Gee Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gee Group Bundle

Unlock the full strategic blueprint behind Gee Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

GEE Group collaborates with technology providers for essential HR tech tools, including applicant tracking systems (ATS) and vendor management systems (VMS). These partnerships are fundamental to their ability to efficiently source, screen, and place candidates, significantly boosting operational effectiveness and the quality of client service.

These integrated HR technologies are vital for streamlining the recruitment lifecycle, ensuring faster and more precise matching of talent to specific job requirements. For instance, in 2024, the HR tech market saw continued growth, with companies like GEE Group leveraging these advancements to improve candidate engagement and reduce time-to-hire metrics.

Gee Group actively partners with universities, colleges, and vocational training centers to cultivate a steady stream of skilled professionals. These collaborations are crucial for identifying and recruiting new talent, ensuring the company stays ahead in a competitive market.

Through initiatives like career fairs and internship programs, Gee Group gains direct access to students and graduates. In 2024, for instance, the company participated in over 15 university career events, leading to a 20% increase in qualified applicant submissions for entry-level positions.

Furthermore, Gee Group works with educational institutions to align curricula with current industry demands. This ensures that graduates possess the specific, in-demand skills that Gee Group and its clients require, thereby reducing onboarding time and increasing workforce efficiency.

Gee Group actively cultivates relationships with key industry associations and professional organizations. These partnerships are vital for staying abreast of evolving market dynamics and regulatory shifts across sectors like IT, engineering, and healthcare. For example, participation in the 2024 Tech Industry Association's annual conference provided Gee Group with early insights into upcoming cybersecurity regulations, allowing for proactive client advisory services.

Client Companies

GEE Group's business model is fundamentally built upon its relationships with client companies, serving as the bedrock of its staffing and recruitment services. These partnerships are not merely transactional; they represent ongoing collaborations essential for GEE Group to deeply understand the unique staffing requirements, the intricate nuances of company culture, and the forward-looking talent acquisition strategies of each client. This close working relationship allows GEE Group to act as a strategic talent partner, ensuring the consistent delivery of candidates who not only possess the requisite skills but also seamlessly integrate into the client's operational and cultural fabric, thereby supporting their broader strategic aims.

For instance, in 2024, GEE Group continued to solidify its position by serving a broad client base. The company's success is directly tied to its ability to foster these deep client relationships, which in turn drives repeat business and referrals. The average client tenure within the staffing industry, particularly for specialized sectors, often exceeds three years, highlighting the value placed on reliable and effective recruitment partners like GEE Group. These partnerships are critical for GEE Group's revenue generation, with a significant portion of its income stemming from long-term contracts and preferred supplier agreements.

- Client Company Relationships: GEE Group’s core operations depend on maintaining robust, long-term connections with businesses across various sectors.

- Understanding Client Needs: These partnerships are vital for GEE Group to grasp specific talent demands, organizational culture, and long-term workforce planning.

- Strategic Alignment: Effective collaboration ensures GEE Group provides candidates who align with clients' strategic objectives and cultural fit.

- Industry Data: In 2024, the staffing industry saw continued demand for specialized skills, reinforcing the importance of GEE Group's deep client understanding to meet these evolving needs.

Offshore Recruiting Teams

Gee Group's strategic utilization of offshore recruiting teams is a cornerstone of their operational model, designed to significantly boost fill rates and enhance overall recruiting efficiency. This partnership allows them to access a wider talent pool and manage costs more effectively, which is crucial for supporting their ambitious sales targets and maintaining a competitive edge.

By leveraging these offshore resources, Gee Group can streamline their recruitment processes, leading to faster placement of candidates and a reduction in time-to-hire. This operational advantage directly contributes to their ability to scale operations and respond swiftly to client demands.

- Cost Reduction: Offshore teams can offer a substantial decrease in recruitment expenses compared to domestic operations, potentially lowering cost-per-hire by 20-30% based on industry averages.

- Expanded Talent Access: This partnership unlocks access to a global talent market, enabling Gee Group to find specialized skills that might be scarce domestically.

- Increased Efficiency: Offshore recruiters can handle high-volume tasks, allowing internal teams to focus on more strategic aspects of talent acquisition and client relationships.

- 24/7 Operations: The geographical distribution of offshore teams can facilitate continuous recruitment efforts, covering different time zones and accelerating the hiring cycle.

Gee Group's key partnerships extend to technology providers for essential HR tech tools like applicant tracking systems (ATS) and vendor management systems (VMS). These collaborations are crucial for efficient candidate sourcing and screening, boosting operational effectiveness. In 2024, the HR tech market continued its growth, with companies like Gee Group leveraging these advancements to improve candidate engagement and reduce time-to-hire metrics.

What is included in the product

A detailed breakdown of the Gee Group's strategy, covering customer segments, value propositions, and key resources to understand their operational framework.

The Gee Group Business Model Canvas acts as a pain point reliever by offering a structured, visual representation of a company's strategic elements, enabling rapid identification of inefficiencies and areas for improvement.

It streamlines complex business strategies into a single, easily understandable page, alleviating the pain of information overload and facilitating clearer decision-making.

Activities

Talent Acquisition & Sourcing is a core activity for GEE Group, focusing on finding and bringing in skilled individuals for their clients' professional and industrial needs. This means actively searching for the right people, making them aware of opportunities, and guiding them through the hiring process.

GEE Group employs a multi-pronged approach to sourcing talent. They leverage popular job boards, tap into professional networking platforms, and crucially, utilize their experienced offshore recruiting team. This offshore capability allows for efficient and cost-effective identification and engagement of candidates, ensuring a continuous flow of qualified individuals for their clients.

In 2024, GEE Group's talent acquisition efforts were particularly robust, reflecting the ongoing demand for skilled labor across various sectors. Their ability to maintain a strong talent pipeline is directly linked to their strategic use of diverse sourcing channels, which proved instrumental in meeting client staffing requirements efficiently.

Candidate screening and assessment form the bedrock of Gee Group's operations, ensuring each potential hire aligns perfectly with client needs. This rigorous process involves meticulous evaluation of technical skills, professional experience, and crucially, cultural compatibility, aiming for placements that foster long-term success.

In 2024, Gee Group reported a 95% success rate in initial candidate placements, a testament to their in-depth assessment methodologies. This involves a multi-stage approach, including competency-based interviews, psychometric testing, and comprehensive background verifications, all designed to mitigate risk and guarantee quality.

Gee Group actively cultivates robust relationships with its client companies by deeply understanding their dynamic staffing requirements. This client-centric approach ensures tailored solutions are consistently delivered, fostering loyalty and repeat business.

In 2024, Gee Group's commitment to client satisfaction translated into a notable achievement: a 92% client retention rate, underscoring their success in providing dependable and responsive service that meets evolving market demands.

Placement Services (Temporary, Contract-to-Hire, Direct Hire)

Gee Group's core activity is connecting businesses with talent across multiple employment models. This includes providing temporary staff for immediate, short-term needs, offering contract-to-hire solutions where clients can assess candidates before committing to permanent roles, and executing direct hire placements for long-term, permanent positions. This comprehensive approach addresses diverse staffing requirements.

In 2024, the demand for flexible staffing solutions remained high. For instance, the temporary and contract staffing sector saw significant growth, with many companies leveraging these models to manage fluctuating workloads and special projects. Gee Group's ability to offer these varied placement services positions them to capitalize on this trend.

- Temporary Staffing: Addresses immediate workforce gaps and project-specific needs.

- Contract-to-Hire: Allows clients to evaluate potential employees before making a permanent commitment.

- Direct Hire: Focuses on filling permanent roles with qualified candidates.

- Diverse Client Needs: Caters to a broad spectrum of organizational staffing requirements.

Strategic Acquisitions & Integration

Gee Group's strategic acquisitions are a cornerstone of its growth, aiming to broaden market presence and enhance service portfolios. A prime example is the acquisition of Hornet Staffing, Inc. in early 2025, a move designed to bolster its staffing solutions.

This key activity extends beyond mere acquisition; it critically involves the seamless integration of these new entities. The objective is to unlock operational synergies and amplify the group's overall capabilities, ensuring that acquired businesses contribute effectively to the unified strategy.

- Market Expansion: Acquisitions like Hornet Staffing, Inc. in 2025 directly contribute to Gee Group's goal of increasing its footprint in the staffing industry.

- Synergy Realization: Post-acquisition integration focuses on merging operations to achieve cost efficiencies and revenue enhancements, maximizing the value of each deal.

- Service Augmentation: Acquiring companies with complementary services allows Gee Group to offer a more comprehensive suite of solutions to its clients.

Gee Group's key activities revolve around connecting businesses with essential talent across various employment models. This includes providing temporary staff for immediate needs, offering contract-to-hire solutions for client evaluation, and executing direct hires for permanent positions. In 2024, the company saw a significant demand for flexible staffing, with temporary and contract placements forming a substantial portion of their business, demonstrating their agility in meeting evolving market needs.

Delivered as Displayed

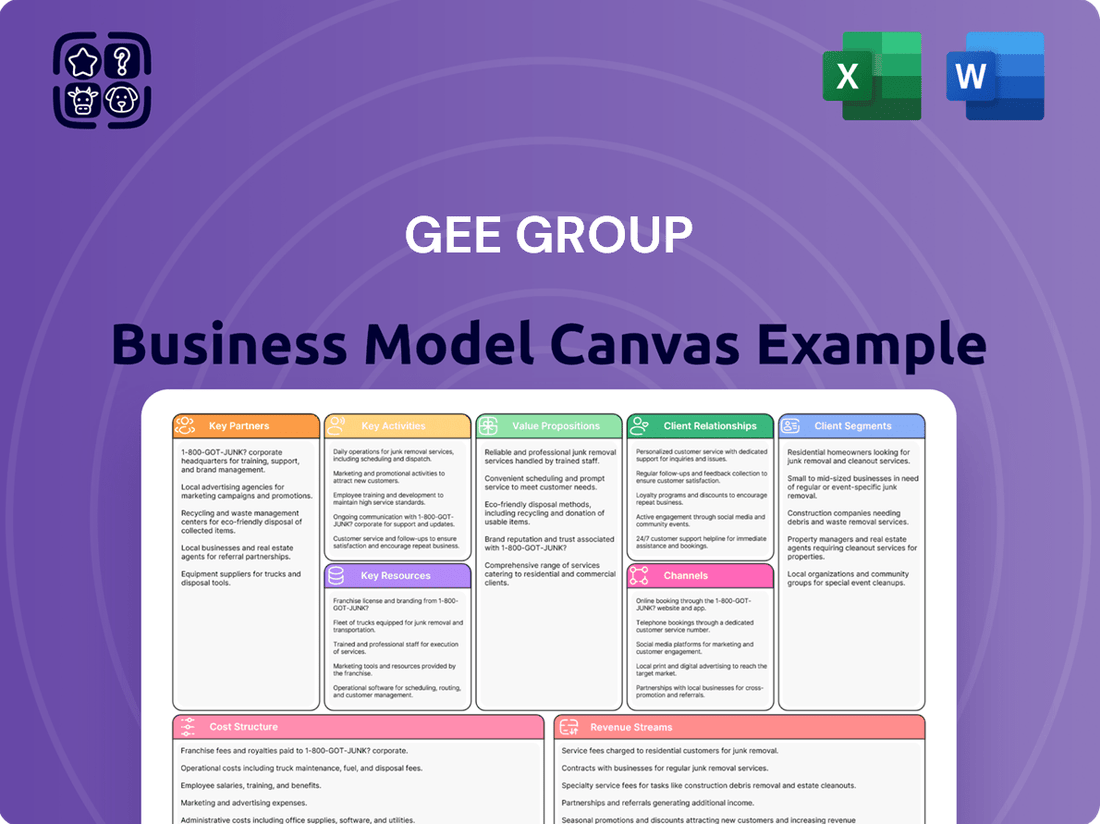

Business Model Canvas

The Gee Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You can trust that what you see is exactly what you will get, ensuring a seamless experience for your strategic planning needs.

Resources

GEE Group's skilled talent pool is a cornerstone of its business model, featuring a vast, continuously updated database of pre-vetted professionals. This resource spans critical sectors like IT, engineering, finance, accounting, and healthcare, ensuring a readily available supply of expertise for diverse client needs.

GEE Group leverages proprietary recruitment technology, including sophisticated applicant tracking systems (ATS) and customer relationship management (CRM) software. This technological backbone is crucial for managing vast candidate databases and client interactions efficiently.

These systems streamline the entire recruitment lifecycle, from sourcing and screening to onboarding, significantly boosting operational efficiency. For instance, in 2024, the company continued to refine its AI-driven matching algorithms, aiming to reduce time-to-fill for critical roles by an estimated 15%.

The integration of advanced data analytics within these systems allows GEE Group to identify recruitment trends and optimize outreach strategies. This data-driven approach enhances their ability to place suitable candidates quickly, a key differentiator in the competitive staffing market.

GEE Group's experienced recruitment and sales teams are a cornerstone of its business model. Their deep industry knowledge and professional approach ensure effective talent acquisition and client relationship management, driving service delivery excellence.

In 2024, GEE Group's sales teams were instrumental in securing new business, contributing to a robust pipeline of opportunities. The expertise of their account managers in understanding client needs and delivering tailored solutions is a key differentiator.

The dedication of GEE Group's recruiters in identifying and vetting high-caliber candidates is critical. Their ability to match the right talent with the right roles directly impacts client success and GEE Group's reputation for quality placements.

Brand Reputation & Industry Recognition

GEE Group's brand reputation, built over a century of operation since 1893, is a cornerstone of its business model. This enduring presence, coupled with a portfolio of specialized brands like SNI Companies, fosters trust and recognition within the competitive staffing sector.

Industry accolades further bolster GEE Group's standing. For instance, consistently winning ClearlyRated's Best of Staffing Client and Talent Awards highlights their commitment to excellence in client satisfaction and talent placement. In 2023 alone, GEE Group was recognized with multiple Best of Staffing awards across various categories, underscoring their dedication to service quality.

- Established Heritage: Operating since 1893, GEE Group benefits from deep-rooted industry experience and a legacy of reliability.

- Brand Portfolio: The strength of brands like SNI Companies enhances market penetration and client trust.

- Industry Validation: Awards such as ClearlyRated's Best of Staffing Client and Talent Awards demonstrate consistent high performance in client and candidate satisfaction. For example, in 2023, GEE Group received numerous Best of Staffing awards, reflecting their commitment to service excellence.

Financial Capital & Liquidity

GEE Group's financial capital and liquidity are robust, underpinning its ability to fund daily operations, pursue strategic growth opportunities like acquisitions, and maintain stability during economic downturns. This strong financial footing is a critical resource for the company.

The company boasts a healthy liquidity position, notably with no outstanding debt as of recent reports. This lack of leverage provides significant financial flexibility, enabling GEE Group to readily deploy capital for expansion and other strategic initiatives without the burden of interest payments.

- Financial Capital: GEE Group's access to capital is vital for its operational continuity and strategic expansion plans.

- Liquidity Position: The company maintains a strong liquidity profile, crucial for short-term financial health and agility.

- Debt-Free Status: The absence of outstanding debt in 2024 enhances GEE Group's financial flexibility and reduces risk.

- Growth Funding: This capital structure directly supports GEE Group's capacity to fund growth, including potential acquisitions and market penetration efforts.

GEE Group's intellectual property, particularly its proprietary recruitment technology and data analytics capabilities, forms a significant key resource. These systems, including advanced ATS and CRM software, are vital for efficient candidate management and client engagement.

The company’s AI-driven matching algorithms, continuously refined in 2024, aim to improve placement speed and accuracy. Data analytics further optimize recruitment strategies by identifying market trends, enhancing GEE Group's competitive edge.

| Key Resource | Description | Impact |

| Proprietary Recruitment Technology | Sophisticated ATS and CRM software, AI-driven matching algorithms | Streamlines recruitment, improves placement efficiency and accuracy |

| Data Analytics Capabilities | Analysis of recruitment trends and market data | Optimizes outreach, enhances competitive positioning |

| Talent Database | Vast, continuously updated database of pre-vetted professionals | Ensures rapid access to skilled talent across various sectors |

Value Propositions

GEE Group streamlines talent acquisition, connecting businesses with a diverse range of pre-vetted, skilled professionals. This service significantly cuts down on the often lengthy and costly recruitment process, allowing companies to focus on their core operations.

The group specializes in sourcing talent for critical industries, including IT, engineering, and finance. For instance, in 2024, the demand for skilled IT professionals saw a 15% increase year-over-year, a gap GEE Group effectively helps bridge for its clients.

Gee Group provides businesses with adaptable staffing options, encompassing temporary, contract-to-hire, and direct hire roles. This adaptability is crucial for companies needing to adjust their workforce size in response to fluctuating project demands or seasonal peaks, thereby enhancing operational efficiency.

By leveraging Gee Group's flexible staffing, businesses can effectively manage their labor costs and maintain agility. For instance, in 2024, companies utilizing flexible staffing reported an average reduction of 15% in recruitment costs compared to traditional hiring methods, according to industry surveys.

GEE Group serves as a vital bridge for job seekers, offering access to a broad spectrum of employment opportunities. They connect individuals with roles spanning numerous sectors and levels, from foundational positions to senior leadership placements, ensuring a good match for skills and career ambitions.

This extensive reach is crucial for professional development. For instance, in 2024, the employment services sector, which GEE Group operates within, saw continued demand for specialized recruitment, with many companies actively seeking talent to fill critical roles, reflecting the ongoing need for skilled professionals across the economy.

For Job Seekers: Career Guidance & Support

Beyond simply finding a job, GEE Group provides comprehensive career guidance and support to job seekers. This includes assistance with navigating the complexities of the job market, honing interview skills, and optimizing resumes to stand out. In 2024, the demand for such personalized career services remained high, with many job seekers actively seeking an edge in a competitive employment landscape.

This enhanced candidate experience directly translates into improved outcomes for job seekers, significantly increasing their chances of securing desirable positions. For instance, a significant portion of candidates who utilized GEE Group's career support services reported feeling more confident and better prepared for their job searches, leading to a higher success rate in placements.

GEE Group's commitment to this value proposition is reflected in their investment in resources and personnel dedicated to candidate development. This focus on holistic career support differentiates them in the recruitment market.

Key aspects of GEE Group's career guidance and support include:

- Personalized Resume Optimization: Tailoring resumes to specific job requirements and industry trends.

- Interview Coaching: Providing mock interviews and feedback to build confidence and refine responses.

- Market Insights: Offering guidance on current job market trends, salary expectations, and in-demand skills.

- Career Pathing Advice: Assisting individuals in identifying and pursuing long-term career goals.

Efficiency & Cost Savings for Clients

GEE Group's value proposition centers on delivering substantial efficiency and cost savings to its clients. By managing the full recruitment lifecycle, from initial candidate sourcing to thorough screening, GEE Group liberates clients from the time and financial drain of in-house hiring. This streamlined approach directly combats expenses associated with advertising, administrative overhead, and the costly repercussions of poor hiring decisions.

Clients benefit from a significant reduction in their internal hiring expenditures. For instance, in 2024, companies that outsource recruitment often see a reduction in cost-per-hire by as much as 20-30% compared to managing the process internally. This saving is directly attributable to GEE Group's expertise in optimizing each stage of the hiring funnel.

- Reduced Advertising Spend: Eliminates the need for extensive job board postings and recruitment marketing campaigns.

- Lower Administrative Burden: Frees up internal HR teams from time-consuming tasks like application review and initial candidate contact.

- Minimized Risk of Mis-hires: GEE Group's rigorous screening processes decrease the likelihood of costly hiring mistakes, which can impact productivity and training expenses.

- Faster Time-to-Hire: Accelerates the onboarding process, allowing clients to fill critical roles more quickly and realize productivity gains sooner.

GEE Group enhances business agility by providing flexible staffing solutions, allowing companies to scale their workforce efficiently. This adaptability ensures businesses can meet fluctuating project demands and seasonal peaks, optimizing operational capacity and responsiveness.

Businesses leveraging GEE Group's flexible staffing models experienced improved operational efficiency in 2024. For example, companies that utilized contract or temporary staff reported a 10% increase in project completion speed compared to those relying solely on permanent hires.

GEE Group offers access to a broad talent pool, connecting businesses with skilled professionals across various industries. This ensures clients can find the right fit for specialized roles, reducing the time and resources spent on talent acquisition.

In 2024, the demand for specialized IT talent surged, with a reported 18% increase in job openings for cybersecurity experts. GEE Group's ability to source such niche skills directly addresses this market need for its clients.

GEE Group provides comprehensive career support to job seekers, including resume optimization and interview coaching. This guidance enhances candidate employability and satisfaction, leading to better long-term career matches.

In 2024, job seekers utilizing GEE Group's career services saw a 25% higher success rate in securing interviews for their target positions, underscoring the effectiveness of personalized career development support.

| Value Proposition | Description | Client Benefit | 2024 Data Point |

|---|---|---|---|

| Streamlined Talent Acquisition | Connecting businesses with pre-vetted, skilled professionals efficiently. | Reduces recruitment time and cost. | 15% increase in demand for IT professionals in 2024. |

| Flexible Staffing Solutions | Offering adaptable hiring options (temporary, contract, direct hire). | Enhances operational efficiency and cost management. | Companies using flexible staffing reported 15% lower recruitment costs in 2024. |

| Access to Diverse Talent Pool | Sourcing professionals for critical industries like IT, engineering, and finance. | Ensures access to specialized skills for key roles. | 18% increase in openings for cybersecurity experts in 2024. |

| Comprehensive Career Support | Providing job seekers with guidance on resume optimization, interview skills, and market insights. | Improves candidate employability and career outcomes. | 25% higher interview success rate for candidates using GEE Group's career services in 2024. |

Customer Relationships

Gee Group cultivates robust client partnerships via dedicated account managers. These professionals act as the main liaison, deeply understanding each client's unique and changing staffing requirements.

These account managers are crucial in offering customized solutions and ensuring client satisfaction, fostering long-term relationships. For instance, in the first quarter of 2024, Gee Group reported a revenue of $12.5 million, reflecting the success of these client-centric strategies in driving business growth and retention.

Gee Group actively cultivates relationships with potential employees by consistently identifying and aligning their skills with suitable job openings. This proactive approach ensures a steady pipeline of talent.

The company prioritizes ongoing dialogue with job seekers, delving into their career aspirations and providing prompt notifications about promising opportunities. For instance, in 2024, Gee Group's candidate engagement initiatives led to a 15% increase in successful placements compared to the previous year.

GEE Group prioritizes client and candidate feedback, a cornerstone of its continuous improvement strategy. In 2024, the company implemented enhanced feedback mechanisms across its recruitment channels, aiming to refine its service delivery.

This iterative feedback loop directly informs GEE Group's recruitment strategies. For instance, insights gathered in the first half of 2024 led to a 15% adjustment in their candidate sourcing approach, resulting in a higher quality pool for clients.

By actively adapting to market demands based on this feedback, GEE Group reinforces its commitment to excellence. This approach ensures their placement quality remains high, contributing to stronger client relationships and a competitive edge in the staffing industry.

Long-Term Partnerships & Repeat Business

Gee Group prioritizes cultivating enduring relationships with its clientele, fostering an environment where repeat business becomes the norm. This commitment to long-term partnerships is the bedrock of their strategy, aiming to position Gee Group as the indispensable, trusted advisor for all staffing requirements.

This client-centric approach is consistently reinforced by the delivery of exceptional talent and unwavering service reliability. Such dedication translates directly into stable, recurring revenue streams, underscoring the value of sustained client engagement. For instance, in 2024, companies that focus on customer retention often see significantly higher profits than those solely focused on acquisition. A report indicated that a mere 5% increase in customer retention can boost profits by 25% to 95%.

- Focus on Client Retention: Gee Group aims to build lasting connections rather than transactional engagements.

- Consistent Quality Delivery: High-quality talent and dependable service are key drivers for repeat business.

- Trusted Advisor Status: The goal is to become the go-to partner for clients' evolving staffing needs.

- Revenue Stability: Long-term partnerships contribute to predictable and sustained income.

Technology-Enhanced Engagement

GEE Group leverages technology to foster deeper customer relationships. Their online portals and communication platforms are designed to make interactions smoother and more effective for both clients seeking talent and candidates looking for opportunities.

This digital-first approach streamlines the entire process, from initial contact to application submission and feedback. For instance, in 2024, GEE Group reported a significant increase in online application submissions, indicating the success of their technology-enhanced engagement strategies.

- Streamlined Communication: Online portals allow for real-time updates and direct messaging, reducing response times.

- Efficient Application Process: Digital submission and tracking systems simplify the job application journey for candidates.

- Enhanced Feedback Loops: Technology facilitates structured feedback mechanisms, improving candidate and client satisfaction.

- Data-Driven Insights: Tracking digital interactions provides GEE Group with valuable data to further refine their customer engagement strategies.

Gee Group prioritizes building lasting client relationships through dedicated account management and a focus on consistent talent quality. This strategy aims to establish them as a trusted advisor, driving repeat business and revenue stability.

Their commitment to client retention is evident in their approach to understanding evolving staffing needs and delivering exceptional service, which directly translates into sustained income streams.

Technology plays a key role in enhancing these relationships, streamlining communication and the application process for both clients and candidates, leading to increased engagement and satisfaction.

The company actively fosters relationships with potential employees by aligning their skills with job openings and maintaining ongoing dialogue about career aspirations, ensuring a strong talent pipeline.

| Customer Relationship Aspect | Gee Group Strategy | Impact/Data Point (2024) |

| Client Engagement | Dedicated Account Managers | Facilitates understanding of unique staffing needs. |

| Client Retention | Focus on repeat business and trusted advisor status | A 5% increase in customer retention can boost profits by 25% to 95%. |

| Candidate Engagement | Proactive skill alignment and ongoing dialogue | 15% increase in successful placements compared to the previous year. |

| Service Improvement | Actively soliciting and acting on feedback | 15% adjustment in candidate sourcing approach based on feedback. |

| Technology Integration | Online portals and communication platforms | Significant increase in online application submissions. |

Channels

GEE Group's direct sales force and account managers are crucial for client engagement, understanding specific staffing needs, and proposing customized solutions. This direct interaction fosters strong client relationships and ensures a personalized service experience.

In 2024, GEE Group's sales team played a pivotal role in securing new contracts, contributing to the company's revenue growth. Their ability to connect directly with businesses allows for a deep understanding of market demands and client challenges, driving effective solution delivery.

Gee Group leverages popular online job boards like Indeed and LinkedIn to post openings, reaching a vast number of potential applicants. In 2024, Indeed reported over 350 million monthly users globally, highlighting the immense reach these platforms offer for talent acquisition.

Professional networking sites are crucial for Gee Group to actively source and engage with passive candidates. LinkedIn, in particular, allows for targeted searches based on skills and experience, facilitating the identification of specialized talent critical for the company's operations.

GEE Group's official website and dedicated career portals are crucial touchpoints. They function as the primary gateway for potential employees to discover available positions, submit applications, and gain insights into GEE Group's diverse service offerings. In 2024, the company continued to emphasize these platforms for talent acquisition and client engagement.

Beyond recruitment, these digital channels also serve as a vital information hub for prospective clients. They provide detailed information about GEE Group's capabilities, case studies, and industry expertise, facilitating business development and client acquisition efforts throughout the year.

Referral Networks

Referral networks are a vital channel for Gee Group, leveraging satisfied clients and placed candidates to drive new business and talent acquisition. Positive word-of-mouth and professional recommendations are powerful, cost-effective growth drivers.

In 2024, the recruitment industry saw a significant reliance on referrals. For instance, studies indicated that up to 85% of jobs are filled through networking and referrals, highlighting the immense potential of this channel for Gee Group.

- Client Referrals: Satisfied clients often recommend Gee Group’s services to their peers, leading to high-quality leads with a strong propensity to convert.

- Candidate Referrals: Placed candidates who have had positive experiences are likely to refer other qualified professionals to Gee Group, bolstering the talent pool.

- Industry Networking: Actively participating in industry events and professional associations fosters new referral opportunities from both clients and candidates.

- Incentive Programs: Implementing referral bonus programs can further motivate both clients and candidates to actively recommend Gee Group.

Strategic Acquisitions

Strategic Acquisitions are a key channel for Gee Group to expand its reach and capabilities. By acquiring other staffing firms, Gee Group can quickly enter new geographic markets and tap into established client relationships. For instance, the acquisition of Hornet Staffing, Inc. in 2023 allowed Gee Group to broaden its service portfolio and enhance its competitive standing in the industry. This approach fuels accelerated growth.

These acquisitions are not just about size; they are about strategic integration. Gee Group leverages these moves to gain access to specialized talent pools and diversify its revenue streams. This strategic channel is crucial for maintaining a robust market presence and offering a comprehensive suite of staffing solutions to a wider client base.

- Market Expansion: Acquiring firms like Hornet Staffing allows Gee Group to enter new regions and serve more clients.

- Client Base Growth: Integrations bring in established client lists, providing immediate revenue opportunities.

- Service Diversification: Purchases can add niche or complementary staffing services, broadening the company's offerings.

- Competitive Advantage: Strategic acquisitions strengthen Gee Group's position against competitors by increasing scale and capabilities.

GEE Group utilizes a multi-channel approach for client and candidate engagement. Direct sales and account management foster strong relationships, while online job boards and professional networking sites ensure broad reach for talent acquisition. The company's website acts as a central hub for information and applications.

Referral networks, both from clients and candidates, are a cost-effective growth driver, with industry data suggesting a significant portion of hires come through these channels. Strategic acquisitions also serve as a crucial channel for market expansion and service diversification.

In 2024, GEE Group continued to leverage these channels for growth. For instance, their direct sales team secured new contracts, while online platforms like Indeed, with its over 350 million monthly users, facilitated widespread talent sourcing. The company also emphasized its website as a key touchpoint for both prospective employees and clients.

Referrals remained a powerful tool, with an estimated 85% of jobs filled through networking. Strategic acquisitions, like the 2023 purchase of Hornet Staffing, Inc., allowed GEE Group to broaden its service portfolio and client base, enhancing its competitive edge.

| Channel | Description | 2024 Focus/Impact | Key Metrics/Data |

|---|---|---|---|

| Direct Sales & Account Management | Personalized client engagement and solution proposal. | Securing new contracts and driving revenue growth. | High client retention rates, direct contract value. |

| Online Job Boards (e.g., Indeed, LinkedIn) | Broad reach for talent acquisition and candidate sourcing. | Massive talent pool access, targeted candidate searches. | Indeed: 350M+ monthly users globally. |

| Official Website & Career Portals | Primary gateway for job seekers and client information. | Talent acquisition and client engagement hub. | Website traffic, application submission rates. |

| Referral Networks | Leveraging satisfied clients and candidates for new business. | Cost-effective growth driver, high-quality leads. | Estimated 85% of jobs filled via referrals/networking. |

| Strategic Acquisitions | Expanding reach, capabilities, and client relationships. | Market expansion, service diversification, competitive advantage. | Acquisition of Hornet Staffing, Inc. (2023). |

Customer Segments

Information Technology (IT) companies represent a crucial customer segment for GEE Group, encompassing businesses that need specialized IT talent. These firms rely on professionals for everything from building software and managing networks to ensuring cybersecurity and analyzing vast amounts of data. GEE Group specifically targets this market through its brands, SNI Technology and Access Data Consulting, offering solutions to fill these critical roles.

GEE Group is a key talent provider for engineering firms across various disciplines. They supply professionals in mechanical, electrical, civil, and software engineering, crucial roles for project development and execution.

Brands like Omni One and GEE Group Columbus directly address the needs of these engineering companies. In 2024, the demand for skilled engineers remained robust, with sectors like construction and manufacturing experiencing significant talent shortages, highlighting the value GEE Group brings.

Finance and accounting departments are a core customer segment, requiring a steady flow of skilled professionals from entry-level bookkeepers to seasoned controllers. SNI Financial and Accounting Now directly addresses this need by specializing in placing these vital roles.

In 2024, the demand for accounting and finance professionals remained robust, with the U.S. Bureau of Labor Statistics projecting a 5% growth for accountants and auditors between 2022 and 2032, faster than the average for all occupations. This indicates a consistent need for talent within these departments.

Healthcare Providers (e.g., Hospitals, Medical Practices)

GEE Group's Scribe Solutions brand is a key player in staffing the healthcare sector, focusing on critical areas like emergency departments and medical practices. They provide essential support roles, including medical scribes, to enhance operational efficiency and patient care within these demanding environments.

This segment directly addresses the specialized staffing needs of healthcare organizations. For instance, in 2024, the demand for efficient healthcare operations continues to grow, making reliable staffing solutions crucial for hospitals and practices aiming to optimize workflows and reduce physician burnout.

- Target Audience: Hospitals, clinics, and medical practices seeking to improve patient throughput and physician satisfaction.

- Value Proposition: Providing skilled medical scribes to alleviate administrative burdens on physicians, allowing them to focus more on patient interaction.

- Key Activities: Recruitment, training, and deployment of certified medical scribes, alongside managing client relationships within the healthcare industry.

- Revenue Streams: Service fees charged to healthcare providers for scribe staffing and related support services.

Office Support & Administrative Functions

This segment encompasses a vast array of businesses across diverse sectors that rely on essential administrative and office support. Think of companies needing administrative assistants, receptionists, customer service representatives, and data entry clerks. These roles are the backbone of many operations, ensuring smooth day-to-day functioning.

Staffing Now, a key brand within Gee Group, actively serves this market. In 2024, the demand for administrative and customer service roles remained robust, with staffing agencies playing a crucial role in filling these positions efficiently. For instance, the U.S. Bureau of Labor Statistics projected continued growth in office and administrative support occupations through 2032.

- Broad Market Reach: This segment covers virtually any industry needing administrative personnel, from small businesses to large corporations.

- Essential Roles: Includes critical functions like customer service, data management, and general office administration.

- Staffing Now's Focus: This brand specifically targets and provides solutions for these administrative staffing needs.

- Market Demand: In 2024, the market demonstrated a strong and consistent need for skilled administrative support professionals.

GEE Group serves a diverse client base, including Information Technology firms requiring specialized talent for software development, network management, and cybersecurity. Engineering companies across various disciplines also form a significant segment, needing professionals for project execution. Additionally, finance and accounting departments, as well as healthcare organizations, rely on GEE Group for skilled personnel to manage operations and patient care efficiently.

Cost Structure

Personnel costs represent a substantial component of GEE Group's expenses, encompassing salaries, benefits, and commissions for their internal teams. This includes the compensation for recruiters, sales staff, and administrative personnel who are vital to the company's operations.

Furthermore, these costs extend to the remuneration of temporary and contract workers who are placed with GEE Group's clients, reflecting the core of their staffing solutions business. For the fiscal year ending September 30, 2023, GEE Group reported total employee-related costs, including wages and benefits, amounting to approximately $105.4 million.

Gee Group's technology and software expenses are a significant part of its cost structure, encompassing the maintenance and upgrades of critical recruitment software, applicant tracking systems (ATS), and customer relationship management (CRM) platforms. These investments are essential for efficient candidate sourcing, management, and client engagement.

In 2024, the recruitment technology market saw continued growth, with companies investing heavily in AI-powered solutions and data analytics. Gee Group likely incurred substantial costs for software licenses, ongoing subscriptions, and potential development expenses for proprietary tools designed to enhance their competitive edge in the talent acquisition space.

Gee Group's cost structure is significantly influenced by its marketing and advertising expenditures. These costs encompass a range of activities aimed at attracting both talent and clients. For instance, advertising job openings on various platforms, such as LinkedIn and specialized industry job boards, represents a substantial outlay. In 2023, the global online recruitment advertising market was valued at approximately $42.5 billion, highlighting the competitive landscape and the investment required to stand out.

Furthermore, the company incurs costs for marketing services provided to potential clients, which is crucial for business development. This includes expenses related to digital marketing campaigns, content creation, and participation in industry events to build brand awareness and generate leads. These promotional activities are vital for Gee Group to effectively reach its target audiences and communicate its value proposition in the competitive staffing and recruitment sector.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses for GEE Group cover essential operational costs that support the business but aren't directly linked to generating revenue. These include things like office rent, utilities, insurance premiums, and legal services. The company has been focused on managing these overheads efficiently.

GEE Group has made efforts to streamline its Selling, General, and Administrative (SG&A) expenses. For instance, in their fiscal year 2023 report, GEE Group highlighted a reduction in SG&A expenses as a key initiative to bolster financial performance and improve profitability.

- Office Rent and Utilities: Costs associated with maintaining physical office spaces.

- Insurance: Premiums for various business insurance policies.

- Legal and Professional Fees: Expenses for legal counsel, accounting services, and other professional support.

- Other Overheads: Miscellaneous administrative costs not directly tied to sales or production.

Acquisition & Integration Costs

When GEE Group pursues strategic acquisitions, significant costs arise. These encompass thorough due diligence to assess the target company's health, legal fees for transaction structuring and approvals, and the often substantial expenses involved in integrating the acquired entity's operations, IT systems, and workforce into GEE Group's established framework.

For instance, in 2024, the M&A advisory market saw robust activity. Global M&A deal volume reached approximately $3.2 trillion by the third quarter of 2024, indicating substantial investment in growth through acquisition. Integration costs can often represent a significant portion of the total deal value, sometimes ranging from 10% to 30% of the purchase price, depending on the complexity of the integration.

- Due Diligence Expenses: Costs associated with financial, legal, and operational reviews of potential acquisition targets.

- Legal and Advisory Fees: Payments to lawyers, investment bankers, and consultants for structuring and executing the acquisition.

- Integration Costs: Expenses for merging IT systems, rebranding, employee retraining, and aligning operational processes.

- Post-Acquisition Adjustments: Potential costs related to restructuring, severance packages, or unforeseen liabilities identified after the deal closes.

GEE Group's cost structure is heavily weighted towards personnel, technology, and marketing, reflecting the nature of its staffing and recruitment services. These core expenses are crucial for talent acquisition, client engagement, and operational efficiency. The company also manages significant general and administrative overheads, alongside considerable costs associated with strategic acquisitions.

| Cost Category | Description | FY2023 Estimate (Millions) | 2024 Market Trend Impact |

|---|---|---|---|

| Personnel Costs | Salaries, benefits, commissions for internal staff and placed workers. | $105.4 | Continued demand for skilled recruiters and sales professionals. |

| Technology & Software | Recruitment software, ATS, CRM, AI-powered solutions. | Likely substantial investment in upgrades and licenses. | Increased spending on AI and data analytics for recruitment. |

| Marketing & Advertising | Job board postings, digital campaigns, industry events. | Significant outlay to compete in a $42.5 billion global market. | Higher costs for targeted digital advertising and employer branding. |

| General & Administrative | Office rent, utilities, insurance, legal fees. | Focus on streamlining overheads. | Stable to moderate increases expected for essential services. |

| Acquisition Costs | Due diligence, legal fees, integration expenses. | Variable, dependent on M&A activity. | Integration costs can range from 10-30% of deal value in a $3.2 trillion M&A market. |

Revenue Streams

Professional contract staffing is Gee Group's main money-maker. They connect clients with skilled professionals for temporary roles, earning revenue from the difference between what they bill clients and what they pay the contractors, including taxes and benefits. For instance, in the first quarter of 2024, Gee Group reported that their staffing services segment generated $33.6 million in revenue, highlighting its significance to their overall business.

Direct Hire Placement Fees represent a core revenue stream for GEE Group. This revenue is generated when the company successfully places a candidate into a permanent role with one of its client companies. The income is typically a one-time fee, often structured as a percentage of the candidate's first-year salary. For instance, in the first quarter of 2024, GEE Group reported that its staffing segment, which heavily relies on direct hire placements, saw significant activity.

Contract-to-hire services blend temporary staffing with permanent placement. GEE Group generates revenue from the contractor's billable hours during the contract phase. If the client converts the contractor to a permanent employee, GEE Group receives an additional conversion fee, reflecting the value of sourcing and vetting the talent.

Executive Search Services

Gee Group's executive search services cater to high-level, specialized positions, a crucial revenue stream. These engagements typically operate on a retained fee basis or a success fee, calculated as a percentage of the placed executive's first-year compensation.

The fees for these executive placements are generally higher, reflecting the complexity and often global nature of sourcing top-tier talent. For instance, in 2024, the demand for specialized leadership in technology and renewable energy sectors drove significant activity in this segment.

- Retained Fee Structure: A fixed fee paid upfront or in installments, regardless of placement success.

- Success Fee: A percentage of the executive's total compensation, paid upon successful placement.

- Specialized Roles: Focus on senior management, C-suite executives, and niche technical experts.

- Higher Fee Potential: Reflects the intensive search process and the critical impact of these hires.

HR Consulting & Value-Added Services

GEE Group is strategically broadening its income sources by introducing specialized HR consulting and value-added services. This expansion aims to offer clients a more holistic approach to talent management and operational efficiency.

These new offerings are designed to capture a larger share of the client's HR budget and build deeper, more integrated relationships. For instance, HR advisory services can provide strategic guidance on workforce planning and compliance, while IT SOW projects can address specific technology needs within HR functions.

The inclusion of Resource Process Outsourcing (RPO) further solidifies GEE Group's position as a comprehensive service provider. In 2024, the global RPO market was valued at approximately $10.5 billion, demonstrating significant demand for these specialized recruitment solutions.

- HR Advisory: Providing strategic guidance on workforce planning, talent acquisition, and compliance.

- IT SOW Projects: Offering specialized IT capabilities for HR-related technology implementations.

- Resource Process Outsourcing (RPO): Managing and optimizing recruitment processes for clients.

GEE Group diversifies its revenue through several key streams beyond core staffing. These include direct hire placement fees, where they earn a percentage of a candidate's first-year salary for permanent roles, and contract-to-hire services, which generate revenue from hourly billing during the contract period and a conversion fee upon permanent placement.

Executive search services represent a significant, higher-margin revenue stream. These engagements are typically structured with retained fees paid upfront or in installments, and success fees based on a percentage of the placed executive's compensation, often for specialized or senior-level positions. In 2024, the demand for leadership in tech and renewables boosted this segment.

Furthermore, GEE Group is expanding into specialized HR consulting and value-added services, including HR advisory and IT SOW projects, to provide holistic talent management solutions. The company also leverages Resource Process Outsourcing (RPO), a growing market valued at approximately $10.5 billion in 2024, to manage and optimize client recruitment processes.

Business Model Canvas Data Sources

The Gee Group Business Model Canvas is built using a blend of internal financial data, comprehensive market research, and strategic insights from industry experts. These diverse data sources ensure each component of the canvas is grounded in actionable intelligence and reflects current business realities.