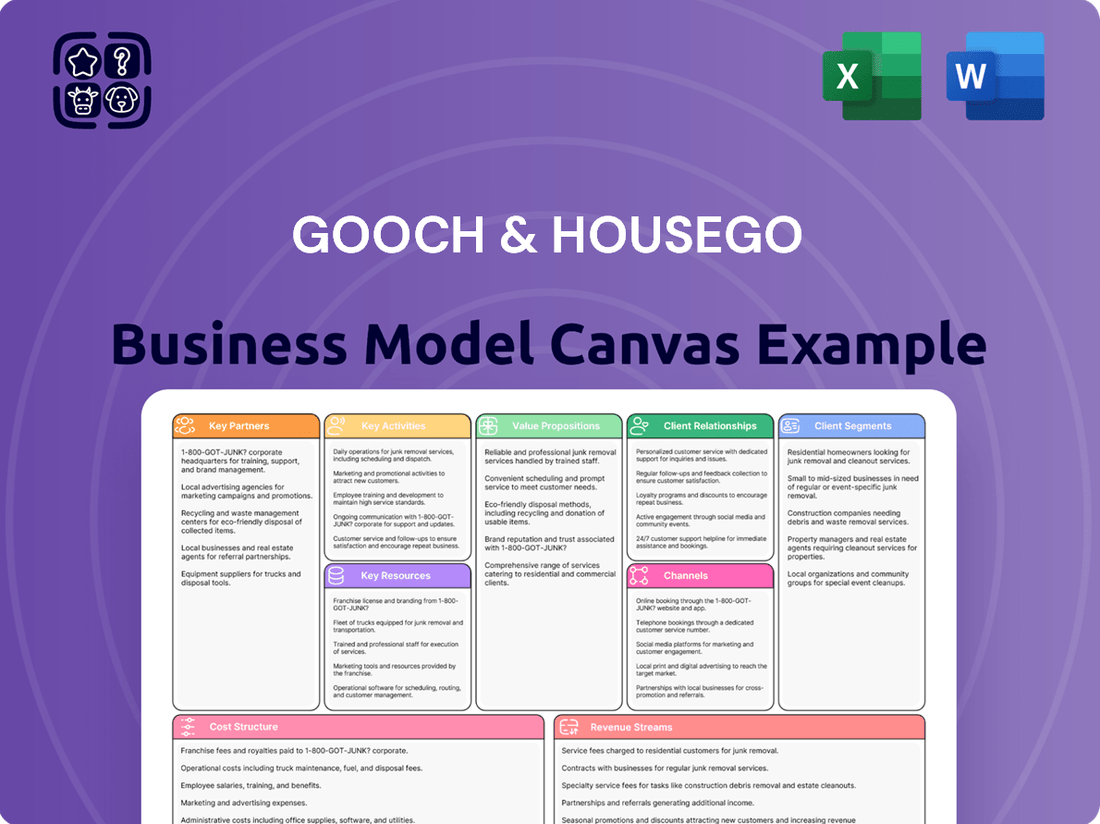

Gooch & Housego Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gooch & Housego Bundle

Discover the strategic framework that powers Gooch & Housego's success. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Download the full version to gain actionable insights for your own business strategy.

Partnerships

Gooch & Housego strategically enhances its business by acquiring companies that broaden its technological expertise and market reach. For instance, the October 2024 acquisition of Phoenix Optical Technologies significantly bolstered its aerospace and defense offerings in the UK and Europe.

Further expanding its footprint, the company acquired Global Photonics in May 2025, reinforcing its manufacturing capabilities and market presence within the US aerospace and defense sector. These moves are designed to bolster the optical systems division and secure future customer business.

Gooch & Housego (G&H) strategically utilizes contract manufacturing partners, especially in regions with lower operational costs, to boost its production capacity and agility. This allows the company to scale up or down quickly in response to fluctuating customer orders, a critical advantage in dynamic markets.

By outsourcing certain manufacturing processes, G&H's in-house expertise can be directed towards more intricate and value-added sub-assemblies, such as advanced optical components. This specialization enhances the overall quality and innovation of their core offerings.

This outsourcing model also plays a significant role in improving G&H's profit margins and ensures a surge build capability. For instance, in the fiscal year 2023, G&H reported revenue of £134.3 million, demonstrating the scale at which these partnerships operate and contribute to their financial performance.

Gooch & Housego cultivates vital relationships with suppliers providing essential raw materials and highly specialized components for its advanced optical systems. These partnerships are foundational to maintaining the precision and quality demanded by their products, ensuring a consistent supply of critical inputs.

The company actively monitors its supply chain for potential disruptions and the impact of new tariffs, diligently identifying and vetting alternative sources. This proactive approach helps to mitigate unforeseen cost increases and maintain production continuity, a key strategy in the volatile global market.

In 2024, Gooch & Housego's commitment to supply chain resilience was underscored by its focus on diversifying its supplier base, particularly for rare earth elements and advanced coatings. This strategic move aims to buffer against geopolitical risks and ensure uninterrupted access to the high-purity materials necessary for their cutting-edge fiber optic components and acousto-optic devices.

Research and Development Collaborations

Gooch & Housego (G&H) actively pursues research and development collaborations, focusing on pioneering photonics applications and the creation of advanced instrument designs. These partnerships are vital for staying at the forefront of technological innovation.

A significant aspect of these collaborations involves working directly with customers to co-design and achieve accreditation for novel medical diagnostic instruments. This customer-centric approach ensures G&H's offerings meet specific market needs and regulatory requirements.

These strategic alliances are instrumental in driving photonics technology forward and translating ambitious technological roadmaps into consistent, recurring revenue streams. For instance, G&H's focus on specialized photonics for medical devices, a sector projected for continued growth, underscores the importance of these R&D partnerships.

- Focus on Emerging Photonics: Collaborations target new and evolving photonics applications to maintain a competitive edge.

- Customer-Driven Design: Partnerships with clients are key for developing and accrediting next-generation medical diagnostic instruments.

- Revenue Generation: These R&D efforts are designed to convert technological advancements into predictable, recurring revenue.

Defense Prime Contractors

Gooch & Housego (G&H) maintains robust, long-standing relationships with major defense prime contractors in both the United States and the United Kingdom. These critical alliances involve supplying essential optical systems and components vital for numerous military land and air platforms.

These partnerships are characterized by high-value quotations for sophisticated systems, including periscopes, sighting equipment, and countermeasure technologies. For instance, G&H's role in supplying advanced optical solutions for next-generation fighter jets and armored vehicles underscores the strategic importance of these collaborations.

- Strategic Alliances: G&H's deep ties with leading US and UK defense primes are foundational to its aerospace and defense business.

- High-Value Contracts: The company consistently secures significant contracts for periscope, sighting, and countermeasure systems, reflecting its specialized capabilities.

- Critical Supplier Status: By providing indispensable optical components, G&H solidifies its position as a key enabler within the defense supply chain, contributing to national security initiatives.

Gooch & Housego's Key Partnerships are crucial for its operational efficiency and market penetration, particularly through strategic acquisitions and contract manufacturing. The company's 2024 and 2025 acquisitions of Phoenix Optical Technologies and Global Photonics, respectively, significantly expanded its technological capabilities and market access in the aerospace and defense sectors. Furthermore, leveraging contract manufacturing partners, especially in cost-effective regions, enhances production agility and allows G&H to focus its in-house expertise on high-value optical components, as evidenced by its £134.3 million revenue in fiscal year 2023.

What is included in the product

This Business Model Canvas provides a strategic overview of Gooch & Housego's operations, detailing its key customer segments, value propositions, and revenue streams within the photonics industry.

It offers a clear, structured representation of how Gooch & Housego creates, delivers, and captures value, serving as a vital tool for strategic planning and stakeholder communication.

Gooch & Housego's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, making complex strategies easily digestible for quick review and adaptation.

Activities

Gooch & Housego's core activities revolve around the intricate research, design, and engineering of advanced photonic systems. This isn't just about creating products; it's about pushing the boundaries of light manipulation and measurement technology.

Their dedicated R&D efforts are constantly focused on innovation, developing cutting-edge solutions. Key areas of expertise include the meticulous assembly of fiber optic modules and the complex integration of electro-optic assemblies, ensuring precision and performance.

For instance, in the fiscal year ending September 30, 2023, Gooch & Housego reported that their Advanced Materials segment, which heavily relies on these R&D capabilities, generated £20.1 million in revenue, demonstrating the commercial impact of their engineering prowess.

Gooch & Housego's core strength lies in its precision manufacturing of specialized optical components, instruments, and systems. This involves deep expertise across acousto-optics, electro-optics, fiber optics, and high-precision optics.

With manufacturing facilities strategically located in the UK, USA, and China, the company leverages advanced capabilities. These include critical processes such as single-point diamond turning for ultra-smooth surfaces and sophisticated thin-film coating technologies to enhance optical performance.

For instance, in fiscal year 2023, Gooch & Housego reported revenue of £221.6 million, with a significant portion driven by its advanced manufacturing operations and the demand for its high-specification optical products in sectors like aerospace, defense, and telecommunications.

Gooch & Housego's strategic portfolio management is a core activity, involving the active buying and selling of businesses and product lines. This approach aims to sharpen their market focus and boost financial performance.

In 2024, G&H continued this strategy by acquiring Phoenix Optical and Global Photonics, expanding their capabilities in key areas. This followed their divestment of the EM4 subsidiary, demonstrating a clear intent to streamline operations and concentrate on higher-growth segments.

The company regularly evaluates its product offerings, looking for opportunities to enhance differentiation and reduce costs. This can involve shifting production to more efficient locations or discontinuing products that are no longer as profitable, ensuring resources are allocated effectively.

Customer Solutions and Integration

Gooch & Housego excels in delivering comprehensive, end-to-end solutions for its Original Equipment Manufacturer (OEM) clients. Their approach centers on enhancing system efficiency and effectiveness through close collaboration. This focus is crucial for clients in sectors like aerospace and defense, where reliability is paramount.

The company designs and manufactures highly specialized, dependable, and top-performing products. These are meticulously crafted to meet the unique demands of specific applications or challenging environmental conditions. For instance, their expertise in integrating complex electronics and optics into sophisticated systems is a key differentiator.

- End-to-End Solutions: Providing integrated optical and electronic components for OEM systems.

- System Efficiency: Collaborating with customers to optimize the performance of their end products.

- Specialized Design: Manufacturing custom solutions for demanding applications and environments.

- Integration Expertise: Combining optics and electronics into complex, high-performance systems.

Operational Efficiency and Supply Chain Management

Gooch & Housego is actively enhancing its production processes to shorten delivery times and increase output. This focus on operational efficiency is key to maintaining competitiveness.

Leveraging contract manufacturing partners allows Gooch & Housego to scale production effectively and manage capacity fluctuations. This strategic outsourcing is a core element of their operational strategy.

The company closely monitors the potential impacts of new tariffs and ongoing supply chain disruptions. Proactive risk management in these areas is vital for business continuity.

Effective supply chain management is paramount for Gooch & Housego to navigate economic uncertainties and secure a stable cost structure. This ensures predictable pricing and reliable product availability for their customers.

- Operational Efficiency: Gooch & Housego aims to reduce lead times and boost production capacity through process improvements.

- Contract Manufacturing: Utilization of external manufacturing partners is a key strategy for managing capacity and flexibility.

- Risk Mitigation: Close monitoring of new tariffs and supply chain vulnerabilities is essential for business resilience.

- Cost Stability: Robust supply chain management is critical for controlling costs amidst macroeconomic volatility.

Gooch & Housego's key activities encompass the sophisticated research, design, and engineering of advanced photonic systems, ensuring innovation in light manipulation and measurement. They also focus on precision manufacturing of specialized optical components and systems, utilizing advanced techniques like diamond turning and thin-film coating. Furthermore, strategic portfolio management, including acquisitions and divestments, sharpens their market focus and financial performance. Finally, they excel at delivering end-to-end solutions for OEMs, integrating optics and electronics for enhanced system efficiency and reliability.

| Key Activity | Description | Fiscal Year 2023 Impact |

|---|---|---|

| R&D and Engineering | Design and development of advanced photonic systems. | Advanced Materials segment revenue: £20.1 million. |

| Precision Manufacturing | Production of specialized optical components, instruments, and systems. | Overall revenue: £221.6 million, with significant contribution from advanced manufacturing. |

| Strategic Portfolio Management | Acquisition and divestment of businesses and product lines. | Acquisitions of Phoenix Optical and Global Photonics in 2024; divestment of EM4. |

| End-to-End OEM Solutions | Integrated design and manufacturing of optical and electronic systems for clients. | Focus on enhancing system efficiency and reliability for sectors like aerospace and defense. |

What You See Is What You Get

Business Model Canvas

The Gooch & Housego Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, professionally structured canvas. Once your order is processed, you will gain full access to this identical file, ready for your strategic analysis and planning.

Resources

Gooch & Housego's (G&H) core strength lies in its profound understanding of photonics, covering areas like acousto-optics, electro-optics, fiber optics, and precision optics. This deep technical knowledge is fundamental to their ability to create cutting-edge products.

Their intellectual property portfolio is a significant resource, featuring proprietary designs, specialized manufacturing techniques, and patented technologies that provide a competitive edge. This IP underpins their innovation and market position.

Gooch & Housego's specialized manufacturing facilities are the backbone of its high-precision optical product creation. Operating across the UK, USA, and China, these sites house advanced machinery and crucial cleanroom environments, enabling the intricate production of optical components, instruments, and sophisticated systems.

The company's commitment to innovation is evident in recent strategic investments, such as the establishment of a new Innovation Hub for Life Sciences located in Rochester, New York. This expansion underscores their dedication to pushing the boundaries in specialized manufacturing for critical sectors.

Gooch & Housego's strength lies in its highly skilled workforce, comprising experienced engineers, dedicated scientists, and precision manufacturing specialists. This deep pool of talent is fundamental to their operations.

Their commitment to innovation is evident in their robust Research and Development (R&D) teams. These teams are crucial for developing cutting-edge photonics technologies, ensuring Gooch & Housego stays ahead in a competitive market.

In 2024, the company continued to invest in its human capital, recognizing that this skilled workforce and their R&D efforts are the bedrock of their research, design, and advanced manufacturing capabilities, directly impacting their product pipeline and market position.

Global Sales and Distribution Network

Gooch & Housego leverages a robust global sales and distribution network, enabling them to effectively reach a diverse customer base across numerous industries worldwide. This extensive reach is crucial for delivering their specialized photonic solutions to clients in various geographic markets.

Their established channels are designed to handle the complexities of distributing advanced optical components and systems. For instance, in the fiscal year ending September 28, 2024, the company reported revenue from continuing operations of £125.3 million, demonstrating the scale of their global operations and customer engagement.

The company's network facilitates market penetration and customer service on an international scale. This global footprint supports their strategy of expanding into new territories and strengthening relationships with existing clients.

- Global Reach: Serves customers across North America, Europe, and Asia, key markets for advanced optics.

- Diverse Customer Base: Engages with clients in sectors including aerospace, defense, medical, and telecommunications.

- Distribution Efficiency: Established logistics and sales channels ensure timely delivery of complex photonic products.

- Market Expansion: The network supports the company's efforts to enter and grow within new geographic regions.

Financial Capital and Strong Order Book

Gooch & Housego (G&H) demonstrates robust financial stability, fueled by diversified revenue streams and strategic access to capital. This financial health allows for crucial investments in research and development, alongside ongoing operational enhancements.

The company’s growing order book is a significant indicator of future revenue, providing valuable visibility and bolstering confidence. As of their latest reporting, G&H has consistently managed its financial resources effectively, ensuring a solid foundation for continued growth and strategic initiatives.

- Financial Stability: G&H maintains a strong balance sheet, enabling strategic investments and acquisitions.

- Order Book Visibility: A consistently growing order book provides clear future revenue projections.

- Investment Capacity: Financial strength supports R&D and operational improvements, driving innovation.

- Capital Access: G&H leverages its financial standing to secure necessary capital for expansion and development.

Gooch & Housego's key resources include its deep expertise in photonics, a strong intellectual property portfolio, specialized manufacturing facilities across the UK, USA, and China, a highly skilled workforce, and robust R&D capabilities. The company also benefits from a global sales and distribution network and strong financial stability with a growing order book.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Photonics Expertise | Acousto-optics, electro-optics, fiber optics, precision optics knowledge. | Underpins cutting-edge product development. |

| Intellectual Property | Proprietary designs, manufacturing techniques, patents. | Provides competitive edge and market position. |

| Manufacturing Facilities | Advanced machinery and cleanrooms in UK, USA, China. | Enables high-precision optical component production. |

| Skilled Workforce & R&D | Experienced engineers, scientists, manufacturing specialists. | Drives innovation and product pipeline. |

| Global Sales Network | Channels reaching diverse industries worldwide. | Generated £125.3 million revenue from continuing operations (FY ending Sep 28, 2024). |

| Financial Stability | Diversified revenue, access to capital, growing order book. | Enables strategic investments and operational enhancements. |

Value Propositions

Gooch & Housego’s value proposition centers on delivering solutions that are absolutely critical for tasks demanding exceptionally precise light manipulation and measurement. This unwavering accuracy and dependability are paramount, especially in sectors like aerospace and defense. In these high-stakes fields, where technology failure can have severe consequences, their engineered products consistently meet and exceed the most rigorous performance standards.

Gooch & Housego's advanced photonics technology and expertise are central to their value proposition. They possess world-leading capabilities in designing, developing, and manufacturing acousto-optics, electro-optics, and fiber optics. This deep technological understanding allows them to create unique product solutions that push innovation boundaries.

This technical prowess translates into tangible benefits for their customers. By providing advanced photonics components and systems, Gooch & Housego empowers clients to innovate and maintain a competitive edge in their respective markets. For instance, their acousto-optic modulators are crucial in applications like laser processing and medical imaging, areas demanding high precision and reliability.

Gooch & Housego (G&H) truly shines by crafting custom optical systems and components. They don't just sell off-the-shelf parts; they partner with Original Equipment Manufacturers (OEMs) to engineer solutions perfectly suited to their unique needs. This means if a client has a very specific application, G&H can design and build the exact optical system required.

Their collaborative approach is key. G&H engages closely with customers from the initial design phase right through to manufacturing. This ensures that the final product not only meets but often exceeds expectations, especially when dealing with complex assemblies or demanding operational conditions. For instance, G&H's expertise in acousto-optic tunable filters (AOTFs) allows for highly specialized spectral filtering crucial in scientific instrumentation and defense applications, demonstrating their capability in niche, high-value markets.

The value proposition here is clear: G&H delivers bespoke, integrated optical solutions that solve complex customer challenges. This capability is particularly impactful for clients needing highly specialized or proprietary optical assemblies where standard solutions simply won't suffice. Their ability to deliver these tailored systems contributes significantly to their clients' product innovation and competitive edge.

Critical Components for Diverse High-Growth Markets

Gooch & Housego's value proposition hinges on providing critical photonics components essential for a wide array of high-growth global markets. Their products serve vital functions across industrial, scientific, R&D, aerospace & defense, and medical sectors, demonstrating significant market breadth.

These photonics solutions are key enablers in rapidly expanding fields. For instance, they are integral to semiconductor manufacturing, a sector that saw global revenue reach approximately $600 billion in 2023. Furthermore, G&H's technology supports subsea data networks, crucial for the ever-increasing demand for internet bandwidth, and advancements in medical diagnostics and defense optics, both experiencing robust growth.

- Broad Market Application: G&H's photonics are critical for industrial, scientific, R&D, aerospace & defense, and medical sectors.

- High-Growth Market Enablement: Solutions drive growth in semiconductor manufacturing, subsea data networks, medical diagnostics, and defense optics.

- Risk Mitigation and Growth Avenues: Diverse market penetration reduces reliance on any single sector and opens multiple avenues for sustained expansion.

Long-Term Partnership and Support

Gooch & Housego cultivates enduring alliances with its clientele, providing continuous assistance and collaborative efforts. Their strategic objective is to be the preferred provider of optical system solutions, achieved through an outstanding customer journey. This dedication to partnership facilitates a profound comprehension of client requirements, thereby nurturing sustained business relationships.

This approach directly translates into tangible benefits, as evidenced by Gooch & Housego's consistent revenue streams. For the fiscal year ending September 30, 2023, the company reported revenue of £122.6 million, demonstrating the financial success of their customer-centric strategy. This long-term focus not only drives repeat business but also positions them as a trusted advisor in the demanding aerospace and defense sectors.

- Customer Retention: Their emphasis on long-term partnerships fosters high customer loyalty, leading to predictable revenue.

- Deep Market Insight: Continuous collaboration provides valuable feedback, allowing Gooch & Housego to anticipate and meet evolving market needs.

- Brand Reputation: An exceptional customer experience builds a strong reputation, attracting new clients and reinforcing their position as a market leader.

- Innovation Synergy: Working closely with customers on ongoing projects facilitates co-development and innovation in optical technologies.

Gooch & Housego's value proposition is built on delivering highly specialized photonics solutions that are critical for precision-driven applications. They excel in custom optical system design and manufacturing, partnering with OEMs to create bespoke components that meet unique and demanding requirements.

Their advanced acousto-optic, electro-optic, and fiber optic technologies enable customers to achieve breakthroughs and maintain a competitive edge. This is particularly evident in high-growth sectors like semiconductor manufacturing, where their components are vital, and in areas such as medical imaging and defense optics, where accuracy and reliability are paramount.

By fostering long-term customer alliances and providing continuous support, G&H ensures deep market understanding and drives innovation. This customer-centric approach leads to strong retention and predictable revenue streams, as demonstrated by their consistent financial performance, with revenues of £122.6 million for the fiscal year ending September 30, 2023.

| Value Proposition Element | Description | Key Benefit | Supporting Data/Example |

|---|---|---|---|

| Custom Optical Solutions | Designing and manufacturing bespoke optical systems tailored to specific OEM needs. | Solves complex customer challenges, enabling product innovation. | Partnership approach from design to manufacturing for unique applications. |

| Advanced Photonics Technology | World-leading expertise in acousto-optics, electro-optics, and fiber optics. | Enables customers to push technological boundaries and maintain a competitive edge. | Crucial in applications like laser processing and medical imaging requiring high precision. |

| Critical Component Supply | Providing essential photonics components for high-growth global markets. | Supports growth in key sectors and diversifies revenue streams. | Integral to semiconductor manufacturing (approx. $600 billion global revenue in 2023) and subsea data networks. |

| Long-Term Customer Partnerships | Cultivating enduring alliances through continuous support and collaboration. | Fosters customer loyalty, deep market insight, and predictable revenue. | FY2023 revenue of £122.6 million reflects successful customer-centric strategy. |

Customer Relationships

Gooch & Housego cultivates enduring relationships with Original Equipment Manufacturers (OEMs), actively engaging from the earliest design stages through production and ongoing support. This collaborative approach ensures their solutions precisely meet the intricate requirements of their OEM clients, particularly for mission-critical components.

Gooch & Housego (G&H) actively partners with clients on technical collaboration and co-development, especially for cutting-edge instruments and sophisticated applications. This proactive engagement ensures their optical components and solutions are perfectly aligned with customer systems and future technological needs.

This deep integration fosters significant trust and a strong sense of mutual dependence between G&H and its clientele, as evidenced by their ongoing work with leading aerospace and defense contractors on advanced sensor systems.

Gooch & Housego (G&H) leverages specialized sales and technical support teams to navigate the complex needs of its clientele, particularly within demanding sectors like aerospace, defense, and medical. These dedicated teams possess deep technical knowledge, enabling them to provide expert guidance and ensure customers can fully optimize their systems.

Responsive Customer Service

Gooch & Housego prioritizes responsive customer service, actively working to shorten lead times and enhance service delivery. This focus is crucial for attracting new business and ensuring high levels of customer contentment. In 2024, the company continued to invest in operational efficiencies to meet these goals.

- Responsive Service: Efforts to reduce lead times and improve service delivery are central to their customer relationship strategy.

- Customer Satisfaction: A commitment to efficient communication and swift problem-solving fosters strong customer loyalty and repeat business.

- Order Acquisition: Enhanced service levels directly contribute to securing new orders and maintaining a competitive edge in the market.

Strategic Customer Engagement

Gooch & Housego (G&H) actively cultivates relationships through strategic customer engagement, including participation in key industry events and direct outreach. This ensures they stay attuned to evolving market trends and specific customer needs.

This proactive strategy allows G&H to pinpoint emerging business opportunities and solidify their standing as a trusted, preferred supplier. For instance, their engagement in the photonics sector, a critical area for their business, helps them understand the demand for advanced optical components.

- Industry Event Presence: G&H consistently exhibits at major trade shows like SPIE Photonics West, providing direct interaction with customers and showcasing their latest innovations.

- Direct Customer Outreach: Dedicated sales and technical teams engage directly with clients to gather feedback and understand project-specific requirements.

- Market Trend Analysis: Insights gleaned from these interactions inform G&H's understanding of market shifts, such as the growing demand for components in aerospace and defense applications, which represented a significant portion of their revenue in recent fiscal periods.

- Product Development Insights: Customer feedback directly influences G&H's R&D pipeline, guiding the development of new products and the refinement of existing offerings to meet future market demands.

Gooch & Housego's customer relationships are built on deep technical collaboration and a commitment to responsive service, particularly with Original Equipment Manufacturers (OEMs). This involves engaging early in the design process and providing ongoing support to ensure their optical solutions precisely meet client needs, especially in demanding sectors like aerospace and defense.

Their strategy emphasizes proactive engagement, including technical collaboration and co-development for advanced instruments, ensuring their components align with future technological requirements. This deep integration fosters significant trust and mutual dependence, as seen in their work with leading aerospace and defense contractors.

Specialized sales and technical support teams navigate complex client needs, offering expert guidance to optimize system performance. In 2024, G&H continued investing in operational efficiencies to shorten lead times and enhance service delivery, crucial for attracting new business and ensuring high customer satisfaction.

G&H actively participates in key industry events like SPIE Photonics West, alongside direct customer outreach, to stay attuned to market trends and specific needs. This proactive approach, evidenced by their significant presence in the photonics sector, helps them identify opportunities and solidify their position as a preferred supplier, with aerospace and defense applications forming a substantial revenue driver.

| Customer Segment | Relationship Type | Key Engagement Methods | 2024 Focus Areas |

|---|---|---|---|

| OEMs (Aerospace, Defense, Medical) | Co-development, Long-term Partnership | Early-stage design involvement, Technical support, Dedicated sales teams | Shortening lead times, Enhancing service delivery, Operational efficiency |

| Research & Development Institutions | Collaborative Projects | Direct outreach, Industry event participation, Feedback integration | Understanding evolving market trends, Identifying new business opportunities |

Channels

Gooch & Housego relies heavily on its direct sales force and specialized business development teams to connect with customers worldwide. This direct approach is vital for engaging with Original Equipment Manufacturers (OEMs) and major defense contractors, enabling in-depth technical conversations and the creation of tailored solutions. These teams are instrumental in fostering and sustaining enduring client partnerships.

In fiscal year 2023, Gooch & Housego reported revenue of £154.5 million, with a significant portion driven by these customer-facing teams. Their ability to navigate complex sales cycles and understand specific application needs directly contributes to securing key contracts and driving revenue growth.

Gooch & Housego's global network of manufacturing and design facilities, strategically located in the UK, USA, and China, are key channels for both production and direct customer delivery. This distributed footprint allows for localized support and streamlined supply chain operations, crucial for serving an international clientele.

The company's US expansion, notably a new facility in California, mirrors the successful model established in the UK. This move is designed to bolster optical systems production and delivery capabilities within North America. For example, in 2023, Gooch & Housego reported a significant portion of its revenue was generated from its Americas segment, underscoring the importance of these regional hubs.

Gooch & Housego (G&H) strategically leverages industry trade shows and conferences, including prominent events like Laser World of Photonics and ADLM, to showcase its cutting-edge photonics solutions. These gatherings are vital for direct customer engagement, allowing G&H to demonstrate its technological prowess and build relationships. In 2024, G&H continued to invest in these channels, recognizing their importance for lead generation and understanding market trends.

Company Website and Investor Relations Portals

Gooch & Housego's official website and dedicated investor relations portal are crucial digital touchpoints. These platforms act as the primary conduits for disseminating vital information to a broad audience, including customers, potential investors, and existing shareholders. They provide a centralized repository for everything from detailed product specifications and technical data to comprehensive financial reports and the latest company news.

These digital channels are instrumental in fostering transparency and ensuring that all stakeholders have easy access to up-to-date corporate information. For instance, as of their latest reporting period in 2024, Gooch & Housego actively updates these sites with quarterly earnings releases, annual reports, and regulatory filings, making this data readily available to the public and financial analysts alike.

- Official Website: Serves as the primary gateway for product information, company overview, and news.

- Investor Relations Portal: Dedicated section for financial reports, presentations, stock information, and regulatory filings.

- Transparency and Accessibility: Ensures stakeholders can easily access critical corporate and financial data.

- 2024 Updates: Continual provision of financial results, operational updates, and strategic announcements through these channels.

Strategic Acquisitions for Market Access

Acquisitions such as Phoenix Optical and Global Photonics are crucial strategic channels for Gooch & Housego. These moves provide immediate access to established customer relationships and open up new market segments, significantly accelerating market penetration.

These bolt-on acquisitions bolster Gooch & Housego's presence in key sectors, notably aerospace and defense. By integrating these businesses, the company gains not only new technologies but also existing sales pipelines and loyal customer bases, driving growth.

- Market Access: Phoenix Optical and Global Photonics offer direct entry into new customer bases.

- Sector Expansion: Strengthened foothold in aerospace and defense markets.

- Sales Acceleration: Leverages existing sales channels and customer relationships.

- Enhanced Offering: Broadens product and service capabilities in targeted sectors.

Gooch & Housego's channels are multifaceted, encompassing direct sales, strategic acquisitions, and digital platforms. Their direct sales force and business development teams are critical for engaging with OEMs and defense contractors, facilitating deep technical discussions and tailored solutions. This direct approach was evident in fiscal year 2023, where these teams played a significant role in securing key contracts and contributing to the company's £154.5 million revenue.

Strategic acquisitions, such as Phoenix Optical and Global Photonics, act as vital channels by providing immediate access to established customer bases and new market segments, particularly in aerospace and defense. The company also leverages industry trade shows and its official website, including the investor relations portal, to showcase solutions, engage customers, and disseminate financial information. In 2024, G&H continued to invest in these digital and event-based channels to maintain market visibility and stakeholder communication.

| Channel Type | Key Activities | Fiscal Year 2023/2024 Relevance |

|---|---|---|

| Direct Sales & Business Development | OEM engagement, defense contractor relations, tailored solutions | Drove significant portion of £154.5M revenue in FY23 |

| Strategic Acquisitions | Market access, sector expansion (aerospace/defense), sales acceleration | Integrated Phoenix Optical and Global Photonics for growth |

| Industry Events & Digital Platforms | Product showcases (Laser World of Photonics), lead generation, information dissemination | Continued investment in 2024 for market presence and stakeholder communication |

Customer Segments

The Aerospace & Defense sector represents a critical customer base for Gooch & Housego, encompassing entities that demand exceptionally precise optics and integrated systems for highly specialized and often harsh operational environments. This segment’s needs span a wide array of applications, from sophisticated periscopes and fire-control systems for armored vehicles to advanced components for air platforms and vital satellite communication systems.

Gooch & Housego’s offerings are tailored to meet the stringent performance requirements of military land applications, including those for tanks, as well as critical components for aircraft and the burgeoning satellite communications market. This focus aligns with global defense spending trends, which have seen a notable uptick in areas such as armored vehicle upgrades, unmanned aerial vehicle (UAV) development, and the expansion of advanced sensing and surveillance capabilities.

Indeed, the global defense market experienced significant growth, with defense spending projected to reach approximately $2.2 trillion in 2024. This expansion is largely fueled by geopolitical tensions and a renewed emphasis on modernizing military hardware, including armored vehicles and drone technology, directly benefiting suppliers of high-precision optical components like Gooch & Housego.

Gooch & Housego's industrial segment heavily supports the industrial laser market, with a key focus on semiconductor and microelectronic applications. These lasers are crucial for advanced lithography and precise material processing within these high-tech sectors.

The demand in this specialized market experienced a period of softness. However, Gooch & Housego anticipates a rebound, projecting a recovery in the latter half of 2025. This outlook is supported by broader trends in semiconductor manufacturing investment expected to pick up pace.

Gooch & Housego's Life Sciences & Medical Sectors segment serves critical areas like medical diagnostics, laser surgery, and DNA sequencing. They supply essential components and complete systems for diagnostic instruments and laser medical devices, vital for advancements in healthcare technology.

In 2024, the demand for medical diagnostic instrument programs continued to show robust strength, reflecting ongoing investment in healthcare infrastructure and innovation. However, certain segments within the medical laser market experienced increased competition, requiring G&H to focus on differentiating its offerings.

Telecommunications and Data Centers

Gooch & Housego serves the telecommunications sector by providing essential fiber optic products and advanced fiber-optic amplifier modules. These components are critical for the infrastructure supporting global communication, including vital subsea data cable networks that underpin international connectivity.

The data center market is a significant focus for Gooch & Housego, driven by the escalating demand for high-bandwidth optical modulators. These modulators are key to enabling the faster data transfer rates required by modern data processing and storage facilities.

- Telecommunications: Gooch & Housego's fiber optic products are integral to the expansion of 5G networks, a trend that saw global 5G subscriptions reach over 1.5 billion by the end of 2023.

- Data Centers: The burgeoning cloud infrastructure market, which is projected to grow significantly in the coming years, directly fuels the need for Gooch & Housego's high-bandwidth optical modulators. In 2024, the global data center market was valued at approximately $275 billion and is expected to continue its upward trajectory.

- Market Drivers: The sustained global investment in 5G deployment and the continuous expansion of cloud computing services are the primary forces propelling demand within this customer segment.

Scientific Research and R&D Institutions

Gooch & Housego (G&H) is a key supplier to scientific research and R&D institutions that need highly specialized optical components and advanced instrumentation. These organizations are often at the forefront of technological advancement, pushing the boundaries of what's possible with photonics.

Their demand for custom solutions and cutting-edge technology directly influences G&H's product development. For instance, G&H's acousto-optic modulators are critical for controlling laser light in spectroscopy and advanced imaging techniques used in university labs and government research facilities.

- Specialized Needs: Research institutions require precision optics for experiments in fields like quantum computing, advanced materials science, and medical diagnostics.

- Innovation Drivers: These customers often commission custom-designed components, driving G&H's innovation in areas like fiber optics and electro-optic modulators.

- Application Breadth: G&H's products are integrated into a wide array of scientific instruments, from electron microscopes to high-energy physics detectors.

Gooch & Housego's customer base is diverse, spanning critical sectors like Aerospace & Defense, Industrial, Life Sciences & Medical, Telecommunications, Data Centers, and Scientific Research. Each segment has unique demands for precision optics and advanced photonics solutions.

The Aerospace & Defense sector relies on G&H for high-performance components in harsh environments, while the Industrial segment, particularly semiconductor manufacturing, requires specialized laser optics. Life Sciences and Medical applications depend on G&H for diagnostic and surgical laser systems.

Telecommunications and Data Centers are driven by the need for high-bandwidth optical components, supporting the growth of 5G and cloud infrastructure. Scientific Research institutions leverage G&H's custom solutions to push technological boundaries.

| Customer Segment | Key Applications | 2024 Market Context/Drivers |

|---|---|---|

| Aerospace & Defense | Periscopes, fire control, satellite comms | Global defense spending ~$2.2 trillion; modernization of armored vehicles & UAVs |

| Industrial (Semiconductor/Microelectronics) | Laser lithography, material processing | Anticipated rebound in semiconductor manufacturing investment |

| Life Sciences & Medical | Diagnostics, laser surgery, DNA sequencing | Robust demand in medical diagnostics; increased competition in medical lasers |

| Telecommunications | Fiber optics, amplifier modules, 5G networks | Over 1.5 billion 5G subscriptions (end 2023); ongoing 5G deployment |

| Data Centers | Optical modulators, cloud infrastructure | Global data center market ~$275 billion; escalating demand for high-bandwidth solutions |

| Scientific Research & R&D | Spectroscopy, advanced imaging, custom components | Demand for precision optics in quantum computing, materials science |

Cost Structure

Manufacturing and production represent a substantial part of Gooch & Housego's expenses. This encompasses the cost of specialized raw materials needed for high-precision optical components, the wages for a skilled workforce of technicians, and the general overheads from running various global manufacturing sites.

In fiscal year 2023, Gooch & Housego reported a Cost of Sales of £191.7 million, highlighting the significant investment in its production capabilities. The company actively seeks ways to make these costs more efficient through better operational practices and smarter sourcing strategies.

Gooch & Housego dedicates significant resources to research and development, a cornerstone of its strategy to stay ahead in the competitive photonics industry and to pioneer novel solutions. For the fiscal year 2023, the company reported R&D expenditure of £17.4 million, underscoring its commitment to innovation.

These R&D investments are vital for creating next-generation photonics technologies and expanding the performance envelope of existing product lines, ensuring Gooch & Housego remains at the forefront of technological advancement.

This ongoing investment is a strategic enabler, designed to cultivate future revenue growth and open new avenues for market penetration and diversification.

Gooch & Housego's growth strategy involves significant acquisition-related costs. These include the actual purchase price, whether paid in cash or stock, and the often substantial expenses tied to integrating acquired entities into their existing operations. For instance, the acquisition of Phoenix Optical and Global Photonics, while crucial for synergy realization, naturally brought these integration costs into play.

These integration expenses are a direct investment in achieving accelerated growth. The company's financial reports often detail these costs as they manage the process of combining operations, systems, and cultures. For the year ended September 30, 2023, Gooch & Housego reported revenue of £122.1 million, with strategic acquisitions playing a role in their market positioning and revenue generation.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses represent a significant portion of Gooch & Housego's operational costs. These costs encompass the expenses associated with their global sales force, marketing efforts to promote their advanced optical components and systems, and the general overhead required to run the corporation. Efficient management of these SG&A expenditures is crucial for maintaining and enhancing profitability.

In fiscal year 2023, Gooch & Housego reported SG&A expenses of approximately £39.1 million. This figure reflects the investment in supporting their international sales operations and brand presence.

- Sales and Marketing: Costs associated with maintaining a global sales team and executing marketing campaigns to reach diverse customer segments in aerospace, defense, and industrial markets.

- Corporate Overheads: Expenses related to executive management, finance, legal, and human resources functions that support the entire organization.

- Administrative Functions: Costs for day-to-day operational support, including IT infrastructure, office supplies, and other administrative necessities.

- Efficiency Focus: Continuous efforts are made to optimize these expenses without compromising the effectiveness of sales, marketing, and administrative support, directly impacting the company's bottom line.

Supply Chain and Tariff-Related Costs

Gooch & Housego's cost structure is significantly shaped by its supply chain, particularly the expense of acquiring essential materials. For instance, in their fiscal year ending September 2023, the cost of goods sold was £125.4 million, reflecting these procurement expenses.

While the company has limited direct exposure to specific tariffs, it actively monitors the broader inflationary pressures that can indirectly increase its overall cost base. This vigilance is crucial given global economic shifts.

Gooch & Housego's strategy involves passing on substantial cost increases to its customers. This approach helps to maintain profitability in the face of rising input prices, a key aspect of their financial management.

- Supply Chain Material Costs: £125.4 million in Cost of Goods Sold for FY2023.

- Tariff Exposure: Low direct impact, but indirect inflationary effects are closely watched.

- Cost Mitigation Strategy: Aim to pass on significant cost rises to customers.

Gooch & Housego's cost structure is dominated by manufacturing, R&D, and SG&A expenses. The company incurred £191.7 million in Cost of Sales in FY2023, highlighting the significant investment in its production capabilities. R&D expenditure stood at £17.4 million for the same period, underscoring its commitment to innovation.

| Cost Category | FY2023 (£ million) |

|---|---|

| Cost of Sales | 191.7 |

| Research & Development | 17.4 |

| Selling, General & Administrative (SG&A) | 39.1 |

Revenue Streams

Gooch & Housego's main income is generated through selling high-quality optical parts, tools, and sophisticated photonic setups. This includes a diverse array of items such as acousto-optic devices, electro-optic components, fiber optic products, and specially designed optical assemblies tailored to client needs.

For the six months concluding on March 31, 2025, the company announced revenues of £70.8 million. Looking at the full fiscal year ending September 30, 2024, Gooch & Housego achieved a total annual revenue of £135.99 million, highlighting the significant contribution of these sales.

Revenue from Gooch & Housego's Aerospace & Defense segment is experiencing robust expansion, fueled by increasing demand for specialized optics and advanced sighting systems crucial for modern military platforms. This strategic focus is evident in the company's performance, with like-for-like sales in this sector surging by 25% in the fiscal year concluding September 2024.

The company is actively bolstering this growth trajectory through targeted acquisitions, including Phoenix Optical and Global Photonics, which are integrated to enhance capabilities and market penetration within the aerospace and defense arena.

Revenue streams from the industrial and telecom sectors are driven by sales of fiber optic modules and assemblies. These components are crucial for advanced lithography systems in semiconductor manufacturing and for subsea data networks in telecommunications. In fiscal year 2024, while some industrial markets faced softer demand, a projected recovery in the latter half of fiscal year 2025 is expected to boost trading performance in these key areas.

Life Sciences and Medical Diagnostics Revenue

Gooch & Housego's revenue streams within life sciences and medical diagnostics are primarily driven by the sale of specialized components and integrated systems. These products are crucial for a variety of medical applications, including diagnostic instrumentation, advanced laser surgery, and other life science research and development activities.

The company has experienced robust growth and significant new customer orders in the medical diagnostics sector, underscoring its strong market position. This positive momentum highlights the demand for their offerings in a rapidly evolving healthcare landscape.

Despite overall strength, Gooch & Housego faces margin pressures on certain medical laser components due to increased competition. In response, the company is actively adjusting its product portfolio to optimize profitability and maintain a competitive edge in this dynamic market.

- Key Revenue Drivers: Sales of components and systems for medical diagnostic instruments, laser surgery, and other life science applications.

- Market Performance: Strong growth and new customer orders observed in the medical diagnostic market.

- Challenges and Strategy: Margin pressure on some medical laser components necessitates portfolio adjustments to address competitive pressures.

Recurring Revenue from Long-Term Programs and Aftermarket Services

Gooch & Housego (G&H) benefits significantly from recurring revenue streams derived from multi-year program wins and long-term supply agreements. These are particularly prevalent in defense sectors and specific industrial applications where their components are mission-critical.

While not always itemized separately, the ongoing demand for spares, upgrades, and support for these advanced systems inherently creates a predictable revenue base. This is a key aspect of their business model, ensuring sustained income beyond initial product sales.

The expansion of acousto-optic technology for EUV semiconductor lithography systems is a prime example of a strong and recurring revenue stream for G&H. This advanced technology, crucial for next-generation chip manufacturing, drives consistent demand for their specialized components and services.

- Long-Term Program Wins: G&H secures multi-year contracts for its specialized optical and acousto-optic components, particularly within the defense industry.

- Aftermarket Services: Ongoing demand for spares, maintenance, and upgrades for mission-critical systems contributes to a stable recurring revenue base.

- EUV Lithography Growth: The increasing adoption of EUV technology in semiconductor manufacturing fuels consistent demand for G&H's acousto-optic solutions.

Gooch & Housego's revenue is primarily generated through the sale of optical components, tools, and photonic systems. This includes a wide range of products like acousto-optic devices, electro-optic components, and custom optical assemblies. For the six months ending March 31, 2025, the company reported revenues of £70.8 million, building on a full fiscal year 2024 revenue of £135.99 million.

| Revenue Segment | Fiscal Year 2024 Revenue Contribution (Illustrative) | Key Growth Drivers |

|---|---|---|

| Aerospace & Defense | Significant portion, with like-for-like sales up 25% in FY24 | Demand for specialized optics, advanced sighting systems, strategic acquisitions |

| Industrial & Telecom | Key contributor, with projected recovery in FY25 | Fiber optic modules for semiconductor lithography and subsea data networks |

| Life Sciences & Medical | Growing segment with strong new orders | Components for diagnostic instruments, laser surgery, and life science R&D |

Business Model Canvas Data Sources

The Gooch & Housego Business Model Canvas is informed by a combination of internal financial performance data, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a robust and accurate representation of the company's strategic framework.