Gee Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gee Group Bundle

Understanding the forces shaping Gee Group's market is crucial for strategic success. This analysis highlights the intense rivalry and the significant bargaining power of buyers within their industry. The threat of substitutes also looms large, demanding constant innovation and differentiation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Gee Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The scarcity of specialized talent, especially in fields like advanced IT, niche engineering, or specific healthcare professions, directly amplifies supplier bargaining power. When highly skilled individuals are in short supply, they command higher wages and better working conditions, giving them significant leverage. For GEE Group, retaining these specialized professionals is crucial for maintaining service quality and profitability.

Candidate mobility and switching costs significantly influence the bargaining power of suppliers in the staffing industry. For GEE Group, this means that candidates typically face very low barriers when moving between different staffing agencies or choosing direct employment. This ease of movement inherently strengthens their negotiating position.

Candidates can readily apply to numerous firms or explore direct hiring options if the terms offered by a specific agency, like GEE Group, are not appealing or competitive. In 2024, the demand for skilled labor across many sectors remained robust, further empowering candidates to be selective. For instance, reports from the Bureau of Labor Statistics in late 2024 indicated continued growth in sectors like healthcare and technology, where specialized talent is highly sought after.

Consequently, GEE Group must consistently provide attractive placement opportunities, competitive compensation packages, and robust support systems to retain its valuable pool of qualified professionals. Failure to do so could lead to a higher attrition rate as candidates are easily lured by more favorable offers elsewhere, impacting the group's ability to fulfill client needs.

GEE Group's employer brand directly impacts its ability to secure quality candidates, a key resource. A strong reputation as a desirable workplace for recruitment professionals can lessen the bargaining power of individual recruiters or small agencies that might otherwise dictate terms. For instance, if GEE Group is consistently ranked among the top staffing firms to work for, it can attract talent without offering excessively high commission splits or benefits.

Impact of Gig Economy Platforms

The proliferation of gig economy platforms significantly influences the bargaining power of suppliers, particularly in the staffing and recruitment sector where GEE Group operates. These platforms offer independent contractors and freelancers direct access to a broad client base, reducing their reliance on traditional intermediaries like GEE Group. This shift empowers these professionals to negotiate terms and rates more assertively, as they have readily available alternatives for securing work.

For instance, platforms such as Upwork and Fiverr connect businesses directly with freelance talent, creating a competitive landscape where staffing firms must differentiate themselves. GEE Group, therefore, faces increased pressure to demonstrate its unique value proposition to both its candidate pool and its clients. This means offering more than just job matching; it involves providing specialized services, robust vetting processes, and streamlined onboarding that justify their fees over direct engagement models.

The ability of professionals to bypass traditional channels means GEE Group must actively cultivate strong relationships and offer compelling benefits.

- Increased Candidate Leverage: Freelancers and independent contractors on gig platforms can often command higher rates due to direct client negotiation.

- Platform Competition: Platforms like Upwork and Fiverr directly compete with staffing agencies for talent and client business.

- GEE Group's Value Proposition: The company must highlight its added value, such as specialized recruitment expertise and compliance management, to retain clients and candidates.

Candidate Skill Obsolescence

In sectors like technology, where change is constant, skills can become outdated very quickly. This means candidates with older skill sets might have less leverage. For GEE Group, understanding what skills will be needed in the future is crucial. They might even need to help their talent pool learn new skills to stay relevant.

This forward-thinking strategy ensures GEE Group always has candidates with the right abilities. It also helps the company stay ahead of its competitors. For instance, as of early 2024, the demand for AI and machine learning expertise has surged, making candidates with these skills highly sought after, while traditional IT support roles might see a decline in demand and thus reduced candidate bargaining power if they haven't upskilled.

- Candidate Skill Obsolescence Impact: In fast-paced industries, the rapid depreciation of technical skills can diminish a candidate's negotiating power.

- GEE Group's Strategic Imperative: Proactive investment in identifying future skill requirements and providing reskilling programs is essential for maintaining a competitive talent pipeline.

- Market Trend Example (2024): The heightened demand for AI/ML specialists contrasts with potentially lower demand for legacy system administrators, illustrating the impact of skill obsolescence on bargaining power.

The bargaining power of suppliers, particularly specialized talent, significantly impacts GEE Group. When skilled professionals are scarce, they can demand higher compensation and better terms, as seen in the robust 2024 demand for IT and healthcare workers. This leverage is amplified by low switching costs for candidates, allowing them to easily move to competitors offering more attractive packages. GEE Group must therefore focus on its employer brand and offer competitive benefits to retain its valuable talent pool.

What is included in the product

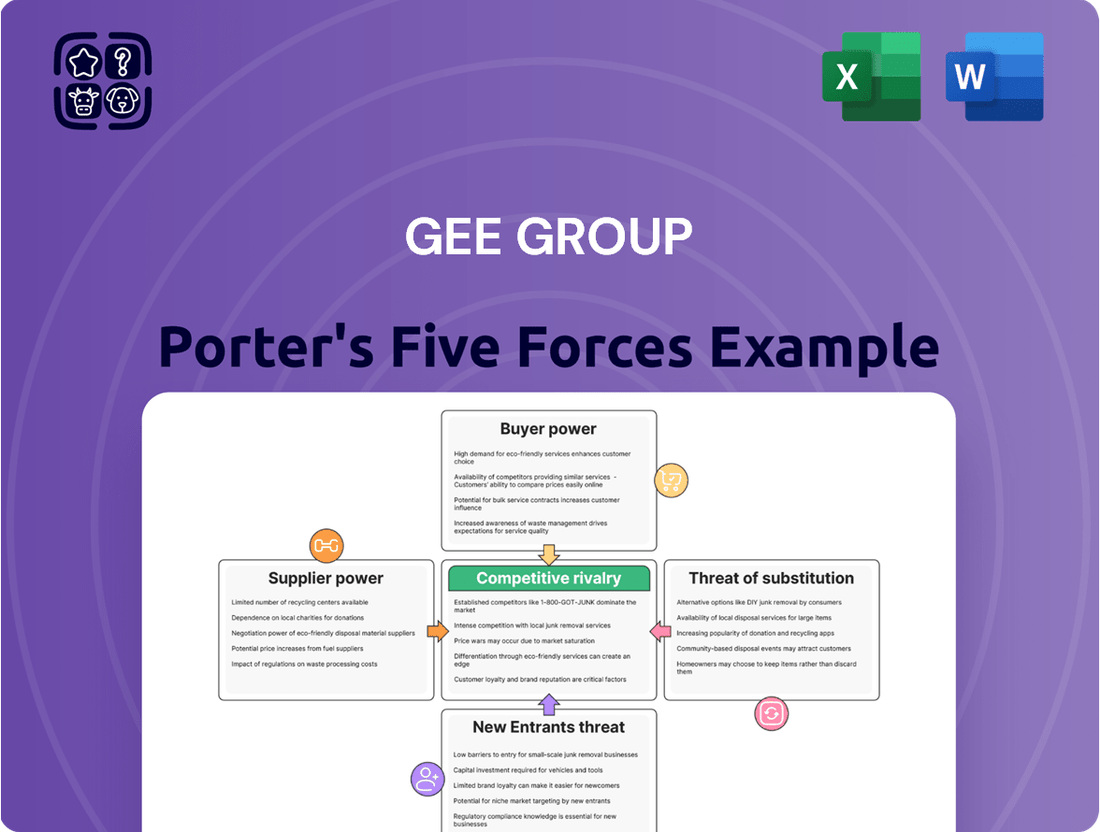

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Gee Group, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces.

Customers Bargaining Power

Large corporate clients, particularly those with substantial and consistent staffing requirements, wield considerable bargaining power. Their ability to offer significant business volume allows them to negotiate for better pricing, tailored service agreements, and extended payment schedules. For instance, GEE Group must carefully manage its relationships with these key accounts, ensuring that the pursuit of large contracts does not compromise its profitability. In 2023, GEE Group reported revenue of $120.5 million, highlighting the importance of these large customer relationships.

The staffing industry's highly fragmented nature, with countless providers from global giants to niche specialists, means customers have a wide array of choices. This abundance directly translates to increased bargaining power for clients, as they can readily switch to a different staffing agency if they are unhappy with GEE Group's service, pricing, or the caliber of candidates provided. For instance, in 2024, the global staffing market was valued at over $600 billion, underscoring the intense competition and the multitude of options available to businesses seeking talent.

This competitive landscape compels GEE Group to actively differentiate its offerings. Focusing on service excellence, building strong client relationships, and developing specialized expertise in particular industries or skill sets are crucial strategies. By demonstrating unique value, GEE Group can mitigate the inherent power of customers who can easily leverage alternative staffing solutions.

Many companies possess capable internal human resources departments that can handle direct hiring, especially for full-time roles. This internal capacity serves as a significant alternative to using external staffing firms, giving clients leverage to negotiate better terms or decrease their dependence on agencies.

For GEE Group, this means they need to clearly show how their services are more cost-effective and efficient than a business's own recruitment efforts. For instance, if a company can fill a role internally for $5,000 and GEE Group charges $8,000, GEE Group needs to highlight the time savings, quality of candidates, or reduced risk that justifies the higher cost.

In 2024, the average cost to hire for a company in the US was reported to be around $4,700, according to some industry estimates. GEE Group must therefore present a compelling value proposition that demonstrates how their specialized expertise or access to a wider talent pool can ultimately lower the total cost of acquisition for their clients, even if the upfront fee appears higher.

Switching Costs for Customers

Switching costs for customers in the staffing industry, including for GEE Group, are typically quite low. While there might be some administrative effort involved in changing providers, the direct financial barriers to switching are generally minimal. This low switching cost significantly amplifies customer bargaining power.

The ease with which clients can move from one staffing agency to another means GEE Group must remain highly competitive on service quality and responsiveness. For instance, if a client finds another provider offering better candidate matching or faster fulfillment times with little to no upfront cost, they are likely to switch. This dynamic necessitates a continuous focus on client satisfaction and operational excellence.

- Low Financial Switching Costs: Customers generally do not incur significant financial penalties or investments when changing staffing providers.

- Administrative Inconvenience: The primary barrier is the administrative task of onboarding a new vendor, which is usually manageable.

- Enhanced Customer Power: Low switching costs empower customers to demand better pricing and service, as alternatives are readily available.

- GEE Group's Response: To counter this, GEE Group focuses on building strong client relationships and integrating its services deeply into client operations to create stickiness.

Importance of Staffing to Customer Operations

The criticality and time-sensitivity of a client's need for talent significantly influence their bargaining power with GEE Group. When a client faces severe operational disruptions due to a lack of immediate staffing, their ability to negotiate aggressively on price or terms diminishes, as securing qualified personnel quickly becomes paramount. This dynamic is particularly pronounced for specialized or urgent placements where GEE Group’s efficiency and expertise are highly valued.

GEE Group's capacity to rapidly fulfill essential staffing requirements directly strengthens its position against customer bargaining power. Clients whose operations would be critically impacted by staffing shortages are inherently more motivated to accept GEE Group's terms, prioritizing the speed and quality of placement over cost savings. For instance, in industries with high demand for skilled labor, such as IT or healthcare, a delay in filling a key position can result in substantial revenue loss for the client, making GEE Group's swift placement a critical service.

- Criticality of Need: Clients requiring immediate or highly specialized talent have less leverage.

- Operational Impact: The greater the negative impact of unfilled roles, the weaker the client's bargaining position.

- GEE Group's Value: Rapid and accurate placements enhance GEE Group's ability to command favorable terms.

- Industry Examples: In sectors like technology, where project timelines are tight, clients are less likely to haggle over fees for essential personnel.

Customers, especially large corporations with significant staffing needs, possess substantial bargaining power. Their ability to offer consistent business volume allows them to negotiate for better pricing and tailored service agreements. For example, GEE Group's 2023 revenue of $120.5 million underscores the importance of managing these key client relationships effectively to maintain profitability.

The highly competitive staffing market, valued at over $600 billion globally in 2024, provides customers with numerous alternatives, increasing their leverage. This fragmentation means clients can easily switch providers if dissatisfied with GEE Group's service or pricing, compelling the company to focus on differentiation through service excellence and specialized expertise.

Internal HR departments can also handle recruitment, especially for permanent roles, presenting an alternative to external agencies. This capability gives clients negotiating power, as they can reduce reliance on staffing firms. For instance, with the average US hiring cost around $4,700 in 2024, GEE Group must clearly demonstrate how its services offer superior value, justifying any cost difference.

Low switching costs in the staffing industry further amplify customer power. Clients can change providers with minimal financial or administrative hurdles, necessitating GEE Group's focus on client satisfaction and operational efficiency to retain business.

| Factor | Impact on GEE Group | Customer Bargaining Power |

|---|---|---|

| Client Size & Volume | Large clients have leverage for better terms. | High |

| Market Competition | Numerous alternatives empower clients to switch. | High |

| Internal Recruitment Capability | Clients can bypass agencies for some roles. | Moderate |

| Switching Costs | Minimal barriers allow easy provider changes. | High |

What You See Is What You Get

Gee Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of the Gee Group. You'll gain detailed insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The staffing industry, where GEE Group operates, is notably fragmented. This means there are many companies of varying sizes, from small local agencies to large international corporations, all vying for business. This sheer number of competitors creates a highly competitive environment.

GEE Group faces rivals that include massive publicly traded staffing firms as well as smaller, specialized agencies focusing on specific industries or skill sets. This diverse competitive landscape means GEE Group must constantly adapt its strategies to stand out against a wide array of players.

In 2024, the staffing industry saw continued intense competition, particularly for generalist positions. Companies often resort to competing on price to win contracts, which can put pressure on profit margins for all involved. For example, the average bill rate for temporary administrative roles can fluctuate significantly based on local market supply and demand.

The staffing industry's growth rate is intrinsically linked to broader economic trends, meaning periods of slower economic expansion naturally lead to heightened competitive rivalry. When the overall market is not growing quickly, companies like GEE Group find themselves fighting harder for each available contract and candidate. This intensified competition can put pressure on pricing and margins.

For instance, during economic downturns, the demand for temporary and contract workers often decreases, forcing staffing firms to compete for a smaller pie. This dynamic was evident in 2023, where many sectors saw reduced hiring activity, directly impacting the revenue streams of staffing agencies. GEE Group, like its peers, must be agile in its strategic planning to navigate these cyclical shifts.

Competitive rivalry intensifies when services are seen as interchangeable, pushing companies to compete primarily on price. GEE Group’s strategic focus on niche sectors such as IT, engineering, and healthcare provides a degree of differentiation through specialized expertise and access to high-quality talent. For instance, in 2024, the IT staffing sector alone was projected to reach over $70 billion in the US, highlighting the scale and competitive nature of even a single specialized area.

However, sustaining this differentiation demands ongoing commitment to enhancing recruiter skills and refining talent sourcing methods. This is crucial as clients increasingly seek partners who understand the nuances of their specific industries. GEE Group’s ability to consistently deliver specialized talent in these competitive markets directly impacts its ability to command premium pricing and maintain client loyalty.

Switching Costs for Clients

The staffing industry, including players like GEE Group, generally faces low switching costs for clients. This means businesses can readily shift their recruitment partners if they find better service, faster placements, or a more suitable candidate pool elsewhere. For GEE Group, this translates to a continuous need to excel in service quality, speed, and the accuracy of candidate matches to retain business.

The ease with which clients can switch agencies intensifies the competitive pressure on GEE Group. They must consistently deliver superior performance to prevent client attrition. For instance, if a competitor offers a more streamlined onboarding process or a wider network of specialized talent, a client might be tempted to switch, especially if GEE Group's service falters.

- Low Switching Costs: Clients can easily change staffing agencies, putting pressure on GEE Group to maintain high service standards.

- Competitive Pressure: Dissatisfied clients can quickly move to competitors, requiring GEE Group to focus on client retention through excellent service delivery.

- Relationship Building: GEE Group can mitigate low switching costs by fostering strong client relationships and offering value-added, integrated staffing solutions that create stickiness.

Exit Barriers

Exit barriers for companies like GEE Group in the staffing industry are generally considered low. This means that if a company is not performing well or decides to exit the market, it can do so without incurring substantial costs or facing significant obstacles. This relative ease of departure can sometimes temper intense competition as struggling firms can leave.

However, this low exit barrier is often counterbalanced by low entry barriers. New, smaller companies can enter the staffing market relatively easily, which can keep the overall level of rivalry high. For GEE Group, this dynamic necessitates a constant focus on operational efficiency and superior service to maintain its competitive edge.

For instance, in 2024, the staffing industry continued to see a dynamic landscape. While specific exit barrier data for GEE Group isn't publicly detailed, industry trends suggest that asset-specific investments in proprietary technology or specialized recruitment databases could create moderate exit barriers for highly specialized firms. Conversely, general staffing agencies often face fewer such hurdles.

- Low Exit Barriers: Staffing firms can typically exit the market with fewer financial penalties compared to industries with heavy, specialized capital investments.

- Offsetting Entry Barriers: The ease with which new, smaller competitors can enter the market helps maintain a competitive and often crowded industry structure.

- Operational Focus: GEE Group’s strategy must emphasize continuous improvement in service delivery and cost management to thrive amidst this competitive environment.

The competitive rivalry within the staffing industry, where GEE Group operates, is intense due to a fragmented market with numerous players, from large corporations to specialized agencies. This fragmentation means companies often compete on price, especially for generalist roles, which can squeeze profit margins. For example, in 2024, the IT staffing sector alone was a multi-billion dollar market, showcasing the scale and fierce competition even within specialized niches.

GEE Group faces constant pressure from rivals, amplified by low switching costs for clients who can easily move to competitors offering better service or talent pools. This necessitates a relentless focus on service quality and client retention. The ease of entry for new firms also contributes to a crowded marketplace, requiring GEE Group to maintain operational efficiency and a strong value proposition to stand out.

| Factor | Impact on GEE Group | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | High rivalry, price competition | Numerous small and large agencies competing |

| Switching Costs | Pressure to retain clients with superior service | Clients can easily change providers if dissatisfied |

| Entry Barriers | Continuous need for efficiency and differentiation | New firms can enter the market relatively easily |

| Service Interchangeability | Risk of competing solely on price | Specialization in IT, engineering, healthcare aims to differentiate |

SSubstitutes Threaten

Internal recruitment, managed by a company's own HR department, presents a direct substitute for external staffing agencies like GEE Group. This in-house capability is particularly prevalent for filling permanent roles, allowing businesses to leverage existing infrastructure and personnel.

For larger corporations with robust HR departments, internal hiring often serves as a cost-effective alternative. These departments can manage the entire recruitment lifecycle, from sourcing candidates to onboarding, potentially reducing the fees associated with third-party recruiters.

GEE Group must therefore emphasize its unique value proposition, showcasing how its specialized expertise, wider talent reach, and efficiency in filling roles, especially for niche or high-volume temporary positions, surpass the capabilities and cost-effectiveness of internal HR efforts.

The rise of online job boards and professional networks presents a significant threat of substitution for staffing agencies like GEE Group. Platforms such as LinkedIn and Indeed allow companies to directly post jobs and find candidates, bypassing the need for third-party recruiters. This trend offers a cost-effective solution for businesses, as evidenced by the vast number of job postings and active users on these sites. For example, Indeed reported over 250 million unique visitors per month as of early 2024, highlighting its reach.

GEE Group's competitive edge must therefore shift from basic candidate sourcing to offering superior value. This includes rigorous candidate vetting, access to specialized talent pools that might be harder to find through general platforms, and demonstrating superior placement speed and quality. The challenge is to prove that the expertise and efficiency of a staffing firm justify its fees compared to the seemingly free or low-cost alternatives available online.

The rise of freelance and gig economy platforms like Upwork and Fiverr presents a significant threat of substitutes for traditional staffing agencies. These platforms directly connect businesses with a vast pool of independent contractors, offering a more agile and often cost-effective solution for project-based needs. This disintermediation challenges GEE Group's traditional model.

Businesses are increasingly leveraging these platforms for their flexibility and direct access to specialized skills, bypassing the need for agency involvement. For instance, the gig economy continued its strong growth trajectory through 2024, with platforms reporting substantial increases in user engagement and transaction volumes, indicating a sustained shift in how companies source talent.

To counter this, GEE Group must emphasize its value proposition in providing rigorously vetted, reliable, and compliant talent, a crucial differentiator in a market often characterized by variable quality and potential legal complexities. Demonstrating superior quality assurance and risk mitigation will be key to retaining clients seeking more than just readily available labor.

Automation and Artificial Intelligence

Advancements in automation and artificial intelligence pose a significant threat of substitution for staffing services. As AI and robotic process automation become more sophisticated, they can increasingly handle routine and repetitive tasks that were previously performed by human workers. This could lead to a reduced demand for temporary or contract staff in sectors heavily reliant on such roles. For instance, in 2024, industries like manufacturing, data entry, and customer service are seeing increased adoption of these technologies.

The shift driven by automation means that the demand for human labor is moving towards roles that require critical thinking, problem-solving, creativity, and complex decision-making – skills that AI currently struggles to replicate. GEE Group needs to strategically position itself to cater to this evolving demand. This involves focusing on placing talent in specialized, high-skill areas that complement, rather than compete with, automated processes.

GEE Group's response to this threat should involve:

- Upskilling and Reskilling Initiatives: Partnering with clients to identify future skill needs and offering training programs to prepare the workforce for these evolving roles.

- Focus on Niche and High-Demand Sectors: Prioritizing placement in industries and job functions that are less susceptible to automation, such as healthcare, specialized IT, and creative fields.

- Talent Development for AI-Augmented Roles: Helping clients find individuals who can effectively work alongside AI systems, managing and interpreting their outputs.

Outsourcing and Offshoring

The threat of substitutes for GEE Group's services comes from outsourcing and offshoring, where companies can opt to move entire functions or operations to regions with lower labor costs. This bypasses the need for domestic staffing solutions and local talent acquisition, directly impacting demand for GEE Group's specialized recruitment and staffing services.

For instance, in 2024, the global outsourcing market continued its robust growth, with IT outsourcing alone projected to reach over $400 billion. This trend highlights the significant cost-saving appeal of outsourcing and offshoring as substitutes for traditional staffing models.

GEE Group must counter this threat by clearly articulating the unique advantages of its flexible staffing models and the value of local, specialized talent. Emphasizing benefits like enhanced quality control, improved communication, and quicker response times associated with domestic staffing can differentiate GEE Group from cost-driven offshore alternatives.

- Outsourcing and offshoring present a direct substitute threat by offering lower labor costs.

- The global IT outsourcing market's projected growth in 2024 to over $400 billion underscores this substitute's appeal.

- GEE Group needs to highlight the strategic advantages of local, specialized talent and flexible staffing.

- Communicating the benefits of domestic staffing over full outsourcing is crucial for GEE Group's competitive positioning.

The threat of substitutes for GEE Group's services is multifaceted, encompassing internal recruitment, online job platforms, freelance marketplaces, automation, and outsourcing/offshoring. These alternatives offer varying degrees of cost savings, flexibility, and direct access to talent, challenging traditional staffing models.

Online job boards like Indeed, with over 250 million monthly visitors in early 2024, directly compete by allowing companies to source candidates themselves, often at a lower perceived cost. Similarly, the gig economy's growth through 2024, with platforms reporting increased user engagement, provides agile, project-based talent solutions that bypass agencies.

Automation and AI are also emerging substitutes, particularly for routine tasks, shifting demand towards specialized skills. The global outsourcing market, projected to exceed $400 billion for IT outsourcing alone in 2024, further highlights the cost-driven substitution threat from offshore providers.

GEE Group must differentiate by emphasizing its value in specialized vetting, access to niche talent pools, and superior placement quality and speed, thereby justifying its fees against these often lower-cost or more direct alternatives.

Entrants Threaten

The barrier to entry for generalist staffing agencies can be quite low, as the initial capital needed to set up a basic operation is not prohibitively expensive. This accessibility means new competitors can emerge relatively easily, especially in localized markets or when focusing on common job types.

For instance, in 2024, many smaller staffing firms were observed to start with minimal overhead, often leveraging online platforms and remote workforces. This trend means that GEE Group must continuously differentiate itself through its specialized services and robust client relationships to maintain its competitive edge against these less capital-intensive newcomers.

Even with lower financial capital requirements, the threat of new entrants is significantly mitigated by the difficulty in replicating established talent and client networks. Building a deep pool of qualified candidates and cultivating strong, long-standing client relationships demands considerable time, consistent effort, and deep industry connections, which new players often lack.

Established firms like GEE Group benefit from extensive, curated databases of candidates and decades of nurtured client relationships. This established network effect acts as a formidable barrier, making it challenging for newcomers to effectively compete for both talent and business, as they cannot easily access the same level of trust and reach.

In the staffing industry, a strong reputation and established brand are significant barriers for new entrants. GEE Group, with its history of consistent performance, has cultivated trust among both clients seeking talent and professionals looking for opportunities. This makes it challenging for newcomers to gain traction and compete for high-value contracts or attract sought-after candidates.

Building brand recognition in a service sector like staffing is a long-term endeavor, often requiring years of delivering exceptional service and cultivating positive client relationships. Newcomers simply do not possess this inherent advantage, often needing to offer lower rates or more aggressive marketing to even get noticed, which can impact their initial profitability.

For instance, GEE Group's ability to secure large, recurring contracts with major corporations is directly tied to its proven track record and the confidence clients place in its ability to deliver. New entrants, lacking this established credibility, find it much harder to penetrate these lucrative markets, facing a steep uphill battle to build the necessary trust and demonstrate their capabilities.

Regulatory and Compliance Complexity

The staffing industry faces significant barriers to entry due to the intricate web of labor laws, compliance regulations, and varying licensing requirements across different states and sectors. New companies must invest heavily in legal counsel and compliance infrastructure to navigate these complexities, a substantial hurdle that deters many potential entrants.

For instance, the Fair Labor Standards Act (FLSA) and state-specific wage and hour laws demand meticulous adherence, and non-compliance can result in severe penalties. GEE Group, having operated for years, has developed sophisticated compliance systems and possesses the necessary expertise to manage these challenges effectively, giving it an advantage over newcomers.

- Regulatory Hurdles: Navigating diverse state and federal labor laws, including those related to worker classification, benefits, and safety, presents a substantial barrier.

- Licensing Requirements: Many states mandate specific licenses for staffing agencies, adding to the initial cost and administrative burden for new entrants.

- Compliance Costs: Establishing robust compliance programs, including legal reviews and ongoing training, requires significant financial investment.

- Industry-Specific Regulations: Certain sectors, like healthcare or government contracting, have additional, highly specialized compliance demands that new entrants must meet.

Economies of Scale and Scope

Larger staffing firms, such as GEE Group, leverage significant economies of scale. This allows them to invest heavily in advanced recruitment technology and broad marketing campaigns, which smaller, newer entrants struggle to replicate. For instance, GEE Group’s investment in proprietary applicant tracking systems and digital marketing reach provides a competitive edge in talent acquisition and brand visibility.

These scale advantages translate into cost efficiencies. GEE Group can spread its fixed costs, like technology development and administrative overhead, across a larger volume of placements. This enables them to offer more competitive pricing to clients or achieve higher profit margins compared to startups that lack this operational leverage. In 2024, the average cost per hire in the recruitment industry can be significantly reduced through scaled operations.

Furthermore, GEE Group benefits from economies of scope by serving a diverse range of industries and offering a spectrum of staffing solutions, from temporary to permanent placements and specialized recruitment. This diversification builds resilience and allows for cross-selling opportunities. New entrants typically focus on niche markets, making it difficult to match GEE Group's comprehensive service offering and broad client base.

- Economies of Scale: GEE Group’s large operational footprint reduces per-unit costs in technology, marketing, and administration.

- Competitive Pricing: This scale allows for more aggressive pricing strategies, making it harder for new firms to compete on cost.

- Economies of Scope: Serving multiple sectors and offering varied services creates a broader market presence and revenue streams.

- Barriers to Entry: The combined effect of these economies creates substantial barriers for new, smaller staffing companies entering the market.

While the initial capital for a basic staffing agency can be low, the threat of new entrants is significantly challenged by the difficulty in replicating established talent and client networks. Building deep candidate pools and strong client relationships takes considerable time and effort, which newcomers typically lack.

GEE Group's established reputation and brand recognition serve as a substantial barrier. Years of consistent performance have fostered trust, making it hard for new firms to secure high-value contracts or attract top talent without a proven track record.

Navigating complex labor laws and licensing requirements across different regions presents a significant hurdle for new entrants. GEE Group, with its established compliance systems, possesses an advantage over startups needing to invest heavily in legal and regulatory infrastructure.

Economies of scale allow larger firms like GEE Group to invest in advanced recruitment technology and broader marketing, which smaller entrants struggle to match. This scale also enables competitive pricing, further deterring new competition.

| Barrier Type | Impact on New Entrants | GEE Group's Advantage |

| Network Effects | Difficult to build candidate and client relationships | Extensive, curated databases and long-standing client trust |

| Brand Reputation | Challenging to gain trust and recognition | Years of consistent performance and positive client relationships |

| Regulatory Compliance | High costs and complexity in navigating laws | Established compliance systems and expertise |

| Economies of Scale | Inability to match technology investment and pricing | Investment in advanced tech, broader marketing, and cost efficiencies |

Porter's Five Forces Analysis Data Sources

Our Gee Group Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research, and publicly available financial statements. We also leverage insights from trade publications and economic indicators to provide a comprehensive understanding of the competitive landscape.