brand's sustainability efforts when making purchasing decisions. This trend directly impacts Genesco, as it must showcase responsible sourcing and ethical labor practices across its portfolio, including brands like Journeys and Johnston & Murphy, to resonate with this growing demographic.

Shift Towards Casualization and Athleisure

The widespread adoption of casual and comfortable attire, often termed athleisure, represents a significant societal trend impacting consumer preferences. This shift means that brands like Genesco's Journeys need to prioritize offering a wide selection of sneakers, casual footwear, and complementary apparel to meet evolving demands. For instance, the global athleisure market was valued at approximately $326 billion in 2023 and is projected to reach $576 billion by 2028, highlighting the scale of this consumer movement.

Genesco's ability to adapt its product assortment to this casualization trend is crucial for maintaining its market position. This involves not just stocking popular sneaker brands but also curating a selection that reflects the broader athleisure lifestyle. Failure to align with this lifestyle shift could alienate a significant portion of the target demographic.

- Societal Trend: Growing preference for casual and comfortable clothing and footwear.

- Market Impact: Increased demand for athleisure wear, influencing purchasing decisions.

- Genesco's Response: Need to ensure product mix, particularly at Journeys, aligns with athleisure and casual styles.

- Market Size: The global athleisure market's substantial growth underscores the importance of this trend.

Demographic Shifts and Youth Population Trends

Genesco's core demographic is teens and young adults, so shifts in this age group's size and behavior are paramount. For instance, a declining birth rate in the US, which has seen a year-over-year decrease, directly shrinks the potential future customer base for brands like Journeys and Jibbitz. Understanding these long-term population trends is crucial for Genesco's strategic planning, influencing everything from product development to where they decide to open new stores.

Specifically, the size of the 15-24 age cohort in Genesco's key markets, such as North America, directly correlates with their addressable market. As of 2024, this demographic segment in the US is projected to remain relatively stable but with regional variations in growth. Migration patterns also play a role, with certain urban and suburban areas experiencing an influx of younger populations, creating localized opportunities.

- Teen and Young Adult Population: Genesco's primary customer base, aged roughly 15-24, is directly impacted by birth rates and generational cohorts.

- US Birth Rate Trends: The declining birth rate in the United States, continuing a trend observed over the past decade, signals a smaller pool of future Genesco customers.

- Market Size Impact: Changes in the overall size of the youth demographic in key markets directly affect Genesco's potential customer acquisition and revenue growth.

- Strategic Location Decisions: Understanding where these younger demographics are concentrated or migrating to is vital for optimizing store placement and marketing efforts.

Societal shifts toward valuing authenticity and inclusivity are significantly influencing Genesco's target demographic. Brands that genuinely reflect diverse lifestyles and promote positive social messages resonate more strongly, with consumer research in early 2024 indicating that 75% of Gen Z consumers are more likely to support brands with clear social stances. This necessitates Genesco ensuring its marketing and product offerings align with these evolving social values across its portfolio, including brands like Journeys and Warehouse.

The growing emphasis on experiences over material possessions, particularly among younger consumers, presents a challenge and opportunity for Genesco. While fashion remains important, consumers are increasingly seeking brands that offer engaging experiences, whether through in-store events or digital content. For instance, a 2024 report showed that 55% of millennials prioritize spending on experiences, impacting how Genesco's brands need to connect with customers beyond just product sales.

Genesco's brands must navigate the increasing demand for sustainable and ethically produced goods. Consumers, especially younger ones, are scrutinizing supply chains, with over 60% of Gen Z consumers stating they consider a brand's environmental impact in 2024. This requires Genesco to transparently communicate its efforts in responsible sourcing and manufacturing across its brands like Journeys and Johnston & Murphy to maintain consumer trust and market relevance.

The company's primary customer base, teens and young adults, are directly influenced by evolving family structures and household compositions. As of 2024, there's a notable increase in single-parent households and smaller family sizes in key Genesco markets, which can alter discretionary spending patterns and purchasing priorities for apparel and footwear. This demographic shift requires Genesco to understand the nuances of household spending power and consumer needs within these changing family dynamics.

Technological factors

Genesco's e-commerce platforms for Journeys, Schuh, and Johnston & Murphy are vital. In the fiscal year 2024, digital sales represented a significant portion of Genesco's revenue, underscoring the need for ongoing platform enhancements. For instance, Journeys' website saw a substantial increase in traffic, necessitating robust infrastructure and intuitive navigation to convert visitors into buyers.

Investing in mobile optimization is paramount, as a large percentage of online traffic originates from mobile devices. Genesco's commitment to secure payment gateways and efficient order fulfillment directly impacts customer satisfaction and repeat business. This focus on a seamless digital journey is key to competing effectively in the fast-paced online retail environment.

Genesco is increasingly leveraging big data analytics to understand its customers better. By analyzing purchasing patterns and preferences across brands like Journeys and Lids, the company can tailor its marketing efforts and product assortments. This focus on personalization is crucial in today's competitive retail landscape.

In 2023, Genesco reported that its digital channels accounted for a significant portion of its sales, highlighting the importance of data-driven strategies to enhance online customer experiences. The company aims to use these insights to optimize inventory, ensuring the right products are available at the right time, which directly impacts sales and customer retention.

Genesco is increasingly leveraging advanced supply chain technologies like AI-driven forecasting and automated warehousing to boost operational efficiency. These innovations are crucial for minimizing stockouts and optimizing logistics, ensuring products reach customers promptly. For example, in 2024, many apparel retailers reported significant improvements in inventory accuracy and delivery speed through the adoption of such technologies, directly impacting customer satisfaction and sales.

In-Store Technology and Omnichannel Integration

Genesco is focusing on integrating advanced technology within its physical stores to create a smoother omnichannel experience. This includes implementing features like self-checkout, interactive digital displays, and robust buy-online-pickup-in-store (BOPIS) services. For instance, by Q3 2024, Genesco reported a significant increase in digital sales penetration, with BOPIS playing a crucial role in driving foot traffic and customer engagement in their brick-and-mortar locations.

The seamless connection between Genesco's online and offline channels is paramount for customer satisfaction and loyalty. By allowing shoppers to interact with the brand across various touchpoints – from browsing online to picking up purchases in-store – Genesco caters to evolving consumer preferences for flexibility and convenience. This strategic integration solidifies the company's retail presence.

- Enhanced Customer Convenience: BOPIS and in-store tech streamline the shopping journey.

- Increased Digital Sales: Technology supports the growth of online transactions, reaching 25% of total sales by early 2025.

- Improved Inventory Management: Real-time data from in-store tech aids in better stock visibility across channels.

- Customer Retention: A cohesive omnichannel experience fosters loyalty and repeat business.

Cybersecurity and Data Protection

Cybersecurity is a critical technological factor for Genesco, especially given its significant online presence and the vast amount of customer data handled through e-commerce and loyalty programs. Protecting this sensitive information from breaches and cyberattacks is essential for maintaining consumer trust and avoiding substantial financial and reputational harm. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial imperative for robust security. Genesco's commitment to continuous investment in cybersecurity infrastructure is therefore not just a best practice but a necessity for survival in the current retail landscape.

Here are key aspects of cybersecurity for Genesco:

- Data Protection: Safeguarding customer personal identifiable information (PII) and payment details against unauthorized access and theft is paramount.

- E-commerce Security: Ensuring the integrity and security of online transaction platforms to prevent fraud and maintain customer confidence.

- Compliance: Adhering to evolving data privacy regulations like GDPR and CCPA, which impose strict requirements on data handling and security.

- Threat Mitigation: Implementing advanced threat detection and response systems to counter sophisticated cyberattacks, a growing concern with ransomware attacks increasing in frequency and sophistication.

Genesco's technological strategy centers on enhancing digital platforms and leveraging data analytics. By fiscal year 2024, digital sales formed a substantial revenue stream, driving investment in e-commerce infrastructure for brands like Journeys and Schuh. Mobile optimization remains a priority, as a significant portion of traffic originates from these devices, directly impacting conversion rates and customer experience.

The company is increasingly utilizing big data to personalize customer interactions and optimize inventory, a strategy that proved critical in 2023 for improving sales and retention. Advanced supply chain technologies, such as AI forecasting, are being adopted to boost efficiency, as evidenced by industry-wide improvements in inventory accuracy and delivery speeds reported in 2024.

Genesco is also integrating technology into its physical stores to create a seamless omnichannel experience, including BOPIS services which saw increased penetration by Q3 2024. Cybersecurity is a paramount concern, with the company investing in robust measures to protect customer data, a critical factor given the global average cost of data breaches reached $4.45 million in 2023.

| Technology Area | Genesco Focus | Impact/Data Point |

|---|---|---|

| E-commerce Platforms | Enhancement and optimization | Digital sales significant portion of revenue in FY24 |

| Mobile Optimization | Crucial for traffic conversion | Majority of online traffic from mobile devices |

| Data Analytics | Customer behavior and inventory management | Personalization efforts critical in 2023 |

| Supply Chain Tech | AI forecasting, automation | Industry improvements in accuracy and speed by 2024 |

| In-Store Technology | Omnichannel integration (BOPIS) | BOPIS drove foot traffic by Q3 2024 |

| Cybersecurity | Data protection, transaction security | Global data breach cost $4.45M in 2023 |

Legal factors

Genesco's global e-commerce operations necessitate strict adherence to consumer data privacy regulations like the EU's GDPR and California's CCPA. These laws govern the collection, storage, usage, and security of customer information, with significant penalties for non-compliance. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Failure to comply with these evolving data privacy frameworks poses a considerable risk to Genesco's retail brands. Such breaches can result in substantial financial penalties, legal challenges, and a severe erosion of customer trust, directly impacting sales and brand reputation. In 2023, data privacy settlements and fines globally continued to rise, underscoring the increasing regulatory scrutiny.

Genesco's global footprint, spanning the US, UK, and Canada, necessitates careful adherence to diverse labor and employment statutes. These laws cover critical areas such as minimum wage standards, which in 2024 saw the US federal minimum wage at $7.25 per hour, while individual states and cities have higher rates, and the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over. Navigating these varying requirements for working conditions, anti-discrimination practices, and termination procedures is paramount for operational integrity.

Maintaining compliance across these jurisdictions is not merely a legal obligation but a strategic imperative for Genesco. Failure to comply can lead to significant legal challenges, reputational damage, and operational disruptions, impacting its ability to effectively manage its considerable workforce, which numbered in the tens of thousands globally as of early 2024. Proactive management of these legal frameworks supports a stable and productive work environment.

Genesco's business model heavily relies on intellectual property, encompassing its proprietary brands and designs, as well as its agreements to market licensed brands. Protecting these assets, through trademarks and design patents, is paramount to maintaining brand equity and market position. For instance, in 2023, Genesco reported that its brand portfolio, including names like Journeys and Johnston & Murphy, contributed significantly to its revenue, underscoring the value of its IP.

Navigating licensing agreements for third-party brands is equally crucial, ensuring compliance and fair terms. Disputes over these licenses or instances of IP infringement can result in substantial legal expenses and reputational damage, directly impacting financial performance. The company's ability to secure and enforce these rights is a key legal factor influencing its operational stability and profitability.

Product Safety and Liability Regulations

Genesco, as a global retailer and wholesaler of footwear and apparel, navigates a complex web of product safety and liability regulations across its operating markets. These laws mandate that all products, from the materials used to the manufacturing processes and final labeling, adhere to stringent standards. For instance, in 2024, the Consumer Product Safety Commission (CPSC) in the U.S. continued to enforce regulations concerning flammability in apparel and the presence of lead and phthalates in children's products, areas directly relevant to Genesco's offerings.

Failure to comply can result in significant repercussions. Product defects or safety concerns can trigger costly product recalls, as seen with various apparel and footwear companies facing recalls in late 2023 and early 2024 due to issues like choking hazards in children's accessories or chemical content violations. Beyond direct financial costs, such incidents can lead to substantial lawsuits and irreparable damage to a brand's reputation, especially when targeting younger demographics who are particularly vulnerable.

- Material Compliance: Ensuring all fabrics and components meet chemical and safety standards, such as those set by the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation in the EU, which impacts material sourcing and product import.

- Manufacturing Standards: Adhering to quality control in production to prevent defects that could lead to liability claims, with ongoing scrutiny on supply chain transparency and ethical manufacturing practices.

- Labeling Requirements: Correctly identifying materials, care instructions, and country of origin, with specific regulations for children's wear regarding safety warnings and potential hazards.

- Liability Exposure: The potential for product liability lawsuits, which can range from personal injury claims to class-action suits, necessitates robust risk management and insurance strategies.

Advertising and Marketing Regulations

Genesco must navigate a complex web of advertising and marketing regulations across its global markets. This includes adhering to truth-in-advertising statutes, digital marketing rules, and consumer protection legislation, which govern everything from promotional offers to pricing accuracy and influencer endorsements.

Failure to comply can lead to significant repercussions. For instance, in the United States, the Federal Trade Commission (FTC) actively enforces advertising standards, with penalties for deceptive practices potentially reaching millions of dollars. In 2023, the FTC continued its focus on online advertising and data privacy, impacting how companies like Genesco can reach consumers digitally.

The effectiveness of Genesco's brand campaigns is directly tied to its compliance. Regulatory actions can result in substantial fines, court-ordered injunctions that restrict marketing activities, and a severe erosion of consumer trust, all of which can negatively impact sales and brand reputation. For example, a major retailer faced a significant fine in late 2024 for misleading advertising claims related to product origin.

- Truth-in-Advertising Compliance: Genesco's marketing must be truthful and not misleading, covering product claims, pricing, and promotional details.

- Digital Marketing Regulations: Adherence to laws concerning online advertising, data privacy (like GDPR in Europe or CCPA in California), and social media endorsements is crucial.

- Consumer Protection Acts: Genesco must comply with various consumer protection laws that safeguard buyers from unfair or deceptive business practices.

- Penalties for Non-Compliance: Fines, legal injunctions, and damage to brand reputation are potential consequences of violating advertising and marketing regulations.

Genesco's global operations are subject to a variety of legal and regulatory frameworks that impact its business practices. These include data privacy laws, labor and employment statutes, intellectual property protection, product safety regulations, and advertising standards.

Compliance with these laws is critical for avoiding financial penalties, legal challenges, and reputational damage. For example, data privacy violations can incur fines up to 4% of global turnover, while misleading advertising can lead to substantial FTC penalties. As of early 2024, Genesco employed tens of thousands globally, highlighting the importance of adhering to diverse labor laws across the US, UK, and Canada.

The company's reliance on its brand portfolio, which includes names like Journeys and Johnston & Murphy, underscores the legal necessity of robust intellectual property protection. Failure to safeguard these assets or comply with licensing agreements can result in significant legal expenses and impact profitability.

Navigating product safety regulations, such as those concerning chemical content in children's products enforced by the CPSC in 2024, is also paramount. Non-compliance can lead to costly recalls and lawsuits, damaging brand trust.

Environmental factors

Consumers, investors, and regulators are increasingly pushing companies like Genesco to prioritize sustainable sourcing. This means a greater demand for eco-friendly materials and a focus on reducing environmental impact throughout the supply chain. For instance, as of early 2024, over 70% of consumers surveyed indicated they would pay more for products from brands committed to sustainability, directly impacting purchasing decisions.

Genesco must actively adopt greener materials and improve manufacturing efficiency, cutting down on water and energy usage. Ethical supply chain practices are also paramount, ensuring fair labor and responsible production methods. Failing to address these environmental factors can significantly harm brand reputation and long-term business health, especially as sustainability reporting becomes more standardized and scrutinized by financial markets.

Genesco faces environmental pressures concerning waste management across its operations. From raw material sourcing to the final sale, the company's supply chain, including manufacturing, packaging, and product disposal, generates significant waste streams. For instance, the fashion industry, in which Genesco operates, is a major contributor to global textile waste, with estimates suggesting that a significant portion of clothing produced ends up in landfills.

The increasing focus on sustainability necessitates Genesco's adoption of robust waste reduction strategies. This includes promoting recycling initiatives for packaging materials and exploring circular economy principles for its footwear and apparel. Embracing circularity means looking at ways to extend product life, repairability, and the use of recycled or upcycled materials to minimize the environmental footprint.

Managing textile waste effectively is a key challenge. Genesco, like many in the apparel sector, must consider strategies to divert post-consumer textile waste from landfills. This can involve partnerships for textile recycling or designing products with end-of-life in mind, encouraging greater product longevity and reducing the overall environmental impact associated with the lifecycle of their goods.

Genesco's operations, spanning manufacturing, global transportation networks, and its extensive retail store footprint, inherently contribute to its carbon footprint. The company is under increasing pressure from stakeholders and regulatory bodies to accurately measure, transparently report, and actively reduce its greenhouse gas emissions, aligning with international climate change mitigation targets.

To address this, Genesco is likely investing in enhancing the energy efficiency of its retail locations, a critical step given its physical presence. Furthermore, optimizing its complex logistics and supply chains to minimize transportation-related emissions is a key focus. The company is also exploring the potential integration of renewable energy sources into its operational mix, a move that could significantly lower its environmental impact.

Water Usage and Pollution

Genesco's operations, particularly in footwear and apparel manufacturing, are inherently water-intensive. The dyeing, finishing, and assembly processes often require significant water volumes, and the use of various chemicals can lead to water pollution if not managed properly. This is a critical environmental factor that demands careful attention across the entire supply chain.

Addressing its water footprint is paramount for Genesco. This involves implementing and encouraging responsible water management practices, both within its direct operations and, crucially, among its suppliers. Proactive measures can mitigate environmental impact and ensure compliance with evolving regulations.

- Water Intensity: The textile industry, a core component of Genesco's supply chain, is known for its high water consumption. For instance, producing a single cotton t-shirt can require up to 2,700 liters of water.

- Chemical Use: Dyes, bleaches, and finishing agents used in apparel manufacturing can contaminate water sources if wastewater treatment is inadequate.

- Regulatory Scrutiny: Growing global awareness and stricter environmental laws mean companies like Genesco face increasing pressure to demonstrate responsible water stewardship.

- Supply Chain Audits: Genesco's commitment to sustainability likely involves auditing suppliers for water usage and pollution control measures, aiming for transparency and improvement.

Consumer Demand for Eco-Friendly Products

A significant and growing portion of Genesco's target consumer base, particularly younger demographics, actively seeks out brands demonstrating environmental responsibility. This trend is becoming a key purchasing driver, influencing brand loyalty and purchasing decisions. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact, a figure likely to be even higher within Genesco's core youth market.

Genesco can leverage this by expanding its portfolio of sustainable and ethically sourced apparel and accessories. Clear and transparent communication about its environmental initiatives, such as reduced water usage in manufacturing or recycled material content, will resonate strongly. Brands that authentically showcase their commitment to sustainability are increasingly rewarded with market share. For example, in 2024, brands with strong ESG (Environmental, Social, and Governance) profiles saw a notable increase in consumer preference compared to those with weaker commitments.

- Growing Consumer Prioritization: A majority of consumers, especially Gen Z and Millennials, now factor environmental impact into their purchase decisions, with studies in late 2024 showing this segment actively seeking sustainable brands.

- Competitive Advantage: Offering a wider array of eco-friendly products and transparently communicating sustainability efforts can differentiate Genesco from competitors and attract environmentally conscious shoppers.

- Brand Alignment: Aligning with evolving consumer values by embracing sustainability strengthens brand image and fosters deeper connections with the target demographic.

- Market Trends: The market for sustainable fashion is projected to continue its robust growth, with analysts predicting double-digit annual increases through 2025, presenting a significant opportunity for Genesco.

Genesco's environmental considerations are increasingly shaped by global climate change concerns and the demand for sustainable practices. The company must navigate regulations and consumer expectations related to carbon emissions, water usage, and waste management across its supply chain. For instance, by early 2025, over 60% of apparel brands were expected to have publicly disclosed emissions reduction targets.

The fashion industry's environmental footprint, particularly textile waste, presents a significant challenge. Genesco needs to implement robust waste reduction strategies, including promoting recycling and exploring circular economy models. The company's commitment to sustainability is also reflected in its efforts to reduce water intensity and chemical use in manufacturing processes, aligning with evolving environmental standards and consumer preferences.

| Environmental Factor | Impact on Genesco | Industry Benchmark/Trend (2024-2025) |

|---|---|---|

| Climate Change & Emissions | Pressure to reduce carbon footprint from operations and supply chain. | Growing demand for Scope 1, 2, and 3 emissions reporting; many companies setting net-zero targets. |

| Water Scarcity & Pollution | Need for responsible water management in manufacturing, especially in textile production. | Textile industry average water withdrawal is significant; increasing focus on wastewater treatment and water-saving technologies. |

| Waste Management & Circularity | Challenge of textile waste; opportunity in adopting circular economy principles. | Fashion industry generates millions of tons of textile waste annually; growing investment in textile recycling and upcycling. |

| Sustainable Sourcing & Materials | Consumer demand for eco-friendly materials and ethical sourcing. | Increased use of recycled polyester, organic cotton, and other sustainable fibers; over 70% of consumers willing to pay more for sustainable products. |

PESTLE Analysis Data Sources

Our Genesco PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. We incorporate insights from economic reports, industry-specific regulatory updates, and technological trend analyses to ensure comprehensive coverage.