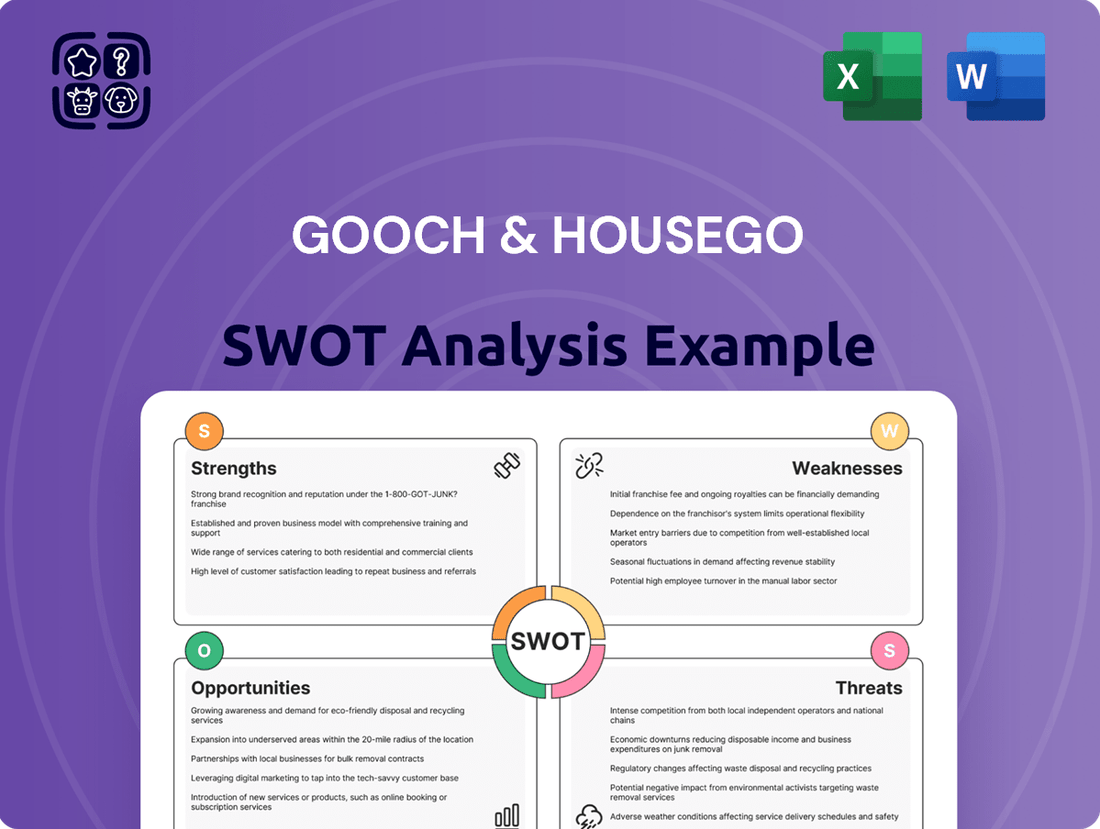

Gooch & Housego SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gooch & Housego Bundle

Gooch & Housego's innovative photonics solutions position them strongly in growth markets, but they face intense competition and evolving technological landscapes. Understanding these dynamics is crucial for strategic advantage.

Discover the complete picture behind Gooch & Housego’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Gooch & Housego's core strength lies in its highly specialized photonics expertise, covering areas like acousto-optics, electro-optics, and fiber optics. This deep technical knowledge enables the creation of sophisticated, high-precision components that are critical for advanced applications.

This niche focus allows Gooch & Housego to carve out leadership positions in demanding markets, setting them apart from broader technology providers. Their ability to innovate in these specialized fields is a key differentiator, fostering strong customer loyalty and premium pricing power.

The company's extensive history in photonics has cultivated significant intellectual property and refined manufacturing processes. For instance, in fiscal year 2023, the company reported revenue of £117.4 million, underscoring the market demand for their specialized optical solutions.

Gooch & Housego's strength lies in its diversified customer base, serving critical global markets such as industrial, scientific, R&D, aerospace & defense, and medical. This broad reach, with a significant portion of revenue historically coming from these high-value sectors, mitigates risk by not being overly dependent on any single industry. For example, in their fiscal year 2023, the company reported that the Medical and Communications segments together represented a substantial portion of their sales, demonstrating the importance of this diversification.

Gooch & Housego's products are critical for applications requiring extremely precise control and measurement of light, making them essential components for their customers' advanced systems. This inherent criticality fosters strong customer loyalty and creates significant barriers to entry for potential competitors, as the performance demands are exceptionally high.

Strong R&D and Engineering Focus

Gooch & Housego's robust commitment to research, design, and engineering is a cornerstone of its competitive advantage. This focus allows the company to consistently innovate and stay ahead in the dynamic photonics industry.

The company's investment in R&D directly translates into the creation of cutting-edge technologies and bespoke solutions tailored to specific client requirements. This capability is crucial for capturing market share in fast-evolving sectors.

- R&D Investment: Gooch & Housego's dedication to R&D is reflected in its consistent allocation of resources towards innovation, ensuring a pipeline of advanced photonics products.

- Technological Advancement: Their engineering prowess enables the development of next-generation components and systems, vital for sectors like aerospace, defense, and telecommunications.

- Customization Capabilities: The ability to engineer customized solutions allows Gooch & Housego to address niche market demands and build strong customer relationships.

- Market Leadership: By prioritizing innovation, the company solidifies its position as a leader in specialized photonics markets, driving sustained growth.

Global Customer Base and Reach

Gooch & Housego's extensive global customer base, spanning numerous countries, is a significant strength. This broad reach allows them to tap into diverse markets and reduces reliance on any single region's economic performance. For instance, in the fiscal year ending September 2023, the company reported that approximately 59% of its revenue was generated from international markets, highlighting its substantial global footprint.

This worldwide presence enables Gooch & Housego to capitalize on varied growth opportunities as they arise in different parts of the world. It also provides a buffer against localized economic downturns, as strong performance in one region can offset weaker performance in another. Their ability to serve clients across continents strengthens their brand and fosters a robust network within the specialized photonics sector.

- Diverse Revenue Streams: ~59% of FY23 revenue from international markets, reducing single-region dependency.

- Market Penetration: Access to a wide array of global markets and customer segments.

- Resilience: Mitigation of regional economic risks through geographic diversification.

- Brand Recognition: Enhanced global brand reputation and industry network within photonics.

Gooch & Housego's primary strength is its deep, specialized expertise in photonics, covering acousto-optics, electro-optics, and fiber optics. This technical mastery allows them to create highly precise components essential for advanced applications, positioning them as a leader in niche, demanding markets.

Their consistent investment in research and development fuels innovation, leading to cutting-edge technologies and customized solutions. This focus on R&D, coupled with refined manufacturing processes built over years of experience, ensures a pipeline of advanced products vital for sectors like aerospace and defense.

The company benefits from a diversified global customer base across industrial, scientific, aerospace, defense, and medical markets. This broad reach, with approximately 59% of fiscal year 2023 revenue generated internationally, provides resilience against regional economic fluctuations and strengthens their brand worldwide.

| Strength Area | Description | Supporting Data (FY23) |

|---|---|---|

| Photonics Expertise | Specialized knowledge in acousto-optics, electro-optics, fiber optics | Niche market leadership, high-precision component development |

| R&D and Innovation | Consistent investment in research and development | Pipeline of advanced technologies, customized solutions |

| Global Diversification | Broad customer base across multiple industries and geographies | ~59% of revenue from international markets |

What is included in the product

Analyzes Gooch & Housego’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address Gooch & Housego's strategic challenges and opportunities.

Weaknesses

While Gooch & Housego's focus on specialized, high-precision applications is a key strength, it inherently limits their total addressable market. This niche concentration can cap scalability, making it difficult to achieve the kind of rapid, broad-based growth seen in more mainstream technology sectors. For instance, their photonics components are vital for specific scientific instruments and industrial processes, but these markets are smaller than, say, consumer electronics. Expansion is therefore more about deepening penetration within these existing high-value segments rather than capturing a wide swath of a larger market.

Gooch & Housego faces a significant hurdle in its need for substantial and ongoing research and development (R&D) investment to stay at the forefront of photonics technology. This commitment, while crucial for innovation, can strain profitability and cash flow, particularly during economic downturns or when facing intense competition. For example, in its fiscal year ending September 30, 2023, the company reported R&D expenses of £20.3 million, a notable portion of its £226.5 million revenue.

Gooch & Housego's reliance on specific, often cyclical, industries like aerospace & defense and medical means a slump in any of these key sectors can hit them hard. For example, a slowdown in aerospace manufacturing, perhaps due to reduced airline orders or defense budget cuts, directly impacts demand for their optical components used in aircraft and defense systems.

Their business is tied to the capital expenditure and research and development spending of their clients. If companies in these sectors decide to cut back on investments, Gooch & Housego sees a direct decrease in orders. This vulnerability was evident in past economic downturns where industrial spending contracted significantly.

Furthermore, shifts in government spending priorities, especially in defense, or changes in healthcare regulations affecting medical device development and deployment, can create unforeseen challenges. For instance, a tightening of regulatory approval for new medical imaging equipment could slow sales of the optical technologies Gooch & Housego supplies.

Complex Manufacturing Processes

Gooch & Housego's manufacturing of precision optical components and systems is inherently complex, requiring significant capital investment and specialized expertise. This intricate production chain can translate into higher operational costs and extended lead times. For instance, the development and calibration of advanced laser optics, a core area for the company, often involve multi-stage processes that are difficult to accelerate.

The inherent complexity poses challenges for rapid scaling. A sudden, significant increase in demand for specialized optical assemblies, like those used in advanced semiconductor manufacturing equipment, could strain production capacity and lead to longer delivery times. This was a factor in supply chain discussions across the photonics industry throughout 2024, as demand for high-performance components outpaced available manufacturing capabilities in certain segments.

Disruptions to either the specialized machinery or the highly skilled workforce essential for these precision operations represent a significant vulnerability. For example, a breakdown in a critical polishing machine or the departure of key optical engineers could directly impact Gooch & Housego's ability to fulfill orders and maintain its quality standards. The company's reliance on a niche talent pool for its advanced manufacturing processes underscores this point.

- High Capital Expenditure: The advanced machinery and cleanroom facilities required for precision optics demand substantial ongoing investment.

- Extended Production Cycles: Complex multi-step processes, from material sourcing to final testing, inherently lengthen manufacturing lead times.

- Skilled Labor Dependency: The intricate nature of the work requires highly trained engineers and technicians, creating a potential bottleneck if talent is scarce.

- Scalability Limitations: Rapidly increasing output to meet unexpected demand surges can be challenging due to the specialized nature of the manufacturing setup.

Dependence on Key Talent

As a high-technology firm, Gooch & Housego's success is deeply intertwined with its specialized workforce. The company relies on a cadre of highly skilled engineers, scientists, and technicians to drive innovation and maintain production quality.

The potential loss of key personnel or challenges in attracting and retaining top-tier talent in a competitive global market represent a significant vulnerability. This human capital dependency can directly impact the company's ability to innovate, maintain production efficiency, and ultimately, its overall business performance.

- Specialized Workforce: Gooch & Housego's operations hinge on engineers, scientists, and technicians with niche expertise.

- Talent Retention Risk: Difficulty in keeping key employees could disrupt operations and slow product development.

- Competitive Talent Market: Attracting and retaining top talent is challenging due to high demand in the tech sector.

- Impact on Innovation: Loss of critical talent can stifle the company's research and development capabilities.

Gooch & Housego's reliance on a highly specialized workforce is a critical vulnerability. The company depends on engineers, scientists, and technicians with niche expertise for innovation and quality. The risk of losing key personnel or struggling to attract top talent in a competitive market could hinder operations and slow product development. For instance, the demand for photonics engineers remains high, making recruitment and retention a constant challenge.

The company's manufacturing processes are complex, demanding significant capital investment and specialized skills. This complexity can lead to higher operational costs and longer lead times, potentially impacting profitability and customer satisfaction. For example, the intricate nature of producing advanced laser optics requires multi-stage processes that are difficult to expedite, and capacity constraints were noted in the photonics industry throughout 2024.

Furthermore, Gooch & Housego's dependence on specific, often cyclical industries like aerospace and defense means that downturns in these sectors can significantly impact demand for their products. A slowdown in aerospace manufacturing, for example, directly affects the need for their optical components. This was observed in past economic contractions where industrial spending decreased.

The company's financial performance is also sensitive to shifts in client R&D and capital expenditure budgets. Reductions in these areas by their customers directly translate to lower order volumes for Gooch & Housego.

| Weakness | Description | Implication | Example/Data Point |

| Specialized Workforce Dependency | Reliance on highly skilled engineers and technicians. | Risk of talent loss, difficulty in recruitment, potential impact on innovation and production. | High demand for photonics engineers in the global tech market. |

| Manufacturing Complexity & Cost | Intricate production processes requiring advanced machinery and expertise. | Higher operational costs, extended lead times, potential capacity constraints. | Multi-stage processes for advanced laser optics are difficult to accelerate. |

| Industry Cyclicality & Dependence | Exposure to fluctuations in key sectors like aerospace and defense. | Vulnerability to economic downturns or reduced spending in these industries. | Reduced airline orders or defense budget cuts directly impact demand. |

| Client Spending Sensitivity | Tied to client R&D and capital expenditure budgets. | Direct impact on order volumes if clients cut investment. | Past economic downturns saw significant contractions in industrial spending. |

Preview Before You Purchase

Gooch & Housego SWOT Analysis

This is the actual Gooch & Housego SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You are seeing a direct preview of the comprehensive report. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

Opportunities

The accelerating pace of emerging technologies, such as quantum computing and advanced AI, is fueling a significant demand for high-precision photonics. Gooch & Housego is well-positioned to capitalize on this trend by developing critical components and systems for these next-generation applications. This strategic focus could unlock substantial new revenue streams and market segments, extending their reach beyond established industries.

The healthcare and life sciences sectors present a significant growth avenue for Gooch & Housego, driven by an escalating need for sophisticated diagnostic, therapeutic, and imaging technologies that depend on high-precision optics. The global medical device market, for instance, was valued at approximately $520 billion in 2023 and is projected to reach over $700 billion by 2028, indicating substantial demand for specialized optical components.

Gooch & Housego can capitalize on this trend by developing bespoke optical solutions specifically for medical devices, biotech research equipment, and clinical diagnostic instruments. This strategic focus allows the company to tap into a rapidly expanding and innovation-rich market, potentially securing new contracts and strengthening its position as a key supplier in critical healthcare applications.

Gooch & Housego can bolster its offerings by acquiring companies with complementary technologies or innovative smaller firms. This strategy would enrich its product range, broaden market penetration, and secure valuable intellectual property. For instance, acquiring a firm specializing in advanced photonics manufacturing could integrate new capabilities into G&H's existing fiber optic components business.

Strategic alliances with other technology pioneers or academic bodies present a significant opportunity. These collaborations can accelerate the development of next-generation products and provide access to novel distribution networks and customer segments. Consider a partnership with a leading aerospace manufacturer to integrate G&H's advanced optical sensors into their next-generation aircraft, as seen in the growing demand for lightweight, high-performance sensor solutions in aviation, projected to reach billions by 2025.

Growth in Aerospace & Defense Spending

Global geopolitical tensions and ongoing military modernization programs are driving substantial growth in aerospace and defense (A&D) spending. For instance, the US Department of Defense budget for fiscal year 2024 was approximately $886 billion, reflecting a continued commitment to national security and technological advancement. This upward trend in A&D expenditure directly benefits companies like Gooch & Housego, whose high-precision optical components are integral to critical defense applications.

Gooch & Housego's expertise in manufacturing advanced optical solutions positions them to capitalize on this expanding market. Their components are vital for:

- Advanced Surveillance Systems: Enabling enhanced reconnaissance and intelligence gathering capabilities.

- Targeting and Navigation Technologies: Improving accuracy and operational effectiveness for military platforms.

- Secure Communication Systems: Facilitating reliable and protected data transmission in complex environments.

The company is well-placed to secure larger, long-term contracts within these burgeoning defense programs, potentially increasing their revenue streams and market share as global defense budgets continue to rise through 2024 and into 2025.

Industrial Automation and Advanced Manufacturing

The increasing global adoption of industrial automation, robotics, and advanced manufacturing techniques, such as additive manufacturing, creates a significant opportunity for Gooch & Housego. These sophisticated processes heavily depend on high-quality optical systems for critical functions like quality control, sensing, and precise component manipulation.

Gooch & Housego is well-positioned to benefit from this trend by supplying specialized optical components that boost efficiency, accuracy, and overall reliability in industrial settings. For instance, the industrial robotics market alone was valued at approximately $50 billion in 2023 and is projected to grow substantially, with optical sensors being integral to their advanced capabilities.

- Enhanced Precision: Offering optical solutions that improve the precision of robotic arms and automated assembly lines, reducing errors and waste.

- Quality Assurance: Providing advanced optical inspection systems that can detect microscopic defects in manufactured goods, crucial for high-tech industries.

- Sensing Technologies: Developing innovative sensors for real-time monitoring and data collection in automated manufacturing environments, enabling predictive maintenance and process optimization.

- Additive Manufacturing Support: Supplying specialized optics for 3D printing processes, ensuring accurate material deposition and high-quality finished products.

The increasing demand for high-precision photonics in emerging technologies like quantum computing and advanced AI presents a significant opportunity for Gooch & Housego to develop critical components. This strategic focus can unlock substantial new revenue streams by extending their reach into next-generation applications.

The healthcare sector's escalating need for sophisticated diagnostic, therapeutic, and imaging technologies, driven by a global medical device market projected to exceed $700 billion by 2028, offers a substantial growth avenue. Gooch & Housego can capitalize by developing bespoke optical solutions for medical devices and biotech research equipment.

Acquiring companies with complementary technologies or innovative smaller firms can enrich Gooch & Housego's product range and broaden market penetration. For instance, integrating advanced photonics manufacturing capabilities through acquisition could enhance their existing fiber optic components business.

Strategic alliances with technology pioneers or academic bodies can accelerate product development and provide access to novel distribution networks. Partnerships in areas like aerospace, where advanced optical sensors are increasingly vital, can tap into growing market segments.

Global military modernization programs, supported by defense budgets like the US fiscal year 2024's $886 billion, drive demand for Gooch & Housego's optical components in surveillance, targeting, and secure communications.

The expansion of industrial automation and advanced manufacturing creates opportunities for Gooch & Housego to supply optical systems that enhance precision and efficiency. The industrial robotics market, valued at approximately $50 billion in 2023, relies heavily on such components.

Threats

The specialized photonics market, though niche, is a battleground with established giants and nimble startups vying for dominance. This intense competition, as seen in the photonics sector which saw significant investment in 2024, directly translates to pricing pressures and a constant need for innovation to maintain market share.

Market saturation in specific photonics segments poses a significant threat, potentially capping growth avenues. Gooch & Housego, like its peers, must therefore focus on aggressive differentiation, perhaps through unique technological advancements or superior customer service, to carve out and protect its market position in 2025.

Global economic slowdowns, particularly those anticipated in late 2024 and into 2025, pose a significant threat to Gooch & Housego. Reduced capital expenditure by their industrial and scientific clients, coupled with potential delays in defense sector R&D, could directly impact demand for the company's advanced photonic components. For instance, a 1.0% contraction in global GDP, as projected by some economic forecasts for 2025, would likely translate to a proportional decrease in orders for high-value, non-essential equipment.

The photonics sector is a hotbed of innovation, meaning Gooch & Housego faces a constant threat of its current technologies becoming outdated. Companies that don't keep their products cutting-edge risk losing market share. This dynamic requires substantial and swift investment in research and development to stay ahead.

Failure to adapt quickly could see Gooch & Housego's offerings become less desirable, impacting sales and their competitive edge. For instance, the market for advanced laser components, a key area for the company, saw significant new product introductions in late 2024, putting pressure on incumbents to match performance and cost metrics.

Supply Chain Disruptions and Geopolitical Risks

Gooch & Housego's reliance on specialized raw materials and global manufacturing exposes it to significant supply chain disruptions. For instance, the semiconductor industry, a key sector for photonics, faced widespread shortages throughout 2021 and 2022, impacting lead times and component costs globally. This vulnerability is amplified by geopolitical tensions, as seen in the trade disputes between major economies that can disrupt the flow of essential components and finished goods.

Such disruptions can directly affect Gooch & Housego's production schedules and its ability to meet international customer demand. The company's financial performance, particularly its revenue and profit margins, can be squeezed by increased input costs and logistical challenges. For example, increased shipping costs in 2022, driven by global supply chain issues, added pressure to operational expenses across many manufacturing sectors.

- Increased component costs: Geopolitical events and supply chain bottlenecks can drive up the price of specialized materials and components essential for photonics.

- Extended lead times: Disruptions can lead to longer waiting periods for critical inputs, delaying production and product delivery.

- Reduced access to international markets: Trade wars or sanctions can limit Gooch & Housego's ability to export products to key international customer bases.

- Impact on profitability: Higher operational costs and potential loss of sales due to delivery delays directly affect the company's bottom line.

Intellectual Property Infringement and Talent Poaching

Gooch & Housego faces a significant threat from intellectual property (IP) infringement. As a company heavily reliant on its technological innovations, the unauthorized use or replication of its patented designs and proprietary processes by competitors, especially in markets with less robust IP enforcement, could erode its competitive advantage and financial performance. For instance, in 2023, the global market for optical components, a key area for Gooch & Housego, continued to see aggressive competition, highlighting the ongoing risk.

Furthermore, the specialized nature of Gooch & Housego's workforce makes talent poaching a critical concern. The loss of key engineers and scientists to rivals or larger technology corporations could disrupt ongoing research and development efforts, slow down product innovation, and impact the company's ability to maintain its technological edge. In 2024, the demand for skilled personnel in advanced manufacturing and photonics remains high, intensifying this challenge.

- Intellectual Property Risk: Competitors may infringe on Gooch & Housego's patents and proprietary technologies, particularly in regions with weaker IP protections, potentially impacting market share and profitability.

- Talent Acquisition and Retention: The specialized skills of Gooch & Housego's engineering and scientific staff are highly sought after, making them vulnerable to poaching by competitors, which could hinder innovation and operational continuity.

- Global IP Enforcement: Varying levels of IP enforcement across different international markets present a challenge for protecting Gooch & Housego's innovations and maintaining a level playing field.

- R&D Continuity: The potential loss of key personnel due to talent poaching poses a direct threat to the ongoing development and successful commercialization of new technologies.

Intense competition within the photonics market, characterized by rapid technological advancements and aggressive pricing strategies from both established players and emerging startups, presents a significant threat to Gooch & Housego. The sector's dynamic nature, with new product introductions frequently occurring, necessitates continuous innovation to avoid obsolescence and maintain market relevance. For instance, the global photonics market was projected to grow robustly, with significant investments in areas like quantum computing and advanced sensing in 2024, indicating a highly competitive landscape.

Global economic headwinds, including potential recessions or slowdowns in major markets anticipated for late 2024 and into 2025, pose a direct risk by reducing capital expenditure from industrial and scientific clients. This could lead to decreased demand for Gooch & Housego's high-value components. For example, a projected 0.8% slowdown in global industrial production for 2025, as estimated by some economic bodies, would likely translate to fewer orders for specialized optical equipment.

Supply chain vulnerabilities, exacerbated by geopolitical instability and trade tensions, create risks of increased component costs and extended lead times for Gooch & Housego. Disruptions in the flow of specialized raw materials, critical for advanced photonics, can directly impact production schedules and profitability. The semiconductor industry, a key supplier to photonics, continued to experience supply chain pressures in early 2024, affecting component availability and pricing.

| Threat Category | Specific Risk | Impact on Gooch & Housego | Example/Data Point |

|---|---|---|---|

| Competition | Rapid Technological Obsolescence | Loss of market share, reduced pricing power | New laser component introductions in late 2024 pressured incumbents. |

| Economic Factors | Global Economic Slowdown | Reduced client capital expenditure, lower demand | Projected 0.8% slowdown in global industrial production for 2025. |

| Supply Chain | Disruptions & Geopolitical Tensions | Increased costs, extended lead times, reduced market access | Semiconductor supply chain pressures persisted into early 2024. |

| Intellectual Property | IP Infringement | Erosion of competitive advantage, reduced profitability | Aggressive competition in optical components market in 2023. |

| Human Capital | Talent Poaching | Disruption to R&D, slowed innovation | High demand for skilled photonics engineers in 2024. |

SWOT Analysis Data Sources

This Gooch & Housego SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market intelligence reports, and expert commentary from industry analysts to provide a well-rounded strategic perspective.