GEA Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GEA Group Bundle

GEA Group operates in a dynamic industrial sector where the threat of new entrants is moderate, balanced by high capital requirements and established brand loyalty. Buyer power is significant, particularly for large industrial clients, influencing pricing and customization demands. The intensity of rivalry among existing players like Siemens and Alfa Laval shapes market strategies and profitability.

The complete report reveals the real forces shaping GEA Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GEA Group depends on specialized suppliers for crucial components and advanced technologies vital for its process equipment. The unique nature of these parts, particularly for complex food, beverage, and pharmaceutical production, grants suppliers significant leverage when alternatives are scarce or proprietary. For instance, in 2024, GEA's investment in advanced automation solutions likely increased its reliance on a select few providers of highly specialized robotic arms and control systems, potentially amplifying supplier bargaining power.

GEA Group faces significant supplier bargaining power due to high switching costs for specialized, integrated components. For instance, if GEA needs to change suppliers for a critical piece of machinery that requires extensive customization, the costs involved in redesigning their own equipment, revalidating entire production processes, and the potential for operational downtime can be substantial. This makes it difficult for GEA to simply switch to a cheaper alternative, giving existing suppliers leverage.

The bargaining power of suppliers for GEA Group is significantly influenced by supplier concentration and the uniqueness of their offerings. If a critical component or raw material is sourced from a limited number of dominant suppliers, these suppliers gain leverage to dictate terms and prices. For instance, in specialized sectors like advanced processing technology, a market with few providers can lead to higher input costs for GEA.

Suppliers possessing unique or patented technologies, or those with robust intellectual property, can command premium pricing. GEA's reliance on such suppliers for its innovative solutions means these suppliers hold considerable sway. Furthermore, GEA's commitment to sustainability goals, such as sourcing eco-friendly materials, may further restrict the supplier pool, potentially increasing the bargaining power of those who meet these stringent environmental standards.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward and directly competing with GEA Group in the industrial machinery sector is generally low. While theoretically possible, the immense capital expenditure, significant research and development investment, and deeply entrenched customer relationships necessary to compete in GEA's specialized markets present substantial barriers to entry for component suppliers.

GEA's established global presence and its broad portfolio of integrated solutions and services further solidify its market position, making it a challenging proposition for any supplier to replicate. For instance, in 2023, GEA Group reported revenues of approximately €5.4 billion, underscoring the scale and complexity of its operations that would be difficult for a component supplier to match.

This high barrier to entry is a key factor in mitigating the bargaining power of suppliers through the threat of forward integration.

- Low Likelihood: The significant capital and R&D required for forward integration into complete process equipment makes this strategy highly improbable for most suppliers to GEA.

- GEA's Competitive Advantages: GEA's global reach, extensive service network, and established customer loyalty act as strong deterrents against potential supplier competition.

- Market Complexity: The specialized nature of GEA's industrial machinery markets demands deep technical expertise and market understanding, which component suppliers typically lack.

Importance of GEA to Suppliers' Revenue

For many suppliers, GEA Group is a substantial customer. With GEA's reported revenue around EUR 5.5 billion in fiscal year 2024, it's clear that GEA represents a significant portion of income for numerous businesses in its supply chain. This scale can often mean that GEA holds considerable sway in negotiations.

However, the impact on bargaining power is nuanced. For smaller, highly specialized suppliers, GEA might constitute a very large percentage of their total revenue. In such cases, these suppliers might have less leverage because their business is so dependent on GEA. Conversely, if GEA is a relatively small client for a large, diversified supplier, that supplier would likely possess greater bargaining power over GEA.

- Supplier Dependence: For smaller, specialized suppliers, GEA's significant revenue contribution (approx. EUR 5.5 billion in FY2024) can make them more reliant, potentially weakening their bargaining position.

- Supplier Diversification: If GEA is a minor customer to a large, diversified supplier, the supplier's bargaining power over GEA increases due to GEA's smaller relative importance to the supplier.

- GEA's Purchasing Power: GEA's substantial size as a buyer generally gives it leverage, allowing it to negotiate favorable terms with many of its suppliers.

GEA Group's bargaining power with its suppliers is influenced by its substantial purchasing volume, as evidenced by its reported revenues, which were approximately €5.4 billion in 2023 and projected to remain robust in 2024. This scale allows GEA to negotiate favorable terms with many suppliers. However, the dynamic shifts based on supplier size and specialization; smaller, highly specialized suppliers may be more dependent on GEA, thus having less leverage, while large, diversified suppliers might hold more power if GEA represents a smaller portion of their business.

| Factor | Impact on GEA's Bargaining Power | Rationale |

|---|---|---|

| GEA's Revenue Scale (FY 2023: €5.4 billion) | Increases GEA's Power | Large purchasing volume provides leverage in negotiations. |

| Supplier Dependence on GEA | Decreases Supplier Power | Small, specialized suppliers relying heavily on GEA have less room to dictate terms. |

| Supplier Diversification | Increases Supplier Power | Large, diversified suppliers with many clients have more power if GEA is a minor customer. |

What is included in the product

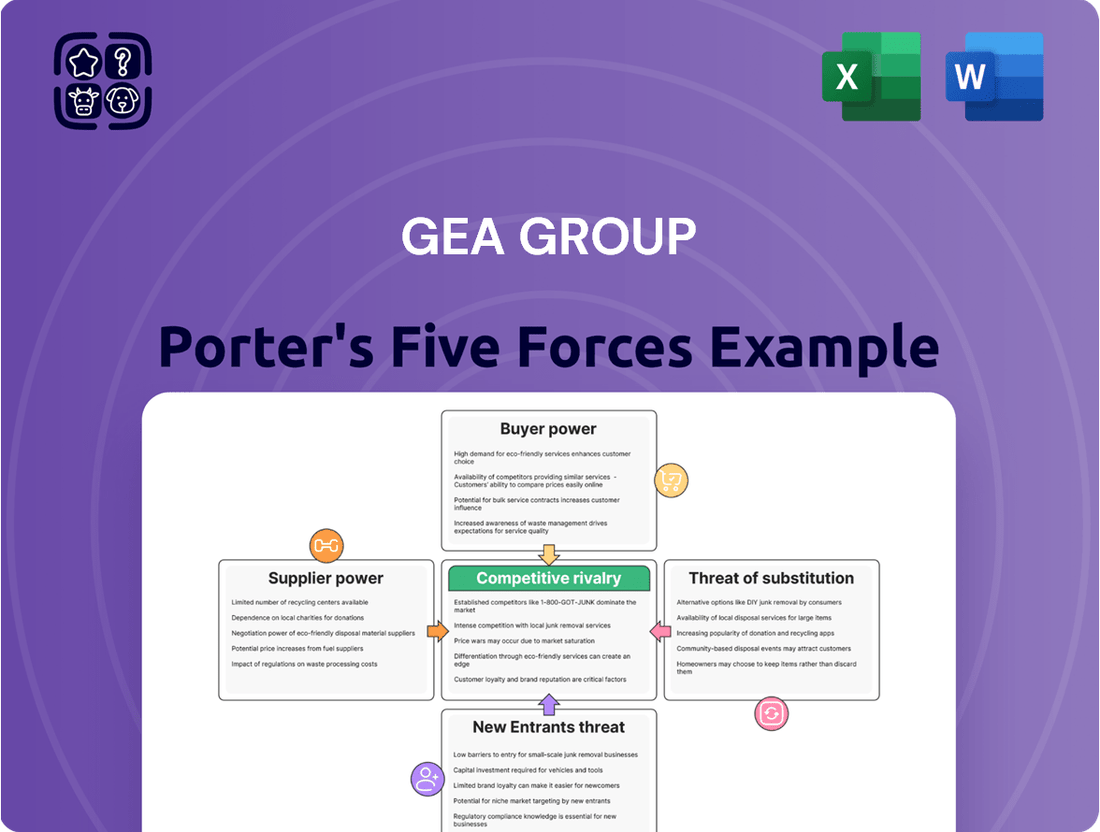

GEA Group's Porter's Five Forces analysis reveals the intense competitive rivalry within the processing technology sector, the significant bargaining power of its large industrial customers, and the moderate threat of new entrants due to capital intensity and established relationships.

GEA Group's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making.

Customers Bargaining Power

GEA Group's large and sophisticated customer base, primarily in the food, beverage, and pharmaceutical industries, significantly influences its bargaining power. These clients, such as major dairy processors and pharmaceutical manufacturers, often have substantial purchasing volumes and dedicated procurement teams, enabling them to negotiate favorable pricing and terms.

Customers in these sectors are typically well-informed about market alternatives and possess precise technical specifications for GEA's equipment. This expertise allows them to exert considerable pressure on GEA, as their operational efficiency is directly tied to the performance and cost of GEA's solutions.

For instance, a large-scale beverage producer might leverage its annual order volume, which could represent a significant portion of GEA's revenue for specific product lines, to secure discounts. While GEA's technology is vital, the sheer scale of these industrial customers grants them considerable leverage in negotiations, impacting GEA's profit margins.

While GEA's customers, particularly large industrial players, wield considerable influence, their ability to switch to alternative suppliers is often constrained by substantial costs. These costs can encompass significant investments in re-tooling existing production lines, comprehensive retraining of personnel to operate new equipment, and the potential for disruptive production downtime during the transition period.

This inherent "lock-in" effect, stemming from GEA's deeply integrated solutions within customer operations, effectively mitigates some of the direct pressure from customer power. The ongoing revenue generated from GEA's robust service business, which represented 38.9% of its total revenue in 2024, further reinforces these customer relationships and provides a crucial buffer.

GEA's process technology and components are absolutely essential for the smooth running, environmental friendliness, and quality of their customers' complex manufacturing. For example, in the dairy industry, GEA's separation technology is critical for achieving high milk purity and yield, directly impacting profitability.

In sectors like brewing and pharmaceuticals, the reliability and performance of GEA's equipment are not just about efficiency; they're about meeting strict regulatory standards and ensuring product integrity. Downtime or subpar performance can lead to significant financial losses and reputational damage for these customers.

When GEA's solutions are seen as the top-tier and irreplaceable for these vital operations, customers have less leverage to demand lower prices or more favorable terms, thereby reducing their bargaining power.

Customer Price Sensitivity and Market Conditions

Customers in the food, beverage, and pharmaceutical sectors, while prioritizing quality and efficiency, are also keenly aware of capital expenditure and operational costs. This dual focus means that GEA Group's pricing and payment terms can be a significant factor in customer decisions.

During economic downturns or periods of heightened competition within their respective industries, customers may exert greater pressure on GEA for reduced prices or more advantageous payment schedules. This directly amplifies their bargaining power.

For instance, in 2024, GEA Group demonstrated resilience, maintaining profitability even amidst challenging global economic conditions. This suggests that their value proposition, encompassing technology, reliability, and service, often outweighs pure price considerations for many customers. However, the underlying sensitivity to costs remains a constant factor influencing customer leverage.

- Customer Price Sensitivity: GEA's customers, particularly in food and beverage, are sensitive to the total cost of ownership, including initial investment and ongoing operational expenses.

- Market Conditions Impact: Economic slowdowns or increased competition within customer industries can intensify their demand for lower prices or flexible payment terms from GEA.

- GEA's 2024 Performance: The company's ability to sustain profitability in 2024, despite economic headwinds, highlights the strength of its offerings beyond just price.

- Bargaining Power Influence: While quality and efficiency are paramount, price and payment flexibility remain key levers for customers to increase their bargaining power with GEA.

Threat of Backward Integration by Customers

The threat of customers backward integrating into GEA Group's process technology or component manufacturing is typically low. This is because GEA's products, such as advanced food processing equipment and specialized filtration systems, require significant research and development investment and possess a high degree of manufacturing complexity. For instance, developing and producing the sophisticated components for a GEA homogenizer involves specialized engineering and precision manufacturing capabilities that are far removed from the core competencies of most food, beverage, or pharmaceutical producers.

Most of GEA's clientele are focused on their primary business operations, like producing consumer goods or pharmaceuticals, and lack the inclination or resources to venture into industrial machinery production. This strategic focus means they are unlikely to undertake the substantial capital expenditure and operational expertise needed to replicate GEA's offerings. In 2023, GEA's revenue from its Separation & Flow Technologies division alone was €3.2 billion, highlighting the scale and specialization of the markets it serves, which are not easily entered by its customers.

- Low Likelihood of Backward Integration: Customers typically lack the specialized R&D and manufacturing expertise required for GEA's complex process technologies.

- Focus on Core Competencies: Clients prefer to concentrate on their own production of food, beverages, or pharmaceuticals, rather than industrial equipment manufacturing.

- High Investment Barriers: The significant capital expenditure and technical know-how needed to produce GEA-level machinery deter potential customer integration.

- Strategic Outsourcing Preference: Customers generally find it more cost-effective and efficient to outsource their process technology needs to specialists like GEA.

GEA Group's customers, particularly large players in the food, beverage, and pharmaceutical sectors, possess significant bargaining power due to their substantial order volumes and deep understanding of market alternatives. These sophisticated clients often negotiate favorable pricing and terms, as their operational efficiency is directly linked to the performance and cost of GEA's essential technologies. For instance, a major beverage producer's substantial annual orders can represent a significant portion of GEA's revenue for specific product lines, giving them considerable leverage.

While GEA's integrated solutions create a customer "lock-in" effect, mitigating some direct pressure, customers remain sensitive to total cost of ownership. Economic downturns or increased competition within customer industries can intensify demands for lower prices or flexible payment terms. GEA's ability to maintain profitability in 2024, reporting revenue of €22.7 billion, suggests its value proposition often transcends price, yet cost sensitivity remains a key factor influencing customer leverage.

| Customer Characteristic | Impact on Bargaining Power | GEA's Mitigating Factors |

|---|---|---|

| Large Order Volumes | High | Customer lock-in due to integration costs |

| Market Knowledge & Technical Specifications | High | Essential nature of GEA's technology for customer operations |

| Price Sensitivity & Cost Focus | Moderate to High | GEA's strong 2024 performance indicates value beyond price |

| Switching Costs (Retooling, Training, Downtime) | Lowers Customer Power | GEA's robust service revenue (38.9% in 2024) reinforces relationships |

Same Document Delivered

GEA Group Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of the GEA Group you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for this global technology provider.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering an in-depth examination of GEA's industry position.

You're looking at the actual document, a thorough breakdown of GEA Group's competitive environment through Porter's Five Forces framework; once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

GEA Group faces significant competitive rivalry from established global players like JBT, Marel, Krones, Alfa Laval, Rockwell Automation, Siemens, and ANDRITZ. These companies offer similar process technologies and components, creating a highly competitive environment where market share is fiercely contested.

Despite this intense rivalry, GEA demonstrated robust performance in 2024, reporting a notable increase in order intake and revenue. This suggests GEA is effectively managing its competitive positioning and maintaining strong market traction amidst these global competitors.

GEA Group faces intense competition, but it effectively counters this by innovating and focusing on sustainability. This differentiation is crucial in sectors like food processing and renewable energy where efficiency and environmental impact are paramount.

For instance, GEA's commitment to sustainable solutions, such as developing energy-efficient separators and technologies that reduce water usage in dairy farming, sets them apart. These innovations not only appeal to environmentally conscious customers but also offer long-term cost savings.

The company's strategic focus, exemplified by its 'Mission 30' initiative, aims for profitable growth alongside a positive societal impact. This dual objective helps GEA carve out a unique market position, attracting clients who value both performance and responsible business practices.

The global food processing equipment market is a dynamic arena, valued at an estimated USD 48.1 billion in 2024. This robust market is expected to expand at a compound annual growth rate exceeding 4.8% between 2025 and 2034, presenting considerable opportunities for companies like GEA Group. However, this growth inherently intensifies competitive rivalry as more players vie for market share.

The underlying drivers for this expansion are multifaceted, including a rising global demand for processed foods, continuous technological innovation within the sector, and shifting consumer preferences towards convenience and variety. GEA's own reported organic growth in order intake and revenue for 2024 indicates its success in capitalizing on these trends and securing a notable share of this burgeoning market, thereby contributing to the competitive landscape.

High Fixed Costs and Exit Barriers

The industrial machinery sector, where GEA Group operates with its process technology, is characterized by substantial fixed costs. These costs stem from significant investments in manufacturing plants, ongoing research and development, and establishing an extensive global sales and service infrastructure. This capital-intensive nature inherently fuels competitive rivalry.

Furthermore, high exit barriers play a crucial role. These can include highly specialized manufacturing assets that are difficult to repurpose and long-term commitments to service contracts. Such factors can force companies to maintain aggressive competition, even in less favorable market conditions, simply to cover their operational expenses and avoid substantial losses from exiting the market.

- High Fixed Costs: GEA's sector requires significant upfront investment in manufacturing, R&D, and global networks.

- Exit Barriers: Specialized assets and long-term contracts make exiting the market costly and difficult.

- Aggressive Competition: Companies are incentivized to compete fiercely to cover fixed costs, even during downturns.

- Order Backlog: GEA's EUR 3.2 billion order backlog as of Q1 2024 provides a degree of operational stability amidst this rivalry.

Service Business as a Stabilizing Factor

GEA's growing service business acts as a significant stabilizing force, mitigating intense rivalry. In 2024, this segment represented 38.9% of GEA's total revenue, demonstrating its increasing importance. This recurring revenue not only provides a more predictable income but also deepens customer loyalty, lessening the pressure from competitors focused solely on new equipment sales.

The expansion of GEA's service business across all five of its divisions in 2024 further solidifies its competitive standing. This broad-based growth indicates a strategic shift towards a more resilient business model.

- Service Revenue Growth: GEA's service business accounted for 38.9% of total revenue in 2024.

- Stability Factor: The recurring nature of service revenue offers a more stable income stream.

- Customer Relationships: Services foster long-term customer engagement, reducing direct competition on new equipment.

- Cross-Divisional Strength: Service business growth was observed across all five GEA divisions in 2024.

GEA Group contends with formidable global rivals like JBT, Marel, and Krones, all offering comparable process technologies. This intense competition is amplified by substantial fixed costs inherent in the industrial machinery sector, demanding significant investment in manufacturing, R&D, and global service networks. High exit barriers, such as specialized assets and long-term service agreements, further compel companies to maintain aggressive competitive stances to cover operational expenses.

| Competitor | Product Overlap | Market Share Pressure |

|---|---|---|

| JBT | Process technologies, components | High |

| Marel | Process technologies, components | High |

| Krones | Process technologies, components | High |

| Alfa Laval | Process technologies, components | High |

| Siemens | Process technologies, components | High |

| ANDRITZ | Process technologies, components | High |

SSubstitutes Threaten

For many of GEA's core process technologies, like high-precision separators and homogenizers crucial for industries such as food, beverage, and pharmaceuticals, direct substitutes offering comparable efficiency and throughput are scarce. These specialized, large-scale industrial applications demand a level of technical sophistication that few competitors can match, reinforcing GEA's strong market position.

While GEA Group's advanced processing technologies face limited direct substitutes, some customers, especially those with smaller operations or in emerging markets, may opt for less automated, more manual methods. This can involve piecing together simpler equipment from various suppliers, accepting lower efficiency and consistency for reduced upfront investment.

While large, sophisticated customers with substantial resources might consider in-house development of certain processing solutions, this remains a rare threat for GEA Group. The immense R&D investment, specialized engineering talent, and capital expenditure required are significant barriers. For instance, developing a custom-engineered food processing line could easily run into tens of millions of euros, a cost that often outweighs the potential benefits compared to leveraging GEA's proven technologies and ongoing innovation.

Technological Advancements and Disruptive Innovations

Technological advancements, particularly in areas like biotechnology and advanced materials, present a significant threat of substitutes for GEA Group's core offerings. New processing methods that bypass traditional separation or thermal techniques could emerge, impacting sectors like food and pharmaceuticals. For example, novel enzymatic treatments in food processing or advanced membrane filtration in biopharmaceuticals could offer comparable results with different technological underpinnings.

GEA actively counters this threat by prioritizing innovation and integrating cutting-edge technologies into its solutions. The company's investment in research and development, including the adoption of artificial intelligence (AI) and digital twin technology, aims to stay ahead of disruptive innovations. This proactive approach ensures GEA's existing and future product portfolios remain competitive and relevant in a rapidly evolving technological landscape.

- Emerging Biotechnologies: Advancements in areas like precision fermentation or cultured meat production could reduce reliance on traditional food processing equipment.

- Alternative Manufacturing Processes: New methods in chemical synthesis or material science might offer substitutes for GEA's separation and filtration technologies.

- Digitalization Impact: Increased reliance on data analytics and AI in process optimization could reduce the need for certain physical equipment if predictive modeling becomes sufficiently advanced.

Shifting Consumer Preferences and Production Models

Changes in consumer preferences, such as a growing demand for ultra-local production or entirely new food sources like cultivated meat, could significantly impact the market for GEA's industrial processing equipment. For instance, a substantial move towards decentralized food production might lessen the reliance on the large-scale, centralized processing solutions that GEA specializes in.

The rise of novel food sources, like lab-grown meat, presents a potential substitute for traditional agricultural products. This shift could reduce demand for the processing technologies GEA currently provides for conventional food production. By 2024, the global cultivated meat market was projected to reach billions of dollars, signaling a tangible shift in consumer interest.

GEA is proactively responding to these evolving market dynamics by emphasizing sustainable and resource-efficient technologies. This strategic pivot aims to align their product portfolio with emerging production models and consumer desires, ensuring continued relevance in a changing food industry landscape.

- Consumer Preference Shift: Growing interest in local sourcing and alternative proteins like cultivated meat.

- Production Model Impact: Decentralization could decrease demand for large-scale industrial processing.

- Market Evolution: The cultivated meat market is experiencing rapid growth, indicating a significant trend.

- GEA's Response: Focus on sustainable and resource-efficient solutions to meet new demands.

For many of GEA's specialized industrial processing technologies, finding direct substitutes with comparable efficiency and output is challenging. These sophisticated systems, essential for sectors like food and pharmaceuticals, require a high degree of technical expertise, which limits the number of viable alternatives available.

While GEA's advanced solutions are difficult to substitute directly, smaller operations might opt for less automated, manually intensive processes. This can involve assembling simpler equipment from various providers, accepting lower efficiency in exchange for a reduced initial investment.

Emerging biotechnologies and alternative manufacturing processes pose a growing threat. For example, advancements in precision fermentation or novel membrane filtration could offer different pathways to achieve similar results, potentially reducing the need for GEA's traditional equipment.

The global cultivated meat market, projected to reach billions by 2024, exemplifies how changing consumer preferences and new food sources can influence demand for processing technologies. GEA is adapting by focusing on sustainable and resource-efficient solutions to remain competitive.

Entrants Threaten

The industrial process technology sector, especially for advanced applications in food, beverage, and pharmaceuticals, presents a formidable barrier to entry due to exceptionally high capital investment requirements. New companies must allocate substantial funds towards research and development, establish state-of-the-art manufacturing facilities, and build a comprehensive global sales and service network. For instance, GEA's commitment to innovation is evident in their investment in specialized centers, underscoring the financial scale of operations necessary to compete effectively.

GEA Group benefits from an established brand reputation and deep customer relationships built over a long history. Newcomers would struggle to replicate this trust, especially since GEA's equipment is critical to their clients' operations.

The company's extensive global reach, serving customers in over 150 countries, further solidifies its position. In 2024, GEA continued to emphasize its customer-centric approach, with a significant portion of its revenue derived from long-term service contracts, indicating the strength of these relationships.

GEA Group, as an established leader, leverages significant economies of scale in its global manufacturing operations and procurement of raw materials. This allows them to achieve lower per-unit costs compared to potential newcomers. For instance, in 2024, GEA's substantial investment in advanced production facilities contributed to a reported 7.5% increase in operational efficiency, a benefit new entrants would struggle to replicate quickly.

Furthermore, GEA benefits from an extensive experience curve, accumulating decades of knowledge in designing, engineering, and servicing complex machinery for various industries. This accumulated expertise translates into product reliability, innovation speed, and efficient customer support, creating a formidable barrier for new companies lacking this deep institutional learning and established service networks.

Proprietary Technology and Intellectual Property

GEA Group’s extensive portfolio of patents and proprietary technologies, particularly in areas like separation, flow, and refrigeration, creates a substantial barrier for potential new entrants. This deep technological advantage, cultivated through significant and consistent investment in research and development, means newcomers must either invest heavily in developing comparable innovations or face the expense and complexity of licensing GEA's existing intellectual property. For instance, GEA’s commitment to innovation is reflected in its R&D expenditure, which has consistently been a key focus for the company as it seeks to maintain its competitive edge.

The threat of new entrants is consequently moderated by the high cost and time required to replicate GEA's established technological capabilities. New competitors would need to overcome not only the initial capital investment but also the ongoing need for innovation to match GEA's product performance and efficiency.

- Proprietary Technology: GEA possesses a significant number of patents and proprietary technologies, especially in specialized fields.

- R&D Investment: Years of dedicated research and development have resulted in a technological edge that is difficult for new players to match.

- Licensing Costs: New entrants face the choice of developing their own costly technologies or licensing GEA's, which presents a financial hurdle.

- Market Entry Barrier: The combination of unique technology and intellectual property rights significantly increases the difficulty and expense for new companies to enter GEA's markets.

Complex Regulatory Compliance and Industry Standards

The food, beverage, and pharmaceutical sectors are heavily regulated worldwide, demanding strict adherence to hygiene, safety, and quality standards. New companies entering these markets must invest significantly in understanding and meeting these complex compliance requirements, including obtaining numerous certifications. For instance, in 2024, the global food safety market was valued at over $60 billion, highlighting the extensive regulatory landscape.

GEA Group, with its decades of experience, possesses established compliance frameworks and deep expertise in navigating these intricate regulations. This existing infrastructure and knowledge base act as a significant barrier to entry, providing GEA with a competitive advantage. Their ability to consistently meet and exceed these standards, often verified through audits and certifications, differentiates them from potential newcomers who would face substantial upfront investment and time delays.

- Global Food Safety Market Value (2024): Over $60 billion.

- Key Regulatory Areas: Hygiene, safety, quality.

- New Entrant Challenge: Navigating complex compliance and certification processes.

- GEA's Advantage: Established frameworks and expertise in regulatory adherence.

The threat of new entrants for GEA Group is significantly mitigated by several factors, including high capital requirements, established brand loyalty, and extensive global reach. These elements create substantial barriers, making it difficult and costly for new companies to compete effectively in GEA's core markets.

GEA's strong intellectual property portfolio and deep technological expertise, cultivated through consistent R&D investment, further deter new entrants. Overcoming these proprietary advantages would necessitate considerable time and financial resources.

The stringent regulatory environment in GEA's key sectors, such as food and pharmaceuticals, also acts as a deterrent. Newcomers must invest heavily in compliance and certifications, a hurdle that GEA, with its established frameworks, is well-positioned to navigate.

| Barrier Type | Description | Impact on New Entrants | GEA's Advantage |

|---|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and sales networks. | Significant financial hurdle. | Established infrastructure and economies of scale. |

| Brand Reputation & Customer Relationships | Decades of trust and critical operational integration. | Difficulty in replicating customer loyalty. | Long-standing relationships and service contracts. |

| Intellectual Property & Technology | Extensive patents and proprietary know-how. | Need for costly development or licensing. | Technological leadership and innovation speed. |

| Regulatory Compliance | Complex global standards in food, beverage, pharma. | Substantial upfront investment and time delays. | Existing compliance frameworks and expertise. |

Porter's Five Forces Analysis Data Sources

Our GEA Group Porter's Five Forces analysis is built upon a robust foundation of data, drawing from GEA's annual reports, investor presentations, and industry-specific market research from firms like Statista and IBISWorld. This ensures a comprehensive understanding of the competitive landscape.