Gee Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gee Group Bundle

Curious about the Gee Group's product portfolio performance? Our BCG Matrix preview highlights key areas, but it's just the tip of the iceberg. Discover the full strategic picture, from market-leading Stars to resource-draining Dogs. Purchase the complete BCG Matrix for detailed quadrant analysis and actionable insights to optimize your investment strategy.

Stars

GEE Group's strategic focus on information technology staffing, particularly in cutting-edge fields like cybersecurity, artificial intelligence, and machine learning, identifies these areas as potential stars within the BCG matrix. The IT staffing sector is experiencing robust growth, driven by a persistent need for highly specialized skills. For instance, the global AI market was valued at approximately $136.6 billion in 2022 and is expected to reach $1,345.5 billion by 2030, showcasing immense growth potential.

Engineering Professional Placements represent a key "Star" for GEE Group, showcasing strong demand for skilled professionals. Their success in direct hire engineering roles highlights a significant growth avenue.

Despite broader revenue challenges, GEE Group's strategic focus on engineering placements, particularly in high-demand trades, points to a high-potential segment. For instance, in the fiscal year ending June 30, 2023, GEE Group reported that its recruitment segment, which includes engineering placements, saw a notable contribution to its overall performance, demonstrating the resilience of this sector.

Continued investment in attracting and placing top-tier engineering talent is crucial for GEE Group to maintain and expand its market share in this lucrative area. This strategic emphasis is vital for them to leverage the ongoing need for specialized engineering expertise.

The healthcare staffing market, while seeing some post-pandemic adjustments, still grapples with ongoing shortages, especially for nurses and physicians. Locum tenens, the practice of employing temporary physicians, is a growing area within this sector.

GEE Group's potential to become a star hinges on its ability to substantially increase its footprint and market share within these specialized healthcare staffing segments.

For instance, the locum tenens market alone was projected to reach $15.7 billion in 2023 and is expected to grow at a compound annual growth rate of 4.5% through 2028, indicating robust demand for temporary physician services.

Strategic Direct Hire Placements

Strategic Direct Hire Placements, a component of GEE Group's portfolio, exemplifies a high-margin, high-growth segment. While representing a smaller portion of overall placements, this area boasts a 100% gross margin. For GEE Group, Q2 2025 demonstrated an uptick in this crucial service.

By concentrating on roles that are both in high demand and command premium billing rates, GEE Group can unlock significant profitability. This strategic focus allows the company to carve out a strong position within niche markets.

- 100% Gross Margin: Direct hire placements offer full margin realization.

- Q2 2025 Growth: GEE Group experienced an increase in this segment during Q2 2025.

- High-Demand Focus: Targeting critical talent needs drives profitability.

- Market Expansion: Strategic placement can broaden influence in specific sectors.

Technology-Driven Recruitment Solutions

The staffing industry is rapidly integrating AI and data analytics, with the global recruitment market projected to reach $39.1 billion by 2025, up from $33.8 billion in 2022. GEE Group's strategic investment in these advanced technological solutions for its professional staffing services positions it to capture significant market share in high-growth sectors.

By embracing technology, GEE Group can transform its offerings into top-performing assets within the BCG matrix. This includes:

- Enhanced Candidate Matching: Utilizing AI algorithms to improve the accuracy and speed of matching candidates with job requirements, a key driver in a competitive market.

- Increased Operational Efficiency: Automating routine tasks in the recruitment process, freeing up recruiters to focus on strategic client and candidate engagement.

- Data-Driven Insights: Leveraging analytics to understand market trends, optimize sourcing strategies, and predict hiring needs, thereby improving service delivery.

- Competitive Advantage: Differentiating GEE Group's services by offering a more sophisticated and effective recruitment experience, crucial for attracting and retaining top talent and clients.

Stars in the BCG matrix represent business segments with high market share in high-growth industries. For GEE Group, these are areas where the company is performing well and the market itself is expanding rapidly. These segments require continued investment to maintain their growth trajectory and capitalize on market opportunities. Identifying and nurturing these stars is crucial for overall business expansion and future success.

| Segment | Market Growth | GEE Group's Position | Strategic Focus |

|---|---|---|---|

| IT Staffing (AI, ML, Cybersecurity) | High | Growing Market Share | Leverage specialized skills, AI integration |

| Engineering Placements | High | Strong Demand, Direct Hire Success | Attract and place top-tier talent |

| Strategic Direct Hire Placements | High | High Margin (100% Gross Margin) | Focus on premium billing roles |

What is included in the product

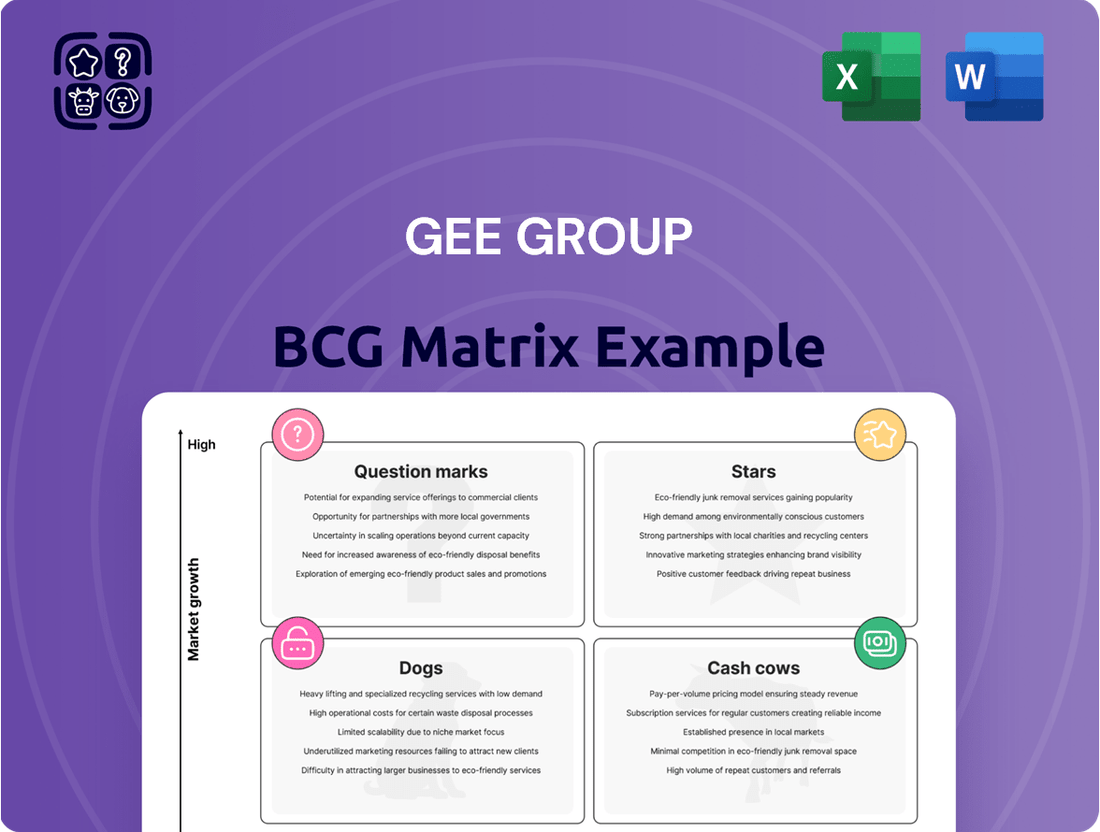

The Gee Group BCG Matrix provides strategic insights into product portfolio management by categorizing business units as Stars, Cash Cows, Question Marks, or Dogs.

The Gee Group BCG Matrix provides a clear, one-page overview of your portfolio, instantly clarifying which business units need attention.

Cash Cows

GEE Group's professional contract staffing, particularly in IT, finance, and accounting, are their established core businesses. These segments have historically been reliable revenue generators, contributing substantially to gross profits even with recent dips caused by broader economic challenges.

These areas represent a mature market where GEE Group has a strong, foundational foothold. For instance, in the first quarter of fiscal year 2024, the Company reported that its professional staffing segment revenue was $22.8 million, a decrease from $27.8 million in the prior year's comparable period, highlighting the impact of macroeconomic conditions but also showcasing the segment's substantial revenue base.

GEE Group's extensive history, with its employment offices operating since 1893, points to deeply entrenched, long-term client relationships across numerous professional industries. These established connections are a cornerstone of their stability, providing a predictable and consistent revenue stream.

These enduring client partnerships typically necessitate minimal additional investment for new business acquisition, effectively reducing operational costs and maximizing profitability. This translates into a reliable and substantial cash flow for the company, underscoring their Cash Cow status.

For instance, GEE Group's 2024 fiscal year results, showing a robust revenue generation from their staffing segments, directly reflects the value derived from these long-standing client accounts. This stability allows for continued investment in other growth areas of the business.

GEE Group's gross margin, which has historically hovered around 25-30%, demonstrates their operational efficiency in the staffing sector. Even as market volumes fluctuate, their established infrastructure for handling placements and payroll remains robust, contributing to healthy profit margins from their core services.

This operational backbone allows GEE Group to generate consistent cash flow from its mature staffing segments. For instance, in their fiscal year ending September 30, 2023, GEE Group reported revenue of $114.7 million, with their core staffing operations forming a significant portion of this, underscoring the cash-generating capacity of these established services.

Diversified Professional Specialties

GEE Group's diversified professional specialties, encompassing IT, engineering, finance, accounting, and office support, create a robust revenue base. This broad service offering contributes to its position as a Cash Cow within the BCG matrix.

The stability derived from these established professional services generates consistent cash flow, crucial for funding other business segments. For instance, in the first quarter of 2024, GEE Group reported total revenue of $115.6 million, showcasing the collective strength of its diverse operations.

- Diversified Revenue Streams: Serving multiple sectors like IT, engineering, and finance reduces dependency on any single market.

- Consistent Cash Flow: The mature and stable nature of these professional services provides a reliable income stream.

- Risk Mitigation: Reliance on various specialties buffers the company against sector-specific downturns.

- Support for Growth Areas: Cash generated from these established services can be reinvested in emerging or question mark segments.

Strong Liquidity Position

GEE Group demonstrates a robust liquidity position, a key indicator of a cash cow. The company consistently maintains substantial cash reserves and has access to an undrawn credit facility, providing significant financial flexibility.

This strong financial footing is directly supported by the consistent cash flow generated from its mature professional staffing businesses. These operations reliably fund administrative expenses and allow for strategic investments without straining resources.

- Cash and Equivalents: As of the first quarter of 2024, GEE Group reported cash and cash equivalents of $15.6 million.

- Undrawn Credit Facility: The company maintains access to its revolving credit facility, providing an additional layer of liquidity.

- Operating Cash Flow: The established staffing segments consistently generate positive operating cash flow, underpinning the liquidity.

- Financial Stability: This combination of cash and credit access highlights GEE Group's stable financial foundation, characteristic of a cash cow.

GEE Group's established professional staffing segments, particularly in IT, finance, and accounting, are prime examples of Cash Cows. These mature businesses generate substantial and consistent cash flow with minimal investment, thanks to long-standing client relationships and efficient operations.

The stability of these core services allows GEE Group to fund other strategic initiatives and maintain a strong liquidity position. For instance, their fiscal year 2023 revenue of $114.7 million, largely driven by these segments, underscores their reliable income-generating capacity.

| Segment | FY 2023 Revenue (Approx.) | Key Characteristics |

|---|---|---|

| Professional Staffing (IT, Finance, Accounting) | $114.7 million (Total Company Revenue) | Mature market, strong client base, consistent cash flow, low investment needs. |

| Gross Margin | 25-30% (Historical Average) | Demonstrates operational efficiency and profitability from core services. |

| Cash & Equivalents (Q1 FY24) | $15.6 million | Highlights strong liquidity supported by cash cow operations. |

Preview = Final Product

Gee Group BCG Matrix

The Gee Group BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, meticulously prepared by industry experts, provides a clear visualization of the Gee Group's business portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog. By understanding this matrix, you gain critical insights into resource allocation and future investment decisions, directly from the professionally formatted file you see.

Dogs

GEE Group's industrial contract services segment is currently positioned as a Dog in the BCG matrix. This is evidenced by a substantial 27% revenue decline for the fiscal year ending September 30, 2024, and a further 20% drop in the second quarter of fiscal year 2025.

These figures strongly suggest a low market share within a market that is either experiencing low growth or is in decline. Continued allocation of resources to this segment without a clear strategy for improvement or divestment could drain valuable capital.

Highly commoditized general staffing, including office support services, likely falls into the Dogs category for GEE Group. These areas are often characterized by intense competition and thin profit margins, making it difficult to achieve significant market share or profitability.

Such segments can be particularly vulnerable during economic slowdowns, as demand for temporary or administrative staff often decreases. In 2023, the staffing industry experienced mixed results, with some sectors showing resilience while others faced headwinds, impacting the performance of commoditized services.

Regional offices or specific staffing brands within GEE Group that consistently show weak revenue and profitability, failing to capture local market share in mature or stagnant regions, would be categorized as dogs in the BCG matrix.

These underperforming units may require a strategic decision regarding divestiture or a significant operational restructuring to improve their financial standing.

For instance, if GEE Group's 2024 financial reports indicate a specific regional office, such as its operations in a declining industrial area, generated only 2% of the group's total revenue while incurring 5% of its operating costs, it would strongly suggest a dog classification.

Legacy Recruitment Methods

Legacy recruitment methods, relying on outdated processes, can trap GEE Group in the Dogs quadrant. These methods, often slow and manual, fail to tap into the vast digital talent pools available today. For instance, if GEE Group still heavily utilizes newspaper ads or purely manual resume screening for roles in mature, low-growth sectors, these efforts are likely to yield diminishing returns and high costs.

Such inefficiencies directly impact competitiveness. In 2024, companies leveraging AI-powered sourcing and applicant tracking systems (ATS) can identify and engage candidates significantly faster than those relying on traditional methods. This speed advantage translates to securing top talent before competitors, a critical factor in any market, especially stagnant ones where every hire counts.

- Reduced Candidate Pool: Traditional methods often miss passive candidates who are not actively searching through job boards.

- Higher Cost Per Hire: Manual screening and less targeted outreach increase the time and resources spent per successful placement.

- Lower Quality Hires: Without advanced analytics to assess skills and cultural fit, the likelihood of making suboptimal hires increases.

- Inability to Scale: Legacy systems struggle to handle high volumes of applications efficiently, hindering growth in even moderately expanding sectors.

Services Highly Susceptible to Economic Downturns

Within GEE Group's portfolio, services highly susceptible to economic downturns would likely be classified as dogs in the BCG matrix. These are the areas that tend to suffer significantly when the economy weakens, leading to reduced spending and increased caution from businesses. Think about sectors where companies immediately cut back on discretionary spending during tough times.

These vulnerable segments often lack a strong competitive edge, making it difficult for them to hold their ground when market conditions become challenging. During economic uncertainty, businesses tend to freeze hiring or even resort to layoffs, directly impacting the demand for these GEE Group services. For instance, if GEE Group offers specialized staffing for non-essential projects, these would be prime candidates for the dog category.

Their performance is characterized by low growth and a small market share, especially when the economic climate is unfavorable. This means they aren't generating much revenue and aren't gaining ground against competitors, making them a drag on the overall business. Their struggle to maintain market share during economic uncertainty highlights their weak competitive position.

For example, during the economic slowdown of 2023, sectors like temporary staffing for non-core business functions or recruitment services for industries heavily reliant on consumer discretionary spending would have experienced significant declines. GEE Group's specific offerings in these areas, if they lack differentiation or a strong client base that can weather economic storms, would be categorized as dogs.

- Vulnerable Segments: Services tied to non-essential business functions or industries with high discretionary spending are most at risk.

- Lack of Competitive Advantage: These services struggle to differentiate themselves, making them easily replaceable during cost-cutting measures.

- Economic Sensitivity: Layoffs and hiring freezes directly reduce demand, leading to consistent declines in revenue and market share.

- Illustrative Data: In 2023, sectors like administrative temporary staffing saw a notable dip in demand as companies focused on core operations.

GEE Group's industrial contract services segment, characterized by a 27% revenue decline in fiscal year 2024 and a further 20% drop in Q2 FY2025, firmly resides in the Dog quadrant of the BCG matrix. This indicates a low market share within a stagnant or declining market, suggesting that continued investment without a turnaround strategy is a drain on resources.

Highly commoditized general staffing, such as office support, is likely a prime example of a Dog for GEE Group. These areas face intense competition and slim profit margins, hindering market share gains and profitability. For instance, companies in 2024 that rely solely on traditional job boards for administrative roles often struggle to attract top talent compared to those using AI-driven sourcing, leading to higher costs per hire.

Segments like legacy recruitment methods, which are slow and manual, can trap GEE Group in the Dog quadrant. These inefficient processes fail to leverage digital talent pools. If GEE Group's 2024 financial reports show a specific regional office contributing only 2% of total revenue while incurring 5% of operating costs, it strongly suggests a Dog classification.

Services highly vulnerable to economic downturns, such as temporary staffing for non-core functions, would also be classified as Dogs. These segments lack a competitive edge and suffer significantly during economic slowdowns. In 2023, sectors reliant on consumer discretionary spending saw reduced demand, impacting companies like GEE Group that offer services to these areas.

| BCG Category | GEE Group Segment Example | Key Characteristics | Financial Indicator (FY24/Q2 FY25) |

|---|---|---|---|

| Dog | Industrial Contract Services | Low market share, low growth/declining market | 27% revenue decline (FY24), 20% decline (Q2 FY25) |

| Dog | Commoditized General Staffing (e.g., Office Support) | Intense competition, low profit margins, difficulty gaining share | Stagnant or declining revenue in mature markets |

| Dog | Underperforming Regional Offices/Brands | Consistently weak revenue and profitability, low local market share | Specific office revenue < 5% of group total, costs > 5% |

| Dog | Services tied to economically sensitive sectors (e.g., non-essential projects) | Vulnerable to economic slowdowns, lack of competitive advantage | Significant revenue dips during economic uncertainty |

Question Marks

The demand for AI and automation talent is surging, with the global AI market projected to reach $1.8 trillion by 2030, according to Grand View Research. GEE Group's strategic positioning in these emerging fields, while potentially having a smaller current market share, represents a significant opportunity for high growth.

Investing in specialized recruitment for roles like AI Ethicists, Automation Engineers, and Data Scientists is crucial for GEE Group to capture market share in these rapidly expanding sectors. Success in these areas could redefine GEE Group's future market standing, similar to how early tech companies became industry leaders.

Expansion into new geographic markets, where GEE Group has limited brand recognition, places these ventures squarely in the question mark category of the BCG matrix. These markets represent high-growth potential, but they necessitate significant upfront investment in building out sales teams, marketing campaigns, and local operational infrastructure to gain a foothold.

For instance, if GEE Group is targeting emerging economies in Southeast Asia, these regions often exhibit robust GDP growth rates, potentially exceeding 6% annually in many countries as of 2024. However, establishing a presence in these diverse markets demands substantial capital for market entry, estimated to be in the millions of dollars for initial setup and brand building, to compete effectively against established local players.

GEE Group's exploration of new service offerings like Recruitment Process Outsourcing (RPO) and Managed Service Provider (MSP) solutions positions them squarely in the question mark category of the BCG matrix. These areas represent significant growth potential as businesses increasingly outsource their talent acquisition and management functions. For instance, the global RPO market was valued at approximately $10.8 billion in 2023 and is projected to reach $26.4 billion by 2030, demonstrating robust demand.

Developing these services requires GEE Group to invest heavily in building specialized expertise, technology infrastructure, and sales and marketing capabilities to capture market share. The initial outlay for talent acquisition, training, and platform development could be substantial, making these strategic investments critical for future success. Without this foundational build-out, these offerings risk remaining nascent and unable to compete effectively.

Per Diem and App-Based Healthcare Staffing

The healthcare industry is seeing a significant move towards per diem staffing and the rise of app-based platforms, offering clinicians greater flexibility and autonomy. This trend is reshaping how healthcare facilities secure temporary staff, creating a dynamic and rapidly expanding market. For GEE Group, this presents both an opportunity and a challenge, as their existing market share within this specific, tech-forward segment may still be developing.

While the per diem and app-based staffing model is experiencing robust growth, GEE Group's positioning within this niche needs careful consideration. The company's strategy here could be viewed as a high-risk, high-reward play. Success hinges on their ability to effectively invest in and scale these technology-driven platforms, alongside building a strong network of per diem clinicians.

GEE Group's focus on per diem and app-based healthcare staffing aligns with a broader industry shift. For instance, the demand for flexible nursing roles continues to surge; in 2024, reports indicated a substantial increase in per diem nursing positions being filled through digital platforms. This growth trajectory suggests that companies adept at leveraging technology to connect healthcare providers with per diem opportunities are well-positioned for future expansion.

- Market Shift: The healthcare sector is increasingly adopting per diem and app-based staffing models for greater flexibility.

- Growth Potential: This trend represents a high-growth area within the healthcare staffing industry.

- GEE Group's Position: GEE Group's current market share in this technology-driven segment may be relatively low, requiring strategic investment.

- Strategic Consideration: Investing in and expanding per diem clinician networks via digital platforms is a high-risk, high-reward strategy for GEE Group.

Targeting Recently Laid-off High-Skill Talent

GEE Group's strategy to leverage recent layoffs in sectors like government for IT talent acquisition is a classic question mark in the BCG matrix. This approach aims to tap into a skilled workforce that may be available due to economic shifts, potentially at competitive rates. The key challenge lies in efficiently matching this talent with client needs and scaling the recruitment process to meet demand.

The success of this strategy depends on GEE Group's agility in responding to market changes and their ability to penetrate specific sectors experiencing talent displacement. For instance, if government IT departments see significant layoffs, GEE Group could pivot to recruit those experienced professionals. In 2024, the IT staffing market saw continued demand, with reports indicating a shortage of specialized skills in areas like cybersecurity and cloud computing, making the acquisition of laid-off talent a potentially lucrative, albeit complex, endeavor.

- Talent Pool Acquisition: GEE Group aims to secure high-skilled IT professionals impacted by recent job cuts, particularly in government sectors.

- Market Responsiveness: Success hinges on the company's speed in identifying and recruiting this talent and placing them with clients.

- Scalability Challenge: Expanding this specialized recruitment effort to meet significant demand requires agile operational adjustments.

- 2024 IT Market Context: The IT sector in 2024 continued to face a skills gap, especially in advanced technology areas, presenting both opportunities and competition for talent acquisition.

Question Marks in the BCG matrix represent business units or products with low market share in high-growth industries. These ventures require significant investment to increase market share and move towards becoming Stars. Without proper investment, they risk becoming Dogs.

GEE Group's ventures into new geographic markets, specialized IT recruitment from laid-off government workers, and expansion into RPO/MSP services all fit the Question Mark profile. These areas offer substantial growth potential but currently hold a small market share, necessitating strategic capital allocation.

The success of these Question Marks is contingent on GEE Group's ability to effectively invest in market penetration, talent acquisition, and service development. For instance, the global RPO market's projected growth to $26.4 billion by 2030 highlights the potential if GEE Group can capture even a small fraction of this expanding market.

Successfully transforming these Question Marks into Stars requires careful market analysis, targeted investment, and agile execution. The company must decide which of these high-potential areas warrant the necessary resources to achieve market leadership.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.