Genesco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genesco Bundle

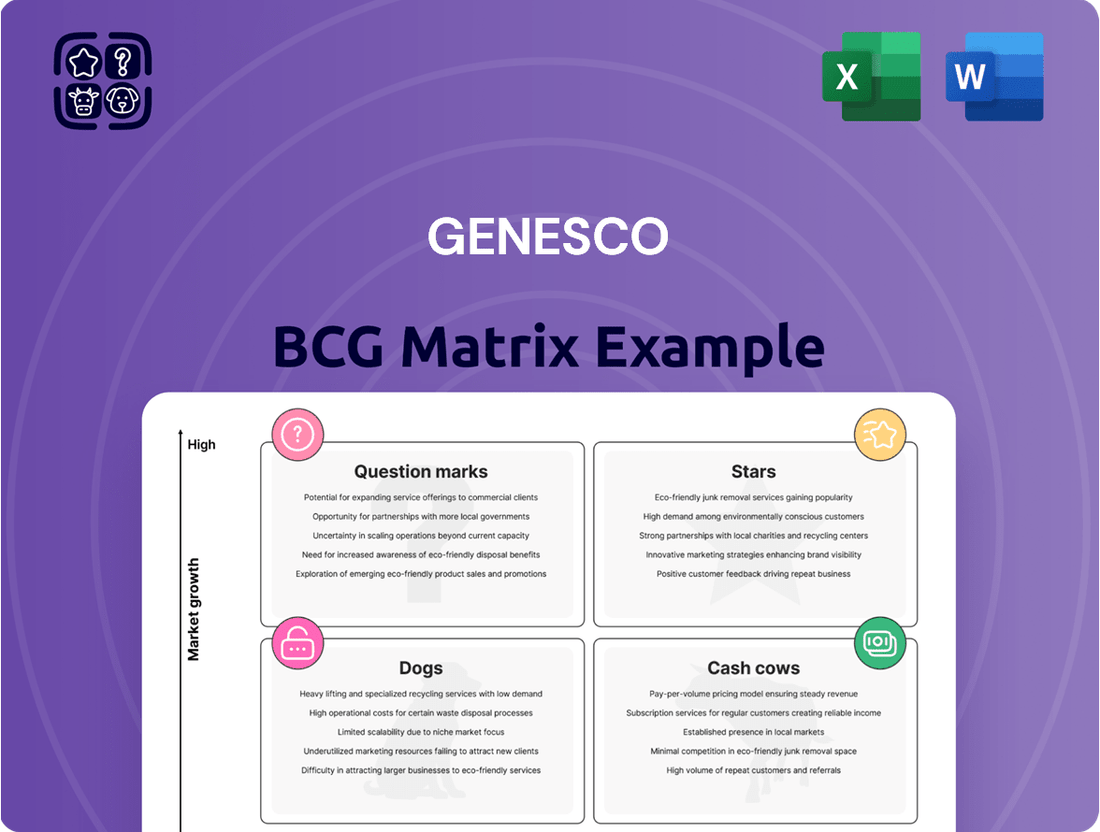

Curious about Genesco's strategic product portfolio? Our BCG Matrix analysis reveals which brands are your Stars, Cash Cows, Dogs, and Question Marks, offering a clear snapshot of their market performance.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Genesco.

Stars

Journeys, Genesco's primary brand targeting teens and young adults, has been a cornerstone of the company's revitalization efforts. Its recent performance, including a notable 14% comparable sales growth in the fourth quarter of fiscal year 2025, underscores its robust market presence.

This strong growth highlights Journeys' significant market share within the expanding youth and athleisure footwear sectors. As a result, it functions as a cash-consuming star, requiring ongoing investment to sustain its leading position and support future expansion initiatives.

Journeys' e-commerce and digital channels are a star performer, demonstrating significant growth. In Q4 FY2025, e-commerce comparable sales surged by 18%, following an 8% increase in Q2 FY2025, highlighting a robust expansion in this high-market-share segment.

Genesco's strategic, multi-year investments in its digital infrastructure are paying off, enabling Journeys to effectively counter challenges faced by its physical stores. This digital prowess is a crucial contributor to the company's overall financial health.

Sustaining this competitive edge necessitates ongoing investment in the e-commerce and digital platforms. The brand's ability to leverage strong online sales is a key differentiator and a primary driver for continued success.

The Journeys Kidz segment, a key part of Genesco's portfolio, is a strong performer, showing a 9% sales increase in Q1 FY2025 compared to the previous year. This growth is happening within a global kids' footwear market expected to expand at a 3.8% compound annual growth rate between 2025 and 2034.

This segment benefits from a significant market share within a growing demographic. Factors like increased parental focus on children's footwear and evolving youth fashion trends are driving this success.

To maintain its upward trajectory, continued strategic investment in both product variety and marketing efforts for the Journeys Kidz sub-brand is essential.

Athletic and Casual Footwear Offerings within Journeys

Journeys' athletic and casual footwear offerings are a significant driver of its success, mirroring broader market trends. The global footwear market is expected to see athletic footwear dominate in the coming years, while casual footwear already holds the largest market share.

By consistently introducing fresh and appealing styles within these popular categories, Journeys secures and maintains a substantial market share. This strategic focus on high-growth segments is key to its leadership position in the ever-evolving footwear industry.

- Journeys' athletic and casual footwear sales are a primary growth engine.

- The global athletic footwear market is projected for significant expansion, while casual footwear maintains its leading market share in 2025.

- Introducing newness in these categories helps Journeys capture a high market share.

- This strategy solidifies Journeys' status as a market leader in a dynamic sector.

Journeys' Strategic Growth Initiatives

Journeys' strategic growth initiatives are propelling its 'Star' status within the Genesco BCG Matrix. These efforts include refreshing product assortments to stay ahead of trends, visually enhancing store layouts to improve customer engagement, and rapidly expanding buy online, pick up in-store (BOPIS) capabilities. These moves are designed to significantly boost the consumer experience and drive comparable sales growth, reflecting substantial investment in solidifying its market leadership in a dynamic retail landscape.

The company's focus on enhancing the customer journey is evident in its performance. For instance, during the first quarter of fiscal 2024, Journeys reported a comparable store sales increase of 10%, a testament to the effectiveness of these strategic plays. This growth is crucial for maintaining its position in a high-growth market segment.

- Product Assortment Refresh: Continuously updating inventory with the latest fashion trends and exclusive collaborations to attract and retain customers.

- Store Visual Reset: Implementing modern store designs and merchandising strategies to create an appealing and engaging shopping environment.

- BOPIS Acceleration: Significantly investing in and promoting buy online, pick up in-store services to cater to evolving consumer shopping habits and provide convenience.

- Comparable Sales Growth: Achieving double-digit comparable sales increases, such as the 10% growth in Q1 FY24, demonstrating the success of these initiatives in driving traffic and transactions.

Journeys, a key Genesco brand, is positioned as a Star in the BCG Matrix due to its strong performance in high-growth segments like athletic and casual footwear. Its recent comparable sales growth, reaching 14% in Q4 FY2025, highlights its market leadership. The brand's digital channels are particularly strong, with an 18% comparable sales surge in e-commerce during the same quarter, demonstrating successful investment in online capabilities.

The Journeys Kidz segment also contributes to its Star status, showing a 9% sales increase in Q1 FY2025 and operating within a growing global kids' footwear market. Continued investment in product variety and marketing for Journeys Kidz is essential to maintain this momentum.

Journeys' strategic focus on refreshing product assortments, enhancing store visuals, and expanding BOPIS capabilities further solidifies its Star position. These initiatives, coupled with a 10% comparable store sales increase in Q1 FY2024, underscore its ability to drive growth and customer engagement in a dynamic retail environment.

| Brand Segment | BCG Category | Key Growth Drivers | Recent Performance Metric (Q4 FY2025 unless noted) |

|---|---|---|---|

| Journeys (Overall) | Star | Athletic & Casual Footwear Trends, Digital Expansion | 14% Comparable Sales Growth |

| Journeys E-commerce | Star | Digital Investment, BOPIS Acceleration | 18% Comparable E-commerce Sales Growth |

| Journeys Kidz | Star | Growing Kids' Footwear Market, Product Variety | 9% Sales Increase (Q1 FY2025) |

What is included in the product

The Genesco BCG Matrix analyzes its brands as Stars, Cash Cows, Question Marks, or Dogs.

It guides strategic decisions on investment, divestment, or holding for each brand.

The Genesco BCG Matrix clarifies strategic priorities, relieving the pain of resource allocation confusion.

Cash Cows

Schuh, a cornerstone of Genesco's portfolio in the United Kingdom, exemplifies a classic Cash Cow within the BCG matrix. Its deeply entrenched position in the UK youth and fashion footwear market translates into a reliable revenue stream. While FY2025 saw flat sales for Schuh, the brand's enduring market presence ensures consistent cash flow generation for Genesco.

Despite a slight uptick in promotional efforts, Schuh's established brand equity in a mature yet stable market segment means it doesn't necessitate substantial capital infusions for market share expansion. This allows Genesco to leverage Schuh as a significant contributor to its overall financial health, effectively milking its established market position for ongoing returns.

Schuh's loyalty program, the Schuh Club, has amassed over 2.5 million members within its initial two years. This substantial membership base indicates a highly engaged and loyal customer segment.

This established customer loyalty translates into a predictable and consistent revenue stream for Genesco. The program's success in retaining customers minimizes the ongoing costs associated with acquiring new shoppers, solidifying its position as a cash cow.

The Schuh Club effectively drives repeat purchases and fosters customer stickiness, crucial for maintaining strong performance in the competitive footwear market. This loyalty is a key driver of stable cash flow for Genesco.

Schuh demonstrates a consistent positive contribution to Genesco's gross margin, even with occasional dips caused by promotional efforts. For instance, in Q1 FY2025, despite a slight decrease in its gross margin, Schuh remained a valuable component of the company's financial results.

The brand's capacity to remain profitable amidst intense market competition, supported by effective inventory control, solidifies its position as a cash cow. This consistent profitability showcases its reliable generation of earnings for Genesco.

Consistent Revenue Generation from Schuh

Schuh's consistent revenue generation is a key characteristic of a Cash Cow for Genesco. For Fiscal 2025, Schuh's sales are projected to be flat, following modest increases in prior quarters. This stability, even in a growing market, highlights its reliable cash flow generation.

This dependable income stream allows Genesco to effectively 'milk' profits from the established Schuh brand. The brand's ability to maintain sales levels signifies a mature but profitable segment for the company.

- Consistent Revenue: Schuh's sales are expected to remain flat in Fiscal 2025, indicating a stable revenue base.

- Mature Market Position: While the overall market may be growing, Schuh's segment shows stability, suggesting a mature but reliable cash flow.

- Profitability: This consistent performance allows Genesco to leverage Schuh as a significant source of 'milked' profits.

Schuh's Role in Portfolio Diversification

Schuh, a significant component of Genesco's portfolio, plays a crucial role in diversification by offering strong geographical and market presence, particularly within the United Kingdom.

Its established operations and consistent performance act as a stabilizing force, balancing Genesco's overall investment mix. This reliability allows for the redirection of funds towards more dynamic growth sectors or to support broader corporate financial needs.

Schuh's strategic stability firmly positions it as a cash cow within the Genesco framework.

- Geographic Diversification: Schuh's primary operations in the UK provide Genesco with exposure to a different economic landscape than its North American businesses.

- Market Stability: As a well-established footwear retailer, Schuh demonstrates consistent revenue generation, contributing to Genesco's overall financial resilience.

- Cash Flow Generation: Schuh's reliable performance generates predictable cash flows, supporting Genesco's investment in growth opportunities and operational expenses.

- Portfolio Balance: The steady contributions from Schuh help mitigate the risks associated with Genesco's more volatile or emerging business segments.

Cash Cows are established brands with high market share in low-growth markets. Genesco's Schuh brand fits this description perfectly, generating consistent profits without requiring significant investment for expansion. Its stable performance allows Genesco to allocate resources to other areas of the business.

Schuh's loyalty program, the Schuh Club, boasts over 2.5 million members, underscoring its strong customer retention and predictable revenue. This deep customer engagement is a hallmark of a successful cash cow, ensuring a steady income stream for Genesco.

While FY2025 projections indicate flat sales for Schuh, this stability in a mature market segment is precisely what defines a cash cow. Genesco can effectively leverage Schuh's consistent profitability to fund growth initiatives in other brands or divisions.

Schuh's consistent positive contribution to Genesco's gross margin, even with occasional promotional impacts, highlights its reliable earnings generation. The brand's ability to remain profitable amidst competition, supported by effective inventory management, solidifies its cash cow status.

| Brand | Market Share | Market Growth | Cash Flow Generation | Investment Need |

|---|---|---|---|---|

| Schuh | High | Low | High | Low |

Delivered as Shown

Genesco BCG Matrix

The Genesco BCG Matrix preview you are viewing is the exact, fully formatted report you will receive immediately after purchase, ensuring no surprises and immediate usability for your strategic planning. This comprehensive document, designed for clarity and professional application, will be delivered to you without any watermarks or demo content, ready for immediate integration into your business analysis. You are seeing the final, editable version of the Genesco BCG Matrix, which means you can confidently use it for internal discussions, client presentations, or further in-depth market research without any need for revisions. This preview accurately represents the quality and content of the Genesco BCG Matrix report you'll download, providing you with a powerful tool for evaluating your business portfolio and making informed strategic decisions.

Dogs

Genesco Brands Group's licensed wholesale business, featuring names like Levi's and Dockers, is struggling. Sales dropped 11% in fiscal year 2025 and 12% in the fourth quarter of fiscal year 2025. This segment is being streamlined, suggesting it has a low market share and limited growth potential within Genesco.

Genesco's Journeys brand is actively addressing its underperforming physical store locations, which are categorized as 'Dogs' in a BCG Matrix analysis. The company has committed to closing over 100 Journeys stores in fiscal year 2024, a move that represents approximately 6% of its total store fleet.

These closures are driven by the fact that these specific locations exhibit low sales productivity and contribute very little to the brand's overall profitability. By divesting these low-performing assets, Genesco is focused on optimizing its store portfolio and enhancing the productivity of its remaining retail footprint.

The strategic decision to close these underperforming Journeys stores is expected to positively impact Genesco's operating income. This portfolio optimization is a key component of the company's strategy to streamline operations and improve financial performance across its retail network.

Genesco's Schuh experienced heightened promotional activity in both the first and fourth quarters of fiscal year 2025. This increased discounting, alongside mentions of fewer markdowns at Journeys in the fourth quarter of FY2025, signals potential issues with slow-moving or outdated inventory across the company. Such inventory ties up valuable capital and yields minimal returns, aligning with the characteristics of 'dog' products in a BCG matrix analysis.

Segments with Negative Sales Trends within Genesco Brands Group

Within Genesco's portfolio, certain segments within the Genesco Brands Group are exhibiting persistent negative sales trends, characteristic of 'dogs' in a BCG Matrix analysis. These are areas with low market share and low growth prospects, indicating a need for strategic re-evaluation or divestment.

While Genesco reported a 10% increase in sales for the third quarter of fiscal year 2025, the overall outlook for fiscal year 2025 and the fourth quarter specifically points to a continued decline. This sustained downturn is particularly evident in the wholesale channel, suggesting a weakening demand or competitive disadvantage in these specific product categories or distribution methods.

- Wholesale Channel Decline: The wholesale segment within Genesco Brands Group has shown consistent negative sales trends, signaling a shrinking market presence.

- Overall FY2025 Outlook: Projections for the full fiscal year 2025 indicate a sustained downturn, reinforcing the 'dog' classification for these underperforming areas.

- Low Market Share and Growth: These segments are characterized by both limited market share and minimal growth potential, making them candidates for strategic review.

Shi by Journeys (Potential Dog)

Shi by Journeys, as part of Genesco's portfolio, likely occupies a position in the BCG matrix that warrants careful consideration. While detailed financial breakdowns for this specific brand are not always readily available in public disclosures, its integration within the larger Journeys segment, which targets youth footwear and accessories, suggests a competitive landscape.

Given the lack of pronounced growth narratives specifically tied to Shi by Journeys in recent Genesco reports, it's plausible to categorize it as a potential 'Dog' or a unit with low market share in a segment that may be mature or facing intense competition. For instance, Genesco's overall fiscal year 2024 results showed a net sales decrease of 4% to $2.16 billion, indicating a challenging retail environment that could impact smaller, less established brands within the company.

- Low Market Share: Shi by Journeys' limited visibility in growth discussions suggests it holds a minor position within the broader footwear market.

- Mature or Competitive Segment: The youth footwear market, where Journeys operates, is highly saturated, making it difficult for smaller brands to gain significant traction.

- Potential for Low Returns: Without substantial investment or a clear strategic pivot to boost its market presence, Shi by Journeys may continue to generate modest returns, characteristic of a 'Dog' in the BCG matrix.

- Strategic Review Needed: Genesco may need to evaluate the long-term viability of Shi by Journeys, potentially divesting or repositioning it if it does not show signs of improvement.

Genesco's wholesale business, particularly licensed brands like Levi's and Dockers, is a prime example of a 'Dog' within its portfolio. This segment experienced an 11% sales decline in fiscal year 2025, with a further 12% drop in the fourth quarter of that year. These figures highlight low market share and limited growth potential, prompting Genesco to streamline operations in this area.

The Journeys brand is actively addressing its underperforming physical stores, identified as 'Dogs' in a BCG Matrix. Genesco plans to close over 100 Journeys stores in fiscal year 2024, representing about 6% of its total store count. These closures target locations with low sales productivity and minimal profitability, aiming to optimize the retail footprint.

Schuh's increased promotional activity in fiscal year 2025, coupled with fewer markdowns at Journeys in Q4 FY2025, suggests slow-moving inventory. This ties up capital and yields low returns, fitting the 'Dog' profile. The overall fiscal year 2025 outlook indicates a sustained downturn, particularly in the wholesale channel.

| Brand/Segment | BCG Category | FY2025 Sales Change (Q4) | FY2025 Sales Change (Full Year) | Strategic Action |

|---|---|---|---|---|

| Genesco Brands Group (Licensed Wholesale) | Dog | -12% | -11% | Streamlining operations |

| Journeys (Underperforming Stores) | Dog | N/A | N/A | Closing over 100 stores in FY2024 |

| Schuh | Potential Dog (Inventory) | Heightened promotional activity | N/A | Addressing slow-moving inventory |

Question Marks

Johnston & Murphy (J&M) is positioned as a Question Mark within Genesco's BCG Matrix. While the luxury footwear market is expected to see robust growth, with a projected CAGR exceeding 7% from 2024 to 2034, J&M has faced sales declines. Specifically, the brand experienced a 6% decrease in sales for fiscal year 2025 and a 9% drop in the second quarter of FY2025.

This performance suggests J&M holds a relatively low market share in a growing industry. As a Question Mark, it likely requires substantial investment to improve its competitive standing and capitalize on market opportunities, otherwise, it risks becoming a Dog.

Little Burgundy, targeting teens and young adults, operates within the dynamic youth and casual footwear sector, a market poised for expansion. However, unlike its sibling brand Journeys, recent financial disclosures from Genesco haven't highlighted robust comparable sales growth for Little Burgundy.

This lack of standout performance suggests Little Burgundy might hold a relatively small slice of its market. It likely requires significant investment to climb the Genesco BCG Matrix, potentially moving towards a Star position, or it could stagnate and become a Dog if its market share doesn't improve.

Genesco is actively investing in new digital and omnichannel strategies beyond its already successful Journeys platform. These efforts are crucial for expanding the company's reach and adapting to evolving consumer preferences in the digital retail landscape.

These newer digital initiatives, while operating in a rapidly expanding market, are currently positioned as Question Marks in the BCG matrix. This signifies their early stage of development and relatively low market share, demanding substantial investment to foster growth and achieve profitability.

For example, Genesco’s investment in enhancing the digital presence for brands like Johnston & Murphy or Schuh, which are not yet Stars, falls into this category. The company's 2024 fiscal year saw continued focus on these areas, with digital sales accounting for a significant portion of overall revenue, indicating the potential for these emerging platforms to capture a larger market share with strategic development.

Exploration of New Product Categories or Brand Partnerships

Genesco’s strategy of exploring new product categories and brand partnerships places them squarely in the Question Mark quadrant of the BCG matrix. These ventures, like the Wrangler licensing agreement announced in July 2025, represent nascent market entries with high growth potential but currently low market share. They require significant investment in marketing and development to gain traction.

These new initiatives are characterized by their unproven market demand and the substantial resources needed to establish them. For instance, if Genesco were to launch a completely new apparel line in a trending but unpenetrated market segment, it would require substantial upfront capital for design, manufacturing, and extensive marketing campaigns to build brand awareness and consumer demand. This aligns with the typical profile of a Question Mark, where the future success is uncertain but the potential rewards are high.

- New Product Category Exploration: Entering markets with high growth potential but low current market share.

- Brand Partnership Initiatives: Collaborating with new brands, such as the Wrangler licensing agreement in July 2025, to expand product offerings.

- Investment Requirements: These ventures demand considerable marketing and development investment to achieve market penetration.

- Risk and Reward Profile: High potential for success and growth, balanced by the risk of low initial market share and demand.

International Expansion into New High-Growth Markets

International expansion into new high-growth markets for Genesco, such as pushing brands like Journeys or Johnston & Murphy into the Asia-Pacific region, would be classified as question marks in the BCG Matrix. These markets, particularly for kids' footwear, exhibit rapid growth, presenting significant potential. However, Genesco's presence would be new, meaning a low initial market share.

These ventures demand substantial investment to establish a foothold and compete in dynamic environments. The Asia-Pacific footwear market, for instance, is projected to continue its strong growth trajectory, with some reports indicating it as the fastest-growing region globally for both children's and overall footwear sales. For example, by 2024, the region's footwear market is expected to reach billions in value, showcasing the high growth potential.

- High Investment Required: Entering new, rapidly expanding international markets necessitates significant capital outlay for marketing, distribution, and brand building.

- Low Initial Market Share: Despite the market's growth, Genesco's brands would start with a negligible share, requiring time and resources to gain traction.

- High Growth Potential: Markets like Asia-Pacific offer substantial long-term revenue opportunities due to increasing consumer spending and demand for footwear.

- Uncertainty of Success: The success of these ventures is not guaranteed, as Genesco faces established competitors and varying consumer preferences in each new market.

Question Marks represent business units or products with low market share in high-growth industries. Genesco's newer digital initiatives and exploration of new product categories, like the Wrangler licensing agreement in July 2025, fit this description. These ventures require significant investment to build market presence and capitalize on their growth potential.

For instance, Genesco's investment in enhancing digital platforms for brands like Johnston & Murphy signifies an effort to improve their standing in a growing market. The company's fiscal year 2024 saw continued focus on digital sales, highlighting the potential for these emerging platforms to capture larger market shares with strategic development.

International expansion, such as into the Asia-Pacific footwear market, also falls into the Question Mark category. While this market is experiencing rapid growth, Genesco's presence would be new, requiring substantial investment to compete effectively.

The success of these Question Marks is uncertain, demanding careful resource allocation and strategic planning to transform them into Stars or Stars, or to divest if they fail to gain traction.

BCG Matrix Data Sources

Our Genesco BCG Matrix draws from comprehensive financial disclosures, detailed market research, and internal sales performance data to provide a robust strategic overview.