GEA Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GEA Group Bundle

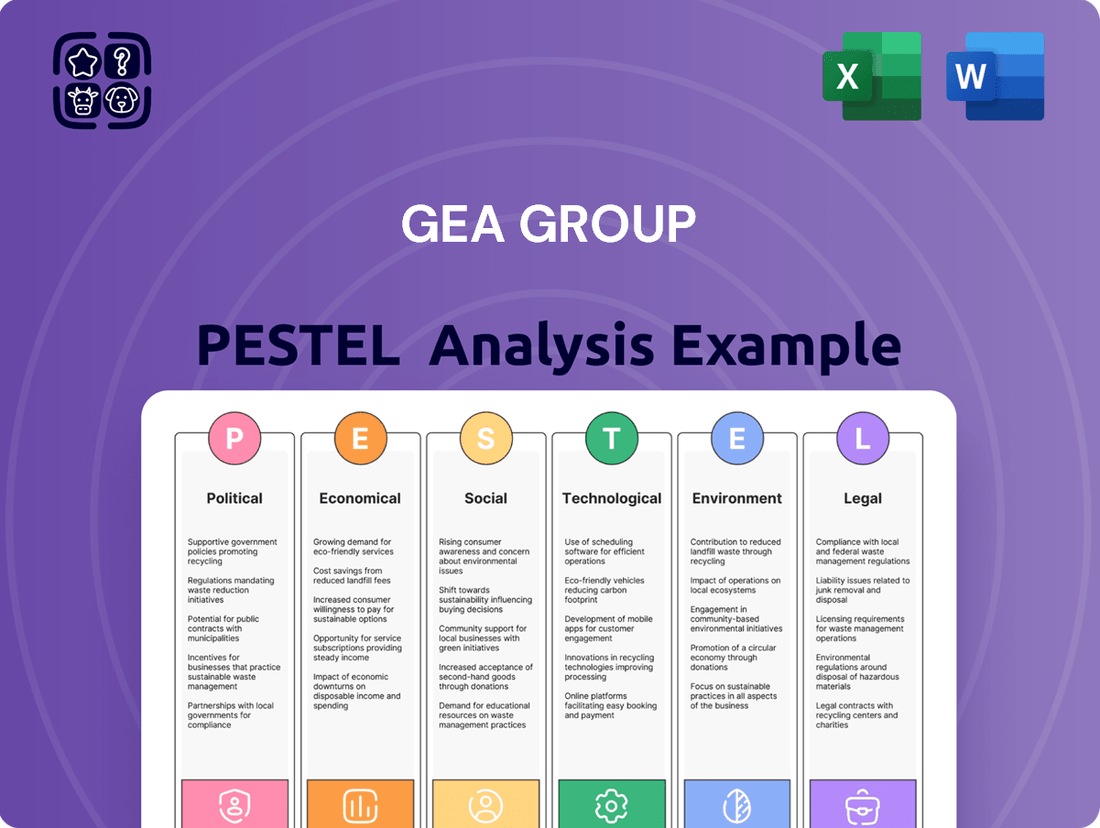

Understand how political stability, economic fluctuations, and evolving social trends are shaping GEA Group's operational landscape. Our PESTLE analysis delves into the technological advancements and environmental regulations impacting the sector, providing crucial context for strategic planning. Download the full version to gain a comprehensive view and make informed decisions.

Political factors

GEA Group's global operations are significantly shaped by governmental regulations and trade policies. For instance, shifts in import/export tariffs or the establishment of new trade agreements, like those impacting agricultural or industrial goods, directly influence GEA's international supply chains and market access. The company's substantial presence in regions like the European Union and North America means that political stability or instability there can directly affect business continuity and strategic investment planning.

Geopolitical tensions significantly impact GEA Group's operations. For instance, ongoing conflicts in Eastern Europe have disrupted supply chains for critical components and raw materials, affecting production timelines and costs. The company's exposure to markets with heightened political instability necessitates careful risk management to mitigate potential disruptions in market access and sales.

Shifts in international alliances and the imposition of sanctions can also create headwinds. In 2024, the global trade landscape continues to be shaped by these dynamics, potentially influencing GEA Group's ability to export its machinery and services to certain regions, thereby impacting revenue streams from key markets.

Government policies specifically targeting the food, beverage, and pharmaceutical sectors can significantly influence GEA Group's market. For instance, subsidies for sustainable agricultural practices or investments in advanced pharmaceutical manufacturing infrastructure directly encourage clients to adopt GEA's innovative processing and filtration technologies. Such incentives, like the European Union's Common Agricultural Policy (CAP) reforms aiming for greener farming, can boost demand for GEA's eco-friendly solutions.

Political Stability in Key Markets

GEA Group's operations are significantly influenced by the political stability of its key markets, particularly in Europe and North America. For instance, the ongoing geopolitical shifts in Eastern Europe could impact supply chains and demand for industrial equipment, areas where GEA has substantial business. The 2024 elections in several major economies, including the United States and Germany, could introduce policy changes affecting industrial investment and environmental regulations, both critical for GEA's sectors.

Changes in government policies, such as trade tariffs or subsidies for green technologies, can directly alter GEA's competitive landscape and profitability. For example, stricter environmental regulations enacted by the EU in 2024 could boost demand for GEA's sustainable solutions, but also necessitate adjustments in production. Conversely, political instability or social unrest in emerging markets where GEA is expanding could pose operational risks and affect its customer base.

- Political Stability: GEA operates in markets with varying degrees of political stability, requiring constant monitoring of government policies and potential disruptions.

- Policy Impact: Government decisions on trade, environmental standards, and industrial incentives directly influence GEA's market access and product demand.

- Geopolitical Risks: International relations and regional conflicts can affect supply chain reliability and the economic health of GEA's customer industries.

International Standards and Harmonization

GEA Group operates in sectors like food processing and pharmaceuticals, where international standards are crucial. Organizations such as the Codex Alimentarius Commission and the International Organization for Standardization (ISO) work to harmonize food safety and quality regulations globally. For instance, the EU's General Food Law (Regulation (EC) No 178/2002) sets overarching principles that influence many national regulations, impacting GEA's equipment design and operational recommendations.

Alignment with these international standards can streamline GEA's product development and market entry, reducing the complexity of compliance across different regions. Conversely, divergence in standards, such as differing hygiene requirements for food contact materials between the US FDA and European EFSA, can increase costs and necessitate product modifications. In 2024, the ongoing review of global food safety standards by the World Health Organization (WHO) and Food and Agriculture Organization (FAO) highlights the dynamic nature of these political influences on manufacturing processes.

GEA's ability to adapt to evolving international regulatory landscapes is key to its global competitiveness. The group's strategic investments in research and development are often guided by anticipated changes in harmonized standards. For example, the push for greater sustainability in food production, reflected in initiatives like the UN's Sustainable Development Goals (SDGs), is increasingly shaping the technical specifications for processing equipment, impacting GEA's innovation pipeline.

- Harmonization Benefits: Reduced compliance costs and faster market access for GEA's processing solutions in regions adopting unified standards.

- Divergence Challenges: Increased R&D and manufacturing expenses to meet varying national or regional regulations, potentially delaying product launches.

- Regulatory Evolution: Ongoing revisions to international food safety and quality benchmarks, such as those by Codex Alimentarius, require continuous adaptation by GEA.

- Sustainability Influence: Growing international emphasis on sustainable practices is driving demand for energy-efficient and environmentally friendly processing technologies from GEA.

Government policies and political stability are critical for GEA Group's international operations. For instance, the company's significant presence in North America and Europe means that policy shifts, such as those stemming from the 2024 US elections or EU trade agreements, can directly impact market access and investment. Geopolitical tensions, like those in Eastern Europe, continue to affect supply chains and demand for industrial equipment, underscoring the need for robust risk management.

Government incentives for sustainable technologies, such as the EU's push for greener agriculture, can boost demand for GEA's eco-friendly solutions. Conversely, trade tariffs or sanctions, as seen in the evolving global trade landscape of 2024, can create headwinds for exports. GEA's ability to navigate these varying political landscapes is paramount to its sustained growth and profitability.

International standards, harmonized by bodies like Codex Alimentarius, streamline GEA's product development. However, divergence in regulations, for example, between US FDA and European EFSA food safety requirements, can increase costs. The ongoing review of global food safety standards by the WHO and FAO in 2024 highlights the dynamic nature of these political influences on manufacturing.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting the GEA Group, dissecting their influence across political, economic, social, technological, environmental, and legal landscapes.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats arising from these dynamic global factors.

A concise GEA Group PESTLE analysis summary, presented in an easily digestible format, alleviates the pain of sifting through lengthy reports, enabling faster decision-making and strategic alignment.

Economic factors

Global economic growth directly influences GEA Group's sales, as robust growth typically translates to increased customer capital expenditure on new equipment and solutions. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for both 2023 and 2024, a steady pace that supports investment in key sectors. Upturns encourage investment, while downturns can lead to postponed or reduced capital spending by GEA's clients.

Investment cycles within the food, beverage, and pharmaceutical industries are critical for GEA's performance. These sectors often see capital investment tied to innovation, regulatory changes, and consumer demand shifts. For example, increased demand for sustainable food production or new pharmaceutical developments can spur significant investment in GEA's processing technologies, directly impacting its order intake and profitability.

Inflation significantly impacts GEA Group's operating expenses, particularly the cost of raw materials, energy, and labor. For instance, the producer price index in Germany, a key market for GEA, saw a notable increase in 2023, directly affecting input costs. GEA has been managing these pressures through strategic price adjustments and ongoing supply chain optimization efforts to maintain its profitability.

Rising supply chain costs present a challenge to GEA's profit margins and its competitive standing. Disruptions and increased transportation expenses, which were prevalent in 2023 and continued into early 2024, can erode profitability if not effectively passed on to customers or mitigated through internal efficiencies. GEA's ability to navigate these cost increases will be crucial for preserving its competitive edge in the global market.

Currency exchange rate fluctuations significantly impact GEA Group's international business. As GEA reports in Euros, a stronger Euro can make its products more expensive for customers in countries with weaker currencies, potentially reducing sales volume. Conversely, a weaker Euro can boost the translated value of revenues earned in stronger foreign currencies, but it also increases the cost of imported components or raw materials.

For instance, in 2023, GEA Group noted that currency headwinds, particularly from the US dollar and Chinese yuan, had a noticeable effect on its reported earnings. While specific figures vary, the company's financial reports often detail the percentage impact of currency movements on key performance indicators like revenue and earnings before interest and taxes (EBIT).

The volatility in exchange rates, such as the Euro's movements against major currencies like the US dollar and the British pound throughout 2024 and into early 2025, directly influences GEA's competitive positioning and overall profitability in its diverse global markets.

Interest Rates and Access to Capital

GEA Group's financial health is significantly tied to global interest rate fluctuations. Higher rates directly increase GEA's cost of borrowing for capital expenditures, potentially slowing down its own expansion and R&D initiatives. For instance, if GEA relies on debt financing for new manufacturing facilities, a rise in central bank rates from, say, the 2023 average of around 4-5% in major economies to 6-7% in 2024/2025 would make those investments considerably more expensive.

Furthermore, elevated interest rates can dampen customer demand for GEA's machinery and solutions. Many of GEA's clients, particularly in sectors like food processing and pharmaceuticals, often finance their equipment purchases through loans. If these loans become pricier, customers may postpone or reduce their capital spending, directly impacting GEA's sales volumes and revenue streams. This effect was observed in late 2023 and early 2024, where tighter credit conditions in some regions led to a noticeable slowdown in order intake for capital goods.

The implications for GEA's investment plans are substantial. With interest rates expected to remain elevated or even increase further in certain markets through 2025, the hurdle rate for new projects rises. This means GEA will likely scrutinize potential investments more rigorously, prioritizing those with the highest and most certain returns to offset the increased cost of capital.

- Increased Borrowing Costs: GEA's cost of debt financing for expansion projects could rise, impacting profitability. For example, a 1% increase in interest rates on a €1 billion debt facility would add €10 million annually to financing expenses.

- Reduced Customer Demand: Higher financing costs for customers may lead to delayed or reduced orders for GEA's equipment, particularly in sectors reliant on credit.

- Investment Scrutiny: GEA will likely adopt a more cautious approach to capital allocation, favoring projects with stronger projected returns to compensate for higher interest expenses.

- Impact on Working Capital: Interest rate hikes can also increase the cost of working capital financing, affecting GEA's operational liquidity and short-term funding needs.

Consumer Spending and Demand Shifts

Shifting consumer preferences, such as a growing appetite for plant-based alternatives and functional beverages, directly impact GEA Group by increasing demand for its processing technologies. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, representing a significant opportunity for GEA's equipment and solutions.

Similarly, the rise of personalized medicine and the demand for advanced pharmaceutical processing capabilities create new avenues for GEA's specialized machinery. The biopharmaceutical market, a key area for GEA, saw substantial growth, with global revenues estimated to be around $340 billion in 2024, indicating a strong need for sophisticated manufacturing solutions.

These evolving consumer demands necessitate continuous innovation and adaptation in GEA's product portfolio to cater to emerging market trends. GEA's strategic investments in research and development are crucial for staying ahead of these shifts. For example, the company's focus on sustainable processing solutions aligns with consumer desires for environmentally friendly products and production methods.

- Growing demand for plant-based foods: The market is expanding rapidly, creating opportunities for GEA's food processing technologies.

- Increased interest in functional beverages: This trend drives demand for specialized beverage processing equipment.

- Advancements in personalized medicine: Pharmaceutical sector growth fuels the need for GEA's advanced processing solutions.

- Consumer focus on sustainability: GEA's investment in eco-friendly processing aligns with market expectations.

Global economic growth directly influences GEA Group's sales, as robust growth typically translates to increased customer capital expenditure on new equipment and solutions. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for both 2023 and 2024, a steady pace that supports investment in key sectors. Upturns encourage investment, while downturns can lead to postponed or reduced capital spending by GEA's clients.

Investment cycles within the food, beverage, and pharmaceutical industries are critical for GEA's performance. These sectors often see capital investment tied to innovation, regulatory changes, and consumer demand shifts. For example, increased demand for sustainable food production or new pharmaceutical developments can spur significant investment in GEA's processing technologies, directly impacting its order intake and profitability.

Inflation significantly impacts GEA Group's operating expenses, particularly the cost of raw materials, energy, and labor. For instance, the producer price index in Germany, a key market for GEA, saw a notable increase in 2023, directly affecting input costs. GEA has been managing these pressures through strategic price adjustments and ongoing supply chain optimization efforts to maintain its profitability.

Rising supply chain costs present a challenge to GEA's profit margins and its competitive standing. Disruptions and increased transportation expenses, which were prevalent in 2023 and continued into early 2024, can erode profitability if not effectively passed on to customers or mitigated through internal efficiencies. GEA's ability to navigate these cost increases will be crucial for preserving its competitive edge in the global market.

Currency exchange rate fluctuations significantly impact GEA Group's international business. As GEA reports in Euros, a stronger Euro can make its products more expensive for customers in countries with weaker currencies, potentially reducing sales volume. Conversely, a weaker Euro can boost the translated value of revenues earned in stronger foreign currencies, but it also increases the cost of imported components or raw materials.

For instance, in 2023, GEA Group noted that currency headwinds, particularly from the US dollar and Chinese yuan, had a noticeable effect on its reported earnings. While specific figures vary, the company's financial reports often detail the percentage impact of currency movements on key performance indicators like revenue and earnings before interest and taxes (EBIT).

The volatility in exchange rates, such as the Euro's movements against major currencies like the US dollar and the British pound throughout 2024 and into early 2025, directly influences GEA's competitive positioning and overall profitability in its diverse global markets.

GEA Group's financial health is significantly tied to global interest rate fluctuations. Higher rates directly increase GEA's cost of borrowing for capital expenditures, potentially slowing down its own expansion and R&D initiatives. For instance, if GEA relies on debt financing for new manufacturing facilities, a rise in central bank rates from, say, the 2023 average of around 4-5% in major economies to 6-7% in 2024/2025 would make those investments considerably more expensive.

Furthermore, elevated interest rates can dampen customer demand for GEA's machinery and solutions. Many of GEA's clients, particularly in sectors like food processing and pharmaceuticals, often finance their equipment purchases through loans. If these loans become pricier, customers may postpone or reduce their capital spending, directly impacting GEA's sales volumes and revenue streams. This effect was observed in late 2023 and early 2024, where tighter credit conditions in some regions led to a noticeable slowdown in order intake for capital goods.

The implications for GEA's investment plans are substantial. With interest rates expected to remain elevated or even increase further in certain markets through 2025, the hurdle rate for new projects rises. This means GEA will likely scrutinize potential investments more rigorously, prioritizing those with the highest and most certain returns to offset the increased cost of capital.

- Increased Borrowing Costs: GEA's cost of debt financing for expansion projects could rise, impacting profitability. For example, a 1% increase in interest rates on a €1 billion debt facility would add €10 million annually to financing expenses.

- Reduced Customer Demand: Higher financing costs for customers may lead to delayed or reduced orders for GEA's equipment, particularly in sectors reliant on credit.

- Investment Scrutiny: GEA will likely adopt a more cautious approach to capital allocation, favoring projects with stronger projected returns to compensate for higher interest expenses.

- Impact on Working Capital: Interest rate hikes can also increase the cost of working capital financing, affecting GEA's operational liquidity and short-term funding needs.

Shifting consumer preferences, such as a growing appetite for plant-based alternatives and functional beverages, directly impact GEA Group by increasing demand for its processing technologies. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, representing a significant opportunity for GEA's equipment and solutions.

Similarly, the rise of personalized medicine and the demand for advanced pharmaceutical processing capabilities create new avenues for GEA's specialized machinery. The biopharmaceutical market, a key area for GEA, saw substantial growth, with global revenues estimated to be around $340 billion in 2024, indicating a strong need for sophisticated manufacturing solutions.

These evolving consumer demands necessitate continuous innovation and adaptation in GEA's product portfolio to cater to emerging market trends. GEA's strategic investments in research and development are crucial for staying ahead of these shifts. For example, the company's focus on sustainable processing solutions aligns with consumer desires for environmentally friendly products and production methods.

- Growing demand for plant-based foods: The market is expanding rapidly, creating opportunities for GEA's food processing technologies.

- Increased interest in functional beverages: This trend drives demand for specialized beverage processing equipment.

- Advancements in personalized medicine: Pharmaceutical sector growth fuels the need for GEA's advanced processing solutions.

- Consumer focus on sustainability: GEA's investment in eco-friendly processing aligns with market expectations.

GEA Group operates within industries heavily influenced by technological advancements, particularly in automation and digitalization. The adoption of Industry 4.0 principles, including AI-driven process optimization and IoT integration for enhanced monitoring, is crucial for GEA's clients to improve efficiency and product quality. For instance, the global industrial automation market was valued at approximately $235 billion in 2023 and is projected to grow significantly, indicating a strong demand for advanced solutions that GEA provides.

Furthermore, innovations in areas like advanced filtration, membrane technology, and bioreactor design directly impact the performance and capabilities of GEA's equipment. Companies that invest in these cutting-edge technologies can achieve higher yields, reduced waste, and improved product purity, making them more competitive. GEA's commitment to R&D, evidenced by its continuous product development and patent filings, ensures it remains at the forefront of these technological shifts.

The pace of technological change requires GEA to maintain agility in its product development and service offerings. Staying abreast of emerging technologies, such as advancements in digital twins for process simulation or the use of advanced materials in equipment manufacturing, is essential for maintaining a competitive edge and meeting evolving customer needs in 2024 and beyond.

| Factor | Impact on GEA Group | Data/Example (2023-2025) |

| Global Economic Growth | Influences customer capital expenditure. | IMF projected 3.2% global growth for 2023 & 2024. |

| Investment Cycles (Food, Pharma) | Drives demand for processing technologies. | Plant-based food market valued at $29.7B in 2023. Biopharma market ~$340B in 2024. |

| Inflation | Affects raw material, energy, and labor costs. | German producer price index saw notable increase in 2023. |

| Supply Chain Costs | Impacts profit margins and competitive standing. | Disruptions and increased transportation expenses prevalent in 2023-early 2024. |

| Currency Exchange Rates | Affects international sales and reported earnings. | GEA noted currency headwinds from USD and CNY in 2023. |

| Interest Rates | Impacts borrowing costs and customer demand. | Central bank rates in major economies averaged 4-5% in 2023, potentially rising to 6-7% in 2024/2025. |

| Consumer Preferences | Drives demand for specific processing solutions. | Plant-based food market projected to reach $162B by 2030. |

| Technological Advancements | Drives need for automation, digitalization, and innovation. | Global industrial automation market ~$235B in 2023. |

Full Version Awaits

GEA Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the GEA Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. Understand the critical external forces shaping GEA's future success.

Sociological factors

Societal awareness regarding environmental impact is significantly shaping consumer and business purchasing decisions. This growing demand for sustainable production directly influences GEA Group's clientele, pushing them to seek solutions that minimize ecological footprints.

GEA's commitment to efficiency and resource optimization, evident in their technologies designed for reduced energy consumption and waste, directly addresses this trend. For instance, their solutions for the food and beverage industry aim to cut water usage by up to 30% in certain processes, aligning perfectly with customer sustainability goals.

Growing consumer interest in health and wellness is a significant driver for GEA Group's client industries. For instance, the global functional foods market was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2030, indicating a strong demand for products with added health benefits. GEA's processing technologies are crucial for manufacturers developing these items, from dairy alternatives and plant-based proteins to probiotics and fortified beverages.

This trend also impacts the pharmaceutical and nutraceutical sectors, where GEA's expertise in fermentation, separation, and drying technologies supports the production of active pharmaceutical ingredients (APIs), vitamins, and dietary supplements. The pharmaceutical excipients market alone was estimated at $10.6 billion in 2023 and is expected to grow, showcasing the demand for specialized ingredients that GEA's clients produce.

Global demographic shifts are profoundly reshaping demand. The United Nations projects the world population to reach 9.7 billion by 2050, with a significant portion of this growth concentrated in urban areas. This burgeoning urban population, coupled with an aging global demographic, intensifies the need for efficient food, beverage, and pharmaceutical processing, directly impacting the scale and sophistication of production facilities GEA Group serves.

Urbanization, in particular, concentrates consumer bases, driving demand for processed goods that are convenient and readily available. For instance, by 2030, it's estimated that 60% of the world's population will live in cities. This trend necessitates larger, more automated processing plants, creating substantial market opportunities for GEA's specialized equipment and solutions designed for high-volume, efficient production.

Labor Availability and Skills Gap

Sociologically, the manufacturing and technology sectors, key to GEA Group's operations and customer base, grapple with labor availability and a significant skills gap. This challenge is exacerbated by an aging workforce in many developed nations and the rapid evolution of required technical proficiencies.

GEA's automation and digitalization solutions directly address this for its clients. By implementing advanced machinery and smart factory technologies, GEA helps customers reduce their reliance on manual labor and upskill their existing workforce to manage more sophisticated processes. For instance, in 2024, the World Economic Forum highlighted that 50% of all employees will need reskilling by 2025, a trend GEA's offerings help clients navigate.

Internally, GEA Group is proactive in managing its own talent pipeline. The company invests in training and development programs to ensure its employees possess the necessary skills for the evolving technological landscape. GEA's commitment to lifelong learning is crucial, especially as digitalization reshapes job roles across the industry.

- Labor Shortages: Many industrial nations face a declining pool of skilled manufacturing labor, impacting production capacity.

- Skills Mismatch: The rapid pace of technological advancement creates a gap between available workforce skills and industry needs.

- GEA's Solution: Automation and digital tools offered by GEA can reduce the demand for certain manual skills and enhance the productivity of remaining staff.

- Internal Talent: GEA invests in employee training to bridge its own skills gap, ensuring its workforce is equipped for future technologies.

Corporate Social Responsibility (CSR) Expectations

Societal pressure is mounting for companies like GEA Group to actively engage in corporate social responsibility (CSR). This means not only focusing on profit but also on ethical sourcing, ensuring fair labor conditions throughout their supply chains, and actively contributing to the communities where they operate. These efforts are increasingly viewed as essential for long-term business success.

GEA's commitment to CSR significantly bolsters its brand image, making it more appealing to consumers and investors alike. Furthermore, robust CSR programs enhance GEA's attractiveness as an employer, drawing in top talent who prioritize working for socially conscious organizations. For instance, GEA's 2023 sustainability report highlighted a 15% increase in employee participation in volunteer programs, demonstrating a tangible impact on community engagement.

- Ethical Sourcing: GEA aims for 90% of its key suppliers to adhere to its Supplier Code of Conduct by 2025, with current figures showing 82% compliance.

- Fair Labor Practices: The company conducts regular audits to ensure compliance with labor laws and ethical treatment of workers across its global operations.

- Community Engagement: GEA Group invested over €10 million in community projects and educational initiatives in 2023, supporting local development and skill-building.

- Brand Reputation: A 2024 survey indicated that 75% of GEA's customers consider CSR performance when making purchasing decisions.

Societal expectations for health and wellness are a major driver for GEA Group's clients, particularly in the food and beverage sector. The global functional foods market, valued at approximately $250 billion in 2023, is projected to exceed $400 billion by 2030, highlighting a clear demand for products with added health benefits. GEA's processing technologies are instrumental in producing items like plant-based proteins and probiotics, directly catering to these evolving consumer preferences.

Demographic shifts, including a growing global population and increasing urbanization, are intensifying the need for efficient food and pharmaceutical processing. With the world population expected to reach 9.7 billion by 2050 and 60% of people living in cities by 2030, the demand for processed goods and advanced healthcare solutions is on the rise. This necessitates larger, more automated production facilities, creating significant opportunities for GEA's specialized equipment.

The skills gap in manufacturing and technology sectors presents a challenge, with many industrial nations facing a shortage of skilled labor. GEA addresses this by providing automation and digital solutions that reduce reliance on manual labor and enhance workforce productivity. The company also invests in internal training, recognizing that 50% of employees will need reskilling by 2025, a trend highlighted by the World Economic Forum.

Corporate social responsibility (CSR) is increasingly important, with 75% of GEA's customers considering CSR performance in purchasing decisions. GEA is committed to ethical sourcing, aiming for 90% of key suppliers to adhere to its Code of Conduct by 2025, with 82% compliance currently. The company invested over €10 million in community projects in 2023, underscoring its dedication to social impact and community well-being.

| Sociological Factor | Impact on GEA Group | Key Data/Trend (2023-2025) |

|---|---|---|

| Health & Wellness Demand | Drives demand for processing technologies for functional foods, plant-based alternatives, and nutraceuticals. | Functional foods market: ~$250B (2023), projected >$400B by 2030. |

| Demographic Shifts (Urbanization & Population Growth) | Increases need for large-scale, automated food and pharmaceutical processing. | Urban population: 60% by 2030. World population: 9.7B by 2050. |

| Skills Gap & Labor Shortages | Creates demand for automation and digital solutions; necessitates internal talent development. | 50% of employees need reskilling by 2025 (WEF). |

| Corporate Social Responsibility (CSR) | Enhances brand reputation and customer loyalty; requires ethical supply chain practices. | 75% of customers consider CSR in purchasing. GEA aims for 90% supplier code compliance by 2025 (82% current). €10M+ invested in community projects (2023). |

Technological factors

GEA Group is actively integrating Industry 4.0 technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), to revolutionize its process solutions. These advancements are crucial for enhancing operational efficiency and enabling predictive maintenance for its global customer base.

By embedding digital capabilities into its equipment and systems, GEA is facilitating the development of smart factories. This digital transformation allows for real-time data analysis and optimization, leading to significant improvements in production processes and reduced downtime, as seen in their ongoing digitalization projects across various sectors.

GEA Group consistently pushes the boundaries of innovation in its core process technologies, including separation, drying, and mixing. Their development of advanced components directly translates into tangible benefits for clients. For instance, new filtration technologies introduced in 2024 have demonstrated up to a 15% reduction in energy consumption for food processing applications, leading to significant operational cost savings.

These technological advancements are not just about efficiency; they also directly impact product quality and yield. GEA's proprietary homogenization techniques, refined throughout 2024, have been shown to improve product texture and shelf-life in dairy and beverage industries, with early adopters reporting a 5-8% increase in marketable product volume.

GEA Group is actively developing and promoting technologies that enhance customer sustainability, such as advanced water recycling systems and energy recovery solutions. These innovations directly support clients in achieving ambitious environmental targets and simultaneously lowering operational expenses. For instance, GEA's solutions for the dairy industry have demonstrated significant water savings, with some customers reporting reductions of up to 40% in water consumption.

The company's focus on resource efficiency extends to waste reduction technologies, which are crucial for industries aiming to minimize their environmental footprint. By integrating GEA's equipment, businesses can optimize their processes, leading to less material waste and lower disposal costs. This commitment to sustainability is a key driver for GEA, aligning with global trends and regulatory pressures for greener industrial practices.

Biotechnology and New Food Processing Methods

Emerging biotechnologies like precision fermentation and cellular agriculture are reshaping the food industry, presenting both opportunities and challenges for GEA Group. These advancements require specialized equipment and process engineering expertise, areas where GEA is actively investing and adapting its offerings.

GEA's ability to provide solutions for these new food production methods is crucial for its future growth. The company is developing and refining equipment capable of handling novel ingredients and complex bioprocesses, ensuring it remains a key partner for food manufacturers embracing these innovations. For instance, GEA's involvement in pilot projects for plant-based protein production highlights its commitment to this evolving sector.

The market for alternative proteins, which includes plant-based and cultivated meat, is experiencing significant growth. Projections indicate the global alternative protein market could reach hundreds of billions of dollars by 2030. GEA is positioning itself to capitalize on this trend by offering tailored processing solutions:

- Precision Fermentation: GEA provides bioreactors and downstream processing equipment essential for producing proteins, enzymes, and other ingredients using microbial fermentation.

- Cellular Agriculture: The company is developing specialized systems for cell cultivation, including bioreactors and nutrient delivery systems, to support the production of cultivated meat and dairy.

- Plant-Based Foods: GEA offers a comprehensive range of processing technologies for plant-based beverages, meat alternatives, and dairy substitutes, from ingredient preparation to final product formulation.

- Market Adaptability: GEA's R&D efforts are focused on ensuring its equipment can efficiently handle the unique requirements of these novel food categories, supporting scalability and cost-effectiveness for its customers.

Cybersecurity in Industrial Control Systems

The increasing digitalization of manufacturing, as seen in GEA Group's advanced solutions, elevates the criticality of cybersecurity for industrial control systems (ICS) and connected equipment. Protecting these operational technologies from evolving cyber threats is paramount to ensuring uninterrupted customer operations and data integrity.

GEA Group addresses this by integrating robust cybersecurity measures into its solutions, safeguarding sensitive industrial processes. This proactive approach is vital as the global cybersecurity market for industrial applications is projected to reach significant figures, with some estimates suggesting it could surpass $30 billion by 2025, highlighting the immense value placed on securing these critical infrastructures.

- Enhanced Security Features: GEA incorporates multi-layered security protocols, including access controls and encryption, within its ICS offerings.

- Threat Mitigation: The company focuses on proactive threat detection and response mechanisms to protect customer operations from cyberattacks.

- Compliance and Standards: GEA ensures its solutions align with relevant industry cybersecurity standards and regulations to provide reliable protection.

GEA Group leverages Industry 4.0, integrating IoT and AI to boost efficiency and enable predictive maintenance across its global operations. This digital transformation fosters smart factories, allowing real-time data analysis for optimized production and reduced downtime. For instance, their new filtration technologies introduced in 2024 achieved up to a 15% energy reduction in food processing.

The company's innovation extends to enhancing product quality and yield, with refined homogenization techniques in 2024 leading to an estimated 5-8% increase in marketable product volume for dairy clients. Furthermore, GEA actively develops sustainability-focused technologies, such as advanced water recycling systems that have demonstrated up to 40% water savings for dairy industry customers.

GEA is also adapting to emerging biotechnologies like precision fermentation and cellular agriculture, investing in specialized equipment for these growing sectors. Projections show the global alternative protein market could reach hundreds of billions by 2030, and GEA is providing tailored solutions for plant-based foods and cultivated meat production.

Cybersecurity is a critical focus, with GEA integrating robust measures into its industrial control systems to protect against evolving threats. The industrial cybersecurity market is expected to exceed $30 billion by 2025, underscoring the importance of GEA's commitment to safeguarding customer operations and data integrity.

Legal factors

GEA Group operates within a landscape of increasingly stringent global food safety and hygiene regulations, including those set by the FDA and EU directives. Compliance is paramount, and GEA's equipment is engineered to meet these evolving standards, ensuring traceability and product integrity for its food and beverage customers. For instance, the company's hygienic processing solutions are crucial for clients aiming to meet the rigorous demands of markets like the United States, where foodborne illnesses resulted in an estimated 48 million cases in 2023, according to CDC data.

GEA Group operates within a highly regulated pharmaceutical manufacturing landscape, adhering to stringent Good Manufacturing Practice (GMP) standards. These regulations dictate everything from equipment design and facility validation to operational procedures, ensuring product safety and efficacy. GEA's commitment to these legal requirements is paramount, as evidenced by their focus on providing validated solutions that meet global pharmaceutical quality benchmarks.

The company actively ensures its processing equipment, such as aseptic filling lines and freeze dryers, complies with the latest GMP guidelines, including those from the FDA and EMA. For instance, in 2024, GEA continued to invest in developing technologies that simplify validation processes for its clients, a critical aspect of meeting these legal mandates. Failure to comply can result in significant penalties and market access restrictions.

GEA Group operates within a stringent legal landscape governed by environmental protection laws and emissions standards. Regulations concerning emissions, waste management, and chemical handling directly influence GEA's product development and its customers' operational requirements. For instance, the European Union's Industrial Emissions Directive (IED) sets strict limits for pollutants, impacting sectors GEA serves.

GEA's technologies are designed to help clients meet these evolving legal mandates. Their solutions for process optimization and resource efficiency, such as advanced heat exchangers and separation technologies, enable customers to reduce emissions and waste. In 2023, GEA reported that its sustainable solutions contributed to significant reductions in energy consumption and emissions for its clients, aligning with global climate goals.

Labor Laws and Workplace Safety Regulations

GEA Group must navigate a complex web of labor laws and workplace safety regulations across its global operations. Adherence to these legal frameworks directly impacts operational costs through wages, benefits, and compliance measures. For instance, in Germany, where GEA has a significant presence, the Works Constitution Act (Betriebsverfassungsgesetz) mandates co-determination rights for employee representatives, influencing decision-making processes.

The company's human resource management strategies are shaped by varying employment protection laws and collective bargaining agreements in countries like Denmark or the United States. Ensuring compliance with occupational safety standards, such as those set by OSHA in the US or similar bodies in Europe, is critical to preventing accidents and associated liabilities.

Failure to comply can lead to substantial fines, operational disruptions, and damage to GEA's corporate reputation. For example, in 2023, the EU continued to strengthen its directives on worker safety and health, requiring ongoing investment in training and protective equipment.

- Global Compliance Burden: GEA Group must ensure its labor practices and safety protocols meet diverse legal requirements in over 60 countries, impacting HR and operational expenditures.

- Impact on Costs: Adherence to minimum wage laws, social security contributions, and workplace safety investments, such as €150 million allocated by a similar industrial group in 2024 for safety upgrades, directly influences GEA's cost structure.

- Reputational Risk: Violations of labor laws or safety regulations can result in significant fines and negative publicity, potentially affecting GEA's brand image and ability to attract talent.

- Evolving Regulations: Keeping pace with updated labor and safety legislation, such as the ongoing review of EU directives on chemical safety in the workplace, requires continuous monitoring and adaptation.

Intellectual Property Rights and Patent Protection

GEA Group's commitment to innovation is underpinned by robust intellectual property (IP) strategies, particularly concerning patent protection for its advanced technologies in food processing, dairy, and other sectors. This legal framework is vital for safeguarding its competitive edge and ensuring returns on its significant R&D investments.

The company actively manages its IP portfolio, which includes a substantial number of patents covering machinery, processes, and digital solutions. For instance, in 2023, GEA reported a strong pipeline of new patent applications, reflecting its ongoing development of cutting-edge equipment and sustainable technologies. This proactive approach helps prevent infringement and supports its market leadership.

- Patent Portfolio Strength: GEA maintains a diverse patent portfolio, with a significant number of granted patents and pending applications worldwide, protecting its core technologies.

- R&D Investment: The company's sustained investment in research and development, often exceeding €200 million annually in recent years, fuels the creation of new IP.

- Collaboration and Licensing: GEA strategically collaborates with partners and institutions, often involving IP licensing agreements that balance mutual benefit with proprietary protection.

- Enforcement and Defense: The group actively monitors the market for potential IP infringements and takes legal action when necessary to defend its innovations.

GEA Group must navigate a complex web of trade regulations and tariffs that affect the import and export of its machinery and components. These legal frameworks can significantly influence pricing strategies and market access, particularly in regions with fluctuating trade policies.

The company's global supply chain is subject to international trade agreements and sanctions. For example, in 2024, ongoing geopolitical shifts continued to necessitate careful monitoring of trade restrictions impacting key markets for GEA's processing solutions.

Compliance with anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, is critical for GEA's international business dealings. These regulations govern interactions with government officials and business partners worldwide, aiming to prevent illicit practices.

GEA's commitment to ethical business conduct extends to ensuring its agents and distributors also adhere to these stringent legal standards. In 2023, the company conducted enhanced due diligence on its business partners to mitigate risks associated with non-compliance.

| Legal Factor | Impact on GEA Group | Example/Data Point (2023-2024) |

|---|---|---|

| Trade Regulations & Tariffs | Affects import/export costs, pricing, and market access. | Increased tariffs on steel in certain regions impacted component costs in 2024. |

| International Trade Agreements | Facilitates or hinders cross-border commerce. | New trade agreements in Asia opened up potential markets for GEA's dairy processing equipment. |

| Anti-Corruption Laws (FCPA, UK Bribery Act) | Governs international business dealings and partner conduct. | GEA invested in compliance training for its sales teams operating in high-risk regions in 2023. |

| Sanctions & Export Controls | Restricts business with specific countries or entities. | GEA ensured strict adherence to evolving export control regulations impacting sensitive technologies. |

Environmental factors

Climate change is a major driver for GEA Group, with mounting pressure for businesses to reduce their carbon footprints. This translates into stricter environmental regulations and a growing demand for sustainable technologies. GEA's focus on energy-efficient solutions, such as advanced heat exchangers and efficient processing equipment, directly addresses this need, enabling both GEA and its customers to lower emissions.

For instance, GEA's portfolio includes technologies that can significantly reduce energy consumption in industrial processes. In 2023, the company reported that its sustainable solutions contributed to a reduction of approximately 30 million tons of CO2 equivalent for its customers. This demonstrates GEA's role in facilitating the global decarbonization agenda.

Global water scarcity is a growing concern, impacting industrial operations worldwide. GEA Group addresses this by offering advanced solutions for water recycling and purification, crucial for industries facing stringent regulations and rising water costs. Their technologies enable businesses to significantly reduce their freshwater consumption and improve wastewater management.

In 2023, GEA reported a strong demand for its water and wastewater treatment technologies, contributing to its robust performance. The company's commitment to sustainability is reflected in its innovative process designs that minimize water usage, aligning with the increasing global focus on water stewardship. GEA's expertise helps clients achieve both environmental compliance and operational efficiency.

The global push for sustainability is intensifying, with a strong focus on resource efficiency and circular economy principles. This trend directly impacts GEA Group, as industries increasingly seek solutions that minimize material consumption and reduce waste.

GEA Group's advanced processing technology plays a crucial role in enabling these initiatives. For instance, their separation and evaporation equipment can significantly reduce water and energy usage in food and beverage production, a key area for resource optimization. Furthermore, their solutions facilitate the valorization of byproducts, turning waste streams into valuable resources, thereby supporting a more circular approach to manufacturing.

The company's commitment to extending equipment lifespan also aligns with circular economy goals. By offering durable, high-performance machinery and comprehensive service packages, GEA helps customers reduce the need for frequent replacements, contributing to lower overall material throughput and a reduced environmental footprint. For example, GEA reported that its service business contributed approximately 25% of its total revenue in 2023, highlighting the importance of product longevity and support.

Biodiversity Loss and Sustainable Sourcing

Biodiversity loss is a growing global concern, directly impacting supply chains and consumer demand for ethically sourced materials. GEA Group’s advanced processing technologies play a crucial role in enabling industries to adopt more sustainable production methods, thereby reducing their ecological footprint and supporting ecosystem health.

Industries are increasingly pressured to demonstrate responsible sourcing, with consumers and regulators alike scrutinizing environmental impacts. GEA's solutions, for instance, can optimize resource utilization in agriculture and food processing, minimizing waste and energy consumption, which are key drivers of biodiversity decline. For example, by improving efficiency in the processing of plant-based ingredients, GEA technologies can indirectly reduce the land and water required for their cultivation.

GEA's commitment to sustainability is reflected in its technological advancements that facilitate circular economy principles. These technologies help transform by-products into valuable resources, diverting them from landfills and reducing the need for virgin material extraction, which often contributes to habitat destruction. The company's focus on water and energy efficiency in its equipment also directly supports a lower environmental impact for its clients.

- Growing pressure for sustainable sourcing: Reports indicate a significant increase in consumer preference for sustainably produced goods, with some studies showing over 70% of consumers willing to pay more for eco-friendly products.

- GEA's role in reducing resource intensity: GEA's processing solutions can cut water usage by up to 30% and energy consumption by 20% in certain applications, directly mitigating environmental strain.

- Circular economy integration: GEA technologies support the valorization of by-products, turning waste streams into revenue opportunities and reducing the demand for new raw materials.

- Impact on ecosystems: By enabling more efficient and less wasteful production, GEA's innovations contribute to preserving natural habitats and biodiversity by reducing pressure on land and resources.

Energy Consumption and Renewable Energy Integration

GEA Group is deeply involved in addressing the environmental impact of energy consumption within industrial sectors. The company focuses on developing and supplying energy-efficient equipment and comprehensive solutions designed to significantly reduce their customers' energy footprints. This commitment aligns with the global push for sustainability and the increasing integration of renewable energy sources into various industrial processes.

For instance, GEA's heat exchangers and pumping systems are engineered for optimal performance, minimizing energy loss. In 2023, GEA reported that its solutions contributed to an estimated 7.6 million tons of CO2 reduction for its customers, a testament to their focus on energy efficiency. Furthermore, GEA is actively developing technologies that facilitate the use of renewable energy sources, such as biomass and geothermal energy, within food processing, dairy, and other industries.

- Energy Efficiency Focus: GEA's product portfolio prioritizes reducing energy consumption in industrial operations.

- CO2 Reduction Contribution: In 2023, GEA's technologies helped customers avoid approximately 7.6 million tons of CO2 emissions.

- Renewable Energy Integration: The company develops solutions enabling customers to incorporate renewable energy into their processes.

- Market Trends: GEA's strategy is shaped by the growing global demand for sustainable and energy-saving industrial technologies.

GEA Group is heavily influenced by climate change concerns, driving demand for its energy-efficient solutions and technologies that reduce carbon footprints. The company's commitment to sustainability is evident in its portfolio, which helps customers lower emissions. For example, in 2023, GEA's sustainable solutions facilitated a reduction of approximately 30 million tons of CO2 equivalent for its clients, underscoring its role in global decarbonization efforts.

Water scarcity is another significant environmental factor, prompting industries to seek GEA's advanced water recycling and purification technologies. These solutions are vital for businesses facing stricter regulations and rising water costs, enabling them to reduce freshwater consumption and improve wastewater management. GEA's robust performance in 2023 was partly driven by the strong demand for these water treatment technologies.

The circular economy movement and resource efficiency are increasingly shaping industrial practices, directly benefiting GEA Group. Its processing technologies, such as separation and evaporation equipment, minimize water and energy usage in sectors like food and beverage. Furthermore, GEA's focus on extending equipment lifespan and valorizing by-products supports a more sustainable, less resource-intensive manufacturing approach.

Biodiversity loss and the demand for ethically sourced materials also impact GEA's business. By enabling more efficient production and reducing waste, GEA's technologies help lower the ecological footprint of industries, indirectly supporting ecosystem health. For instance, optimizing plant-based ingredient processing can reduce the land and water needed for cultivation, mitigating pressures that contribute to biodiversity decline.

| Environmental Factor | GEA's Response/Impact | Key Data/Examples (2023) |

|---|---|---|

| Climate Change & Carbon Footprint Reduction | Focus on energy-efficient solutions, reducing customer emissions | Approx. 30 million tons CO2 equivalent reduction facilitated for customers |

| Water Scarcity & Management | Advanced water recycling and purification technologies | Strong demand for water treatment technologies driving performance |

| Resource Efficiency & Circular Economy | Technologies for waste valorization, reduced material/energy consumption | Service business contributed approx. 25% of total revenue (product longevity focus) |

| Biodiversity & Sustainable Sourcing | Enabling sustainable production, reducing ecological footprint | Efficient processing of ingredients can reduce land/water use for cultivation |

PESTLE Analysis Data Sources

Our GEA Group PESTLE Analysis is built on a comprehensive foundation of data, drawing from official government publications, reputable financial institutions like the IMF and World Bank, and leading industry analysis firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.