GEA Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GEA Group Bundle

The GEA Group's robust engineering capabilities and strong market presence are clear strengths, but understanding their potential vulnerabilities and the competitive landscape is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these factors, providing actionable insights for informed decision-making.

Want to fully grasp GEA Group's strategic positioning, from their innovative technologies to potential market challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

GEA Group commands a leading position in vital sectors like food, beverage, and pharmaceuticals, offering indispensable process technology and components. This robust market standing is further bolstered by its extensive portfolio, encompassing machinery, plants, cutting-edge process technology, and a full suite of services, addressing a wide array of industrial needs.

The company's global footprint, spanning over 150 countries, significantly enhances its market penetration and mitigates risks associated with dependency on any single region. For instance, GEA reported a substantial order intake of €5.7 billion in the first half of 2024, demonstrating continued demand for its diversified offerings across these key industries.

GEA Group showcased impressive financial strength in fiscal year 2024, with order intake, revenue, and profitability all showing healthy increases, a notable achievement given broader industry headwinds. This performance underscores the company's resilient business model and effective management strategies.

The company's confidence in its future is reflected in its raised 2025 guidance for organic sales growth, EBITDA margins, and Return on Capital Employed (ROCE). This upward revision signals strong operational execution and a commitment to capital efficiency.

GEA's Return on Capital Employed (ROCE) reached a substantial 35.3% in the first half of 2025. This figure substantially surpasses the sector average, clearly demonstrating the company's exceptional ability to utilize its assets effectively and generate strong returns.

GEA Group stands out as a leader in pioneering sustainable and innovative solutions, directly addressing critical global megatrends such as decarbonization and digitalization. This strategic focus isn't just about corporate responsibility; it's a fundamental driver of their business performance.

The company's dedication to sustainability is demonstrably translating into tangible results. For instance, GEA reported significant growth in its sustainable food processing division, a testament to market demand for environmentally conscious solutions. Furthermore, orders in the clean energy sector, especially for hydrogen electrolysis equipment, have seen a substantial surge, indicating strong market traction for their green technologies.

GEA's innovative edge is further amplified by its adoption of advanced technologies. Solutions like digital twins and AI-driven predictive maintenance are not merely buzzwords; they are actively enhancing operational efficiency and minimizing downtime for their clientele, solidifying their value proposition in a competitive landscape.

Robust Service Business and Order Backlog

GEA Group has cultivated a robust service business, a key strength that significantly contributed to its financial stability. In 2024, this segment represented a substantial portion of the company's total revenue, with its profitability further underscored by its performance in Q1 2024. This focus on recurring revenue provides a predictable income stream.

The company also benefits from a strong order backlog, a testament to sustained demand for its products and services. A notable aspect of this backlog is the significant proportion of recurring orders, which offers further visibility into future revenue generation and reinforces GEA's market position.

- Profitable Service Business: GEA's service segment has seen considerable expansion, contributing a significant share to total revenue in 2024 and Q1 2024.

- Recurring Revenue Stability: The emphasis on services creates a stable and predictable financial performance due to its recurring nature.

- Healthy Order Backlog: GEA maintains a substantial order backlog, indicating strong demand and future revenue potential.

- Recurring Order Component: A significant portion of the order backlog consists of recurring orders, enhancing revenue visibility.

Strategic Acquisitions and Mission 30 Targets

GEA Group has strategically bolstered its market position through a series of acquisitions, completing 11 to date. This proactive approach included two significant acquisitions in 2024, notably expanding into the burgeoning field of robotic milking systems. These moves underscore a commitment to portfolio enhancement and diversification.

The company's forward-looking 'Mission 30' strategy outlines aggressive financial objectives, aiming for an average organic sales growth exceeding 5% and a Return on Capital Employed (ROCE) above 45% by the year 2030. This strategic roadmap clearly signals GEA's dedication to achieving sustained, profitable expansion and market leadership.

- Strategic Acquisitions: 11 completed, including 2 in 2024, focusing on areas like robotic milking.

- Mission 30 Targets: Aiming for >5% average organic sales growth and >45% ROCE by 2030.

- Portfolio Strength: Acquisitions enhance GEA's offering and market reach.

- Growth Ambition: Clear financial targets demonstrate a strong growth trajectory.

GEA Group's leading market positions in essential industries like food, beverage, and pharmaceuticals, coupled with a broad portfolio of process technology and components, provide a significant competitive advantage. Its global presence across over 150 countries diversifies revenue streams and mitigates regional economic risks, as evidenced by a €5.7 billion order intake in H1 2024. The company's strong financial performance in FY 2024, with healthy growth in orders, revenue, and profitability, further solidifies its market strength.

GEA's commitment to innovation and sustainability is a key differentiator, with a focus on decarbonization and digitalization driving demand for its green technologies, such as hydrogen electrolysis equipment. The company's impressive ROCE of 35.3% in H1 2025 highlights its efficient asset utilization and strong returns. Furthermore, a robust service business and a substantial order backlog, including a significant recurring order component, contribute to predictable revenue streams and enhanced financial stability.

What is included in the product

Delivers a strategic overview of GEA Group’s internal and external business factors, highlighting its strengths in technology and market position alongside potential weaknesses in integration and external threats from competition and economic volatility.

Offers a clear, structured framework to identify and address GEA Group's strategic challenges, transforming potential weaknesses into actionable opportunities.

Weaknesses

GEA Group's reliance on industrial capital spending presents a notable weakness. While the company has demonstrated adaptability, its financial results are still closely tied to the ebb and flow of global industrial investment. For instance, a projected slowdown in capital expenditure across key sectors could directly translate to lower demand for GEA's sophisticated machinery and plant solutions, thereby affecting order volumes and overall revenue streams.

This sensitivity to the broader economic climate in capital-intensive industries, such as food processing and pharmaceuticals, introduces a degree of volatility. GEA's performance in 2024 and projections for 2025 will likely reflect these macroeconomic trends. A cautious approach to capital investment by its clients, driven by geopolitical uncertainties or rising interest rates, could hinder GEA's ability to achieve consistent, robust growth.

GEA Group faced a noticeable dip in order intake during the first quarter of 2024, falling short of the exceptionally high levels seen in the previous year. This indicates a degree of market uncertainty, even as the company reported profitable growth overall.

While GEA explained this as a return to more normal levels after significant one-off deals in 2023, a steady stream of new orders is vital for sustained, long-term expansion. The company's performance in specific segments, such as Liquid & Powder Technologies and Food & Healthcare, also saw a decline in EBITDA for Q1 2024, suggesting these areas might require closer attention.

GEA operates within a fiercely competitive global arena, facing established giants and agile newcomers alike. Competitors such as JBT, Marel, SMS Group, Sidel, and Tetra Laval consistently present comparable or alternative technologies, intensifying market dynamics.

This intense rivalry directly impacts GEA's ability to dictate pricing and expand its market footprint. To counter this, significant and ongoing investment in research and development is crucial to stay ahead of the curve.

Integration Risks of Acquisitions

While acquisitions can fuel growth, GEA Group faces significant integration risks. Merging disparate corporate cultures, IT systems, and product lines is complex and can disrupt operations. For instance, a poorly executed integration of a newly acquired business could result in significant cost overruns, estimated by some industry analyses to impact profitability by up to 15% in the initial year post-acquisition if synergies aren't realized.

These integration challenges can manifest in several ways:

- Cultural Clashes: Differences in management styles and employee expectations can hinder collaboration and productivity.

- System Incompatibilities: Merging IT infrastructure and operational software often leads to technical hurdles and increased implementation costs.

- Synergy Shortfalls: Failure to achieve anticipated cost savings or revenue enhancements from the acquisition can erode the deal's strategic value.

In 2024, the industrial sector saw an average of 20% of acquisitions fail to meet their projected financial targets within the first two years, primarily due to integration failures, highlighting the critical nature of this challenge for companies like GEA Group.

Exposure to Geopolitical and Macroeconomic Volatility

GEA Group's extensive global footprint, a significant strength, also presents a key vulnerability. Its operations are inherently exposed to geopolitical tensions and broader macroeconomic fluctuations. For instance, regional conflicts or shifts in global economic growth can directly impact demand for GEA's machinery and services, as well as disrupt the flow of raw materials and components. This was evident in late 2023 and early 2024, where supply chain disruptions stemming from ongoing global conflicts led to increased logistics costs for many industrial manufacturers, including those in GEA's sector.

These external forces can create a ripple effect, leading to higher input costs for GEA and potentially causing customers in affected regions to postpone or scale back their capital investment decisions. While GEA has a track record of navigating such challenges, sustained periods of global instability, such as the ongoing inflationary pressures seen through mid-2024, could continue to test its operational resilience and impact its profitability.

- Geopolitical Risk: Exposure to regions with political instability can disrupt operations and sales.

- Macroeconomic Sensitivity: Downturns in key markets reduce demand for capital equipment.

- Supply Chain Vulnerability: Global disruptions can increase costs and lead times for essential components.

- Currency Fluctuations: Operating in multiple currencies exposes GEA to exchange rate volatility, impacting reported earnings.

GEA Group's dependence on industrial capital spending makes it susceptible to economic downturns. A slowdown in investment by its clients, particularly in sectors like food processing and pharmaceuticals, can directly impact order volumes. For instance, GEA reported a dip in order intake in Q1 2024 compared to the previous year, signaling market caution.

Intense competition from players like JBT and Marel necessitates continuous, significant R&D investment to maintain a competitive edge. Furthermore, the company faces integration risks with acquisitions, as seen in the industrial sector where an estimated 20% of acquisitions fail to meet financial targets within two years due to integration issues.

GEA's global presence exposes it to geopolitical risks and currency fluctuations. Supply chain disruptions, a persistent issue through mid-2024, can increase costs and lead times, impacting profitability.

| Weakness | Description | Impact |

|---|---|---|

| Capital Spending Dependence | Reliance on clients' investment in machinery and plants. | Vulnerability to economic cycles and reduced order intake during downturns. |

| Intense Competition | Presence of strong global competitors offering similar technologies. | Pressure on pricing, market share, and need for constant R&D. |

| Acquisition Integration Risks | Challenges in merging acquired companies' cultures, systems, and operations. | Potential for cost overruns, operational disruptions, and failure to achieve synergies. |

| Geopolitical & Macroeconomic Exposure | Global operations subject to political instability, supply chain disruptions, and currency volatility. | Increased costs, delayed projects, and impact on reported earnings. |

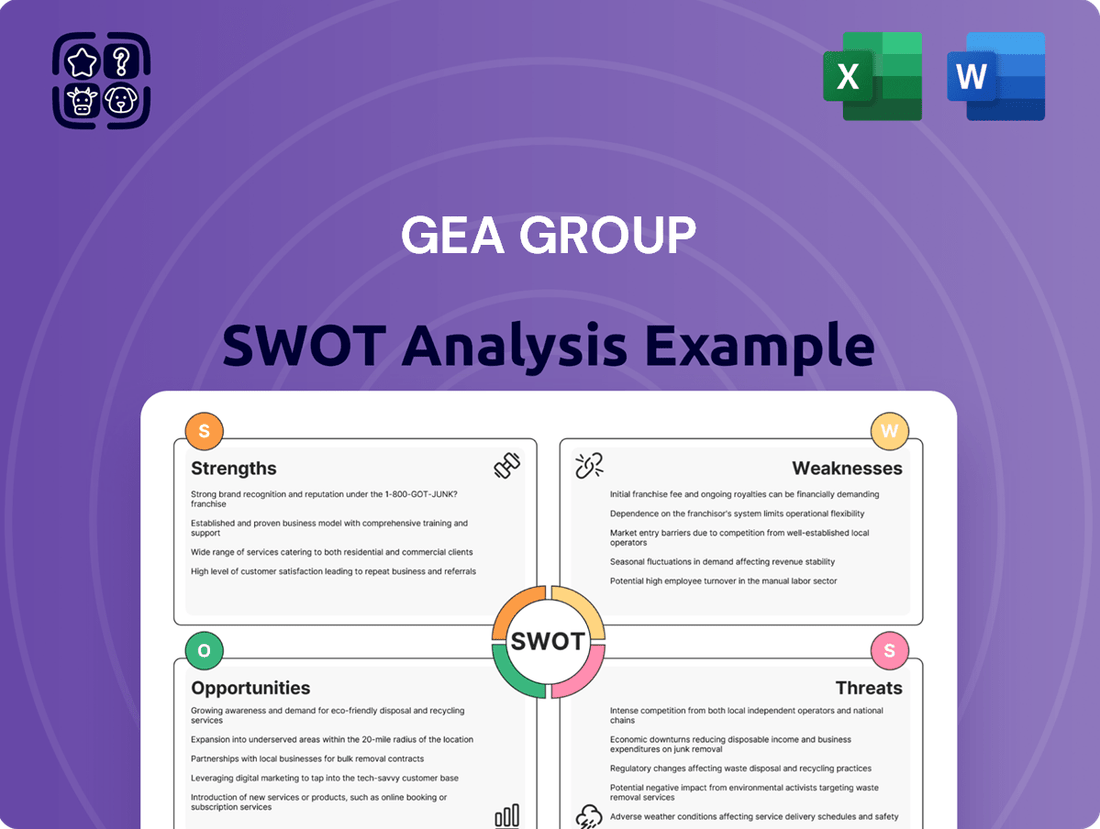

Preview the Actual Deliverable

GEA Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of the GEA Group's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis is unlocked upon purchase.

Opportunities

The global drive for decarbonization is a significant opportunity for GEA, especially within the clean energy market. The company's work in hydrogen electrolysis, evidenced by increasing orders and major projects, places it well to benefit from the rising need for sustainable energy systems.

This focus on clean energy aligns perfectly with GEA's strategic direction towards higher-margin industrial technologies, allowing it to leverage its expertise in a rapidly expanding sector.

The global appetite for sustainably produced food, beverages, and pharmaceuticals is on the rise, presenting a substantial growth avenue. GEA's commitment to zero-waste technologies, energy-saving systems, and innovations in alternative proteins and plant-based foods directly taps into this expanding market. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach over $160 billion by 2030, showcasing the immense potential. GEA is well-positioned to capitalize on this by offering solutions that help customers meet increasingly stringent environmental regulations and consumer preferences for eco-friendly products.

GEA is well-positioned to capitalize on the increasing digitalization of industrial processes, a trend that offers substantial opportunities to enhance its product and service portfolio. This ongoing digital transformation allows GEA to integrate advanced technologies into its offerings, meeting evolving customer demands for efficiency and automation.

The company's existing investments in digital twins and AI-driven predictive maintenance have already yielded tangible results, such as a reported reduction in downtime for its clients. For instance, GEA's digital solutions have been instrumental in optimizing operations for customers in the food and beverage sector, a key market for the group.

By further developing and seamlessly integrating end-to-end digital solutions, GEA can unlock new revenue streams. These advanced digital offerings not only streamline customer production processes but also foster deeper, more collaborative relationships, solidifying GEA's role as a strategic partner rather than just a supplier.

Strategic Partnerships and Innovation Challenges

Strategic partnerships and innovation challenges offer a significant avenue for GEA Group to accelerate its technological development. By collaborating with startups and actively participating in open innovation initiatives, GEA can tap into a wider pool of novel ideas and disruptive technologies. For instance, challenges focused on water strategies in the dairy industry, aiming for objectives like zero-freshwater use, directly align with GEA's sustainability goals and can yield groundbreaking solutions.

These collaborations foster a dynamic culture of innovation within GEA, enabling the company to tackle complex industry challenges more effectively. This approach not only speeds up the adoption of new technologies but also positions GEA as a leader in sustainable solutions. In 2023, GEA reported a significant increase in its innovation pipeline, with a substantial portion of new product developments stemming from external collaborations and open innovation platforms.

- Accelerated Technology Adoption: Partnerships with startups provide access to cutting-edge technologies, reducing R&D timelines.

- Disruptive Solution Development: Open innovation challenges encourage the creation of novel solutions for critical industry issues like water scarcity.

- Enhanced Sustainability Focus: Collaborations can drive advancements in areas such as achieving zero-freshwater use in sectors like dairy.

- Innovation Culture Cultivation: Engaging with external innovators strengthens GEA's internal capacity for creative problem-solving.

Service Business Expansion and Recurring Revenue

GEA Group's strategic expansion into its high-margin service business offers a prime opportunity for predictable, recurring revenue streams. By providing integrated maintenance, performance optimization, and advanced digital solutions, GEA can solidify its customer partnerships and foster sustained value creation.

This emphasis on robust after-sales support not only bolsters GEA's market standing but also cultivates enhanced customer loyalty. For instance, in 2024, GEA reported a significant increase in its service segment revenue, contributing to an improved overall profit margin.

- Service Revenue Growth: GEA's service business is projected to continue its upward trajectory, driven by an increasing installed base and demand for advanced digital offerings.

- Recurring Revenue Model: The shift towards service contracts and digital subscriptions creates a more stable and predictable revenue base, mitigating cyclicality in equipment sales.

- Customer Retention: Enhanced service offerings directly translate to higher customer satisfaction and retention rates, reducing churn and increasing lifetime customer value.

- Margin Enhancement: The service segment typically commands higher profit margins compared to equipment manufacturing, directly contributing to GEA's profitability.

GEA is strategically positioned to capitalize on the global transition to clean energy, particularly in the burgeoning hydrogen market. The company's increasing order intake for hydrogen electrolysis solutions underscores its role in developing sustainable energy infrastructure.

The growing demand for sustainable food, beverages, and pharmaceuticals presents a significant growth avenue for GEA, with its focus on zero-waste and energy-saving technologies aligning with market trends. The plant-based food market alone, valued at nearly $30 billion in 2023, highlights this potential.

Digitalization offers GEA substantial opportunities to enhance its offerings, with AI-driven predictive maintenance already demonstrating reduced client downtime. Further integration of digital solutions can unlock new revenue streams and strengthen customer relationships.

Strategic partnerships and open innovation are accelerating GEA's technological development, enabling access to cutting-edge solutions and fostering innovation in areas like water-saving technologies. In 2023, a notable portion of GEA's new product developments originated from these external collaborations.

GEA's expanding service business provides a crucial opportunity for predictable, recurring revenue, enhancing customer loyalty and profit margins. The service segment's revenue saw a significant increase in 2024, contributing positively to overall profitability.

Threats

Despite GEA Group's robust performance, ongoing macroeconomic challenges, such as a global economic slowdown and a hesitant recovery in investments, pose a significant threat. These conditions could dampen the demand for GEA's industrial solutions.

The broad economic uncertainty translates into a potential reduction in capital expenditures by GEA's clients. This directly impacts order intake and the visibility of future projects across GEA's various business segments.

For instance, in 2023, global industrial production growth was modest, and projections for 2024 suggest continued, albeit varied, economic pressures. This environment makes it harder for companies like GEA to predict and secure long-term contracts.

Global supply chain vulnerabilities continue to be a significant threat for GEA Group. For instance, in 2023, GEA reported that supply chain issues, including higher raw material and logistics costs, impacted their ability to meet demand and increased their expenses, contributing to a slight slowdown in order intake growth compared to earlier periods.

Rising input costs for crucial materials and energy directly affect GEA's manufacturing expenses. These escalating costs can compress profit margins, especially if GEA faces challenges in fully passing these increases onto their customers through product pricing. This dynamic was evident in late 2023 and early 2024, where many industrial companies, including those in GEA's sector, grappled with this margin pressure.

GEA Group faces significant threats from aggressive competition within the process technology and components sector. Established rivals and emerging companies are constantly vying for market share, intensifying the competitive landscape.

This rivalry often translates into considerable pricing pressure, especially in market segments where product differentiation is less pronounced. For GEA, this could mean a squeeze on revenue growth and profit margins if competitors undercut pricing or introduce superior, more cost-effective solutions.

For instance, in the dairy processing equipment market, a key segment for GEA, competition from companies like Tetra Pak and Alfa Laval remains fierce. Reports from 2024 indicate that price sensitivity is a growing factor for customers, particularly in emerging markets, forcing suppliers to balance innovation with cost competitiveness.

Technological Obsolescence and Rapid Innovation Cycles

The relentless pace of technological change, particularly in digital and sustainable solutions, presents a significant threat to GEA Group. To maintain its competitive edge, the company must commit to ongoing innovation. For instance, in 2023, GEA invested €300 million in research and development, a crucial step to stay ahead of rapid innovation cycles.

Failure to adapt to new technologies and evolving industry standards could render GEA's current product portfolio obsolete. This risk is amplified as competitors increasingly leverage advancements in areas like AI-driven process optimization and advanced materials for sustainable applications. For example, the global market for industrial automation solutions, a key area for GEA, was projected to grow by 8% in 2024, highlighting the urgency to integrate cutting-edge digital capabilities.

- Rapid Digitalization: The increasing demand for smart, connected equipment and data analytics in food processing and other sectors requires constant software and hardware upgrades.

- Sustainable Technology Adoption: Competitors are rapidly developing and deploying more energy-efficient and environmentally friendly technologies, potentially displacing older GEA solutions.

- Shortened Product Lifecycles: The speed of innovation means that product lifecycles are shortening, necessitating quicker R&D and product refresh cycles to avoid obsolescence.

Regulatory Changes and Environmental Compliance

Evolving environmental regulations, particularly concerning emissions and water usage, present a significant threat. Stricter compliance requirements could lead to increased operational costs and complexities for GEA Group. For instance, in 2024, the European Union's proposed carbon border adjustment mechanism (CBAM) could impact the cost of imported materials if GEA's supply chain isn't fully aligned with stricter environmental standards.

While GEA is actively investing in sustainability initiatives, unforeseen or rapidly implemented regulatory changes could necessitate substantial R&D investments or operational adjustments. This could potentially affect financial performance by diverting capital from other growth areas or requiring costly retrofitting of existing facilities.

- Increased operational costs due to stricter emission standards.

- Potential need for significant capital expenditure on compliance technologies.

- Risk of penalties for non-compliance with evolving environmental laws.

- Impact on supply chain costs from new environmental regulations.

GEA Group faces substantial threats from a fluctuating global economic climate, characterized by a slowdown and hesitant investment recovery, which could reduce client demand for its industrial solutions. Supply chain disruptions, including higher raw material and logistics costs, continue to impact GEA's operational efficiency and profitability, as seen in 2023 where these factors affected order intake growth.

Intensified competition, particularly in core markets like dairy processing, exerts significant pricing pressure, potentially squeezing margins. Furthermore, the rapid pace of technological advancement, especially in digitalization and sustainability, necessitates continuous R&D investment, with GEA's €300 million R&D spend in 2023 underscoring this challenge, to avoid product obsolescence.

Evolving environmental regulations pose another threat, potentially increasing operational costs and requiring substantial capital for compliance technologies, as suggested by the potential impact of mechanisms like the EU's CBAM in 2024.

SWOT Analysis Data Sources

This GEA Group SWOT analysis is built upon a foundation of credible data, drawing from official financial reports, comprehensive market intelligence, and expert industry analysis to provide a robust strategic overview.