Gee Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gee Group Bundle

Navigate the complex external forces impacting Gee Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory and uncover hidden opportunities and potential threats. Gain the strategic foresight needed to make informed decisions and secure a competitive advantage. Download the full PESTLE analysis now to unlock actionable intelligence.

Political factors

Government labor policies, such as minimum wage laws and worker classification rules, directly impact GEE Group's operational costs and compliance. For instance, a potential increase in the US federal minimum wage to $15 per hour, a topic of ongoing political discussion in 2024-2025, would raise labor expenses for businesses employing many individuals. Similarly, shifts in regulations defining independent contractors versus employees could necessitate significant adjustments to GEE Group's business model and the way it engages with its workforce.

Immigration and visa regulations significantly influence GEE Group's operational capacity, particularly in its IT and healthcare staffing divisions. For instance, changes in skilled worker visa programs, such as those in Australia, can directly impact the influx of qualified professionals available to meet client needs. In 2024, discussions around revising temporary skilled migration pathways in several key markets could either broaden or narrow the talent pool GEE Group can access.

International trade policies and the broader landscape of global relations significantly shape the environment for staffing services. For a company like GEE Group, which operates within a globalized talent market, shifts in trade agreements or geopolitical stability can directly impact economic growth and, consequently, business investment in hiring. For instance, the World Trade Organization (WTO) reported a 0.7% growth in global trade volumes in 2023, a modest increase that reflects ongoing geopolitical uncertainties.

Stable trade relations foster a more predictable operating environment, crucial for companies that might engage in cross-border recruitment or serve international clients. Conversely, political tensions or trade disputes, such as those seen between major economic blocs impacting supply chains, can introduce economic uncertainty. This uncertainty often leads businesses to delay or scale back hiring decisions, thereby affecting demand for staffing solutions. The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, but warned that geopolitical fragmentation poses a significant downside risk.

Healthcare Policy Changes

Changes in healthcare policy, particularly around funding and regulations, directly impact GEE Group's healthcare staffing business. For instance, shifts in government spending on public health initiatives, such as the projected $1.5 trillion in US federal health spending for FY2025, can either boost or dampen demand for medical professionals. New mandates for healthcare providers, like those related to staffing ratios or specific service offerings, can create immediate needs for temporary or permanent staff. Staying informed about these evolving policies is crucial for GEE Group to adapt its recruitment strategies and service offerings effectively to meet market demands.

The healthcare sector is highly sensitive to legislative actions. For example, ongoing debates and potential reforms in healthcare coverage and delivery models in major markets could influence hospital budgets and, consequently, their reliance on staffing agencies. The increasing focus on value-based care by governments and payers, which often necessitates more specialized or efficient staffing models, presents both challenges and opportunities for GEE Group. Understanding these political currents is key to anticipating future demand for healthcare talent.

- Government Healthcare Spending: Fluctuations in national healthcare budgets, such as the projected growth in global health expenditure to over $10 trillion by 2025, directly correlate with the need for healthcare personnel.

- Regulatory Compliance: Evolving regulations on patient care, licensing, and employment practices for medical staff can create demand for compliant staffing solutions.

- Healthcare Reform Initiatives: Policy changes aimed at expanding access to care or improving service delivery often lead to increased hiring needs within healthcare facilities.

- Public Health Funding: Increased investment in public health programs, especially in areas like infectious disease management or preventative care, can drive demand for specialized healthcare professionals.

Government Spending and Infrastructure Projects

Government spending, especially on infrastructure, directly fuels demand for skilled workers, a core area for GEE Group's staffing solutions. For instance, the Australian government's commitment to infrastructure investment, with an estimated AUD 120 billion allocated for the 2023-2024 financial year, is expected to drive significant job creation across construction, engineering, and manufacturing sectors. This presents a clear opportunity for GEE Group to capitalize on increased project pipelines and the need for specialized talent.

GEE Group's strategic positioning allows it to benefit from this surge in public sector investment. As government initiatives like the National Reconstruction Fund, aiming to boost manufacturing capabilities, roll out, the demand for tradespeople and technical professionals will likely escalate. The company's ability to supply these essential workers aligns perfectly with the government's objectives to stimulate economic activity and build critical national assets.

- Increased Demand: Government infrastructure spending, projected to remain robust through 2025, directly translates to higher demand for GEE Group's industrial and professional staffing services.

- Job Creation: Initiatives like the National Reconstruction Fund are designed to create jobs, providing a ready market for GEE Group's recruitment expertise.

- Sector Growth: Understanding the specific sectors targeted by government investment, such as renewable energy infrastructure or transportation upgrades, allows GEE Group to proactively align its service offerings with emerging growth opportunities.

Government policies on labor, immigration, and trade directly influence GEE Group's ability to source and deploy talent globally. For instance, the US federal minimum wage debate and changes in skilled worker visa programs in countries like Australia in 2024-2025 could significantly impact operational costs and talent availability. Geopolitical stability and trade relations, highlighted by the WTO's 0.7% global trade growth in 2023, also shape the demand for staffing services by affecting business investment and hiring decisions.

Healthcare policy shifts, such as projected US federal health spending of $1.5 trillion for FY2025, directly influence GEE Group's healthcare staffing demand. Government initiatives to expand care access or improve delivery models, alongside debates on healthcare coverage, create opportunities for specialized staffing. The increasing focus on value-based care by payers also necessitates adaptable staffing solutions, presenting both challenges and growth avenues for the company.

Government infrastructure spending, like Australia's AUD 120 billion allocation for 2023-2024, directly fuels demand for GEE Group's industrial and professional staffing services. Initiatives such as the National Reconstruction Fund are designed to create jobs, providing a direct market for the company's recruitment expertise and aligning with objectives to stimulate economic activity and build national assets.

| Policy Area | Impact on GEE Group | 2024-2025 Data/Projections |

|---|---|---|

| Labor Laws | Increases operational costs and compliance needs. | Potential US federal minimum wage increase to $15/hour. |

| Immigration & Visas | Affects talent pool availability for IT & healthcare. | Discussions on revising temporary skilled migration pathways in key markets. |

| Trade & Geopolitics | Influences global hiring and business investment. | WTO reported 0.7% global trade growth (2023); IMF projected 3.2% global growth (2024) with geopolitical risks. |

| Healthcare Spending | Drives demand for healthcare professionals. | Projected US federal health spending: $1.5 trillion (FY2025); Global health expenditure to exceed $10 trillion by 2025. |

| Infrastructure Investment | Boosts demand for industrial & professional staff. | Australia's AUD 120 billion allocation (2023-2024); National Reconstruction Fund. |

What is included in the product

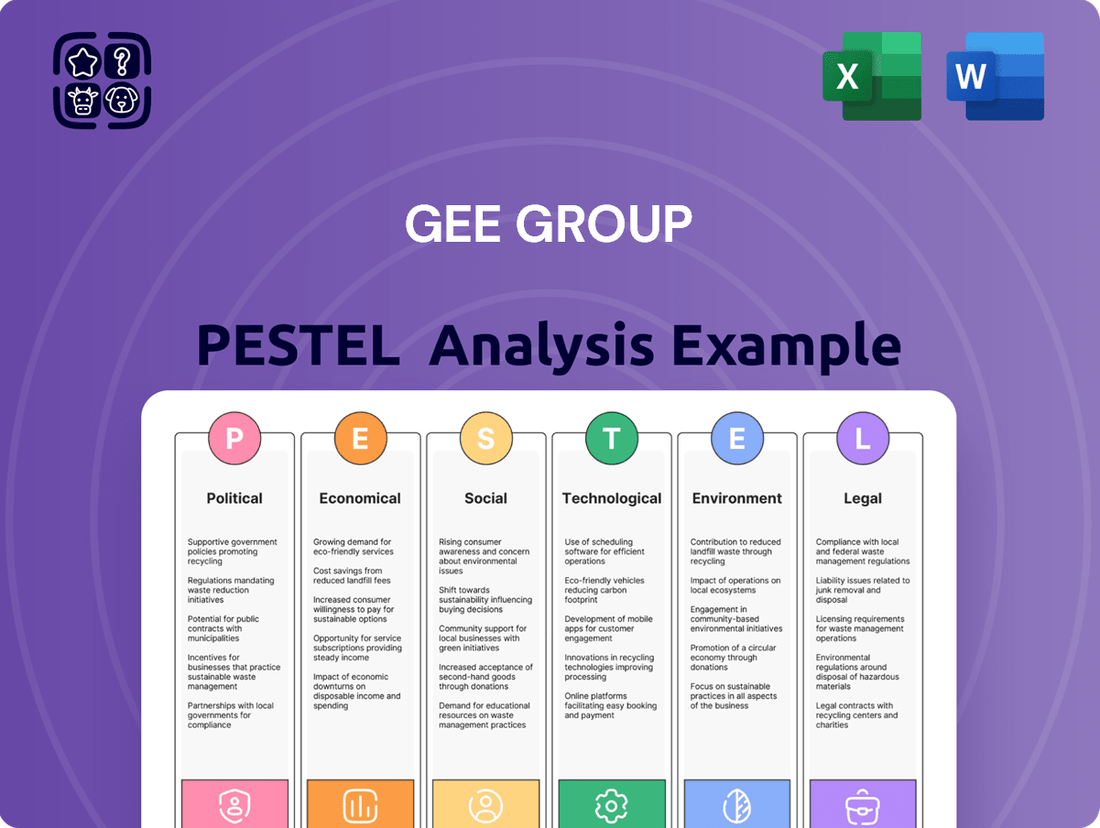

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Gee Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering quick insights into the external factors impacting Gee Group.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, legal, and environmental influences on Gee Group.

Economic factors

The overall health of the economy, as indicated by Gross Domestic Product (GDP) growth, directly influences the demand for staffing services. A robust economy typically sees businesses expanding and thus increasing their need for both temporary and permanent staff. For instance, in the United States, GDP grew at an annualized rate of 2.1% in the first quarter of 2024, signaling continued, albeit moderate, economic expansion. This trend generally translates to higher demand for GEE Group's services.

Conversely, economic slowdowns or recessions can significantly dampen hiring activity. Businesses facing reduced consumer spending or investment are likely to cut back on recruitment, impacting staffing firms like GEE Group. For example, if a global economic downturn were to occur, leading to decreased business investment, GEE Group's revenue streams could be directly affected by a reduction in client hiring needs.

Therefore, closely monitoring key economic indicators, such as GDP growth rates, unemployment figures, and consumer confidence, is crucial for GEE Group to accurately forecast business activity and adapt its strategies. Understanding these macroeconomic trends allows for more informed planning and resource allocation to navigate varying economic conditions effectively.

Unemployment rates directly impact GEE Group's ability to source talent. In late 2024, the US unemployment rate hovered around 3.9%, presenting a tight labor market where skilled professionals are in high demand, potentially increasing recruitment expenses for GEE Group.

Conversely, a rising unemployment rate, though potentially increasing the candidate pool, could signal a broader economic slowdown, negatively affecting client demand for staffing services. This delicate balance is crucial for staffing firms like GEE Group to navigate.

Interest rates significantly impact GEE Group's operating environment by influencing the cost of capital for businesses. For instance, the US Federal Reserve's benchmark interest rate, held steady in early 2024 after a series of hikes, still reflects a higher borrowing cost than in previous years, potentially dampening client investment in new projects and thus reducing demand for staffing services.

High inflation presents a dual challenge for GEE Group. As of early 2024, inflation, while moderating from its 2022 peaks, remained a concern, eroding the purchasing power of both consumers and businesses. This can lead to increased operational costs for GEE Group due to rising wages and overheads, while also putting upward pressure on salary expectations from potential hires.

These macroeconomic forces directly affect both sides of the staffing market. On the supply side, inflation and interest rate expectations influence the cost and availability of talent as candidates seek compensation that keeps pace with living expenses. Conversely, on the demand side, businesses facing higher borrowing costs and inflationary pressures may reduce their hiring budgets, impacting the volume of placements GEE Group can facilitate.

Wage Growth and Labor Costs

Wage growth and overall labor costs are significant economic factors influencing GEE Group's pricing and profitability. For instance, in the United States, average hourly earnings for all employees saw a 4.1% increase year-over-year as of April 2024, according to the Bureau of Labor Statistics. This trend can pressure GEE Group's margins if clients resist passing on higher service costs, but it also means a larger pool of potential customers with increased spending power.

Understanding these dynamics is key. If wage growth outpaces productivity gains, GEE Group might face challenges in maintaining competitive pricing without impacting its bottom line. Conversely, a tight labor market with rapidly escalating wages could make it more expensive to attract and retain skilled personnel, a critical component for service-based businesses like GEE Group.

- Impact on Profitability: Rising wages directly increase operating expenses, potentially squeezing profit margins if GEE Group cannot effectively pass these costs onto its clients.

- Talent Acquisition and Retention: Competitive wage offerings are essential for attracting and retaining high-quality employees, especially in specialized fields relevant to GEE Group's services.

- Pricing Strategy: GEE Group must align its pricing with prevailing wage trends to remain competitive while ensuring profitability.

- Economic Indicator: Wage growth data, such as the 4.1% YoY increase in average hourly earnings in the US as of April 2024, serves as a crucial indicator for GEE Group's operational planning and market positioning.

Consumer Spending and Business Confidence

Consumer spending is a major engine for economic growth, directly impacting a company's need for workforce solutions. When consumers feel secure and have disposable income, they tend to spend more on goods and services, leading businesses to ramp up production and, consequently, their hiring needs. This sentiment is reflected in retail sales figures and consumer confidence indices.

Business confidence, often measured by surveys of executives, indicates how optimistic companies are about future economic conditions and their own prospects. High business confidence encourages investment in new projects, expansion, and, importantly, increased staffing. Conversely, low confidence can lead to hiring freezes or even layoffs.

For GEE Group, these factors are critical. For instance, in late 2024 and early 2025, analysts noted a cautious optimism in consumer spending, with retail sales showing modest but steady growth. Business confidence surveys in the same period indicated a willingness among many sectors to invest, particularly in technology and infrastructure, creating demand for skilled labor that GEE Group can supply.

- Consumer Spending: Retail sales in the US saw a year-over-year increase of approximately 3.5% in Q4 2024, signaling robust consumer demand.

- Business Confidence: The Purchasing Managers' Index (PMI) for manufacturing remained above the 50-point mark throughout late 2024, indicating expansion and a positive outlook among businesses.

- Impact on Staffing: Increased consumer spending and sustained business confidence directly correlate with higher demand for temporary and permanent staffing services, GEE Group's core business.

- Economic Outlook: Projections for 2025 suggest continued moderate growth, which should support ongoing demand for GEE Group's recruitment and staffing solutions.

Economic factors significantly shape the demand for and supply of labor, directly impacting staffing firms like GEE Group. GDP growth, unemployment rates, interest rates, inflation, wage growth, consumer spending, and business confidence all play a crucial role in GEE Group's operational environment and profitability. For instance, a 2.1% annualized GDP growth in Q1 2024 in the US indicated moderate expansion, generally supporting demand for staffing services. However, a tight labor market, with US unemployment around 3.9% in late 2024, increases recruitment costs. High interest rates, with the Fed's benchmark rate still reflecting higher borrowing costs in early 2024, can dampen business investment and thus staffing needs. Inflation, though moderating, presents challenges with rising operational costs and wage expectations. Wage growth, exemplified by a 4.1% YoY increase in US average hourly earnings by April 2024, directly affects GEE Group's margins and pricing strategies. Robust consumer spending, with retail sales up 3.5% YoY in Q4 2024, and positive business confidence, indicated by a manufacturing PMI above 50 throughout late 2024, generally fuel demand for GEE Group's services.

| Economic Factor | 2024/2025 Data Point | Impact on GEE Group |

|---|---|---|

| GDP Growth (US) | 2.1% annualized (Q1 2024) | Supports moderate demand for staffing services. |

| Unemployment Rate (US) | ~3.9% (Late 2024) | Tight labor market, potentially increasing recruitment costs. |

| Interest Rates (US Fed) | Benchmark rate held steady (Early 2024) | Higher borrowing costs may reduce client investment and staffing demand. |

| Inflation | Moderating from 2022 peaks (Early 2024) | Increases operational costs and wage expectations. |

| Wage Growth (US Avg. Hourly Earnings) | 4.1% YoY increase (April 2024) | Pressures margins if costs cannot be passed to clients; essential for talent attraction. |

| Consumer Spending (US Retail Sales) | 3.5% YoY increase (Q4 2024) | Stronger spending signals higher demand for goods/services, boosting hiring needs. |

| Business Confidence (US Manufacturing PMI) | Above 50 (Late 2024) | Indicates business expansion and positive outlook, driving staffing demand. |

Full Version Awaits

Gee Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Gee Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

The workforce is getting older, with the average age of workers in many developed nations steadily increasing. For instance, in the US, the share of workers aged 55 and over reached approximately 22% in 2024, a notable rise from previous decades. This aging demographic brings a wealth of experience but also necessitates adjustments in workplace policies and benefits to accommodate longer careers and potential health considerations.

Simultaneously, Gen Z, born roughly between 1997 and 2012, is entering the job market in increasing numbers. By 2025, this generation is projected to constitute a significant portion of the global workforce, bringing with them different expectations regarding technology, work-life balance, and social responsibility. GEE Group must understand these evolving preferences to attract and retain this new talent pool.

Furthermore, workforce diversity is expanding across multiple dimensions, including ethnicity, gender, and background. In 2024, many companies, including those in the staffing sector like GEE Group, are prioritizing inclusive recruitment strategies to tap into a broader range of skills and perspectives. This focus on diversity is not just a social imperative but a strategic advantage, enabling better understanding of varied client needs and fostering innovation.

The growing desire for work-life balance is reshaping the employment landscape, influencing how companies like GEE Group attract and retain staff. Job seekers in 2024 and 2025 are prioritizing flexibility, with surveys indicating a significant percentage would consider a pay cut for better work-life integration. This means GEE Group must actively highlight and source roles offering remote or hybrid options to appeal to this evolving candidate pool.

The increasing adoption of the gig economy and freelance work models is a major sociological shift. By 2024, it's estimated that over 60 million Americans will participate in freelance work, a significant portion of the workforce. This trend directly benefits companies like GEE Group, which specialize in temporary and contract staffing, by expanding the talent pool for flexible engagements.

Skills Gap and Education Trends

The persistent skills gap across industries, especially in tech and specialized sectors, presents a significant sociological challenge. GEE Group's effectiveness hinges on its capacity to address these gaps through talent sourcing, training initiatives, or strategic alliances. For instance, a 2024 report indicated that 82% of employers faced a shortage of workers with the skills needed for their open positions, with technology roles being particularly affected.

Educational trends and the workforce's readiness for evolving job markets directly influence the caliber of talent available for placement. As of early 2025, there's a growing emphasis on digital literacy and adaptability in educational curricula. This shift aims to better equip graduates for roles that may not even exist today, a trend GEE Group can leverage by partnering with institutions at the forefront of these changes.

- Skills Gap Impact: In 2024, the U.S. Chamber of Commerce Foundation reported that the skills gap cost the U.S. economy an estimated $1.2 trillion in lost economic activity.

- Tech Talent Demand: Projections for 2025 show continued high demand for cybersecurity analysts, data scientists, and AI specialists, with many roles remaining unfilled due to a lack of qualified candidates.

- Educational Alignment: Universities are increasingly incorporating micro-credentials and bootcamps focused on in-demand tech skills, aiming to bridge the gap between academic learning and industry requirements.

- Future Workforce Preparedness: Surveys from late 2024 revealed that over 60% of graduating students felt their education adequately prepared them for the current job market, highlighting areas where improvement is still needed.

Social Attitudes Towards Staffing Agencies

Public sentiment regarding temporary and contract employment significantly impacts the demand for staffing agencies like GEE Group. A growing acceptance of flexible work arrangements, often driven by evolving generational preferences and economic shifts, generally bolsters the industry. For instance, in 2024, surveys indicated a continued rise in the number of individuals seeking contract roles for greater autonomy, with over 30% of the U.S. workforce participating in some form of contingent work. This positive outlook enhances GEE Group's ability to attract both clients and candidates.

Conversely, negative social attitudes, such as concerns about job security or benefits for temporary workers, can create headwinds. If the public perceives contract work as exploitative or unstable, it can deter businesses from utilizing staffing services and discourage skilled professionals from engaging with them. GEE Group's brand reputation is therefore closely tied to its ability to demonstrate the value and fairness of the opportunities it facilitates. In 2025, industry reports highlighted that companies prioritizing worker welfare and offering clear career progression pathways through staffing agencies experienced higher retention rates and stronger client satisfaction.

- Growing acceptance of flexible work: In 2024, over 30% of the U.S. workforce engaged in contingent work, signaling a positive trend for staffing agencies.

- Impact of negative perceptions: Concerns about job security and benefits can deter both clients and candidates, posing challenges for GEE Group.

- Brand reputation is key: Demonstrating value and fairness in contract roles is crucial for building trust and attracting talent and clients.

- Worker welfare correlation: Companies offering better welfare and progression through staffing agencies saw improved retention and client satisfaction in 2025.

Sociological factors significantly shape the employment landscape, influencing workforce demographics and expectations. The aging workforce, with the U.S. seeing about 22% of workers aged 55+ in 2024, brings experience but requires policy adjustments. Conversely, Gen Z's entry by 2025 brings new demands for flexibility and social responsibility. GEE Group must adapt to these generational shifts to attract and retain talent effectively.

Diversity and inclusion are increasingly vital, with companies in 2024 focusing on broader recruitment to leverage varied skills. The demand for work-life balance is also paramount, with many job seekers prioritizing flexibility, even at a salary cost, making remote and hybrid roles essential for GEE Group to offer. The rise of the gig economy, with over 60 million Americans freelancing by 2024, directly benefits staffing firms like GEE Group by expanding the available talent pool.

The persistent skills gap, particularly in technology, remains a challenge, with 82% of employers facing worker shortages in 2024. Educational trends are shifting towards digital literacy and adaptability, preparing graduates for future roles, a trend GEE Group can capitalize on by partnering with innovative institutions. Public sentiment towards flexible work is generally positive, with over 30% of the U.S. workforce in contingent roles in 2024, benefiting staffing agencies.

| Sociological Factor | 2024/2025 Data Point | Implication for GEE Group |

| Aging Workforce | ~22% of US workers aged 55+ (2024) | Need for policies supporting experienced workers. |

| Gen Z Entry | Significant workforce portion by 2025 | Adapt to new expectations on flexibility and social impact. |

| Work-Life Balance Demand | High priority for job seekers | Offer and highlight flexible/remote positions. |

| Gig Economy Growth | >60 million US freelancers (2024) | Expanded talent pool for contract roles. |

| Skills Gap | 82% of employers face shortages (2024) | Focus on sourcing and training for in-demand skills. |

| Contingent Work Acceptance | >30% US workforce in contingent roles (2024) | Positive market for staffing services. |

Technological factors

The recruitment industry is rapidly integrating automation and AI, transforming how companies like GEE Group find talent. Tools now excel at sifting through applications, matching candidates to roles, and even scheduling interviews, significantly streamlining operations. This technological shift is expected to boost efficiency and reduce hiring costs.

For GEE Group, embracing AI in recruitment isn't just about efficiency; it's a strategic imperative. A report by Gartner in 2024 predicted that AI in HR could save businesses up to 30% on recruitment costs by automating repetitive tasks. Companies that fail to adopt these advancements risk falling behind competitors who can hire faster and more effectively.

The digital landscape, with its myriad of platforms and online job boards, has fundamentally reshaped talent acquisition. For GEE Group, this means a dual opportunity and challenge: leveraging these channels for robust candidate sourcing and enhanced client visibility, while also contending with direct hiring by companies bypassing recruitment agencies. A strong, active online presence across professional networking sites and niche job boards is no longer optional but a core necessity for staying competitive in the 2024-2025 hiring market.

Data analytics is revolutionizing how companies like GEE Group anticipate their staffing needs. By analyzing vast datasets, they can pinpoint future skill gaps and market demands, allowing for proactive recruitment. For instance, in 2024, the demand for AI and machine learning specialists saw a significant surge, a trend that predictive analytics could have flagged early.

This technological edge enables GEE Group to optimize recruitment strategies, not just by finding candidates faster, but by identifying those with the highest potential for retention. Understanding market trends through data helps them offer more effective talent solutions to their clients, ensuring they have the right people at the right time.

Leveraging big data allows for more informed, data-driven decisions across the board. GEE Group can use these insights to forecast demand more accurately, potentially reducing time-to-fill metrics which, in 2023, averaged around 42 days for many specialized roles, and improving overall client satisfaction.

Cybersecurity and Data Privacy

For GEE Group, maintaining strong cybersecurity and adhering to data privacy is critical, especially given the sensitive client and candidate information they manage. As of 2024, the global cost of data breaches reached an average of $4.45 million, highlighting the significant financial risk involved. Staying ahead of evolving threats requires continuous investment in secure IT infrastructure and compliance with regulations like GDPR and CCPA, which govern data handling practices.

Technological advancements in data protection are not just a necessity but a competitive advantage. A recent report indicated that companies with mature cybersecurity programs are 80% less likely to experience a significant breach. This focus on security builds trust with stakeholders and mitigates severe legal and reputational damage that could arise from data compromises.

GEE Group's commitment to these areas can be seen through their proactive approach:

- Investment in advanced encryption and multi-factor authentication systems.

- Regular security audits and vulnerability assessments.

- Ongoing training for employees on data protection best practices.

- Development of robust incident response plans.

Remote Work Technologies

The surge in remote work technologies, such as Zoom, Microsoft Teams, and Slack, has fundamentally altered talent acquisition. GEE Group can now tap into a global talent pool, a significant advantage in 2024 and 2025, as companies continue to embrace flexible work arrangements. This broadens the candidate base exponentially.

However, this shift necessitates that GEE Group ensures both clients and candidates possess the requisite technological infrastructure for seamless remote collaboration. A recent survey indicated that over 70% of companies now offer hybrid or fully remote work options, highlighting the critical need for robust digital capabilities across the board.

This technological evolution directly impacts GEE Group's operational models and service delivery. The company must adapt its processes to facilitate effective remote onboarding, training, and ongoing support, ensuring productivity and engagement for placed candidates regardless of location.

- Global Talent Access: Remote work technologies allow GEE Group to source candidates from anywhere, significantly expanding the available talent pool.

- Infrastructure Requirements: Clients and candidates need reliable internet, suitable hardware, and proficiency with collaboration tools for successful remote placements.

- Operational Adaptations: GEE Group must refine its service delivery to support remote work environments, including virtual onboarding and communication strategies.

- Market Trend: As of early 2025, approximately 60% of the workforce participates in some form of remote or hybrid work, underscoring the importance of these technologies.

Technological advancements are reshaping the recruitment landscape, with AI and automation becoming key drivers of efficiency for firms like GEE Group. By leveraging these tools, recruitment processes are becoming faster and more cost-effective, with Gartner projecting up to 30% savings in recruitment costs by 2024. The digital realm also presents opportunities for broader candidate sourcing and client engagement, though it necessitates a strong online presence to counter direct hiring trends.

Data analytics empowers GEE Group to proactively identify future skill demands, as seen with the 2024 surge in AI specialists. This predictive capability enhances talent solutions by focusing on candidate retention and optimizing recruitment strategies. For instance, utilizing big data can help reduce the average time-to-fill for specialized roles, which stood at around 42 days in 2023, thereby improving client satisfaction.

Cybersecurity and data privacy are paramount, with global data breach costs averaging $4.45 million in 2024. GEE Group's investment in advanced security measures and compliance with regulations like GDPR is crucial for building trust and mitigating risks. Companies with robust cybersecurity are 80% less likely to face significant breaches.

The rise of remote work technologies has expanded GEE Group's access to a global talent pool, with roughly 60% of the workforce engaged in remote or hybrid work as of early 2025. This trend requires GEE Group to adapt its service delivery, ensuring effective virtual onboarding and communication to support a geographically dispersed workforce.

| Technology Area | Impact on GEE Group | Key Data/Trend (2024-2025) | Strategic Implication |

|---|---|---|---|

| AI & Automation | Streamlined recruitment, cost reduction | Projected 30% recruitment cost savings (Gartner, 2024) | Enhanced efficiency, competitive hiring speed |

| Digital Platforms | Expanded candidate sourcing, client visibility | Increased reliance on professional networks for talent | Necessity for strong online presence |

| Data Analytics | Predictive workforce planning, skill gap identification | Surge in demand for AI/ML specialists (2024) | Proactive talent solutions, improved retention focus |

| Cybersecurity | Data protection, trust building | Average data breach cost: $4.45M (2024) | Mitigation of financial and reputational risk |

| Remote Work Tech | Global talent access, flexible work support | ~60% workforce in remote/hybrid work (early 2025) | Adaptation of service delivery for virtual environments |

Legal factors

GEE Group navigates a dynamic landscape of labor and employment laws, encompassing fair wages, overtime, anti-discrimination statutes, and Occupational Safety and Health Administration (OSHA) mandates. Failure to comply can result in significant fines; for instance, in 2024, the U.S. Department of Labor continued to enforce wage and hour laws rigorously, with penalties often calculated based on back wages owed and liquidated damages.

Maintaining compliance is paramount for GEE Group to prevent costly legal battles and protect its brand reputation. The company must ensure all its staffing solutions, whether for temporary or permanent roles, align with evolving legal requirements, which can vary significantly by state and even city. For example, minimum wage laws saw adjustments in numerous states throughout 2024, impacting payroll calculations for many of GEE Group's placements.

Worker classification is a critical legal area for staffing firms like GEE Group. Misclassifying workers as independent contractors when they should be employees can result in substantial penalties, including back taxes, unpaid overtime, and legal fees. For instance, the IRS reported that worker misclassification continues to be a significant compliance issue, with many businesses facing audits and penalties.

GEE Group must diligently adhere to both federal and state regulations concerning worker classification. This is especially true as legal interpretations, particularly in light of the growing gig economy, continue to evolve. A 2024 report indicated an increase in state-level enforcement actions against companies for worker misclassification, highlighting the heightened risk.

Ensuring correct classification directly influences GEE Group's operational costs, risk exposure, and overall business model sustainability. Failure to comply can lead to costly litigation and damage to the company's reputation, impacting its ability to attract and retain both clients and talent.

GEE Group's operations are significantly shaped by data privacy and protection laws. As a company that processes substantial personal data for both job seekers and clients, adherence to regulations like the General Data Protection Regulation (GDPR) for European data and the California Consumer Privacy Act (CCPA) is non-negotiable. These laws mandate secure data handling, clear usage policies, and explicit consent, with non-compliance carrying the risk of substantial financial penalties, such as the potential €20 million or 4% of global annual turnover fines under GDPR.

Anti-Discrimination and Equal Opportunity Laws

GEE Group must navigate a complex landscape of anti-discrimination and equal opportunity legislation. These laws, which prohibit bias in hiring and employment based on factors like race, gender, age, religion, and disability, are fundamental to fair business operations.

Adherence to these legal frameworks is paramount for GEE Group, ensuring that recruitment and placement practices are equitable and unbiased. This commitment extends beyond mere compliance, fostering an ethical business environment and safeguarding the company's reputation.

- Legal Mandates: GEE Group is legally obligated to comply with federal, state, and local anti-discrimination statutes. For instance, the Equal Employment Opportunity Commission (EEOC) reported that in fiscal year 2023, it received over 100,000 charges of workplace discrimination.

- Fair Hiring Practices: Implementing objective and merit-based selection processes is crucial to avoid discriminatory outcomes. This includes standardized interview questions and diverse hiring panels.

- Reputational Impact: Demonstrating a commitment to equal opportunity can enhance GEE Group's brand image, attracting a wider talent pool and improving employee morale.

- Risk Mitigation: Non-compliance can lead to significant legal penalties, including fines and lawsuits, as well as damage to the company's public perception.

Industry-Specific Regulations and Licensing

GEE Group's operations, particularly in sectors like healthcare staffing, necessitate adherence to industry-specific regulations and licensing. For example, healthcare staffing firms must often comply with stringent credentialing standards and background check requirements to ensure patient safety and regulatory compliance. Failure to meet these specialized demands can lead to penalties and operational disruptions.

These niche regulations extend beyond general employment law, impacting how GEE Group sources, vets, and places candidates in specialized fields. For instance, in 2024, the healthcare staffing market continued to be shaped by evolving compliance mandates around worker classification and data privacy, particularly concerning patient information. Staying ahead of these changes is crucial for maintaining legal standing and market trust.

- Healthcare Staffing Compliance: Regulations often mandate specific background checks, drug screenings, and verification of professional licenses for healthcare professionals.

- Financial Services Scrutiny: If GEE Group places professionals in finance, they might face regulations related to financial conduct and data security.

- Data Privacy Laws: Compliance with regulations like HIPAA for healthcare or GDPR for European placements is paramount, impacting how candidate data is handled.

- State-Specific Licensing: Certain states may have unique licensing or registration requirements for staffing agencies operating within their borders.

GEE Group must navigate a complex web of contractual obligations and potential litigation. Ensuring clear, legally sound contracts with both clients and temporary employees is vital to prevent disputes over terms of service, payment, and liability. In 2024, the legal landscape saw continued emphasis on contract enforceability, with courts often scrutinizing ambiguous clauses.

The company's risk management strategy must include robust procedures for contract review and dispute resolution. Failure to manage contractual relationships effectively can lead to costly legal battles and financial penalties, impacting GEE Group's profitability and operational stability.

GEE Group's commitment to compliance with intellectual property laws is also essential. Protecting its own proprietary information and ensuring it does not infringe on the intellectual property rights of others is critical for maintaining its competitive edge and avoiding legal challenges.

In the staffing industry, specific legal frameworks govern the relationship between agencies, clients, and workers, often involving joint employer liability considerations. GEE Group must stay abreast of evolving interpretations of these laws, as demonstrated by ongoing legal discussions and rulings throughout 2024 regarding shared responsibility for worker treatment.

Environmental factors

Societal and client demands for corporate social responsibility (CSR) and sustainability are increasingly shaping how companies like GEE Group operate and are perceived. This means a strong commitment to environmental, social, and governance (ESG) principles is becoming a key differentiator.

While GEE Group's direct environmental footprint might be less significant than heavy industry, clients are actively seeking partners who align with their own sustainability goals. For instance, a 2024 survey by Accenture found that 72% of consumers are more likely to buy from companies that demonstrate strong sustainability practices, impacting GEE Group's client acquisition and retention strategies.

Integrating CSR, such as reducing office energy consumption or supporting remote work to lower travel emissions, enhances GEE Group's brand appeal. This focus can lead to a competitive advantage, as evidenced by the growing trend of ESG investing, where sustainable companies often see better financial performance and lower cost of capital.

Resource scarcity, while not directly impacting GEE Group's core staffing services, can indirectly influence demand. For instance, if key client industries face production slowdowns due to limited access to critical resources, their need for temporary or permanent staff may decline. This ripple effect highlights how environmental constraints on other sectors can shape the labor market.

Moreover, even for a service-oriented company like GEE Group, the availability and cost of essential operational resources are subject to environmental pressures. Fluctuations in energy prices, driven by climate events or geopolitical factors affecting supply, can directly increase overheads. Similarly, the cost and accessibility of office supplies and technology, often reliant on raw materials, can also be impacted, affecting the company's bottom line.

Climate change is a growing concern, with extreme weather events like heatwaves and floods becoming more frequent. For GEE Group, this means potential disruptions for both their offices and their clients' operations. Imagine a severe storm causing temporary office closures or making it hard for employees to get to work. This instability can directly impact client businesses, potentially reducing the demand for staffing services.

The financial implications are also significant. For instance, the World Meteorological Organization reported that weather and climate disasters caused over $100 billion in economic losses globally in 2023 alone. This highlights the need for GEE Group to proactively develop robust contingency plans to navigate these environmental challenges and ensure business continuity.

Waste Management and Recycling Initiatives

As an office-based service provider, GEE Group recognizes its environmental duty concerning waste management. Implementing effective recycling programs, reducing paper consumption, and championing digital workflows are key to cultivating a favorable environmental impact. For instance, many companies in 2024 are reporting significant reductions in paper usage through digital transformation initiatives, with some aiming for a 30% decrease in paper-based processes by year-end.

Adhering to local waste disposal regulations is paramount, and actively seeking ways to lessen environmental impact resonates with increasing societal and stakeholder expectations. Companies are increasingly investing in sustainable waste management solutions, with the global waste management market projected to reach USD 664.3 billion by 2030, indicating a growing focus on this area.

- Recycling Programs: Enhancing office recycling for paper, plastics, and electronics.

- Paper Reduction: Promoting digital document management and double-sided printing.

- Waste Minimization: Implementing strategies to reduce overall office waste generation.

- Regulatory Compliance: Ensuring strict adherence to all local waste disposal laws.

Regulatory Pressure for Green Practices

While GEE Group operates primarily in the service sector, where environmental impact might seem less direct than manufacturing, regulatory pressure for green practices is a significant factor. Governments worldwide are increasingly implementing policies that encourage or mandate environmentally responsible business operations. For instance, the European Union’s Corporate Sustainability Reporting Directive (CSRD), which began applying to larger companies in fiscal year 2024, requires extensive reporting on environmental, social, and governance (ESG) matters. This trend is expected to cascade, influencing service-based industries.

Clients, too, are becoming more discerning, often favoring companies that demonstrate a commitment to sustainability. This client-driven demand can be as powerful as regulatory mandates. GEE Group can anticipate future regulations potentially requiring more detailed environmental impact reporting or offering incentives for adopting greener operational models, even for service-oriented businesses. Staying ahead of these trends by proactively integrating sustainable practices is crucial.

By embracing sustainability, GEE Group can position itself advantageously. This includes:

- Developing clear sustainability reporting frameworks: Aligning with evolving standards like those from the Global Reporting Initiative (GRI) or Task Force on Climate-related Financial Disclosures (TCFD).

- Reducing operational carbon footprint: Implementing strategies for energy efficiency in offices, promoting remote work where feasible, and encouraging sustainable travel options for employees.

- Engaging with supply chain partners: Encouraging or requiring suppliers to adopt their own green practices, thereby extending the positive environmental impact.

- Communicating sustainability efforts: Clearly articulating GEE Group's commitment to environmental responsibility to clients and stakeholders, potentially leading to new business opportunities and enhanced brand reputation.

Environmental factors are increasingly influencing business operations, even for service-based companies like GEE Group. Growing societal demand for corporate social responsibility (CSR) and sustainability means a strong commitment to ESG principles is becoming crucial for client acquisition and retention, as 72% of consumers in a 2024 Accenture survey favored sustainable companies.

While GEE Group's direct environmental footprint might be smaller than heavy industry, indirect impacts like resource scarcity affecting client industries or increased operational costs due to energy price volatility are significant. The World Meteorological Organization reported over $100 billion in global economic losses from weather and climate disasters in 2023, underscoring the need for robust contingency planning.

Regulatory pressures are also mounting, with directives like the EU's CSRD (effective 2024) mandating extensive ESG reporting. GEE Group can proactively enhance its brand by focusing on waste minimization, paper reduction through digital workflows, and adhering to disposal regulations, mirroring industry trends where the waste management market is projected to reach USD 664.3 billion by 2030.

By adopting clear sustainability reporting, reducing its carbon footprint, engaging its supply chain, and communicating its efforts, GEE Group can gain a competitive advantage and align with evolving stakeholder expectations.

| Environmental Factor | Impact on GEE Group | Example/Data Point (2024/2025) |

| Climate Change & Extreme Weather | Operational disruptions, reduced client demand | Over $100 billion in global economic losses from weather/climate disasters in 2023 (WMO) |

| Resource Scarcity | Indirect impact on client industries, potentially reducing staffing needs | |

| Energy Price Volatility | Increased operational overheads | |

| Regulatory Mandates (ESG Reporting) | Need for compliance and transparent reporting | EU's CSRD effective for large companies from FY2024 |

| Consumer & Client Demand for Sustainability | Competitive advantage, client retention | 72% of consumers more likely to buy from sustainable companies (Accenture, 2024) |

| Waste Management | Operational costs, regulatory compliance, brand image | Global waste management market projected to reach USD 664.3 billion by 2030 |

PESTLE Analysis Data Sources

Our PESTLE analysis is built upon a robust foundation of data, drawing from official government publications, reputable financial institutions like the World Bank and IMF, and leading industry research firms. This ensures each factor, from political stability to technological advancements, is informed by credible and current information.