GEA Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GEA Group Bundle

Curious about the GEA Group's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the dynamics at play and gain a competitive edge.

Unlock the full potential of this analysis by purchasing the complete GEA Group BCG Matrix. You'll receive detailed quadrant placements, data-backed insights, and actionable strategies to optimize your investments and product development.

Stars

GEA's sustainable food processing solutions, a key component of its BCG matrix, are experiencing robust expansion. In the first half of 2025, this segment, featuring energy-efficient dairy and beverage systems, saw growth exceeding the industry average, reflecting a strong market demand.

This upward trend is largely fueled by the global adoption of circular economy principles and a growing client preference for suppliers who actively minimize water and energy usage. Major food industry players are increasingly investing in GEA's innovative zero-waste processing technologies, establishing a consistent revenue stream through ongoing maintenance and optimization services.

GEA is a powerhouse in the pharmaceutical industry, manufacturing a significant portion of the separators used for vital products like vaccines and cutting-edge biopharmaceuticals. This dominance is underscored by the fact that GEA produces every second separator for these critical healthcare applications.

The market for pharmaceutical processing equipment is booming. Forecasts suggest it will hit USD 33.72 billion by 2032, growing at a robust compound annual growth rate of 9.41% from 2025 to 2032. GEA's leading position within this rapidly expanding sector clearly places its pharmaceutical separators and biopharmaceutical technologies in the 'Star' category of the BCG Matrix.

GEA Group is making significant strides in the alternative proteins sector, recognizing its substantial growth potential. The company's commitment is underscored by its investment in a new technology center in Janesville, Wisconsin, set to open in 2025. This facility is designed to bolster the scaled production of plant-based, microbial, and cell-based food alternatives, signaling GEA's strategic focus on this high-demand market.

Industrial Refrigeration and Heating Solutions

GEA's Industrial Refrigeration and Heating Solutions division is a strong performer within the group. In 2024, this segment experienced a notable increase in both revenue and EBITDA margin, reflecting robust demand for sustainable energy solutions. This growth is directly tied to the global push for energy efficiency and reduced CO2 emissions, positioning the division as a key player in a high-growth market.

The division's strategic alignment with environmental goals is further demonstrated by its participation in critical clean energy projects. For instance, their involvement in hydrogen electrolysis plants highlights their commitment to and capability in supporting the burgeoning green hydrogen economy. This forward-looking approach ensures their relevance and competitive edge in the evolving energy landscape.

- Revenue Growth: GEA's Heating & Refrigeration Technologies division saw increased revenue in 2024, driven by demand for sustainable energy.

- EBITDA Margin Improvement: The division also reported an improved EBITDA margin, signaling enhanced profitability.

- Market Alignment: Focus on energy efficiency and CO2 reduction aligns with global sustainability trends, fostering growth.

- Clean Energy Projects: Involvement in initiatives like hydrogen electrolysis plants underscores their role in the clean energy sector.

Digitalization and AI-Driven Solutions

GEA Group's commitment to digitalization and AI is a key driver of its success, placing it firmly in the "Stars" category of the BCG Matrix. Their investment in digital twins and AI-powered predictive maintenance has demonstrably cut manufacturing downtime and boosted production efficiency. For instance, GEA reported that digital solutions contributed significantly to their order intake, highlighting the market's demand for these advanced capabilities.

These technological advancements allow GEA to provide comprehensive digital solutions, including smart dairy farms and hydrogen electrolysis systems. This strategic direction not only enhances their existing offerings but also opens new avenues for growth in rapidly evolving sectors. The company's focus on integrating digital technologies into its process engineering solutions is a testament to its forward-thinking approach.

- Digital Twins & AI Predictive Maintenance: Reduced downtime and improved throughput in manufacturing.

- End-to-End Digital Solutions: Offering smart dairy processing plants and hydrogen electrolysis systems.

- Market Demand: Digital solutions represent a substantial portion of GEA's order intake.

- Growth Strategy: Positioning for continued high growth and market leadership through digitalization.

GEA's pharmaceutical and biopharmaceutical processing technologies are definitively "Stars" due to their market leadership and the sector's rapid expansion. The company's role in producing every second separator for vaccines and biopharmaceuticals highlights its critical position. With the pharmaceutical processing equipment market projected to reach USD 33.72 billion by 2032, growing at a 9.41% CAGR from 2025 to 2032, GEA is capitalizing on substantial, high-growth demand.

GEA's commitment to alternative proteins, evidenced by its new technology center in Janesville, Wisconsin, opening in 2025, positions this segment as a "Star." This investment directly supports the scaled production of plant-based, microbial, and cell-based foods, tapping into a burgeoning market with significant future growth potential.

The Industrial Refrigeration and Heating Solutions division is another "Star" for GEA. In 2024, this segment saw increased revenue and EBITDA margins, driven by the global demand for energy efficiency and CO2 reduction. Their involvement in clean energy projects, such as hydrogen electrolysis plants, further solidifies their position in a high-growth, future-oriented market.

GEA's digitalization and AI initiatives, including digital twins and AI-powered predictive maintenance, are "Stars" due to their proven impact on efficiency and the strong market demand for these advanced solutions. Digital solutions significantly contributed to GEA's order intake, underscoring their role in driving growth and market leadership.

| Segment | BCG Category | Key Growth Drivers | 2024/2025 Data Points |

|---|---|---|---|

| Pharmaceutical & Biopharmaceutical Processing | Star | Growing healthcare demand, market expansion (USD 33.72B by 2032, 9.41% CAGR) | Produces every second separator for vaccines/biopharma |

| Alternative Proteins | Star | Increased investment in sustainable food, new technology center | Janesville, WI center opening 2025 for scaled production |

| Industrial Refrigeration & Heating Solutions | Star | Demand for energy efficiency, CO2 reduction, clean energy projects | Increased revenue and EBITDA margin in 2024 |

| Digitalization & AI | Star | Efficiency gains, predictive maintenance, smart solutions | Digital solutions significantly contributed to order intake |

What is included in the product

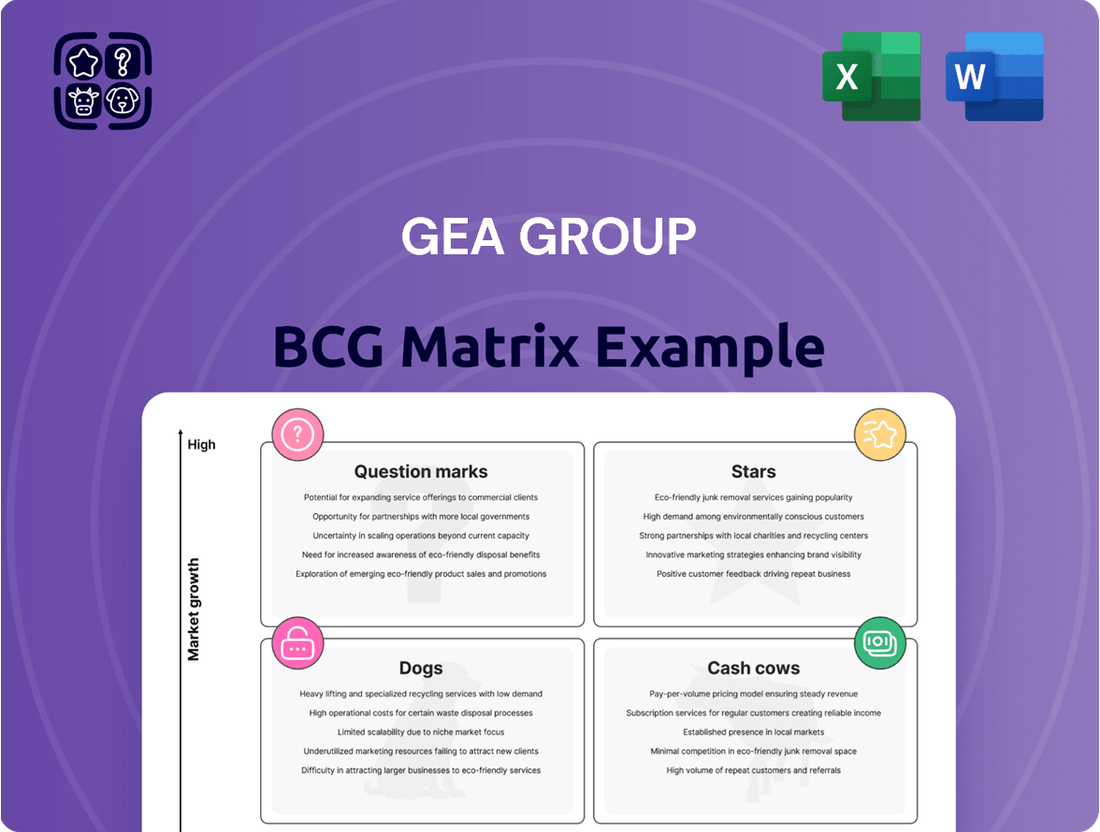

The GEA Group BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting units for growth, harvest, or divestment.

The GEA Group BCG Matrix provides a clear, visual roadmap, alleviating the pain of strategic uncertainty by pinpointing cash cows and problem children.

Cash Cows

GEA Group is a major player in the dairy processing equipment sector, a market characterized by its maturity yet consistent stability. The company's technologies are integral to a substantial portion of global dairy production, reflecting its strong market position. This segment is considered a Cash Cow for GEA, generating reliable revenue streams.

GEA's significant market share in dairy processing equipment is bolstered by its comprehensive product range and advanced technological capabilities. The recent upgrade to their Parma, Italy, homogenizer production facility, completed in 2024, underscores their commitment to meeting ongoing demand and maintaining efficiency in this established business area.

GEA's traditional food processing equipment, vital for products like pasta and chicken nuggets, holds a significant market share within a mature industry. This established position generates a steady and robust cash flow for the group.

While the broader food processing equipment market is experiencing growth, GEA's extensive portfolio of machinery and complete plant solutions solidifies its competitive edge. The company's commitment to enhancing efficiency and upholding stringent hygiene standards further reinforces its strong market standing.

GEA's Separation & Flow Technologies division, a cornerstone of the group, includes essential equipment like separators, decanters, homogenizers, valves, and pumps. This segment is vital across numerous industries, contributing significantly to GEA's overall revenue and profitability.

The division boasts high profit margins, a testament to the indispensable role its products play in critical processing lines and its strong, established market presence. For instance, GEA's homogenizers are crucial in dairy, beverage, and pharmaceutical applications, where product quality and consistency are paramount.

Ongoing strategic investments, such as the expansion of its homogenizer production facility in Alzenau, Germany, underscore GEA's commitment to maintaining operational efficiency and ensuring a steady, reliable cash flow from this mature business unit.

Service Business

GEA Group's service business is a prime example of a cash cow within the BCG matrix. This segment consistently delivers above-average profitability and has seen expansion across all of GEA's five divisions. In 2024, the service business represented a substantial 38.9% of total revenue, underscoring its critical role in the company's financial success.

The recurring nature of the service business means it demands lower investment for promotion and placement. This efficiency contributes to its status as a reliable cash generator for GEA Group.

- Revenue Contribution: In 2024, the service business accounted for 38.9% of GEA Group's total revenue.

- Profitability: This segment consistently achieves above-average profitability.

- Investment Efficiency: Lower promotional and placement costs due to its recurring revenue model.

- Growth: Expanding across all five of GEA's operational divisions.

Integrated Solutions for Mature Industries

GEA Group's integrated solutions for mature industries like brewing and chemical processing represent its Cash Cows. These sectors, while not experiencing rapid growth, benefit from GEA's established market presence and deep customer relationships.

The company's offerings in these areas generate stable and predictable cash flows due to the critical nature of the equipment and long-term contracts. For instance, in 2023, GEA reported that its Process Technology division, which serves many of these mature industries, maintained robust performance, contributing significantly to overall group profitability.

- Stable Revenue Streams: Mature industries rely on consistent, high-quality equipment, ensuring ongoing demand for GEA's solutions.

- High Market Share: GEA's strong position in sectors like brewing allows for efficient operations and cost advantages.

- Focus on Optimization: The strategy emphasizes improving existing processes and efficiency, maximizing returns from established markets.

- Predictable Cash Generation: Long-term customer relationships and essential equipment needs translate into reliable earnings.

GEA's service business is a clear Cash Cow, consistently delivering high profitability with lower investment needs due to its recurring revenue model. In 2024, this segment represented a significant 38.9% of GEA Group's total revenue, showcasing its vital role in generating stable cash flows across all five of the company's divisions.

The company's offerings in mature sectors like brewing and chemical processing also function as Cash Cows. These established markets, while not experiencing rapid growth, benefit from GEA's strong market share and deep customer relationships, leading to predictable and robust cash generation.

| Business Segment | BCG Category | 2024 Revenue Contribution | Profitability Trend | Investment Needs |

|---|---|---|---|---|

| Service Business | Cash Cow | 38.9% | Above-average | Low |

| Dairy Processing Equipment | Cash Cow | Significant | Stable | Moderate (for efficiency upgrades) |

| Brewing & Chemical Processing Solutions | Cash Cow | Substantial | Consistent | Low (focus on optimization) |

What You See Is What You Get

GEA Group BCG Matrix

The GEA Group BCG Matrix preview you see is the complete, unwatermarked document you will receive after purchase, offering a comprehensive strategic analysis. This exact file, meticulously prepared with market data and expert insights, will be instantly downloadable, allowing you to leverage its findings immediately for business planning. You are viewing the final, professionally formatted report, ready for immediate integration into your strategic decision-making processes without any further editing or revisions. This is the authentic GEA Group BCG Matrix analysis, designed for clarity and actionable insights, ensuring you get precisely what you need to understand their portfolio.

Dogs

GEA Group's legacy product lines, particularly those serving mature or declining industries, represent potential Dogs in its BCG Matrix. For instance, certain older equipment for traditional food processing or outdated water treatment technologies might fall into this category. These segments often struggle with low market share and minimal growth, acting as resource drains.

In 2024, GEA has been actively managing its portfolio. While specific figures for declining product lines aren't publicly detailed, the company’s strategic focus on innovation and sustainability implies a continuous review of its offerings. GEA’s commitment to reducing its environmental footprint and investing in digital solutions suggests a proactive approach to phasing out less competitive or environmentally impactful legacy products.

Underperforming regional markets within GEA Group can be classified as 'Dogs' in the BCG matrix. These are areas where GEA has a low market share and faces significant competition, with little prospect for future growth. Identifying these segments is crucial for strategic resource allocation.

For example, while GEA saw positive order intake growth across most regions in the first quarter of 2025, the Asia Pacific region presented an exception. This specific regional underperformance, if persistent and coupled with intense competition, would strongly suggest the presence of 'Dog' operations within that geographical segment.

Niche products with limited scalability often find themselves in the Dogs quadrant of the BCG Matrix. These are typically highly specialized items, like a unique component for a specific industrial machine or a very niche software tool. Their market is so small that even with a dominant share within that tiny segment, overall growth is severely restricted. For instance, a company might produce a specialized sensor designed for a single model of a discontinued scientific instrument. While they might hold 90% of the market for that specific sensor, the total market size could be only a few thousand units globally, leading to minimal revenue and profit.

These products, despite potentially having a loyal customer base within their narrow niche, are often characterized by low market share and even lower growth prospects. They require ongoing investment for maintenance and support, but the return on that investment is minimal. In 2024, many companies are re-evaluating such offerings, as they can act as cash traps, tying up resources that could be better allocated to high-growth potential products. A hypothetical example could be a manufacturer of a very specific type of vacuum tube for vintage audio equipment; while they might be the sole supplier, the overall demand is declining, and the market is capped.

Inefficient or Outdated Manufacturing Facilities

GEA Group may have manufacturing facilities or operational units that are significantly less efficient compared to their newer counterparts. These older facilities often incur disproportionately high maintenance and operational costs. Without a clear strategy to improve their profitability, these assets could be considered underperforming within the GEA Group's portfolio.

Such underperforming units represent a drag on overall efficiency and profitability. GEA Group's strategy would likely involve evaluating these facilities for potential optimization, such as modernization or consolidation, or considering divestment if a turnaround is not feasible. This approach aligns with a proactive management of the company's asset base to enhance resource allocation and financial performance.

- Asset Utilization: Older plants may exhibit lower output per unit of capital invested compared to modern facilities.

- Cost Inefficiencies: Higher energy consumption, increased labor requirements, and more frequent breakdowns contribute to elevated operating expenses.

- Strategic Review: GEA Group's management would assess these facilities against current market demands and technological capabilities to determine the best course of action.

Products with High Maintenance Costs and Low Customer Retention

Products within GEA Group that exhibit high maintenance costs coupled with low customer retention often fall into the Dogs category of the BCG Matrix. These are typically offerings that, while they might have seen some initial market traction, require significant ongoing investment in upkeep and support, ultimately failing to build a loyal customer base. This can be due to underperforming features, reliability issues, or simply being outpaced by more innovative or cost-effective competitor solutions.

For instance, imagine a specific line of industrial filtration systems that GEA might have introduced. If these systems consistently experience breakdowns, necessitating frequent and costly repairs, and customers find that newer, more efficient alternatives are readily available from rivals, then these filtration systems would likely be considered Dogs. GEA’s 2024 financial reports might highlight increased service and warranty expenses related to older product lines, indicating a drag on profitability.

- High Service Expenses: Products demanding frequent repairs and spare parts contribute to inflated operational costs for GEA.

- Customer Churn: Poor performance or lack of competitive edge leads to customers seeking alternatives, reducing long-term revenue streams.

- Resource Drain: These offerings consume valuable engineering and support resources without generating commensurate returns, hindering investment in growth areas.

- Market Obsolescence: Competitors may offer superior technology or value, making these products less attractive and difficult to sustain.

GEA Group's "Dogs" represent product lines or business segments with low market share and low growth potential. These are often older technologies or niche offerings that consume resources without generating significant returns. Identifying and managing these segments is crucial for optimizing GEA's overall portfolio performance.

In 2024, GEA's strategic focus on innovation and sustainability means a continuous evaluation of its product portfolio. While specific "Dog" segments aren't detailed, the company's investment in digital solutions and environmentally friendly technologies suggests a move away from less competitive legacy offerings.

Underperforming regional markets or specialized niche products can also be classified as Dogs. These segments require careful assessment for potential divestment or repositioning to free up capital for more promising ventures within GEA.

For example, GEA reported order intake growth in most regions during Q1 2025, but the Asia Pacific region showed an exception. If this underperformance persists and is linked to intense competition, it could indicate a Dog operation within that geographical segment.

Question Marks

GEA Group's investment in alternative proteins places some nascent "New Food" technologies in the question mark category of the BCG matrix. These represent high-growth potential sectors but currently hold minimal market share due to their novelty and the substantial investment needed for market penetration and scaling.

The Janesville technology center is specifically designed to accelerate the development of these early-stage innovations, aiming to transition them into the "Stars" quadrant. This strategic focus acknowledges the inherent risks and rewards associated with pioneering new food solutions, such as precision fermentation or cultivated meat, which are poised to disrupt traditional food production.

GEA Group is exploring cutting-edge digital solutions beyond established areas like digital twins and AI. These emerging technologies, currently in pilot phases, represent significant innovation but haven't yet proven their return on investment. For instance, GEA might be testing novel predictive maintenance platforms leveraging advanced machine learning models for highly specialized industrial equipment, with initial R&D investments in 2024 reaching several million euros across various pilot projects.

These ventures, while carrying high growth potential, demand considerable capital for research, development, and market penetration. The aim is to secure a dominant market share in these nascent digital spaces. For example, a new cloud-based data analytics platform for optimizing complex industrial processes could be undergoing trials, with GEA aiming to capture a significant portion of a projected multi-billion euro market by 2028, contingent on successful validation of its ROI.

GEA Group's exploration into advanced sustainable technologies in nascent markets, like novel materials recycling or niche clean energy solutions, positions them in areas with significant future potential. These ventures, while promising high growth, often start with a low market share for GEA, necessitating substantial capital infusion to establish a dominant presence.

Acquired Niche Technologies with Integration Challenges

GEA Group's acquisition of niche technologies with integration challenges would likely place them in the Question Marks quadrant of the BCG Matrix. These acquisitions, while possessing high growth potential, often struggle with seamless integration into GEA's established operational framework and sales networks.

For instance, if GEA acquired a specialized water treatment technology in 2023, its high growth prospects in emerging markets might be hampered by difficulties in adapting it to GEA's existing product lines or training its global sales force. Such situations demand significant investment in integration, potentially through dedicated R&D or targeted marketing campaigns, to unlock their full market potential. Without successful integration, these ventures could drain resources and fail to achieve expected returns.

- High Growth Potential, Low Market Share: Niche technologies often operate in rapidly expanding markets but GEA may initially hold a small share due to integration hurdles.

- Integration Costs: Significant capital expenditure is often required to align acquired technologies with GEA's existing infrastructure and processes.

- Strategic Decision Point: GEA must decide whether to invest further to overcome integration challenges and capture market growth or consider divesting if the hurdles prove insurmountable.

- Example Scenario: A 2024 acquisition of a novel bioprocessing component might face challenges in GEA's existing manufacturing lines, requiring substantial retooling and employee retraining.

Expansion into New Geographic Markets with Low Penetration

Expansion into new geographic markets with low penetration, where GEA Group might have limited brand awareness or an underdeveloped distribution network, would be classified as a question mark in the BCG matrix. These markets, however, offer substantial growth potential, necessitating strategic investments to establish a foothold.

GEA's approach here would involve significant upfront capital for market research, building sales channels, and tailoring products or services to local needs. For instance, if GEA were targeting a rapidly growing emerging market in Southeast Asia in 2024, where their presence is minimal, this would exemplify a question mark. Such ventures demand careful planning to navigate regulatory landscapes and competitive pressures, aiming to transform these nascent opportunities into future stars.

- High Growth Potential: Markets with a low GEA penetration but significant future expansion prospects.

- Low Market Share: GEA's current limited presence and brand recognition in these regions.

- Significant Investment Required: Capital allocation for market entry, marketing, and infrastructure development.

- Strategic Importance: Potential to become future market leaders if successful, driving long-term revenue growth for GEA Group.

GEA Group's ventures into novel food technologies, advanced digital solutions, and new geographic markets often fall into the Question Mark category of the BCG matrix. These represent areas with high growth potential but currently low market share for GEA, requiring substantial investment to develop and penetrate. The company strategically invests in these nascent areas, aiming to nurture them into future market leaders.

For example, GEA's 2024 investment in pilot projects for emerging digital solutions, such as advanced AI for predictive maintenance in specialized industrial equipment, could reach several million euros. These initiatives are designed to test and validate new technologies that, if successful, could capture significant portions of multi-billion euro markets by the late 2020s, though they carry inherent risks of not achieving expected returns.

Similarly, expanding into emerging markets in Southeast Asia in 2024, where GEA has minimal brand recognition and an underdeveloped distribution network, exemplifies a question mark. These efforts require significant capital for market research, building sales channels, and tailoring offerings to local needs, with the goal of establishing a strong foothold and future market leadership.

GEA's acquisitions of niche technologies with integration challenges also place them in this quadrant. While these technologies may have high growth prospects, difficulties in integrating them into GEA's existing framework necessitate considerable investment in R&D and marketing to unlock their full potential, with some integration efforts in 2024 requiring dedicated capital allocation.

| Category | Characteristics | GEA Examples (Illustrative) | Investment Focus | Potential Outcome |

| Question Marks | High Market Growth, Low Relative Market Share | New Food Technologies, Emerging Digital Solutions, New Geographic Markets, Acquired Niche Technologies | R&D, Market Penetration, Integration, Sales Channel Development | Become Stars or Cash Cows, or Divested if Unsuccessful |

| Investment Example (2024) | Pilot projects for AI-driven predictive maintenance | Several million euros | Technology validation, ROI assessment | Potential for significant market share in specialized industrial equipment optimization |

| Market Expansion Example (2024) | Entry into Southeast Asian markets | Capital for market research, distribution network building | Brand awareness, tailored product offerings | Establishment as a future market leader in these high-growth regions |

BCG Matrix Data Sources

Our GEA Group BCG Matrix leverages comprehensive market data, including GEA's financial reports, industry growth rates, and competitor analyses, to accurately position each business unit.