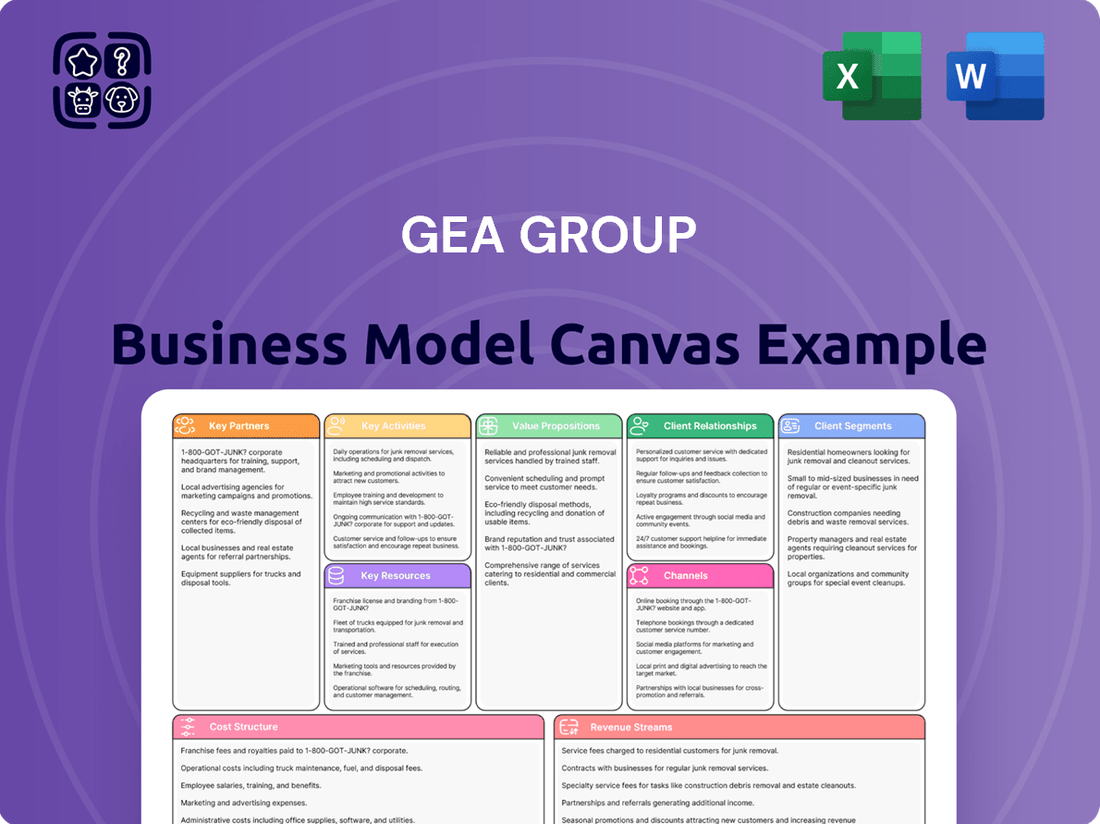

GEA Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GEA Group Bundle

Unlock the strategic blueprint behind GEA Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how GEA Group effectively serves its diverse customer segments and leverages key partnerships to deliver its innovative solutions. Discover the core activities and value propositions that drive their market leadership.

Dive deeper into GEA Group’s operational engine with the full Business Model Canvas. This downloadable resource provides a clear, section-by-section breakdown of their revenue streams, cost structure, and key resources, offering invaluable insights for strategic planning and competitive analysis. See how GEA Group builds and sustains its competitive advantage.

Partnerships

GEA actively partners with technology firms and academic bodies to pioneer advancements, especially in digitalization and AI for predictive maintenance. These collaborations allow GEA to embed sophisticated features into its machinery and operational workflows, boosting performance and delivering novel customer solutions.

For example, GEA’s integration of digital twins and AI-powered predictive maintenance strategies has demonstrably cut downtime within its production facilities. In 2024, the company reported a significant reduction in unplanned equipment stoppages, attributed in part to these innovative partnerships.

GEA Group actively cultivates strategic alliances to facilitate market entry and bolster its presence in established territories, particularly within burgeoning industries such as alternative proteins and carbon capture technologies. These collaborations are crucial for accessing new customer bases and leveraging specialized expertise.

A prime illustration of this strategy is GEA's partnership with EEW Energy from Waste, focused on advancing carbon capture solutions. This alliance is designed to rigorously test and refine processes, paving the way for their implementation at an industrial scale, a critical step for environmental sustainability initiatives.

GEA Group relies heavily on its suppliers for a steady stream of high-quality raw materials and specialized components essential for its advanced machinery and plant solutions. These partnerships are foundational to maintaining production efficiency and upholding the superior quality of GEA's offerings.

In 2023, GEA Group's procurement strategy focused on strengthening relationships with key suppliers, aiming for greater supply chain resilience and cost optimization. The company actively seeks suppliers who can meet stringent quality standards and demonstrate a commitment to sustainability, aligning with GEA's broader corporate goals.

Academic and Research Collaborations

GEA Group actively fosters academic and research collaborations to remain at the cutting edge of scientific innovation and to cultivate the next generation of engineers and food technologists. These partnerships are crucial for GEA to integrate emerging technologies and methodologies into its operations and product development, ensuring continued leadership in its sectors.

A prime example of this commitment is GEA's new Food Application and Technology Center in Wisconsin, scheduled for its grand opening in 2025. This facility is specifically designed to assist manufacturers in scaling up production for innovative plant-based, microbial, and cell-based food products. Furthermore, it plays a vital role in developing a skilled workforce prepared for the future demands of the food industry.

- University Partnerships: GEA collaborates with leading universities on joint research projects, accessing specialized knowledge and talent pools.

- Research Centers: Engagement with research institutions allows GEA to explore novel scientific frontiers and validate advanced technological solutions.

- Talent Development: These collaborations provide platforms for internships, thesis projects, and graduate recruitment, directly contributing to GEA's future talent pipeline.

- Innovation Hub: The Wisconsin Food Application and Technology Center, opening in 2025, will serve as a nexus for applied research and development in next-generation food production.

Customer Co-development Partnerships

GEA actively engages in customer co-development partnerships, working hand-in-hand with key clients to craft bespoke solutions. These collaborations are designed to tackle specific operational hurdles and meet unique industry demands, ensuring GEA’s products are both relevant and impactful. This strategy fosters deeper customer loyalty and drives innovation in product offerings.

A prime illustration of this approach is GEA's significant order from Baladna Algeria S.P.A. to construct the planet's largest integrated dairy facility. This project underscores the value of co-development, with GEA delivering a complete suite of dairy farming and processing technologies.

- Customer-Centric Innovation: GEA's co-development model directly addresses customer pain points, leading to highly specialized and effective solutions.

- Strengthened Relationships: Collaborative projects deepen ties with clients, moving beyond transactional exchanges to true partnerships.

- Market Relevance: By working closely with customers, GEA ensures its innovations align with current and future market needs.

- Baladna Algeria Project: This landmark deal exemplifies the success of co-development, showcasing GEA's ability to deliver comprehensive, large-scale solutions for the dairy sector.

GEA's key partnerships are vital for driving innovation and market expansion. Collaborations with technology firms and universities, like those focused on AI and digitalization, enhance machinery performance and create new customer solutions. Strategic alliances are crucial for entering new markets, particularly in emerging sectors such as alternative proteins and carbon capture, exemplified by the partnership with EEW Energy from Waste to advance carbon capture technologies.

| Partner Type | Focus Area | Benefit to GEA | Example | Impact/Data Point |

|---|---|---|---|---|

| Technology Firms | Digitalization, AI | Enhanced machinery, predictive maintenance | AI integration for predictive maintenance | Reduced unplanned equipment stoppages in 2024 |

| Academic Bodies/Universities | Research, Talent Development | Cutting-edge innovation, future workforce | Joint research projects, Wisconsin Food Application and Technology Center (opening 2025) | Cultivating next-gen engineers and food technologists |

| Strategic Allies | Market Entry, New Industries | Access to new customers, specialized expertise | EEW Energy from Waste (Carbon Capture) | Advancing industrial-scale implementation of carbon capture |

| Key Customers | Co-development, Bespoke Solutions | Customer loyalty, product relevance | Baladna Algeria S.P.A. (Dairy Facility) | Delivery of world's largest integrated dairy facility |

What is included in the product

GEA Group's Business Model Canvas outlines its strategy as a leading technology supplier for the food processing and a wide range of other industries, focusing on delivering integrated solutions and services.

It details customer segments, value propositions centered on efficiency and sustainability, and channels for reaching diverse global markets.

The GEA Group Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their complex operations, enabling efficient identification and resolution of inefficiencies across their diverse business segments.

It offers a concise, one-page snapshot of GEA's value proposition and customer relationships, simplifying the management of intricate supply chains and customer needs.

Activities

GEA Group places a strong emphasis on Research & Development, consistently driving innovation in its process technologies and components. This commitment is geared towards enhancing efficiency, promoting sustainability, and elevating product quality across its diverse offerings.

In 2024, GEA continued its investment in cutting-edge solutions, particularly for complex production processes. A significant focus area includes the development of digital twins and the integration of AI for predictive maintenance, aiming to optimize operational performance for its clients.

GEA's core activities revolve around the sophisticated design, intricate engineering, and precise manufacturing of specialized processing equipment. This includes a vast array of products like high-performance separators, critical valves, and comprehensive, integrated production lines tailored for diverse industrial applications.

In 2023, GEA reported a significant portion of its revenue stemming from the sales of its extensive equipment portfolio, underscoring the critical nature of these manufacturing capabilities for the group's overall financial performance and market position.

GEA excels at managing intricate projects, delivering fully integrated solutions and entire plants to clients across the globe. This encompasses the complete project lifecycle, from the initial design stages through to final installation and operational commissioning, ensuring all diverse technologies work together harmoniously.

A prime example of GEA's capability in this area was their significant contract to construct the world's largest integrated dairy facility in Algeria. This massive undertaking covered the entire milk powder production value chain, showcasing their end-to-end project management expertise.

Global Service and Aftermarket Support

GEA's global service and aftermarket support is a cornerstone of its operations, focusing on delivering comprehensive solutions such as maintenance, spare parts, and system optimization. This dedication ensures the sustained high performance and efficiency of GEA's installed systems, fostering long-term customer loyalty and generating predictable, recurring revenue. In 2024, this vital service segment contributed significantly, representing 38.9 percent of GEA Group's total revenue.

- Aftermarket Services: GEA provides a full spectrum of services, including preventative maintenance, emergency repairs, and system upgrades to maximize operational uptime and efficiency for its clients.

- Spare Parts Management: Ensuring the availability and timely delivery of genuine spare parts is critical to minimizing downtime and maintaining the integrity of GEA's equipment.

- Optimization and Modernization: GEA offers services aimed at optimizing existing systems and providing modernization solutions, enhancing performance and extending the lifespan of installed assets.

- Revenue Contribution: The aftermarket and service division demonstrated its financial importance in 2024, accounting for 38.9% of the group's overall revenue.

Sales, Marketing, and Customer Relationship Management

GEA’s global sales and marketing efforts are crucial for connecting with its varied customer base across industries like food and beverage, and pharmaceuticals. In 2024, the company continued to invest in digital marketing channels and direct sales forces to enhance market penetration and brand awareness, aiming to reach new and existing clients effectively.

Customer relationship management is central to GEA's strategy, focusing on building enduring partnerships by deeply understanding client requirements. This involves offering customized equipment and process solutions, backed by comprehensive after-sales service and technical support, ensuring customer satisfaction and loyalty.

- Global Reach: GEA operates sales and marketing across numerous countries, tailoring approaches to local market demands and regulatory environments.

- Customer-Centric Solutions: The company emphasizes providing bespoke solutions that address specific customer challenges, from individual components to complete plant installations.

- Long-Term Partnerships: GEA’s relationship management focuses on continuous engagement, offering lifecycle services, spare parts, and upgrades to maintain client retention and drive repeat business.

- Market Insights: Continuous market analysis and customer feedback loops inform product development and sales strategies, ensuring GEA remains competitive and responsive to evolving industry needs.

GEA Group's key activities encompass the design, engineering, and manufacturing of specialized processing equipment, alongside project management for integrated solutions and plants. A significant portion of their business also relies on global sales, marketing, and customer relationship management to deliver tailored solutions and foster long-term partnerships.

Full Version Awaits

Business Model Canvas

The GEA Group Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file, offering full transparency into the detailed analysis of GEA's strategic framework. You'll gain immediate access to this same comprehensive document, ensuring no surprises and providing you with all the insights you need.

Resources

GEA Group's intellectual property, including a vast patent portfolio and proprietary process technologies, is a cornerstone of its business. This deep well of specialized engineering know-how allows GEA to develop and offer highly differentiated solutions, particularly in complex industrial sectors. For instance, in 2023, GEA continued to invest significantly in research and development, a key driver for expanding this intellectual capital and maintaining its edge.

GEA Group's most vital resource is its extensive global workforce, numbering over 18,000 individuals. This team includes a significant contingent of highly skilled engineers, specialized technicians, and experienced project managers who are the backbone of the company's operations.

The collective expertise of these professionals is indispensable for GEA's ability to conceptualize, engineer, produce, and maintain sophisticated industrial systems and solutions across various sectors.

In 2024, GEA continued to invest in talent development, recognizing that this human capital is key to innovation and customer satisfaction in the highly competitive process technology market.

GEA Group operates a vast global manufacturing and service infrastructure, featuring numerous production sites, service hubs, and sales locations strategically positioned across the world. This extensive network is crucial for its international reach, allowing for efficient production and delivery of its specialized equipment and services to a diverse customer base.

In 2023, GEA Group reported that its global presence included approximately 70 production facilities and over 500 service centers, underscoring the scale of its operational footprint. This infrastructure is fundamental to supporting its business model by ensuring proximity to key markets and enabling responsive customer support, a vital component for its specialized industry offerings.

Research and Development Facilities

GEA's commitment to innovation is underpinned by its dedicated research and development facilities. These centers are crucial for developing and testing cutting-edge technologies and solutions that drive the company's offerings. For instance, the new Food Application and Technology Center in Wisconsin, set to open in 2025, exemplifies this investment in future capabilities.

These facilities are not just about creating new products; they are hubs for collaboration and knowledge sharing, ensuring GEA stays at the forefront of industry advancements. This focus on R&D directly supports GEA's ability to provide advanced solutions to its diverse customer base.

- Dedicated R&D Centers: GEA operates specialized facilities for the development and testing of new technologies.

- Innovation Hubs: These centers foster innovation, enabling the creation of advanced solutions.

- Future Investments: The upcoming Food Application and Technology Center in Wisconsin, opening in 2025, highlights ongoing strategic investments.

- Technological Advancement: R&D facilities are key to GEA's continuous pursuit of technological leadership in its sectors.

Financial Capital and Strong Balance Sheet

GEA Group's robust financial capital is a cornerstone of its business model, enabling significant investments in research and development to drive innovation in its core markets. This financial strength also underpins the company's capacity to expand and upgrade its manufacturing facilities, ensuring operational efficiency and the ability to handle complex, large-scale projects for its global clientele.

Furthermore, a strong balance sheet allows GEA to strategically pursue acquisitions that complement its existing portfolio and market reach. This approach to growth is vital for maintaining a competitive edge and capturing new opportunities in dynamic industries.

GEA Group demonstrated solid financial performance throughout 2024, reporting key financial metrics that underscore its resilience and strategic execution. For instance, the company's order intake in the first nine months of 2024 reached approximately €4.3 billion, reflecting sustained demand for its solutions. The company also provided an updated outlook for 2025, anticipating continued growth and profitability, which further solidifies its financial stability and capacity for future investments and strategic initiatives.

- Financial Capital: Essential for funding R&D, manufacturing upgrades, and strategic acquisitions.

- 2024 Performance: Order intake of ~€4.3 billion (first nine months) indicates strong market demand.

- 2025 Outlook: Positive projections for continued growth and profitability support future investments.

- Balance Sheet Strength: Enables GEA to pursue growth opportunities and maintain operational excellence.

GEA Group's intellectual property, including a vast patent portfolio and proprietary process technologies, is a cornerstone of its business. This deep well of specialized engineering know-how allows GEA to develop and offer highly differentiated solutions, particularly in complex industrial sectors. For instance, in 2023, GEA continued to invest significantly in research and development, a key driver for expanding this intellectual capital and maintaining its edge.

GEA Group's most vital resource is its extensive global workforce, numbering over 18,000 individuals. This team includes a significant contingent of highly skilled engineers, specialized technicians, and experienced project managers who are the backbone of the company's operations.

The collective expertise of these professionals is indispensable for GEA's ability to conceptualize, engineer, produce, and maintain sophisticated industrial systems and solutions across various sectors. In 2024, GEA continued to invest in talent development, recognizing that this human capital is key to innovation and customer satisfaction in the highly competitive process technology market.

GEA Group operates a vast global manufacturing and service infrastructure, featuring numerous production sites, service hubs, and sales locations strategically positioned across the world. This extensive network is crucial for its international reach, allowing for efficient production and delivery of its specialized equipment and services to a diverse customer base. In 2023, GEA Group reported that its global presence included approximately 70 production facilities and over 500 service centers, underscoring the scale of its operational footprint. This infrastructure is fundamental to supporting its business model by ensuring proximity to key markets and enabling responsive customer support, a vital component for its specialized industry offerings.

GEA's commitment to innovation is underpinned by its dedicated research and development facilities. These centers are crucial for developing and testing cutting-edge technologies and solutions that drive the company's offerings. For instance, the new Food Application and Technology Center in Wisconsin, set to open in 2025, exemplifies this investment in future capabilities. These facilities are not just about creating new products; they are hubs for collaboration and knowledge sharing, ensuring GEA stays at the forefront of industry advancements. This focus on R&D directly supports GEA's ability to provide advanced solutions to its diverse customer base.

GEA Group's robust financial capital is a cornerstone of its business model, enabling significant investments in research and development to drive innovation in its core markets. This financial strength also underpins the company's capacity to expand and upgrade its manufacturing facilities, ensuring operational efficiency and the ability to handle complex, large-scale projects for its global clientele. Furthermore, a strong balance sheet allows GEA to strategically pursue acquisitions that complement its existing portfolio and market reach. This approach to growth is vital for maintaining a competitive edge and capturing new opportunities in dynamic industries. GEA Group demonstrated solid financial performance throughout 2024, reporting key financial metrics that underscore its resilience and strategic execution. For instance, the company's order intake in the first nine months of 2024 reached approximately €4.3 billion, reflecting sustained demand for its solutions. The company also provided an updated outlook for 2025, anticipating continued growth and profitability, which further solidifies its financial stability and capacity for future investments and strategic initiatives.

Value Propositions

GEA Group delivers cutting-edge solutions designed to streamline customer production, boosting efficiency and lowering operational expenses. This focus on optimization translates directly into higher output volumes.

For instance, GEA's advanced separation technology, a key component in many of their offerings, saw significant adoption in the food and beverage sector throughout 2024, with installations contributing to an average efficiency gain of 15% for clients.

These improvements are realized through the integration of sophisticated process technologies and high-quality components, creating seamless operational systems that maximize throughput for their diverse customer base.

GEA Group's commitment to sustainability is a core value proposition, offering customers solutions that significantly reduce their environmental impact. This includes helping businesses lower CO2 emissions and minimize plastic waste, directly addressing critical global environmental challenges.

A prime example of this is GEA's work in combating food waste, a significant issue with economic and environmental ramifications. By providing advanced processing technologies, GEA enables the efficient utilization of resources, thereby reducing waste throughout the food production chain.

Looking ahead, GEA is actively pursuing ambitious environmental goals, aiming for net-zero operations by 2040. This forward-thinking strategy is complemented by their development of innovative solutions for carbon capture, demonstrating a proactive approach to climate change mitigation.

GEA's commitment to high product quality and safety is a cornerstone of its value proposition, especially for demanding industries like food, beverage, and pharmaceuticals. Their advanced technologies are engineered to maintain stringent quality standards and ensure consumer safety throughout production processes.

This is achieved through meticulous process control, ensuring every step meets exact specifications, and a focus on hygienic design principles that prevent contamination. For instance, in 2024, GEA continued to innovate in areas like aseptic processing, crucial for extending shelf life and maintaining product integrity in sensitive food and beverage applications.

Adherence to rigorous industry regulations and certifications, such as GMP and HACCP, further solidifies GEA's reputation. These standards are not just met but often exceeded, providing customers with confidence in the safety and reliability of their end products, a critical factor in these highly regulated markets.

Tailored and Integrated Solutions

GEA Group excels by crafting solutions that are not just products, but complete, integrated systems designed for specific industrial needs. This approach moves beyond a transactional sale to delivering comprehensive value chains, particularly for large-scale, complex projects.

For instance, GEA's expertise is evident in providing entire integrated dairy facilities, showcasing their ability to manage and deliver complete operational setups. This tailored and integrated offering is a cornerstone of their business model, ensuring clients receive a holistic solution.

In 2024, GEA continued to emphasize these integrated solutions, contributing to their robust order intake. The company reported that its order backlog remained strong, reflecting the demand for these comprehensive project deliveries across various sectors.

Key aspects of GEA's tailored and integrated solutions include:

- Customization: Solutions are specifically engineered to meet the unique requirements of each client and application.

- Integration: GEA provides end-to-end system delivery, managing multiple components and processes seamlessly.

- Value Chain Focus: The company delivers complete value chains, simplifying complex projects for customers.

- Industry Specialization: Deep expertise in sectors like food and beverage allows for highly effective, specialized solutions.

Reliable Aftermarket Service and Support

Customers rely on GEA's vast global service network for dependable operation, upkeep, and performance enhancement of their installed equipment. This robust support system is designed to maximize operational uptime and preserve the long-term value of their assets.

The service sector represents a substantial and expanding component of GEA's overall financial performance. For instance, in 2023, GEA reported that its Service segment contributed significantly to its revenue, highlighting its importance.

- Extensive Global Network: GEA's worldwide presence ensures localized support for customers, regardless of their location.

- Maximized Uptime: Proactive maintenance and rapid response minimize equipment downtime, crucial for continuous operations.

- Long-Term Asset Value: Expert service and optimization strategies help extend the lifespan and efficiency of GEA equipment.

- Growing Revenue Stream: The service business is a key driver of GEA's financial growth, demonstrating its strategic importance.

GEA Group offers optimized production solutions that enhance efficiency and reduce costs, leading to increased output volumes for clients.

Their advanced separation technologies, widely adopted in the food and beverage sector during 2024, achieved an average client efficiency gain of 15%.

These gains are driven by sophisticated process integration and high-quality components that maximize throughput.

GEA's value proposition also centers on sustainability, providing solutions that lower CO2 emissions and minimize plastic waste.

The company is actively working towards net-zero operations by 2040 and developing innovative carbon capture technologies.

In 2024, GEA's commitment to product quality and safety was evident in their advancements in aseptic processing, vital for sensitive food and beverage applications.

GEA provides complete, integrated systems tailored to specific industrial needs, moving beyond simple product sales to deliver comprehensive value chains.

This integrated approach, exemplified by their provision of entire dairy facilities, contributes to a strong order backlog, as seen in their robust performance throughout 2024.

GEA's extensive global service network ensures reliable operation and performance enhancement, with the service segment representing a significant and growing part of their revenue.

Customer Relationships

GEA Group prioritizes its most significant customers by assigning dedicated key account managers. These specialists offer tailored support and strategic advice, building robust, long-term partnerships. This focus ensures GEA deeply understands and effectively addresses the unique requirements of its major clients.

GEA Group cultivates robust customer relationships via extensive long-term service contracts. These agreements, encompassing vital maintenance, readily available spare parts, and crucial technical support, are designed to guarantee the uninterrupted and optimal performance of GEA's installed equipment. This focus on after-sales service fosters loyalty and ensures customers receive ongoing value.

These service contracts are a cornerstone of GEA's revenue strategy, providing predictable and stable cash flows. This stability acts as a buffer against the inherent volatility of the capital expenditure cycles common in the industries GEA serves. For instance, in 2023, GEA reported a significant portion of its revenue stemming from services, demonstrating the financial impact of these customer relationships.

GEA Group actively fosters collaborative innovation with its customers, a strategy that has proven vital in shaping its product development. This partnership approach allows GEA to jointly develop cutting-edge solutions and refine existing processes, ensuring offerings are precisely tailored to market needs.

This co-creation model directly addresses evolving customer demands and emerging market trends. For instance, in 2023, GEA reported a significant portion of its revenue stemming from new product introductions, a testament to the success of these customer-centric innovation efforts.

Global and Local Support Presence

GEA Group's customer relationships are significantly bolstered by its extensive global and local support network. Operating in over 150 countries, GEA combines worldwide technological expertise with on-the-ground service capabilities. This dual approach ensures customers receive timely and culturally appropriate solutions, fostering strong, reliable partnerships.

- Global Reach, Local Touch: GEA's presence in 150+ countries provides customers with consistent, high-quality support regardless of their location.

- Prompt and Relevant Solutions: The localized support teams are equipped to offer prompt responses and solutions tailored to specific regional needs and cultural contexts.

- Enhanced Customer Experience: This comprehensive support structure aims to build trust and loyalty by ensuring customers feel understood and well-served at every interaction.

Training and Knowledge Transfer

GEA Group actively invests in training and knowledge transfer for its clientele. These programs are designed to equip customers with the skills needed to operate and maintain GEA equipment efficiently, ultimately optimizing their operational processes. This focus on customer capability building is a cornerstone of their relationship strategy, fostering deeper engagement and loyalty.

In 2024, GEA continued to emphasize these customer-centric initiatives. For instance, their digital learning platforms saw increased utilization, with a reported 15% rise in engagement for online training modules compared to the previous year. This reflects a growing demand for accessible and flexible knowledge transfer solutions.

- Enhanced Operational Efficiency: GEA's training empowers customers to maximize the performance of their installed base, leading to reduced downtime and improved output.

- Skill Development: Customers gain expertise in operating and maintaining complex GEA technologies, fostering self-sufficiency and reducing reliance on external support.

- Process Optimization: Knowledge transfer extends beyond equipment operation to encompass best practices for process optimization, driving tangible business benefits for clients.

- Strengthened Partnerships: By investing in customer success through education, GEA cultivates long-term, collaborative relationships built on trust and shared expertise.

GEA Group's customer relationships are built on a foundation of dedicated support, long-term service agreements, and collaborative innovation. Key account managers provide tailored advice, while extensive service contracts ensure optimal equipment performance, contributing to stable revenue streams. This customer-centric approach is further enhanced by a global support network and robust training programs, fostering loyalty and driving product development.

| Customer Relationship Aspect | Key Features | Impact on GEA | 2023/2024 Data Point |

|---|---|---|---|

| Dedicated Support | Key account managers, tailored advice | Strong long-term partnerships, deep client understanding | Focus on major clients |

| Service Contracts | Maintenance, spare parts, technical support | Predictable revenue, customer loyalty, optimized equipment performance | Significant portion of revenue from services (2023) |

| Collaborative Innovation | Joint product development, process refinement | Tailored solutions, market responsiveness, new product revenue | Revenue from new products (2023) |

| Global & Local Support | 150+ countries, on-the-ground service | Timely, relevant solutions, enhanced customer experience | Extensive global presence |

| Customer Training | Knowledge transfer, operational efficiency | Customer self-sufficiency, process optimization, strengthened partnerships | 15% rise in digital learning engagement (2024) |

Channels

GEA Group's direct sales force, supported by a robust global network, is a cornerstone of its customer engagement strategy. This direct approach enables close collaboration, allowing GEA to deeply understand client needs and deliver highly customized equipment and solutions, particularly for large-scale projects and intricate machinery.

In 2024, GEA continued to leverage this extensive network, which spans numerous countries, to foster direct relationships. This channel is vital for managing complex sales cycles and ensuring that the specialized needs of industries like food and beverage, chemicals, and pharmaceuticals are met with precision and expertise.

GEA Group leverages its corporate website and various digital platforms as key channels for global marketing and information sharing. These online presences serve as a central hub for customers seeking details on their extensive product portfolio and services.

In 2024, GEA's digital strategy likely focused on enhancing user experience and providing readily accessible resources. For instance, their website offers detailed product specifications, case studies, and contact points for service inquiries, streamlining customer engagement.

These digital platforms are crucial for building brand awareness and reaching a diverse international customer base. They also facilitate lead generation and can support the sale of smaller components or the initiation of service requests, contributing directly to operational efficiency.

GEA Group actively participates in major industry trade shows and conferences to highlight its cutting-edge technologies and solutions. These events serve as crucial platforms for direct engagement with a global audience of customers and partners. For instance, in 2024, GEA showcased its advanced processing equipment and digital solutions at events like Anuga FoodTec and ACHEMA, attracting significant interest from potential clients.

These gatherings are instrumental for GEA in generating qualified leads and reinforcing its brand presence as a leader in specialized equipment manufacturing. By demonstrating its technical capabilities and innovative approaches, GEA strengthens its market position and fosters valuable business relationships. The company reported a substantial increase in qualified leads from its 2024 conference participation.

Service and Aftermarket Network

GEA Group's Service and Aftermarket Network is a crucial channel for maintaining customer relationships and generating ongoing revenue. This global infrastructure of service centers and skilled technicians provides essential support, including maintenance, repairs, and the supply of spare parts. This ensures operational continuity for their clients and fosters loyalty.

The network is instrumental in delivering value beyond the initial sale, directly impacting customer satisfaction and retention. In 2024, GEA reported that its service business continued to be a significant contributor to overall revenue, demonstrating the channel's financial importance. For instance, aftermarket services often carry higher profit margins than new equipment sales.

Key aspects of this channel include:

- Global Reach: GEA operates a vast network of service locations worldwide, ensuring prompt support regardless of customer location.

- Expertise: Technicians are highly trained on GEA's diverse product portfolio, guaranteeing specialized and effective service.

- Spare Parts Availability: A robust supply chain for spare parts minimizes downtime for customers, a critical factor in industrial operations.

- Customer Support: Beyond technical fixes, this channel offers consulting and optimization services, deepening customer engagement.

Strategic Partnerships and Distributors

GEA Group often utilizes strategic partnerships and a robust network of distributors to amplify its market presence, especially in regions where direct operations might be less efficient or for specific product categories. This approach is particularly valuable for reaching niche markets or for distributing their more standardized offerings, ensuring customers receive timely access and support.

In 2024, GEA continued to emphasize these channels. For instance, their filtration and separation technologies often rely on specialized distributors who possess deep local market knowledge and established customer relationships. This allows GEA to effectively serve diverse industries, from food and beverage to pharmaceuticals and chemicals, by leveraging the expertise of their partners.

- Extended Market Reach: Partnerships and distributors allow GEA to access geographies and customer segments that might be challenging to penetrate directly.

- Niche Market Penetration: Specialized distributors can cater to the unique needs of niche markets, offering tailored solutions and support.

- Efficient Delivery and Support: Local partners ensure efficient logistics and provide localized customer service and technical assistance.

- Cost-Effectiveness: For standardized products or in certain regions, this model can be more cost-effective than establishing and maintaining GEA's own extensive infrastructure.

GEA Group's channels are multifaceted, encompassing direct sales, digital platforms, industry events, aftermarket services, and strategic partnerships. These diverse avenues ensure broad market reach and deep customer engagement across various sectors. The company's commitment to these channels in 2024 aimed to bolster its global presence and service delivery capabilities.

The direct sales force and global network are crucial for complex projects, while digital channels like the corporate website handle marketing and information dissemination. Industry events provide direct engagement and lead generation, with GEA actively participating in major trade shows in 2024 to showcase its innovations.

GEA's Service and Aftermarket Network is vital for customer retention and revenue, offering maintenance, repairs, and spare parts globally. Strategic partnerships and distributors extend market reach, particularly for niche markets and standardized offerings, a strategy GEA continued to leverage in 2024.

| Channel | Primary Function | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Global Network | Complex sales, customized solutions, client relationship building | Strengthened for large-scale projects and intricate machinery needs. |

| Digital Platforms (Website, etc.) | Global marketing, information sharing, lead generation | Enhanced user experience, accessible resources for product details and service inquiries. |

| Industry Trade Shows & Conferences | Technology showcasing, direct engagement, lead generation | Active participation in key events like Anuga FoodTec and ACHEMA, reporting increased qualified leads. |

| Service & Aftermarket Network | Customer retention, ongoing revenue, operational continuity | Significant revenue contributor; aftermarket services often yield higher profit margins. |

| Partnerships & Distributors | Market reach expansion, niche market penetration, efficient delivery | Leveraged for specialized technologies and regional access, enhancing localized support. |

Customer Segments

The Food and Beverage Processors segment is a cornerstone for GEA Group, encompassing diverse operations such as dairy, meat, plant-based foods, and beverage production. GEA's value proposition here centers on enhancing production efficiency, promoting sustainability, and elevating product quality through advanced equipment and integrated solutions.

This critical market segment demonstrated significant strength in 2024, with the dairy industry alone contributing 30% to GEA's total sales. The broader food industry accounted for an additional 26% of sales, underscoring the vital role these processors play in GEA's business portfolio.

GEA Group is a key partner for pharmaceutical and biotechnology companies, supplying critical process technology and components essential for manufacturing vital healthcare products like vaccines and biopharmaceuticals. This sector places a premium on exacting precision, stringent hygiene standards, and unwavering adherence to regulatory requirements.

The pharmaceutical industry represented a significant 7% of GEA's total sales in 2024, underscoring the importance of this segment to the group's overall performance and market reach.

GEA's Farm Technologies division directly serves dairy farmers and agricultural enterprises by offering advanced solutions aimed at enhancing operational efficiency and sustainability. This includes state-of-the-art milking equipment and sophisticated farm management systems designed to optimize herd health and milk yield.

The core focus for this segment is on improving both animal welfare and the overall productivity of dairy operations. By providing tools that monitor and manage individual animal health, GEA helps farmers achieve better milk quality and quantity, contributing to their profitability.

In 2024, the global dairy market continued its growth trajectory, with demand for efficient farming solutions increasing. GEA's commitment to innovation in this area positions them to capture a significant share of this expanding market, supporting farmers in meeting the rising global demand for dairy products.

Chemical and Industrial Process Industries

GEA provides essential process technology and components for a wide array of chemical and industrial applications. Their specialization lies in optimizing critical operations like separation, fluid handling, and thermal processes, directly benefiting industries that rely on efficient and complex workflows. In 2024, the chemical industry represented a significant 8% of GEA's total sales, underscoring the segment's importance.

Key contributions to this segment include:

- Advanced Separation Technologies: GEA offers centrifuges, filters, and membrane systems crucial for purifying and concentrating chemical products.

- Efficient Fluid Handling: Their pumps, valves, and piping solutions ensure safe and reliable transfer of diverse chemical substances.

- Optimized Thermal Processes: GEA's expertise in evaporation, drying, and heat exchange technologies enhances energy efficiency and product quality in chemical manufacturing.

- Customized Solutions: The company tailors its offerings to meet the specific demands of various chemical sub-sectors, from petrochemicals to specialty chemicals.

Emerging Industries (e.g., New Food, Clean Energy)

GEA Group is strategically focusing on burgeoning sectors like new food and clean energy, recognizing them as significant growth avenues. These industries are propelled by strong global sustainability initiatives and rapid technological progress.

For instance, the alternative protein market is projected to reach substantial figures. By 2030, the global plant-based meat market alone is estimated to be worth over $140 billion, showcasing the immense potential in new food technologies.

In the clean energy space, GEA's involvement in hydrogen electrolysis and carbon capture technologies aligns with the urgent need for decarbonization. The global green hydrogen market, a key area for electrolysis, is expected to grow from approximately $3 billion in 2023 to over $50 billion by 2030.

- Targeting Growth: GEA is actively pursuing opportunities in alternative proteins and clean energy solutions.

- Market Drivers: Sustainability trends and technological innovation are key factors fueling demand in these emerging industries.

- Financial Outlook: The alternative protein market is anticipated to exceed $140 billion by 2030, while the green hydrogen market is projected to surpass $50 billion by 2030.

- Strategic Alignment: GEA's focus on these sectors positions it to capitalize on the global shift towards a more sustainable economy.

GEA Group serves a diverse customer base, including food and beverage processors, pharmaceutical and biotech firms, dairy farmers, and chemical and industrial clients. Their offerings are tailored to enhance efficiency, ensure quality, and meet stringent regulatory demands across these varied sectors.

The company also targets emerging markets such as alternative proteins and clean energy, driven by global sustainability trends and technological advancements. This strategic focus aims to capture growth in industries critical for a decarbonized future.

| Customer Segment | 2024 Sales Contribution | Key Needs |

|---|---|---|

| Food & Beverage Processors | 56% (Dairy 30%, Food 26%) | Production efficiency, sustainability, product quality |

| Pharmaceutical & Biotechnology | 7% | Precision, hygiene, regulatory compliance |

| Farm Technologies (Dairy Farmers) | N/A (Integrated into Food & Bev) | Operational efficiency, animal welfare, milk yield |

| Chemical & Industrial Applications | 8% | Process optimization, separation, fluid handling, thermal processes |

| New Food & Clean Energy | Emerging Growth Areas | Sustainability, decarbonization, alternative proteins, hydrogen |

Cost Structure

GEA Group's manufacturing and production costs represent a substantial part of its overall expenses. These costs encompass the procurement of raw materials, the wages paid to direct labor involved in assembly and fabrication, and the various factory overheads like energy, maintenance, and depreciation of machinery. For instance, in 2023, GEA reported its Cost of Sales, which includes these manufacturing expenses, at €4.9 billion, highlighting the significant investment in producing its specialized equipment.

Optimizing these production processes is paramount for GEA to maintain cost competitiveness and profitability. This involves streamlining workflows, investing in automation where feasible, and carefully managing supply chains to secure favorable pricing for raw materials. GEA's focus on efficient production directly impacts its ability to offer high-quality machinery while keeping its pricing attractive in the global market.

GEA Group dedicates significant resources to Research and Development, recognizing it as a cornerstone for innovation and maintaining its competitive edge. These substantial costs encompass highly skilled personnel, advanced laboratory facilities, and extensive experimental projects aimed at developing cutting-edge solutions for the food and beverage, and process industries.

This strategic reinvestment underscores GEA's commitment to future growth and technological leadership. In 2024, GEA Group's R&D expenditure was reported at 4.5% of its total revenue, a figure that highlights the company's ongoing focus on pioneering new technologies and improving existing product lines.

GEA Group's cost structure is heavily influenced by its extensive Sales, Marketing, and Distribution efforts. These activities are crucial for engaging its broad global customer base, which spans various industries. For instance, the company's commitment to maintaining a worldwide sales force and executing targeted marketing campaigns represents a substantial investment.

Participation in key industry trade shows and events is another significant cost, enabling GEA to showcase its innovative solutions and connect with potential clients. Furthermore, the logistics and infrastructure required for the worldwide distribution of its specialized equipment and services add to these expenses, ensuring products reach customers efficiently across different regions.

Service and Aftermarket Support Costs

GEA Group's extensive global service network, a crucial element of its business model, generates significant costs. These expenses are primarily tied to maintaining a skilled workforce of field engineers, managing a substantial spare parts inventory, intricate logistics for timely delivery, and ongoing training programs to keep staff updated on new technologies.

While aftermarket support is a vital revenue stream, it also represents a considerable cost center for GEA. The company's commitment to comprehensive customer service necessitates substantial investment in these operational areas.

- Field Engineers: Costs associated with salaries, travel, and equipment for a global team of technicians performing installations, maintenance, and repairs.

- Spare Parts Inventory: Capital tied up in maintaining sufficient stock of critical components across various locations to minimize downtime for customers.

- Logistics and Supply Chain: Expenses related to warehousing, transportation, and customs for efficient delivery of parts and services worldwide.

- Training and Development: Ongoing investment in educating service personnel on new product lines, diagnostic tools, and safety protocols.

General and Administrative Expenses

General and Administrative (G&A) expenses for GEA Group encompass the essential corporate functions that keep a global technology enterprise running smoothly. These include the costs of running the executive leadership, finance departments, human resources, and the vital IT infrastructure supporting worldwide operations. For instance, in 2023, GEA reported administrative expenses of €435 million, reflecting the scale of these overhead functions.

These G&A costs are critical for maintaining the company's structure and compliance. They also include expenses related to strategic initiatives aimed at improving efficiency. GEA's commitment to operational excellence means that restructuring expenses, designed to optimize processes and resource allocation, are also factored into this category. Looking at 2024 projections, analysts anticipate G&A expenses to remain a significant, yet managed, portion of the overall cost base, crucial for supporting GEA's diverse business segments.

- Corporate Management: Costs associated with executive salaries, board fees, and strategic planning.

- Finance & Accounting: Expenses for financial reporting, treasury, and compliance.

- Human Resources: Costs for talent acquisition, payroll, benefits administration, and employee development.

- IT Infrastructure: Spending on hardware, software, network maintenance, and cybersecurity for global operations.

- Restructuring Expenses: Costs incurred from initiatives to improve operational efficiency and streamline business processes.

GEA Group's cost structure is multifaceted, encompassing significant investments in production, research, sales, service, and administration. Manufacturing and production costs, including raw materials and labor, were a substantial €4.9 billion in 2023. R&D investments represented 4.5% of revenue in 2024, crucial for innovation.

Sales, marketing, and distribution costs support GEA's global reach, while an extensive service network with field engineers and spare parts inventory incurs considerable operational expenses. General and administrative costs, amounting to €435 million in 2023, cover essential corporate functions and restructuring initiatives.

| Cost Category | 2023 Actual (€ million) | 2024 Projection/Focus |

|---|---|---|

| Cost of Sales (Manufacturing) | 4,900 | Focus on optimization and supply chain efficiency. |

| Research & Development | N/A (4.5% of revenue) | Continued investment in new technologies and product improvement. |

| Sales, Marketing & Distribution | N/A | Supporting global customer engagement and logistics. |

| Service Network Operations | N/A | Investment in skilled personnel, spare parts, and training. |

| General & Administrative | 435 | Maintaining corporate functions, compliance, and efficiency initiatives. |

Revenue Streams

GEA Group's core revenue generation stems from the sale of its extensive portfolio of processing equipment and machinery. This includes everything from individual components to fully integrated, turnkey solutions designed for diverse industrial sectors.

In 2023, GEA reported significant revenue from equipment sales, highlighting the demand for their advanced technological offerings. For instance, their order intake in 2023 reached €21.5 billion, with a substantial portion attributable to these capital equipment and solution sales.

These large-scale projects and integrated solutions represent a key revenue driver, often involving complex installations and long-term customer relationships. The company's ability to deliver comprehensive packages solidifies its position as a leading supplier in its target markets.

GEA Group generates a significant portion of its income from aftermarket services and the sale of spare parts. This segment is crucial for ongoing customer support and revenue generation after the initial equipment sale.

In 2024, GEA's service business represented a substantial 38.9% of its total revenue, highlighting the importance of this revenue stream. This includes vital maintenance, repair, and the supply of essential spare parts to keep their installed equipment running efficiently.

GEA Group can tap into revenue streams by licensing its advanced, proprietary technologies to other companies, allowing them to leverage GEA's innovations. This is particularly relevant in areas like food processing, dairy, and beverage production where GEA holds significant intellectual property.

Beyond licensing, GEA offers specialized consulting services. These services focus on optimizing industrial processes, designing efficient plants, and developing sustainable solutions for their clients, drawing on GEA's extensive engineering expertise and industry knowledge.

In 2024, the demand for sustainable solutions and process efficiency is high, driven by global environmental regulations and cost-saving imperatives. GEA's ability to provide these specialized services and license its cutting-edge technologies positions it to capitalize on these market trends, contributing to its overall revenue diversification.

Upgrades and Modernization Projects

Revenue is also generated through upgrading and modernizing existing customer facilities. GEA offers newer technologies that enhance efficiency and prolong the life of installed equipment. This strategy capitalizes on established customer relationships.

These projects are crucial for GEA’s aftermarket business. For instance, in 2024, GEA reported a significant portion of its revenue coming from services and spare parts, which includes modernization projects. This revenue stream is particularly stable as it taps into the installed base of GEA equipment worldwide.

- Revenue from Upgrades: GEA leverages its installed base by offering technological enhancements.

- Efficiency and Lifespan Extension: Modernization projects improve operational performance and equipment longevity.

- Customer Relationship Leverage: Existing partnerships provide a foundation for these revenue streams.

- 2024 Financial Impact: Services and spare parts, encompassing modernization, formed a substantial part of GEA's 2024 earnings.

Digital Solutions and Software Subscriptions

GEA Group is seeing a significant uptick in revenue from its digital solutions and software subscriptions. This growth is directly tied to their strategic push towards becoming an industrial technology leader. These offerings, like software for predictive maintenance and real-time process monitoring, are becoming increasingly vital for their customers.

The company's focus on digitalization is clearly reflected in its financial performance. For instance, in 2023, GEA reported a substantial increase in its service business, which includes these digital offerings, indicating strong customer adoption. This trend is expected to continue as more industries recognize the value of data analytics for optimizing operations.

- Digital Solutions: Revenue from software for process optimization and data analytics.

- Software Subscriptions: Recurring income from platforms enabling predictive maintenance and remote monitoring.

- Industrial Technology Pivot: These digital streams support GEA's broader strategy to be a key player in advanced industrial technology.

- 2023 Performance: GEA’s service business, encompassing digital solutions, demonstrated robust growth, underscoring market demand.

GEA Group's revenue streams are diverse, encompassing the sale of processing equipment, aftermarket services, technology licensing, consulting, and digital solutions. The company's ability to offer integrated solutions and ongoing support solidifies its market position.

The sale of machinery and integrated systems forms the bedrock of GEA's revenue. This is complemented by a substantial income from services, spare parts, and modernization projects, which accounted for 38.9% of GEA's revenue in 2024. Furthermore, the company is increasingly capitalizing on digital offerings and software subscriptions, reflecting a strategic shift towards industrial technology leadership.

| Revenue Stream | Description | 2024 Significance |

| Equipment & Machinery Sales | Sale of processing equipment, components, and turnkey solutions. | Core revenue driver, supported by strong order intake. |

| Aftermarket Services & Spare Parts | Maintenance, repair, and supply of spare parts for installed equipment. | 38.9% of total revenue in 2024, indicating high customer reliance. |

| Technology Licensing | Granting rights to use GEA's proprietary technologies. | Diversifies income by leveraging intellectual property. |

| Consulting Services | Expert advice on process optimization, plant design, and sustainability. | Capitalizes on demand for efficiency and regulatory compliance. |

| Digital Solutions & Subscriptions | Software for process monitoring, predictive maintenance, and data analytics. | Growing segment, supporting GEA's industrial technology strategy. |

Business Model Canvas Data Sources

The GEA Group Business Model Canvas is built upon a foundation of comprehensive market analysis, internal financial reports, and operational data. This ensures each component, from value propositions to cost structures, is grounded in factual evidence and strategic foresight.