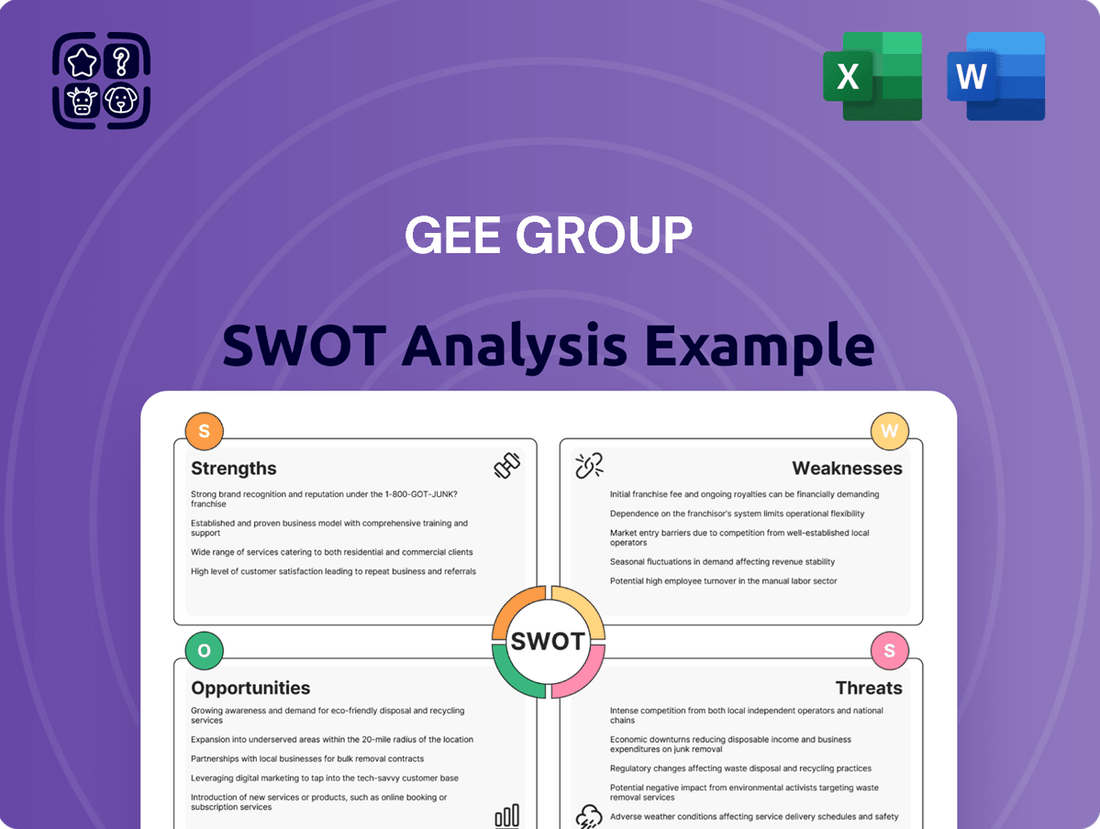

Gee Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gee Group Bundle

The Gee Group demonstrates notable strengths in its established market presence and diversified service offerings, but also faces challenges from evolving industry regulations and competitive pressures. Understanding these dynamics is crucial for navigating its future.

Want the full story behind the Gee Group’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GEE Group boasts a diversified service portfolio, encompassing temporary staffing, contract-to-hire, direct hire placements, and executive search. This broad range allows them to serve a wide spectrum of client requirements and market conditions.

This comprehensive offering acts as a buffer against sector-specific downturns, potentially stabilizing revenue. For instance, in the fiscal year ending September 30, 2023, GEE Group reported total revenue of $144.4 million, demonstrating the scale of their operations across these various staffing solutions.

Gee Group's strength lies in its significant presence across multiple industries, including information technology, engineering, finance and accounting, healthcare, and office support. This diversification is a key advantage, as it means the company isn't overly dependent on any one sector's performance. For instance, if the IT market experiences a slowdown, their robust presence in healthcare or engineering can help offset those losses.

This multi-industry approach also broadens Gee Group's opportunities for talent acquisition and placement. By serving a wide array of sectors, they can tap into a larger and more varied pool of skilled professionals, ensuring they can meet the diverse staffing needs of their clients. This wide reach is crucial for maintaining consistent revenue streams and mitigating the impact of industry-specific economic fluctuations.

GEE Group has a proven track record of executing strategic acquisitions that expand its service offerings and market presence. A prime example is the acquisition of Hornet Staffing, Inc., which significantly bolstered its capabilities in Managed Service Provider (MSP) and Vendor Management System (VMS) solutions.

These acquisitions are designed to be accretive, meaning they are expected to add to GEE Group's earnings per share. The integration of acquired companies aims to consolidate operations, improve efficiency, and leverage synergies, ultimately strengthening the group's overall market position and financial performance.

Strong Balance Sheet and Liquidity

GEE Group’s financial foundation is exceptionally robust, as evidenced by its balance sheet as of March 31, 2025. The company held $18.7 million in cash, a significant indicator of its immediate financial health and operational capacity. This strong liquidity position is further bolstered by the absence of any long-term debt, eliminating interest burdens and financial risk associated with leverage. Additionally, GEE Group maintains substantial borrowing capacity under its existing credit facility, providing a flexible financial buffer for unforeseen circumstances or strategic opportunities.

This solid financial footing offers considerable resilience, particularly during periods of economic uncertainty or market volatility. The company’s ability to weather downturns is enhanced by its ample cash reserves and access to credit. Furthermore, this financial strength is a key enabler for pursuing future growth strategies. It provides the necessary capital for organic expansion, research and development, and crucially, for undertaking strategic acquisitions that could expand market share or introduce new capabilities.

The implications of GEE Group's strong balance sheet and liquidity are multifaceted:

- Financial Stability: The $18.7 million in cash and zero long-term debt as of March 31, 2025, highlight GEE Group's low financial risk and operational flexibility.

- Strategic Agility: Significant borrowing availability under its credit facility empowers the company to act decisively on growth opportunities, including potential acquisitions.

- Resilience: The strong liquidity provides a crucial safety net, enabling the company to navigate challenging market conditions effectively.

- Growth Enabler: The financial capacity supports investment in new projects, market expansion, and strategic M&A activities.

Focus on High-Margin Services

Gee Group's strategic emphasis on high-margin services is a significant strength. The company has successfully increased its gross margins, demonstrating a clear benefit from a favorable revenue mix. This includes a strong contribution from direct hire placements, which boast a 100% gross margin, directly boosting overall profitability.

This focus on higher-margin offerings is further bolstered by strategic bill rate increases implemented across their professional and industrial contract services segments. For instance, in fiscal year 2023, Gee Group reported a notable improvement in gross profit margins, reflecting the success of this strategy.

- Direct Hire Dominance: 100% gross margin on direct hire placements significantly enhances profitability.

- Margin Expansion: Favorable service mix and increased bill rates are driving gross margin improvements.

- FY23 Performance: Gee Group's fiscal year 2023 results showcased a tangible uplift in gross profit margins, underscoring the effectiveness of this strategic direction.

Gee Group's diversified service portfolio, spanning temporary staffing, contract-to-hire, direct hire, and executive search, provides a robust buffer against sector-specific downturns. Their broad industry presence, including IT, engineering, and healthcare, further stabilizes revenue streams. In fiscal year 2023, the company achieved $144.4 million in revenue, showcasing the scale of their operations across these varied staffing solutions.

The company's strategic focus on high-margin services, particularly direct hire placements with their 100% gross margin, significantly boosts profitability. This is complemented by successful strategic bill rate increases across key service segments, leading to tangible improvements in gross profit margins as seen in their fiscal year 2023 performance.

Gee Group's financial strength is a key asset, highlighted by $18.7 million in cash and no long-term debt as of March 31, 2025. This strong liquidity, coupled with substantial borrowing capacity, ensures financial stability and strategic agility for future growth and acquisitions.

| Metric | Value (as of March 31, 2025) | Significance |

|---|---|---|

| Cash Holdings | $18.7 million | Indicates immediate financial health and operational capacity. |

| Long-Term Debt | $0 | Eliminates interest burdens and financial risk from leverage. |

| Credit Facility Availability | Substantial | Provides flexible financial buffer for opportunities or unforeseen circumstances. |

What is included in the product

Delivers a strategic overview of Gee Group’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Gee Group's strategic challenges.

Weaknesses

GEE Group's consolidated revenues have seen a downturn, especially in professional contract staffing and direct hire placement. This decline is largely attributed to the persistent macroeconomic weakness and uncertainty surrounding trade policies, which have dampened hiring enthusiasm.

The cautious approach adopted by many companies translates directly into fewer job orders and longer decision-making processes for GEE Group. For instance, in the first quarter of fiscal year 2024, GEE Group reported a revenue of $35.1 million, a decrease from $41.3 million in the prior year's comparable period, highlighting the impact of these market conditions.

Gee Group's selling, general, and administrative (SG&A) expenses have been a notable concern, consistently exceeding typical benchmarks as a proportion of its revenue. This situation arises primarily because fixed SG&A costs, such as those related to personnel and property leases, have not scaled down proportionally with the company's declining revenue streams, highlighting potential inefficiencies in managing operational overhead during periods of reduced sales. For instance, in the fiscal year ending September 30, 2023, Gee Group reported SG&A expenses of $40.9 million, which represented a significant 34.4% of its total revenue of $118.7 million, a ratio that remains elevated compared to industry averages. This persistent imbalance suggests a critical need for strategic cost management to improve profitability in a challenging revenue environment.

Gee Group's reliance on direct hire placements makes it particularly vulnerable to economic downturns. For instance, during periods of economic contraction, businesses often freeze hiring or reduce their workforce, directly impacting Gee Group's revenue streams from these placements. This cyclical nature means that a slowdown in the broader economy, such as the projected moderation in GDP growth for 2024-2025, could significantly depress the company's top-line performance.

Dependence on Job Order Volume

Gee Group's significant dependence on job order volume presents a notable weakness. Adverse market conditions, such as economic downturns or increased uncertainty, directly impact the number of job orders the company receives. This reliance on client demand for new hires makes Gee Group particularly susceptible to external economic factors that influence hiring decisions.

For instance, during periods of economic contraction, businesses often scale back or freeze hiring, leading to a direct reduction in Gee Group's revenue streams. This vulnerability was evident in the staffing industry's performance during economic slowdowns, where order volumes can shrink considerably.

- Vulnerability to Economic Cycles: Gee Group's revenue is directly tied to the hiring activities of its clients, which are heavily influenced by broader economic conditions.

- Impact of Reduced Hiring: When companies reduce their hiring plans due to economic uncertainty, Gee Group experiences a proportional decrease in job orders and, consequently, revenue.

- Susceptibility to Market Fluctuations: The company's business model inherently exposes it to the volatility of the labor market and the hiring sentiments of its client base.

Need for Cost Structure Adjustment

Gee Group recognizes the ongoing necessity to fine-tune its cost structure, particularly focusing on reducing Selling, General, and Administrative (SG&A) expenses as a proportion of its revenue. This strategic imperative indicates that current operational expenditures might be misaligned with the company's revenue generation capabilities, potentially hindering profitability.

For instance, in the fiscal year 2023, Gee Group reported SG&A expenses of $26.5 million, which represented 32.8% of its total revenue. This figure highlights a persistent challenge in optimizing overheads relative to sales performance, a critical area for improvement to bolster bottom-line results.

- SG&A as a percentage of revenue remains a key focus for cost optimization.

- In FY2023, SG&A expenses were $26.5 million, accounting for 32.8% of total revenue.

- The company is actively working to align operational costs with current revenue levels.

GEE Group's revenue is highly sensitive to economic cycles, with downturns directly impacting hiring activities and thus its job order volume. This reliance makes the company vulnerable to market fluctuations and reduced client demand for new hires.

The company's high Selling, General, and Administrative (SG&A) expenses, which represented 32.8% of revenue in FY2023 ($26.5 million), indicate potential inefficiencies in managing overhead during periods of declining sales. This cost structure needs careful recalibration to improve profitability.

GEE Group's dependence on direct hire placements exposes it to the risks of hiring freezes or workforce reductions by clients during economic contractions, directly affecting its top-line performance.

| Metric | FY2023 | FY2024 (Q1) |

|---|---|---|

| Total Revenue | $118.7 million | $35.1 million |

| SG&A Expenses | $26.5 million | N/A |

| SG&A as % of Revenue | 32.8% | N/A |

Same Document Delivered

Gee Group SWOT Analysis

The preview you see is the actual Gee Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of the company's strategic position.

Opportunities

The increasing integration of AI and automation in recruitment offers a significant opportunity for GEE Group. By leveraging these technologies, the company can streamline its internal hiring processes, making them more efficient and cost-effective. This also extends to enhancing their recruiting and sales efforts, allowing for faster candidate identification and better client matching.

Furthermore, GEE Group can capitalize on this trend by developing and offering AI-driven staffing solutions directly to its clients. This could involve AI-powered candidate screening, predictive analytics for workforce planning, or automated onboarding processes. For instance, the global AI in recruitment market was projected to reach over $2.5 billion by 2024, indicating a strong demand for such services.

GEE Group is strategically pursuing acquisitions in premium sectors, aiming for deals that enhance earnings and offer good value. This approach is designed to drive expansion and create significant shareholder value as the economy recovers.

The company's M&A strategy focuses on integrating businesses that either bolster its current service offerings or introduce entirely new competencies, positioning GEE Group for sustained growth and market leadership.

Despite broader economic headwinds, the staffing industry is seeing pockets of strong demand, particularly in sectors like information technology and healthcare. These areas are expected to experience significant growth through 2025, driven by ongoing digital transformation and an aging population requiring more medical services.

GEE Group, already established in both IT and healthcare staffing, is well-positioned to leverage this trend. By strategically allocating resources and focusing on these high-demand segments, the company can capture increased market share and drive revenue growth. For instance, the IT staffing market alone was valued at over $60 billion globally in 2023 and is projected to expand further.

Upskilling and Reskilling Workforce Needs

The accelerating pace of technological evolution, particularly in areas like artificial intelligence and automation, creates a significant demand for a continuously updated skillset within the workforce. This presents a prime opportunity for GEE Group to expand its offerings in specialized training and development programs. By focusing on skills that are currently in high demand across various industries, GEE Group can enhance its market position and attract both clients seeking qualified talent and individuals eager to advance their careers.

Leveraging this trend, GEE Group can develop targeted training modules that address critical skill gaps. For instance, a report from the World Economic Forum in early 2024 highlighted that skills like data analysis, cloud computing, and AI proficiency are projected to see substantial growth in demand over the next five years. By offering courses in these areas, GEE Group can directly cater to this burgeoning market need.

- Focus on emerging technologies: Develop training programs in AI, machine learning, cybersecurity, and advanced data analytics.

- Partnerships with educational institutions: Collaborate with universities and vocational schools to offer accredited upskilling courses.

- Customized corporate training: Provide tailored reskilling solutions for businesses looking to adapt their workforce to new technological landscapes.

- Placement services for skilled workers: Facilitate the transition of trained individuals into roles demanding these in-demand skills.

Expansion of Flexible Staffing Models

The burgeoning gig economy presents a significant opportunity for GEE Group to broaden its flexible staffing solutions. As businesses increasingly seek agile workforces, GEE Group can capitalize on this trend by offering more contract and freelance placements, meeting the demand for specialized skills on a project basis.

This expansion aligns with market shifts, where companies in 2024 and projected into 2025 are prioritizing cost-efficiency and adaptability in their talent acquisition strategies. GEE Group's established infrastructure and expertise in talent sourcing are well-suited to facilitate this growth.

- Gig Economy Growth: The freelance sector is projected to continue its upward trajectory, with estimates suggesting that by 2025, a substantial portion of the workforce will engage in some form of contingent work.

- Demand for Agility: Companies are actively seeking flexible staffing models to manage fluctuating project needs and access niche expertise without the overhead of permanent hires.

- GEE Group's Position: The company is strategically positioned to leverage its network and recruitment capabilities to connect businesses with skilled freelance professionals across various industries.

GEE Group can significantly enhance its service offerings by integrating AI and automation into recruitment processes, improving efficiency and client matching. The global AI in recruitment market was expected to exceed $2.5 billion by 2024, highlighting a strong demand for these solutions.

The company's strategic acquisitions in premium sectors are poised to drive earnings growth and shareholder value, particularly as the economy recovers. Furthermore, GEE Group is well-positioned to capitalize on strong demand in IT and healthcare staffing, sectors projected for significant growth through 2025, with the IT staffing market alone valued over $60 billion in 2023.

Expanding into specialized training for in-demand skills like AI and data analysis, as identified by the World Economic Forum in early 2024, offers another growth avenue. Additionally, leveraging the expanding gig economy by providing flexible staffing solutions aligns with business needs for agility and cost-efficiency, a trend expected to continue through 2025.

Threats

Persistent macroeconomic weakness, marked by ongoing inflation and interest rate volatility throughout 2024 and into 2025, continues to be a significant threat. This environment fosters client caution, extending decision-making timelines and dampening hiring activity, which directly impacts GEE Group's revenue streams and overall profitability.

GEE Group operates within a highly fragmented staffing sector, facing a multitude of competitors, from large global players to smaller niche agencies. This intense competition, a persistent challenge in the industry, can exert downward pressure on pricing, impacting profit margins. For instance, in 2023, the global staffing market was valued at approximately $600 billion, with a significant portion of that revenue generated by a vast number of smaller, regional firms.

The sheer number of companies vying for market share necessitates continuous innovation and a strong focus on client and talent retention. GEE Group must consistently differentiate its service offerings and adapt to evolving market demands to maintain its competitive edge. Failure to do so risks losing business to more agile or cost-effective rivals.

GEE Group's revenue is directly tied to the health of the labor market. When the job market cools, meaning fewer people are looking for new jobs and companies prioritize keeping their current employees, GEE Group sees less demand for its staffing services. This was evident in early 2024 as some sectors experienced hiring slowdowns.

Technological Disruption and Skill Obsolescence

The swift evolution of technology presents a significant challenge, as skills crucial today might be outdated tomorrow. This rapid obsolescence threatens GEE Group if it fails to proactively retrain its workforce and update its service portfolio to align with emerging client demands. Failure to adapt could cede market share to nimbler rivals who are quicker to embrace new technologies and skillsets.

For instance, the global IT services market is projected to grow, but the specific technologies in demand are constantly shifting. A report from Gartner in late 2024 indicated that AI and machine learning skills are now paramount, with a significant deficit in qualified professionals. If GEE Group's existing talent pool isn't continuously upskilled in these areas, their service offerings could quickly become uncompetitive.

This threat is amplified by the increasing demand for specialized digital transformation expertise. Companies are actively seeking partners who can leverage cutting-edge solutions, and GEE Group risks being bypassed if its capabilities lag behind industry advancements. The need for continuous learning and investment in new technological infrastructure is therefore paramount for GEE Group's sustained relevance and growth.

Wage Inflation and Increased Operating Costs

Persistent inflation continues to put upward pressure on labor costs for contractors, a key segment for GEE Group. This, coupled with broader economic trends, is also driving up selling, general, and administrative (SG&A) expenses. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for all employees in the professional and business services sector, which includes staffing, rose by 4.5% year-over-year as of Q2 2024, signaling a significant increase in labor input costs.

While GEE Group has strategies to implement pricing enhancements to mitigate these rising costs, there's a tangible risk that these measures may not fully offset the inflationary impact. Should the company be unable to pass on the full extent of increased labor and operational expenses to its clients, its profit margins could face erosion. This delicate balancing act is crucial for maintaining financial health in the current economic climate.

- Rising Labor Costs: Wage inflation directly impacts GEE Group's contractor workforce costs.

- Increased SG&A: Broader inflationary pressures elevate operating expenses.

- Margin Erosion Risk: Inability to fully pass on cost increases threatens profitability.

- Pricing Strategy Challenge: The need to balance competitive pricing with cost recovery.

The intense competition within the staffing industry, characterized by numerous global and niche players, poses a significant threat by potentially driving down prices and impacting GEE Group's profit margins. In 2023, the global staffing market, valued at approximately $600 billion, saw a substantial portion generated by smaller, regional firms, highlighting the fragmented nature of the sector.

The rapid pace of technological advancement necessitates continuous adaptation, as skills can quickly become obsolete, threatening GEE Group's relevance if its workforce and service offerings are not proactively updated. For instance, a late 2024 Gartner report emphasized the critical demand for AI and machine learning skills, indicating a potential disadvantage for GEE Group if its talent pool is not adequately upskilled in these rapidly evolving areas.

Persistent inflation continues to exert upward pressure on contractor labor costs and overall operating expenses for GEE Group. Data from the U.S. Bureau of Labor Statistics showed a 4.5% year-over-year increase in average hourly earnings for the professional and business services sector as of Q2 2024, directly impacting labor input costs.

The risk of margin erosion is substantial if GEE Group cannot fully pass on these increased labor and operational costs to clients, creating a delicate balancing act between competitive pricing and cost recovery to maintain financial health.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Gee Group's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.